Ch.6- Cash, fraud, and Internal Control

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

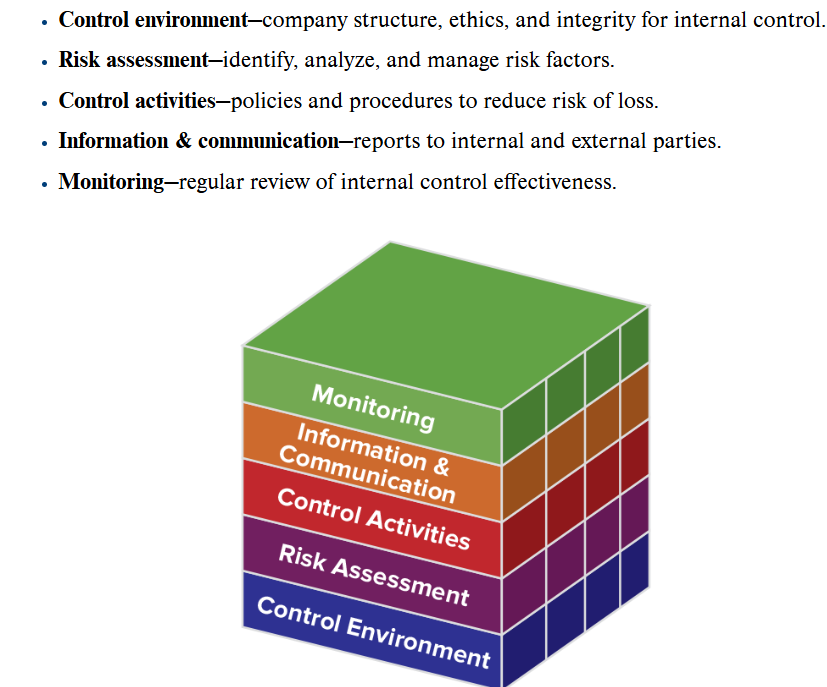

Internal Controls or Internal Control System

All policies and procedures used to protect assets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies.

Sarbanes-Oxley Act (SOX)

Legislation that created the Public Company Accounting Oversight Board, regulates analyst conflicts, imposes corporate governance requirements, enhances accounting and control disclosures, impacts insider transactions and executive loans, establishes new types of criminal conduct, and expands penalties for violations of federal securities laws.

Committee of Sponsoring Organizations (COSO)

Committee of Sponsoring Organizations of the Treadway Commission (or COSO) is a joint initiative of five private sector organizations and is dedicated to providing thought leadership through the development of frameworks and guidance on enterprise risk management, internal control, and fraud deterrence.

Principles of Internal Control

Principles prescribing management to establish responsibility, maintain records, insure assets, separate recordkeeping from custody of assets, divide responsibility for related transactions, apply technological controls, and perform reviews.

Blockchain

Technology used to create a secure ledger of transactions.

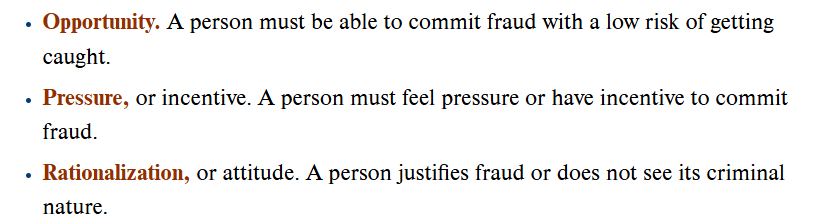

Fraud Triangle

Highlights three factors that push a person to commit fraud: opportunity, pressure, and rationalization.

Liquidity

Availability of resources to meet short-term cash requirements.

Liquid Assets

Resources such as cash that are easily converted into other assets or used to pay for goods, services, or liabilities.

Cash

Includes currency, coins, and amounts on deposit in bank checking or savings accounts.

Cash Equivalents

Short-term investment assets that are readily convertible to a known cash amount or sufficiently close to their maturity date (usually within 90 days) so that market value is not sensitive to interest rate changes.

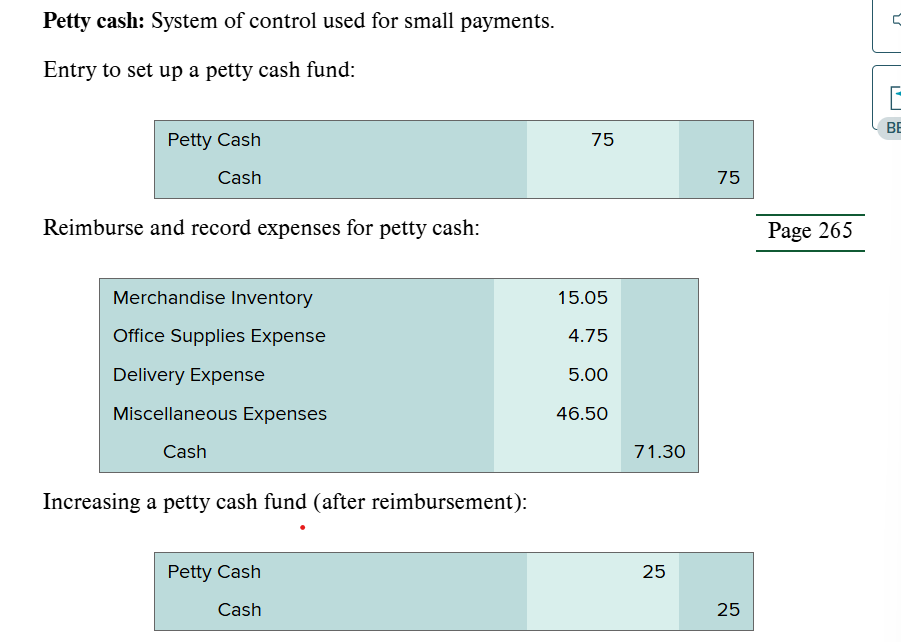

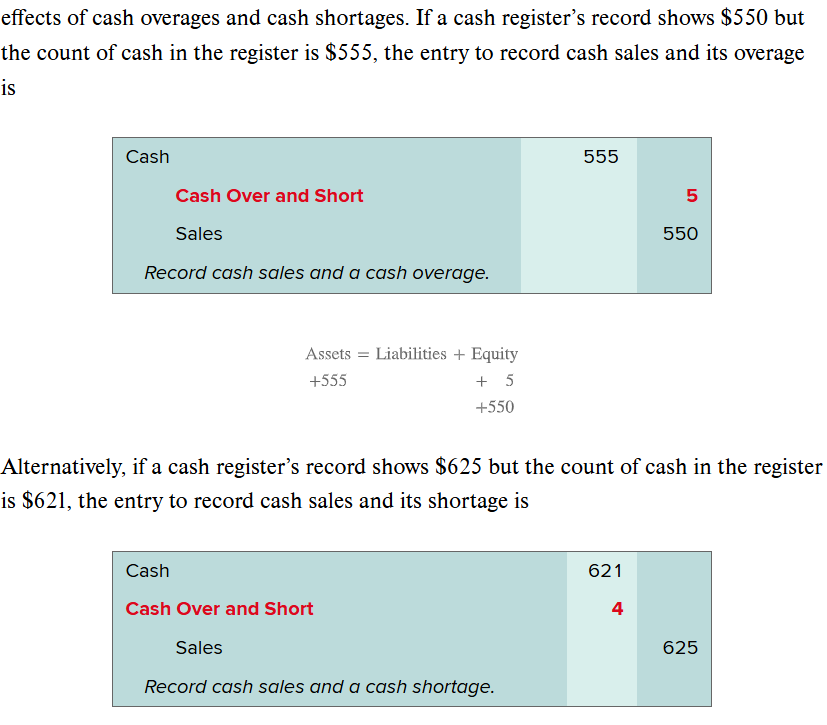

Cash Over and Short

Income statement account used to record cash overages and cash shortages arising from errors in cash receipts or payments.

Voucher System

Procedures and approvals designed to control cash disbursements and acceptance of obligations.

Voucher

Internal file used to store documents and information to control cash disbursements and to ensure that a transaction is properly authorized and recorded.

Signature Card

Included that signature of each person authorized to sign checks on the bank accounts.

Deposit Ticket

Lists items such as currency, coins, and checks deposited and their corresponding dollar amounts.

Check

Documents signed by a depositor instructing the bank to pay a specified amount to a designated recipient.

Electronic Funds Transfer (EFT)

Use of electronic communication to transfer cash from one party to another.

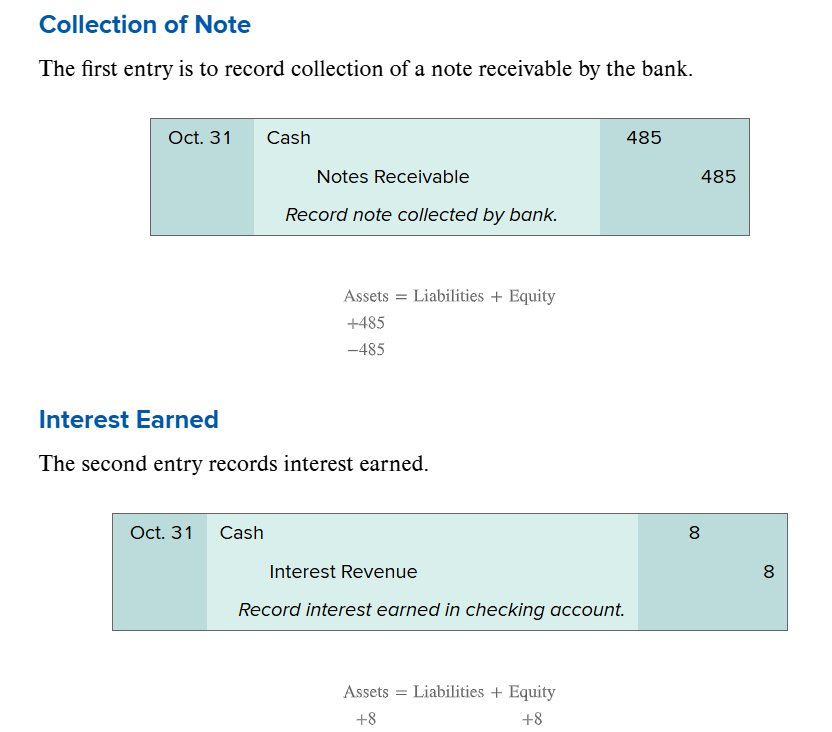

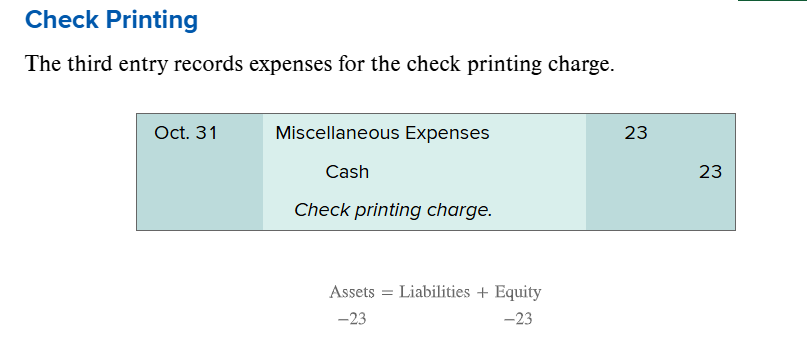

Bank Statement

Bank report on the depositor’s beginning and ending cash balances, and a listing of its changes, for a period.

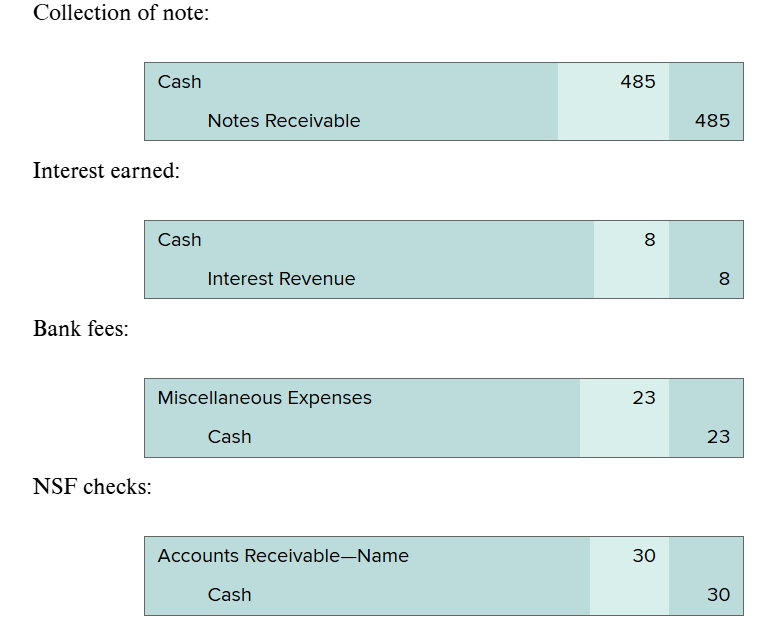

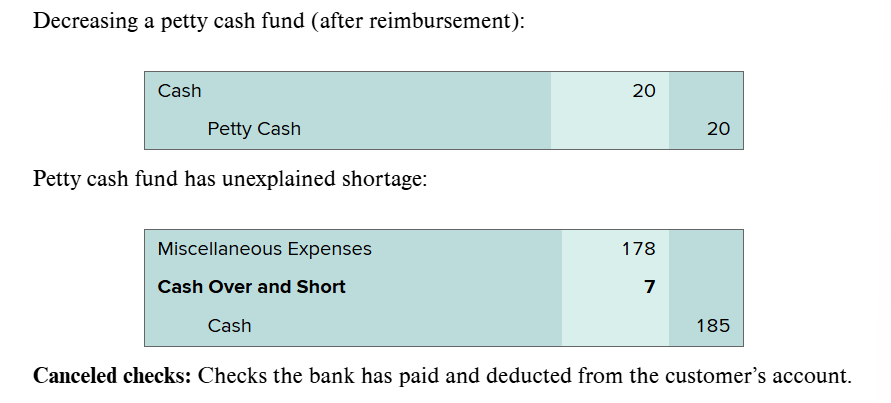

Canceled Checks

Checks that the bank has paid and deducted from the depositor’s account.

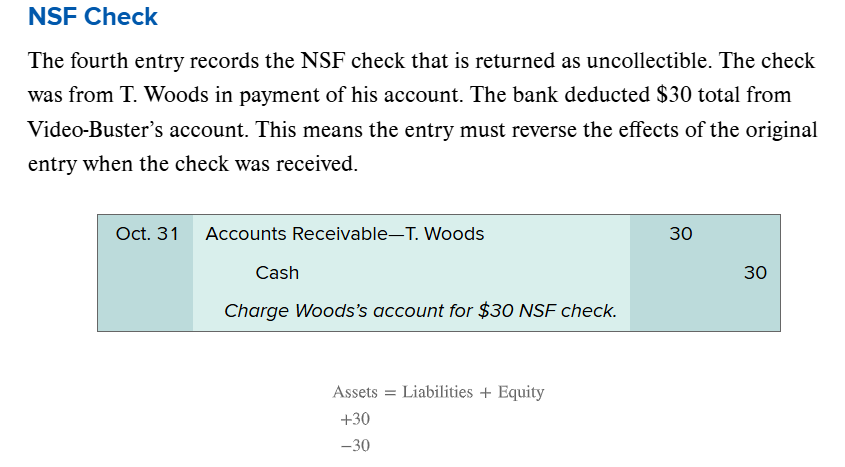

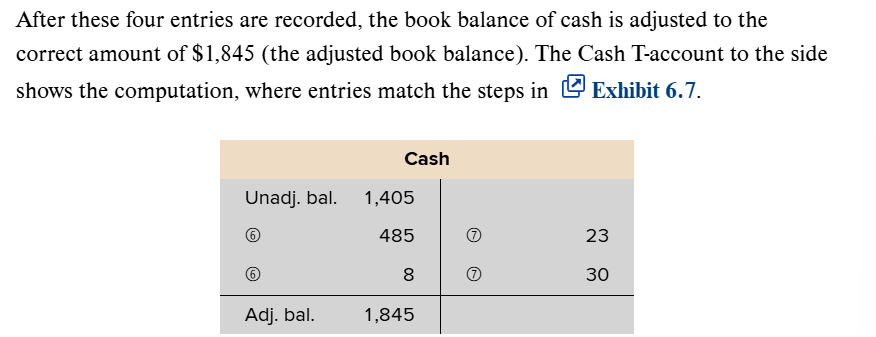

Bank Reconciliation

Report that explains the difference between the book (company) balance of cash and the cash balance report on the bank statement, for purposes of computing the adjusted cash balance.

Deposit in Transit

deposits recorded by the company but not yet recorded by its bank.

Outstanding Checks

Checks written and recorded by the depositor but not yet paid by the bank at the bank statement date.

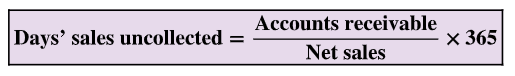

Day’s Sales Uncollected

Measure of the liquidity of receivables, computed by dividing the current balance of receivables by the annual credit (or net) sales and then multiplying by 365; also called days’ sales in receivables.

Purchase Requisition

Document listing merchandise needed by a department and requesting it be purchased.

Purchase Order

Document used by the purchasing department to place an order with a seller (vendor).

Vendor

Seller of goods or services.

Invoice

Itemized records of goods prepared by the vendor that lists the customer’s name, items sold, sales prices, and terms of sale.

Vendee

Buyer of goods or services.

Receiving Report

Form used to report that ordered goods were received and to describe their quantity and condition.

Invoice Approval

Document containing a checklist of steps necessary for approving the recording and payment of an invoice; also called check authorization.

Voucher Register

Journal (referred to as book of original entry) in which all vouchers are recorded after they have been approved.

Check Register

Another name for a cash payments journal has a column for check numbers.