MANAGERIAL DISCRETION MODELS

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

why do we have managerial discretion models

traditionally firms rise financial capital through bank loans but these are risky due to repayments ect

risk adverse banks restrict their lending which consequentially constrains the size of their firm

thus modern coporations relay on equity finance this has advatntages for firms amd banks:

vary dividens

non repayment

the risk is spread

for accepting risk shareholders receive ownership rights

the seperation of ownership from managmeent leads to manager discretion where managers persure different objectives to owners

what is the principle agent problem

managers persue different objectives to the owners this depends on if the owners are informed about the environment in which the firm operates

if fully informed managers maximise profits

if partially informed then managers have the discretion

this leads to the principle agent problem

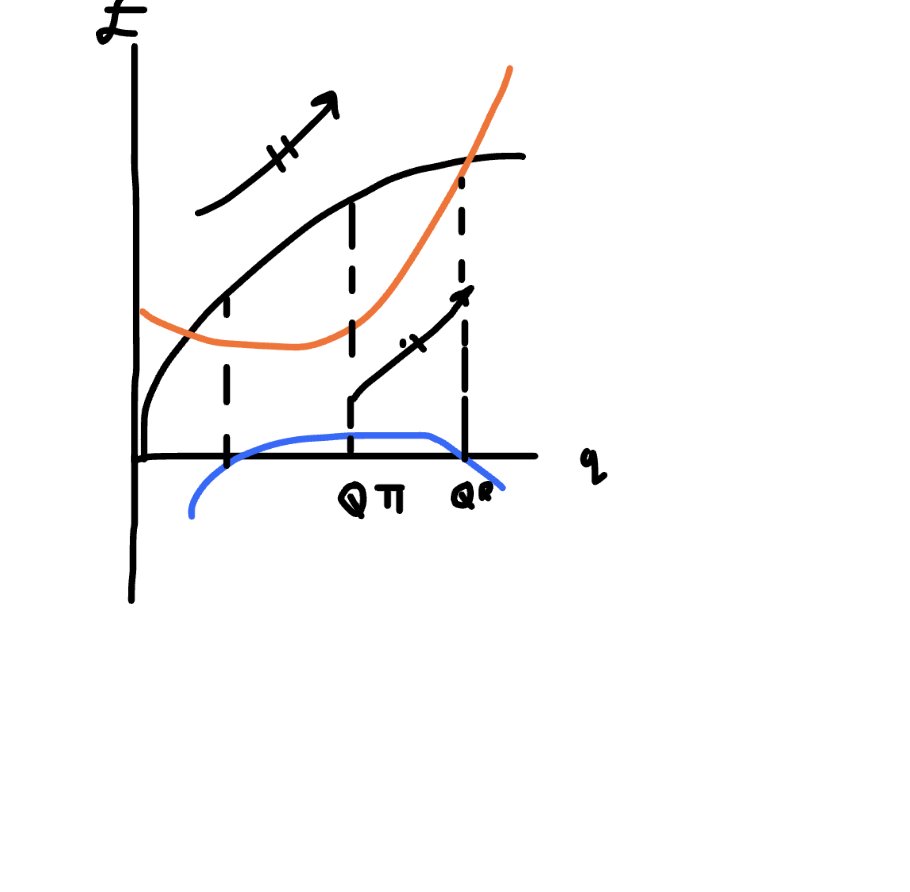

explain the sales revenue maximisation PAP

managers get prestigre from the size of the business which they maximise

this is assoicated with imperfect competition

sales maximisation implies a higher level of output then profit maximiation

we can show this on the baumol model:

the firm must take a min profit to keep shareholders satisfied

this reflects asymetric information this is our minimum prifit constraint

if PIR>PIC then the constraint is non binding and produces QR

if PIR<PIC then the constraint is binding and produce between QR and QPI

only if PIC=PI then we prodice Qpi this is symetric infomration

owners wish managers to produce at QPi

managers with discretion will produce at QR which results in lwoer profits

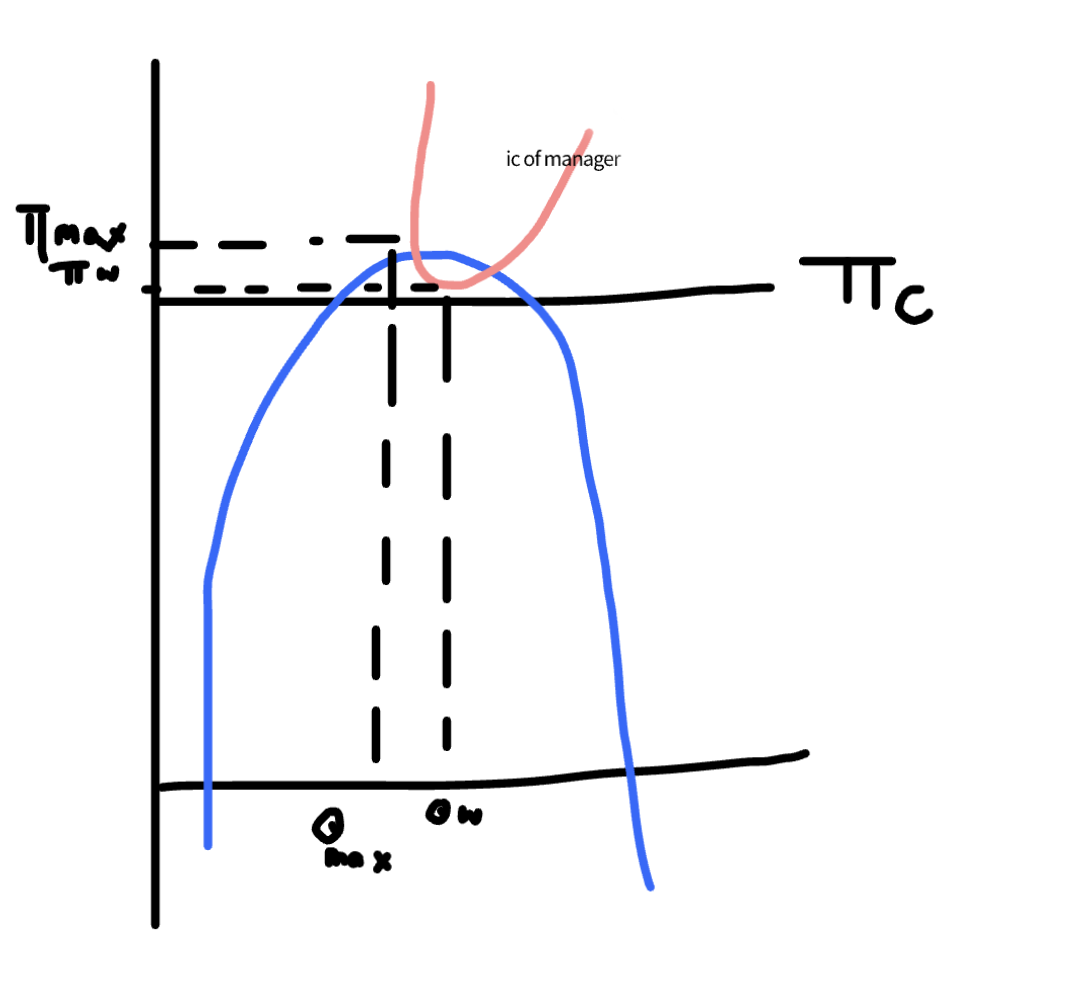

explain the expense preference model

managers maximise utility including a preference for expenses eg personal assistents

the manager still gets utility from the size of the business and any discrentionary profits that can be used after the shareholder have been satisfied and with which to fund perks

so our managers utlity function is u(QD) where Q= scale of the operation and D=discrentionary profts

we can show this in our williamson model

shareholders require a minimum acceptable profit level of pic

discretionary profits are D=pi-pic which now have value to our manager

managers will produce QW and get profits PIw

these profits are less then the profit max as theyre trading some profit for a rise in output

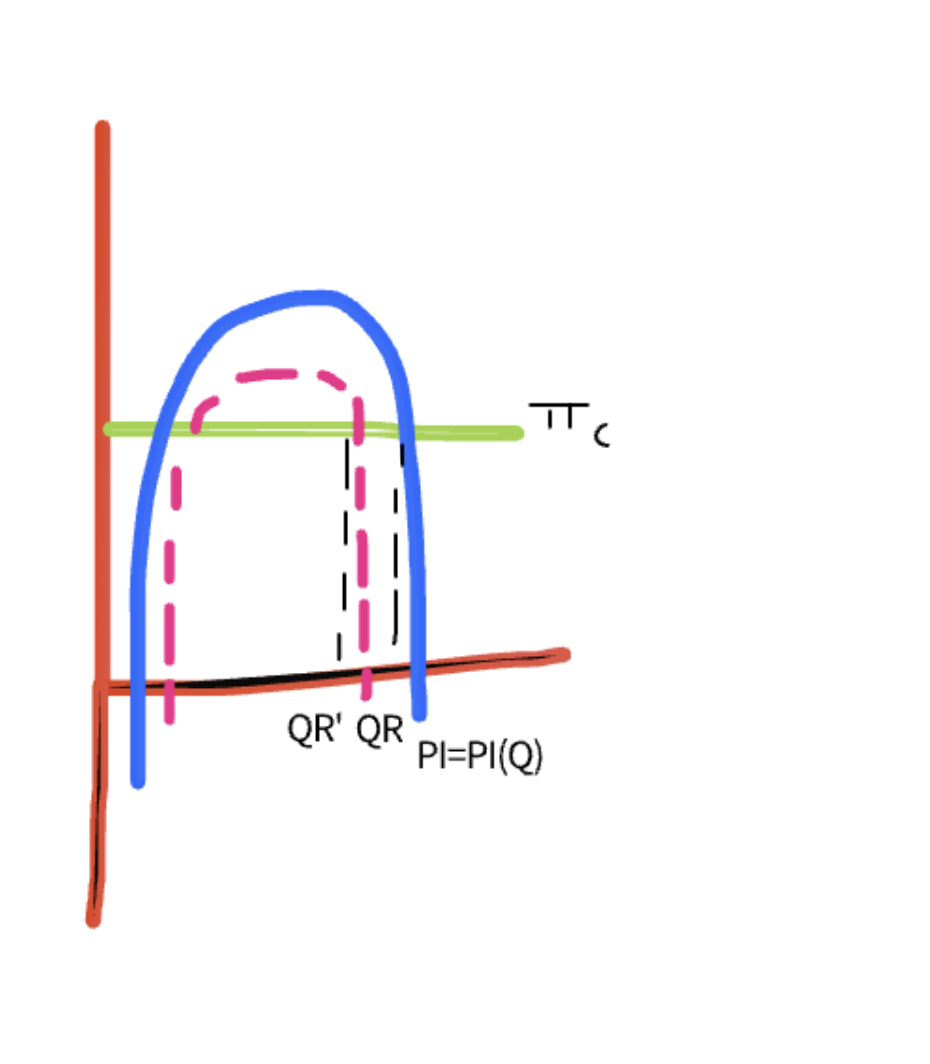

how do lump sum taxes impact the baumol model

taxes reduce output when the minimum profit constraint is bidning or becomes binding

PIC= binding min profit constraint

blue= profit line

if we carry on producing at QR’ we wont satisfy our profit constraint so managers will be forced to cut output to QR’

output dincreases in response to our lump sum tax

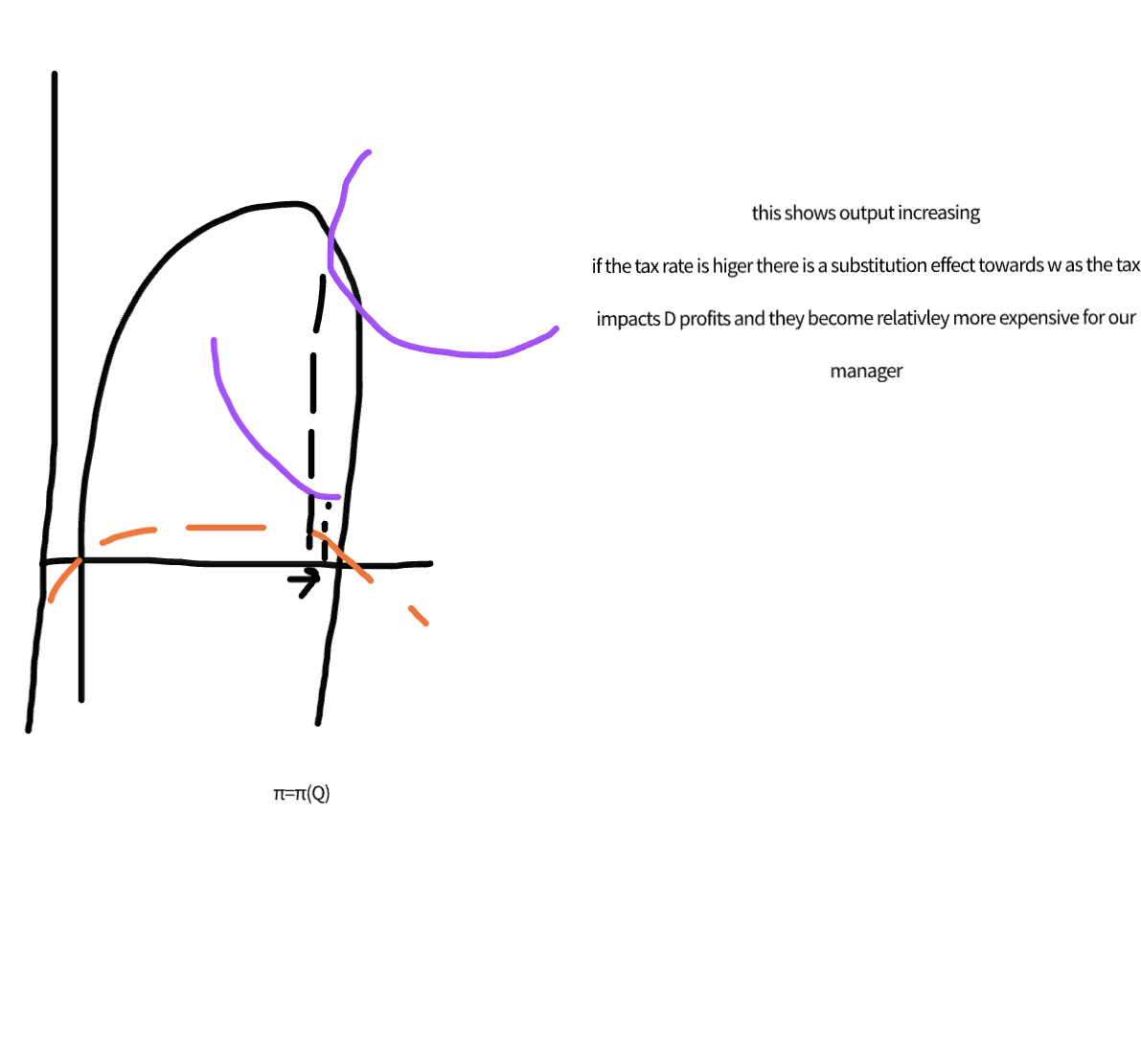

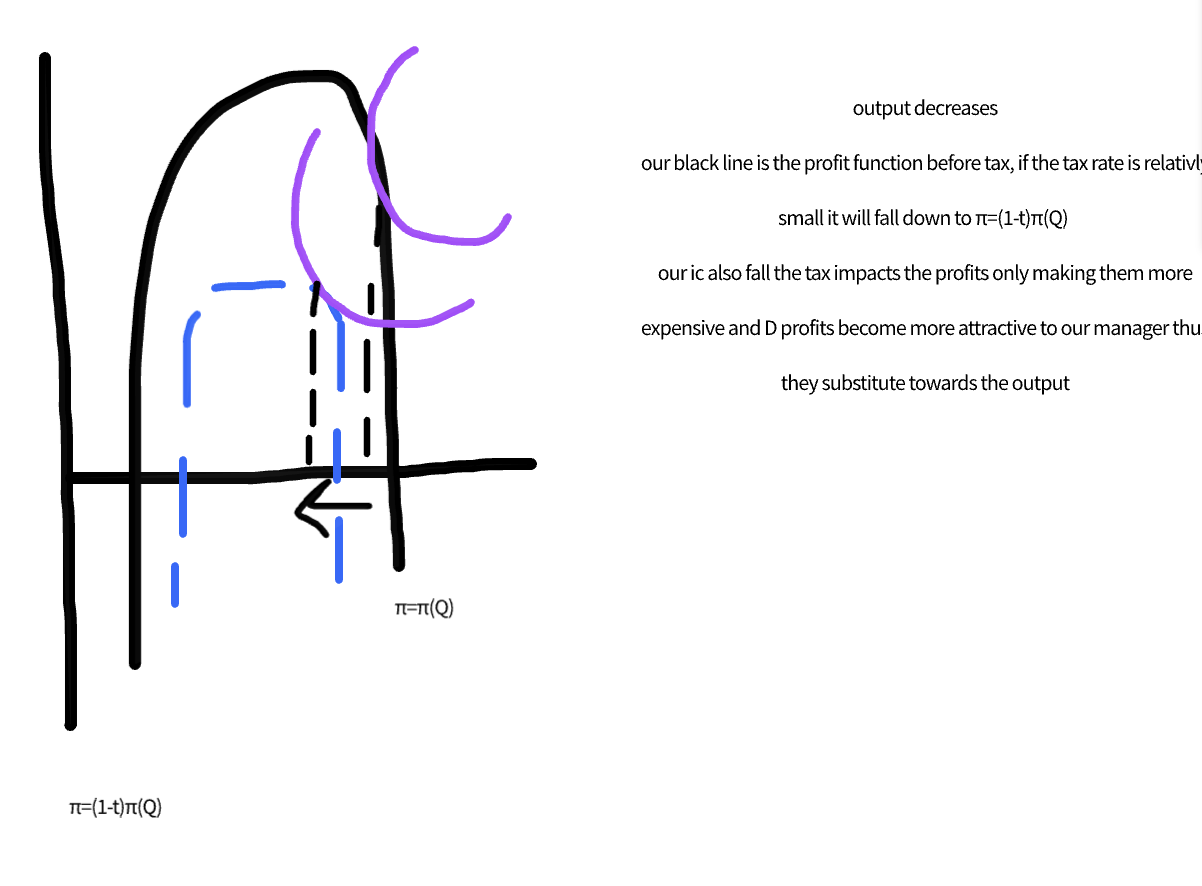

Show the effect of proportional tax in the williamson model

taxes may reduce otuput althorugh since the tax makes discretionary profits, D, more expensive it may rise output as the manager will substitute towards output

this substitution effect is larger for porpotional tax then lump sum and itll increase with our tax rate

output may change if the profit constraint, pic, adjusts to the tax

this dependsn on the preferecnces , ic, of our managers

what are the alternative approaches

capatilist firms maximise profits, but we also have labour managed firms like john lewis

the labour force takes the entreprenurial role

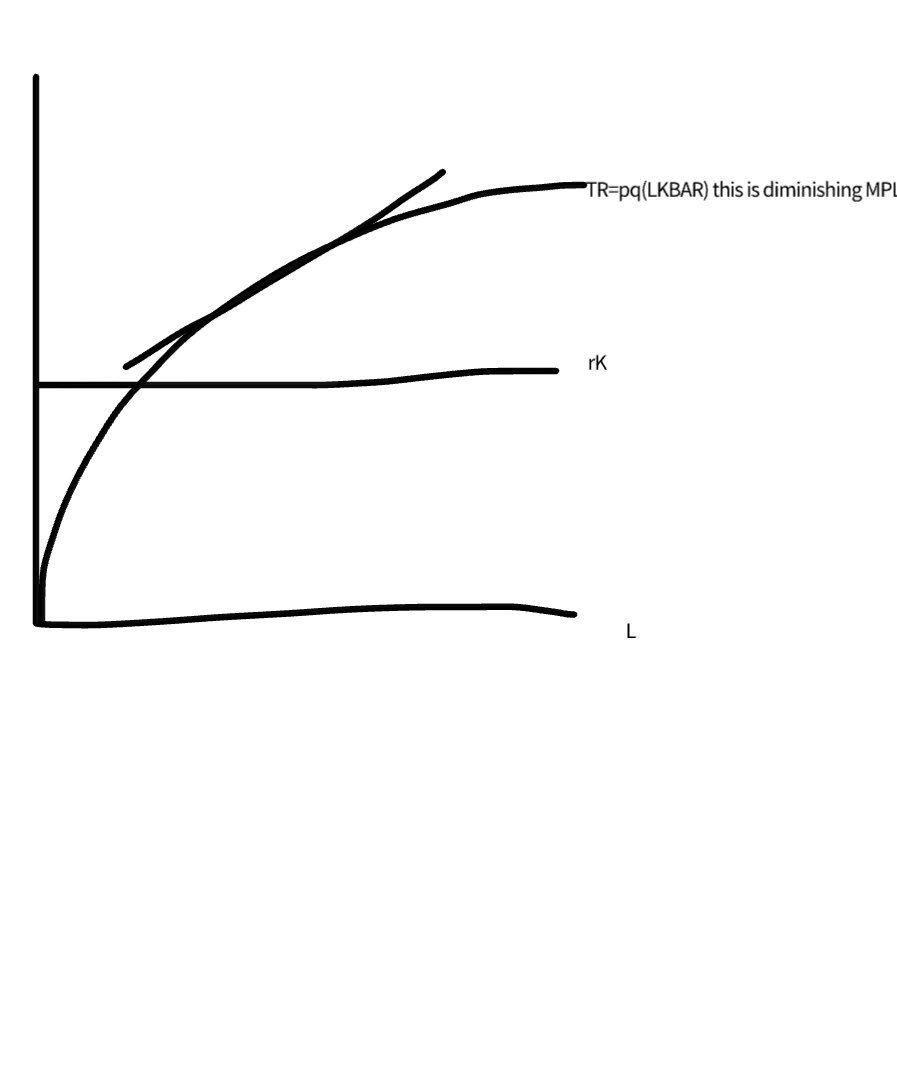

eg if the firm is a price taker

their problem in the short run if k is fixed is:

max L w+π/L subject to π=pQ-wL-rK

this is that the firm maximises the residuel (value added profits) per employee: max L(pQ-rK/L).

the firm takes on more employees as long as they increase the averaeg earnings per head

we can show this on the optimal employment for labour managed firms diagram

what are the assumptions of the manager

they are

well informed

they optimise

there is no conflict in decision making