TAXATION - FRINGE BENEFITS

1/46

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

fringe benefit tax

managerial employees subject to

fringe benefit tax

A final tax withheld at source, Imposed on the employer and Deductible by the employer

fringe benefits tax

Housing, Expense account and Vehicle of any kind are fringe benefit that are subject to

35% of the grossed-up monetary value

what is the rate of fringe benefit tax

employee

A fringe benefit which is not subject to the fringe benefit tax is part of the taxable compensation income of the

Fringe benefit

it is a form of pay which may be in the form of property, services, cash or cash equivalent to supplement a stated pay for the performance of services under an employee employer relationship.

Grossed-up monetary value

it is reflected in the books of accounts as fringe benefit expense and fringe tax expense.

employer

Any amount not withheld by the employer on employee’s salary is the liability of the

income tax

De minimis benefits of managerial employees within the ceiling is exempt from

fringe benefit tax

Temporary housing for a stay in the housing unit for six (6) months or less is a housing benefit that are subject to

Other benefits

it is subject to P90,000 ceiling include Christmas bonus, productivity incentive bonus, loyalty awards and gifts in cash or in kind and other benefits of similar nature

over the P90,000 ceiling

The excess of de minimis benefits over their respective ceilings are considered as part of other benefits subject to tax only on the excess

fringe benefits tax

Convenience of the employer

Necessity to the business or trade

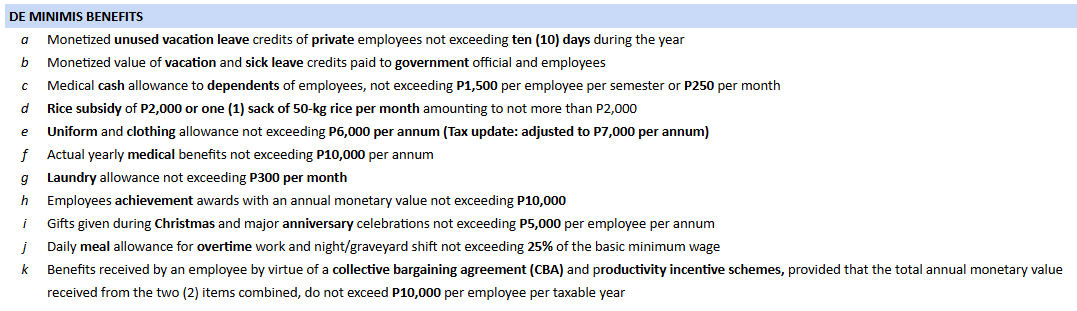

De minimis benefits

The following denote exemption from the

75%

The grossed-up monetary value of fringe benefit subject to fringe benefit tax received by a non resident alien not engaged in trade or business (NRANETB) in the Philippines is computed by dividing the monetary value of the fringe benefit by

Rental paid x 50%

if the Employer leases residential property for the use of the employee the monetary value of the benefit is

no

does the Employer leases residential property for the use of the employee have the transfer of ownership

Higher of FMV or Zonal Value x 5% x 50%

if the Employer owns residential property for the use of the employee the monetary value of the benefit is

no and 20 years (5%)

does the Employer owns residential property for the use of the employee have the transfer of ownership and how long is the useful life

Acquisition cost exclusive of interest x 5% x 50%

if the Employer purchases residential property in installment for the use of the employee the monetary value of the benefit is

no and 20 years (5%)

does the Employer purchases residential property in installment for the use of the employee have the transfer of ownership and how long is the useful life

Higher of acquisition cost or zonal value (100%)

if the Employer purchases a residential property and transfers the ownership in the name of the employee the monetary value of the benefit is

yes

does the Employer purchases a residential property and transfers the ownership in the name of the employee have the transfer of ownership

FMV or zonal value, whichever is higher, less payment by employee (100%)

if the Employer purchases a residential property and transfers ownership to the employee on a lesser amount the monetary value of the benefit is

yes

does the Employer purchases a residential property and transfers ownership to the employee on a lesser amount have the transfer of ownership

Acquisition cost of all motor vehicles not normally used for business divided by 5 years x 50%

if the Employer owns and maintains a fleet of motor vehicles for the use of the business and employees the monetary value of the benefit is

no and 5 yrs

does the Employer owns and maintains a fleet of motor vehicles for the use of the business and employees have the transfer of ownership and how long is the useful life

Amount of rental payments for motor vehicle not normally used for business purposes x 50%

if the Employer leases and maintains a fleet of motor vehicles for the use of the business and the employees the monetary value of the benefit is

no

does the Employer leases and maintains a fleet of motor vehicles for the use of the business and the employees have the transfer of ownership

Acquisition cost (100%)

if the Employer purchases the motor vehicle in the name of the employee the monetary value of the benefit is

Yes

does the Employer purchases the motor vehicle in the name of the employee have the transfer of ownership

Amount of cash received by the employee (100%)

if the Employer provides the employee with cash for the purchase of a motor vehicle in the name of the employee the monetary value of the benefit is

yes

does the Employer provides the employee with cash for the purchase of a motor vehicle in the name of the employee have the transfer of ownership

Amount shouldered by the employer (100%)

if the Employer shoulders a portion of the amount of the purchase price of a motor vehicle in the name of the employee the monetary value of the benefit is

yes

does the Employer shoulders a portion of the amount of the purchase price of a motor vehicle in the name of the employee have the transfer of ownership

Acquisition cost exclusive of interest divided by 5 years (100%)

if the Employer purchases the car on installment in the name of the employee the monetary value of the benefit is

yes and 5 yrs

does the Employer purchases the car on installment in the name of the employee have the transfer of ownership and useful life

Depreciation of a yacht at an estimated

useful life of 20 years

if the Use of yacht, whether owned and maintained or leased by employer the monetary value of the benefit is

no and 20 years (5%)

does the Use of yacht, whether owned and maintained or leased by employer have the transfer of ownership and useful life

Amount paid or given by the employer (always 100%)

the others like Expense, Household personnel, Membership fees, Expenses for foreign travel, Holiday and vacation expenses, Educational assistance and Life or health insurance and other non-life insurance premiums their monetary value is

exempted (not subjected to fringe benefit tax)

Housing privilege of military officials of AFP

Housing unit which is situated inside or adjacent to the premises of a business or factory (within the maximum of 50 meters from the perimeter of the business premises)

Temporary housing for an employee who stays in a housing unit for 3 months or less

these are housing privilege that are

exempted (not subjected to fringe benefit tax)

Use of aircraft and helicopters owned and maintained by the employer (treated as business expense). these is a Vehicle of any kind that are

exempted (not subjected to fringe benefit tax)

Expenses incurred by employees but paid by employer and reimbursed by employer are

fringe benefit tax

Expenses for foreign travel - Expenses in connection with attending business meeting or convention (except lodging cost in a hotel) at an average of $300 per day, cost of economy and business class airplane ticket, and 70% of the cost of first class airplane ticket shall not be subjected to

fringe benefit tax

Educational assistance - When the study is directly connected with the employer’s trade, business or profession and there is a written contract between the employee, obligation to remain in the employer for a period of time, and dependents through a competitive scheme under scholarship program shall not be subjected to

fringe benefit tax

Life or health insurance and other non-life insurance premiums- sss, gsis, Premiums for group insurance of employees shall not be subjected to

fringe benefit tax

Benefits given to rank and file employees, Benefits given for the convenience or advantage of the employer, benefits which are authorized and exempted from tax under the Tax Code or special laws, Benefits required by the nature of, or necessary to the trade, business or profession of the employer, and Contributions of the employer for the benefit of the employee to retirement, insurance and hospitalization benefit plans is not subject to

fringe benefit tax

This de minimis shall not be subjected to