SL Business Unit 2

1/50

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

51 Terms

Stakeholder

An individual, group, or organization with a direct interest or involvement in the operations and performance of a business

Internal vs External (Stakeholders)

External Stakeholders own shares but are not directly involved in the daily operations of a business

Internal Stakeholders

Employees, Managers/Directors, Shareholders/Stockholders

2 objectives of shareholders

Maximize dividends (proportion of the profits given to them)

Achieve capital gain (a rise in the value of shared)

External Stakeholders

Customers, Suppliers, Financiers, Pressure Groups, Competitors, Government

Objectives of Suppliers

Regular contracts, good work relations with clients, clients pay on time

Objectives of Financiers

Long term relationships, ability of firm to repay debts

Objectives of Government

Avoid unfair practices, ensure correct corporate tax is paid, health and safety standards are met, compliance with the employment legislation

Conflict between stakeholders

Inability of an organization to meet all of its stakeholder objectives simultaneously (Due to differences in the varying needs of stakeholders)

Resolving stakeholder conflict

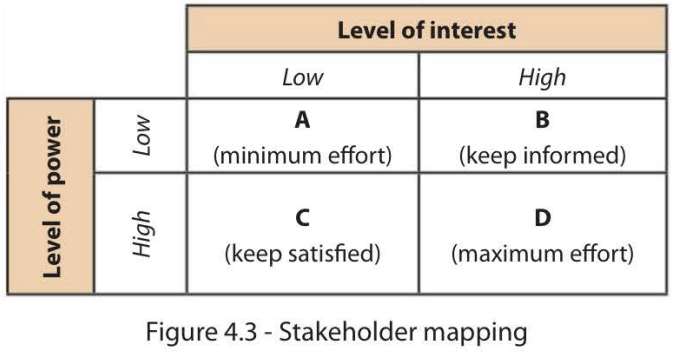

Stakeholder Conflict: Maximum Effort

For key stakeholders

Stakeholder Conflict: Mimimum Effort

Receive the lowest priority

Stakeholder Conflict: Keep Informed

Stakeholders can become highly disgruntled

Stakeholder Conflict: Keep Satisfied

via consultation on strategic decisions

Economies of Scale

When average costs of production decrease as the organization increases the size of its operations

Diseconomies of Scale

When an organization becomes too large - causing product inefficiencies affecting the whole industry (cost of product goes up)

Internal Economies of Scale

Technical, Financial, Managerial, Marketing, Purchasing

Internal Economies of Scale: Technical

Use sophisticated capital and machinery to mass produce. High fixed cost of equipment is spread out (reducing average cost of production)

Internal Economies of Scale: Financial

Borrowing large sums of money at lower rates of interest since they are seen as “less risky”

Internal Economies of Scale: Managerial

Sell products in bulk.

Benefit from:

Saves time

Transaction costs

Spread the high costs of advertising by using the same marketing campaigns

Internal Economies of Scale: Purchasing

Lower average costs by buying resources in bulk

External Economies of Scale

Technological Process, Improved Transportation, Regional Specialization

External Economies of Scale: Technological Process

Increases productivity levels

External Economies of Scale: Improved Transportation

Ensures to promote deliveries. Inefficiencies raise business costs and reduce profits.

External Economies of Scale: Regional Specialization

Particular locations have trustworthy reputations for producing certain goods. Industries benefit from specialists and thus reduces average cost for production.

Internal Diseconomies of Scale

Lack of control and coordination, poor working relationship, bureaucracy

Internal Diseconomies of Scale: Lack of control and coordination

Causes communication problems and add to firm cost without an increase in productivity. Increases Unit Cost

Internal Diseconomies of Scale: Poor working relationship

Senior managers become detached from workers lower down in the “hierarchy” Damaged communication flow and motivation.

Internal Diseconomies of Scale: Bureaucracy

Excessive admin paperwork/company policies. Decision making is more time consumer, communication is challenging. Increases Unit Cost

External Diseconomies of Scale

Higher rent, higher pay, traffic conjection

External Diseconomies of Scale: Higher rent

Add to fixed cost. Increases Unit Cost

External Diseconomies of Scale: Higher pay

Increases cost without necessarily increasing output. Raising average cost of production

External Diseconomies of Scale: Traffic Congestion

Too many businesses in one area → delayed deliveries, increased transportation cost, more competitiveness. Increases Unit Cost

Internal Growth (Organic Growth)

Business grows by using their own resources and capabilities to increase the scale of operations and sales revenue

Examples of Internal Growth

Changing prices

Effective promotions

Product innovation

Increased distribution

Pros/Cons of Internal Growth

Pro

Better control/ co-ordination

Inexpensive

Corporate culture

Less risky

Con

Diseconomies of scale

Restructure

Dilution of control and ownership

Slower growth

External Growth (Inorganic Growth)

Dealing with outside organizations rather than from an increase in the organization’s own business operations

Examples of External Growth

Mergers and Acquisitions

Acquisitions: when a company buys a controlling interest in another form with permission/agreement of the board of directors

Takeovers

When a company purchases a controlling stake in another company without permission or agreement

Joint Ventures

2+ businesses come together to form a separate entity (share costs, risk, control, etc)

Strategic Alliance

2+ businesses come together but do not form a separate entity (“project”, share costs, marketing, operations)

M&A Pro/Cons

Benefits: greater market share, economies of scale, diversification

Drawbacks: Redundancies (too many employees), conflict, culture clash, diseconomies of scale, loss of control

Strategic Alliances Pro/Cons

Benefits: Spreads costs/risks, relatively cheap, competitive advantage

Drawbacks: Rely heavily on goodwill of counterparts, large expenditure, culture clash

Multinational Companies

Organizations that operate in 2+ countries, with a head office based in the home country

MNC Pro/Cons

Pro

Creates jobs

Higher national income (GDP increases)

Knowledge/technology transfer

Increased competition

Con

Job losses

Repatriation of profits (negative for the country’s tax revenues)

Vulnerability

Social responsability

Competitive pressure

Reasons to become a MNC

Increased customer base

Cheaper production cost

Protectionist policies

Economies of scale

Brand development/value

Spreads risks

Reasons to stay a Small Business

Cost control, Loss of control, Financial risks, Government aid, Local monopoly power, Personalized services, Flexibility, Small market size

Reasons to become a Large Business

Economies of scale, Lower prices, Brand recognition, Brand reputation, Value-added services, Greater choice, Customer loyalty

Synergy

Creates greater output and improved efficiencies → why organizations seek to grown inorganically.

Joint Venture Pro

Benefit: Synergy, cost/risk spread, entry to foreign markets, relatively cheap, competitive advantage, high success rate

Franchising

an individual/business buys a license to trade using another company's products/name/brand/trademarks. Franchisee pays a license fee and royalty payments (based on sales revenues).

Benefits/Drawbacks for Franchisor

Benefits: Cheaper/Faster than internal growth, national/international presence, rapid growth with minimal effort, chances of success are increased

Drawbacks: risk in using name, difficult to control, difficult to meet standards, M&As are faster

Benefits/Drawbacks for Franchisee

Benefits: low start up cost, low risk, value-added services, large scale advertising, “their own bosses”

Drawbacks: overseen by franchisor, expensive, sales revenues are lost

Brand awarness vs Brand loyaly

Brand awareness is when customers recognize and recall your brand, while brand loyalty is when customers are dedicated to your brand and unwilling to switch to a competitor