4.1.8

1/143

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

144 Terms

Economic system

A network of organisations used to resolve what, how and for whom to produce i.e. a way of solving the basic economic problem (where there are infinite demands on finite resources)

Examples of econ system

Free market system, mixed economy, transition economy, socialist planning

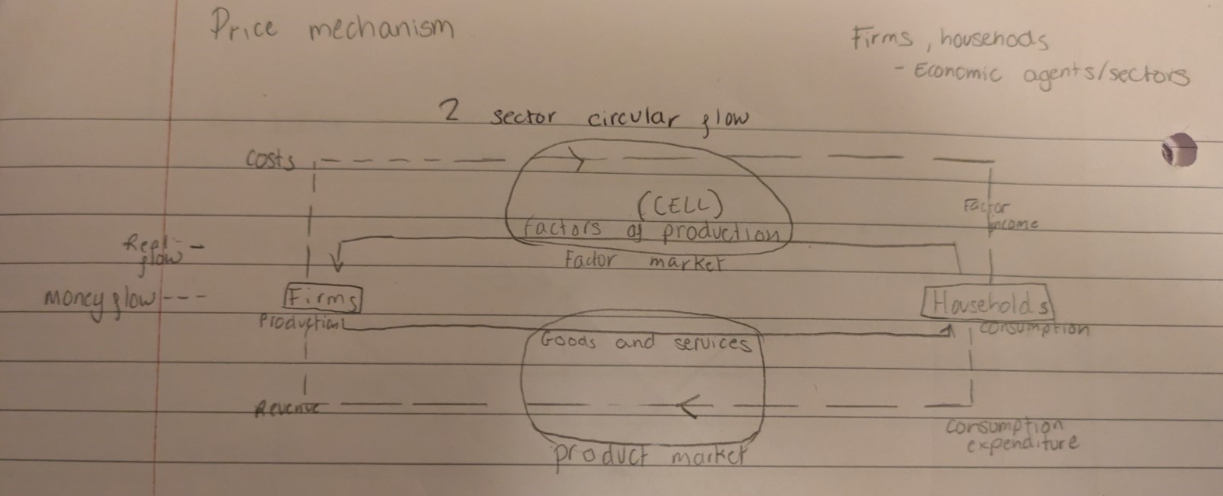

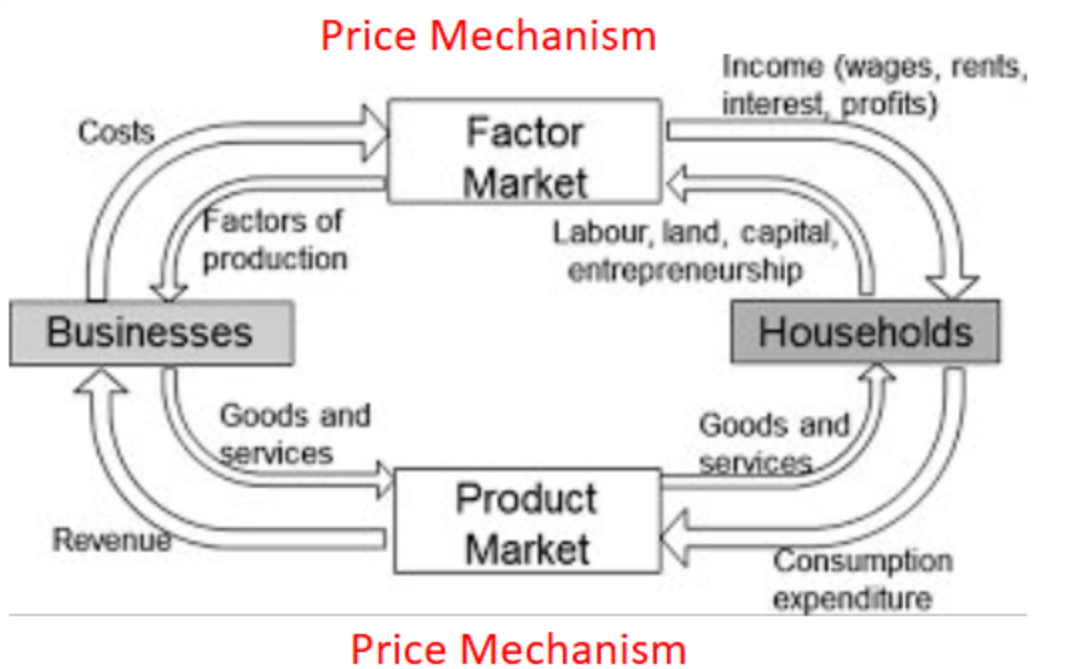

2 circular flow diagram

Production is .. things for .. to enjoy

producing, consumers

consumption is … for goods and … by consumers

enjoying, services

Market economy

resources are mostly privately owned and market / price mechanism is used

Price mechanism example

buying a car if someone else pays a higher price than you they will get the car

Planned / command economy

decisions about what to produce, how much to produce and for whom are decided by central planners working for the government rather than allocated using the price mechanism

Mixed economy

economies in which resources are allocated partly through the price mechanism and partly through state intervention

1949-… China close to pure … economy, opened up …policy, move a bit away from pure planned economy

1980, planned, reform

example of planned and mixed economy countries

north korea vs south korea

Advantages of free market economies:

Efficient allocation of resources: In free market, resources allocated based on supply and demand. Prices serve as signals, guiding producers and consumers to make efficient choices -> allocation of resources to the most valuable

Advantages of central planning / command

Generally low level of inequality

Resources allocated according to ‘common good’ rather than according to the ‘profit motive’ - less likely to cause market failure distribution of resources

May be more straightforward/ fast to get large-scale infrastructure projects built

Problems with central planning / command economies

Inefficiency in resource allocation

Cause: central planners lack the ability to collect and process al the information about consumer preferences, production capabiities, and market demand in real time

Result: mismatches between supply and demand, causing shortages (essential goods not produced in sufficient quantities) and surpluses (wastage of unwanted goods).

Bureaucratic complexity and corruption

Monetarism

Money supply should be increased steadily and predictably

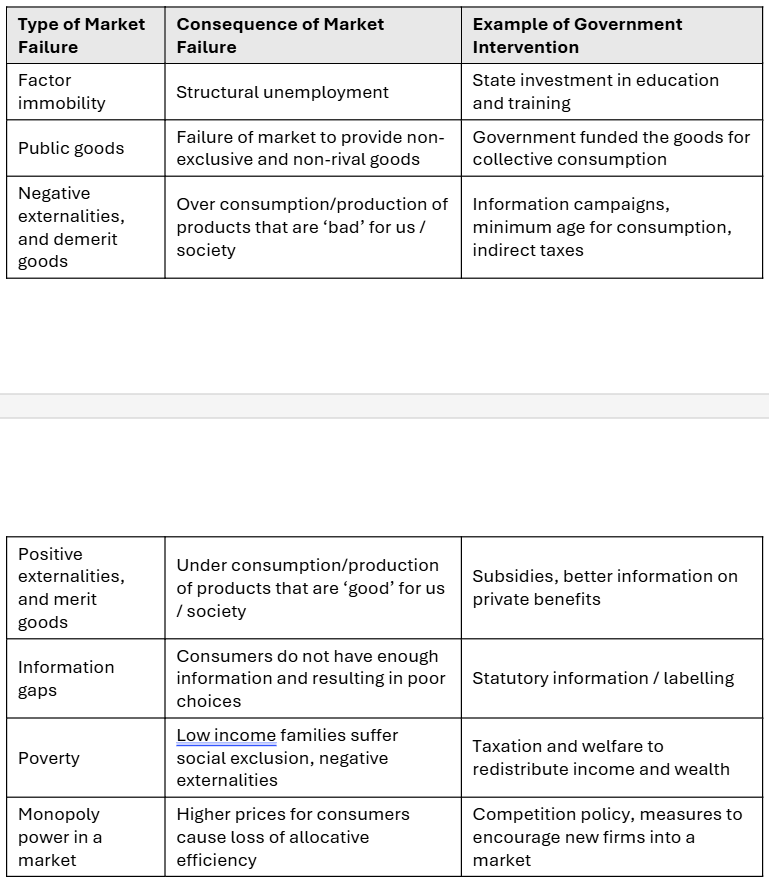

Market failure

Markets operating without government intervention result in a misallocation of resources

Market failure leads to … and … in community surplus.

DWL, reduction

Market failure example

factory emitting harmful smoke, producing at profit max Q -> someone breathes it in and gets cancer -> prolonged absence from work -> burden on the NHS -> divergence of private cost and social cost

housing

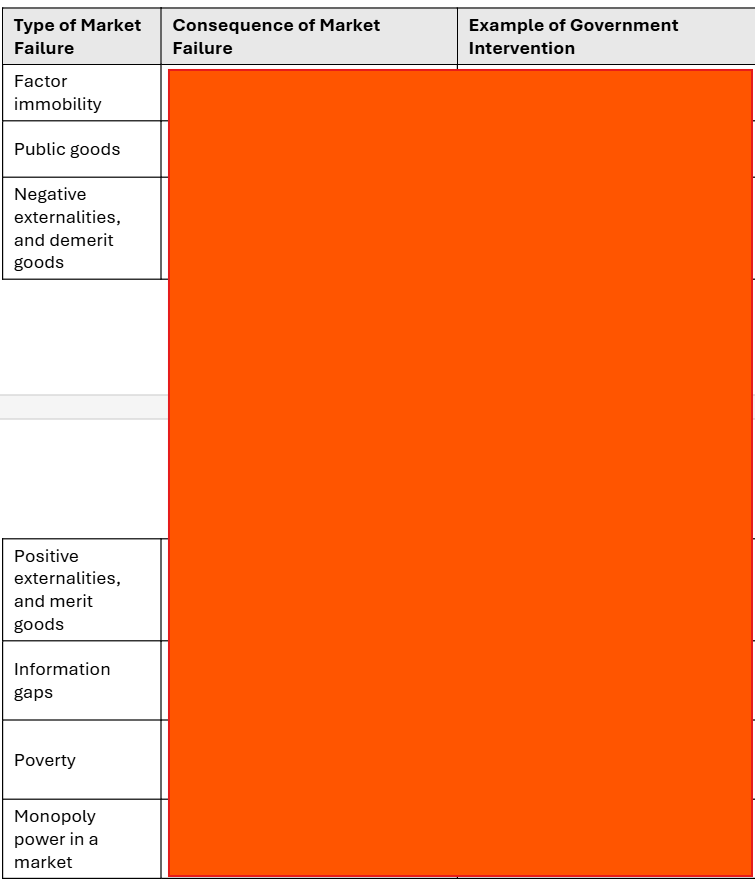

Types of market failure (NIPMIP)

Negative externalities, Information failures, Positive externalities, Monopolies / market power, Immobility (occupational and geographical) and inequality, Public goods

Example of market failure for negative externalities

pollution from factory

Example of market failure for positive externalities

training and education, vaccines

Example of market failure for public goods

national defence, park, difficult to ask for pay (free riders, If you consume it, you will not reduce the consumption of others

Example of market failure for information failures (including merit + demerit goods)

demerit - sugar drink, merit - fruit / health supplement, financial crisis (overconsumption due to info fail - demerit, underconsumption due to info fail - merit)

Example of market failure for monopolies / market power

electricity, water supplies, lower Q and higher P than perfect competition

Example of market failure for immobility (occupational and geographical) and inequality

threat of employment by robot, poverty and crime, coal miners declining industry

complete market failure

results in missing market when market does not supply products at all e.g. gov does not provide public goods a private market unlikely to supply the goods bc of free riders and lack of profit

Partial market failure

market exists but contributes to resource misallocation e.g. externalities, info gap, market conc, inequality

merit good

society judges to be especially worthwhile and is likely to be underconsumed bc benefits not fully appreciated. MSB > MPB

demerit good

society judges to be undesirable and is likely to be overconsumed bc costs not fully recognised. MPB > MSB, imperfect information

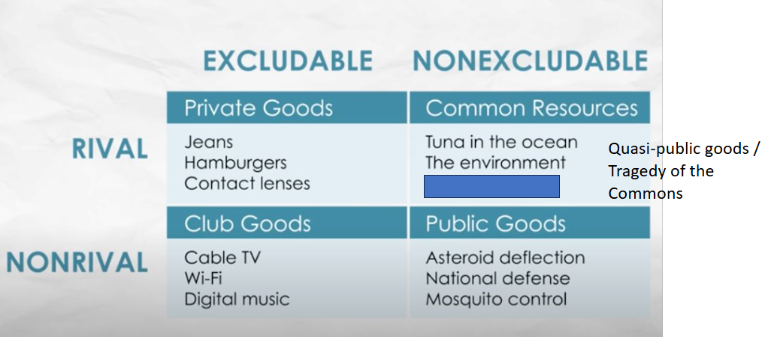

Excludable

easy or possible to exclude people who are not willing to pay to use certain goods (e.g. you use an iphone and now there’s one less iphone for someone else to use)

non-excludable

difficult or impossible to exclude people who are not willing to pay to use certain goods (e.g services provided by a lighthouse), easy to have free-riders

non-rival

Consumption of it will not reduce other’s consumption e.g. national defence, street lamps

rivalry

Consumption of it will reduce the consumption of others e.g. iphone

goods classification table

Tragedy of the commons

individuals, acting in self-interest, overuse a shared resource with the result that it is depleted (used up) and degraded (damaged) e.g. fish pond issue

A …… good is a near-public good. Usually, it is … but will become rival up to a certain limit.

quasi-public, non-excludable

Public goods are … and non-rival. They cause complete market failure due to the problem of … …..

non-excludable, missing markets

Club goods are … because the… … of an additional viewer is very small. e.g. Netflix

non-rival, marginal cost

Technology and the changing nature of public goods

Advances in tech → blur of distinction between public and private good, can change a good from excludable → non-excludable, open source / creative commons movement has made much info public good nature

example of tech changing nature of public goods

Non-excludable -> excludable: e.g. encryption allows suppliers to exclude non-payers from watching Netflix

Non-excludable -> excludable: e.g. smart metering used in road pricing

Externalities

Impacts on ‘third parties’ i.e. people not directly involved in the market transaction or spill-over effects from production and/or consumption to third parties (no compensation is paid)

Externalities exist when …

there is a divergence between private and social costs and benefits.

Private costs

costs faced by the producer or consumer directly involved in a transaction e.g. raw material cost, labour cost

External costs

costs imposed on third parties who are not directly involved (synonym for negative externalities)

Social cost

private costs + external costs

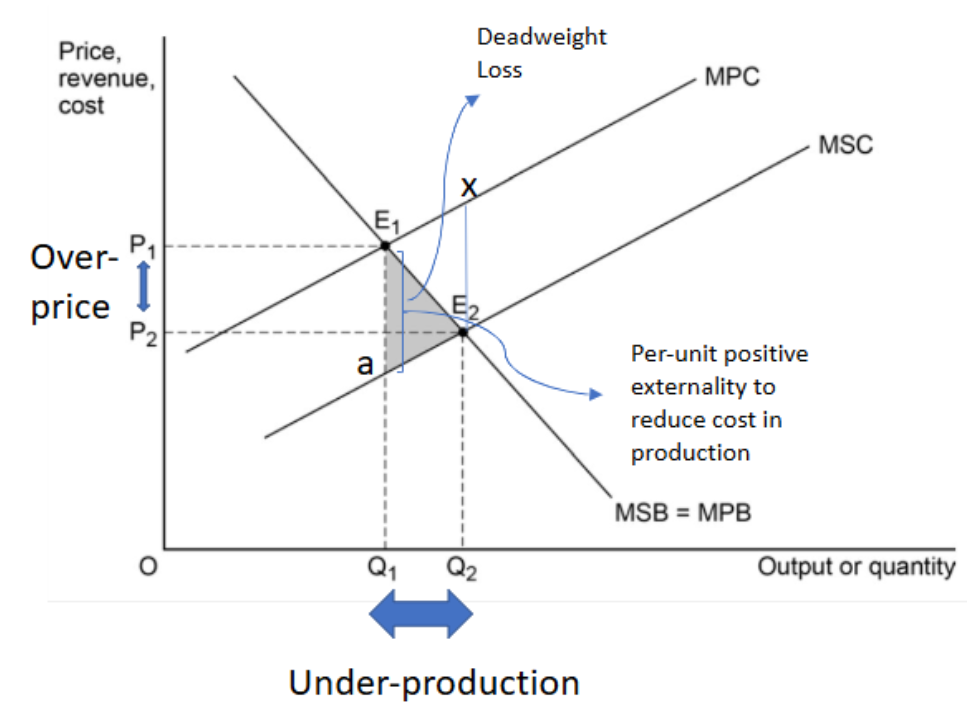

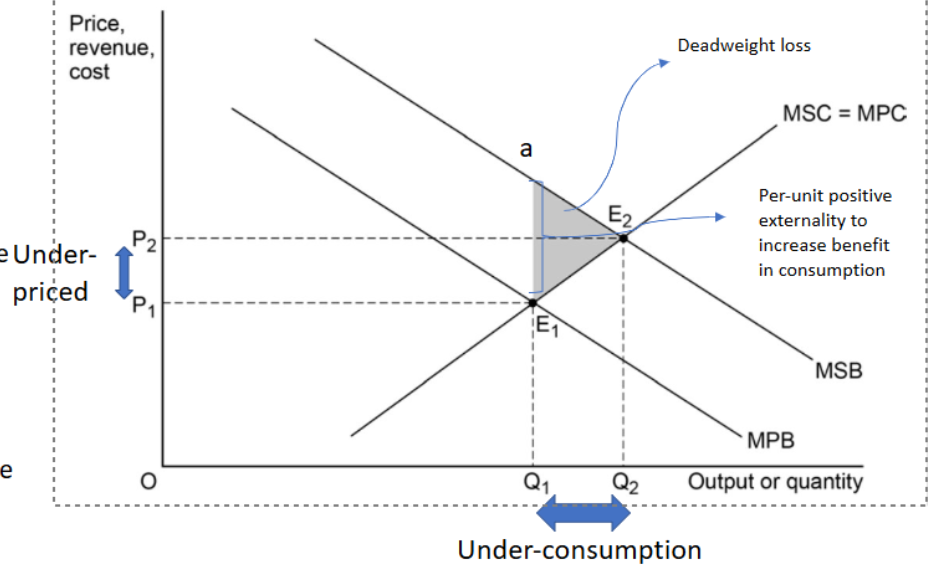

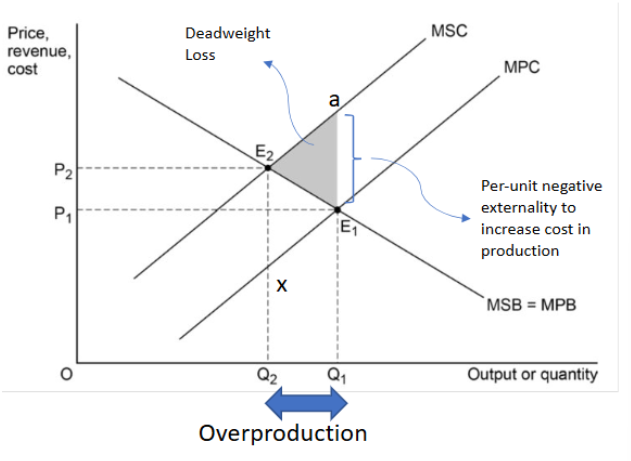

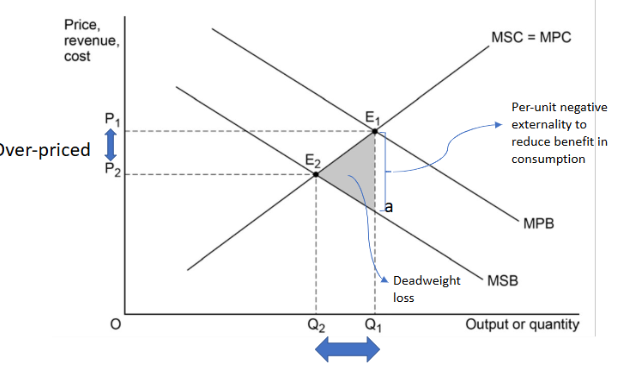

Externalities graph explanation

Marginal private benefit/marginal private benefit curve = demand curve

MPB = MSB bc no external (negative) benefits

Marginal private cost = original supply curve

Does not take externalities into account

Marginal social cost = social supply curve

Considering private and social costs

Negative externalities are likely to result in …production and that positive externalities are likely to result in ….production.

over, under

Why the absence of property rights leads to externalities in both production and consumption and hence market failure.

Markets = inefficient where there are no property rights.

e.g. impossible to establish property rights on goods such as sea water and air. → free-riders can have unlimited access → exploitation of the good. The moral hazard assumes someone else will pay the consequences for a poor choice.

For example, some people might litter the street if they think that other people will clear up after them. Scarce resources could be over-used or exploited. For example, rainforests are depleting and many species of fish are becoming endangered. This is because the environment cannot be protected by applying property rights

Free market economy flow diagram

Negative externalities

Social cost > private cost of production, or when private benefit > social benefit of consumption

Positive externalities

Social cost < private cost of production, or when private benefit < social benefit of consumption

Positive externality production (graph + eg)

building an airport, inventing the WWW, constructing 5G network

Positive externality consumption (graph + eg)

Health programmes e.g. NHS services, public libraries, museums, free school meals

Negative externality in production (graph + eg)

air pollution from factories, pollution from fertilisers, noise pollution, collapsing fish stocks

Negative externality in consumption (graph + eg)

traffic congestion, impact of addiction on families, litter from tourists

under-provision of merit goods and over-provision of demerit goods may also result from … …

imperfect information

Solutions to tackle market failure

Subsidies and taxes, pollution permit, regulation and standards, public goods provision, price controls, nationalisation, behavioural approach

Indirect taxes are used to solve (2)

negative externality in consumption, negative externality in production

Subsidies are used to solve (2)

positive externality in production and consumption

Information failure

Occurs when people have inaccurate, incomplete, uncertain or misunderstood data and so make potentially ‘wrong’ or sub-optimal choices

Causes of information gaps (IMULCH)

Inaccurate information, Misunderstanding the true costs/benefits, Uncertainty about costs and benefits, Lack of awareness, Complex information, Habitual purchase

Asymmetric information

an imbalance in information between buyer and seller which can distort choices

Asymmetric information examples

car insurance companies, used-car seller, landlords

Moral hazard (def + eg)

When one party, after entering into a contract or agreement, has an incentive to take risks because they do not bear the full consequences of their actions. Form of asymmetric information

e.g. health insurance

Adverse selection is due to … … and it happens when…

information failure, one party takes advantage of having more information before a transaction takes place, leading to inefficient or undesirable outcomes. I.e. the selection process is “adverse” because it causes only the least desirable participants to engage in the market, leading to market failure or inefficiency

Example of adverse selection

Insurance market, used car market (“Lemon Problem”)

Monopoly and monopoly power leading to market failure

Low Ped -> profits can be increased by restricting Q and elevating P

Higher profit -> may allow greater dynamic efficiency gains

In reality, any abuse of monopoly power may be limited by the actions of the regulatory authorities and competition from international firms

Some may achieve E of S-> ability to decrease price bc lower AC

X-inefficiency -> lower quality

e.g. Thames Water

Factor immobility

causes market failure bc resources unable to move quickly and without cost in response to factor price signals and incentives. One of the functions of the price mechanism has broken down → immobile FoPs lead to market failure

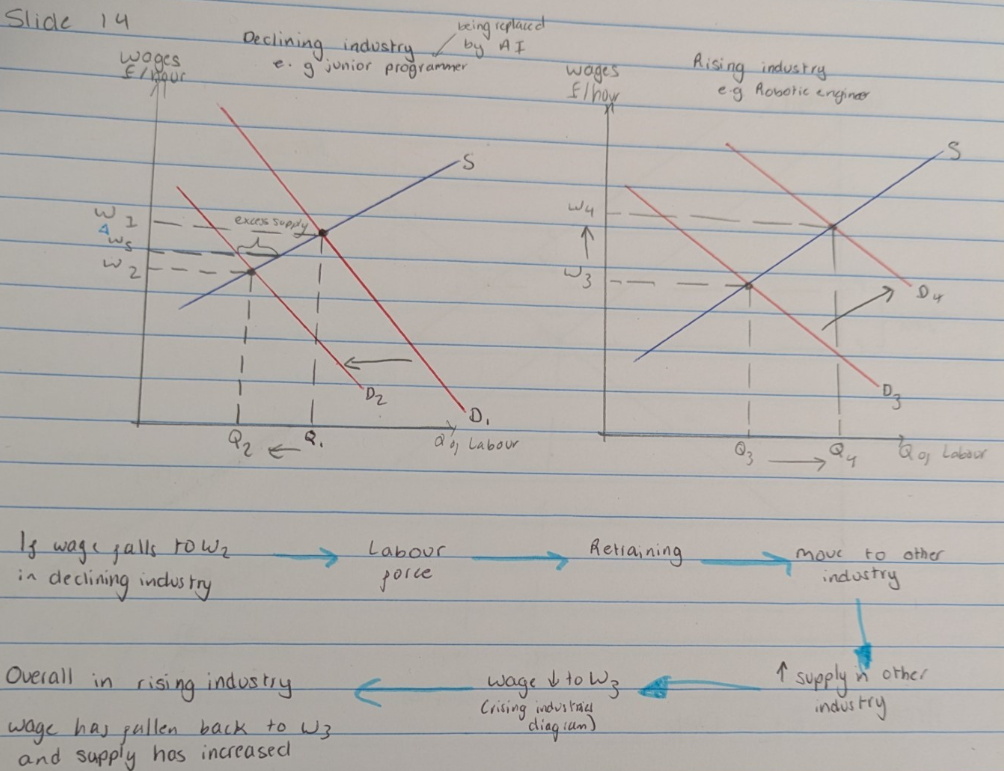

Occupational immobility

Exists when there are barriers to the mobility of FoPs between different sectors of the economy, leading to these factors being unemployed or used in ways that are not efficient

Occupational immobility leads to a problem called … …. due to declining industry which leads to a … of scarce resources and represents market failure. It is related to ….

structural unemployment, waste, skills

Geographical immobility refers to… for example…

barriers to people moving from one area to another to find work, family ties, transport costs, financial costs, migration controls

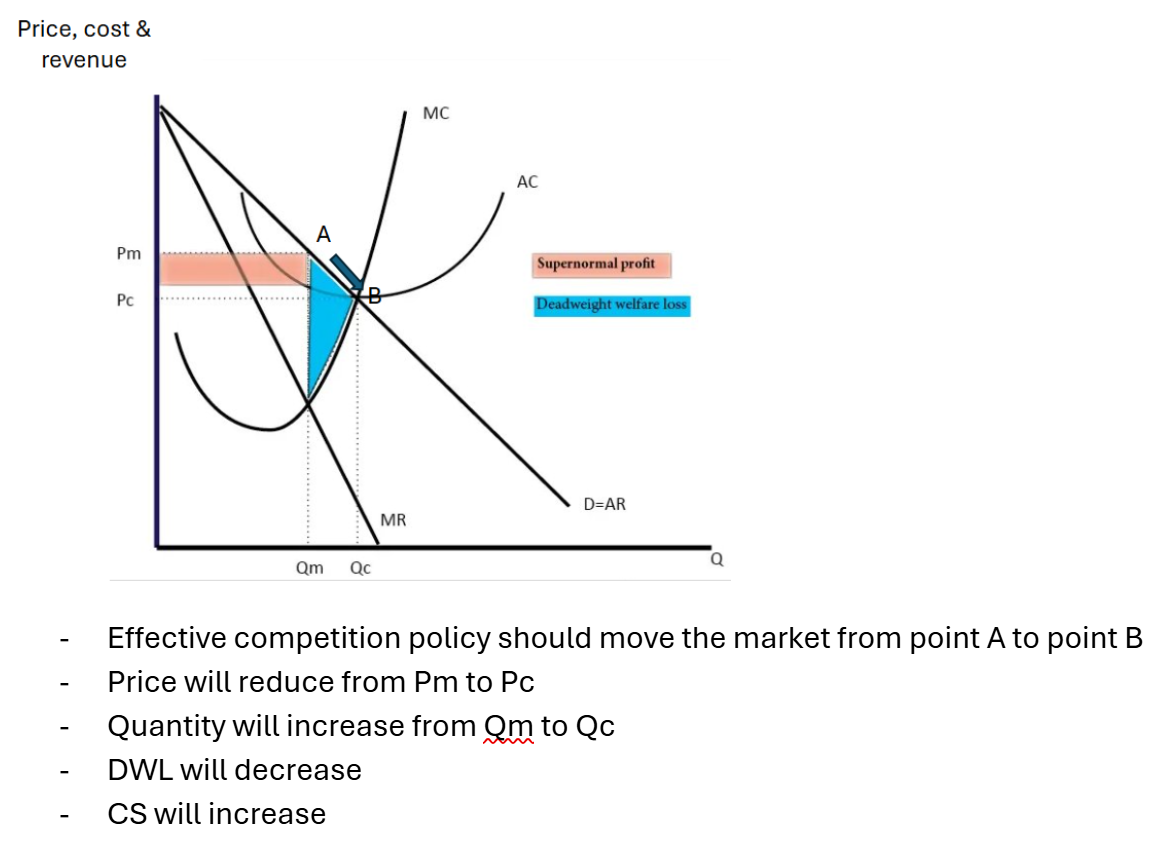

Competition policy (def + objective)

Government measures designed to promote competition and prevent anti-competitive behaviour in markets

Objective: ensure markets remain competitive, benefiting consumers through lower prices, better quality, innovation, and efficiency

Reasons for competition policy (PEEEP)

Protecting customers

Encouraging innovation

Ensuring fair market access

Enhancing economic efficiency

Preventing market failures

Impact of competition policy diagram

Market imperfections diagram and cycle

Monopoly power by market share %

Market share of 25%+

can be investigate for anti-competitive behaviour

no automatic dominance, but may face CMA scrutiny

Market share of 40%+

firm likely to be dominant

increased risk of intervention

Market share of 50%+

presumed dominanced; firm justify its actions

high risk of being fined for abusing monopoly power

Competition and Markets Authority (CMA)

UK government body that investigates and prevents monopolistic behaviour

Types of monopoly abuse

excessive pricing

predatory pricing

limit pricing

tying and bundling

Anti-competitive practices

collusion, price fixing, market sharing, bid-rigging, cartels

Advantages of competition policy

✅ Protects consumers from unfair pricing.

✅ Encourages innovation and dynamic efficiency.

✅ Promotes productive efficiency and lower costs.

✅ Prevents the exploitation of monopoly power.

✅ Reduces collusion and unfair practices.

Disadvantages of competition policy

❌ Regulatory enforcement is costly and time-consuming.

❌ Risk of government failure if intervention is excessive.

❌ Difficulties in detecting and proving collusion.

❌ Mergers can have efficiency benefits (economies of scale).

❌ Market forces may naturally correct anti-competitive behaviour over time.

Nationalisation

private sector assets sold to the public sector

Nationalisation examples

Coal industry

Nationalised, 1947 with the establishment of the National Coal Board

Part of the post-WWII Labour gov’s broader strategy to take control of the major industries.

Coal mines were seen as essential for Britain’s recovery and future development

Railways

Nationalised, 1948, becoming British Railways under the control of the British Transport Commission

Aimed to consolidate the UK’s fragmented and financially struggling railway companies into a more efficient and publicly owned network

Steel industry

Nationalised, 1949 under the Iron and Steel Corporation of Great Britain

Later denationalised, but was renationalised in 1967

Global financial crisis, 2008/9 nationalisation examples

Northern Rock, 1st UK bank to be nationalised in Feb 2008, sold and split into different parts: Virgin Money – 2011, gov sold Northern Rock to Virgin Money for approx £747 mil

Lloyds Banking Group (LBG)

UK gov initially took a 43% stake in LBG in 2009 after Lloyds merged with the struggling HBOS → This injected liquidity (cash) into the bank

Stake increased to 65%

Over time, gov gradually sold off its shares, and by 2017, Lloyds fully returned to private ownership

Royal Bank of Scotland (RBS) - Now NatWest Group

2008, UK gov acquired a 68% stake in RBS, later increasing to 84% at its peak

RBS underwent significant restructuring, including asset sales and cost-cutting measures.

The government began selling its stake in stages, gradually reducing its holding.

As of 2023, the Treasury's ownership had decreased to less than 40%, with continued plans for full privatisation.

Arguments for state ownership (nationalisation)

target social objectives rather than profit max, firms charge lower P, natural monopolies = gain in productive efficiency, used as vehicle to hit macroeconomic aims e.g. keep stability of financial system

Arguments against state ownership (nationalisation)

Prioritisation of political motives, lack of competition = X-inefficiency, nationalised firms = Diseconomies of scale, Losses of state-owned firms absorbed by tax payers and can lead to higher budget deficits

Privatisation and deregulation examples

Before privatisation (pre-1986)

British Gas was only gas supplier

Electricity controlled by gov through the Central Electricity Generating Board (CEGB) and regional electricity boards

Privatisation (1986-90s)

British Gas privatised in 1986, but remained a monopoly

Electricity companies privatised in 1990, breaking up CEGB into separate generation, distribution, and supply companies

Deregulation (1990s-2000s)

Gov removed restrictions so new private firms could enter and compete

By 1998-99, full competition introduced, allowing households to choose their energy supplier instead of being tied to one company

Companies like Octopus Energy, Ovo Energy, and Bulb later emerged as competitors

Arguments for privatisation and deregulation

Increases efficiency and innovation, encourages competition and lower Ps, reduces gov spending + debt, improves consumer choice and service quality

Arguments for privatisation and deregulation

loss of public control and accountability, job losses and worsening worker conditions, monopoly power and exploitation of consumers, essential services may be underserved

Privatisation and deregulation evaluation

Impact depends on no. firms entering industry

form of privatisation used determines whether revenue or costs to gov

size of newly privatised firm determines Eos benefits or losses

may be consumer inertia that stops consumers switching supplies

Liberalisation

Opening up of a market for competition

More often used when a country opens its markets to foreign competition

e.g. if UK sign a trade deal with another country (e.g. Japan) reducing the tariff imposed on that country’s goods. Allows more competition from that country's goods

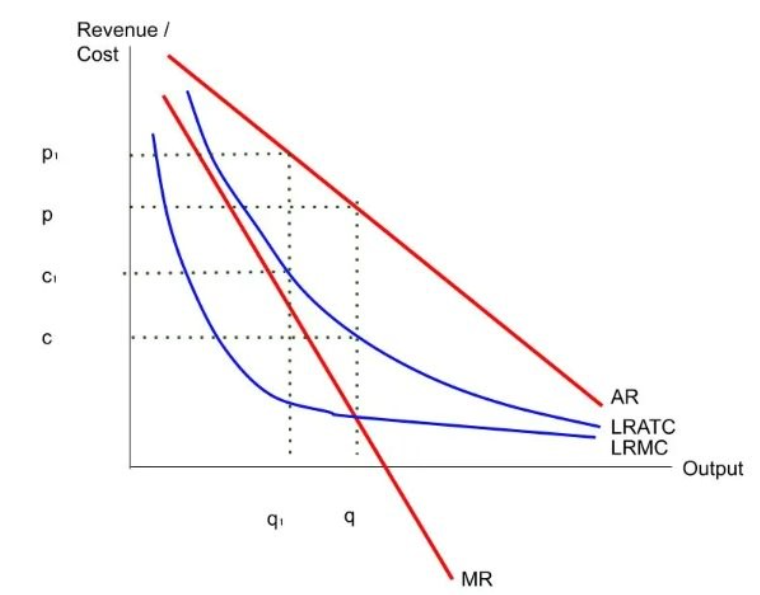

Natural monopoly

High fixed costs – average fixed costs

Shows why a larger firm may be more beneficial than a smaller firm

Suppose the nationalised firm is larger than the privatised firm.

The nationalised firm can exploit the economies of scale.

Produces at lower long-run average cost c.

If, instead, the private firm produces the good, it produces at a higher LRATC at c1

Relevant diagram in nationalisation and privatisation

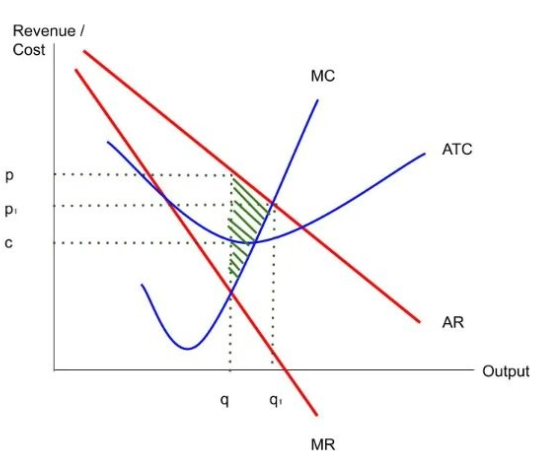

Monopoly diagram

Label supernormal profit

Shows monopoly private outcome vs allocatively efficient gov outcome.

Also references dynamic efficiency of private monopoly.

Private firm may produce at (q,p) to profit max, where MC=MR.

But nationalised firm may produce at (q1,p1), allocatively efficient outcome where MC=AR.

This leads to a welfare gain shown by the shaded area.

Alternatively, the private firm is likely to be dynamically efficient. Its supernormal profits are (p-c)q. So the private firm can reinvest more in the quality and in reducing costs.

The problem of regulatory capture

when regulators start acting in the interests of the company, due to impartial information, rather than in consumer interests.

Laissez faire economics

In free system, gov take view that markets are best suited to allocating scarce resources and allow the market forces of supply and demand to set prices

Role of gov = protect property rights, uphold the rule of law, maintain value of currency

Forms of gov intervention

Regulations

Taxes

Subsidies (to either consumer or producer)

Max and min prices to change price signals (so price increase/decrease to change behaviour of consumption) - depends on Ped of good

Better information or direct provision to change resource allocation

CSR

Corporate social responsibility, firm can try to do something to benefit society along with producing their profits

Helps corporate image

Shows that firms can redistribute income

Fiscal policy (change in gov spending and change in taxation, budget balance)

indirect taxes, subsidies (to consumers), tax relief, changes to taxation and welfare payments

stakeholder

any person or organisation that has an interest in a specific project or policy decision