Chapter 10 - Economic Growth, the Financial System, and Business Cycles

0.0(0)

0.0(0)

Card Sorting

1/94

There's no tags or description

Looks like no tags are added yet.

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

95 Terms

1

New cards

Long-run economic growth is

the process by which productivity increases the average standard of living

2

New cards

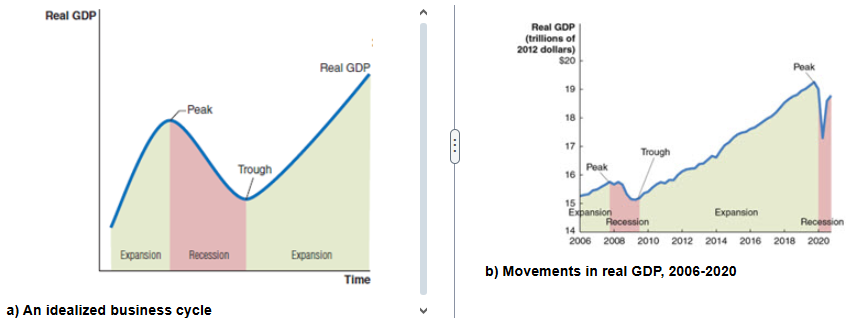

Business cycle

the alternating periods of economic expansion and economic recession

3

New cards

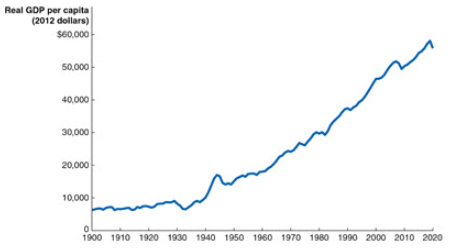

Real GDP per capita

the amount of production in the economy, per person, adjusted for changes in the price level

4

New cards

Economic prosperity and health go hand in hand

richer nations can devote more resources to improving the health of their citizens, and healthier citizens are more productive

5

New cards

Another important measure of our improvement is

the increase in our lifespans

6

New cards

A good measure of economic prosperity is

the amount of time we can spend on leisure

7

New cards

As our lifespans grow

we can spend more time on leisure; and also as we grow more productive, we can devote less time to work, and hence more leisure

8

New cards

Calculate the growth rate (percentage change). In 2021 Real GDP was $21.4 trillion and in 2022 Real GDP was $21.8 trillion.

( ($21.8 trillion - $21.4 trillion) ÷ ($21.4 trillion) ) × 100 = 1.9% Remember ( ( current year - base year) ÷ base year) × 100 = percentage change

9

New cards

Calculate the growth rate over a few years. In 2020: real GDP growth -2.2%. In 2021: real GDP growth 5.8%. In 2022: real GDP growth 1.9%. So, the average annual growth rate over this three year period was?

(-2.2% + 5.8% + 1.9%) ÷ 3 = 1.8%

10

New cards

(Growth rates over longer periods) Rule of 70 can help us determine how long it will take for an economic variable to double:

Number of years to double = 70 ÷ growth rate

11

New cards

Apply Rule of 70. If the growth rate is 5 percent, the variable will double in

70 ÷ 5 = 14 years

12

New cards

Increases in real GDP per capita rely on increases in

labor productivity

13

New cards

What is labor productivity?

The quantity of goods and services that can be produced by one worker or by one hour of work

14

New cards

Why can the average American consume more than nine times as many good and services now than in 1900?

Because the average American produces more than nine times as many goods and services in an hour now than in 1900.

15

New cards

Use the graph to help determine which one of the following statements is true:

The average American in the year 2020 could buy more than eight times as many goods and services as the average American in the year 1900.

16

New cards

What are factors that affect labor productivity growth?

Increases in capital per hour worked, technological change, and property rights

17

New cards

Property rights

A market system can't function unless right to private property are secure. Governments can aid growth by establishing independent court systems to enforce contracts between private individuals.

18

New cards

Technological change

improvements in capital or methods to combine inputs into outputs (new tech) allowing workers to produce more. The role of entrepreneurs here is critical in pioneering new ways to being together the factors or production to produce better, lower cost products

19

New cards

Increases in capital per hour worked

capital is physical assets and intellectual property that are used to produce other goods and services. The more capital a worker has the more productive they'll be.

20

New cards

Potential GDP is

the level of real GDP attained when all firms are operating at capacity. Capacity refers to "normal" hours and sized workforce

21

New cards

What happens when the labor force expands, a nation acquires more capital stock or when new technologies are created?

the Potential GDP rises

22

New cards

Retained earnings

reinvesting profits back into the firm

23

New cards

Firms can finance some of their own expansion through

retained earnings, often firms want to obtain more funds for expansion than are available in this way

24

New cards

How do firms obtain retained earnings?

via the financial system

25

New cards

What is the financial system?

the system of financial markets and financial intermediaries through which firms acquire funds from households

26

New cards

Financial markets are

markets where financial securities, such as stocks and bonds, are bought and sold

27

New cards

What is Financial security

a document (sometimes electronic) stating the terms under which funds pass from the buyer of the security to the seller

28

New cards

What is a stock?

a financial security representing partial ownership of a firm

29

New cards

What is a Bond?

a financial security promising to repay a fixed amount of funds…essentially a loan from a household to a firm

30

New cards

Financial intermediaries are

firms, such as banks, mutual funds, pension funds, and insurance companies, that borrow funds from savers and lend them to borrowers.

31

New cards

Risk sharing

by allowing investors to spread their money over many different assets, investors can reduce their risk while maintaining a high expected return on their investment

32

New cards

Liquidity

the financial system allows savers to quickly convert their investments into cash

33

New cards

Information

This aggregation of information makes funds flow to the right firms: the prices of financial securities represent the beliefs of other investors and financial intermediaries about the future revenue stream from holding those securities.

34

New cards

Recall that we can express the GDP of a nation (Y) as

the sum of consumption C, investment (I), government purchases (G), and net exports (NX)

35

New cards

The equation for the GDP of a nation is

Y = C + I + G + NX

36

New cards

The equation for a closed economy is

Y = C + I + G

37

New cards

The expression for investment spending by businesses is

I = Y - C - G

38

New cards

Savings is composed of

private savings (by households, S-private) and public savings (S-public)

39

New cards

Private saving or S-Private is

household income that is not spent

40

New cards

Private saving is equal to

Y - C - T

41

New cards

Private savings with transfers is equal to

Y + TR - C - T

42

New cards

Labor productivity is

The quantity of goods and services that can be produced by one worker or by one hour of work.

43

New cards

Increases in real GDP per capita depend on

increases in labor productivity

44

New cards

Labor productivity is affected by two factors:

Capital per hour worked and Technological change

45

New cards

Technological change refers to

the processes a firm uses to turn inputs into outputs of goods and services. Technological change is the increase in the quantity of output that firms can produce given a quantity of inputs.

46

New cards

Capital Hours Worked refers to

the manufactured goods that are used to produce other goods and services, such as computers, factory buildings, machine tools, and warehouses.

47

New cards

Which of the following does NOT lead to long-run economic growth?

increase in average wages

48

New cards

Which of the following do lead to economic growth?

Increase in the capital stock, technological change, improved labor productivity

49

New cards

Long-run economic growth is

the process by which rising productivity increases the average standard of living

50

New cards

Potential GDP

increases over time as technological change occurs AND increases over time as the labor force grows.

51

New cards

A firm's capacity is measured by

its production during normal business hours. This changes as the economy experiences long-run growth.

52

New cards

Math Practice: Real GDP in 2006 = $11,567 and Real GDP in 2007 = $11,916. Assuming the population is constant over the two years, how many years will it take for real GDP per capita to double? (Rule of 70)

First find percentage change: ((11,916 - 11,567)÷11,567) × 100 = 3.0172% Now apply the rule of 70: 70 ÷ 3 = 23.3333….23.3 Years to double

53

New cards

Which of the following statements about real and potential GDP is true?

potential GDP increases every year (as technological change happens and labor force grows)

54

New cards

What other key services do financial intermediaries provide to savers and lenders?

allows savers to spread their money through investments, provides easy method of exchanging money or financial security, collect and communicate info about borrowers to savers

55

New cards

Market for loanable funds is

the interaction of borrowers and lenders that determines market interest rate and quantity of loanable funds exchanged

56

New cards

The demand for loanable funds is determined by the

willingness of firms to borrow money for investment spending

57

New cards

The supply of loanable funds is determined by the

willingness of households to save and the extent of government saving or dissaving.

58

New cards

Evaluate the statement: "Saving money is not lending. How can it be? When I save my money, I put it in a bank. I don't loan it out to someone else." The statement is

incorrect. The supply of loanable funds is determined by household saving

59

New cards

During expansions

inflation and employment increase.

60

New cards

During recessions

inflation and employment decrease.

61

New cards

Expansion: During a business cycle

spending by firms and households is strong. As sales increase, firms increase production and hire more workers. With spending strong, firms find it easier to raise prices.

62

New cards

Recession: A recession will often begin with

A decline in spending by firms on capital goods or by households on consumer durables leads to lower sales. As sales fall, firms cut production and lay off workers, causing rising unemployment and lower incomes. This further reduces spending, and during a recession, firms struggle to sell goods and are unlikely to raise prices.

63

New cards

What is the general relationship between the business cycle and unemployment and inflation?

During an expansion, unemployment falls and inflation increases.

64

New cards

During the expansion phase of the business cycle, production, employment, and income

increase

65

New cards

During the recession phase of the business cycle, production, employment, and income

decrease

66

New cards

Increasing importance of services and the declining importance of goods:

During a recession, households reduce purchases of durable goods more than they reduce purchases of services, such as medical care.

67

New cards

Unemployment insurance and government transfer programs are:

programs that make it possible for workers who lose their jobs during recessions to have higher incomes. As a result, they spend more than they would otherwise.

68

New cards

Government policies:

Arguably, policies, such as monetary policy (conducted by the Federal Reserve Bank) and fiscal policy (conducted by the federal government), have played a key role in stabilizing the economy.

69

New cards

Which of the following contribute(s) to shorter recessions, longer expansions, and less severe fluctuations in real GDP?

a service based economy, monetary policy, and social security benefits, fiscal policy,

70

New cards

Panel (a) shows an idealized business cycle. Panel (b) shows an actual business cycle by plotting fluctuations in real GDP during the period from 2006 to 2020. Use the graphs to help determine which one of the following statements is NOT true:

Inconsistent movements in real GDP around the business cycle peak can mean that the beginning and ending of a recession are clear-cut.

71

New cards

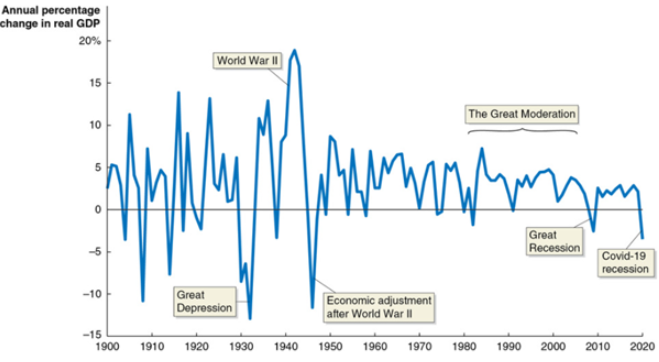

Use the graph to help determine which one of the following statements regarding fluctuations in real GDP is true:

In the first half of the twentieth century, real GDP had much more severe swings than in the second half of the twentieth century.

72

New cards

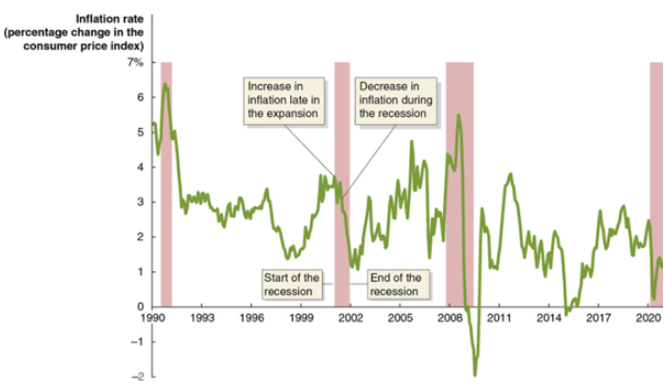

Use the graph to help determine which one of the following statements regarding inflation and business cycles is true. Note: The points on the figure represent the annual inflation rate measured by the change in the consumer price index (CPI) for the year ending in the indicated month.

Toward the end of the 1991-2001 expansion, the inflation rate began to rise.

73

New cards

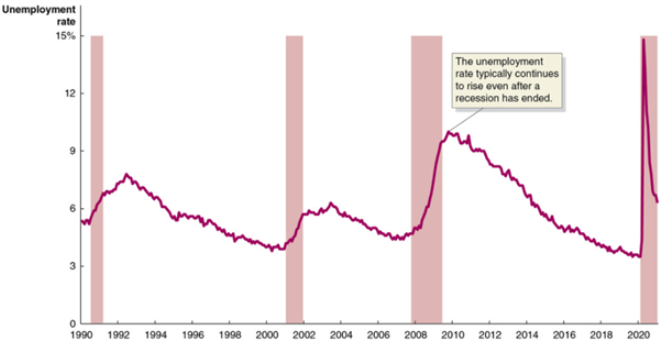

Use the graph to help determine which one of the following statements regarding unemployment and business cycles is true.

The unemployment rate usually continues to rise even after the recession has ended.

74

New cards

The computation of the average annual growth rate of real GDP

is more complex when examining data for a long period of time than when examining data for only a few years.

75

New cards

What is the best use of the rule of 70 among those listed below?

to judge how rapidly real GDP per capita is growing over long time periods

76

New cards

Which of the following changes does not cause an increase in the quantity of goods and services that can be produced by one worker, or in one hour of work?

an increase in the number of workers

77

New cards

Which of the following changes will ensure that an economy experiences sustained economic growth?

technological change

78

New cards

Potential GDP is

sometimes greater, sometimes less, and sometimes equal to actual real GDP.

79

New cards

Which of the following are financial securities that represent promises to repay a fixed amount of funds?

bonds

80

New cards

Which of the following is NOT a service that the financial system provides for savers and borrowers?

guaranteeing savers high rates of return

81

New cards

Which of the following equals the amount of public saving?

Government tax revenue minus the sum of government purchases and transfer payments to households.

82

New cards

A government that collects more in taxes than it spends experiences

a budget surplus.

83

New cards

In determining whether to borrow funds, firms compare the rate of return they expect to make on an investment with

the interest rate they must pay to borrow the necessary funds.

84

New cards

Which of the following factors determines the supply of loanable funds?

the willingness of households and governments to save

85

New cards

Holding all else constant, a federal government budget deficit will

decrease the supply of loanable funds and increase the equilibrium real interest rate.

86

New cards

From a trough to a peak, the economy goes through

the expansionary phase of the business cycle.

87

New cards

Typically, when will the National Bureau of Economic Research (NBER) announce that the economy is in a recession?

a year or more after the recession has begun

88

New cards

As the economy nears the end of an expansion, which of the following typically occurs?

Interest rates are usually rising, the profits of firms will be falling, and wages are usually rising faster than prices

89

New cards

Purchases of which types of goods are business cycles most likely to affect?

durable goods

90

New cards

Recessions cause the inflation rate to _________, and the unemployment rate to _________.

decrease; increase

91

New cards

Which of the following is NOT a reason that the economy is considered to have been more stable in the 1950-2007 period than in other periods?

continually falling oil prices

92

New cards

During the last half of the twentieth century, the U.S. economy experienced

long expansions, interrupted by relatively short recessions.

93

New cards

Long-run growth in GDP is determined by

capital, labor productivity, and technology.

94

New cards

Technological progress is affected by

entrepreneurship, private property rights, new software developments, investment capital

95

New cards

In a closed economy, the values for GDP, consumption spending, investment spending, transfer payments, and taxes are as follows: Y = $11 trillion, C = $8 trillion, I = $2 trillion, TR = $1 trillion, T = $2 trillion. Using the information above, what is the value of private saving and public saving?

Private saving equals $2 trillion and public saving equals $0 trillion.