4.1 - International Economics (Edexcel A-level Economics Theme 4)

1/150

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

151 Terms

What is globalisation?

Globalisation is the economic integration of different countries through increasing freedoms in the cross-border movement of people, goods/services, technology and finance

What are the main four characteristics of globalisation?

Increasing foreign ownership of companies

Increasing international trade

Increasing movement of labour and technology across borders

Easy flows of capital (finance) across borders

Specialisation

Factors Contributing to Globalisation in the Last 50 Years (5)

EOS due to containerisation

Ability for firms connect and promote internationally as a result of the internet and improvements to communications technology e.g Whatsapp

New trade agreements and promoting trade liberalisation, thus increasing international specialisation and the volume of trade

Growth in transnational corporations

Deregulation

Causes of globalisation (5)

Trade liberalisation

Trading blocs

Growth of MNCs

Technological advances

Greater mobility of labour and capital

OR

Improvement in IT/tech

Improvement in transport

trade lib

containerisation

Advantages of globalisation (8)

Reduction in absolute poverty

Lower prices due to more comp

Increased trade = greater choice = lower prices

Greater employment

Large economies of scale = lower prices

Free movement of labour and captial

Rising incomes

Rising levels of edu

Lower COP = low labour cost location

Gov tax reveneue collected from tarriff

Disadvantages of globalisation (5)

Growing inequality

Structural unemployment (shifting sectors as countries specialise)

Environmental costs e.g defores, less natural resources

Monoploy power of multinationals = EOS = lower prices cant compete

Increase in organised crime

Overdependence on imports/exports e.g Saudi reliant on oil ex which is 50% of gdp

Transfer pricing shift profit to low corp like ireland tax avoidance and gov misses out

What is the result of an increase in international trade?

Reduces prices

Increases the variety of goods/services available to a nation

Comparative advantage

A country should specialise in the goods and services it can produce at the lowest opportunity cost, and then trade with another country

Why would this be useful to a country? (3)

By specialising, the volume of production increases

Excess production can be exported

Goods/services which are not produced in the country can be imported

What are the assumptions of comparative advantage? (4)

Transport costs are zero: it does not account for moving the goods/services between countries. Depending on a nation's location this is more or less of a problem

There is perfect knowledge: each country knows what it has a comparative advantage in and also the comparative advantages of other countries

Factor substitution is easily achieved: economies can quickly adjust to changing global market conditions by switching from capital to labour - and vice versa

Constant costs of production: the theory does not take into account the economies of scale that can be achieved with an increase in output

Absolute advantage

When a country can produce a product using fewer factors of production than another country

Limitations to the theory of comparative advantage (4)

Over-dependence

Environmental damage

Distribution of Income

Structural unemployment

What is meant by over-dependence?

Specialisation creates a dependence on other countries which generates vulnerability e.g gas from Russia due to war

What is meant by environmental damage?

The impact of negative externalities of production is not considered by the theory and these can significantly worsen the quality of life in towns, cities and countries

What is meant by distribution of income?

The GDP/capita is likely to increase, however the distribution of the extra income is likely to be uneven with the wealthier sections of the population gaining more

What is meant by structural unemployment?

As countries specialise certain industries are likely to shut down resulting in unemployment for some workers. These workers may not be able to move into other occupations and if so the number of long-term unemployed will rise

Specialisation

When a worker, firm, region or country produces a narrow range of goods and services

Advantages of specialisation (6)

Lower prices

Greater variety of goods/services

More competition leads to better quality products

Economies of scale create efficiencies

Higher economic growth

Improved living standards

Disadvantages of specialisation and trade (8)

Global Monopolies Emerge

Exposure to external shocks

Deficit on the Current Account of the Balance of Payments

Unemployment

Dumping due to illegal Government support

Challenges for Developing Countries

Over-specialisation in developing economies

Loss of sovereignty and culture

What is meant by Global Monopolies Emerge?

As transnational firms grow in size and increase market power, they can dictate prices and output in many regions. They are also able to wield their influence to influence governments and gain access to raw materials through bribery and corruption

What is meant by Exposure to external shocks?

Shocks to other economies have a knock-on effect due to the interdependence that develops with trade e.g. the Russian war on Ukraine has created global shockwaves in the energy and grain markets

What is meant by Deficit on the Current Account of the Balance of Payments?

Some countries will import more than they export resulting in a deficit on the current account.

In developed countries, it is usually because incomes are high and they are importing to improve their standard of living.

In developing countries, this situation is usually as a result of a lack of global competitiveness and it is importing necessity products

What is meant by Unemployment?

Employment in successful industries will increase and employment in unsuccessful industries will decrease. Structural unemployment is a particular concern. Government supply-side policies make a significant difference to the length and severity of structural unemployment

What is meant by Dumping due to illegal Government support?

Some governments support key industries to ensure they are globally competitive e.g subsidies which encourage excess production. This excess production is then dumped on world markets at low prices e.g US subisiding US farmers

What is meant by Challenges for Developing Countries?

Start-up firms in developing countries (infant industries) find it harder to compete due to global competition.

Global monopolies also exert large amounts of pressure on developing countries through the use of monopsony power and transfer pricing

What is meant by Over-specialisation in developing economies?

Developing countries often lack the finance to develop a diversified product base and end up over-specialising in commodity products. This makes the country's GDP very dependent on the commodity prices

What is meant by Loss of sovereignty and culture?

With an increase in trade, languages and cultures have blended impacting on some indigenous languages and cultures. Countries have also lost some sovereignty as they are more easily influenced by dominant trading partners

What are the 4 factors that influence pattern of trade?

Comparative advantage: changes what countries produce and trade as they focus on different things

Impact of emerging economies: obtained a much higher share of the global business which means that other countries are losing out as trading relationships change

Growth of trading blocs and bilateral trading agreements: Trade creation and diversion

Changes in relative exchange rates: appreciating and depreciating will change cost of import and exports

What is meant by Terms of trade?

Refers to the ratio at which a country's exports are exchanged for imports.

The relative price of imports and exports can have a direct bearing on the standard of living within a country

Exporting goods which are highly priced results in higher incomes and the ability to buy cheaper imports

The terms of trade capture the relationship between the average prices of a country's exports and imports

terms of trade will deteriorate i.e. fewer imports can be bought with one unit of exports

Terms of trade equation

Index of average export prices/index of average import prices x 100

Factors influencing the terms of trade (3)

Relative inflation rates

Relative productivity rates

Changes in exchange rates

Cost of raw mats

Tariffs

Explain how inflation rates affect terms of trade

Inflation increases the price of goods/services within a country.

Exports become more costly and domestic firms become less competitive.

If the exports are price inelastic in demand this will improve the terms of trade, if elastic then it is likely to worsen the terms of trade

Explain how Relative productivity rates affect terms of trade

Improvements in productivity can lower costs and these can be passed on in the form of lower prices.

Lower prices for export products will mean that the terms of trade will deteriorate i.e. fewer imports can be bought with one unit of exports

Explain how affect Changes in exchange rates terms of trade

Exchange rates constantly change the price of exports and imports.

If prices change then the terms of trade between the two countries change.

Impact of Changes in the Terms of Trade? (6)

Depending on the contribution that net exports make to GDP, changes to the terms of trade can have far reaching impacts on an economy. These include:

Changes to the current account balance in the Balance of Payments

Changes to national output (GDP)

Changes to unemployment levels

Changes to the level of international competitiveness

Changes to disposable income

Changes to standards of living

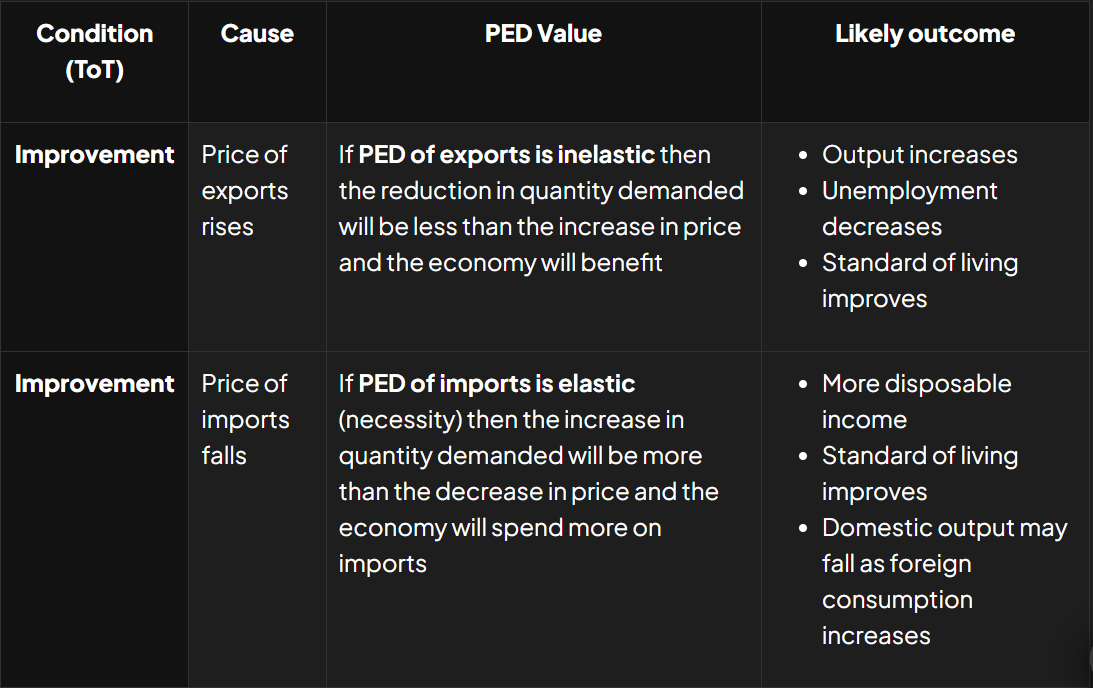

Why can you not assume that an improvement in the terms of trade is good and a deterioration is bad?

The impact of changes in the terms of trade (TOT) is nuanced and depends on the cause and price elasticity of demand (PED) for exports and imports.

While an improvement in TOT (e.g., higher export prices) allows a country to buy more imports with fewer exports, it may lead to a decline in export demand if foreign consumers buy less due to higher prices. The extent of this effect depends on the PED for exports, potentially reducing income and worsening living standards despite improved TOT.

Trading bloc

A trading bloc is a group of countries who come together and agree to reduce or eliminate any barriers to trade that exist between them

Free trade area

A free trade area is a bloc in which countries agree to abolish trade restrictions between themselves but maintain their own restrictions with other countries e.g Canada–United States–Mexico Agreement (CUSMA)

Customs union

Countries eliminate trade barriers between them but must set same external trade barriers on non member countries e.g. EU countries setting 10% tariff on cars

Common market

Similarly, to a customs union,

The European Union is a customs union and a common market

Trade barriers between member countries removed and have to set same common external trade barrier ALSO FOP can move around freely like the European single market

Monetary union

Members enjoy all of the benefits of a customs union and common market, but then also establish a common central bank which issues a common currency e.g. Euro and controls the monetary policy of member countries

No trade barriers

Common external barrier

Free movement of labour and capital

Common currency and central bank

What are the Essential Conditions for a Successful Monetary Union Such as the Eurozone? (4)

Movement of labour: Labour should be able to move freely without any major barriers e.g. language.

Mobility of finance: should be complete mobility of finance with prices and wages free to adjust based on market conditions.

Similar trade cycles: The trade cycles of member countries should be similar so as to avoid tensions with the union

Fiscal transfers: To maintain stability, there should be automatic fiscal transfers to countries that are performing poorly.

What are the benefits of regional trade agreements? (6)

Trade creation improves efficiency and generates higher income

Tariffs between member states are eliminated = trade creation = more goods imported = increased living standards

Common tariffs to third party countries simplify trading conditions

A monetary union simplifies trading costs and provides pricing transparency

Some member countries gain from improved monetary policy conditions e.g. European interest rates may well be lower than an individual country's rates would have been

There is less uncertainty surrounding exchange rates as members all use the same currency

Costs of regional trade agreements? (5)

Trade diversion occurs as countries reallocate trade to partners in their agreement. This may worsen global efficiency = e.g tariff bc of eu means that more expesnive to import from outisde meaning switch to high cost producers

Some domestic industries experience structural unemployment

Increased negative externalities of production, resource depletion and environmental damage

Transitioning to a monetary union can be expensive and firms may find it hard to adjust/change their menu prices

Member countries lose their ability to set interest rates and control the supply of money (monetary policy)

World Trade Organisation (WTO)

International organisation that regulates world trade & promote free trade

What is trade liberalisation?

Trade liberalisation is the process of rolling back the barriers to free trade e.g. removing tariffs

Role of the WTO in liberalising trade (2)

It brings countries together at conferences and encourages them to reduce or eliminate protectionist trade barriers between themselves e.g. The Doha Round conferences

It acts as an adjudicating body in trade disputes. Member countries can file a complaint if they believe a trading partner has violated a trade agreement. The WTO will then run a hearing and make a judgement

How WTO conflicts with trading blocs (3)

Regional trade agreements can be beneficial for member countries but may result in global inefficiency in the allocation of resources

Regional agreements often shift trade from a non-member who has comparative advantage, to a member who does not

Regional trade members then often institute common trade barriers on non-members which is the opposite of trade liberalisation (protectionism)

What does free trade aim to do?

Free trade aims to maximise global output based on the principle of comparative advantage

What is protectionism?

Government policies that restrict international trade to help domestic industries

What are the reasons for protectionism? (7)

Infant industries

Sunset industries

Strategic industries

Dumping

Employment

Current account deficit

Labour/environmental

Reasons for protectionism - Infant industries

To protect new firms that would be unlikely to succeed at start-up due to the level of global competition.

Once established support is removed

Reasons for protectionism - Sunset industries

Similar to above, but at the other end of the life cycle, these firms are on their way out and the government chooses to support them to help limit the economic damage that would occur if they closed abruptly

Reasons for protectionism - strategic industries

Industries such as energy, defence and agriculture are essential to self-sufficiency and security.

Being reliant on other countries for these creates vulnerabilities for a nation

Reasons for protectionism - Dumping

Dumping is anti-competitive and can harm a country's industries

Reasons for protectionism - Employment

When firms outsource production to other countries or certain industries are experiencing structural unemployment governments will step in to protect jobs

Reasons for protectionism - Current Account deficit

When imports > exports the amount of money leaving the country to support foreign firms is greater than that entering to support domestic firms.

Protectionism aims to correct this imbalance

Reasons for protectionism - Labour/environmental regulations

Many countries offer cheap labour and low-cost production due to poor environmental regulations.

Protectionism can help apply pressure to bring about change in these countries

What are the types of protectionism? (4)

Tariffs, subsidies, quotas and administrative barriers

What is a tariff + who pays it?

A tariff is a tax on imported goods/services (customs duty)

Domestic producers have to pay the traiff when importing

Raises COP for domestic firms

Passed on in form of higher prices

Higher prices may allow for increased output

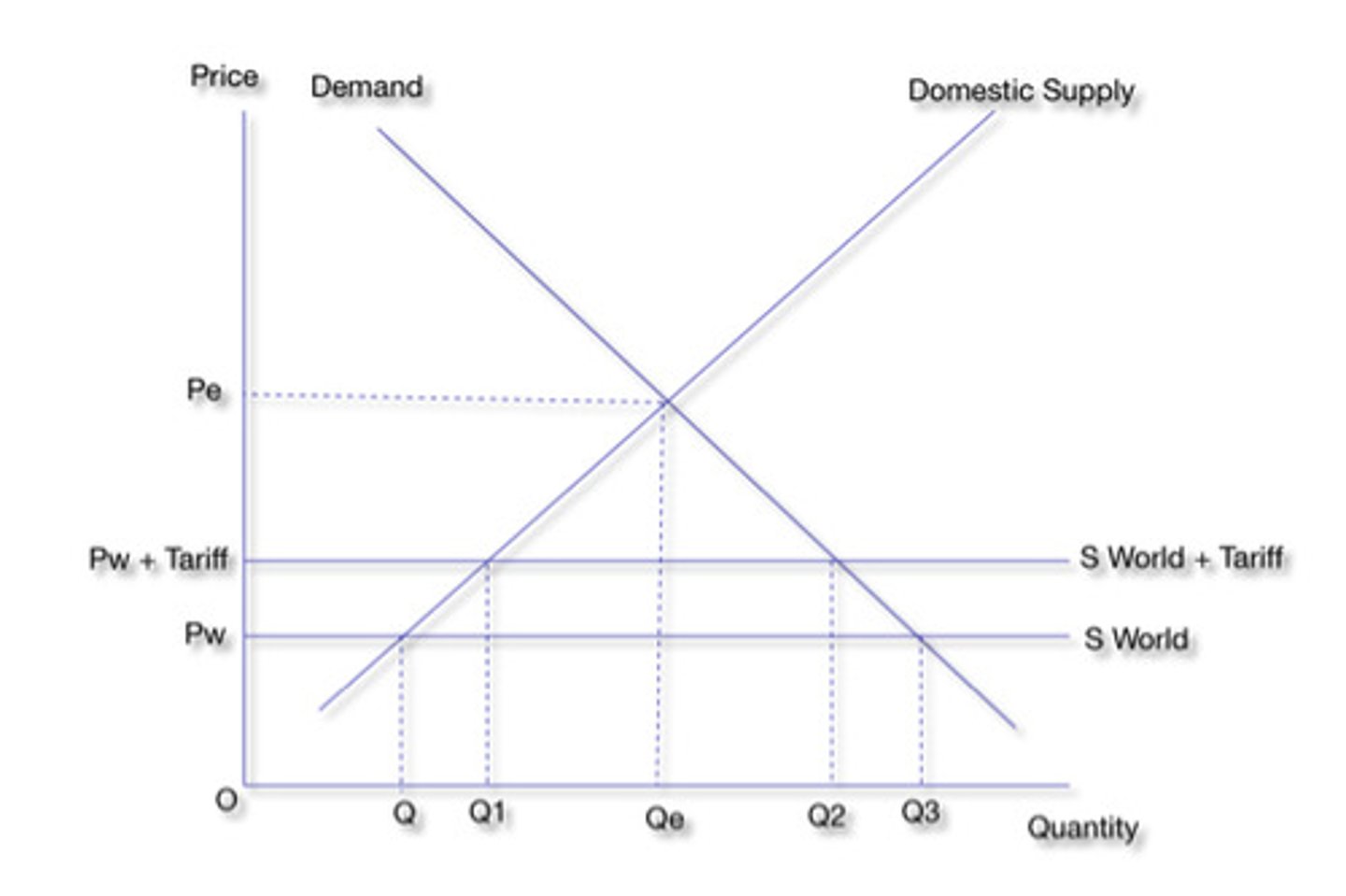

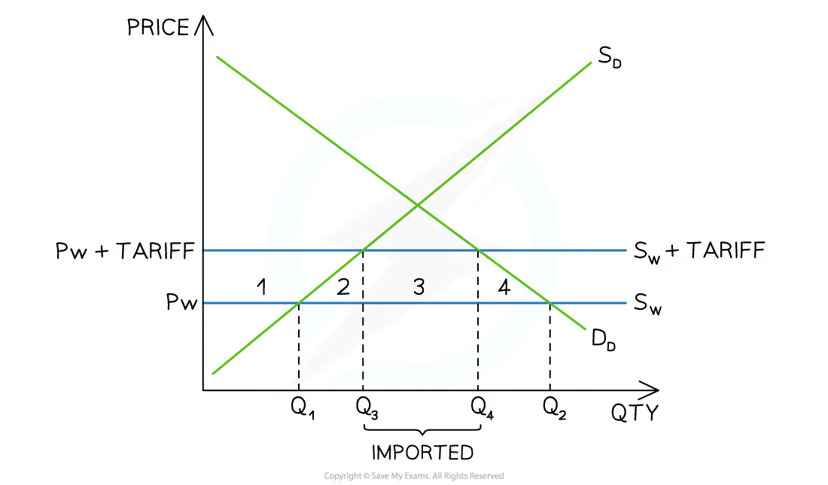

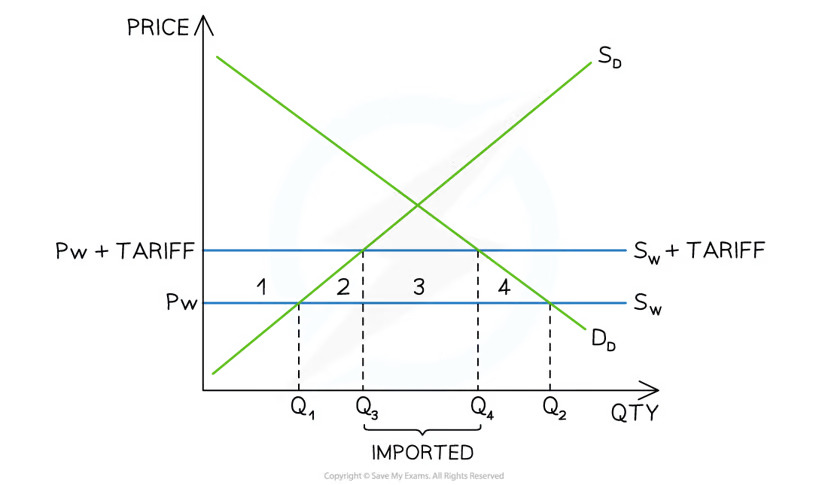

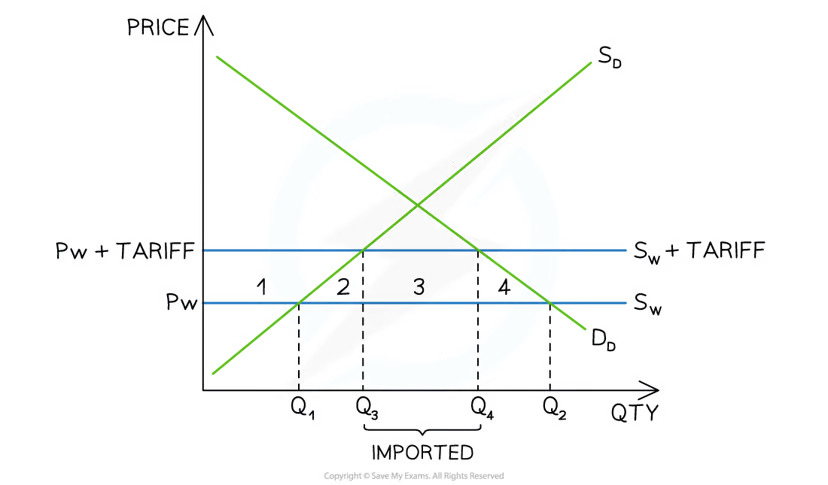

Describe

World supply (Ws) is considered to be infinite and this supply curve is added to the domestic demand (DD) and supply (SD) curves

The pre-tariff market equilibrium is seen at PwQ2

Domestic firms supply up to Q1 at a price of Pw

Foreign firms supply the difference equal to Q1Q2 at a price of Pw (imports)

After the tariff is imposed, the world price increases from Pw to Pw+ tariff

The new market equilibrium is seen at Pw+tariffQ4

Following the law of demand, the quantity demanded contracts from Q2 to Q4

Following the law of supply, the quantity supplied by domestic firms extends from Q1 to Q3

The level of imports is reduced from Q1Q2 to Q3Q4

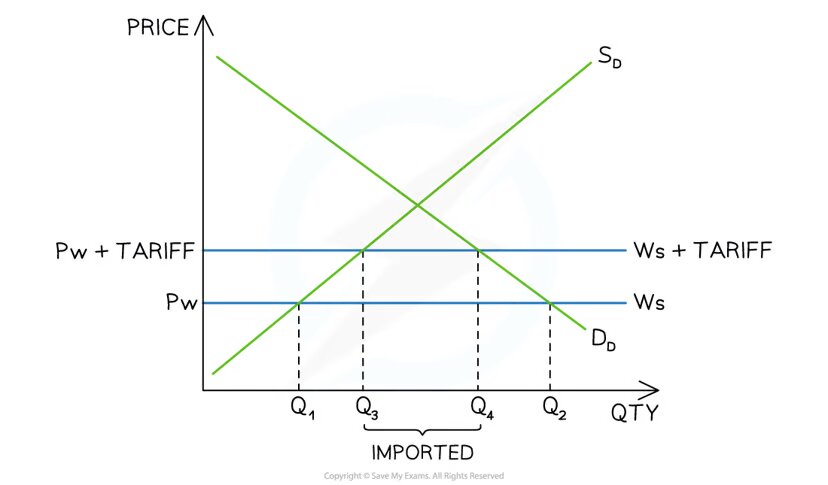

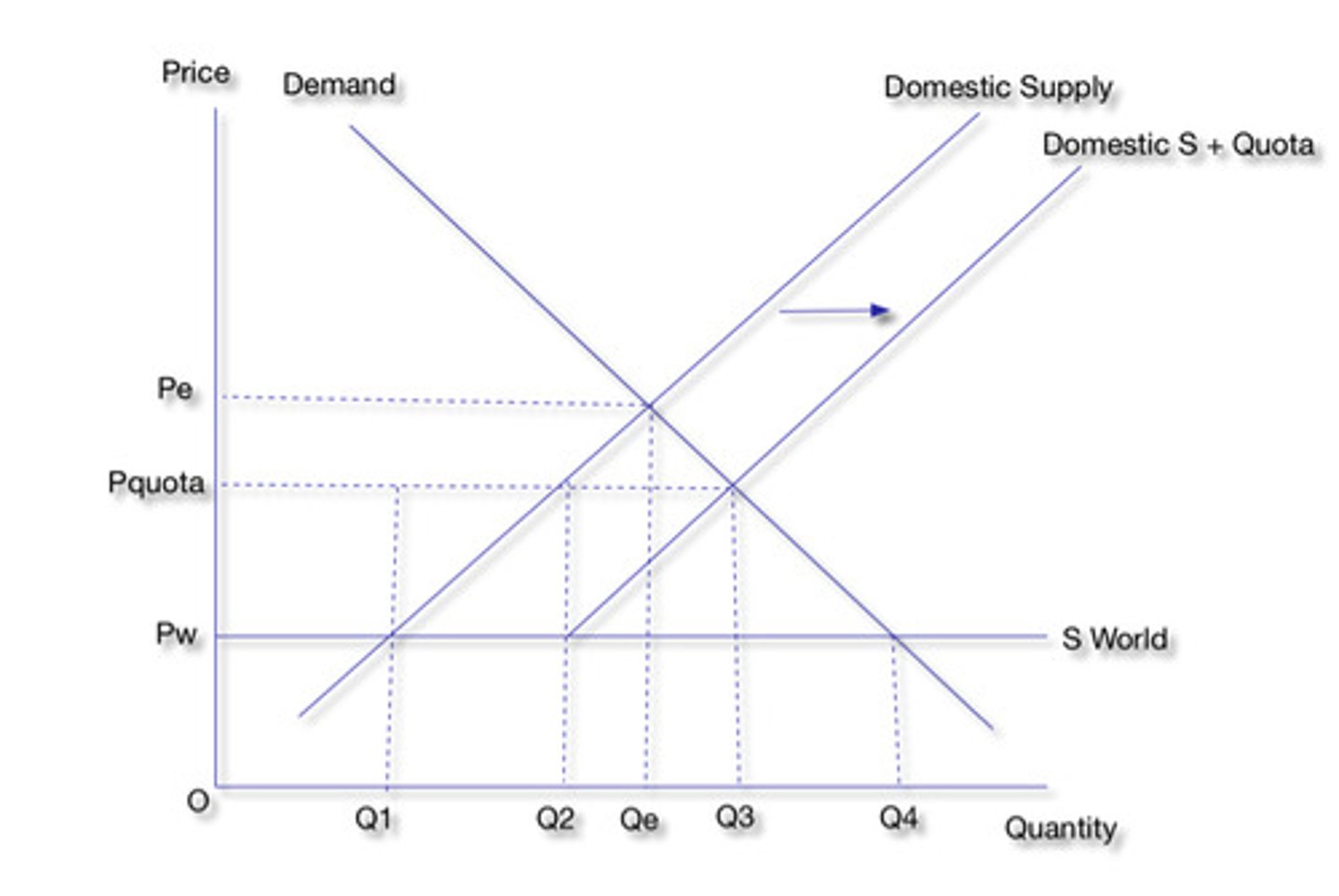

What is a Quota + who does it affect?

A quota is a physical limit on imports

This limit is usually set below the free market level of imports

As cheaper imports are limited, a quota raises the market price

As cheaper imports are limited a quota may create shortages

Some domestic firms benefit as they are able to supply more due to the lower level of imports

This may increase the level of employment for domestic firms

Impact/Aim of subsidies to domestic producers?

They can increase output and lower prices

With lower prices their goods/services are more competitive internationally

The level of exports increases

The increased output may result in increased domestic employment

Non-tariff barriers (4)

Health and safety regulations

Product specifications e.g. Canada specified that all jam imported into Canada needed to be in a certain size of jar.

Environmental regulations

Product labelling can be expensive for firms to apply and may limit their desire to sell into certain markets

Impact of tariff on domestic producers?

Before the tariff domestic producers produced output equal to 0Q1 and their revenue was equal to Pw X Q1

After the tariff was imposed domestic producers produced 0Q3 and their revenue was equal to Pw X Q3

Domestic producer surplus has increased by area 2

Impact of tariff on domestic consumers?

Before the tariff domestic consumers consumed Q2 products at a price of Pw

After the tariff domestic consumers consumed fewer products (Q4) at a higher price of Pw+tariff

Domestic consumer surplus has decreased by areas 1, 2, 3 and 4

Impact of tariff on government?

After the tariff is imposed the government receives tax revenue equal to ((Pw+tariff) - Pw) x (Q4-Q3) - area 3

Impact of tariff on standards of living?

The standards of living for consumers worsen as the value of their income is eroded as they are paying higher prices

Domestic firms who benefit from increased production may increase employees' wages

This would increase the standard of living for employees

Impact of tariff on equality?

Workers in industries that have been experiencing structural unemployment due to foreign competition will feel that the tariff results in them being treated more fairly

Impact of quotas on domestic producers? (3)

Increases their output

Raises the selling price

Increases their revenue

Impact of quotas on foreign producers? (2)

Decreases their output

Compared to a tariff, those firms who manage to export in the quota receive a higher price for their sales

Impact of quotas on consumers? (1)

Results in higher prices and less choice

Impact of quotas on government? (2)

They do not receive any tariff revenue (as there is no tariff)

They may receive higher tax revenue at the end of the financial year when domestic firms pay their corporation tax

Impact of quotas on standard of living (1)

Reduces for consumers as higher prices erode the purchasing power of their income

Impact of quotas on equality (1)

Improves for domestic firms but worsens for foreign firms

Impact of subsidies on domestic producers? (3)

Decreases costs of production

Increases output

Increases international competitiveness

Impact of subsidies on foreign producers? (1)

Makes it harder for them to compete with domestic firms

Impact of subsidies on consumers? (1)

Lowers prices

Impact of subsidies on government? (2)

This costs the government the amount of the subsidy

There is an opportunity cost associated with every subsidy provided

Impact of subsidies on standard of living? (1)

Improves for consumers as they benefit from lower prices - their income goes further

Impact of subsidies on equality? (1)

Domestic firms can compete more equally

Impact of non tariffs on domestic producers? (3)

Limits foreign competition

Protects levels of outputs

May increase selling price and revenue

Impact of non tariffs on foreign producers? (2)

Acts as a disincentive to sell into foreign markets

Costs of meeting the non-tariff barriers may significantly reduce profit margins

Impact of non tariffs on consumers? (1)

May reduce choice/variety in a market

Impact of non tariffs on government? (2)

They may lose some credibility with the WTO

Enforcing the non-tariff barriers may be difficult or expensive

Impact of non tariffs on standards of living? (2)

Less choice and higher prices erode standards of living

Product labelling information may improve decision making and quality of life

Impact of non tariffs on equality? (2)

May help improve equality e.g. environmental standards help create equal production inputs which results in equality in the costs of production

Balance of Payments

Measures the inflows and outflows of money into and out of a country/record of all the financial transactions that occur between it and the rest of the world

What are the two components of the current account?

The current account: all transactions related to goods/services along with payments related to the transfer of income

The financial and capital account: all transactions related to savings, investment and currency stabilisation

Capital account

The Capital Account records small capital flows between countries and is relatively inconsequential

E.g. debt forgiveness by the government towards developing countries

E.g. capital transfers by migrants as they emigrate and immigrate

What is the finanical account?

The Financial Account records the flow of all transactions associated with changes of ownership of the UK’s foreign financial assets and liabilities

Components of financial account (3)

FDI

Portfolio investment

Financial derivatives

Reserve Assets

What is meant by FDI?

Flows of money to purchase a controlling interest (10% or more) in a foreign firm. Money flowing in is recorded as a credit (+) and money flowing out is a debit (-)

What is meant by portolio investment?

Flows of money to purchase foreign company shares and debt securities (government and corporate bonds). Money flowing in is recorded as a credit (+) and money flowing out is a debit (-)

What is meant by financial derivatives?

Sophisticated financial instruments which investors use to speculate and return a profit. Money flowing in is recorded as a credit (+) and money flowing out is a debit (-)

What is meant by reserve assets?

Assets controlled by the Central Bank and available for use in achieving the goals of monetary policy. They include gold, foreign currency positions at the International Monetary Fund (IMF) and foreign exchange held by the Central Bank (USD, Euros etc.)

What is the formula for a current account balance?

Current account should balance with the capital and financial account and be equal to zero

If the current account balance is positive, then the capital/financial account balance is negative (and vice versa)

What happens if there is a current account deficit?

If there is a current account deficit, there must be a surplus in the capital and financial account

The excess spending on imports (current account deficit) has to be financed from money flowing into the country from the sale of assets (financial account surplus)