4.3 Govt Revenue

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

What is tax?

compulsory payment to govt by all ppl in economy

Why tax?

> Funds p__ expenditure

> Discourage using d__ goods (e.g. tobacco)

> Manage m__ (↓tax = ↑ppl spending power)

> R__ income (tax rich, give back to poor via welfare)

> Discourage spending on i__ (protects domestic firms)

public, demerit, macroeconomy, redistribute, imports

What makes a good tax?

o E__: should be f__

o N__-dis__: shouldn’t impact e__ behaviour (too high tax = why work?)

o C__: ppl should know w__ & how much tax is paid

o Co__: ez to pay & simple process

equity, fair, nondiscretionary, economic, certainty, when, convenience

Tax systems

1. D__ tax: tax on __ e.g. PAYE

direct, income

Direct tax

1. P__ tax system: ↑i__ = __(more/less) tax = ↓i__

progressive, income, more, inequality

Direct tax

1. R__ tax system: ↑i__ = __(more/less) tax = __(more/less) inequality

regressive, income, less, more

Direct tax

3. P__l tax system: s__ amt of tax on any amt of i__

proportional, same, income

Direct tax

> Adv: less i__

> Disadv: tax e__, __(more/less) work incentive

inequality, evasion, less

Tax systems

2. I__ tax: tax on __/s__ sold e.g. GST

> is r__ as ppl w/ lower i__ spend more of their $$ = can’t s__

indirect, goods/services, regressive, income, save

Indirect tax

1. E__ d__: tax on d__ goods

excise duty, demerit

Indirect tax

2. i__ t__: custom duties on value of i__ goods

> as price is __(higher/lower), ppl buy d__ goods instead

import tariffs, imported, higher, domestic

Indirect tax

3. U__ c__: tax on using s__ g__/service e.g. toll

user charges, specific, good

Indirect tax adv

> c__ & easy to collect

> e__ pays, even if retired e.g. GST

> can be used to t__ specific goods to encourage / l__ consumption

> f__ as rate can be changed easily

cheap, everybody, target, lower, flexible

Indirect tax disadv

> R__ (everybody pays same amt so poor pays more of their $$)

> i__ (as ↑price)

> Tax e__

> Hard to p__ revenue

regressive, inflationary, evasion, predict

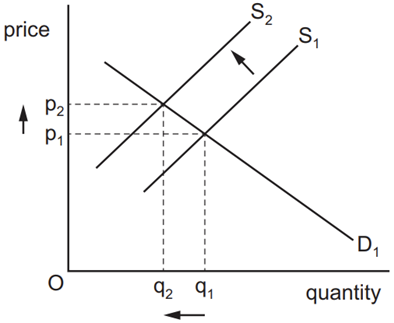

Effect of indirect tax

↑firm cost of p__

= ↑price

production