Lecture 2 (01/26/26) (The Bank of Japan Address)

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

What is the governor Uchida addressing in this speech?

The “broad perspective review” of Japan’s monetary policy over the last 25 years in combating deflation and avoiding zero lower bound (when interest rates drop to zero).

Why are we addressing this speech in class? What were the focus objectives during this lecture?

-Short-run demand factors

-Long-run productivity issues

-Role of expectations (Inflation, Prices)

What is important about the economy in the long run?

The economy is constrained by the supply of labor, capital, resources and the existing technology or full employment GDP= F(L,K, Resources; technology). However, the demand of agents in the economy is more important at any point in time (hence this speech).

How is demand divided? What impacts demand endogenously? (Important points about how demand shocks impact aggregate demand!)

Consumption is 40%, investment is 15%, government spending is 30% and Net exports (Exports minus Imports) are 15%.

Imports drain from domestic demand because domestic consumers use their income to buy foreign goods instead of domestic goods.

Government spending is goods and services purchased by the government not including transfers such as social security, snap benefits, unemployment insurance, etc.

Investment refers to the purchase of goods and services by firms to be used in production in the future

Buying stocks and bonds (called “investment in common usage”) is actually saving-abstaining from consumption in this framework

Why is this speech important to this class?

The exchange rate between the US and Japan is impacted by the events discussed in this speech. (Exchange rate is the rate in which traders will exchange one currency for another ex- 1 USD = 137 Yen).- In order to buy goods and services from another country, you must first purchase that country’s currency

-Most trade in currency occurs due to the desire to purchase financial assets in order countries

-Sometimes there is a trade in currency when purchasing goods and services- in that event, trade relies on the relative cost of said goods and services which includes the cost of currency- (if USD loses value relative to yen, then American consumers will be less willing to buy Japanese goods and services b/c they will be more expensive— and Japanese consumers will be more willing to buy American goods and services b/c it will be cheaper).

What is the comparative rate of return across countries?

The trade that occurs when traders want to purchase foreign financial assets (stocks or bonds)- that trade establishes some level of private standard between the two traders that can impact the market.

How does investment and net exports respond to the interest rate?

Investment and net exports decrease as the interest rate increases. This is because firms require borrowing to purchase new capital- when r rises it’s more expensive to borrow and investment falls as a result. For NX, when domestic R rises, domestic assets (stocks and bonds) become appealing to foreign and domestic traders— the value of domestic currency rises and exports fall (more expensive to foreign traders) while imports rise (less expensive to domestic traders).

Why is this case study significant to economic history?

Japan was the only country experiencing deflation after world war II and is the only rich country that wasn’t experiencing deflation any time before then.

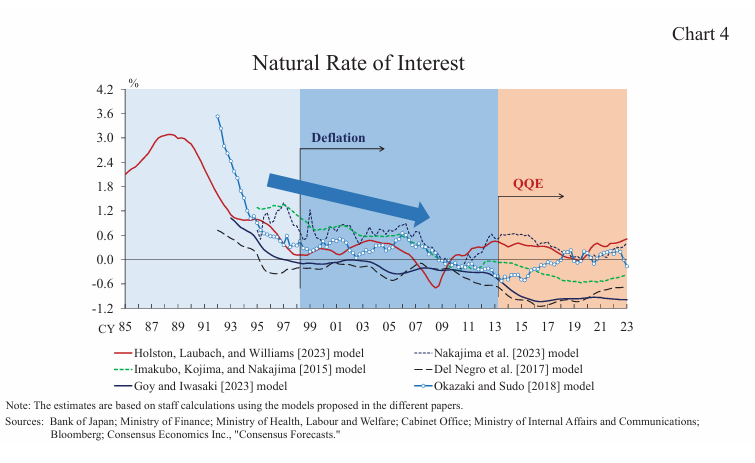

What is r*?

r* refers to the natural rate of interest, that is the theoretical real short-term interest rate that keeps the economy at full employment with stable inflation. It is also the interest rate that sets the unemployment rate equal to the natural rate of unemployment- that is unemployment that exists at equilibrium in a Keynesian model.

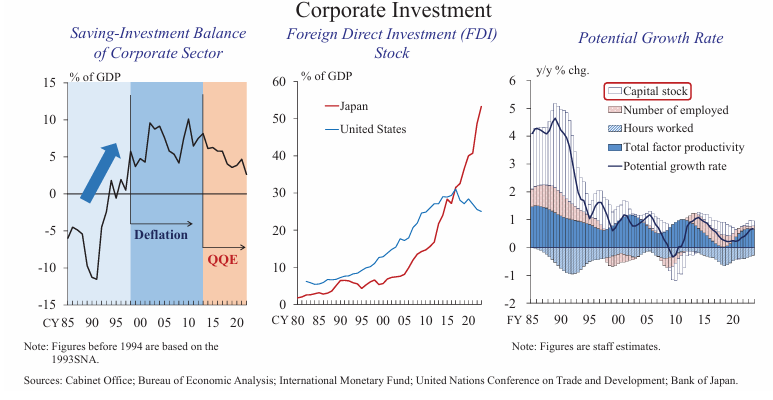

What are the reasons given for why Japan was experiencing deflation (use this chart to discuss one reason- use the chart on the other side to discuss the other reason)?

The corporate sector of Japan started saving and investing in international market sector (S increases, C decreases). They were attempting to address excess debt and excess capacity. The speech notes this as the “burst in in the asset bubble”. (Japan outsourced to China because China was experiencing growth due to capital increases instead of investing in their own Research and development-shown in Chart 3 where Japan’s Saving-investment balance shows more saving with r rising, foreign investment is higher in Japan, and capital stock fell greatly due to lack of investment). Demand falling due to Demographic changes, causing national saving to rise even more than before. Chart 4 demonstrates the change in r* overtime using multiple models in which r* is shown to have started falling in the 1990s and continued until 2013 after quantitative easing occured.

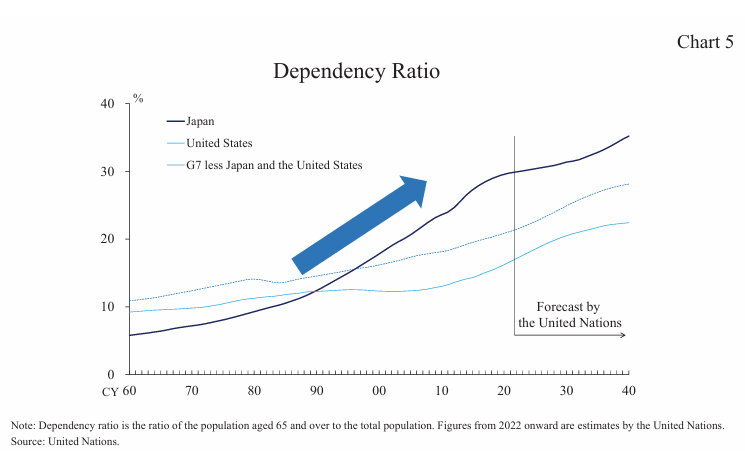

What were the sources of chronic shortage of demand?

Demand fell due the Demographic changes as the Japanese were getting older and living longer so they saved more as opposed to consuming, furthering the effects created by the firms’ saving- private and public saving both rising which further lowers r*. (Chart 5 shows a higher dependency ratio lowers per-capita growth- that is more older people per total population leads to less GDP growth because they are saving instead of consuming and are working less).

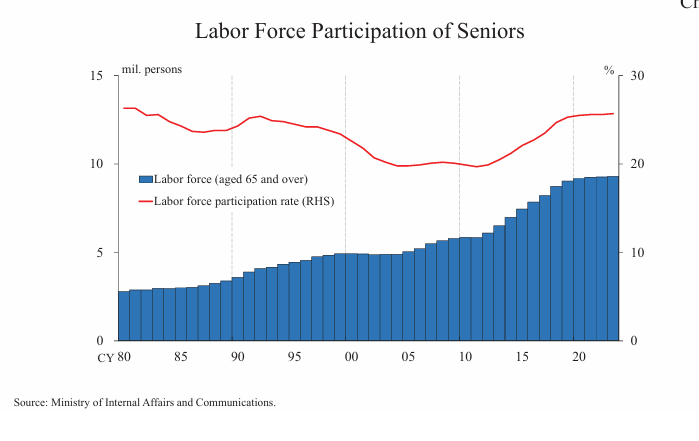

What caused Japan’s demand to rise in later years?

The labor force participation rate of seniors rose following 2012. This is because the aggressive Quantitative easing caused companies to rely on senior workers; the result is more consumption and less saving occurred. Chart 6 shows seniors joining the labor force more after 2010.

What is the equation for the Phillips curve? What part of the Phillips curve is impacted by an increase in national savings?

πt = πe - β (ut - un) + Σt

+ β (yt - yfe) + Σt

If S increases, GDP (y) falls because investment (in domestic market) has fallen so there are less resources to grow income internally.

What is the equation for Aggregate demand, how is the equation impacted by the events discussed in the speech?

AD = C + I + G + NX

*NX is net exports

-Consumption and Investment fell and since they are part of this equation they can be considered demand-side shocks

-What happened in the speech is addressing the affects of these demand side shocks, which was a fall in r*

Why is r* significant in this speech?

r* is notable because Japan hit the zero lower bound to encourage investment in private sectors, however, demand was slow to respond. r* in Japan is lower than other countries since the 1990s and is still declining (Paul Krugman even claimed that it was negative for Japan at some point because of chronic shortage of Japan). The causes of r* being lowered are due to the burst in the asset bubble and chronic demand shortage.

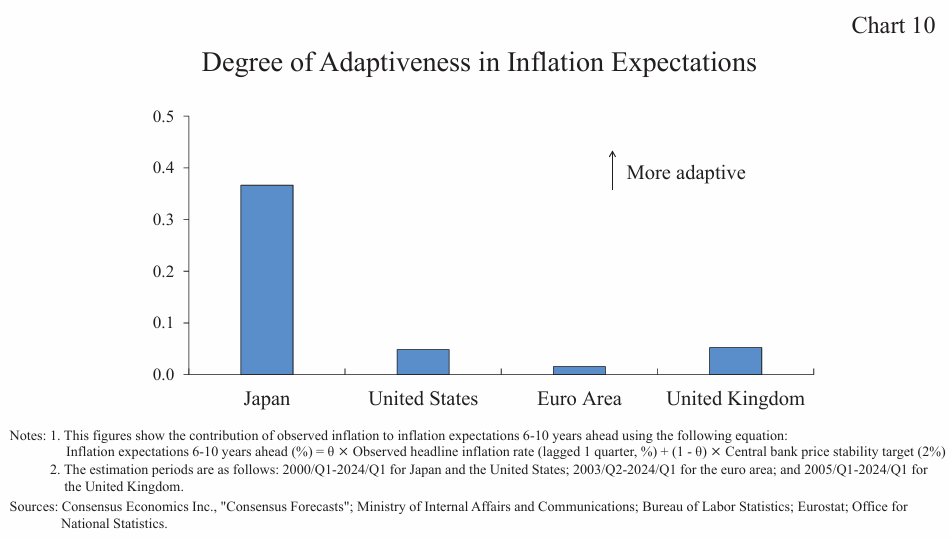

How do “adaptable” expectations of inflation impact actual inflation?

Inflation expectations that are adaptable and fluctuate based on past events. What occurs in Japan is that people had low expectations of inflation because it had remained low in years prior due the zero lower bound constraint (that is, with r* hitting zero, people were still saving more than consuming and demand remained low so prices were low).

How did firms react to consumption falling (aggregate demand fall) due to aging demographics? What is the “social norm “ or “deflationary norm” discussed in the article? (Think prices)

Firms didn’t adjust their prices to meet demand and instead prices were kept the same (Price rigidity). The “social” and “deflationary norm” arises from price rigidity in which people believed that prices and wages would stay the same in the future. The reason why is because Japanese companies wanted to maintain employees for as long as possible-something to note, it’s strange that nominal wages are sticky and downward sloping because Japan is a functional and rich country- usually workers wouldn’t accept lower nominal wages. (Labor hoarding was supported by the government)

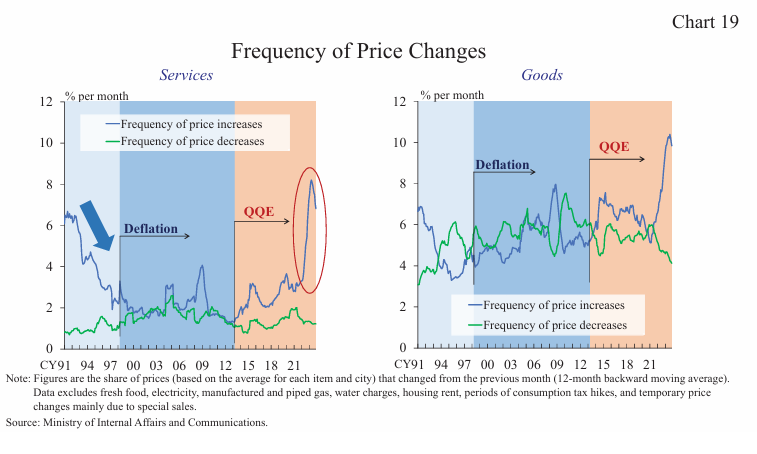

What caused price rigidity for firms (the theoretical explanation for the deflationary norm)? (Chart 19 just proves that there was a deflationary norm with decreasing frequency of price changes).

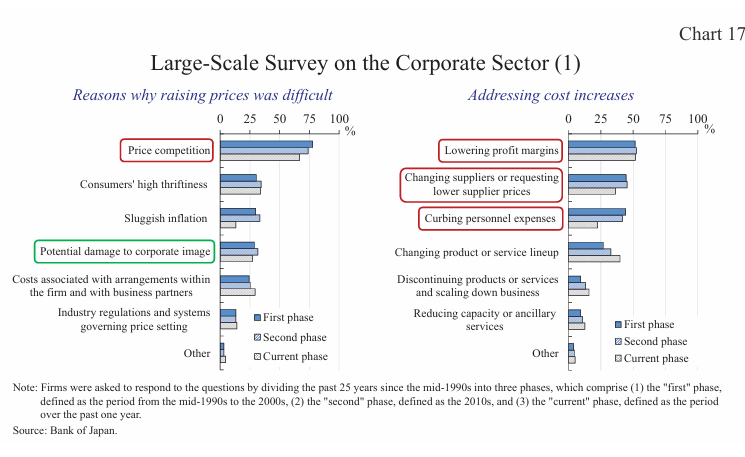

Menu costs, these are costs that firms incur from changing nominal prices (reprinting menus, updating price tags, etc.), changing nominal prices are costly to firms so they may keep prices fixed even when demand or costs change. Menu costs lead to the phenomena known as “sticky prices”- where prices are slow to adjust to supply and/or demand changes. Chart 17 shows why price changing prices was difficult to firms and in this case most cite price competition and potential damage to corporate image as the main reasons. Firms mainly addressed cost increases by lowering profit margins, changing suppliers and curbing personnel expenses.

What are the long-run implications of these shocks?

Aggregate demand stays low because investment in abroad resources (investment in other sectors). Unemployment also increases because firms can’t afford to keep domestic workers (they are able to keep prices low by cutting costs not technology and also older people don’t want to work). Assets also fall and it becomes harder to purchase capital so capital also falls.

How did the government respond to the deflation and recession?

Japan tries to stimulate the economy using government spending to increase income and encourage consumption (which would cause saving to fall and AD will rise) more women and seniors started working which increase labor supply- menu costs haven’t necessarily been addressed by quantitative easing, however the deflationary norm seems to have been addressed by global inflation.

Chart 10 shows different inflation expectations for each country in the long run (5-10 years) Japan has the highest expectations because they experienced deflation. Japan noticeable has “adaptable” expectations as opposed to “forward thinking” expectations. This means that Japan’s expectations are based in past business cycles and not based in the future. (In America our expectations are anchored by the Fed’s target of 2%).

What did Japan experience following the recession?

Japan had a big spike in GDP due to innovation in processes (increased productivity), labor hoarding, and most importantly quantitative easing.