macroeconomics

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

trade deals that have been signed

singapore,south korea, swtizerland, australia, new zealand, EU, member of ttp(trans pacific)

ongoing trade talks

USA,India,EU,GCC(gulf co operation council)

pros of free trade deals

trade creation and growth, prices decreasing and quantity/ choice increasing, technology diffusion(spread of technology), inward FDI

Cons of free trade deals

domestic industry harm, increased unemployment( therefore inequality), reduced standards ( us low product standards), trade deficits, over specialisation(service industry), environmental trade off

evaluation of free trade deals

time and extent of trade(trade deals with countrys we dont trade with), unfair trade practices, non tariff barriers, stakeholder tradeoffs

why some trade deals are less impactful

countrys are far, EU holds many other frictions of trade

non tariff barriers to trade with EU

proof that we meet thier standards that are manually checked at EU ports, differing EU local VAT rates

examples of unfair trade practices

subsidies, state interventions, competitive devaluations

national debt increase

80% of GDP, to 97% of GDP

what fiscal policys is bieng used currentely

contractionary

covids effect on the economy

worst recession in 300 years

why contractionary policy is currentely bieng used

huge expansionary policy due to covid ( healthcare and welfare spending, uk furlough scheme), dramatic tax cuts targeted to industrys,causing the ruining of the government budget deficit

government budget deficits

2019(£40 billion),2020/21( 15.1% of GDP/£305 billion), 2022(5.2% of GDP), 2023(4.9% of GDP), 2024(4.8% of GDP), 2025 ( 5.3% of GDP)

structural budget deficit

structural budget deficit is deficit at full employment ( 2025 2% of GDP)

consequences of covid government spending

debt interest spending high, causing opportunity cost ( over £100 billion), inflation, wage growth( wage price sprials along with inflation)

liz truss not so little budget policys

policys : unfunded tax cuts, unfunded spending to counter energy price increase

lizz truss not so little budget effects

effects: due to loss of information - gov lenders scared of bankrunpcy, mass selling of bonds, driving down bond prices, driving down bond interest rates fast ( by 3%, within 5 days), causing gov bankruptcy, panic currency selling - devaluation of pound

how did BOE stop government bankrupcy after liss truss

bailed out government

current contractionary tax rises

uk and scotland freezing income tax bands(wage increases dragging people into higher tax bands, equivalent to 7% rise) , corperation tax 19% to 25% (2024), national insurance increase(employer national insurance), windfall taxes on energy manufacturers, council tax

contractionary government spending cuts

cuts in actual and real term spending, cuts in current and capital budgets(HS2 stopped)

pros and cons of contractionary policy

pros: reduced bond interest rates ( confidence in gov finances), fiscal policy flexibility, reduced inflation cons: macro objective tradeoffs( reduced growth, increased unemployment), reduced living standards, laffer discincentives, inequalities gini ( 0.34 to 0.357)

what causes a shift in the AD curve

change in the components of AD ( C + I + G + (x-m))

what is autonomous investment and induced investment

autonomous doesnt change with income or interest rate ( gov expenditure), induced investment changes with income or interest rate ( pirvate firm invesment)

what causes shifts in SRAS

changes in production costs

what does the horizontal area of keynsian SRAS display

the economy is not operating at full capacity/ resources are not fully employed ( no increase in price level/ no inflation)

what changes effect LRAS

change in quality or quantity of goods/ services ( can be displayed by shift in ppf curve)

what is red tape

regulation which limits efficiency of firms

what is assumed about the AD curve

the supply of money available for borrowing is fixed

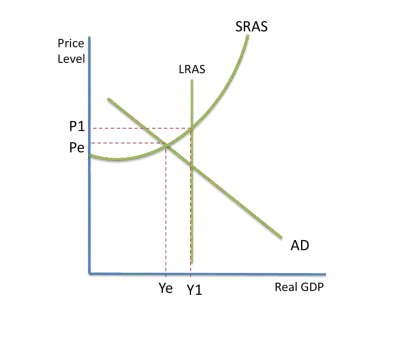

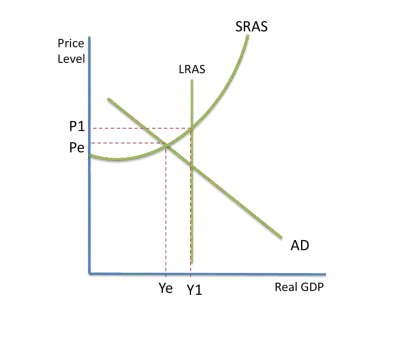

display inefficient AD producing a negative output gap due to unemployment

factors that determine national income multiplier

MPC,MPS,MPT,MPM, spare capacity

what does the significance of the multiplier depend on

the elasticity of sras

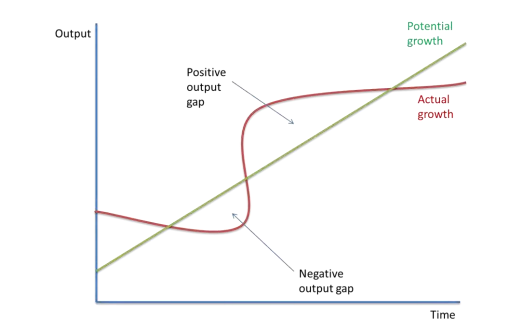

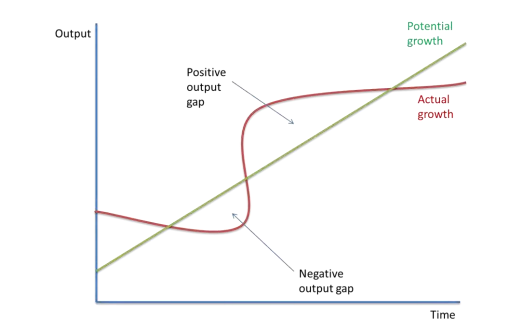

alternative output gap diagram

what is capital deepening

an increase in the size of physical capital stock

the cuases for short term and long term economic growth

short term - shifts in AD (capacity stays the same), long term - shifts in LRAS ( increase in poructive potential/ capacity)

when did trump start the trade war

2018-2019

what were trumps intial tariffs(china)

$363 billion at a 15% tariff rate

reasons for trumps intial tariffs (china)

preventing dumping, unemployment, trade deficit increases

what did joe biden raise trumps intial tariffs to (china)

up to 25%

what industry did joe bidens tariffs target (china)

climate industrys

what are examples of joe bidens tariffs towards china

100% tariffs on ev vehicles, 50% tariffs lithium ion batterys,50% tariffs on semiconductor chips, 25% tariffs on solar panels

what countrys did trump threaten with tariffs 2025

mexico and canada

trumps tariffs 2025 targeted

25% worldwide steel and aliminium, 25% cars and car parts worldwide

trumps tariffs 2025 untargeted

reciprocal tariffs up to 50%( baseline 10%)

trumps tariffs 2025 china

145%

chinese tariffs to usa

125%

reasons for 2025 tariffs

government revenue, inward investment( tariffs not faced if businesses operate in us)

risks of tariffs

retaliation(on sensitive industrys), supply side shocks(usa), demand side shocks(china), tarrifs are highly regressive and inflationary