FSA prelim 2

1/59

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

60 Terms

should you forecast all of the financial statements even if you only care about earnings? why

yes This avoids internal inconsistencies • E.g., sales growth increases the need for working capital/PP&E/financing, which affect asset turnover, leverage etc. Need to make sure the forecast of all these items is reasonable.

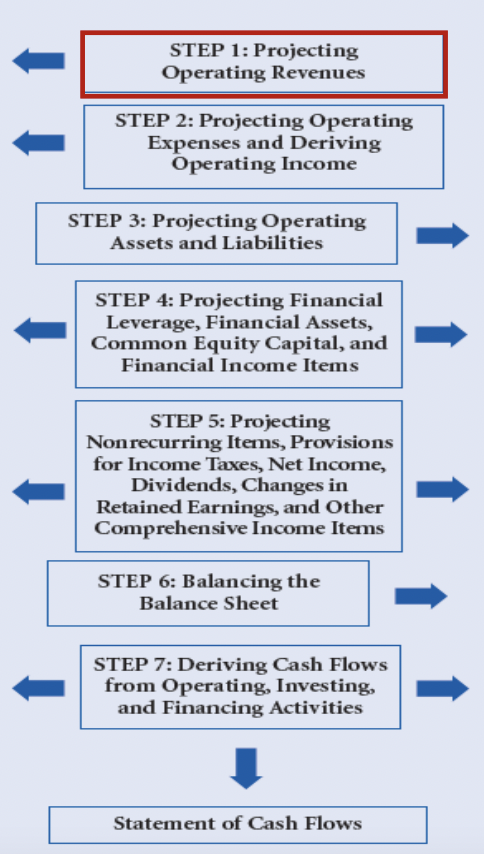

financial statements forecasting steps (7 steps)

what’s the key to forecasting revenue?

understanding the key drivers that determine price and quantity of sales.

proxies include using historical growth rates and adjusting the growth rate to current conditions

what is economic gravity in revenue growth

Revenue growth rate mean reverts to 4-7% range over relatively short time (mean reversion)

regression analysis to determine cogs, sga, randd

regression between historical cogs for example and sales to get an intercept and project cogs based on forecasted revenue

how do you forecast operating assets and liabilities

turnover technique:

get turnover by taking sales / ending AR for example to give you turnover

take turnover and go forecasted sales / turnover for AR to get forecasted AR

don’t use average AR because then you get the sawtooth problem

what is the sawtooth problem

A pattern in financial forecasts where projected figures fluctuate irregularly over time, often due to reliance on average measures rather than actual turnover rates.

why do you need a plug and what should it be in the balance sheet forecast

need the plug so that any issues balance in the balance sheet. usually use cash

how should you forecast cash flow statement

don’t go directly from historical cash flow statement

Derive forecasts of CFS using forecasts of balance sheet and income statement

Increases in assets imply uses of cash; decreases in assets imply cash being conserved/generated

• Increases in liabilities and stockholders’ equity imply sources of cash or cash being conserved; decreases in liabilities and stockholders’ equity imply uses of cash

• Classify increases/decreases into operating, investing, and financing

what is relative valuation

Valuing a firm by appealing to the valuation of other (comparable) firms • E.g., PE, PEG, TEV/Revenue, TEV/EBITDA

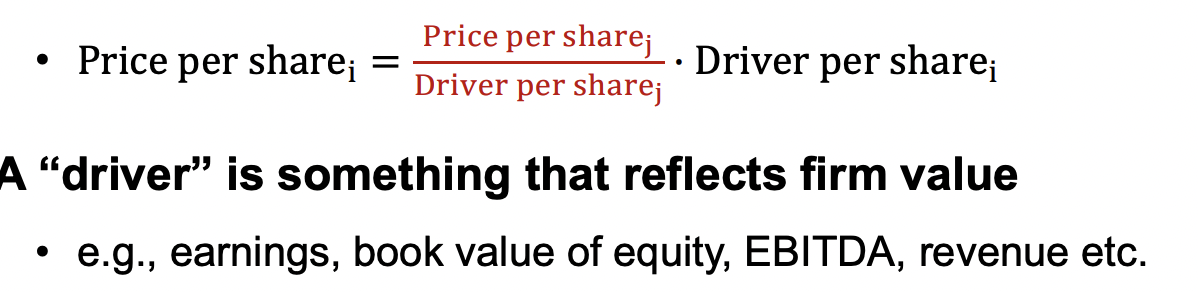

Firm i is valued by using price multiples of the comparable firms formula

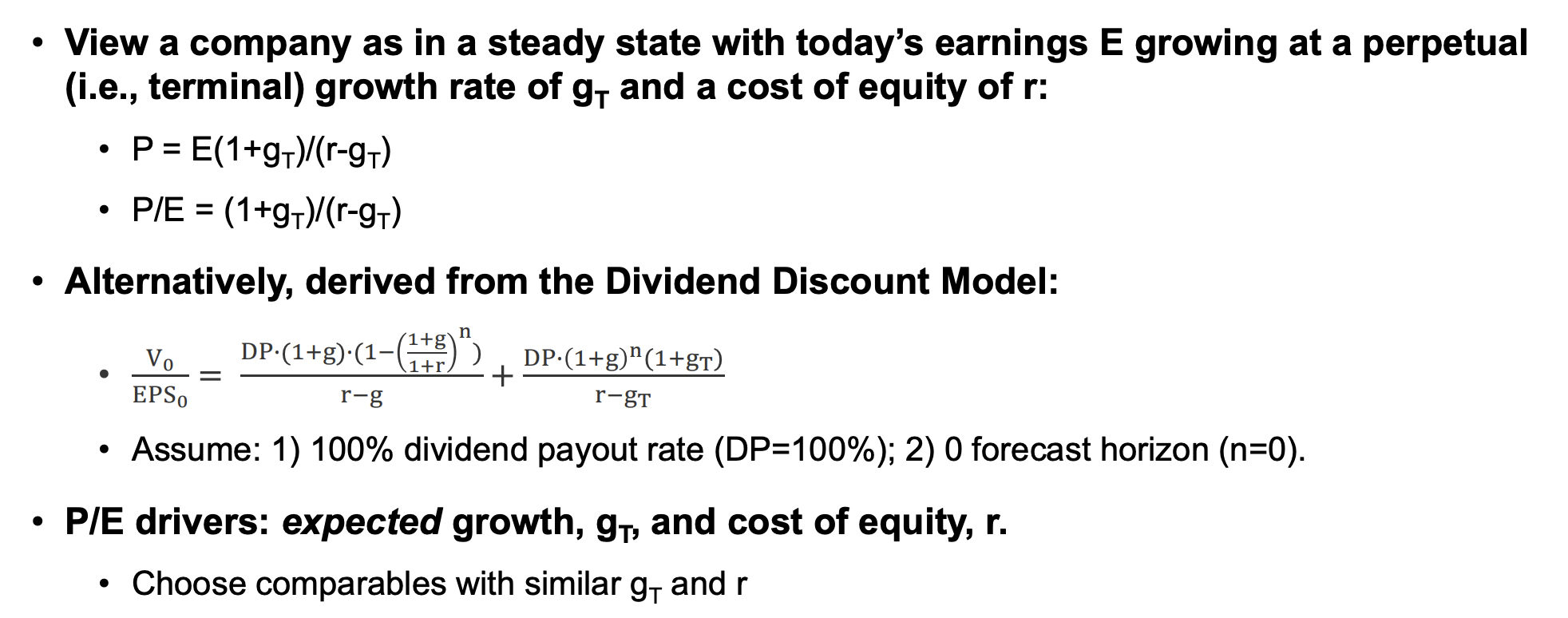

basic idea of P/E relative valuation

3 key considerations when using multiples

choosing good comparisons

make adjustments to assure apples to apples comparison

choose appropriate multiples

how do you select comparables?

risk and growth are good drivers

match risk on industry and strategy

match growth rates with historical growth rates and future projections of growth (similar age and size)

what adjustments are important for relative valuation with comparables

accounting choices (straight line vs accelerated depreciation)

special items like acquisitions, law suits, restructuring, etc

what is equity value

What is the market value of equity (i.e., stock price)? • Information is easily available.

what is enterprise value

Market Value of Equity + Market Value of Debt - Cash

How much money is needed to buy the entire company today? • More precisely: EV = Market value of common stock + Market value of preferred equity + Market value of debt + Minority interest – Cash. • Makes firms with different capital structures more comparable.

what is price to earnings growth (PEG)

PE / G = (1+g)/ (g*(r-g))

g* is in % terms in the denominator: g=26% g* = 26 not 0.26 • Example: PEG = 15 / (12 * 100) = 1.25 for company with PE of 15 and forecasted earnings growth of 12%

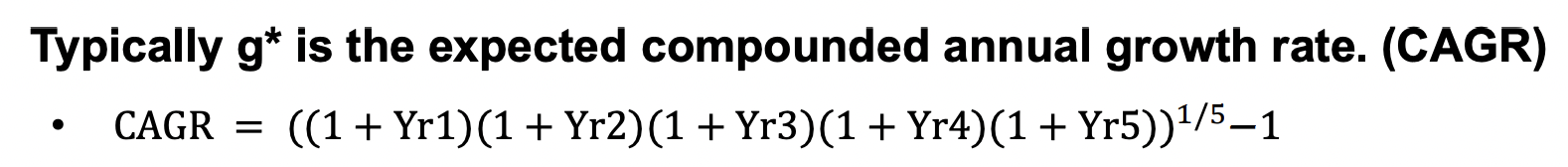

Typically g* is the expected compounded annual growth rate. (CAGR) what is CAGR

why ebitda, concerns of ebitda

popular because it focuses on a company’s core profitability by removing the effects of financing decisions, tax environments, and non-cash expenses.

EBITDA ignores important cash outflows like capital expenditures (CapEx) and changes in working capital.

It can make companies look healthier than they are because it hides debt payments and necessary reinvestments.

what method yields the highest and lowest valuations error usually

lowest - PEG

highest - Enterprise value / sales

key features of direct valuation

• Emphasizes fundamentals of the firm

• Ignores the current mood of the market

• Need lots of forecasts

• Explicit assumptions

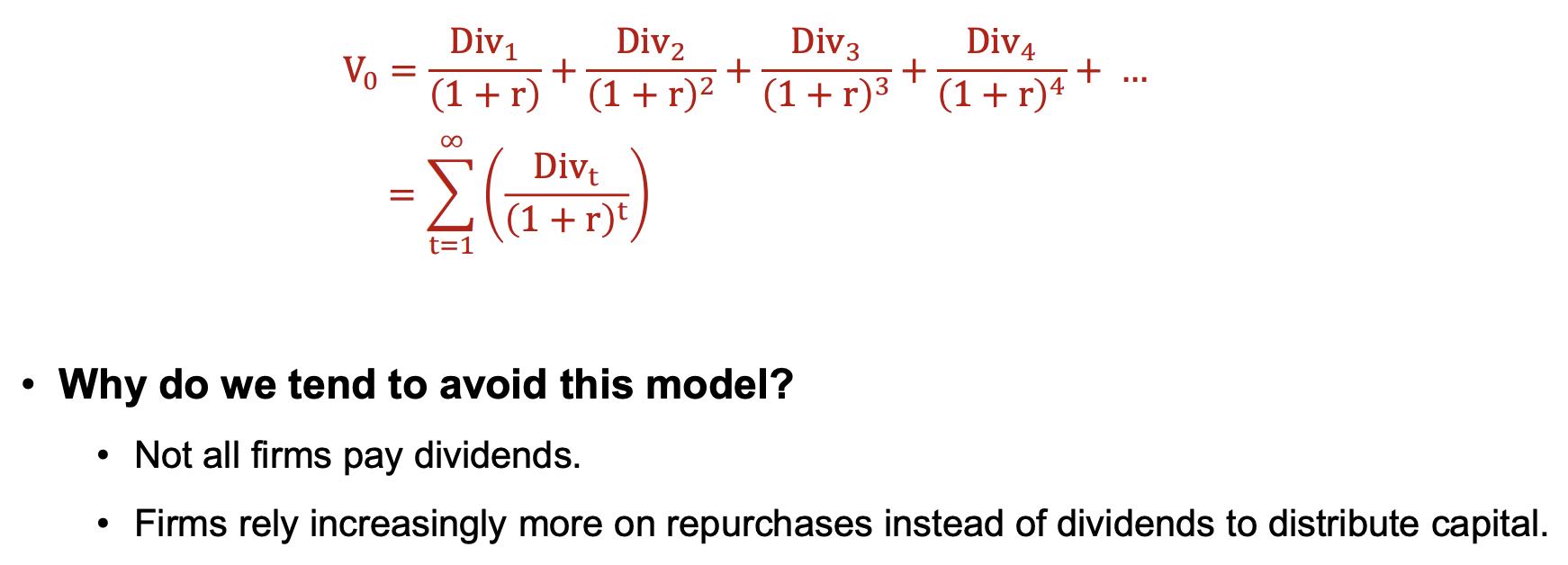

ddm formula and why it’s problematic

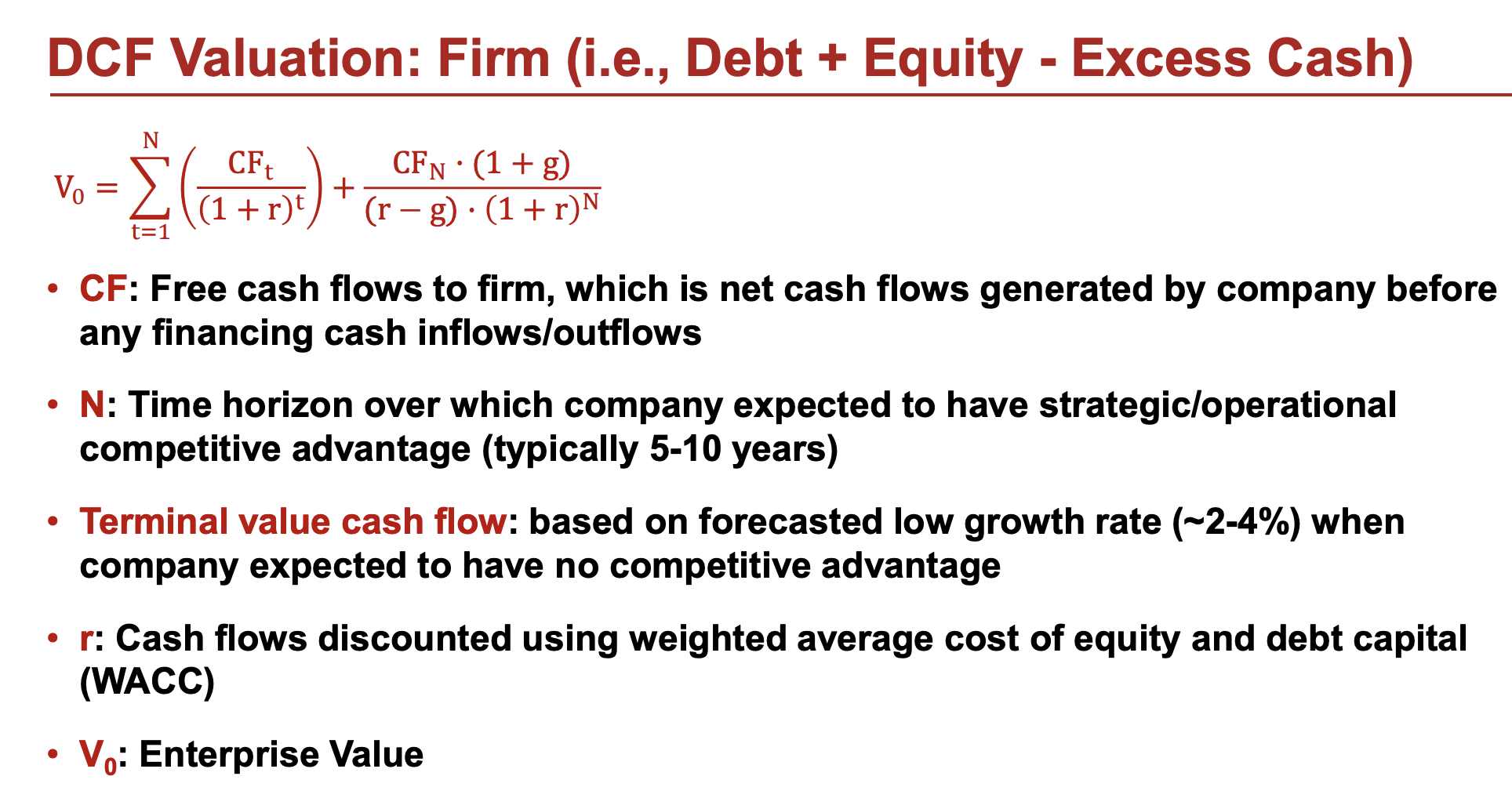

dcf model formula

free cash flow formula and what it means

Cash Flow from Operations + Cash Flow from Investing

free cash flow to firm formula

many different formulas

free cash flow + Interest Expense * (1-tax rate) is one

Free cash flows to firm = EBIT * (1 – tax rate) + depreciation and amortization – capex for PP&E – Δworking capital

employee stock options

The right to purchase shares at a pre-determined price (often lower than current price)

should stock based compensation be added back to future fcf?

No don’t do this

MV of Equity = EV – Debt – Other capital claims + Non-operating net assets in this formula what does SBC belong to?

belongs to other capital claims

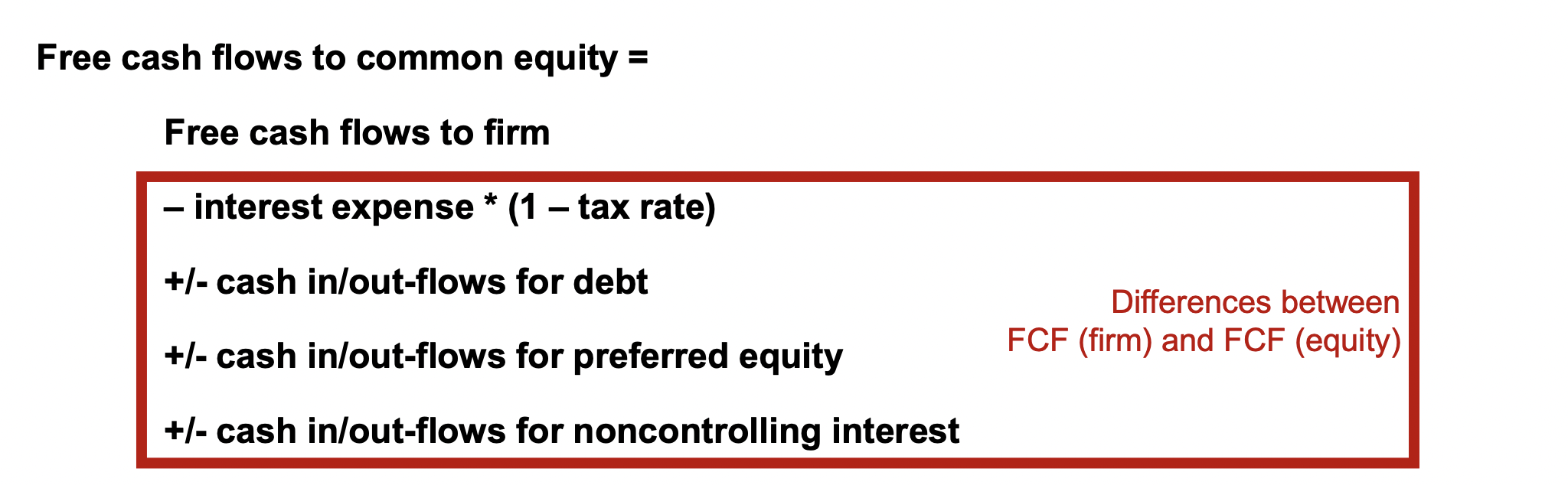

free cash flows to common equity

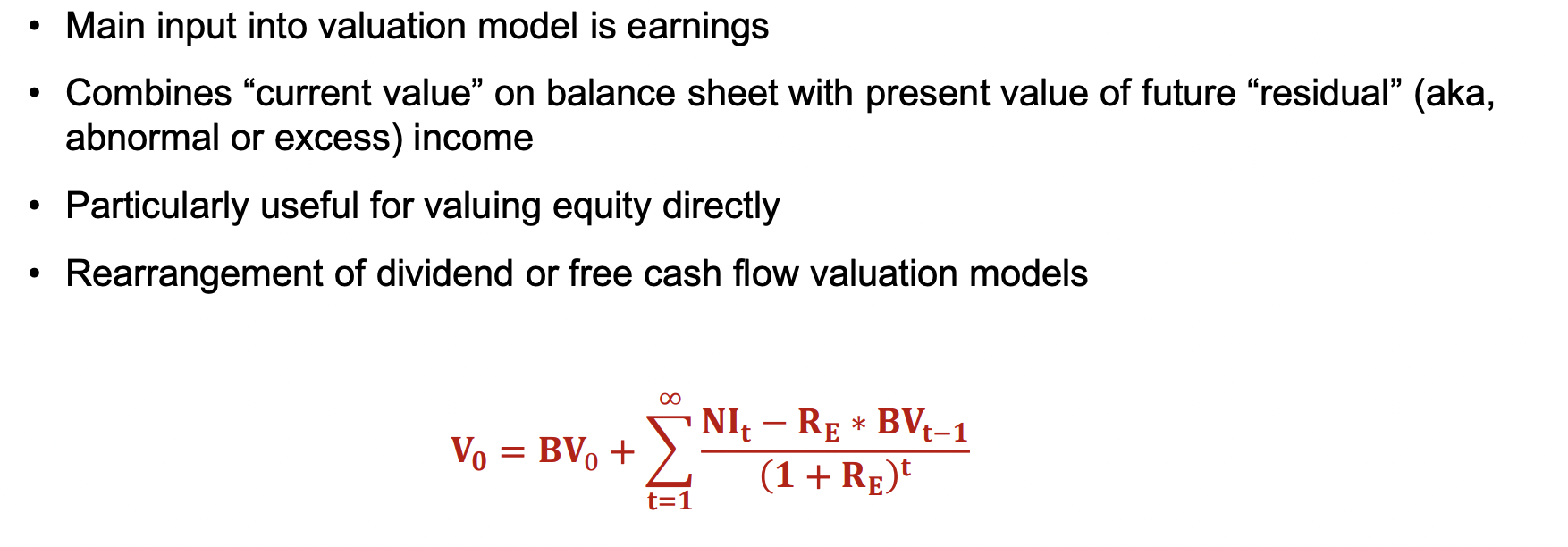

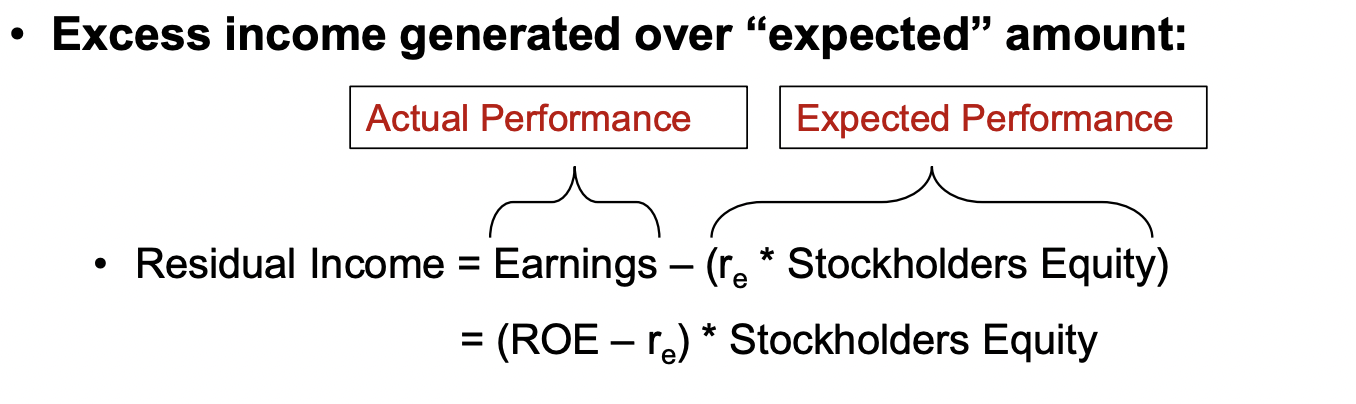

residual income model

residual income big idea equation

do different accounting methods affect the residual income valuation, if so how?

they do not change the valuation

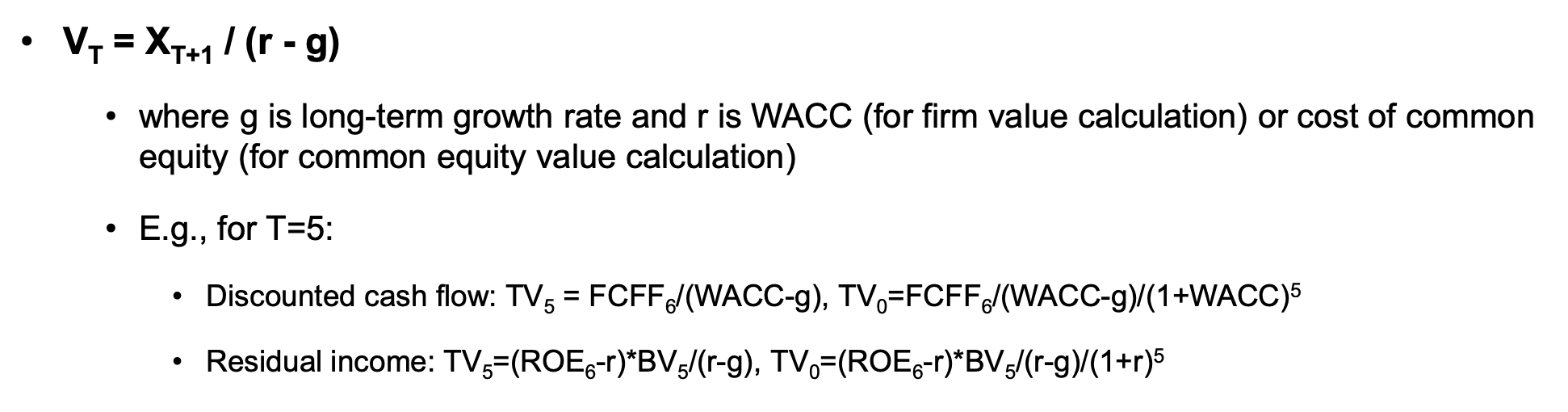

which is more reliant on terminal value, residual income or dcf?

The discounted cash flow (DCF) model is generally more reliant on terminal value than the residual income model, as it often represents a larger portion of the overall valuation in DCF analyses.

what does the residual income model assume with its income

assumes that it’s clean surplus, meaning that all income goes through net income. GAAP allows for dirty surplus, like AOCI

advantages of residual income valuation vs dcf

easy to implement

earnings forecasts are more readily available than cash forecasts

terminal value is less important

terminal value equation

coupon rate formula

annual coupon payment / bond face value

debt yield formula

annual coupon payment / bond price

what’s the interest expense in the 10k

The total of all coupon payments during the period.

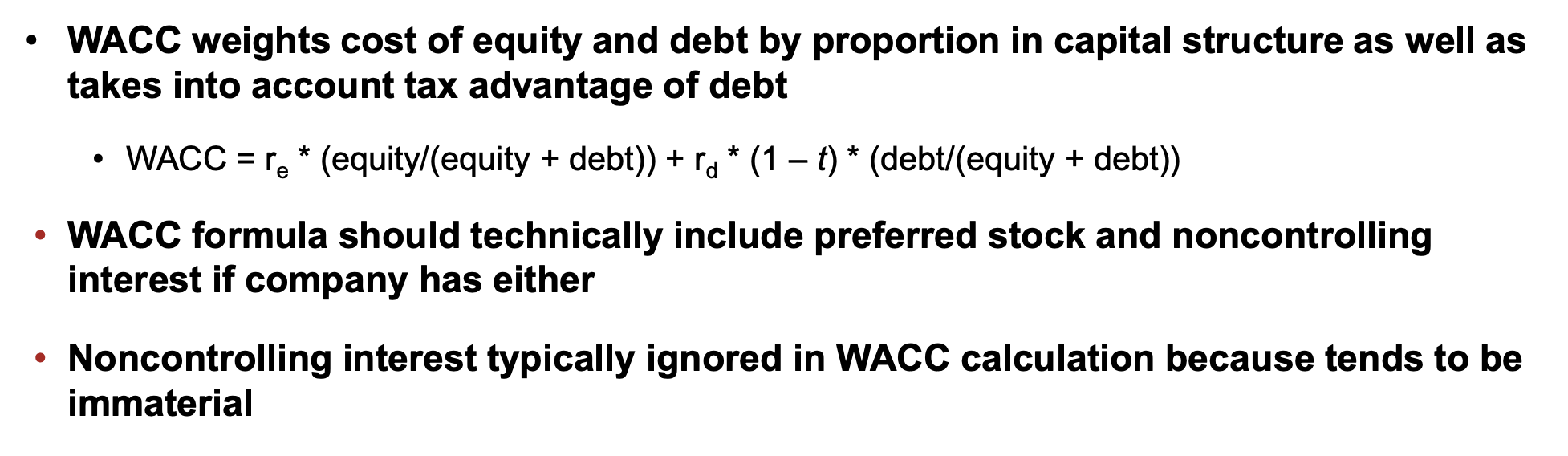

what does wacc do and equation

which times of firms does the cost of equity matter less

Firms with front-loaded cash flows. If value is found in the terminal value (e.g., start-up with later cash flows), then Cost of Equity matters more

two types of credit risk

short term liquidity risk: : the near-term ability to generate cash to service working capital needs and debt service requirements

long term solvency risk: the longer-term ability to generate cash internally or from external sources to satisfy debt repayment needs

examples of short term liquidity measures

Current ratio and quick ratio.

examples of long term solvency measures

Debt to equity ratio and interest coverage ratio (EBIT / Interest exp)

inventory turnover ratio

cogs / avg inventory

days sales in inventory

365 / inventory turnover

Tells us how many days it takes to sell inventory

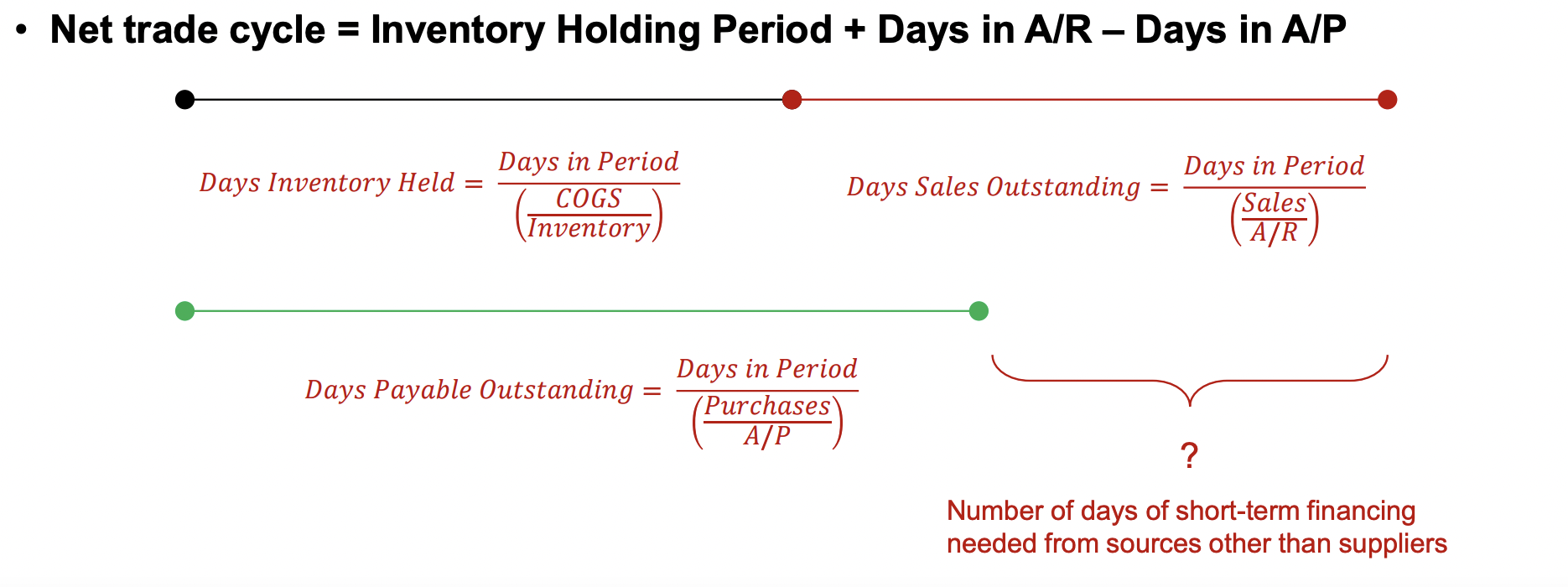

what does purchases in accounts payable tell you

Tells us how many days it takes to pay trade creditors (e.g., suppliers)

365 / (purchases / avg accounts payable)

net trade cycle =

what does Z-score > 2.675 mean

not bankrupt

what makes a good lbo candidate

Stable, predictable cash flows.

• Large tangible asset base

• Low CAPEX requirements

• Growth opportunities

• Strong management

• Barriers to entry in the industry

• Viable exit strategy