2.4.3 Equilibrium levels of real national output

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

EQUILIBRIUM POSITION OF NATIONAL OUTPUT

where AD and AS curves intersect

if either AS or AD shift, then equilibrium position will change

size of change will depend on size of shift and elasticity of the curve which hasn’t moved

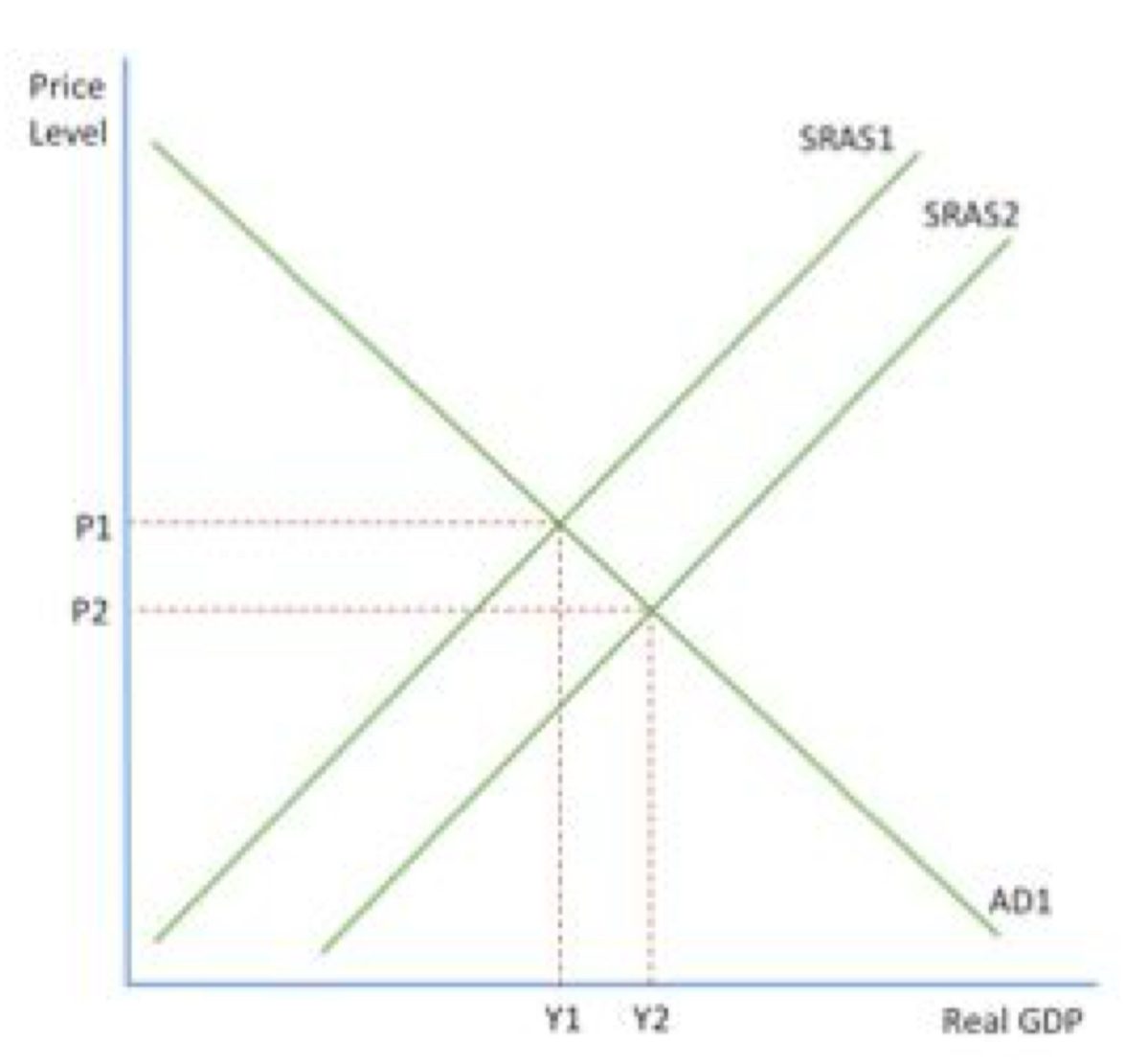

SHORT TERM- SRAS SHIFT

initial equilibrium level is P1Y1, where AD1 and SRAS1 intersect

but increase in SRAS1 to SRAS2 has changed the equilibrium position to P2Y2

led to fall in the price level and increase in real GDP

decrease in SRAS would lead to higher prices and lower real GDP

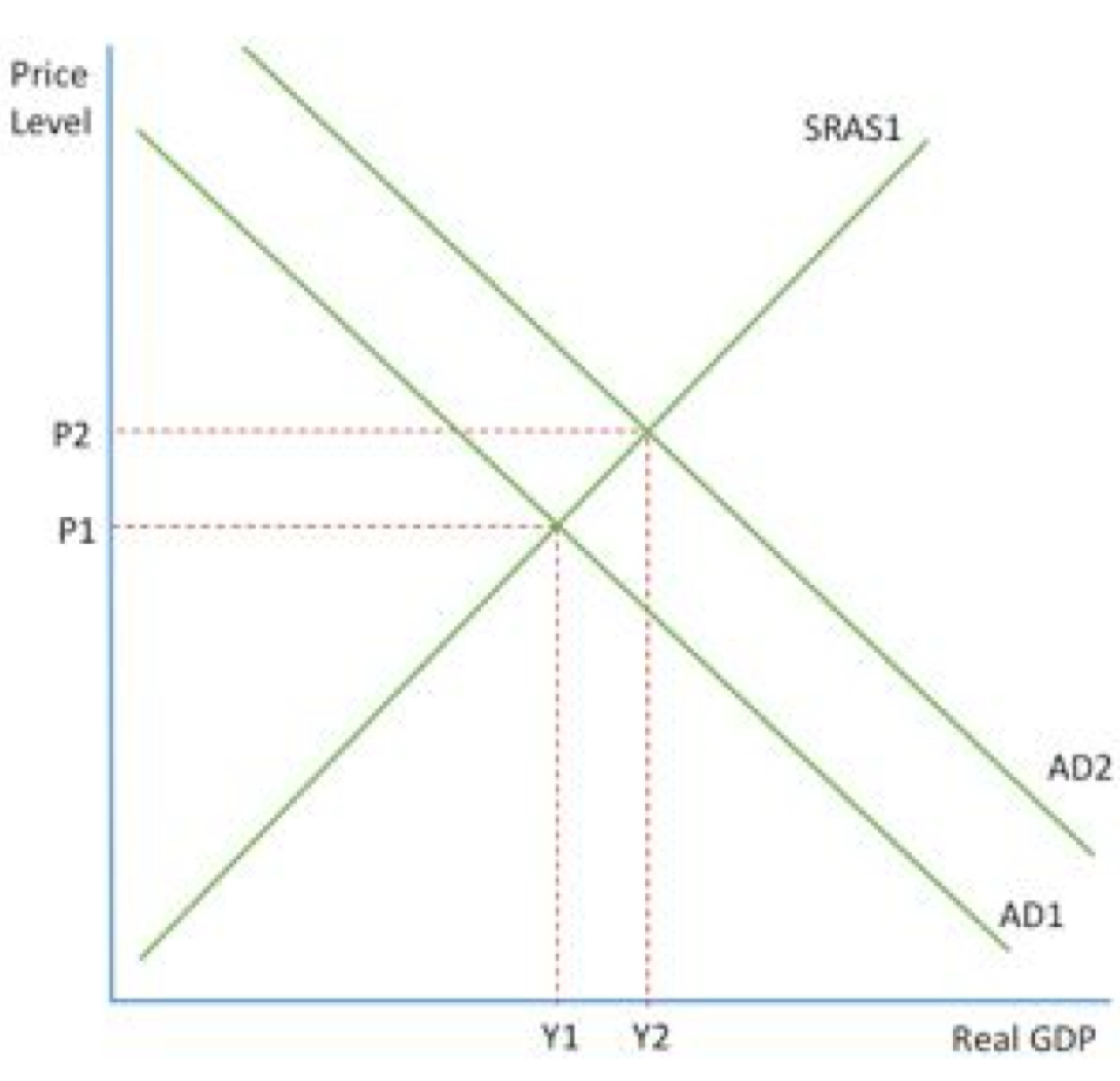

SHORT TERM- AD SHIFT

initial equilibrium level is P1Y1 where AD1=SRAS1

increase in AD curve to AD2 led to change in equilibrium to P2Y2

prices and real GDP are higher

fall in AD would lead to lower prices and lower real GDP

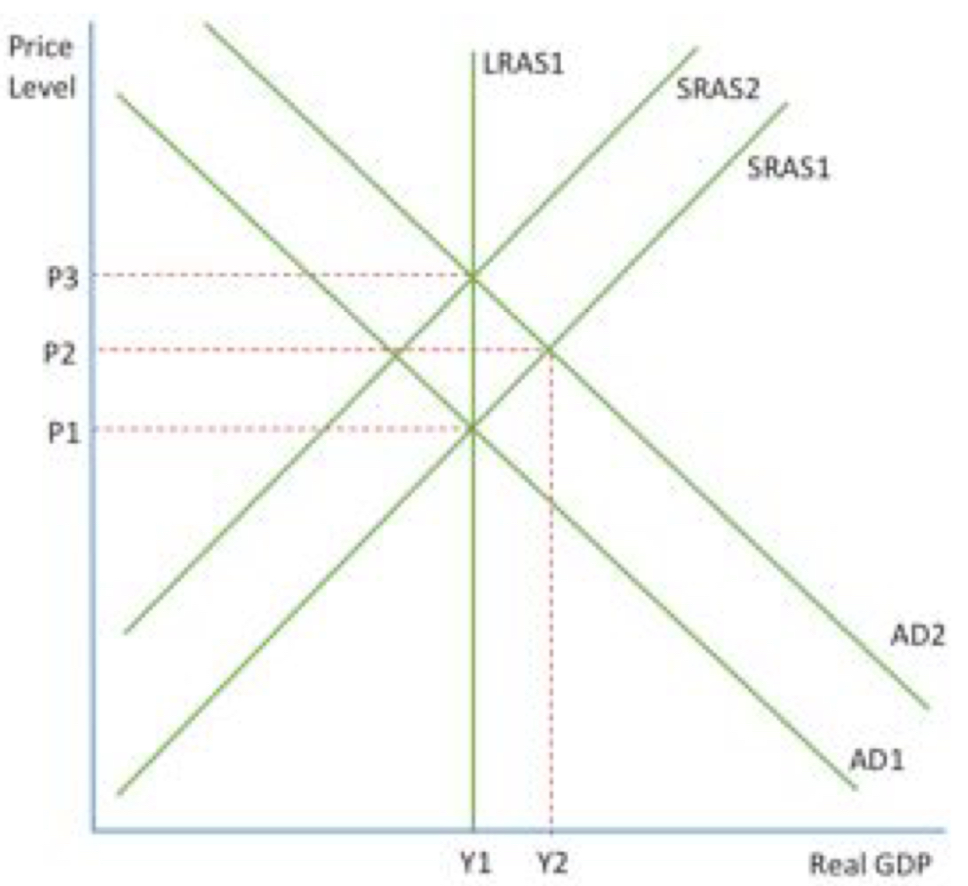

LONG TERM- CLASSICAL

as classical LRAS curve is perfectly inelastic, a shift of AD curve wouldn’t affect long run national output and would only affect price levels

classical economists believe that economy will always return to full employment level and so there won’t unemployment in long run

CLASSICAL LRAS- DIAGRAM

believe that increase in AD from AD1 to AD2 will lead to pos output gap

economy is in long term disequilibrium as SRAS1 and AD2 don’t intersect on LRAS curve

short-term equilibrium is P2Y2- means that there’s over-full employment and firms will end up bidding up wages of labour and other factor prices

so SRAS shifts to SRAS2 as cost of production has increased

economy is producing the same amount but now at higher prices: they are producing at Y1P3

short run equilibrium has shifted and is now the same as the long run equilibrium

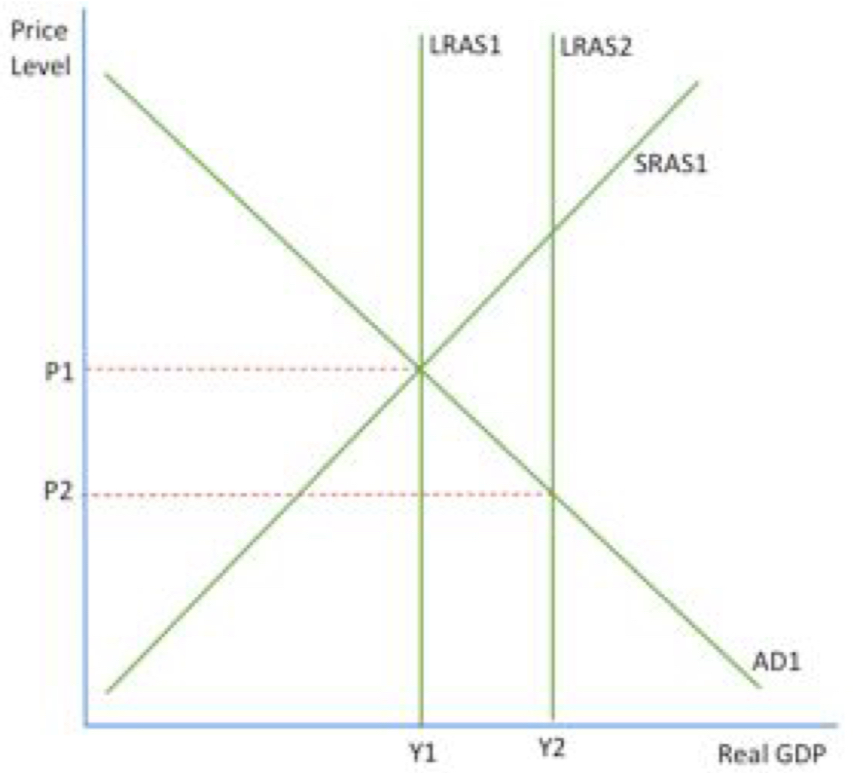

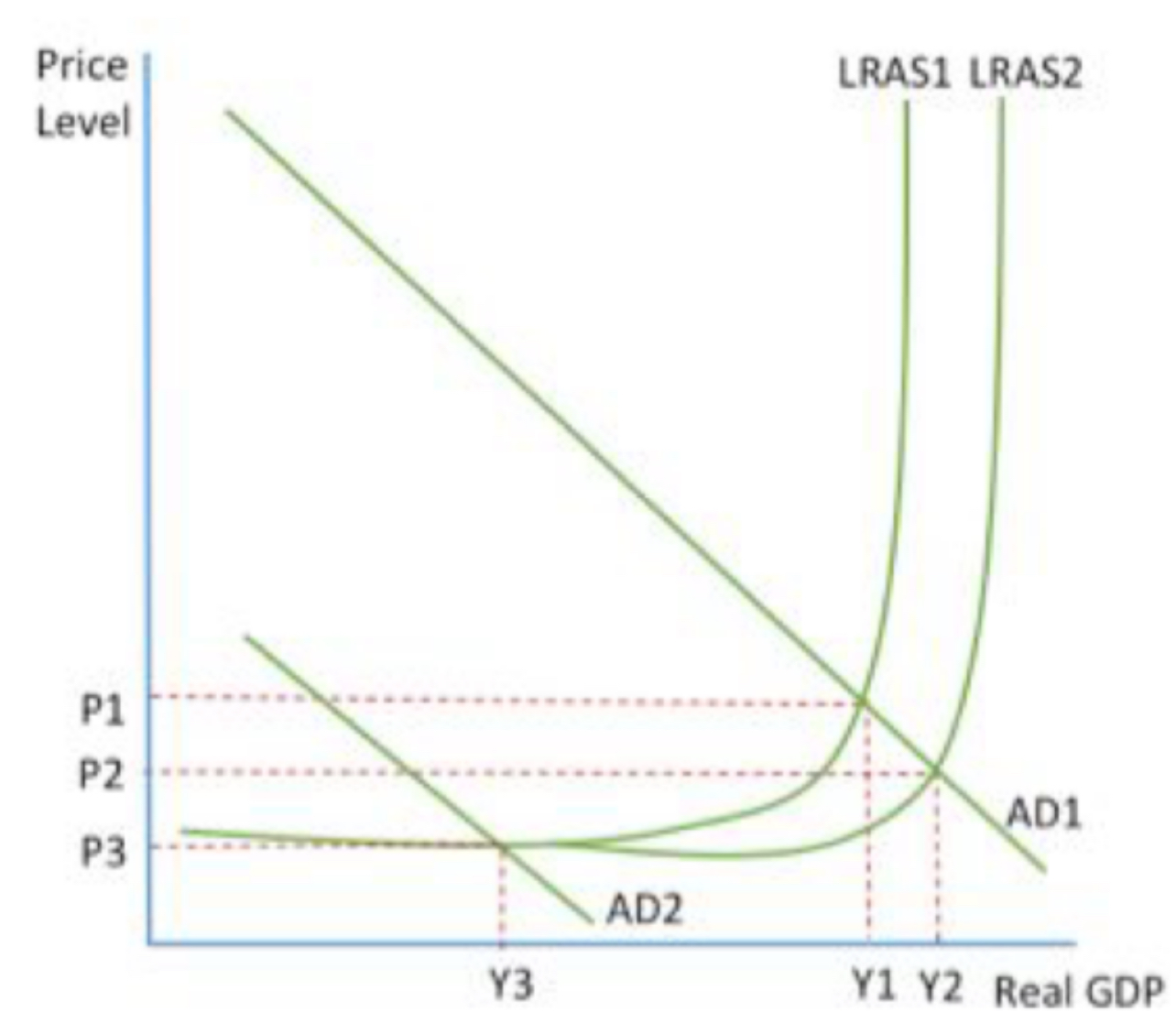

CLASSICAL LRAS- LRAS SHIFT

only way to increase output is by increasing LRAS- changes in AD w/out change in LRAS are only inflationary

initial equilibrium is where AD1=LRAS1 at P1Y1

increase in LRAS from LRAS1 to LRAS2 caused lower prices and higher output, at P2Y2

although there’s short term disequilibrium, as SRAS1 doesn’t intersect the curve at this point, they believe this will be closed by a shift in SRAS

rise in LRAS likely to lead to lower prices and higher output

when compared to rise in AD which causes increase prices and no higher output, its clear to see why classical economists favour supply-side policies over demand management

LONG TERM- KEYNESIAN

agree with classicists that there is full employment where LRAS is vertical

but believe there can be equilibrium at less than full employment- where curve is horizontal

bc they don't believe that rise in unemployment rapidly leads to a fall in real wages

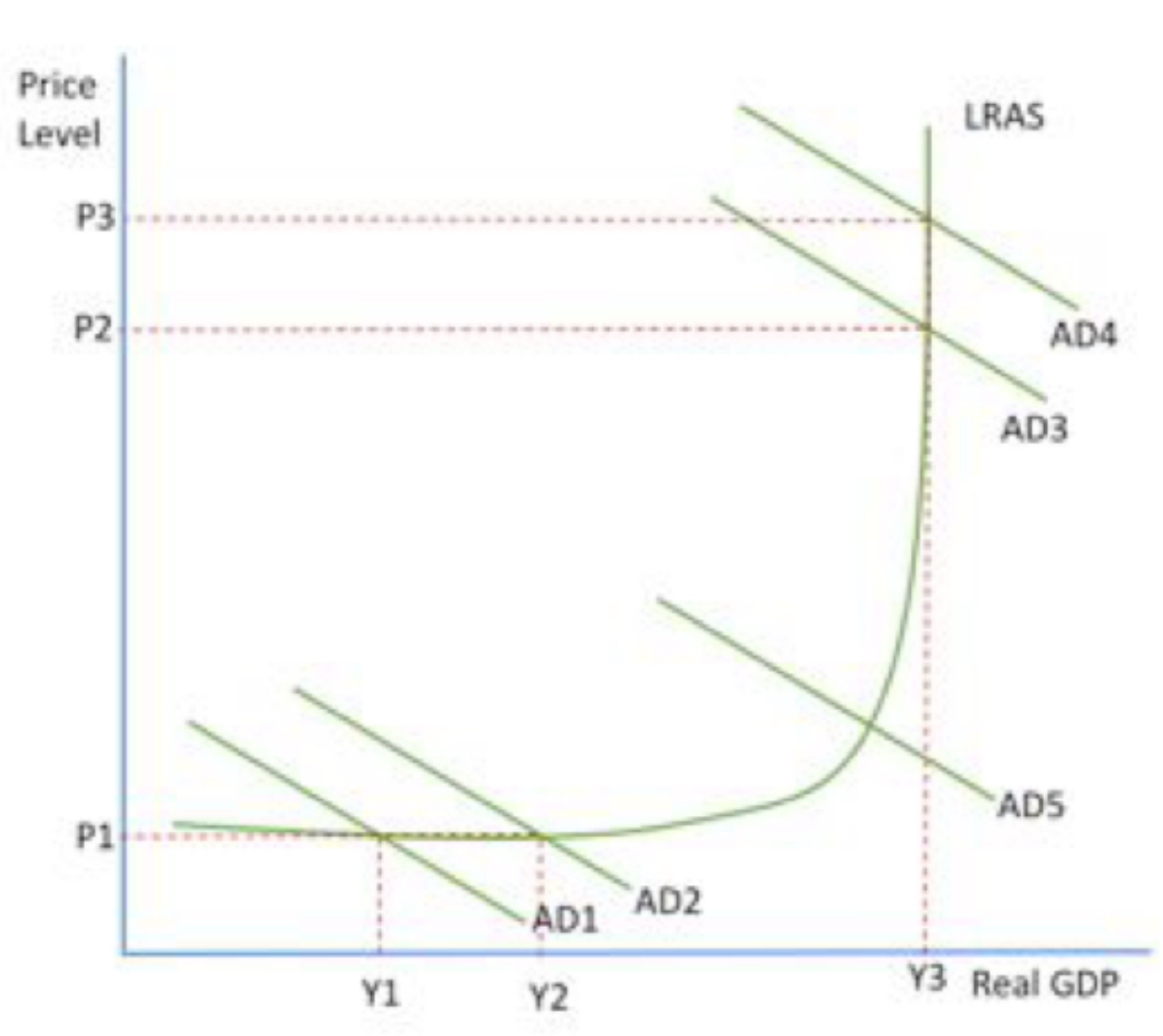

KEYNESIAN- DIAGRAM

would agree with classicists that shift from AD3 to AD4 is purely inflationary

but believe if economy is in a recession then an increase from AD1 to AD2 is opposite and only increases output not price

KEYNESIAN- LRAS SHIFT

impact of shift in AD strongly depends on elasticity of the curve, and whether economy is at or near full employment

If economy is producing at or near full employment, (e.g. AD1) then rise in LRAS will increase output and decrease price level

but if economy is in recession (e.g. AD2) then increase in LRAS will have no effect on prices or output

why Keynesians argue that during recessions gov has to increase AD rather than using supply side policies

INCREASING AD AND AS

in macro, factor which affects AD can affect AS

e.g. investment- component of AD so an increase in it will increase AD but could also increase LRAS as firms can produce more if they have more machines etc.

may mean that the long run disequilibrium caused by shift in AD will be brought back to equilibrium by an increase LRAS rather than a fall in AD

but not all investment results in increased production (e.g. firm may invest but then go out of business) and so LRAS won’t increase

so extent to which investment increases output and lessens inflation depends on its rate of return