IB Economics SL/HL Unit 2 (Microeconomics)

1/86

Earn XP

Description and Tags

All microeconomics terms and formulas for IB Economics. Includes both SL and HL. 2022~2029 syllabus. Imported from EcoNinja.net. (Unit 3 Now Available)

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

87 Terms

Law of Demand

States that the quantity demanded for a good or service decreases as price increases and vice versa.

The Income Effect

States that as the price of a product falls, consumers' real income increases and more will be bought.

The Substitution Effect

States that as the price of a product increases, more consumers will choose it over rivals and more will be bought.

Substitute Goods

Goods or services that compete against each other and are hence in competitive demand.

Shift

A change in a non-price determinant changes the quantity.

Quantity Supplied

The amount of goods and services producers are willing and able to provide.

Law of Supply

States that the quantity supplied is directly proportional to price.

Diminishing Marginal Returns

As more factors of production are utilized, each additional unit brings declining returns.

Competitive Supply

The output of one good or service prevents the output of another.

Joint Supply

The output of one good or service increases the output of another.

Price Mechanism

The interactions between consumers and producers that allocate resources and determines prices of goods and services.

Signalling Function

Provides information to consumers and producers on where resources should be allocated.

Incentive Function

Provides motivation for consumers and producers to change their behavior to maximize profits.

Rationing Function

Ensures scarce goods and services deter consumers by raising prices.

Consumer Surplus

The gain of all consumers who can consume a product at a lower price than what they were willing and able to pay.

Social Surplus

The sum of consumer and producer surplus.

Allocative Efficiency

The social optimum when resources are distributed in the most effective and beneficial way.

Rational Consumer Choice

The assumption that all consumers make the most rational decisions.

Imperfect Information

A situation where an economic agent has incomplete information on the product they're buying/selling.

Bounded Rationality

The idea that consumers do not always have the capability to make perfectly rational decisions.

Bounded Selfishness

The idea that consumers are not always completely selfish, in contrast to traditional economic theory.

Bounded Self-Control

The idea that consumers may give in to their temptations and consume products they know are not maximizing their utility.

Rule-of-Thumb

General rules consumers stick to when faced with a lack of information regarding a product.

Anchoring Bias

A cognitive bias where consumers over-rely on information they've received in the past, rather than current information.

Framing Bias

A cognitive bias where consumers decide on products based on how positively (or negatively) they are portrayed.

Availability Bias

A cognitive bias where consumers decide on products based on what information they can first remember is associated with the product.

Choice Architecture

The study of how choices can be presented in a way that influences which choice is taken.

Nudge Theory

Ways to influence consumers into choosing something, without actively restricting their choices; They are simply "nudged" into the "right" direction.

Corporate Social Responsibility

The consideration firms make on how they impact society and the environment.

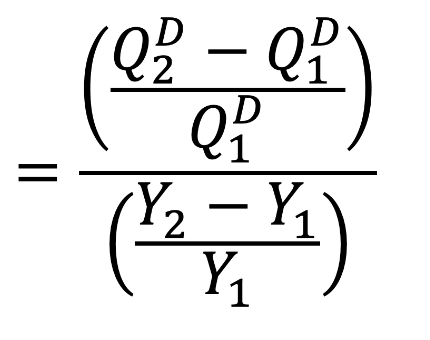

Income Elasticity of Demand

A measure of how quantity demanded for a product varies based on income.

Inferior Goods

Goods with a negative income elasticity (as incomes increase, less will be demanded)

Necessities/Normal Goods

Goods with an income elasticity between 0 and 1 (as incomes increase, more will be demanded, but less than the proportionate change).

Luxury Goods

Goods with an income elasticity of more than 1 (as incomes increase, more will be demanded, and more than the proportionate change).

Indirect Tax

A payment taken indirectly from consumers by charging for their expenditure on goods and services.

Specific Tax

A fixed amount of tax on a good or service.

Ad Valorem Tax

A percentage tax on a good or service.

Government Failure

Arises when government intervention causes more social costs than benefits.

Market Failure

The inability of the free market to achieve allocative efficiency.

Marginal Private Benefits

The additional value gained by households or firms when consuming/producing an extra unit of a good or service.

Marginal Private Costs

The additional expense incurred by households or firms when consuming/producing an extra unit of a good or service.

Marginal Social Benefits

The additional value gained by society when consuming/producing an extra unit of a good or service.

Marginal Social Costs

The additional expense incurred by society when consuming/producing an extra unit of a good or service.

Common Pool Resources

Non-excludable but rivalrous resources.

Tradable Permits

Government-regulated tradable contracts that allow for pollution. They can be traded amongst firms to result in a more socially optimum level.

Subsidies

Financial assistance from the government to firms that lower their costs of production, in order to increase output.

Public Goods

Goods for consumption that are non-excludable and non-rivalrous.

Free-Rider Problem

The issue that arises when people that do not pay for a good or service have access to it.

Asymmetric Information

The issue that arises when the seller has more information about the good or service than the buyer, or vice versa.

Adverse Selection

A market situation where buyers and sellers have more information than the other, leading to the party with the most information making optimal decisions for themselves, at the cost of the other party.

Moral Hazard

A market situation where a buyer or seller protected from risk makes optimal decisions for themselves, at the cost of the other party.

Perfect Competition

A market structure with many firms holding no market power, no barriers to entry, and homogeneous products.

Monopolistic Competition

A market structure with many firms holding little market power, low barriers to entry, and differentiated products.

Oligopoly

A market structure with a few large firms holding significant market power, high barriers to entry, and differentiated products.

Collusive Oligopoly

A market structure where oligopolistic firms engage in practices to restrict competition by price fixing or limiting output.

Monopoly

A market structure with one large firm holding all market power, high barriers to entry, and no close substitute products.

Natural Monopoly

A market structure where only one large firm is able to operate with profit.

Variable Costs

Expenses that change with output of a good or service.

Profit Maximization

When a firm produces at the largest possible difference between total revenue and total costs.

Income Inequality

The issue of income being unequally distributed in a country.

Wealth Inequality

The issue of assets being unequally distributed in a country.

Quantity Demanded

The amount of goods and services consumers are willing and able to purchase.

Diminishing Marginal Utility

As more of a product is consumed, each additional unit brings declining satisfaction, and consumers are only willing to buy more at lower prices.

Market Demand Curve

The sum of all individual demand for a good or service.

Complementary Goods

Goods or services that are jointly demanded.

Movement

A change in price changes the quantity.

Marginal Costs

The cost of producing one additional good or service.

= (Change in TC) / (Change in Q)

Market Supply Curve

The sum of all individual supply for a good or service.

Shortage

When there is excess demand for a good or service.

Surplus

When there is excess supply for a good or service.

Producer Surplus

The gain of all producers who can produce a product at a higher price than what they were willing and able to earn.

Perfect Information

A situation where an economic agent has complete information about everything related to the product they're buying/selling.

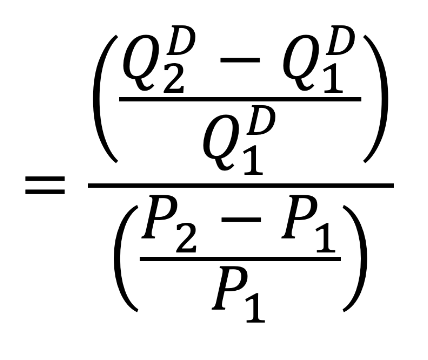

Price Elasticity of Demand

A measure of how quantity demanded for a product varies based on price.

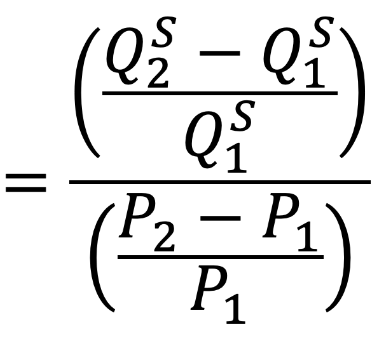

Price Elasticity of Supply

A measure of how quantity supplied for a product varies based on price.

Price Ceiling

Government regulations that set a maximum price for a good or service.

Price Floor

Government regulations that set a minimum price for a good or service.

Positive Externalities

Benefits of a good or service enjoyed by a third party not directly involved in an economic transaction.

Negative Externalities

Costs of a good or service experienced by a third party not directly involved in an economic transaction.

Merit Goods

Goods and services that create positive externalities when produced or consumed

Demerit Goods

Goods and services that create negative externalities when produced or consumed

Carbon Tax

A tax on greenhouse gas emissions that aim to reduce pollution.

Market Power

The ability of a firm to manipulate prices of a good or service.

Revenue

The money gained by a firm for selling their goods and services.

Fixed Costs

Expenses that do not change with output of a good or service.

Profit

The money remaining after expenses have been subtracted from revenue.

= TR - TC

Marginal Revenue

The additional revenue when producing one additional unit of a good or service.

= (Change in TR) / (Change in Q)

Abnormal Profit

Profit left after accounting for costs, incentivizing the entry of new firms into the market.

Normal Profit

When the cost of production equals the revenue of selling.