Macroeconomics Flashcards

1/268

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

269 Terms

What are the shifters of demand?

TONIE

Tastes

Other Goods (Substitutes/Complements)

Number of Buyers

Income

Expectations

What are the shifters of supply curve?

Expectation of future Prices

# Producers

Technology

Price of other things

Price of inputs (How much it costs to make smth vs another)

Why does the demand curve shift down?

SLIM

Substitution effect,

law of diminishing

Income effect,

marginal utility

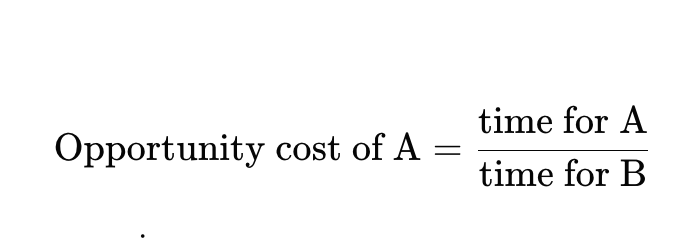

Opportunity cost formula for input

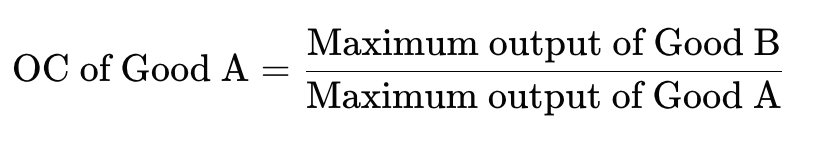

Opportunity cost formula for output

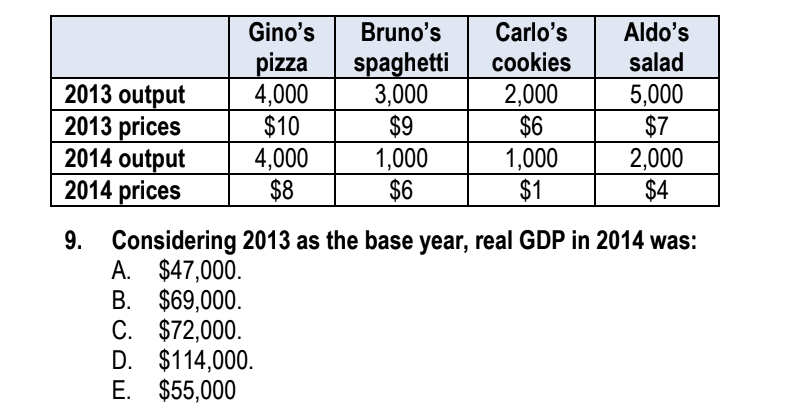

GDP

All of the final goods and services produced in a country

GNI

All of the final goods or services produced by a countries citizens/businesses

Unemployment

Anyone who is willing and able to work that is not employed

Unemployment rate

Unemployed / labor force

Labor Force

Total of everyone willing and able to work

Natural Rate of Unemployment

When an economy is at full employment (ppl can get job at a normal amount of time)

Calculate Cyclical Unemployment

Cyclical Unemployment = Actual Unemployment - Natural Rate of Unemployment

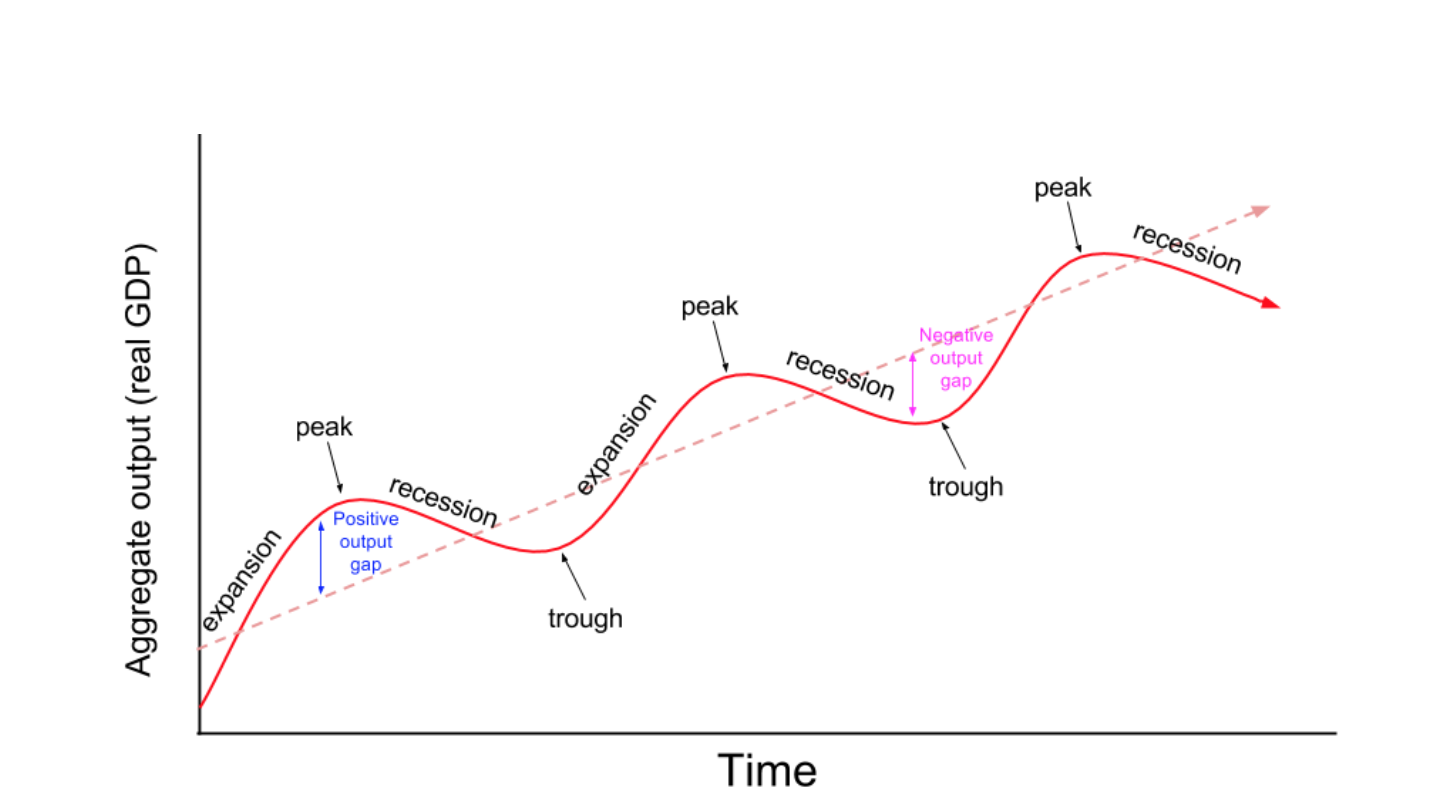

What is Cyclical Unemployment

Ups and Downs in the Business cycle.

Recessions (Downturns): Unemployment increases as businesses reduce production and lay off workers due to lower consumer spending and demand.

Expansions (Upturns): Unemployment decreases as demand grows, prompting businesses to hire more.

Calculate Natural Rate of Unemployment

Structural + Frictional

Structural unemployment

When skills dont match with jobs available

Frictional Unemployment

Natural Period it takes to get a job

Labor force participation rate

LF/ (LF + not in LF)

Draw The business cycle

Investment Definition

Something you do for future gain

Investment Examples (Firms)

Capital Goods, Inventory, NEW Building/Equipment

Investment Examples (Households)

HOUSES ONLY

Examples of things that are not investments that count towards GDP

Stocks, Education, Cars (For households), etc.

Consumption Goods

Anything you buy with no future benefit.

Capital Goods

Goods that produce a future economic benefit

Four Factors of Production

Land

Labor

Capital

Entrepreneurship

Land

Any Natural Resource

Labor

Human work that is put in to make a good or service

Capital

Any good that is used to produce another/has a future value

Entrepeneurship

AKA Technology - Creating a good or service by using the Four Factors of Production

Capital Good Example

Clothing Machines

Consumption Good Example

Movie Ticket

Positive Statement

A statement that can be proven/disproven

Normative Statement

An opinion

Ceteris Paribus

All things Equal (No external factors)

Production Possibilities Curve

Opportunity Cost

AKA Marginal Cost - The next best thing you lose

Comparative Advantage

When your opportunity Cost is lower than anothers

Absolute Advantage

Whoever can make more given the same amount of resources

OR Make same amount in less time

Trade

Beneficial

Curved PPC

Increasing Opportunity Cost

Linear PPC

Constant Opportunity Cost

How Does Trading Occur

Through Specialization

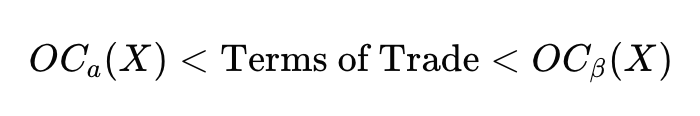

Determine Terms of Trade

Law of Demand

If Prices go up, Quantity Demanded goes down.

Demand

Entire Curve

Quantity Demanded

Point along demand curve

Substitutes

Goods that can replace each other

Complement Goods

Goods that are consumed together

Normal Good

A good that’s demand goes up when incomes go up

Inferior Good

A good that’s demand goes down when income goes up.

Expectations (Demand)

If people expect prices to go up later, they buy now

If people expect prices to go down, they will buy Later

Expectations (Supply)

If producers expect higher future prices, they are more likely to reduce current supply to sell more later.

If producers expect lower future prices, they are more likely to increase current supply to sell before prices fall.

Law of Supply

If prices go up, quantity supplied goes up

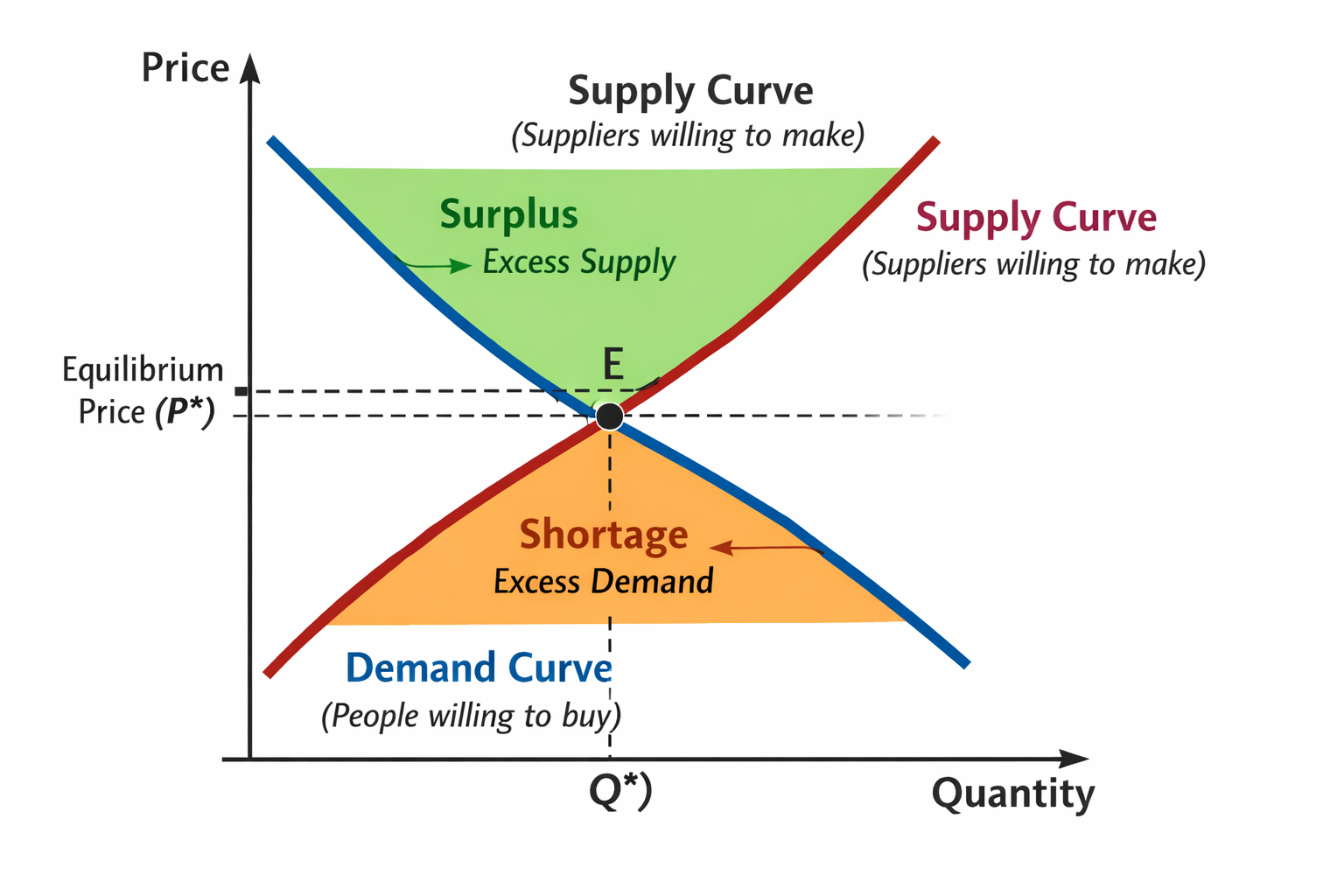

Supply and Demand Graph

Shortage

Bellow Graph - Quantity Demanded is higher than the Quantity Supplied

Surplus

Above Graph - Quantity Supplies is higher than quantity demanded

Equilibrium

When quantity demanded is the same as quantity supplied (intersection)

expenditures approach

The expenditure approach adds up all the spending done in the economy by households, businesses, the government, and other countries.

income approach

The income approach adds up all the income earned in the economy, including wages, rent, interest, and profit.

value-added approach

The value-added approach calculates GDP by adding up the dollar value added at each stage of the production process.

Expenditure Approach Equation

GDP = C+I + G + (X−M)

Income Approach Equation

GDP=W+R+i+P+Indirect Taxes−Subsidies+ Depreciation

W (Wages): Income earned by labor.

R (Rent): Income earned from land and natural resources.

i (Interest): Income earned from capital.

P (Profit): Corporate profits and proprietors’ income.

Indirect Taxes - Subsidies: Taxes on production minus government subsidies.

Depreciation: Also called capital consumption allowance; accounts for wear and tear on capital.

Value-Added Approach Equation

(Value of Output−Value of Intermediate Goods)

Limitations of GDP

Under the table

Ilegal

Non Marketed Goods (unpaid household work, volunteer labor, wildlife, public goods, e.g., streetlights)

GDP per Capita

GDP / Population

Inflation

When the Price of a Good Rises

What is CPI

Consumer Price Index: Avg. Change over time that consumers pay for a basket of goods

CPI Equation

CPI = (Cost of Basket Current Year) / (Cost of Basket Base Year)

Deflation

Negative Inflation

Disinflation

Sustained decrease in price level

Price Index

Measure that calculates changing costs

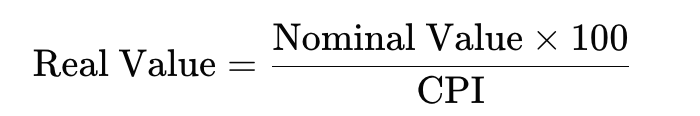

“real ___ “

Adjusted for inflation

“Nominal ___ “

Not adjusted for inflation.

Purchasing Power

What can actually be bought with your money

Inflation Rate Equation

Real GDP Equation

Nominal GDP / GDP Deflator

Economic Growth

When the Potential of growth increases

depression

long recession

negative output

When an economy’s actual output is bellow potential output

Potential Output

the maximum sustainable level of goods and services an economy can produce using all its resources (labor, capital, technology) efficiently, without causing inflation to rise

Positive Output

When economy’s actual output is above potential output

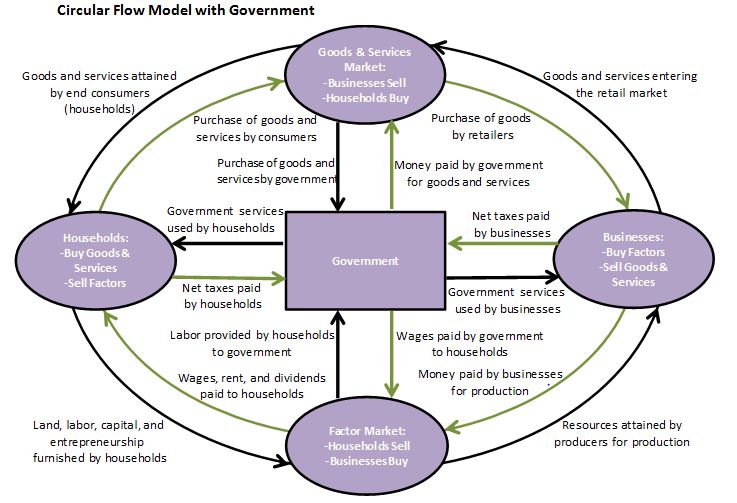

Full Circular Flow Model

Real Value Formula

Assume the CPI is 140 and the value of a market basket adjusted for inflation is $200. What is the dollar value of the basket in current prices?

$280=(200x140)/100

What is the difference between the CPI and the GDP Deflator?

The CPI measures prices of a fixed basket of consumer goods. The deflator is an index number that measures all prices and is used to convert nominal GDP into real GDP.

What's Measured: All domestic production (GDP Deflator) vs. household consumption (CPI).

Imports/Exports: GDP Deflator includes exports but not imports; CPI includes imports but not exports.

Basket Type: Variable (GDP Deflator) vs. Fixed (CPI).

Identify the equation for the GDP deflator:

(Nominal GDP / Real GDP) × 100

How can CPI Overstate Inflation

if consumers substitute cheaper goods.

Identify who is hurt and who is helped by unexpected inflation.

Savers and lenders (that lend at fixed interest rates) are hurt, and borrowers are helped.

B.

Real Interest rates vs Inflation

Inverese

Nominal Interest rates vs Inflation

Directly related because banks raise Nom when Inf is high

Aggregate Demand

The total Demand in an economy

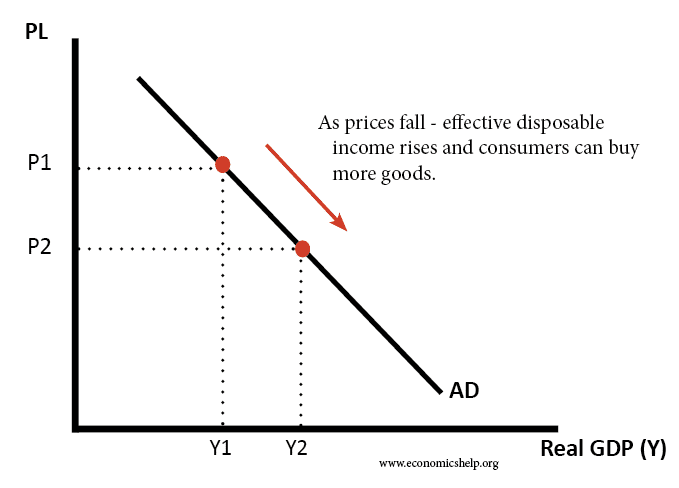

AD Curve

Reasons AD Curve is downward sloping

Wealth Effect. As Prices go down people will be able to buy more.

Interest Rate Effect. As Price levels go down interest rates go down so more investment can happen (loans)

Foreign Currency Effect. As Price levels go down foreigners will view it cheaper to buy products in our country so exports go up.

Things That Shift AD Curve

C + I + G + NX. If the cause is a change in the price level, it is a movement along the curve. If the cause is something besides a change in the price level, the entire AD curve will shift.

ALSO MONETARY POLICY

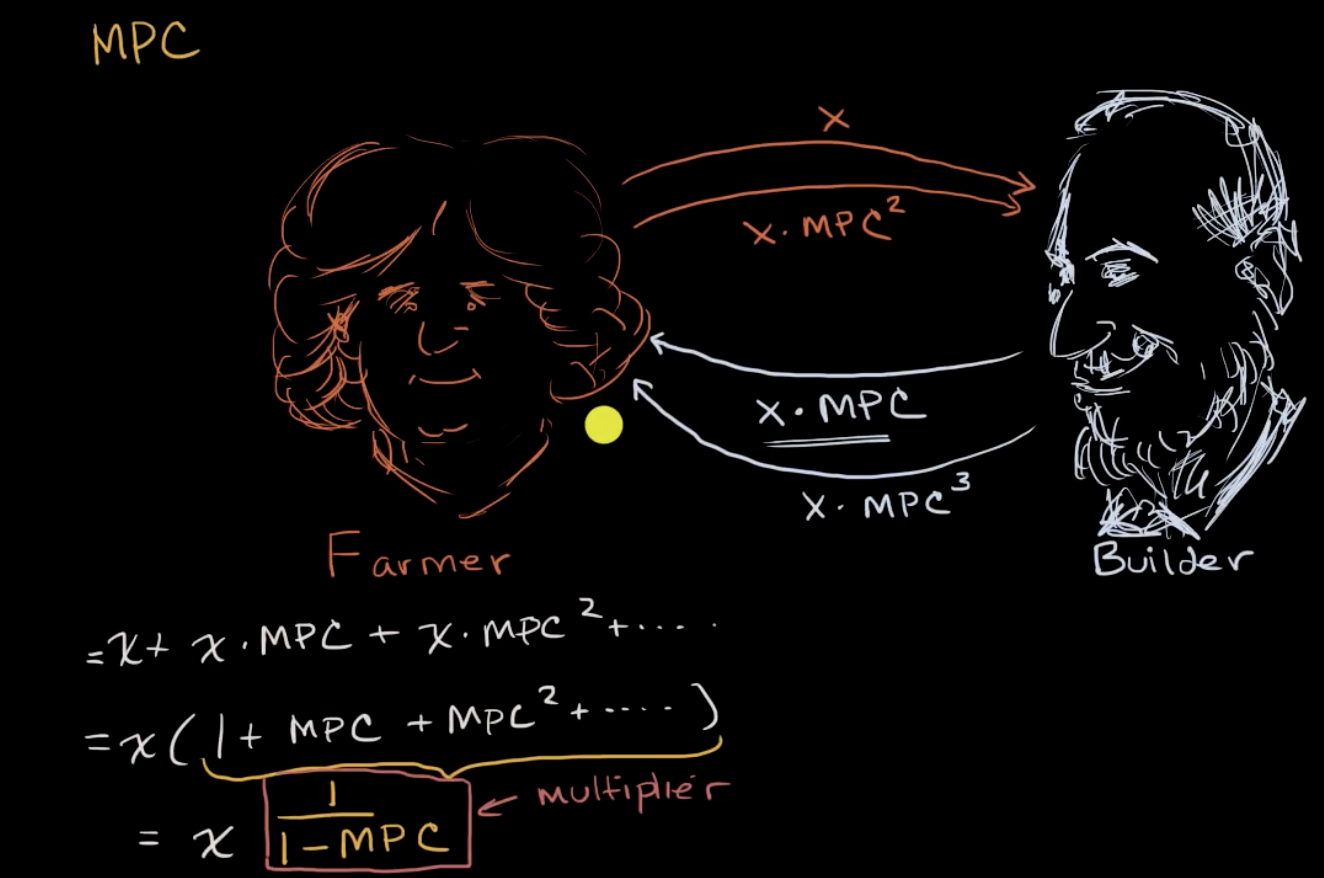

How does MPC Multiplier Work?

What is MPC

Marginal Propensity to Consume, the percentage of every dollar you choose to spend.

MPC Multiplier

Calculates the total amount of money that is added to an economy through its MPC

MPC Multiplier Formula

1 / 1 - MPC

Short-Run Aggregate Supply

The total output of goods and services an economy produces at different price levels in the short term