Chapter 12 - Labor markets, poverty & income distribution

The economic value of work

In competitive labor markets, employers face pressure to pay each worker the value of his/her marginal product. When a firm can hire as many workers as it wishes at a given market wage, it should expand employment as long as the value of marginal product of labor exceeds the market wage.

Marginal product of labor (MP): additional output a firm gets by employing one additional unit of labor.

Value of marginal product of labor (VMP): dollar value of the additional output a firm gets by employing one additional unit of labor.

The equilibrium wage and employment levels

The demand for labor in a perfectly competitive labor market is the horizontal sum of each employer's value of marginal product (VMP) curve.

The supply curve of labor for an individual labor market is upward-sloping, even though the supply curve of labor for the economy as a whole may be vertical or even downward sloping.

In each labor market, the demand and supply curves intersect to determine the equilibrium wage and level of employment.

Explaining differences in earnings

Earnings differ among people in part because of differences in their human capital, an amalgam of personal characteristics that affect productivity. But pay often differs substantially between two people with the same amount of human capital. This can happen for many reasons:

- One may belong to a labor union while the other does not

- One may work in job with less pleasant conditions

- One may be the victim of discrimination

- One may work in an arena in which technology or other factors provide greater leverage to human capital.

Human capital theory: theory of pay determination that says a worker's wage will be proportional to his/her stock of human capital.

Human capital: amalgam of factors such as education, training, experience, intelligence, energy, work habits, trustworthiness, and initiative that affects the value of a worker's marginal product.

Labor union: group of workers who bargain collectively with employers for better wages and working conditions.

Compensating wage differential: difference in the wage rate (negative/positive) that reflects the attractiveness of a job's working conditions.

Employer discrimination: arbitrary preference by an employer for one group of workers over another.

Customer discrimination: willingness of consumers to pay more for a product produced by members of a favored group, even if the quality of the product is unaffected.

Winner-take-all labor market: one in which small differences in human capital translate into large differences in pay.

Methods of income redistribution

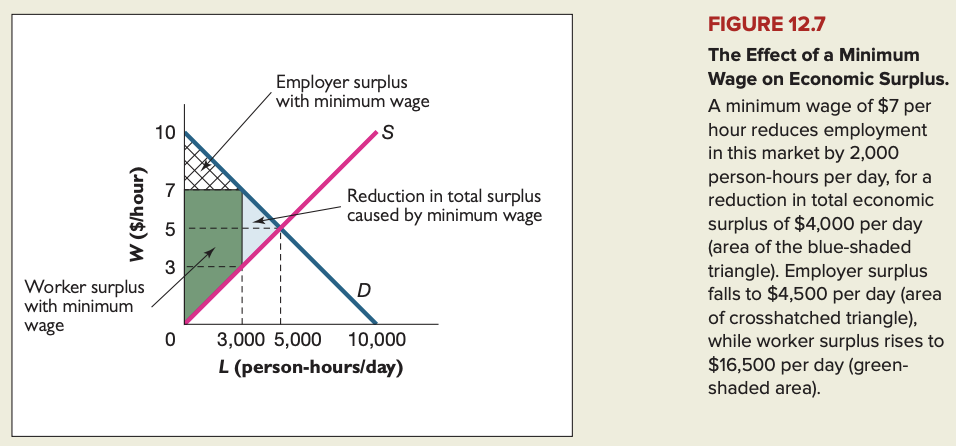

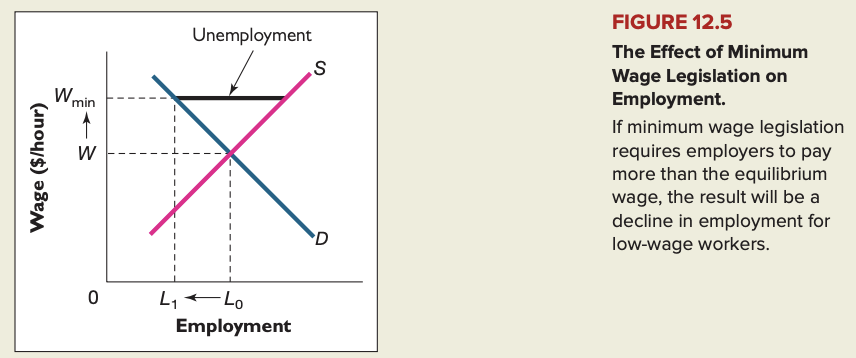

Minimum wage laws reduce total economic surplus by contracting employment. The earned-income tax credit boosts the incomes of the working poor with out that drawback, but neither policy provides benefits for those who are not employed.

Other instruments in the battle against poverty include in-kind transfers such as food stamps, subsidized school lunches, Medicaid, and public housing as well as cash transfers such as Aid to Families with Dependent Children. Because benefits under most of these programs are means-tested, beneficiaries often experience a net a decline in income when they accept paid employment.

The negative income tax is an expanded version of the earned-income tax credit that includes those who are not employed. Combining this program with access to public service jobs would enable government to ensure adequate living standards for the poor without significantly undermining work incentives.

In-kind transfer: payment made not in the form of cash, but in the form of a good/service.

Means-tested: benefit program whose benefit level declines as the recipient earns additional income.

Negative income tax (NIT): system under which the government would grant every citizen a cash payment each year, financed by an additional tax on earned income.

Poverty threshold: level of income below which the federal government classifies a family as poor.

Earned-income tax credit (EITC): policy under which low-income workers receive credits on their federal income tax.