Always-In Trading

1/24

Earn XP

Description and Tags

The Always-In concept, as taught by Dr. Al Brooks, is a powerful framework for understanding market direction and trader commitment. This flashcard deck will help you identify when the market is Always-In long or short, how to spot transitions, and how to align your trades with the dominant force. Key topics include: ✅ What is Always-In? – The core principle behind recognizing when the market has a clear directional bias. ✅ Reading Price Action – Identifying strong moves, consecutive trend bars, and signals that indicate traders are trapped or doubling down. ✅ Reversals vs. Continuations – Understanding when a counter-trend move is a trap vs. a genuine shift in control. ✅ Trade Execution – How to enter, exit, and manage risk when trading with the Always-In concept. ✅ Common Pitfalls – Why traders misread transitions and how to stay on the right side of the market. Whether you’re a beginner or refining your skills, this deck will sharpen your ability to read price action and confidently trade with the market’s momentum. 🚀

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

25 Terms

Consider an ALWAYS IN approach when?

…you miss too many big moves.

What is Always in

If you had to be in the market at all times

either long or short

the always in position

is whatever your current position is

60%

1R at least

If a signal is clear enough to be an always in reversal

Always in and entry

Always in doesn’t mean HIT THE BUTTON NOW

That is always in position

If right now you were forced to enter the market and could decide at least slightly in favour of one of the other

How to decide ALWAYS IN

Look at the closes if most of them above the moving average always in is probably long

If the move up to this trading range was a rally it’s probably long

if you’re hoping for a pull back to buy. It’s probably long

if you can’t decide the markets in a trading range.

Identifying always in long bar by bar

Consecutively strong trend bars

Start a shift to always in

Not confirmed until breakout and follow-through

OPEN - What if GAP UP

but

consecutive bear bars?

Scalp only short

Bulls looking for a pullback

Look where the buy was here above B3

Explain reversals and always in

The market often needs one more bar to reverse (that second good bear bar in a bull trend)

But doesn’t get it

Market works higher

Always-in swing approach to trading

3-10 setups day

Taking profits 2-3x initial risk

AB’s method is using the tightest stop possible, different from where beginners think the stop is

Always in and trading ranges

The trading range does not flip always-in

It is better to scalp in the direction of the previous always-in

TRD and always in

Always in is a swing concept that applies to trends and is dangerous in trading ranges

If you look at a move up and wonder if it has truly flipped into always in and you are uncertain uncertainty means trading range

Trends create sustained urgency

Urgency will lead to a measured move of this trading range plenty of room for profit

What need to see for always in?

Spike

1 very strong bar (better FT)

2 good bars good closes pref above MA

3 smaller bars in a row

Open - First hour looking for always in

Before clear trend started

Pair good bars

Look for scalps in that direction

Trading range , why would a trader buy the close of a bear bar?

Traders expect FT to be bad

Front run reversals

Failed breakout

Open profits - swing vs scalp

Scalpers don’t let open profit positions turn into losers

Scale-in for scalpers only if original was losing

Most traders should take small loss and wait

Breakout and FT entry?

Buy the close

Or if doji wait

Buy as goes few ticks / points past that bar as forming

Fade CT breakout

Examples:

Buy bear bar low in BLF / Sell bull bar high in BRF

Buy below in a Bull MC

Sell above a strong bear spike

Buy pullback to the MA

Fade breakout of a TR (DT and DB)

Enter late where stops?

Why?

Prob below signal bar

Sense urgency, but then none appears

Always in short

but FT bad?

Sell rallies, not the close

Low 1, Low 2 setups

From spike

Mm TR

Once confident always in

Breakout and FT

Look for MM

Before Always-In there is a move that changes market

Strong counter trend move that tells swing traders to take profits

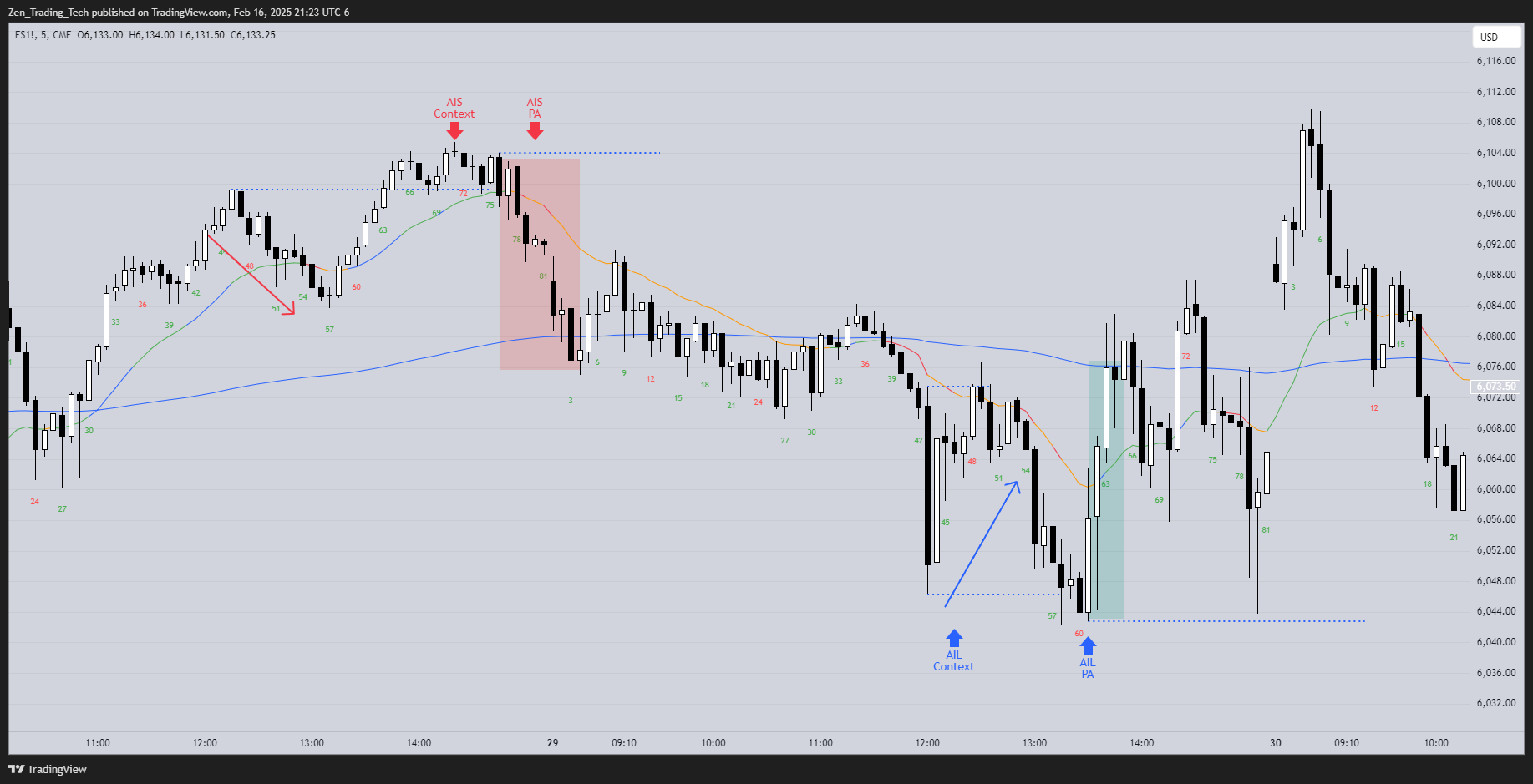

What are the 2 kinds of ALWAYS IN?

Always in PRICE ACTION (bar x bar)

Always in CONTEXT (structure / pattern complete / leg count / Other)

So it can be ALWAYS IN CONTEXT before ALWAYS IN PRICE ACTION

No

STC Strong BL ->Below MA

BTC Strong BR -> Above MA

AIL?