econ exam study guide. follow dus10goss on IG if helpful 😋

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

HOW TO USE FOR A GUARANTEED A

Raw dog exam to see where you are weak

Click on Learn and then options.

Set the options to “written” and “answer with definition” as well as turn off “shuffle” and turn on “retype answers”

Study until you memorize every term (about an hour- two hours)

For extra practice, go through the TopHat HW readings and whatnot. Good luck

A pure monopoly is an industry in which:

A. one firm is the producer or seller of a product with close, but not perfect,

substitutes.

B. one firm is the sole producer or seller of a product that has no close substitutes.

C. there are no barriers to prevent other firms from entering the industry.

D. price is determined by competitive market forces but output is determined by the

seller.

one firm is the sole producer or seller of a product that has no close substitutes.

All of the following are examples of barriers to entry into a market except:

A. patents and copyrights.

B. government franchises and licenses.

C. brand awareness.

D. sole ownership of key resources.

brand awareness.

The demand curve for a monopoly firm is:

A. more elastic than the industry, or market, demand curve for its product.

B. less elastic than the industry, or market, demand curve for its product.

C. the same as the industry, or market, demand curve for its product.

D. perfectly inelastic at the output where MR=MC.

the same as the industry, or market, demand curve for its product.

If electrical service can be more efficiently provided to a market by a single supplier than by many competing suppliers, the market is considered to be a(n):

A. rent-seeking monopoly.

B. output-maximizing monopoly.

C. natural monopoly.

D. efficient monopoly.

natural monopoly.

Which of the following is always true for a monopolist?

A. Profit is maximized where marginal revenue equals marginal cost.

B. Economic profit is positive in both the short run and the long run.

C. Consumer surplus is zero because the monopoly price is greater than the

competitive price.

D. All of the above are always true for a monopolist.

Profit is maximized where marginal revenue equals marginal cost.

Obstacles that make it impossible or unprofitable for new firms to enter a market are:

A. always illegal for firms to erect in the U.S.

B. barriers to entry that may lead to monopoly power.

C. common in both monopoly and competitive markets.

D. the defining characteristic of monopolistically competitive markets.

barriers to entry that may lead to monopoly power.

First-degree (perfect) price discrimination occurs when:

A. the seller is able to charge each buyer the highest price the buyer will pay.

B. the seller offers a volume discount to buyers who are willing to purchase more.

C. the seller is able to separate customers into two different groups and charge one

group a higher price than the other group is charged.

D. the price charged to all buyers is the same as the competitive price.

the seller is able to charge each buyer the highest price the buyer will pay.

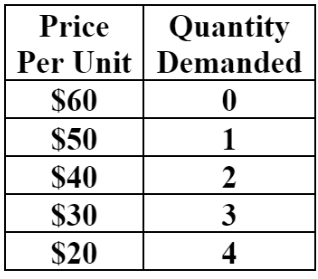

For a monopolist that is unable to price discriminate, the marginal revenue of the

3rd unit is:

A. $30, and total revenue for 3 units is $90.

B. $10, and total revenue for 3 units is $120.

C. $30, and total revenue for 3 units is −$10.

D. $10, and total revenue for 3 units is $90.

$10, and total revenue for 3 units is $90.

For a monopolist that is able to engage in perfect (first-degree) price discrimination, the marginal revenue of the 3rd unit is:

A. $10, and total revenue for 3 units is $90.

B. $120, and total revenue for 3 units is $140.

C. $30, and total revenue for 3 units is $120.

D. $90, and total revenue for 3 units is $120.

$30, and total revenue for 3 units is $120.

In order to engage in price discrimination, a seller must be able to:

A. separate customers into groups with different elasticities of demand.

B. charge each customer the same price.

C. incur a different cost for producing each unit of output.

D. All of the above conditions are necessary for price discrimination.

separate customers into groups with different elasticities of demand.

When a profit-maximizing monopolist charges all consumers the same price:

A. P > MR = MC

B. P < MR = MC

C. P > MR > MC

D. P = MR = MC

P > MR = MC

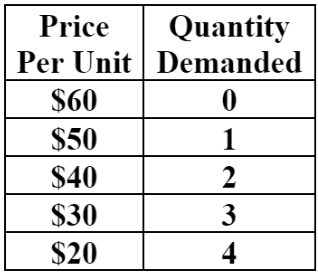

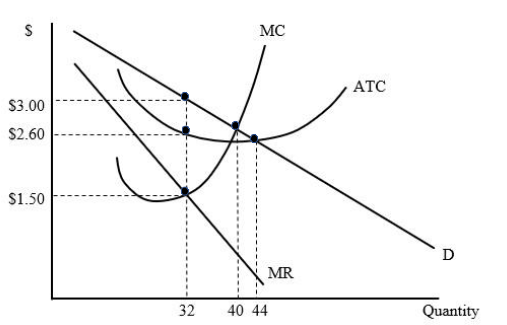

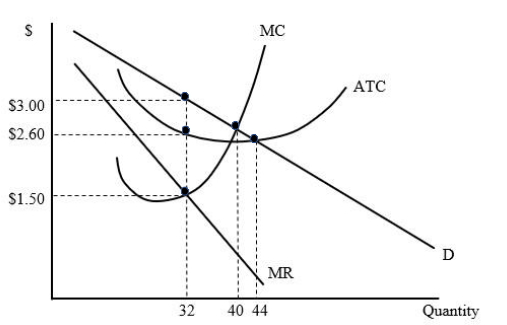

This monopolist will produce:

A. 32 units of output and charge a price of $3.00.

B. 32 units of output and charge a price of $2.60.

C. 44 units of output and charge a price of $1.50.

D. 40 units of output and charge a price of $2.60.

32 units of output and charge a price of $3.00.

This monopolist is:

A. earning zero economic profit.

B. earning positive economic profit equal to $48.

C. incurring economic losses equal to $12.80.

D. earning positive economic profit equal to $12.80.

earning positive economic profit equal to $12.80.

The efficient level of output in this market is:

A. 40 units which means there is no deadweight loss at the profit-maximizing output.

B. 44 units which means there is no deadweight loss at the profit-maximizing output.

C. 40 units which means there is a deadweight loss of approximately $6 at the profit- maximizing output.

D. 44 units which means there is a deadweight loss of approximately $9 at the profit- maximizing output.

40 units which means there is a deadweight loss of approximately $6 at the profit- maximizing output.

A monopolist that earns positive economic profit in short-run equilibrium will:

A. definitely continue to earn positive economic profit in the long run.

B. earn positive economic profit in the long run if it can maintain barriers to entry, ceteris paribus

C. earn higher economic profit in the long run because of economies of scale.

D. earn economic profit equal to zero in long-run equilibrium.

earn positive economic profit in the long run if it can maintain barriers to entry, ceteris paribus

From society’s perspective, it is generally the case that:

A. monopoly markets are more efficient than competitive markets.

B. there is no difference between the outcome in monopoly markets and competitive markets.

C. there is never a situation in which it more efficient to have only one firm service an entire market.

D. competitive markets are more efficient than monopoly markets.

competitive markets are more efficient than monopoly markets.

Ceteris paribus, compared to a perfectly competitive market, a monopoly market:

A. produces a higher level of output and charges a lower price.

B. produces a higher level of output and charges a higher price.

C. produces a lower level of output and charges a lower price.

D. produces a lower level of output and charges a higher price.

produces a lower level of output and charges a higher price.

At the profit-maximizing level of output for an unregulated monopolist:

A. marginal benefit exceeds marginal cost which creates a deadweight loss.

B. marginal cost exceeds marginal benefit which creates a deadweight loss.

C. marginal benefit equals marginal cost which is efficient.

D. price is equal to marginal cost but price is greater than marginal revenue.

marginal benefit exceeds marginal cost which creates a deadweight loss.

Government addresses the potential inefficiency associated with monopoly markets by:

A. requiring all firms to seek government approval before raising prices.

B. blocking all proposed mergers.

C. promoting and protecting competition through antitrust laws and regulation.

D. protecting monopolies from the forces of competition through regulation.

promoting and protecting competition through antitrust laws and regulation.

All of the following are characteristics of a monopolistically competitive market except:

A. there are many firms in the market.

B. the firms in the market produce goods that are close, but not perfect, substitutes.

C. there are no significant barriers to entry into the market in the long run.

D. the firms in the market engage in interdependent decision making.

the firms in the market engage in interdependent decision making.

Monopolistically competitive firms derive some degree of market power from:

A. high barriers to entry.

B. perfect information.

C. mutual interdependence with other firms.

D. product differentiation.

product differentiation.

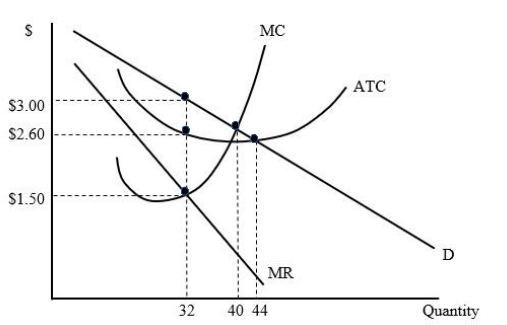

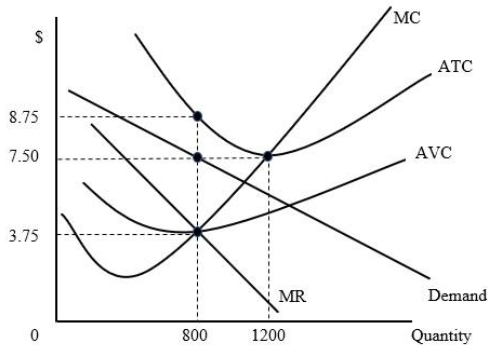

This firm’s total fixed costs (TFC) are equal to:

A. $3,000.

B. $4,000.

C. $7,000.

D. $9,000.

$4,000.

In the short run, the best strategy for this firm is to:

A. shut down and pay total fixed costs.

B. produce where the ATC curve is minimized to minimize losses.

C. produce where MR = MC and incur a loss equal to $1,000.

D. produce where MR = MC and incur a loss equal to $4,000.

produce where MR = MC and incur a loss equal to $1,000.

The demand curve for a firm in a monopolistically competitive market is relatively more elastic than the demand curve for the general product due to:

A. the existence of close substitutes.

B. the existence of perfect substitutes.

C. the fact that there are no substitutes for the firms product.

D. unpredictable consumers.

the existence of close substitutes.

Like a monopoly firm, a monopolistically competitive firm:

A. has some control over the price it charges.

B. sets price above marginal cost.

C. maximizes profit by producing the quantity where marginal revenue equals

marginal cost so long as price exceeds average variable cost.

D. All of the above statements are true.

All of the above statements are true.

For monopolistically competitive firms in long-run equilibrium, economic profit is:

A. positive because their products are unique.

B. positive because their products are differentiated.

C. zero because there are no barriers to entry.

D. zero because of strong barriers to entry.

zero because there are no barriers to entry.

An industry dominated by a few large firms whose pricing and output decisions are dependent on one another is:

A. illegal in the United States.

B. monopolistically competitive.

C. monopolistic.

D. oligopolistic.

oligopolistic.

The characteristic that distinguishes oligopoly from other market structures is:

A. the existence of barriers to entry.

B. interdependence among firms in pricing and output decisions.

C. product differentiation.

D. the ability of firms to earn long-run economic profits.

interdependence among firms in pricing and output decisions.

To be successful at increasing price and maintaining a high price for their product, members of a cartel must:

A. produce as much as they can.

B. encourage new firms to enter the market.

C. adhere to quotas and agree to limit their output.

D. find ways to lower costs of production.

adhere to quotas and agree to limit their output.

The game theory model assumes that:

A. firms anticipate rival firms’ decisions when they make their own decisions.

B. firms ignore rival firms’ decisions when they make their own decisions.

C. markets are contestable because there are no barriers to entry.

D. a firm will always follow the pricing strategy of the dominant firm in the industry.

firms anticipate rival firms’ decisions when they make their own decisions.

Behavior in which a dominant firm’s pricing strategy is followed by other firms in the industry is called:

A. oligopoly power.

B. contestable behavior.

C. price leadership.

D. cartel membership.

price leadership.

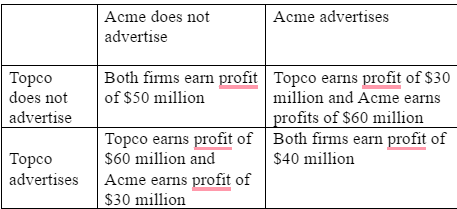

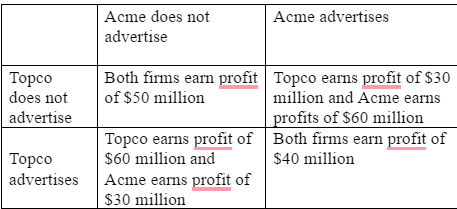

Suppose Acme and Topco must choose whether or not to advertise without knowing what the other will do. In the Nash equilibrium:

A. neither Acme nor Topco chooses to advertise.

B. both Acme and Topco choose to advertise.

C. Acme advertises, but Topco does not.

D. Topco advertises, but Acme does not.

both Acme and Topco choose to advertise.

Which strategies maximize Acme’s and Topco’s combined profit?

A. Neither advertises

B. Both advertise

C. Acme advertises, but Topco does not

D. Topco advertises, but Acme does not

Neither advertises

The market structure that satisfies the efficiency conditions of MB = MC and no deadweight loss is:

A. perfect competition.

B. monopolistic competition.

C. oligopoly.

D. monopoly.

perfect competition.

The marginal product of labor (MPL) is the:

A. change in total revenue that results from selling one more unit of output.

B. change in output that results from employing one more unit of labor.

C. additional revenue generated from employing one more unit of labor.

D. total revenue generated from the use of labor.

change in output that results from employing one more unit of labor

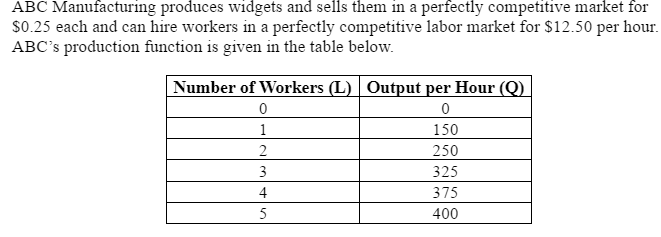

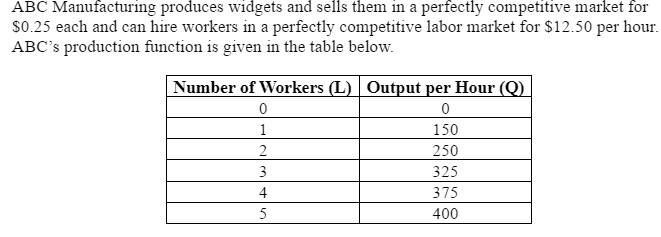

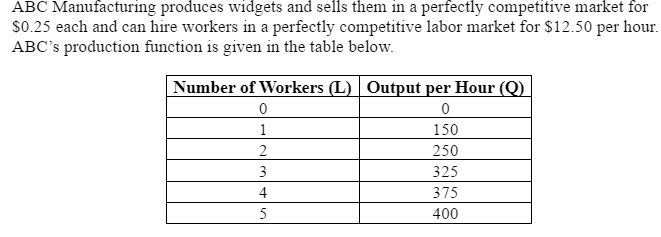

The marginal product of the 2nd worker is:

A. 150, and the marginal product of the 3rd worker is 250.

B. 250. and the marginal product of the 3rd worker is 325.

C. 100, and the marginal product of the 3rd worker is 150.

D. 100, and the marginal product of the 3rd worker is 75.

100, and the marginal product of the 3rd worker is 75.

The value of marginal product (VMP) of the 2nd worker is:

A. $37.50 per hour.

B. $25 per hour.

C. $18.75 per hour.

D. $12.50 per hour.

$25 per hour.

If ABC Manufacturing follows the profit maximizing hiring rule, it will hire:

A. 2 workers and produce 250 units of output per hour.

B. 3 workers and produce 325 units of output per hour.

C. 4 workers and produce 375 units of output per hour.

D. 5 workers and produce 400 units of output per hour.

4 workers and produce 375 units of output per hour.

Which of the following best represents a derived demand for labor?

A. The demand for tickets to the World Series by baseball fans

B. The demand for data input services by a marketing firm

C. The demand for new novels by recreational readers

D. The demand for the services of a pediatrician by new parents

The demand for data input services by a marketing firm

In a competitive labor market, an increase in the supply of labor, ceteris paribus, will:

A. increase the demand of labor.

B. decrease the demand of labor.

C. increase the market wage rate.

D. decrease the market wage rate.

decrease the market wage rate.