Multinational Companies(1.6), and Investment Appraisal(3.8)

1/16

Earn XP

Description and Tags

This set of flashcards covers key concepts related to multinational companies (MNCs) and their impacts on globalization, competition, and host countries.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

What is globalization?

The process by which the world's regional economies are becoming one integrated global unit.

What does 'post-national' mean in terms of MNCs?

Companies that consider no 1 place their home, conducting business wherever they can make a profit, despite having a registered home office.

What is a Multinational Company (MNC)?

A business that operates in more than one country or is legally registered in more than one country.

List the reasons for the rapid growth of multinational companies.

1:Improved communication methods such as technology and transport networks for access to more people

2:globalization of supply chains which reduces costs and tariffs

3:increasing political and economic power

4:Dismantling trade barriers for easier movement of products

What is skills transfer in the context of MNCs?

A two-way transfer of knowledge where the MNC learns from local workers and vice versa.

How can domestic producers compete with MNCs? And how does it affect the domestic country’s economy

By creating their own unique selling point (USP) to differentiate from large foreign brands.This competition can strengthen the domestic economy by fostering innovation, job creation, and supporting local industries.

What impact do MNCs have on local culture?

MNCs can lead to a loss of cultural identity as global brands may overshadow domestic products and cultural norms.

What is a host country in terms of MNC?

A nation where a multinational company operates its business facilities or engages in production outside its home country, typically benefiting from local resources and markets.

Why is the Dismantling of trade barriers and Deregulation of the world's financial markets beneficial to MNCs?

Dismantling trade barriers and deregulation allow MNCs to operate more freely across borders, reducing costs and increasing market access. This fosters increased competition and can enhance profit margins for these companies.

what are some positive impact of MNCs on host country?

MNCs can contribute to economic growth, create job opportunities, help new infrastructure, more products sold and enhance transfer of technology and skills in the host country.

what are some negative impact MNCs have on the host country?

Negative effects can include exploitation of local resources and environment,

loss of cultural identity

Domestic brands lose market share

Brain drain(skilled people go work for overseas instead of domestic)

Multinational company leaving for short term for cheaper producers.

Profits being repatriated(profits brought back to the company's home country instead of being reinvested locally)

What are some effects of globalization with MNCs?

Increase in trade, investment flows, and cultural exchange, enhancing market opportunities for MNCs. It can also result in greater competition, pressure on local businesses, and potential shifts in power dynamics between nations.

What is the payback period?

The length of time required for an investment to generate enough cash flow to cover its initial cost.

What is the average rate of return?

The average annual income an investment generates, expressed as a percentage of the initial investment.

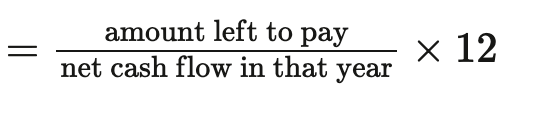

What is the formula for the payback period?

(Initial Investment - Netflow of year before payback is paid) / Netflow of the year cummulative cash flow is more than initial investment

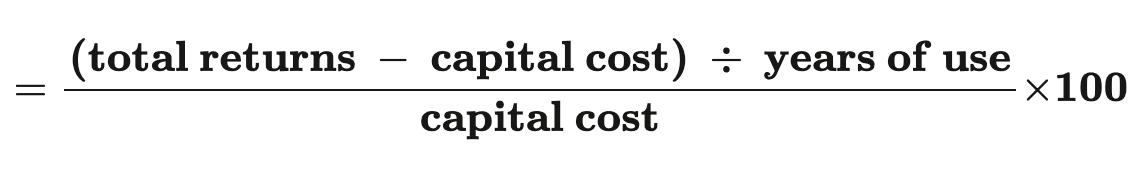

What is the formula for the average rate of return?

(Average Annual Profit-investment cost / years of use *Initial Investment) * 100

What is investment appraisal

Investment appraisal is the process of evaluating the potential profitability and risks of an investment project to determine its feasibility.