Chapter 11: Government and Public Sector : Market Failure, Externalities, Public Goods, Efficiency

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

Market failures

Market failures occur when the free market fails to allocate resources efficiently, leading to a loss of economic and social welfare.

MSB and MSC

MSB is the additional benefit to society from consuming one more unit of a good or service.

MSC is the additional cost to society from producing one more unit of that good or service.

At the point where MSB = MSC, society is maximizing welfare because the value of the last unit produced is exactly equal to the cost of producing it. There is no overproduction or underproduction, and resources are allocated efficiently.

Externalities

Externalities are side effects of economic activities that affect third parties who are not involved in the activity. They can be either positive or negative and are a key cause of market failures because they lead to inefficient outcomes where the market does not account for the social costs or benefits.

These effects can. be caused by producers and consumers

Ex. negative externality is consumption of ciggartes causing second ahdn smoke

and a positive externality is immunity from consumption of vaccine

MSC AND MSB curve

sweetspot where they cross is how much society wants built and that exact number is how much has been built

Per unit subsidy

A per unit subsidy is a payment the government gives to producers (or sometimes consumers) for each unit of a good or service produced or purchased. It is designed to lower the cost of production or consumption, and encourage more of that good to be produced or consumed—especially when the good has positive externalities (e.g., education, vaccinations, clean energy).

Marginal external benefit

Marginal Exit Benefit (MEB) refers to the benefit a firm receives by exiting a market, measured on a per-unit basis. It is used in analyzing a firm's decision to leave the industry, especially in the long run when all costs are variable.

lump sum subsidy

A lump sum subsidy is a fixed amount of money given to a firm regardless of the quantity produced. It’s the opposite of a per-unit subsidy, which is based on output. The lump sum subsidy is commonly used in theory to demonstrate effects on fixed costs.

🔍 Key Characteristics of a Lump Sum Subsidy:

Does not vary with output — it’s a one-time or flat amount.

Increases total profit by reducing fixed costs, not variable costs.

Does NOT affect marginal cost (MC) or marginal revenue (MR).

Does NOT change the firm’s output decision (since MR = MC is unchanged).

Can reduce losses or create profits, but won't change how much is produced.

Positive Externality in production

if msb is greater than msc the cost is underproduced

deadweight loss points to optimal output

underproduction between q1 and optimal.

Positive externality in consumption

msb and mob downturned

supply / msc upturned

socially optimal point is the further most intersection of msb and msc

deadweight loss at top and pointing to socially optimal

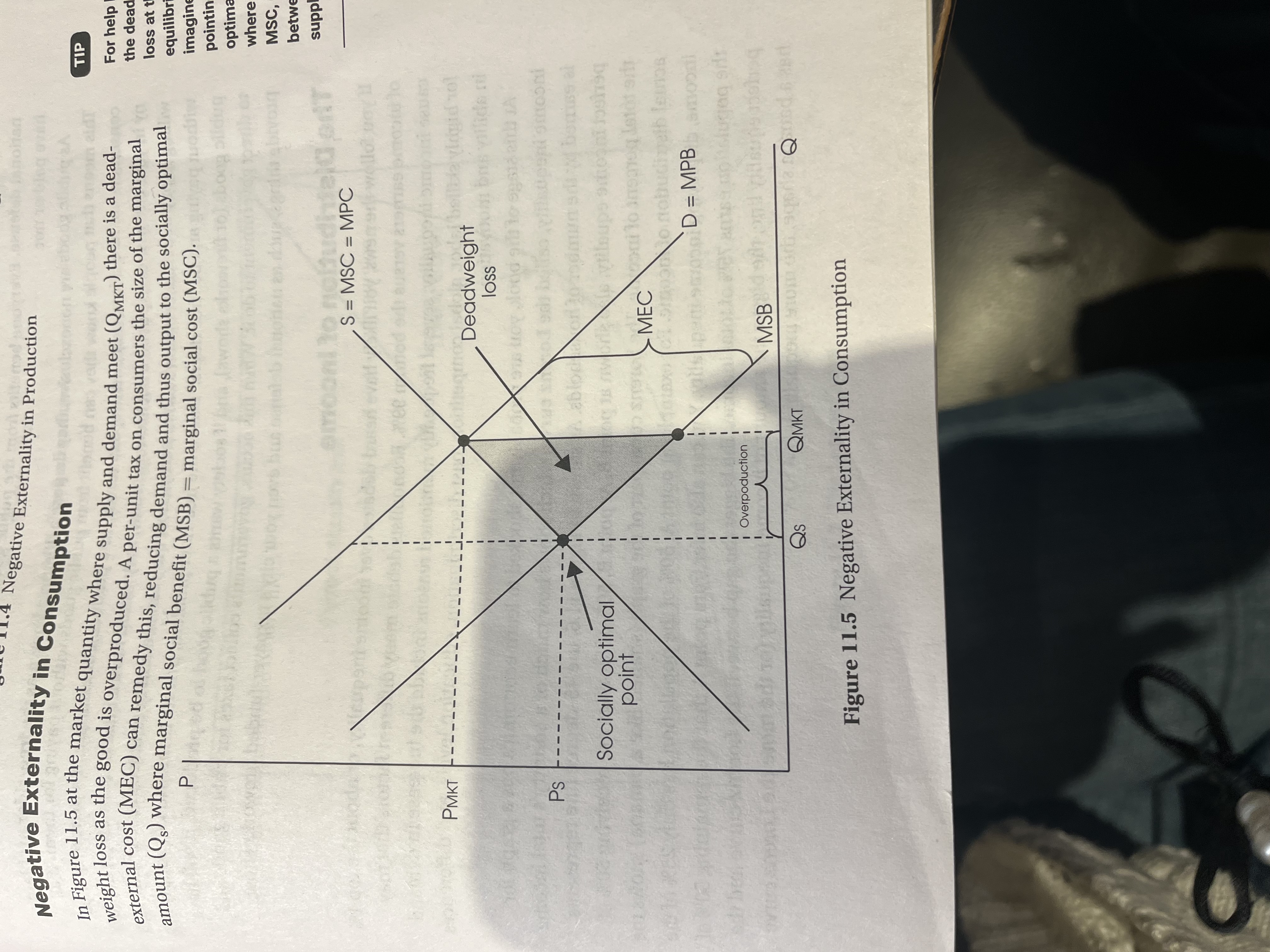

ways to combat negative externalities

if a firm is producing more than desirable and causing pollution

impose a per unit tax = marginal external cost

it’s more helpful than a lump sum tax which isn’t based on quantity and doesn’t affect MC or MR

Negative externality in production

arrow points to socially optimal output but opposite from y axis.

MSC AND MPC upwards, MEC exists in the middle

overproduction between Q optimal and other Q

Negative externality in consumption

MPB and MSB pointing down

MSC AND MPC UPWARDS

Coase Theorem

Private parties can solve the issues created by Externalities on their own. For example, a polluting firm may pay the affected parties to compensate for the harm of pollution or homes Next to a new airport may receive soundproof windows from an airline company.

public vs private goods

private good - both has exclusion and is a rival in consumption

for example, a person may be excluded from the benefits of a private good by not being able to pay the price. ex could be limited concert tickets.

public goods are nonexclusive and and nonrival As one person consumption of a public good does not exclude others from benefiting from it. public goods include national defense, clean, air, or a light house These can be paid for by taxes

free rider problem

People know that they can benefit from public goods without paying for them, and if all consumers are free riders demand drops zero for the product. For example, if a private company wishes to put on a big fireworks show, they would have a hard time, finding people willing to pay to watch, because people who live nearby can see it without paying.

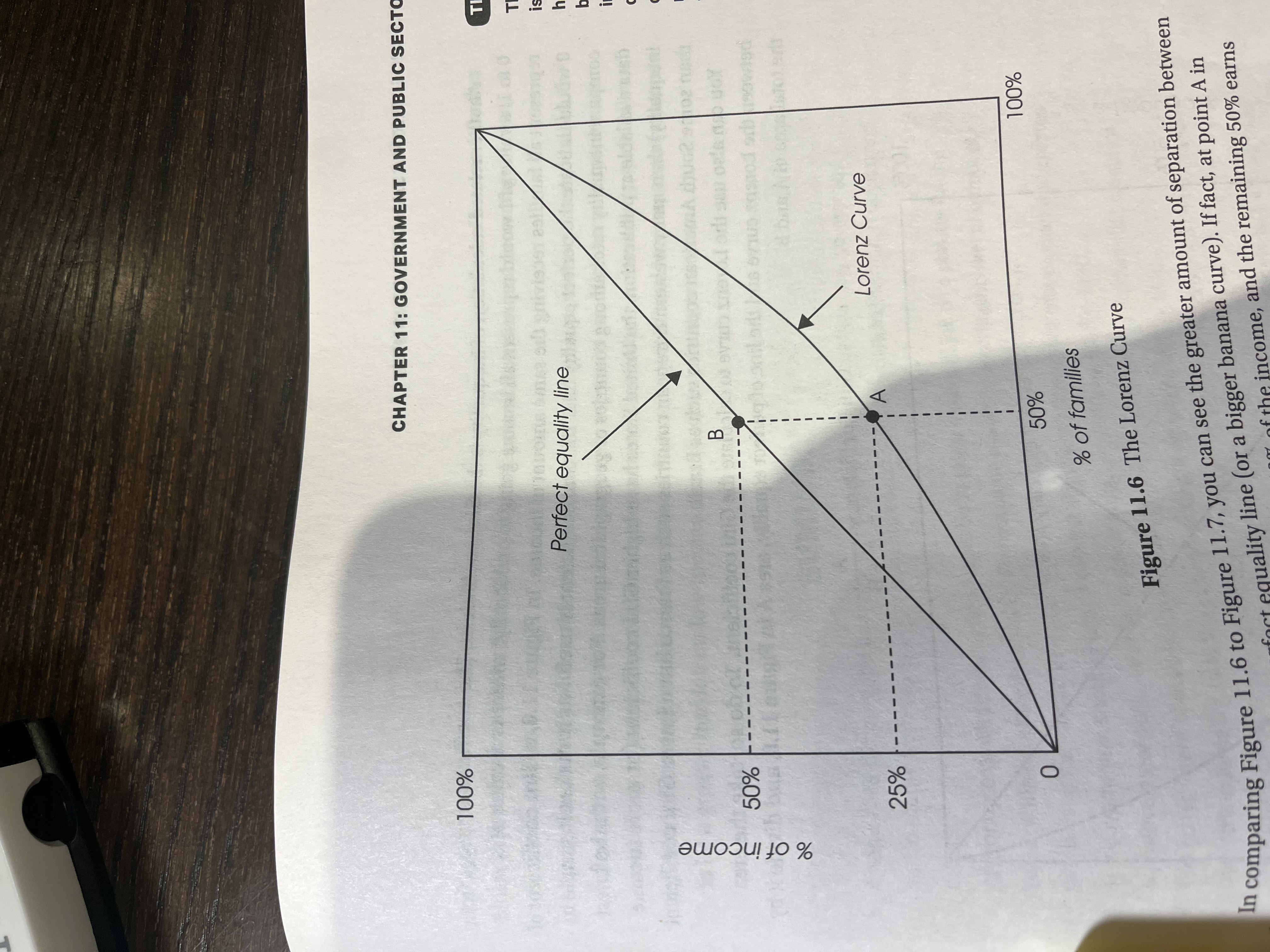

Lorenz curve

shows how much of a countries total income is earned by the number of households.

Gini coefficient

A Measure of income inequality that ranges from 0 to a value of one would represent all income, going to one family, where, as a value of zero would represent all families receiving the same amount of income.

A / A + B

Types of taxes

Progressive tax : Results in higher tax rates as income increases.

Proportional tax : Imposes the same tax rates on everyone, regardless of income.

Regressive tax : The average tax burden decreases as percent of income rises.