Economic Growth and Economic Cycle

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

Short vs long run growth

Short run - the actual annual percentage change in real national output (% change in real GDP): At least one factor of production is fixed

Long run - an increase in the potential productive capacity of the economy (shifts in PPF/LRAS curves)

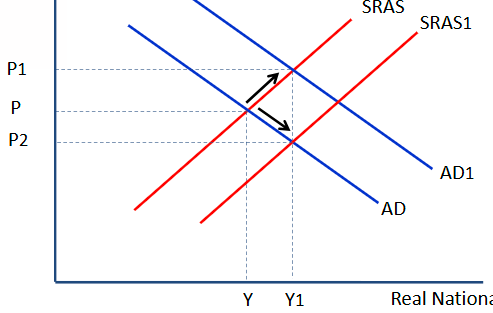

Short run growth graph

Both AD and SRAS shift rightward.

What must increase for long run economic growth to occur

The productive capacity of the economy.

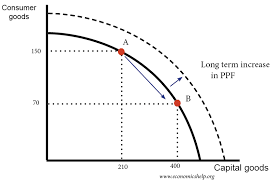

Long run growth - PPF

Initially, with all factor resources fully employed, economy can only produce on solid line.

Increase in factor resources shifts curve right.

Can now produce on dashed line, but this is max capacity, still difficult to achieve.

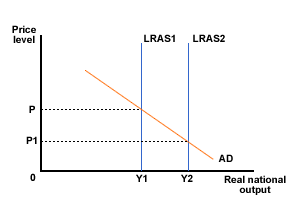

Long run economic growth - LRAS curve

If technological processes become more efficient, will be an increase in productive capacity

LRAS will shift right

Real GDP (national output) will increase to Y2, and price levels will fall to P1

Evaluating short run (demand-side) vs long run (supply side) policies for growth.

Stimulating demand-side is important, but will lead to inflation if supply-side remains constrained.

Equally, improving supply-side has little effect if demand-side is suppressed, leading to spare capacity and unused resources.

However, enhancement of supply side has time lags and doesn’t always improve productive efficiency.

Productive capacity - definition

Maximum amount of goods and services that we can produce with available resources.

GDP - definition

The value of goods + services produced in the economy over a period of time.

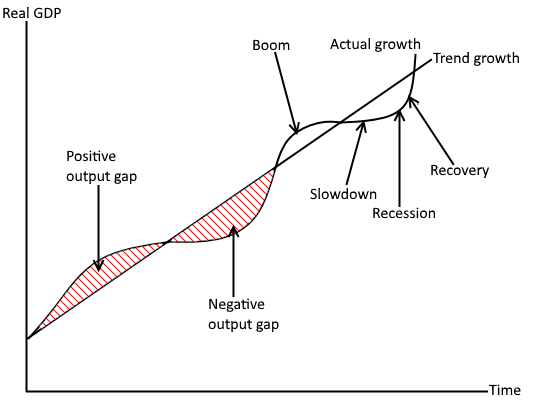

Economic Cycle graph

Output gap - definition

Difference between actual GDP and potential GDP (trend line)

Potential GDP - definition

Highest possible level of long term growth, with all factor resources employed.

Real GDP - how does it work?

If GDP growth is 5%, but inflation is 2%, then real GDP is 3%.

Whats a boom characterised by?

Peaks of the economic cycle

High growth rate and demand

Low unemployment

Inflationary pressure

Labour skills shortage

High confidence in economy, so high investment

Downturn vs recession

Downturn is when rate of GDP growth starts to fall. Recession is when a downturn is sustained for 6 months

Recession characterised by?

Demand falls

Unemployment rises

Some firms go bust

Low confidence, reduced investment

Slump (bottom of economic cycle) characterised by:

Low or negative growth

Demand + inflation low

Unemployment high

Confidence in economy low

High rate of bankruptcy

Recovery (green shoots) when growth starts to rise - characterised by:

Economic growth starts to rise

Demand increases

Unemployment falls

Inflation starts to rise

Confidence in the economy increasees

Capital investment increases

Shocks - definition

What might cause unexpected changes in the economic cycle

Demand-side shocks - definition

Unexpected changes in the economy that directly impact Aggregate Demand (Investment, Consumption, Govt spending, Net Exports

Supply-side shocks - definition

Unexpected changes in the economy that directly impact on aggregate supply

Long run: Changes in quality/quantity of factor resources

Short run: Changes in costs of production

Benefits of economic growth (4)

Rise in living standards: Real GDP/ Capita increases

Lower unemployment: Demand rises, so firms require more labour to increase production

Reduced poverty: Rise in avg. incomes leads to fall in absolute poverty

Government’s fiscal position: More jobs = increase in income tax received and decrease in welfare payments

Costs of economic growth (4)

Negative externalities: Damage to the environment, pollution and congestion may all reduce living standards

Scarce resources: may be unsustainable

Inequality: Benefits are unevenly distributed, creating divisions in society

Inflation: As resources become scarcer, demand-pull inflationary pressure arises

How can growth benefit the environment?

May lead to the development of low carbon tech through increased R&D

4 Sources of cyclical instability

Excessive growth in credit + debt

Asset price bubbles

Destabilising speculation

Animal spirits or herding

Excessive growth in credit and debt: explained

During economic boom, high consumer confidence leads to increased borrowing. If there’s a downturn in confidence, many may be unable to afford repayments, magnifying existing instability

Asset price bubbles- definition

When the price of an asset deviates significantly from its intrinsic value, with sharp price rises

Effects of asset price bubbles

They are unsustainable and will eventually burst, negative impact on the economic cycle

Speculation - definition

Trading in an asset or conducting a transaction that has a significant risk of losing initial outlay in expectation of gain due to market fluctuations .

The risk of loss is offset by the possibility of huge gain.

Effects of speculation

Drives sharp movements in the price of a stock, asset or currency due to belief of under/over valuation. This exacerbates booms and busts, linked to price bubbles

Animal spirits - definition

The instincts and emotions that guide behaviour rather than simple, rational and quantifiable facts. H

Herding - definition

Irrational behaviour where there’s a lack of individual decision making as people act like those around them while ignoring the underlying economic facts.