4.1 international economics

1/96

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

97 Terms

globalisation

the process where countries become increasingly interdependant on each other for trade

characteristics of globalisation

greater percentage of foreign trade

higher levels of migration

increasing capital flow between countries

emergance of global brands

greater use of outsourcing and offshoring

e.g. dyson moved manufacturing from wiltshire to malaysia

factors contributing to globalisation

improvements in transport

e.g. containerisation - technical economy of scale reduces unit cost of shipping

increased free trade - lower barriers becuase its mutually beneficial

closer political ties

abolition of capital (money) control - easier to move money + invest overseas

impact of globalisation on workers

more opportunities - easier to work overseas

manual/ low skilled jobs lost oversease (outsourcing)

impact of globalisation on consumers

cheaper price

wider choice + increase quality

impact of globalisation on producers

access to low cost resources overseas - labour, land

danger of export ineffecieny e.g. diseconomies

also need to maintain quality + ethics e,g, exploitation

impact of globalisation on environment

increase trade - increase pollution (extrenal costs)

shared knowledge e.g. green technology

increase efficiency may reduce waters

impact of globalisation on governments

increase econ activity - increase tax revenue

developing countries may attract investment

(MNC’s - increase hard currency)

developing countries may be exploited e.g. land, labour by MNC’s

impact of globalisation on individual countries

can specialise in their comparitive advantage

increase GDP - can increase living standards

danger of overspecialisation

why do countries specialise then trade

it can be mutually advantagous

e.g prices, choice, growth

how do countries gain

absolute advantage

comparative advantage

absolute advantage

the ability of one country being able to produce more of a good or service than another country with the same inputs, meaning its more efficient

comparitive advantage

occurs when one country can produce a good or service at a lower opportunity cost than another

how to calculate comparative advantage

work out the opportunity cost of producing one good over another in both parties/ countries

assumptions and limitations of comparative adavantage

factor immobility between countries i.e land, labour,capital

assumed perfect factor mobility within a country

no economies or diseconomies of scale i.e constant returns to scale

no transport costs

no artificial barriers e.g. tarriffs, health and safety checks etc

advantages of specialisation and trade

higher income and living standards

lower prices ( allocative efficiency, econ of scale)

increased choice

less dominance of national monopolies -benefit customers

disadvantages of specialisation and trade

overspecialisation - primary product dependency - over reliant on one commodity - volatile prices

infant industries struggle

risk of “dumping” - occurs when below cost products are dumped into the market - considered unfair, domestic firms suffer

global monopolies may emerge e.g. tech

increased local unemployment - some jobs outsourced or offshored

factors influencing the pattern of trade

comparitive advantage e.g recent growth of the exports in manufactured goods from developing countries to developed countries since they have an advantage in production - this has led to more industrialisation in china and india

emerging economies - growing countries will need to increase imports for products and increase exports to pay for this

trading blocs and bilateral agreements - increase the trade between countries

relative exchange rates

trading blocs

a group of contries that reduce or elimated trade barriers among themselves to increase integration and cooperationb

bilateral agreements

legally binding agreement which outline specific rights and obligation for the parties included

terms of trade

the rate of exchange of one product for another when 2 countries trade

improvement in terms of trade

when one country can buy more imports for the same amount of exports

deterioration in terms of trade

when one country has to buy less imports for the same amount of exports due to a ris in price of imports or fall in price of exports

how to calculate terms of trade

(average export price index/average import price index) x 100

why is terms of trade measured in the form of an index

because it is taken from a weighted average of thousandes of import and export prices

the change in price of oil has a bigger weightage than the change in price of a rolls royce

what happens if tot index rises

increase X price > increase M price

then coutnry will benefit from

improve current account

improve standard of living

reasons why terms of trade may improve

specialisation in higher value exports

world real income levels change in favour of this exchange rate appreciating

reasons why terms of trade may worsen

opposite of improvements

trading blocs

groups of countries that come together and form agreements to promote trade and economic cooperation among themselves, remove barriers to trade

examples of trading blocs

EU

ASEAN

african continental free trade agreement

types of trading blocs

free trade areas

custom unions

common markets

monetary unions

free trade areas

no barriers to trade in between members and members negotiate their own trade deals with non-members e.g. NAFTA

customs unions

free trade between members + a common external tariff on non-members

common markets

same characteristics as customs union but include free movement of factors of production between member countries

monetary unions

customs unions that adopt a common currency e.g. the eurozone in the EU

regional trade agreement

a treaty between 2 or more countries where they agree to reduce or elimate barriers between them i.e tariffs and quotas

bi-lateral trade agreement

a type of regional trade agrement where its only 2 countries

benefits of regional trade agreement

trade creation

increase in FDI

increase in economic power

trade creation

occurs when trade increases due to membership of a trading bloc

this happens because free trade and reduce tariffs means cosumers/firms cansource goods for cheaper

moving from a high cost source to a low cost source

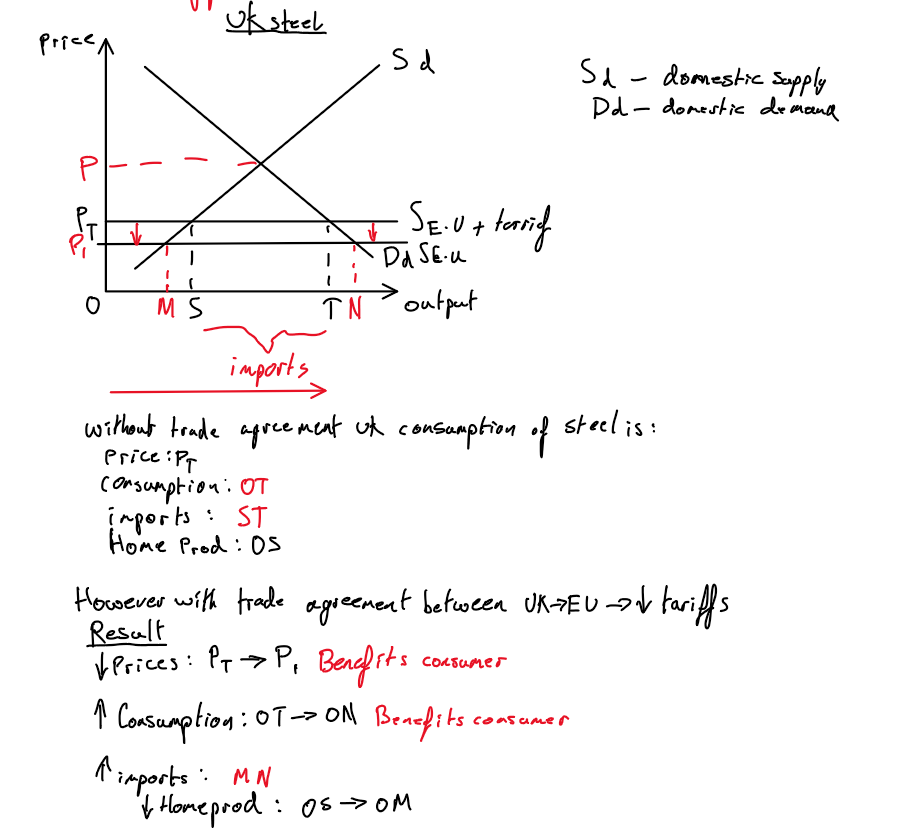

trade creation graph

increase in FDI

foreign direct investment:

because they can avoid a commmon external tariff e.g. increase sale of cars → increase profit

this is also beneficial to a “hot” country → increase jobs → increase wages + tax revenue

e.g. nissan -→ sunderland(uk - EU 1980s) → 85% of the cars produced are exported → helps our balance of payments

increase in economic power

a large trading bloc may be in a better position to negotiate trade agreements with other countries and trading blocs

costs of regional trade agreements

trade diversion

lack of negotitation power

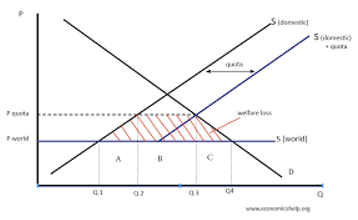

trade diversion

this occurs when trade is switched from a low cost source (outside bloc) to a high cost source (inside bloc)

low cost source is subject to C.E.T → increase tax → increase price e.g. when UK joined E.U in 1975. imports of butter switched from Anchor butter (NZ) to Lurpak (denmark) - to expensive after tariff imposed

lack of negotiation power

members are unable to negotitate seperate trade deals if members of customs union

roles of the W.T.O in trade liberalisation

W.T.O has 166 members

to promote free trade - this is acheived through trade rounds - disputes can be taken to the W.T.O to resolve

to settle trade dispute between countries

why was the W.T.O setup

after WW2 - many countries were bankrupt and global economy was weak, setup to discourage tariffs and increase free trade

possible conflicts between the RTAs and the W.T.O

trade discrimination - RTAs may discriminate against non-members, potentially violating W.T.O’s most favoured principle

trade diversion - if RTAs lead to trade diversion, they can be seen as contrary to the W.T.O’s goal to reduce trade

inconsistent rules - conflicting rules between RTAs and W.T.O can lead to legal and practical challenges

preferred treatment - W.T.O rules generally favour non-dicrimination whereas RTAs have preferred treatment to its members

dispute resolution - can arise when W.T.O and RTAs rules conflict, requiring resolution mechanics to reconcile differences

non-economic arguements for protectionism

independence in time of war e.g fppd, steel, energy

maintain national heritage USA - Disney, canada - lumber, UK - rolls royce

diverse economy, socially desirable , science, engineering, creative

political links - solidatiry/sanctions e.g. Africa 1980s

economic arguements for protectionism

dangers of overspecialisation e.g. Ghana → X cocoa beans 30%, Malawi → raw tobacco 47%, if global demand falls for cocoa or tobacco - problems for ghana or malawi - worsen terms of trade, commodity price are volatile

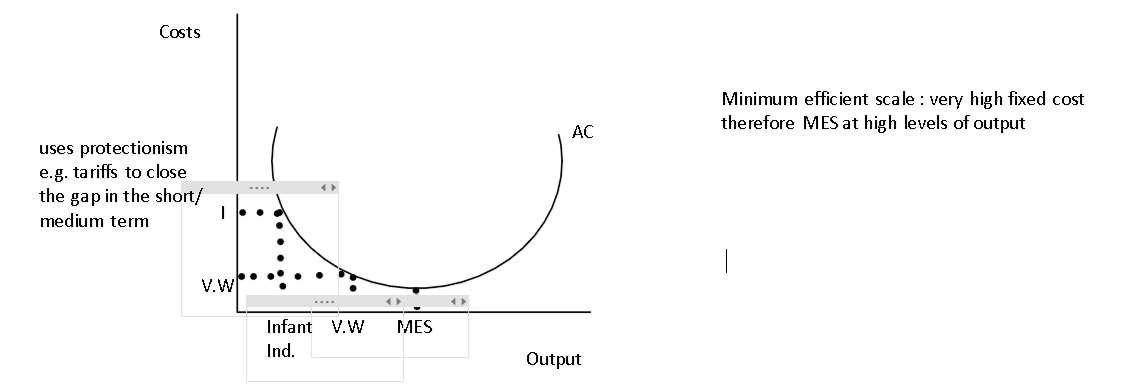

protection of infant industries - need breathing room before they can compete, GRAPH →

protect declining industries - allow gradual decline and allow workers to re-train and reduce structural unemployment, e.g. UK 80s/90s deindustrialisation, they may be cases where a coountry loses its comparitive advantage in this sector

protects from unfair competition - subsidies - distorts comparitive advantage, dumping of goods

correction of an adverse balance of payments - attempt to bring M’s in line with X’s

traditional means of protectionism

tariffs

quotas

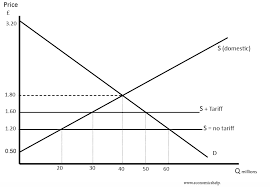

tariffs

a tax on imports

reduces demand for imports

qoutas

a physical limit on the quantity of imports e.g. EU - 1980s - quota on japanese cars therefore encourages Japan to open car plants in EU

other measures of protectionism

export subsidies - govt subsidies domesti exports

red tape/ artificial barriers

impact of protectionist policies

home producers may increase market share

price - higher price for consumers

may improve current account however chance of retaliation

reduces Y due to higher prcie so may reduce living standards

increase tax revenue for Govt. however paid by consumers (Trump)

balance of payments

records all financial transactions between one country and the rest of the world

inflows of foreign currency - counted as positive entry

outflows of foreign currency - counted as negative entry

the current account of the balance of payments is the main measure of external trade peformance

the financial account emasure inflows and outflows of financial capital (money) across national boundaries

current account

balance of trade in goods

balance of trade in services

net primary income (interests, profits, dividends and migrant remittences)

net secondary income (contribution to EU, military aid, overseas aid)

capital account

sale/transfer of of patents,copyrights, franchises and other transferable contracts

financial account

net balance of foreign direct investment (FDI)

net balance of portfolio flows (e.g. shares)

balance of banking flows (e.g. hot money flowing in/out of banking system)

FDI

an ownership stake in a company, made by a foreign investor, company, or government from another country.

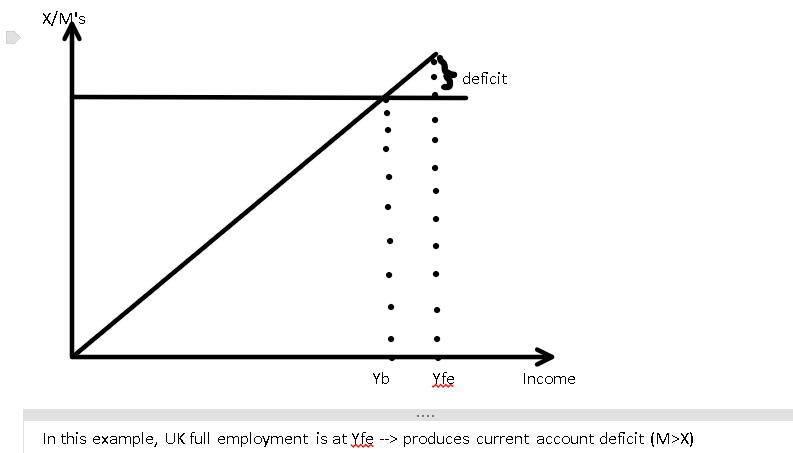

what makes a current account deficit/surplus

exchange rates

relative productivity

domestic economic growth

relative inflation

measure to deal with a crrent account deficit

improve infrastructure →decrease unit cost → increase international competiveness

subsidise exporters

tariffs

increase red tape

increase income tax

policies to deal with current account deficit

expenditure reducing

expenditure switching

supply side policies (longer term)

protectionism

expenditure reducing

deflation → reduce Y → to reduce M’s

UK has a high marginal propensity to import

expenditure switching

reduce UK demand for imports to domestic goods e,.g. devaluation, protectionism

how to deflate the economy

increase income tax

increase IR’s

Decrease govt.exp

devaluation - decrease ER value

protectionism

all these will have significant trade-offs e.g. econ growth, inflation

what does devaluation depend on

marshall lerner criterion

J-curve effect

marshall lerner criterion

states that devaluation of a currency will only only improve BOP if net price elasticity of X’s + M’s is price elastic i.e >1

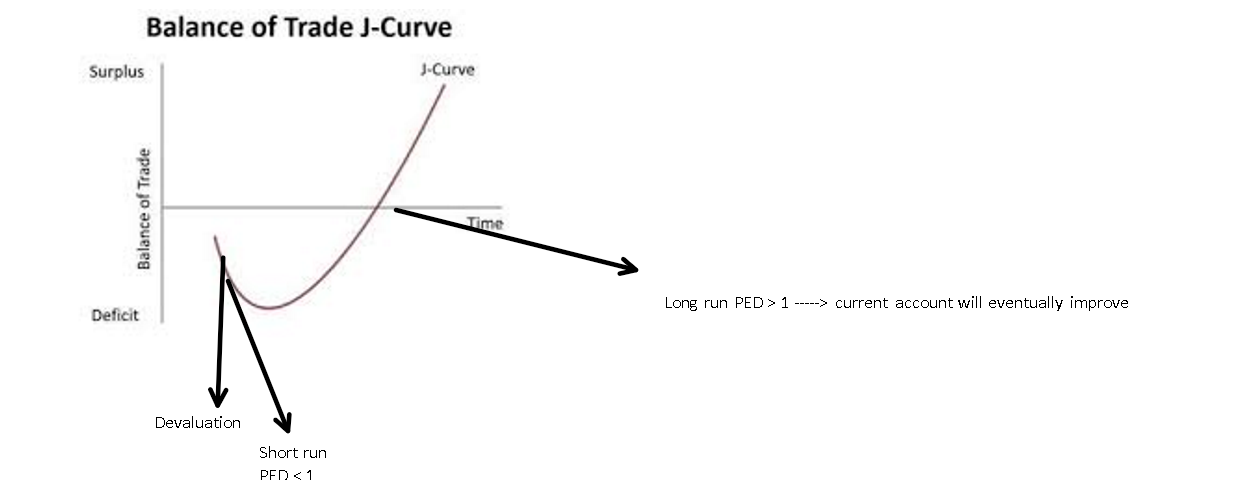

J-curve effect

basically a devaluation will not improve bop immediately

in the short run theyll be little change to demand, buyers need time to switch i.e contracts already signed etc

how does protectionism deal with current account deficit

increase price of M reduces M’s therefore improve current account deficit

however:

may lead to retaliation

demand for imports may be inelastic i.e uk importing lithium

members of a custome union - not allowed to impose on others

trade imbalances

occur when some countries run persistant surpluses on their trade accounts, whereas others experience persistant and often large deficit

mercantalism

is the notion that the wealth of a nation is based on how much it could export in excess of its imports

surplus countries

Germany 300 billion dollars

Japan 200 billion dollars

China 165 billion dollars

deficit countries

USA 466 billion dollars

UK 106.7 billion dollars

India 51 billion dollars

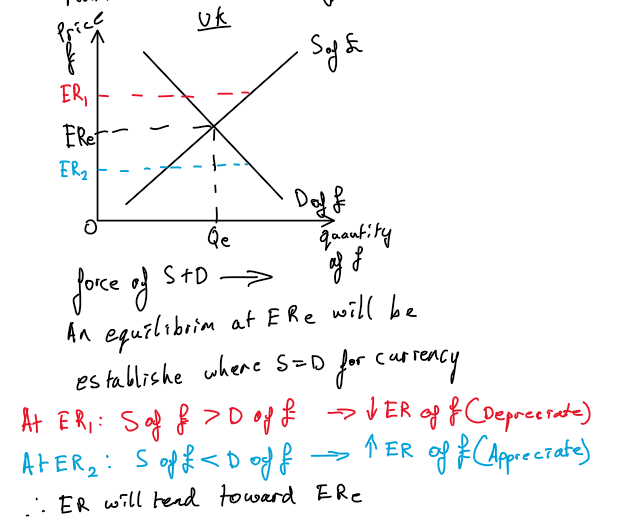

exchange rates

the price of ones currency in terms of another currency

bought and solf on the forex market

how is ER determined

largely determined by S + D

however govt has a choice of ER systems

what are the ER systems

floating ER system

fixed ER system

mixed system - “dirty” float, adjustable peg

floating ER system

the market determines the ER i.e by force of S + D

uk policy since 1990

fixed ER system

ER is set by govt

“dirty” float

a managed float

here ER is allowed to float but govt will step in if its damaging to the economy

i.e appreciate too much → deflationary

depreciate too much → inflationary

adjustable peg

here the government fixes the ER, but will adjust ER value if the fixed ER is deemed to “high” or to “low” i.e damaging to the economy

how does the forex market look for a floating system in the UK, and how do the forces of S + D move ER

what determines demand and supply of £

BoP helps

current account

financial account

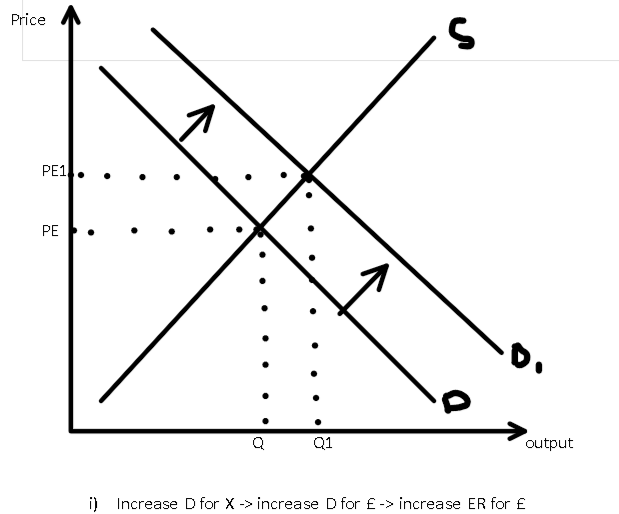

how does BoP affect D for £

to buy UK goods and services - i.,e current atc → this requires £ → implies D for £ therfore anything that affects D for UK goods and services

e.g. uk inflation rising faster than rivals → decrease Uk competitiveness → decrease exports → decrease D for £

level of econ growth overseas → boom → increases D for X

quality of UK goods and services

financial account: to put capital into UK requires £, reasons are

FDI - nissan - sunderland → increase D for £

speculation - if ER £ expected to rise→ increase D for £

portfolio investment e.g if canadian pensino fund invests in FTSE 100

what are the decisions to invest into UK made by overseas countries/firms affected by

interest rates e.g. increase IR → increase D for £

perceived peformance for UK econ

expected ERs

what determines supply of £

1) current account - UK demand for overseas goods + services so if £ sold there is more supply

financial account - UK demand for FDI, portfolio, speculation overseas

when do we use revaluation/devaluation vs appreciation/depreciation

revaluation/devaluation when its moved on purpose e.g. fixed ER system, but appreciation/depreciation is natural movement e.g. forces ofS + D

what does a rising and falling currency mean

ER is strenghthening or weakening

what would happend to market for £ when there is an increase in demand for UK military ships and planes overseas

shift right in demand

ways a government can intervene in currency markets

open market operations

interest rate changes

open market operations

using foreign currency reserves (central bank) to buy and sell currency

e.g. assume UK wanted to devalue the £ against the $, they would sell £ and buy $

interest rates changes

interest rates can be either used to attract (increase D for £) flows and “hot money” or the opposite

i.e

increase IR → makes £ more attractive → increase D for ER

decrease IR → decrease D for £

why would a country want to devalue its currency

to increase competitiveness of its X, to boost current account

to boost X → increase AD → growth

however whether it succeeds depends on PED (mlc) and inflationary therfeore long run bad (increase X → increase AD)

impact of changes of ER

devaluation - makes X relatviely cheaper, increase FDI

however these impacts depend on : marshal lerner criterion and J-curve

decrease ER of £ makes X cheaper (increase D.pull inflation), it also makes M more expensive → increase cost pull inflation therefore long term decreases UK competitiveness

decrease ER of £ may increase hostile mergers + takeovers

uk investment overseas becomes more expensive → long run reduces income

How is international competitiveness measured

1) Relative unit labour costs

2) relative export prices

Factors influencing international competitiveness

Productivity and workforce

Unit labour costs

Real exchange rates

Non-wage labour costs

Paternity rights

Level of technology and R+D

Government laws

Benefits of Int.Comp

Increase econ growth → increase living standards

Boost current atc

Increase D for ER → appreciates → deflationary