Financial Accounting Ch. 4

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

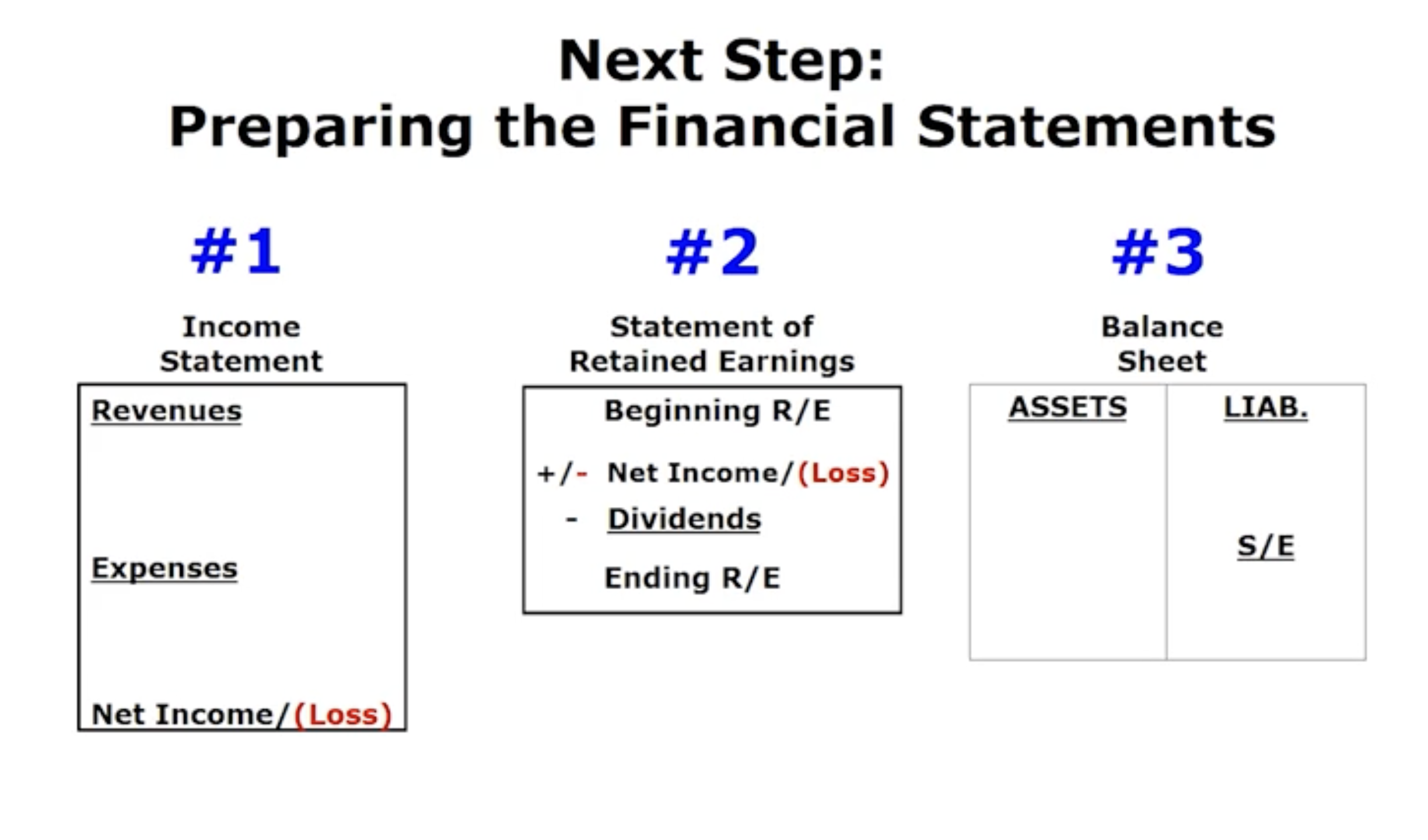

How Do We Prepare Financial Statements: (using the Adjusted Balance)

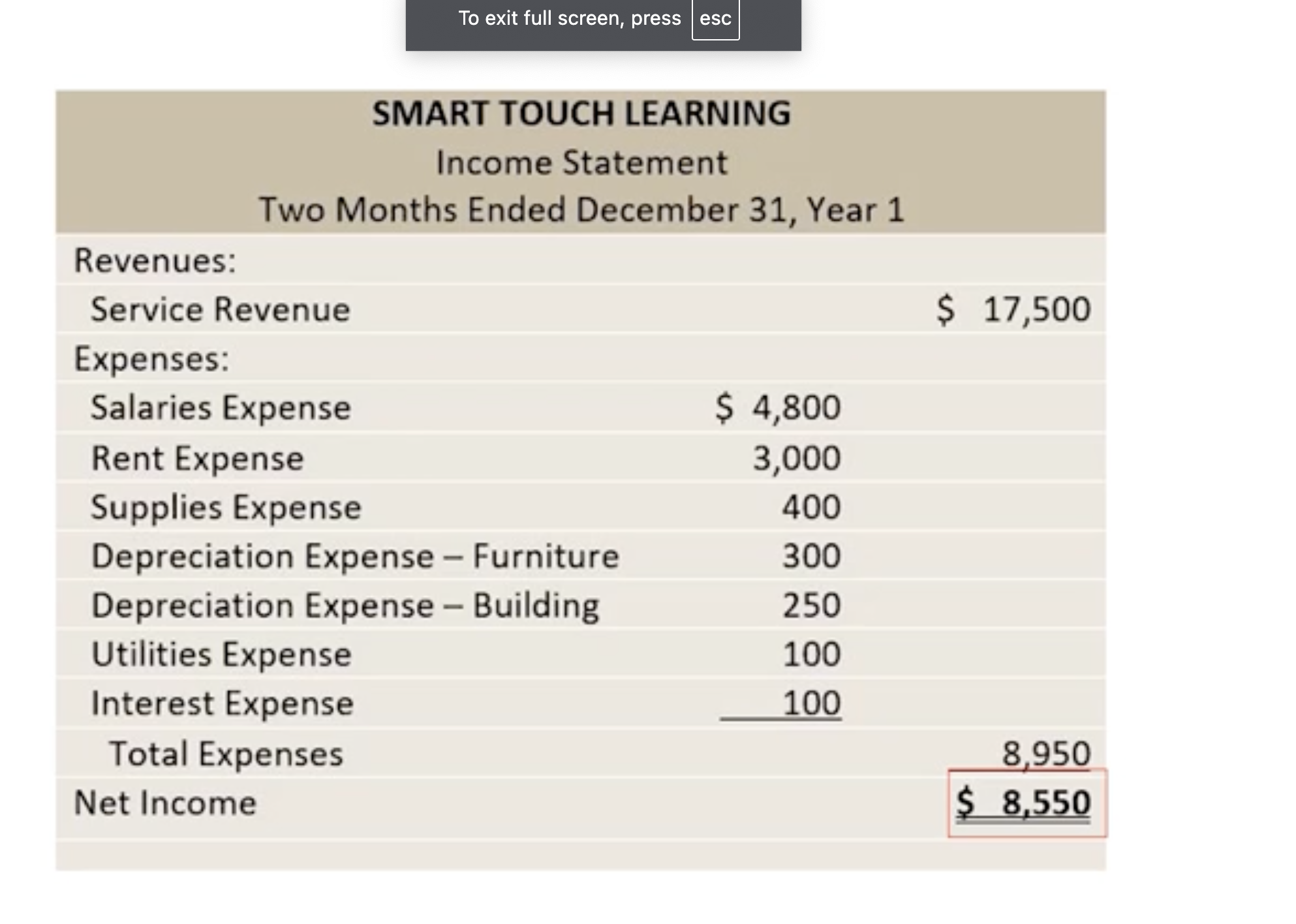

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Income Statement

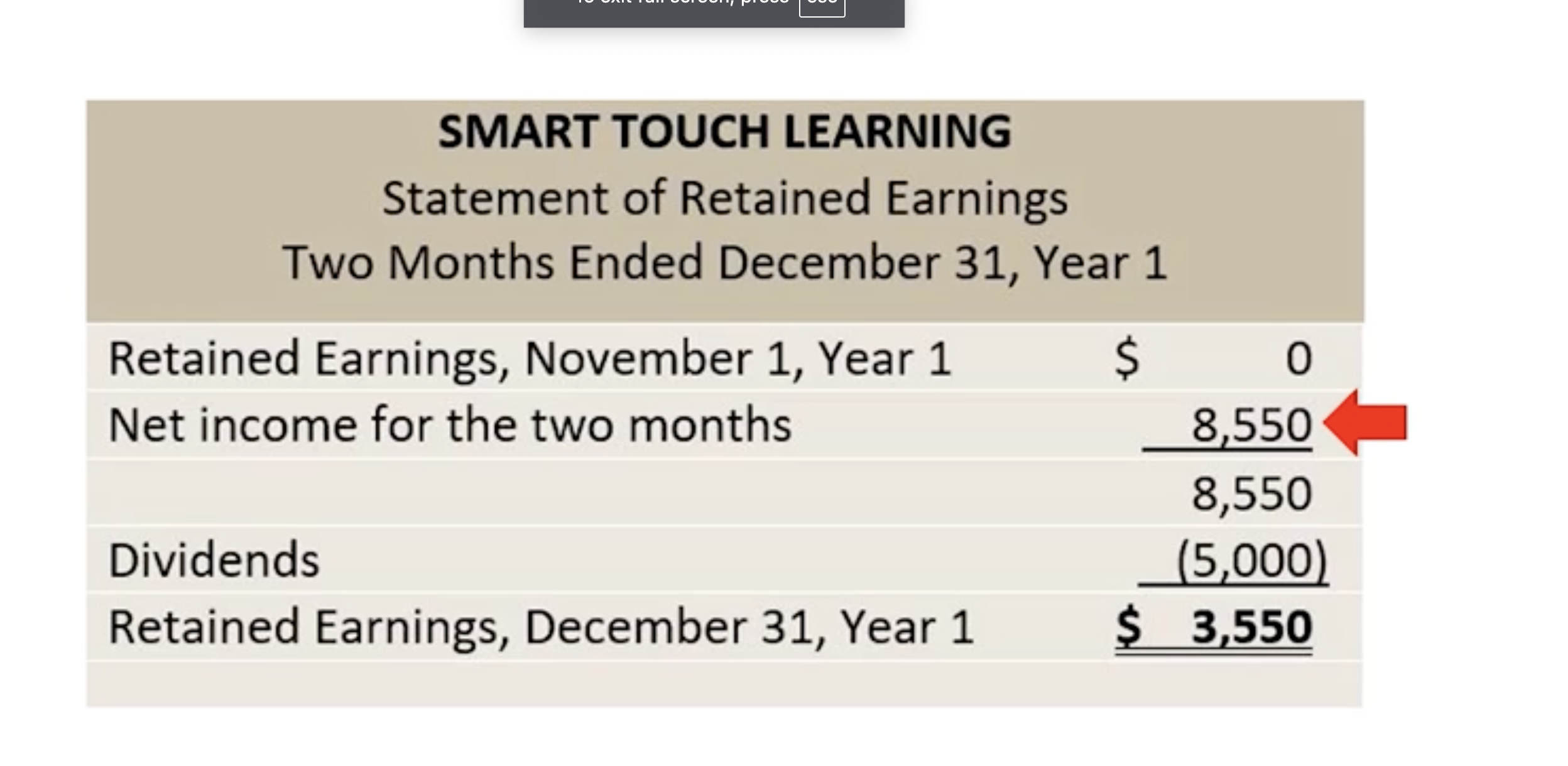

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Statement of Retained Earnings

Plug in the net income

Smart TL created on Dec31st— so thats why there is no beginning of retained earnings ($0)

Subtract the 5k dividend

Statements of Retained Earnings tells us how Smart TL is using their earnings throughout the period

Remember, we need ENDING Retained Earnings to plug in to the Smart TL Balance Sheet on Dec. 31 (Stockholder Equity)

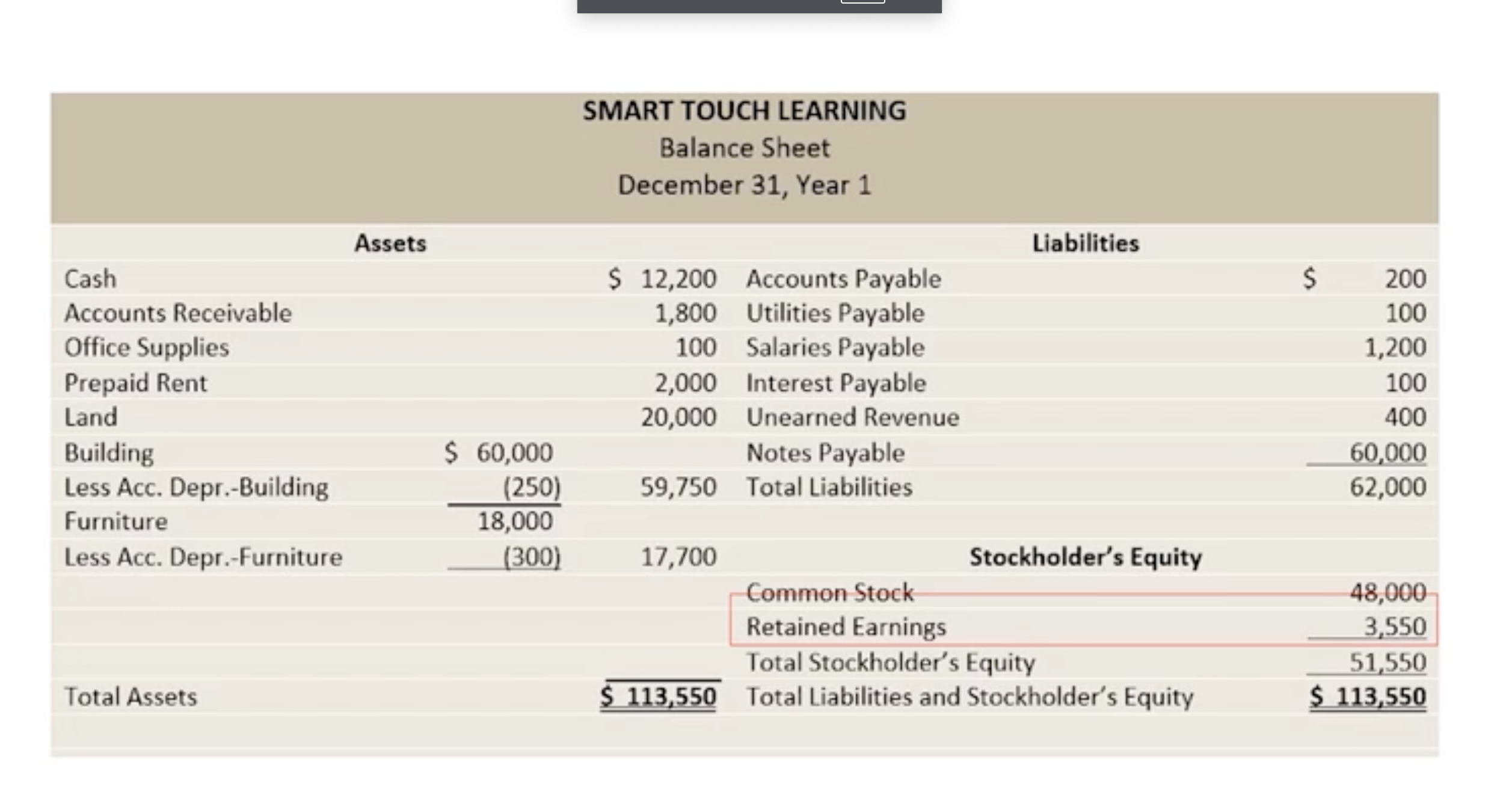

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Balance Sheet

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Classified Balance Sheet (most companies use)

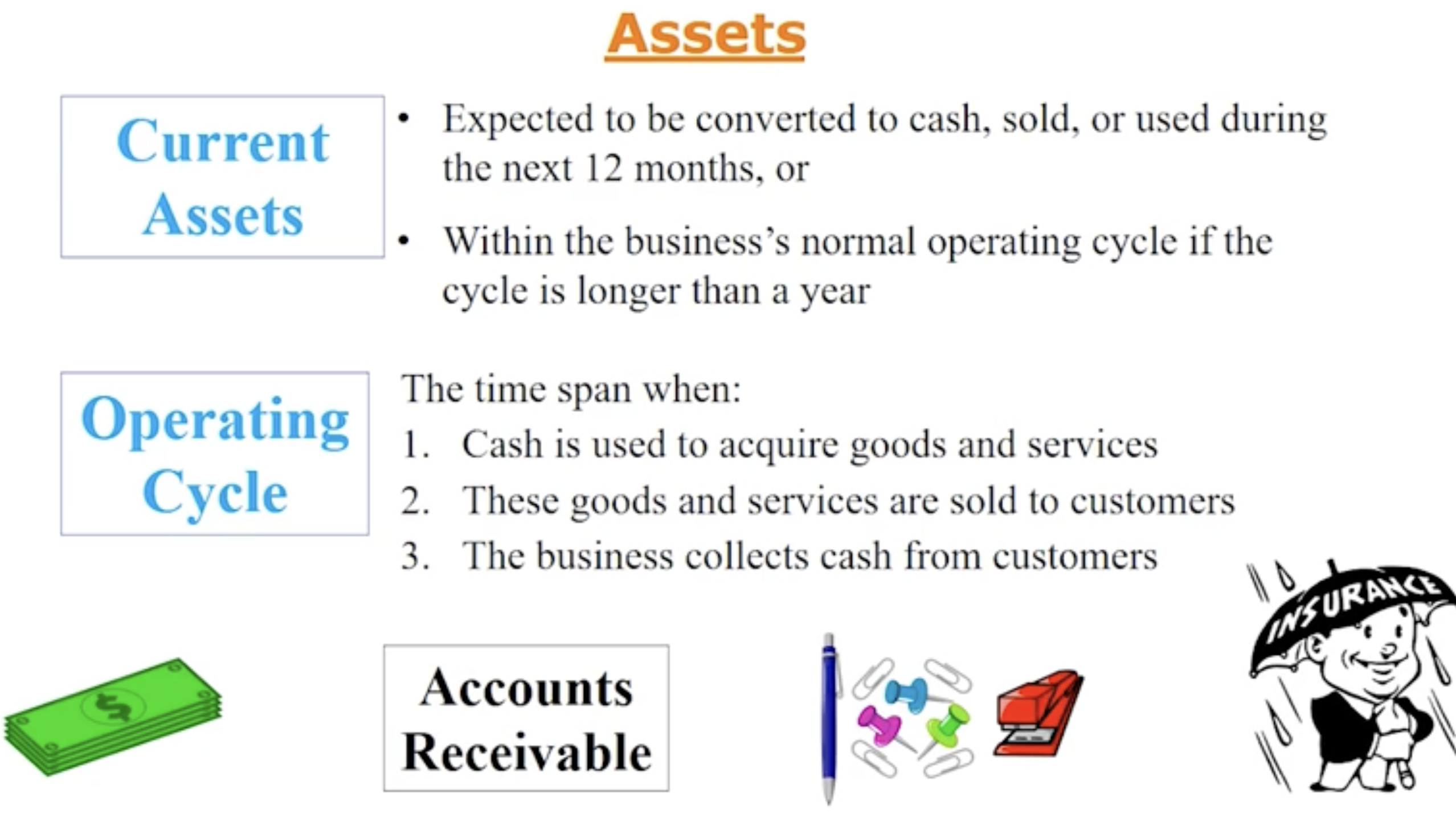

A balance sheet that places each asset and each liability into a specific category

So Assets & Liability can be categorized as current meaning Assets are used up or turned into cash within one year. The liability will be paid off within one year.

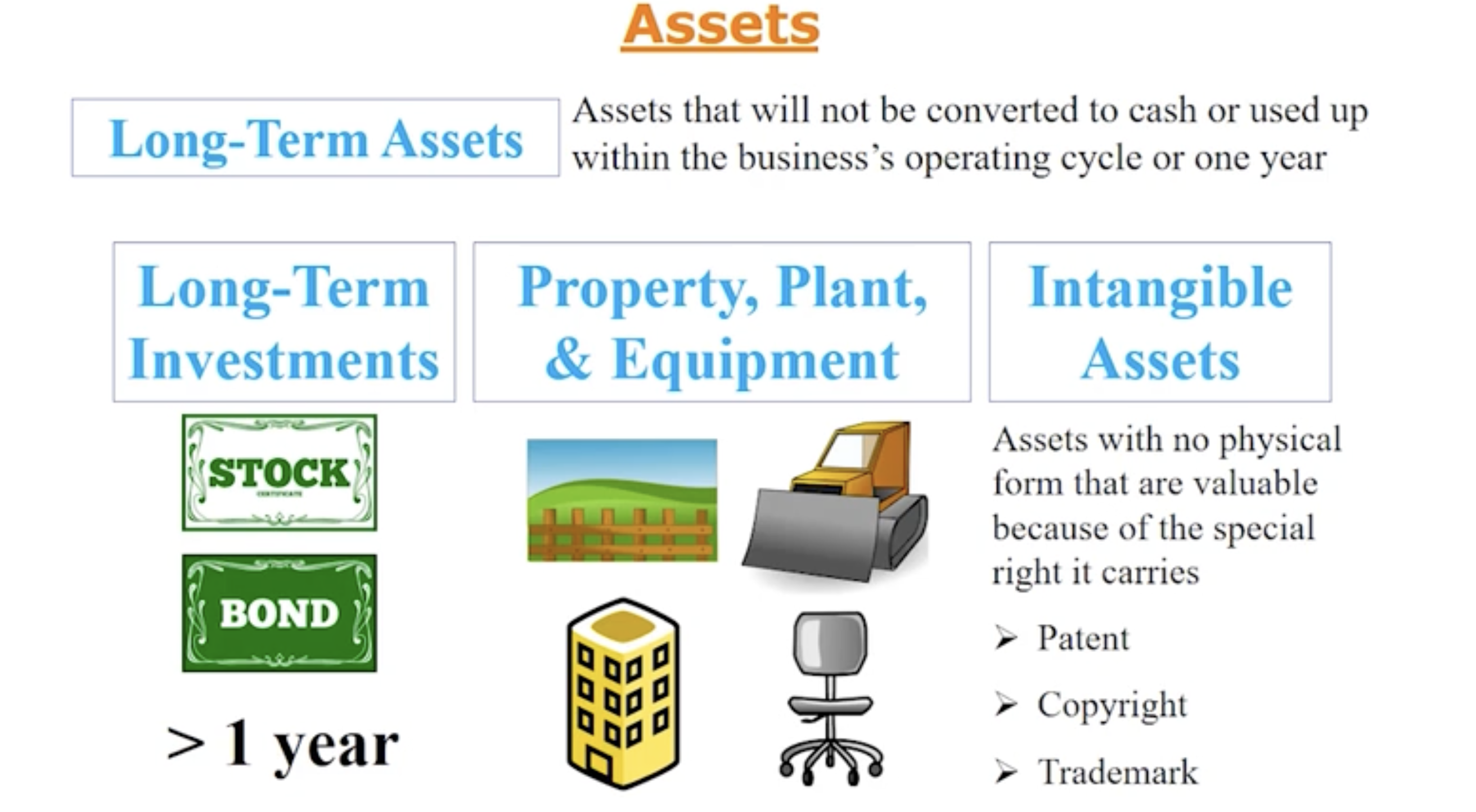

Assets & Liability can be categorized Long- Term meaning Assets will be in the business for longer than one year. The liability will take longer than one year to pay it off.

Assets will be placed on the balance sheet in order of liquidity. (Liquidity: A measure of how quickly an item can be converted into cash).

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Current Assets

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Long -Term Assets

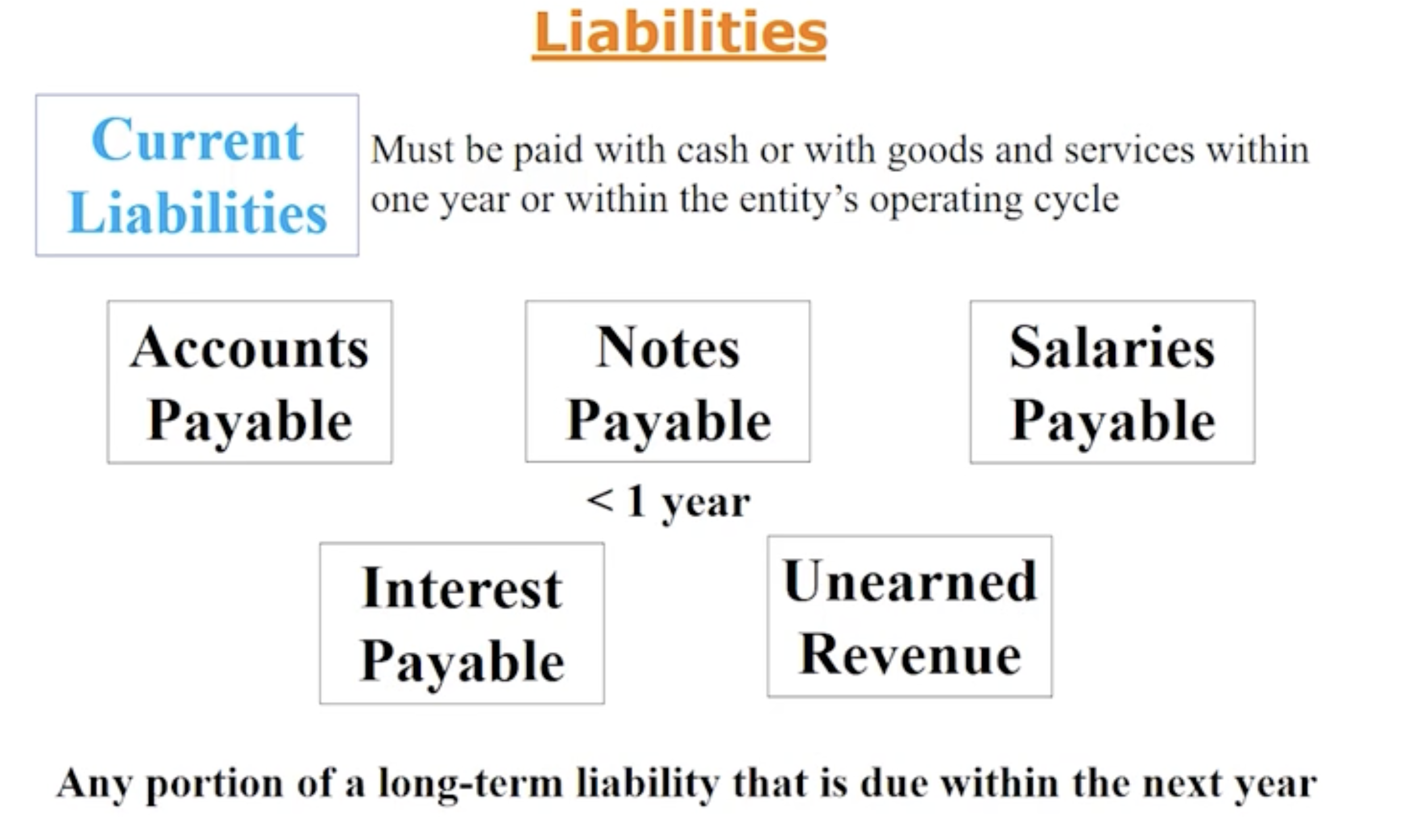

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Current Liability

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Long- Term Liability

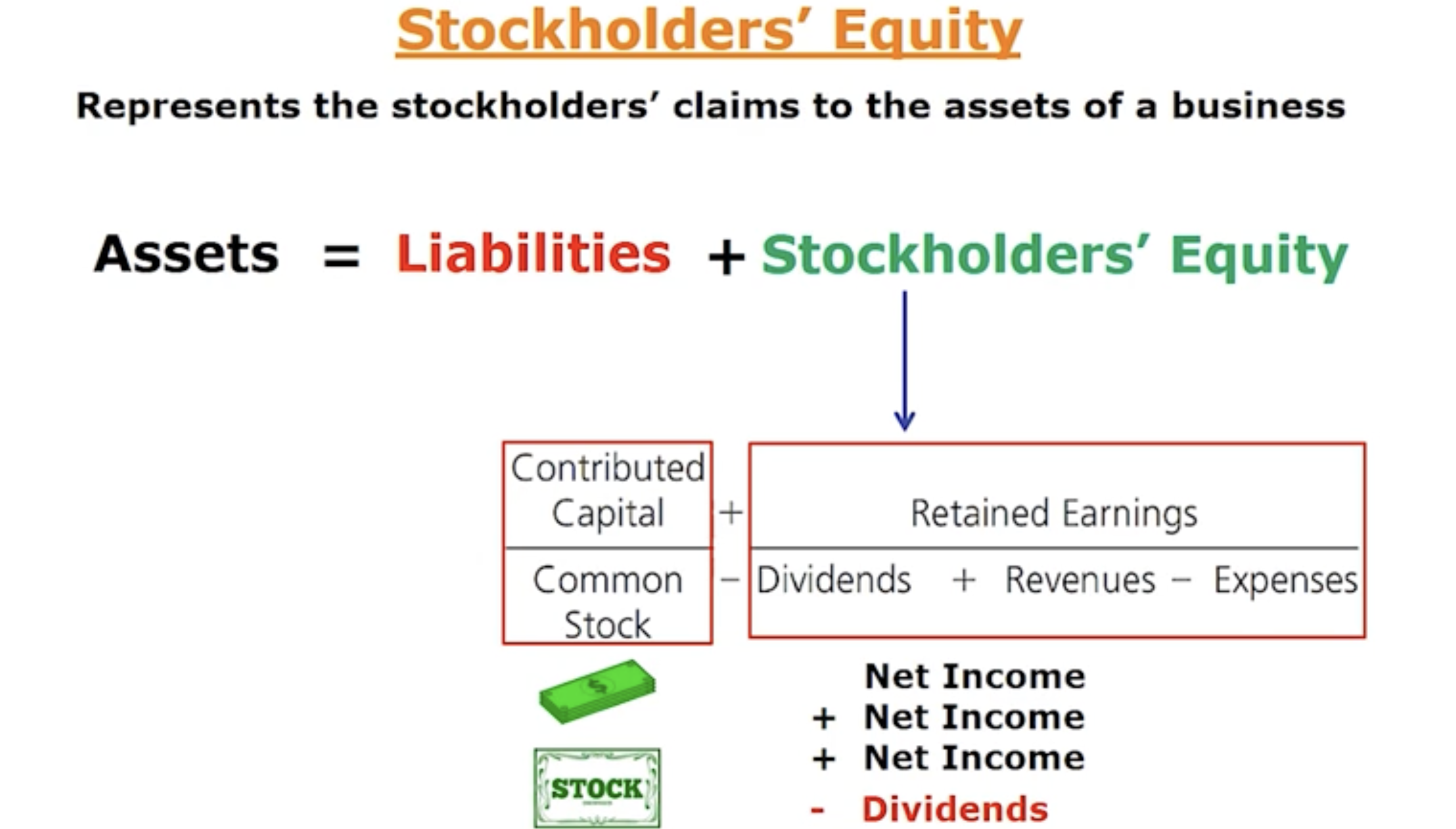

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Stockholder’s Equity

This represents the stockholder claims to the assets of a business.

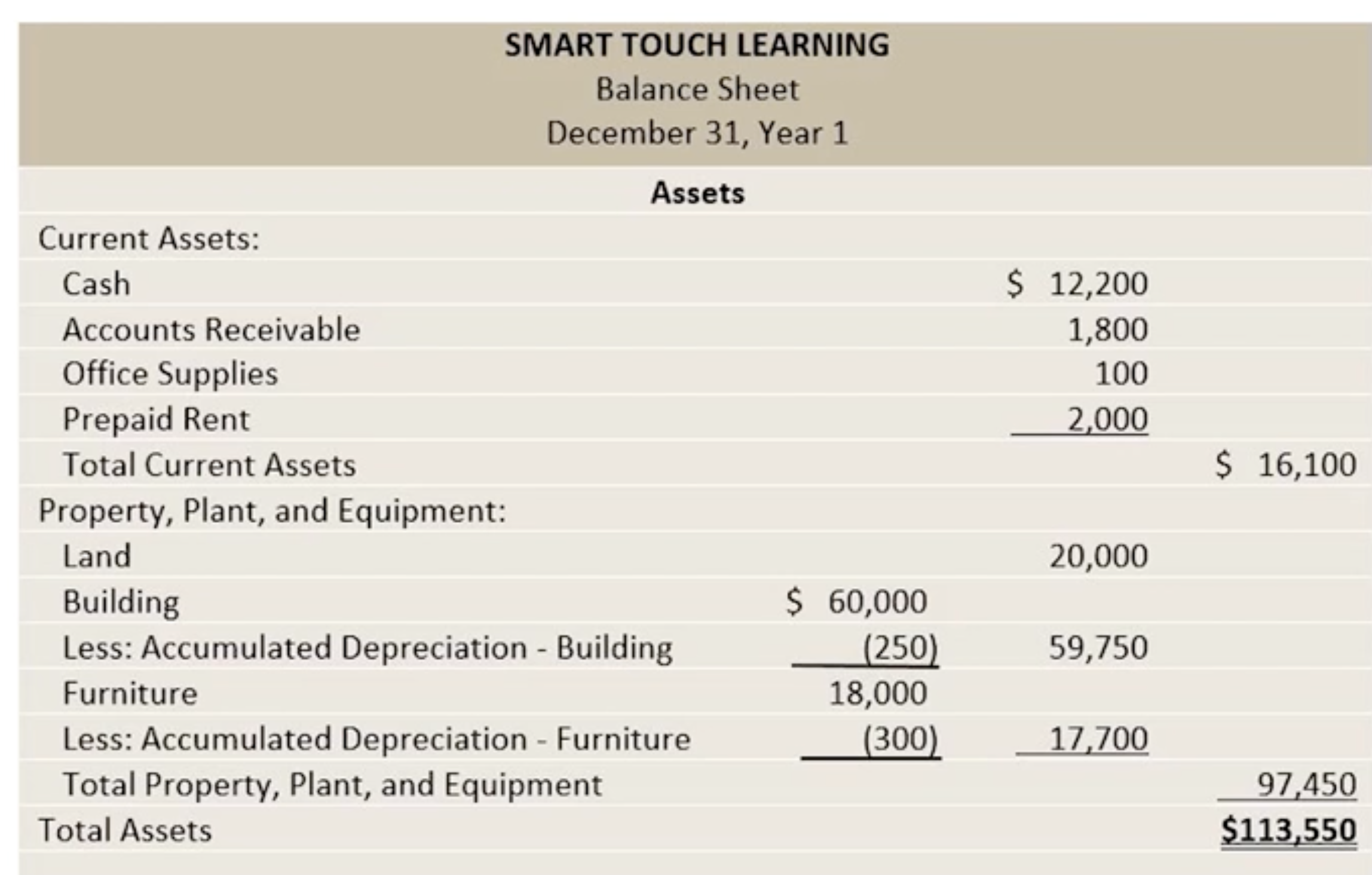

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Classified balance sheet (Assets) P.1

Now there is two categories, Current & Property, Plant, & Equipment

Assets are listed in order of liquidity (Cash will be the most liquid asset) (Acc. Receivable is normally second)

Land is not Depreciated which is why there is no contra like Building and Furniture

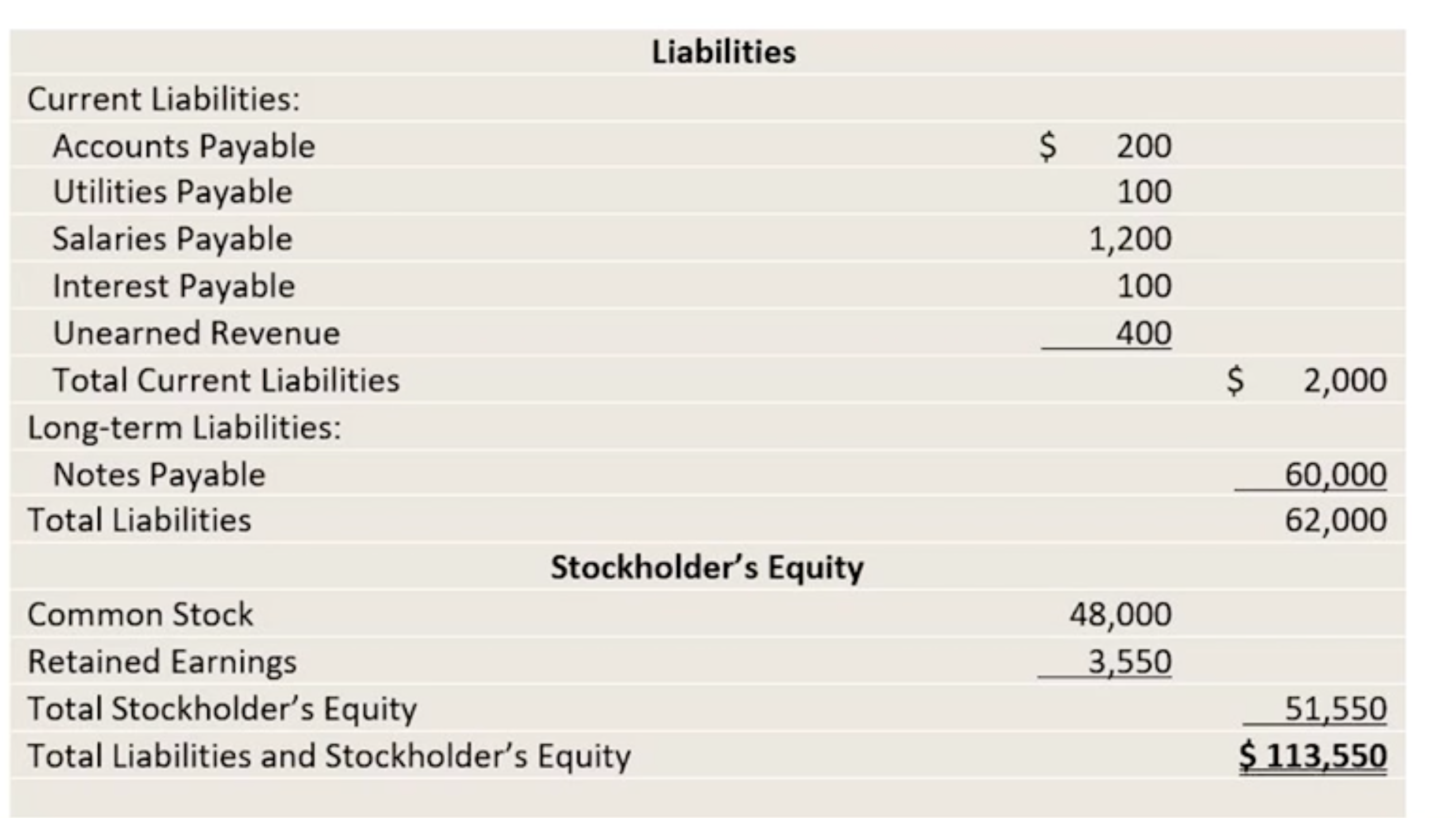

How Could a Worksheet help in Preparing Adjusting Entries and the Adjusted Trial Balance: Classified balance sheet (Liabilities) (Stockholder Equity) P.2

The two categorize, Current & Long- term

Smart TL learning is expected to pay the $2000 in the next upcoming year or operating cycle

Notes Payable is the only Long- term Liability which was the 60k that was used for the office building

Stockholder Equity:

Retained Earning: Grabbed the # from the ending of the retained earning statement

Total Liability + Total Stockholder Equity= Total Assets from. the previous slide

What is the Closing Process, and How Do we Close the Account: Closing Process

Zeros out all revenue accounts and expense accounts to measure each period’s net income separately from all other period

Updates the Retained Earnings account balance

TIME PERIOD CONCEPT: A business can slice its activities into small segments for specific needs— whether its monthly, orderly or yearly.

Helps with the activities being sliced into time segments to record the revenues & expenses for a particular period of time

What is the Closing Process, and How Do we Close the Account: Temporary Account

An account that relates to a particular accounting period and is closed at the end of that period. (Closed= setting it back to 0 and starting over).

Includes all Revenues, all Expenses, Income Summary, and Dividends ←These 4 accounts relates to a particular period and get wiped out (closed to 0) at the end of the period.

What is the Closing Process, and How Do we Close the Account: Permanent Account

An account that is NOT closed at the end of the period and are carried forward into the next period.

Includes all Assets, all Liabilities, Common Stock, and Retained Earnings ←All of our Balance Sheet Accounts! (Any account that goes on the balance sheet is a permanent account and that balance carries from one period to the next.

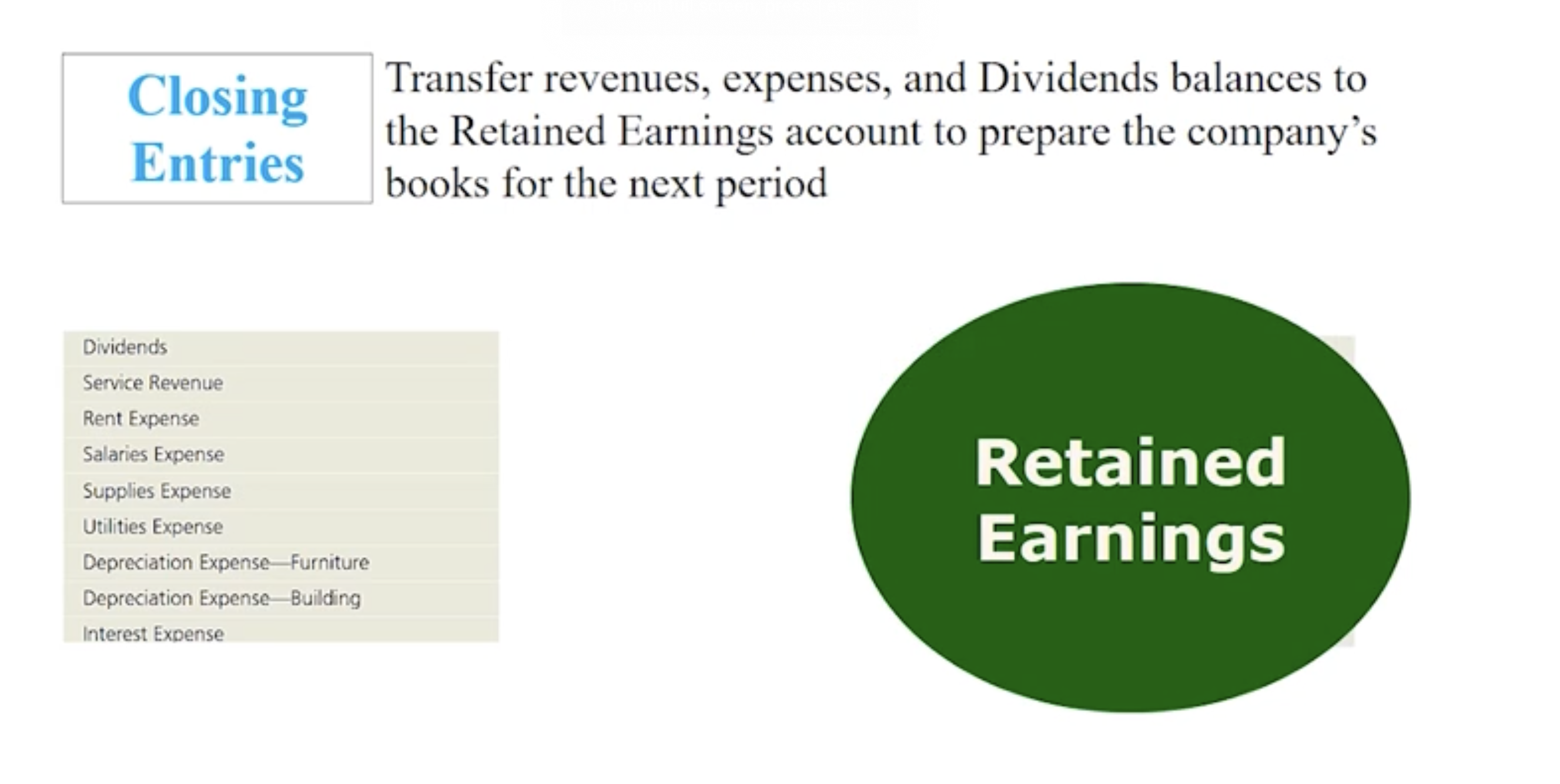

What is the Closing Process, and How Do we Close the Account: Closing Entries

Transfer revenues, expenses, and Dividends balances to the Retained Earnings account to prepare the company’s books for the next period.

The small green sheet is part of the Adjusted Trial Balance that only includes the temporary accounts, Dividends, Service Revenue and all Expenses. All the balances are transferred to the Retained Earnings account to update retained earnings for the next period. This process also allows the ledger balance of RE to equal the balance of RE of the Balance Sheet.

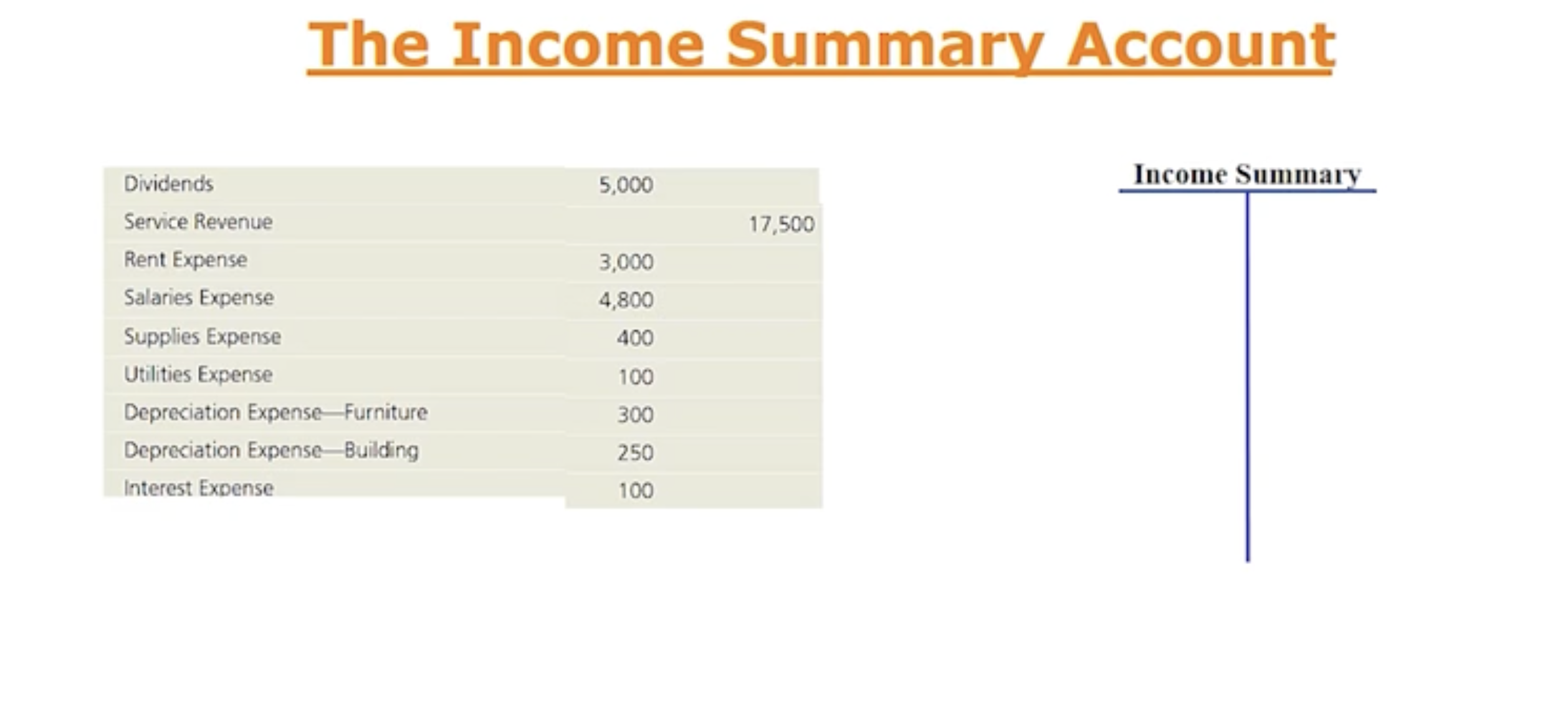

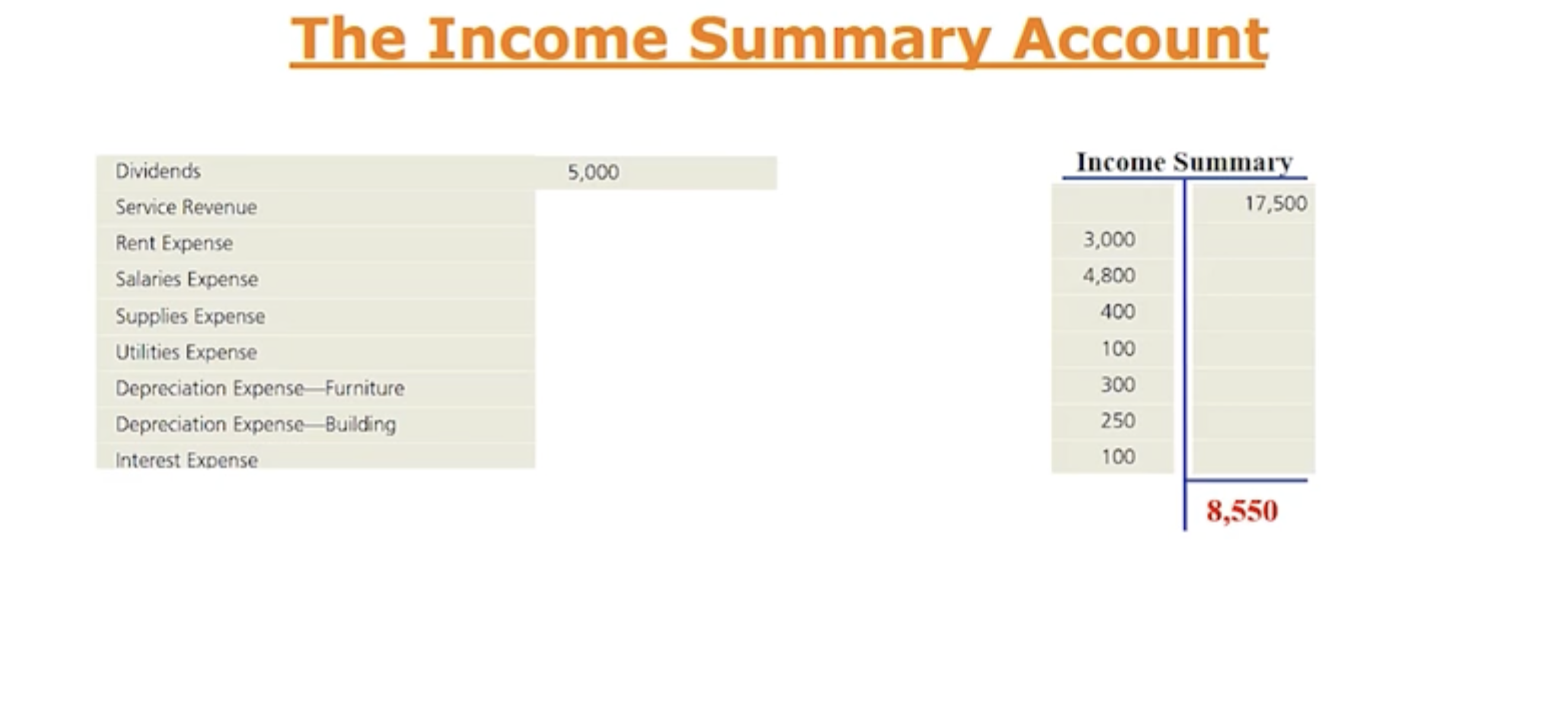

What is the Closing Process, and How Do we Close the Account: The Income Summary Account (Only used during the Closing Entry Process) Match the ss

Think of it like a garbage pale Account, dump some #’s in temporarily and then take out the trash and transfer those #’s into Retained Earnings (RE).

8550 is the net income #

The 8550 then gets transferred to retained earnings, which increases it

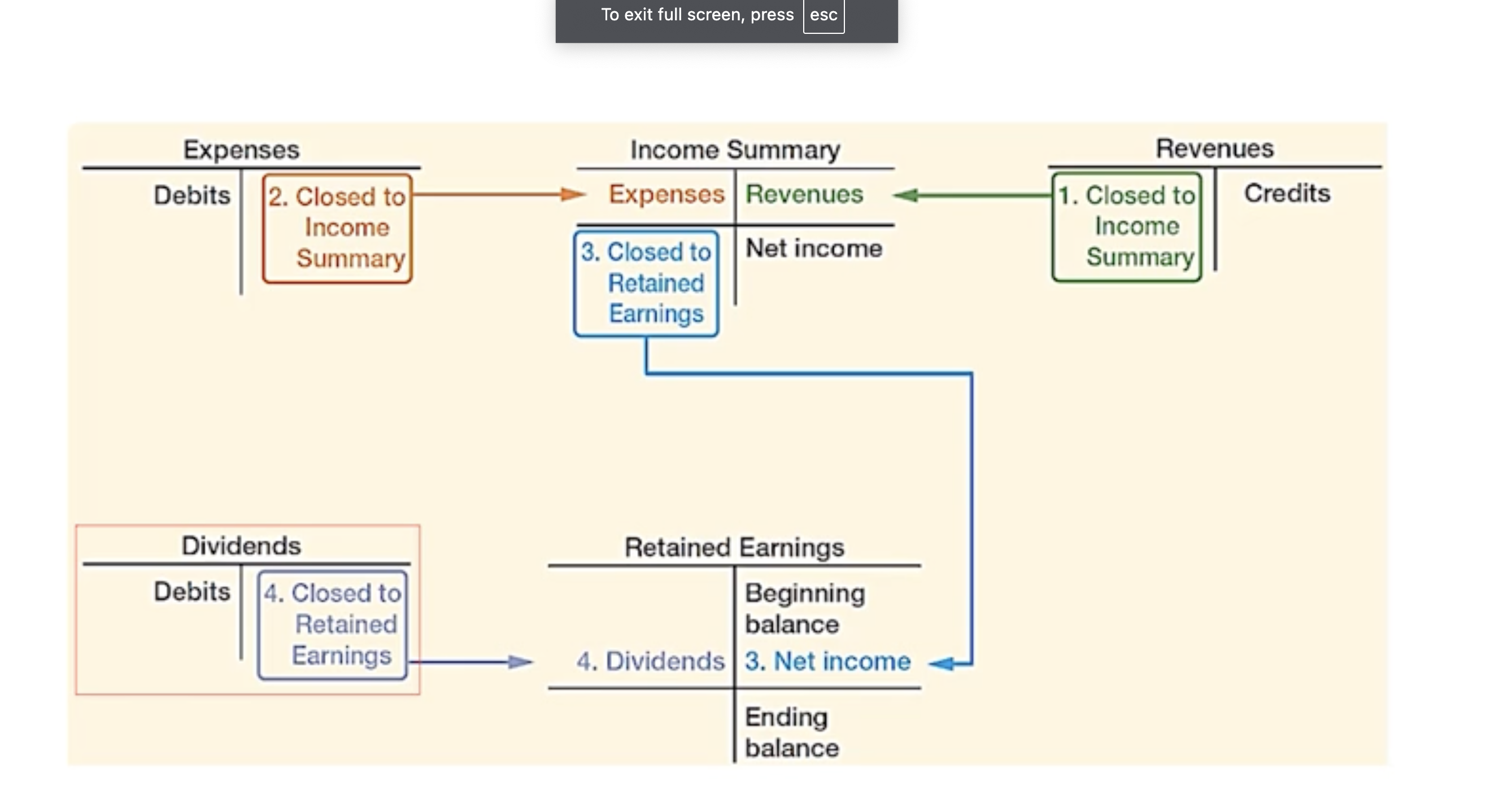

What is the Closing Process, and How Do we Close the Account: Quick overview

Press edit, click the record button on the bottom left to hear the audio explanation

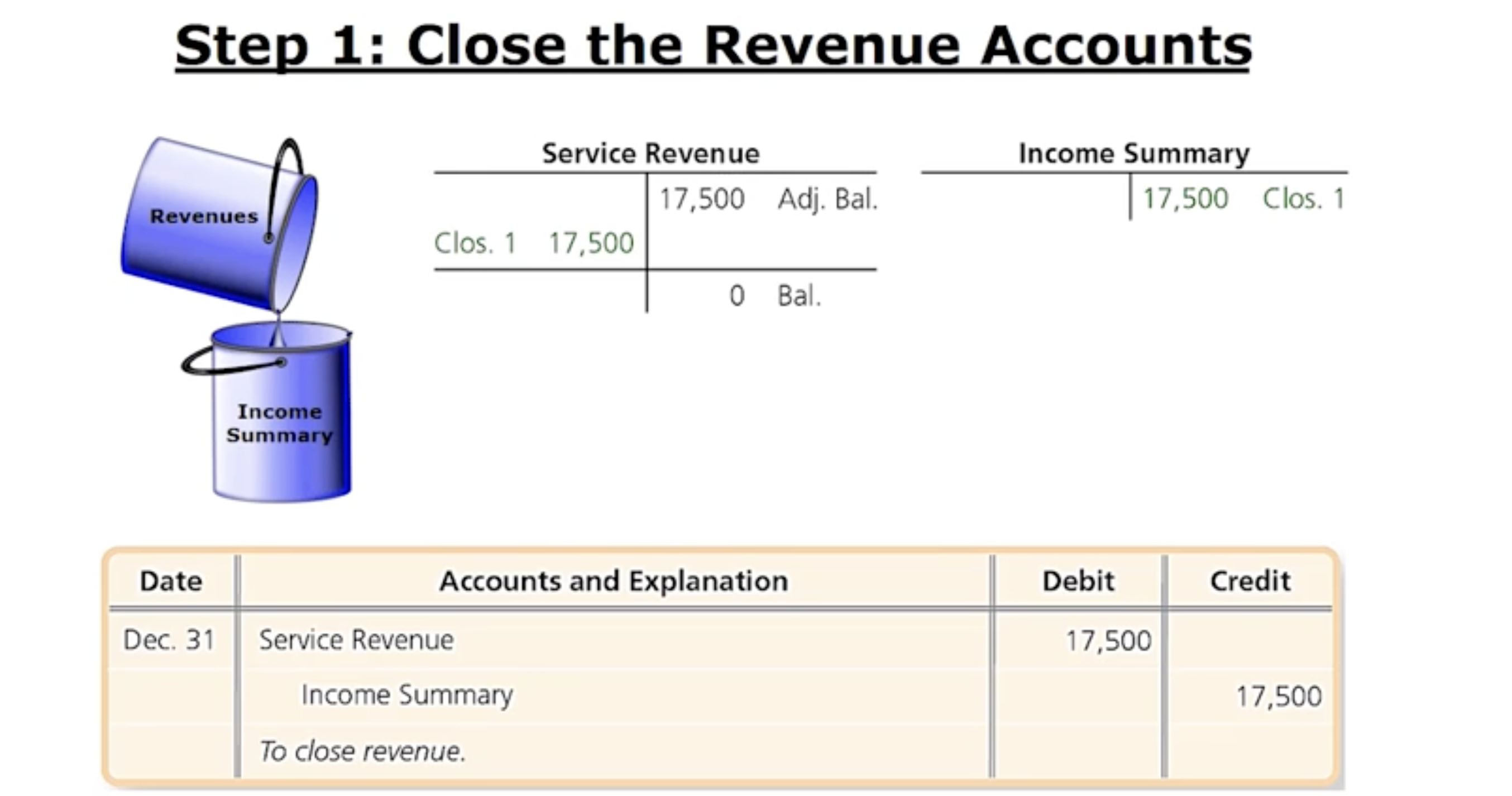

What is the Closing Process, and How Do we Close the Account: (Net Income for the Period) 1. Close the Revenue Accounts

Picture ex: Dumping the Revenues into the Income Summary. Service Revenue for Smart TL for the two months ended Dec. 31st, was 17,500 and like all Revenue accounts it has a Credit balance. If we want to take the Credit balance (17,500) and dump it into the Income Summary, it needs to be wiped out by Debiting the Service Revenue which means it has to be Credited in Income Summary.

The first Closing Entry on Dec 31st, will be to Debit Service Revenue for 17,500 and Credit Income Summary for 17,500.

Wipe out the Revenue Account

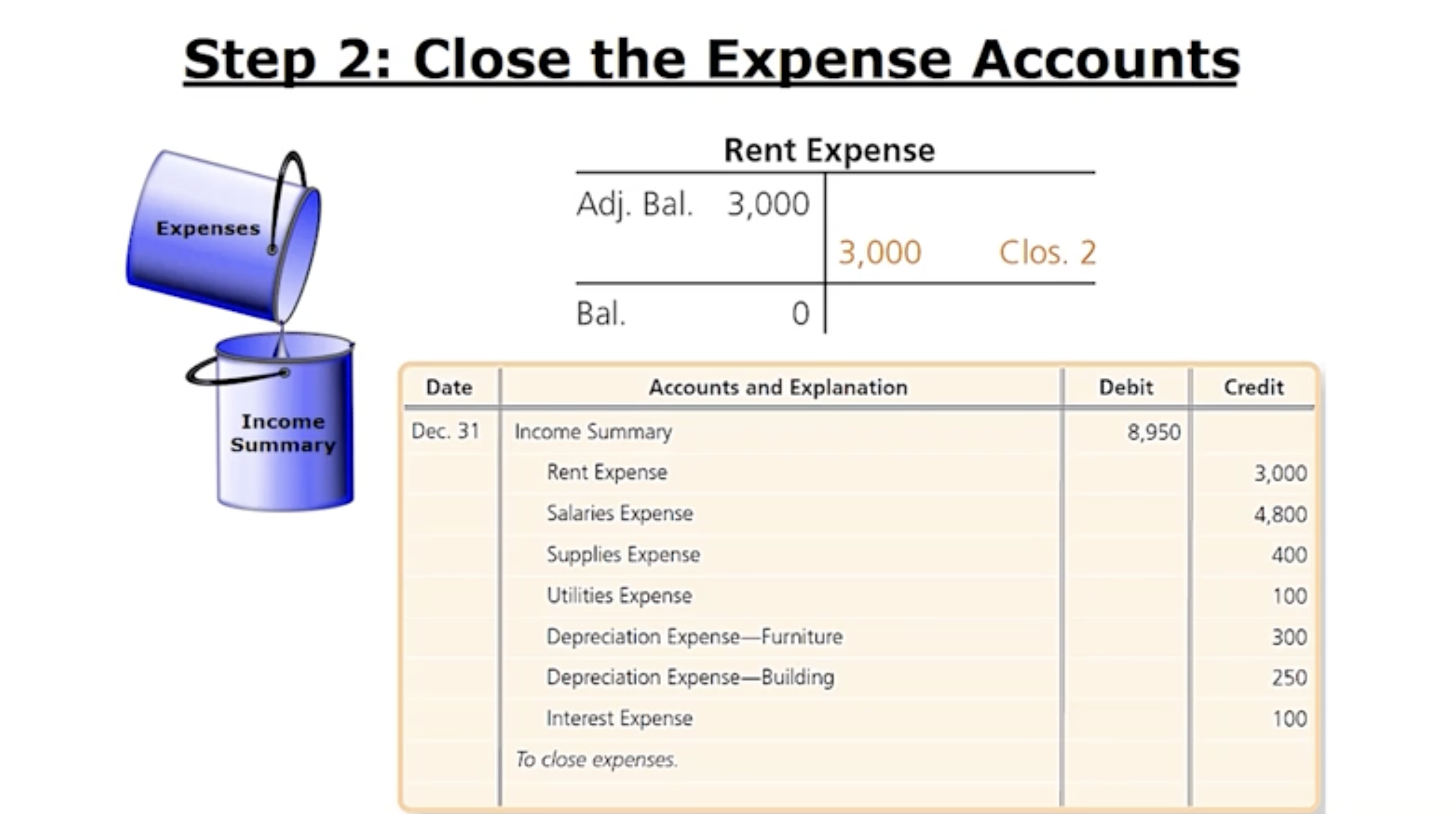

What is the Closing Process, and How Do we Close the Account: (Net Income for the Period) 2. Close the Expense Accounts

Picture ex: Dumping the Expenses into the Income Summary. Rent Expense is one of the Expenses and like all expenses it has a normal Debit balance. If the rent expense was set down to 0 on the account and wipe it out, it needs to be Credited to Rent Expense. This will apply to not only Rent but to all Expenses. This will be done in a Compound Journal Entry.

Summary: Debit Income Summary, wipe out all of the expenses by Crediting the balances

Close all of the Expenses

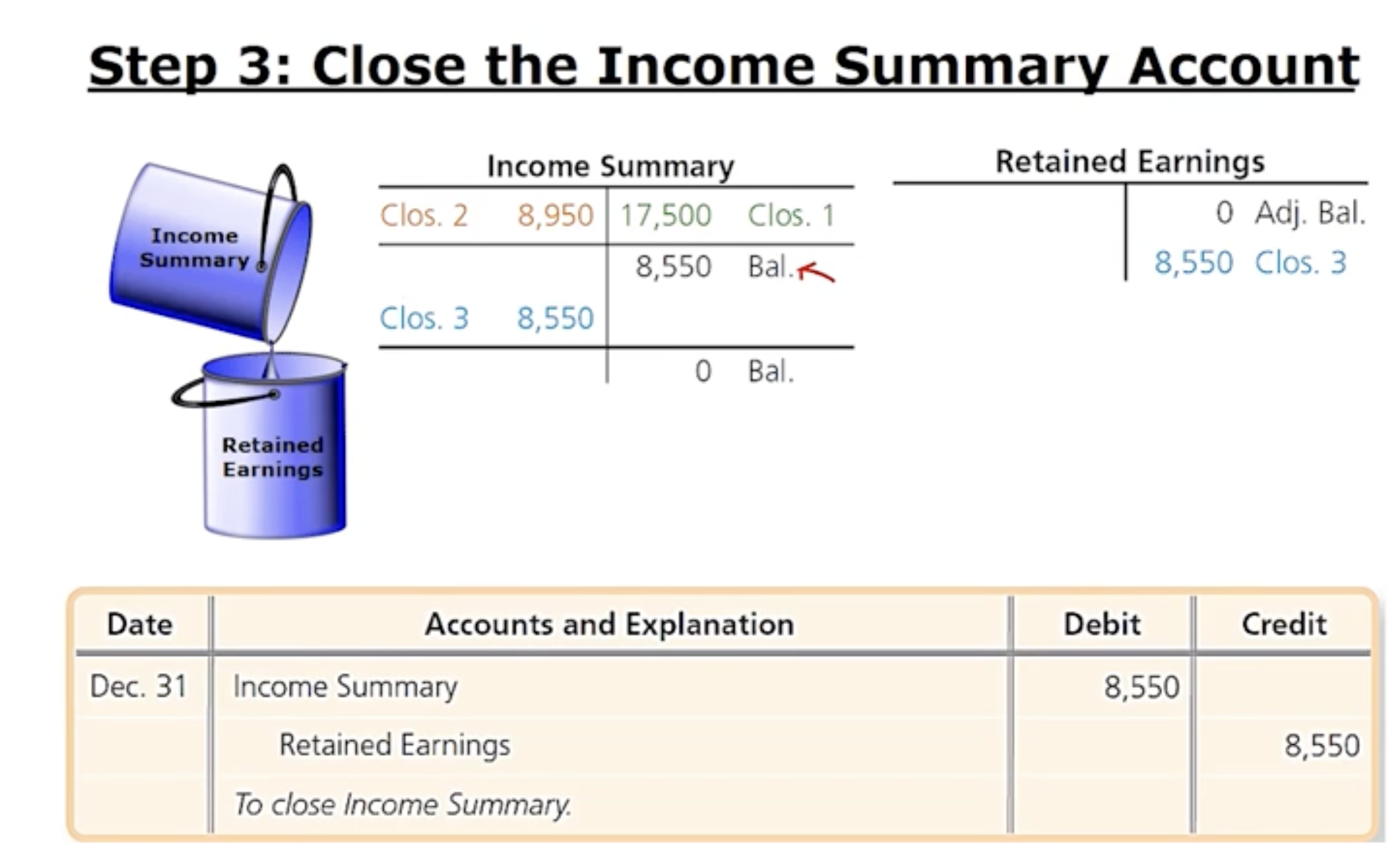

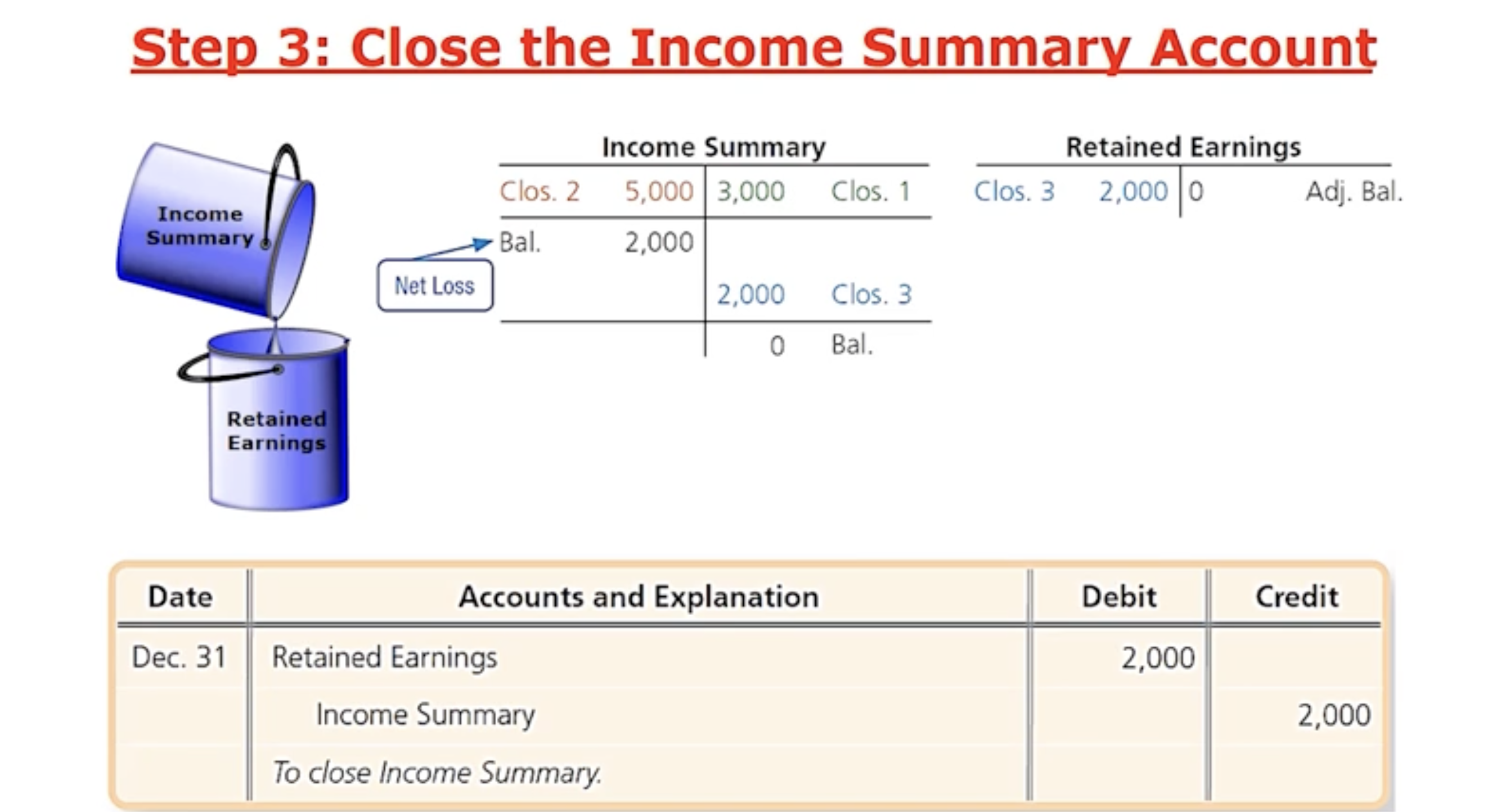

What is the Closing Process, and How Do we Close the Account: (Net Income for the Period) 3. Close the Income Summary Account

Picture ex: Take the balance of the Income Summary account which should not equal the net income and now dump the balance into the Retained earnings and update the RE for Smart TL. The Income Summary now has a balance of 8,950 matching the net income. To get Income Summary down to 0, it has to be Debited which means it has to be Credited to RE in the Closing Entry. Closing Entry N.3, when RE was Credited for 8,950— it is increasing the RE account by the amount of Net Income.

Closing Entry will be a Debit of Income Summary and a Credit of RE

Will have a balance of either the net income or net loss

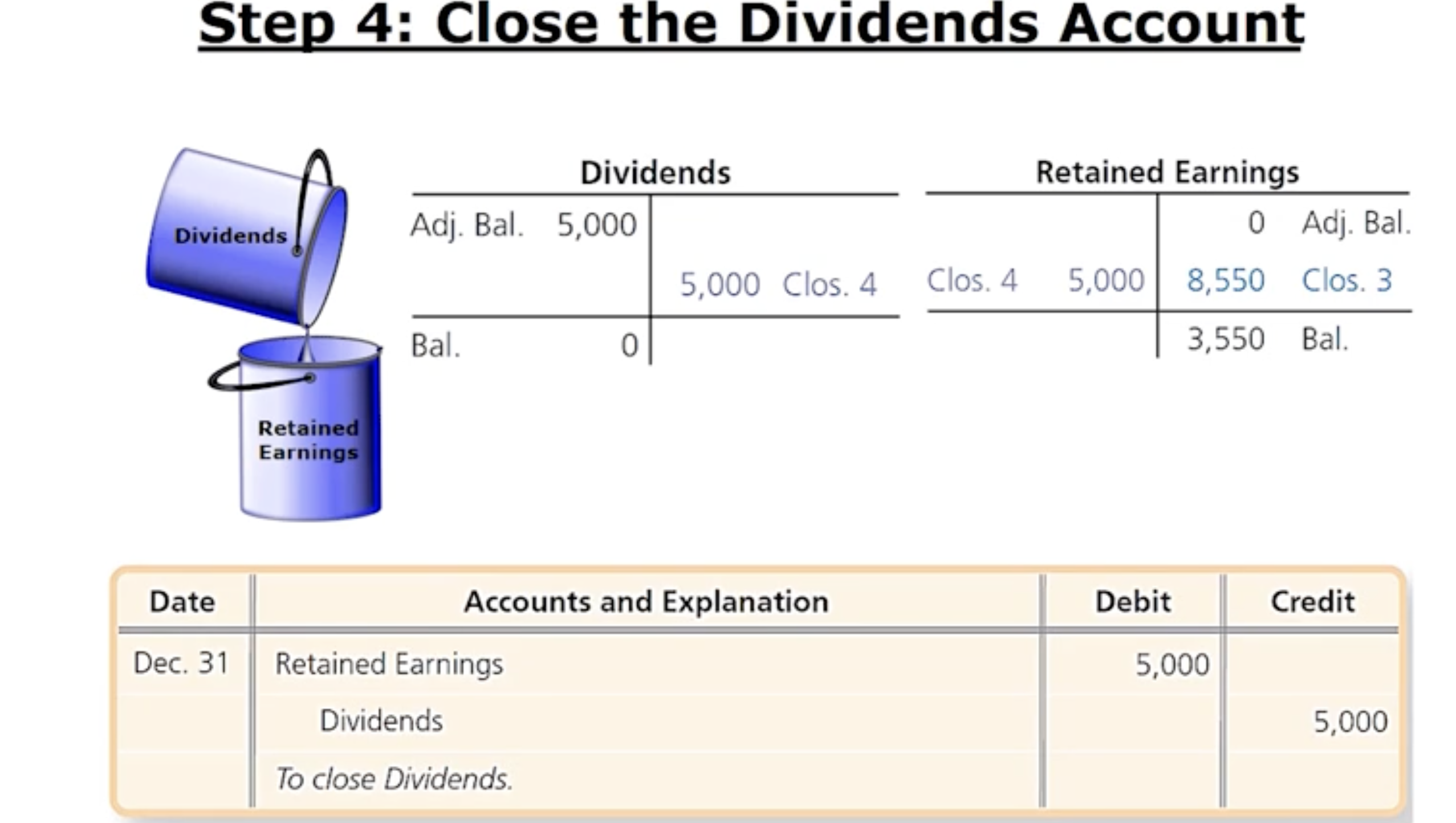

What is the Closing Process, and How Do we Close the Account: (Net Income for the Period) 4. Close the Dividends Account

Picture ex: Going to close the Dividends account by transferring the 5k of Dividends and update Retained Earnings. Remember Dividends has. a normal Debit balance so it needs to be Credited to get it down to 0. This means RE has to be Debited for that 5k. Remember again that RE has a normal Credit balance so anytime the RE is Debited (in this ex) it decreases the RE balance which knocks that balance down to 3,550.

RE is Debited for 5k and Dividends is closed out with a credit of 5k.

Close the Dividends Account— Credit Dividends to close it out to 0 and decrease the RE with Debit

What is the Closing Process, and How Do we Close the Account: (Net Loss for the Period) Reference pic from N.3 bc only Step can CHANGE

(Net Loss: Expenses were simply higher than Revenue).

When it comes to Income Summary would mean the expenses would be greater and would have a Debit balance

To wipe it out: Income Summary has to be Credited and RE would Debited which decreases the RE account

So the RE would be Debited and Income Summary would be wiped out 2k (Credited)

The only thing that changes is the 3rd Closing Entry where RE is Debited and Income Summary is Credited— the 1,2 and 4th does NOT CHANGE.

What is the Closing Process, and How Do we Close the Account: Summary

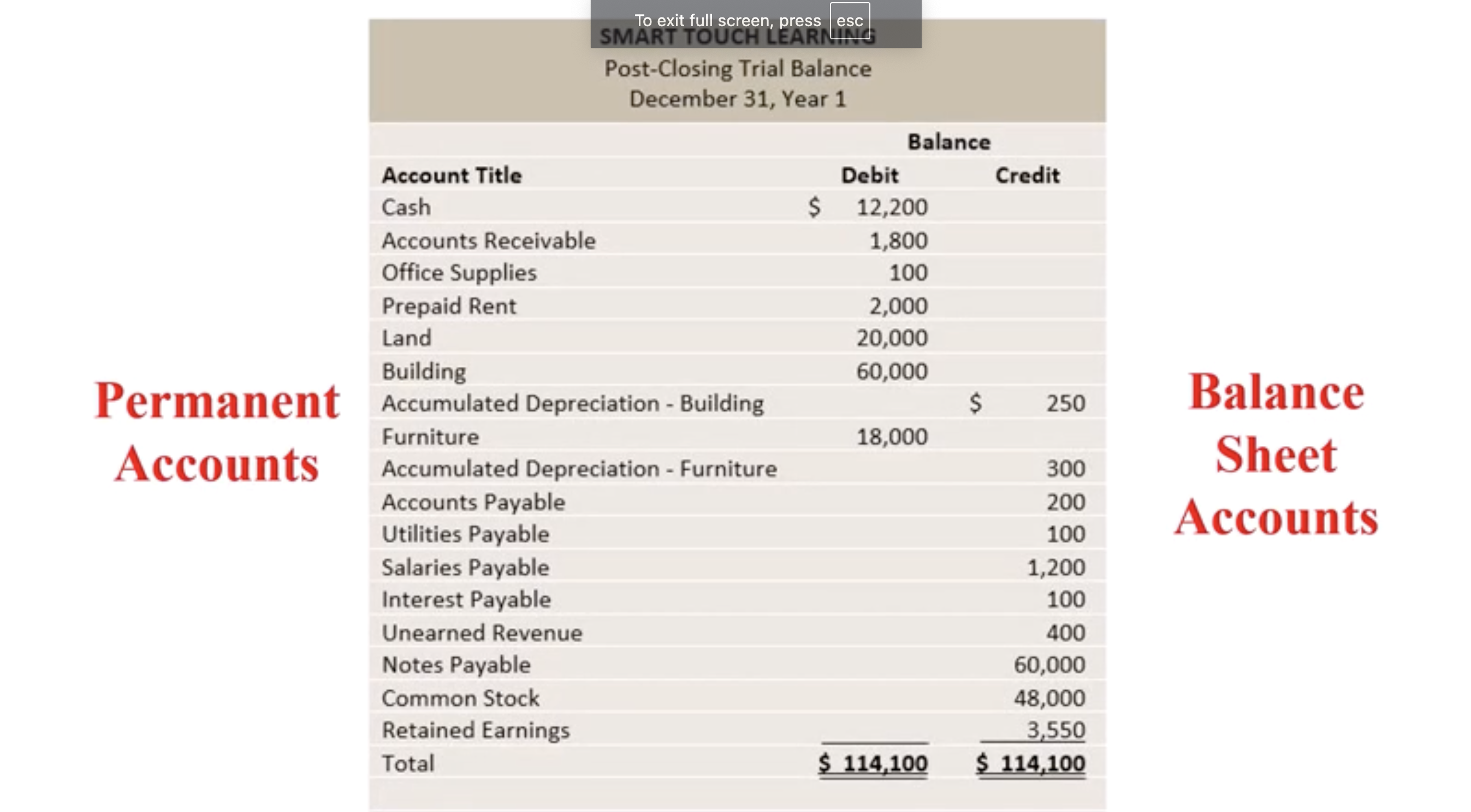

How Do We Prepare a Post- Closing Trial Balance: Post- Closing Trial Balance

A list of the accounts and their balances at the end of the period after journalizing and posting the Closing Entries.

How Do We Prepare a Post- Closing Trial Balance: Post- Closing Trial Balance Ex pic

Only list the Permanent Accounts which are the Balance Sheet Accounts

NO Revenues, Expenses, Income Summary or Dividends on the Post- Closing Trial Balance Sheet

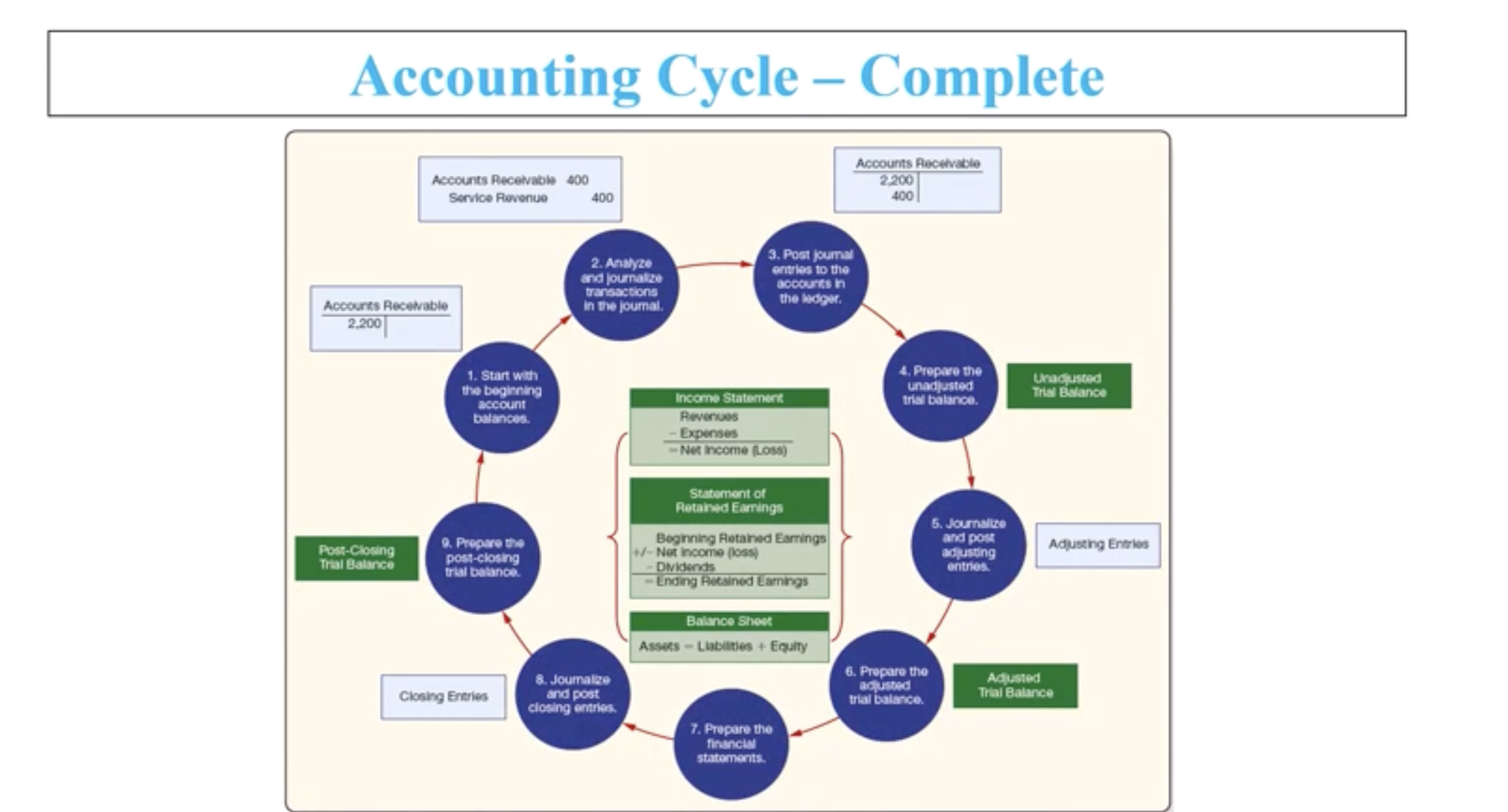

What is the Accounting Cycle:

The process by which companies produce their financial statements for a specific period of time. (End of the continuation from the last chapters on the Accounting Cycle).

How Do we Use the Current Ratio to Evaluate a Business’s Financial Position: Accounting is designed to

provide info that stockholder, managers, and lender can use to make decisions.

Answer to the question in the photo: If a business already has alot of debt or liability, repayment is less certain.

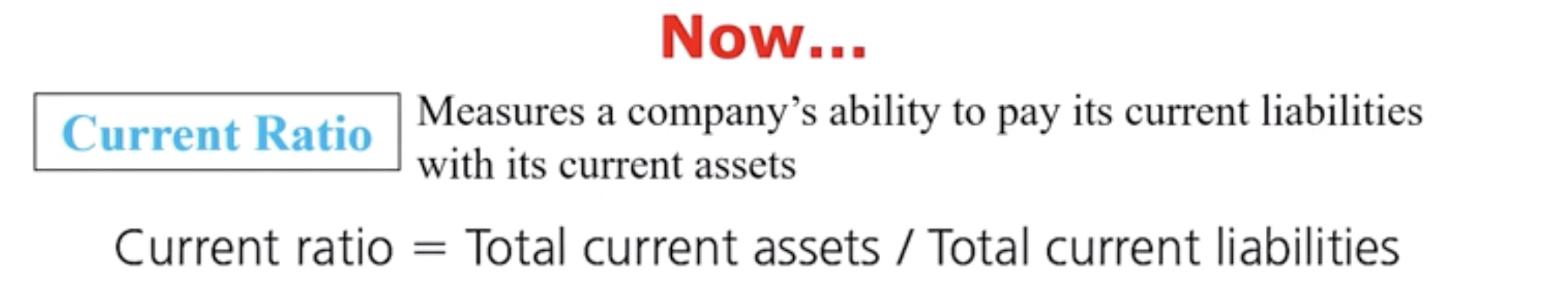

How Do we Use the Current Ratio to Evaluate a Business’s Financial Position: Current Ratio

Measures a company’s ability to pay its current liabilities with its current assets.

Current Ratio: Total Current Assets / Total Current Liabilities

Preferably to have a high Current Ratio

Plenty of current assets to pay its current liabilities

An increase from the prior period shows improvement in a company’s ability to pay back its current debts

Rule of Thumb: A strong ratio is 1.50

A business has $1.50 of current assets for every $1.00 of current liabilities

A current ratio of 1.00 is considered low and somewhat risky

How Do we Use the Current Ratio to Evaluate a Business’s Financial Position: How to calculate Current Ratio from the Balance Sheet

The total current asset: $16,100 then the liabilities sections is $2,000. Divide the two number and get 8.05 (Current Ratio). Not much doubt that they will be able to pay back the current debts next year.

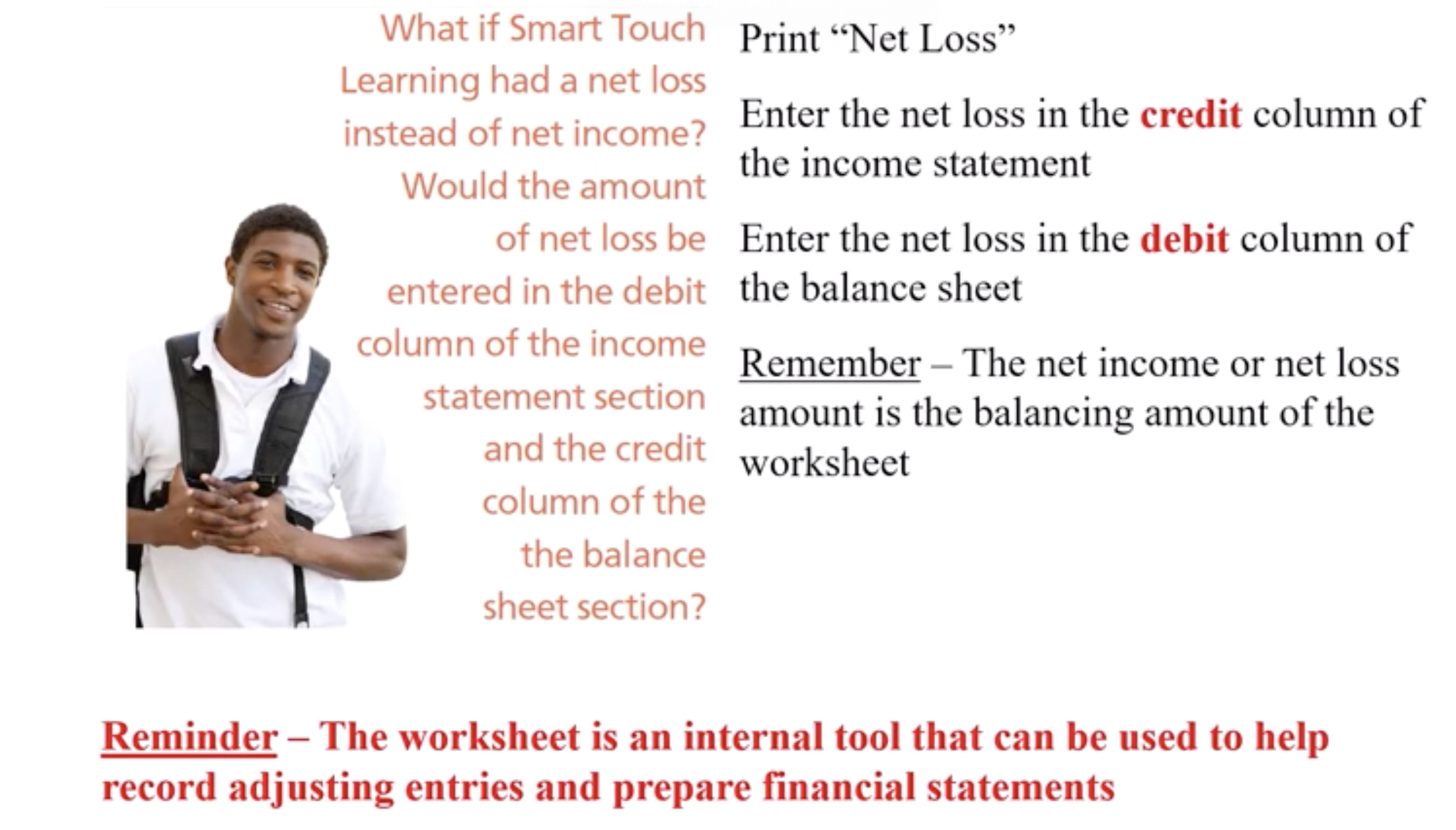

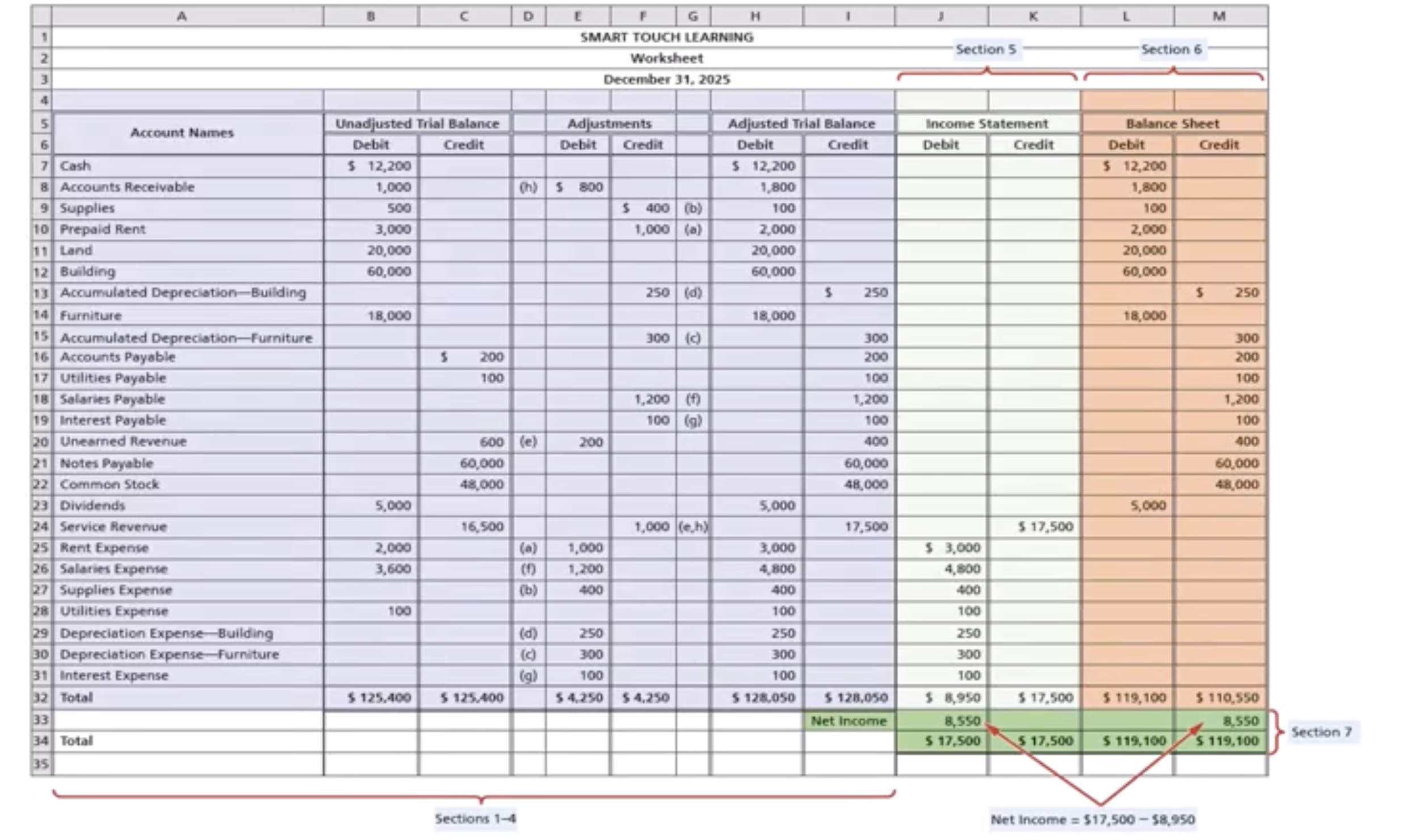

How Could a Worsheet Help in Preparing Financial Statements: Income Statement & Balance Sheet

Take all the revenues and expenses, the balances from the Adjusted Trial balance and slide all of the balances over to the income statements section.

Now when the Income Statements are prepared all that needs to be done is to take a look at the income statements column worksheets and use these numbers— revenues and all expenses to prepare the income statement.

Anything Dividends or above are being taken (the numbers) being slid over to the balance sheet column

Now all the numbers are ready to prepare the balance sheet

One thing that is noticeable when the numbers get slid over, the DR do not equal the CR for the Income & Balance columns but the difference between the DR & CR columns should equal the net income.

Will always have less than the DR column of the Income statement

Will always have less than the CR column of the Balance sheet

Total the CR & DR in both income and balance and should equal out!

How Do we Use the Current Ratio to Evaluate a Business’s Financial Position: Questions