fiscal monteru polocy and supply side

1/84

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

85 Terms

Fiscal policy

Decisions made by the government on its

-expenditure

-taxation

-borrowing

Government budget

The balance between government receipts and outlays

Transfer payments

Occur when the government provides benefits (in cash or in kind) to poor households

Direct taxation

A tax levied directly on income

Indirect taxation

A tax on expenditure, e.g. VAT

Progressive taxation

A tax in which the marginal tax rate rises with income, i.e. a tax bearing most heavily on the relatively well-off members of society

Proportional taxation:

Tax that is proportional to income, being neither regressive nor progressive

Regressive taxation

A tax bearing more heavily on the poorer members of society

Fiscal Deficit

If a gov spends more than what it earns, it leads to the deficit

Fiscal Surplus

If a gov spends less than what it earns, it creates a fiscal surplus

Current government expenditure

Spending by the government on goods and services

Capital government expenditure

Spending by government on capital projects

Budget surplus

A situation in which government expenditure is less than government revenue

Budget deficit

A situation in which government expenditure exceeds government revenue

Balanced budget

A situation in which government expenditure equals government revenue

Cyclical budget position

A government budget deficit that occurs during the downturn of the business cycle, but disappears in the upturn

Structural budget position

A government budget deficit that persists even when the economy is at full employment

National and government debt

The total amount of government debt, based on accumulated previous deficits and surpluses

Discretionary fiscal policy

A situation in which the government uses its discretion to intervene in the economy in an attempt to stabilise it

Automatic stabilisers

Process by which government expenditure and revenue vary with the economic cycle, thereby helping to stabilise the economy without any conscious intervention from government

Crowding out

Process by which an increase in government expenditure ‘crowds out’ private sector activity by raising the cost of borrowing

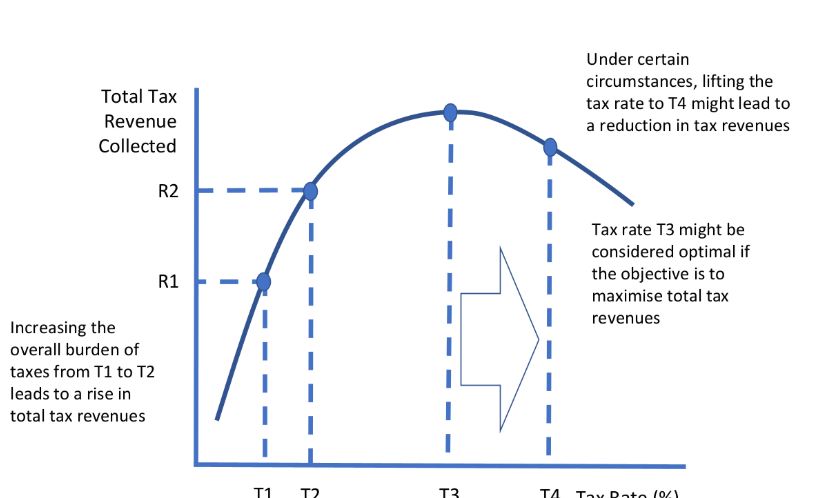

The Laffer curve:

An inverted U-shaped relationship between the tax rate and the amount of revenue raised

Average tax rates

Total taxes paid divided by total taxable income

Marginal tax rates

Tax on additional income, defined as the change in tax payments due divided by the change in taxable income

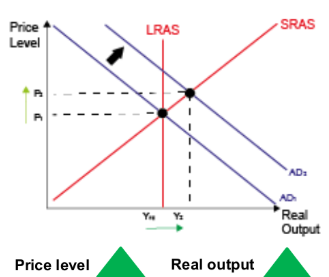

Expansionary fiscal policy diagram

Reduction in taxes and/or increase in govt. spending

Increase in AD

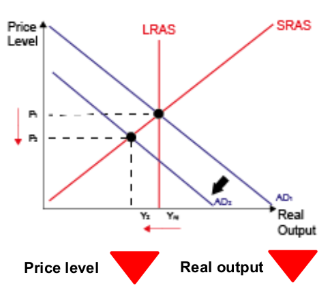

Contractionary fiscal policy diagram

Increase in taxes and/or decrease in govt. spending

Decrease in AD

Key roles for fiscal policy

Correcting for market failures:

-Carbon border taxes

-Subsidies to help people afford social housing

-Changing the final distribution of income and wealth

-Progressive direct taxes (marginal tax rates, new wealth tax)

-Stabilizing & stimulating aggregate demand and GDP growth

-Changes in income tax, NICs and VAT

-Changes in state welfare / public sector pay policies

-Improving the economy’s supply-side potential (LRAS)

-Increased state spending in education and public health

-Funding for infrastructure spending including energy & transport

Current government spending

Also known as public

expenditure, refers to money that a

government allocates to fund various

state-provided programmes and public

services. These expenditures are typically

financed through taxes and government

borrowing (such as issuing bonds).

Capital spending

New public infrastructure

Changes of fiscal policy that can affect SRAS

-Changes in VAT affect the supply costs of businesses – a fall in VAT reduces costs and – ceteris paribus – will cause SRAS to shift outwards

-Changes in environmental taxes – a rise in a carbon tax will increase the costs especially of energy-intensive firms. SRAS will shift inwards

-Changes in import tariffs – lower tariffs as a result of trade liberalisation will lead – ceteris paribus – to lower costs, SRAS shifts outwards

-Changes in government subsidies – input subsidies paid to producers (such as farmers) lower their costs and cause an outward shift of supply

Changes of fiscal policy that can affect LRAS

-Changes in marginal and average income tax rates can have a significant effect on work incentives in the labour market

-State funding of research and development can have important effects on process innovation and the pace of dynamic efficiency in markets

-Higher government spending on education & training, can increase human capital / productivity to lift the long-term trend rate of growth.

-Changes in corporation tax and import tariffs can influence the size and direction of foreign direct investment (FDI)

-Government spending on new infrastructure is crucial to lift LRAS – it often makes private sector firms more efficient and profitable too.

economic arteries and veins

refers to infrastructure

roads, ports, railways, airports, power lines., pipes and wires that enable people goof, commodities, water, energy and info to move about efficiently

Taxation

is the process by which governments

collect revenue from individuals, businesses,

and other entities to finance public services,

infrastructure, and various government

functions.

Main reason for taxation

Revenue Generation- for education, military etc.

Redistribution of Income and Wealth- e.g. Progressive taxation, where higher income individuals pay a higher percentage of their income in taxes

Economic Stabilization: Governments may implement countercyclical fiscal policies, such as reducing taxes during economic downturns to stimulate spending or increasing taxes during economic booms to cool down inflation.

Regulation and Incentives: For example, higher taxes on tobacco and alcohol can discourage consumption, while tax incentives for research and development can encourage innovation.

Public Goods: Taxes are essential for financing pure public goods and services that are non-excludable and non-rivalrous. These are goods and services that benefit society as a whole and would not be adequately provided by the private sector.

Equity in terms on taxes

Taxation should be fair and equitable, meaning that individuals and businesses with similar financial capacities should pay similar amounts of tax. Equity can be a chieved through progressive, proportional, or regressive taxation systems.

Efficiency in terms on taxes

Taxation should minimize economic distortions and deadweight losses. An efficient tax system should not discourage productive activities or create unnecessary administrative burdens.

Economic neutrality in terms on taxes

Taxes should not distort economic decision-making. In other words, they should not unduly influence individuals or businesses to engage in specific economic activities solely for tax reasons.

Horizontal Equity

Similar taxpayers in similar circumstances should be treated equally in terms of their tax liabilities.

Vertical Equity

Tax burdens should be distributed in a way that is fair and reflects differences in the ability to pay.

Direct taxes

is levied on income, wealth and profit

include income tax, inheritance tax, national insurance contributions, capital gains tax, and corporation tax. The burden of a direct tax cannot be passed on

Indirect taxes

are taxes on spending

Examples include excise duties on fuel, cigarettes and alcohol

Producers may be able to pass on an indirect tax – depending on the coefficient of price elasticity of demand and supply

Regressive tax

Puts a greater burden on lower-income taxpayers than higher-income taxpayers.

For example, a sales tax such as VAT on groceries would affect a lower-income person more than a higher-income person, since a lower-income person spends a greater portion of their income on groceries than a higher-income person.

Proportional tax

Everyone pays the same percentage of their income or wealth in taxes. The tax rate does not change as income or wealth increases or decreases.

In a system, the tax rate remains the same for all taxpayers.

Fiscal Balance formula

Total Tax Revenue - Total Expenditure

National debt

Accumulation Over Time: is the result of a country consistently running budget deficits, where the government's expenditures exceed its revenues. When this happens, the government borrows money to cover the deficit, leading to an increase in the debt.

Purpose: Governments often use debt to finance critical infrastructure projects, public services, and other expenditures. It can also be used as an economic tool during recessions to stimulate economic growth.

Debt Servicing: Servicing involves paying interest on the outstanding debt and, when necessary, repaying the principal amount borrowed.

How is a budget deficit financed

-Issuing Government Bonds

-International Borrowing

-Central Bank Financing

Government bond yields

Represent the return an investor can expect to earn by investing in a government-issued bond

Coupon Yield

This is the fixed annual interest rate paid by the government on the face value of the bond. It's expressed as a percentage of the bond's face value and determines the periodic interest payments to bondholders.

Current Yield

Is the annual interest payment divided by the bond's current market price. It represents the bond's yield at its current market value, which may differ from its face

Yield curve

Is a graphical representation of the yields or interest rates of a series of fixed-income securities (typically government bonds or Treasuries) with varying maturities.

It shows the relationship between the yield (interest rate) and the time to maturity for bonds of the same credit quality.

Normal Yield Curve

In a typical economic environment, the yield curve is upward-sloping, which means that longer-term bonds have higher yields than shorter-term bonds.

This reflects the expectation that investors typically demand higher compensation (interest) for locking in their funds for a more extended period due to factors like inflation risk.

Budget deficits - impact on aggregate demand

-Direct Increase in Government Spending (G)

-Lower taxes

-Multiplier Effect

increases AD demand

Budget deficits - Negative effects on AD

-Increased Borrowing

-Higher Interest Rates: Higher interest rates can lead to reduced private sector investment and borrowing. "crowding out"

-Expectations of Higher Taxes

Crowding out

Can happen when an increase in government borrowing leads to a rise in demand for loanable funds which in turn causes market interest rates to rise. This can then squeeze or crowd-out capital investment spending by private sector businesses. It can also occur when rising government borrowing ultimately leads to a higher tax burden which cuts real disposable incomes for households and reduces post-tax profits for businesses.

Automatic Stabilisers

Automatic stabilisers are automatic fiscal changes as an economy moves through different stages of the business cycle – such as a fall in tax revenues from the circular flow during a recession or an increase in state welfare benefits when the unemployment rate is rising.

Evaluating the impact of economic stabilizers

-Impact depends on whether a government allows the automatic stabilisers to operate fully – and does not introduce fiscal austerity measures such as real spending cuts during a slowdown / recession

-Impact depends on the relative generosity of the welfare system such as base levels of payment for universal credit and unemployment support. Some governments have capped total welfare payments.

-Impact depends on the marginal propensity to spend and save of those households whose income is boosted by welfare during a recession

Expansionary Fiscal Policy

An expansionary fiscal policy involves the government aiming to increase aggregate demand – through deliberately increasing real government spending and/or lowering direct and indirect taxes, which is financed by an increase in the size of the budget (fiscal) deficit.

Expansionary Fiscal Policy why is it used

-Usually to stimulate real output and employment and perhaps reduce the risk of a persistent deflationary recession.

-impact takes time to feed through the circular flow – but the time lags are also variable – contrast higher welfare payments with long-term infrastructure spending.

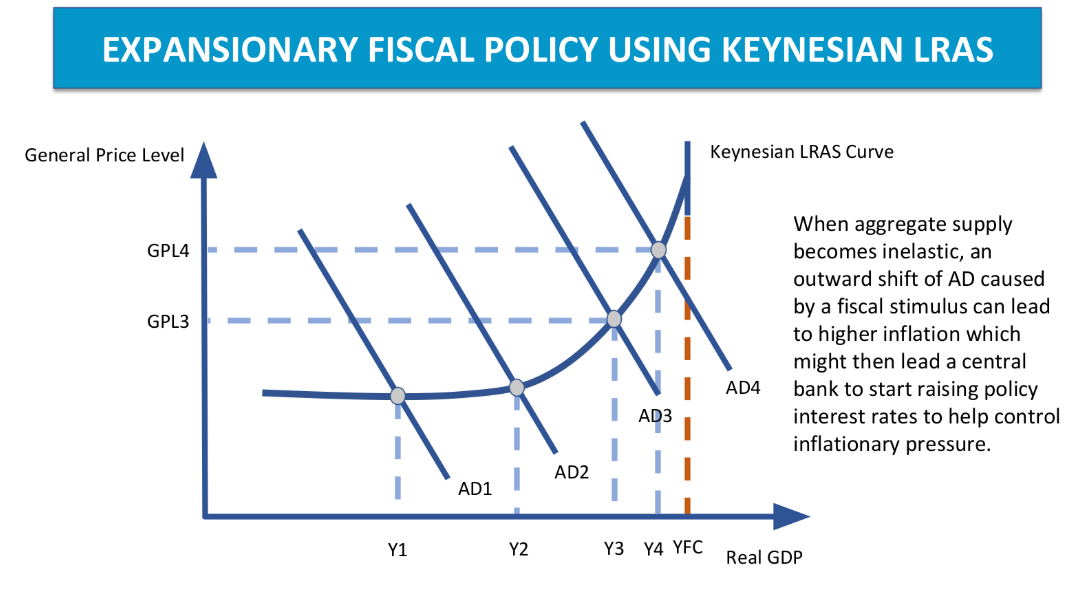

Expansionary fiscal policy using Keynesians LRAS

Fiscal multiplier

The fiscal multiplier estimates the final

change in real national income (GDP)

that results from an initial (exogenous)

change in government spending and/or

revenue plans.

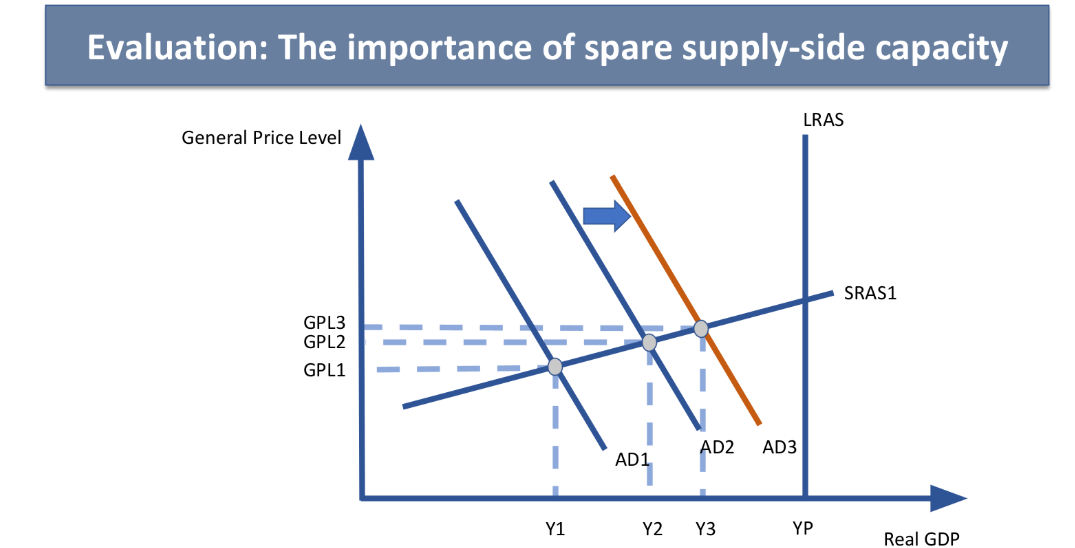

Importance of spare supply side capacity diagram

Laffer curve

The Laffer Curve is a theoretical idea beloved of free-market Economists who believe in tax cutting as a means of stimulating work incentives and economic growth. They argue that lower taxes can increase growth and can therefore contribute to higher direct and indirect tax revenues for the Government.

Laffer curve diagram

Monetary policy

Decisions made by the government regarding monetary variables such as:

-Interest rates

-Supply of money

-Currency

Central Banks

A central bank is the monetary authority and major regulatory bank in a country. A central bank is responsible or operating monetary policy and maintaining financial stability. ‘symmetric’ inflation target

-BoE (UK)

-ECB (EU)

Objectives of monetary policy

-Price stability

-Supporting economic growth and employment

Monetary stability

Means a lengthy period of stable prices and market confidence in the external value of a currency. Stable prices are defined by the inflation target, which the Bank of England seeks to meet through the decisions taken by the Bank’s Monetary Policy Committee (MPC).

Base Interest Rate

The main interest rate set by a nation’s central bank. This is the rate of interest charged to commercial banks if they must borrow from the central bank when short of liquidity.

The nominal rate of interest

Is known as the money rate of interest. For example, paid to covers, or charged on a loan.

Negative interest rates

Negative interest rates occur when a central bank reduces the nominal interest rate to zero meaning banks pay to store reserves at the central bank rather than receive interest. This policy is often used during periods of economic slowdown or deflation to encourage spending and borrowing.

Factors Considered When Setting Policy Interest Rates

The BoE sets policy interest rates consistent with the need to

-Meet an inflation target of consumer price inflation of 2%

-GDP growth and spare capacity / estimates of output gap

-Bank lending, consumer credit figures, retail sales data

-Equity markets (share prices) and trends in house prices

-Consumer confidence and business confidence / sentiment

-Growth of wages, average earnings, labour productivity and unit labour costs, surveys on labour shortages

-Unemployment and employment data, unfilled vacancies

-Trends in global foreign exchange markets (i.e. is sterling

-appreciating or depreciation against other currencies)

-International data – e.g. GDP growth rates in economies of major trading partners such as USA and Euro Area

Deflationary monetary policy

is an approach taken by a central bank to reduce the money supply or raise interest rates with the primary goal of decreasing aggregate demand and slowing down economic activity. The aim of a deflationary monetary policy is to combat inflation and maintain price stability.

ECONOMIC EFFECTS OF HIGHER INTEREST RATES

-Consumer Spending: Higher interest rates make it more expensive for households to service their debts, reducing effective disposable income.

-Household Saving: The return on saving usually rises – leading to an increase in the propensity to save and a fall in consumer demand

-Investment: Higher interest rates make borrowing more expensive for firms, which can reduce their investment in new capital

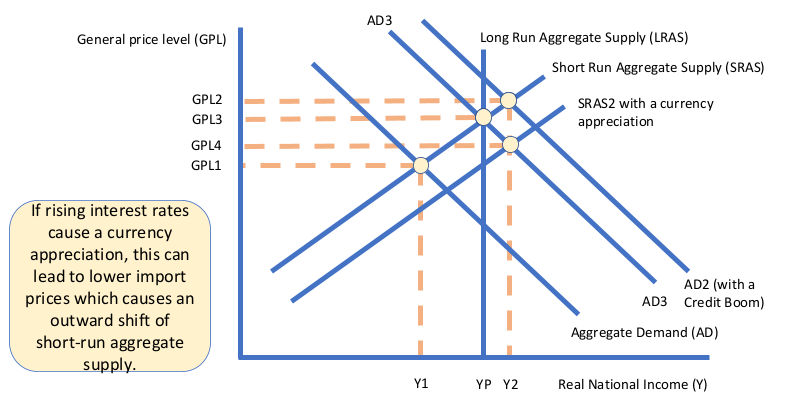

-Exchange Rates: A rise in interest rates can lead to an appreciation of the domestic currency, making exports more expensive and imports cheaper. This can lead to a decrease in aggregate demand as firms and consumers reduce spending on foreign goods.

-Asset Prices: Higher interest rates can also reduce the value of assets such as stocks, bonds, and housing, leading to a decrease in aggregate demand as households reduce spending in response to lower wealth.

Affect of higher interest rates on a AD-AS diagram

Effects of higher interest rates on business

Firstly, they increase the cost of borrowing, which can make it more expensive for businesses to invest in new equipment or expand their operations.

Secondly, they can lead to a decrease in consumer spending, as higher interest rates tend to reduce people’s effective disposable income and make them less likely to spend on non-essential items.

Thirdly, higher interest rates can make it more expensive for businesses to refinance existing debt. They can increase the cost of working capital, which can put pressure on a business's cash flow and profitability.

If higher interest rates lead to a currency appreciation, then exporters may find that they become less price competitive in overseas markets.

Effects of higher interest rates on households

Firstly, they can make borrowing more expensive. This can impact consumers looking to take out a loan or credit card, as well as those with existing variable-rate debts like mortgages or car loans.

Secondly, higher interest rates can lead to lower levels of consumer spending, as consumers may tighten their belts and focus on paying down their debts.

Higher rates can also lead to a worsening of consumer confidence (or animal spirits) especially if people fear that they might lead to a recession.

Increase mortgage rates might cause a drop in average house prices.

Higher interest rates can have an impact on the value of people's savings, as interest rates on savings accounts increase – good news for savers!

How can higher interest rates affect aggregate supply?

When interest rates rise, it becomes more expensive for firms to borrow money for capital investment, causing a decrease in investment and hence a possible decrease in long run aggregate supply.

A drop in investment means that an economy’s capital stock will age possibly leading to a fall in productivity / efficiency

Higher interest rates can reduce the profitability of businesses (borrowing costs are increased and consumer demand contracts). If profits decline, then businesses may have less to spend on research and development and innovation which might then lead to lower labour productivity.

Evaluation – benefits of higher interest rates on LRAS

1.Higher interest rates usually cause an appreciation of the exchange rate. This can allow domestic businesses to buy imported capital equipment / software and hardware at a lower price. This might cause capital spending to rise.

2.Higher interest rates are designed by a central bank to help control inflation. If this policy is successful, then lower inflation will help to improve macroeconomic stability and business confidence. This in turn can help promote investment demand.

3.Higher interest rates can encourage households to save more money, which can increase the pool of funds available for lending to businesses, potentially making it easier and cheaper for them to access financing.

Quantitative Easing

A central bank uses quantitative easing (QE) to increase the supply of money in the banking system designed to encourage commercial banks to lend at cheaper interest rates to small & medium sized businesses. It is a form of expansionary monetary policy and has been used as a technique to stimulate aggregate demand at a time when nominal interest rates have fallen to historically low levels.

How does quantitative easing work

Central bank (such as the Bank of England) creates new money electronically to make large purchases of assets (bonds) from the private sector

Commercial banks then receive cash from BoE asset purchases, and this increases their liquidity and might encourage them to lend out to customers which will help to stimulate an increase in loan-financed capital investment

Increased demand for government bonds increases the market price of bonds. Higher bond price causes a fall in the yield on a bond (this is because there is an inverse relationship between bond prices and yields). Lower bond yields / long term interest rates may cause the currency to depreciate

Those who have sold bonds may use the extra cash to buy assets with relatively higher yields such as shares of listed businesses and corporate bonds

Quantitative tightening

Is the opposite of quantitative easing (QE).

While QE increases the money supply by creating new money and using it to purchase government bonds, QT decreases the money supply by the central bank going into financial markets and selling government bonds.

The goal of QT is to reduce the amount of money in circulation and to increase market interest rates.

This can help to slow down inflation and to correct imbalances in the economy, such as an overheated housing market. QT can also reduce the amount of credit available in the economy and can lead to a contraction in economic activity.

Supply-side Policies

Are a set of economic measures and strategies that aim to improve the long-run productive capacity and efficiency of an economy.

Primary goal is for long term economic growth and increase productivity

Main aims of supply side policy

-Improve incentives to work and invest in people’s skills (human capital)

-Increase labour and capital productivity

-Increase occupational and geographical mobility of labour

-Increase capital investment and research and development spending

-Promote contestability and stimulate innovation (dynamic efficiency)

-Encourage start-ups and expansion of new businesses especially those with significant export potential / promote economic diversification

-Improve price & non-price competitiveness in global markets

-Improve the trend rate of sustainable growth of real GDP to help support improved living standards & better regional economic balance