Tax exam

1/91

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

92 Terms

What are the standard rules for recovering the cost of assets?

Standard depreciation rules are covered first, followed by special rules like §179 expensing and bonus depreciation.

What information is needed to compute MACRS depreciation for an asset?

The asset's initial basis, date placed in service, applicable depreciation method, recovery period, and applicable depreciation convention.

What types of property are included under personal property depreciation?

All tangible property such as computers, automobiles, furniture, machinery, and equipment, excluding real property.

How is an asset's recovery period determined for financial accounting purposes?

Based on the taxpayer-determined estimated useful life.

How is an asset's recovery period determined for tax purposes?

Predetermined by the IRS in Rev. Proc. 87-56 based on the property's description.

What is the half-year convention in depreciation?

One-half of a full year's depreciation is allowed in the first and last year of an asset's life.

What happens if an asset is disposed of before it is fully depreciated?

Only one-half of the table's applicable depreciation percentage is allowed in the year of disposition.

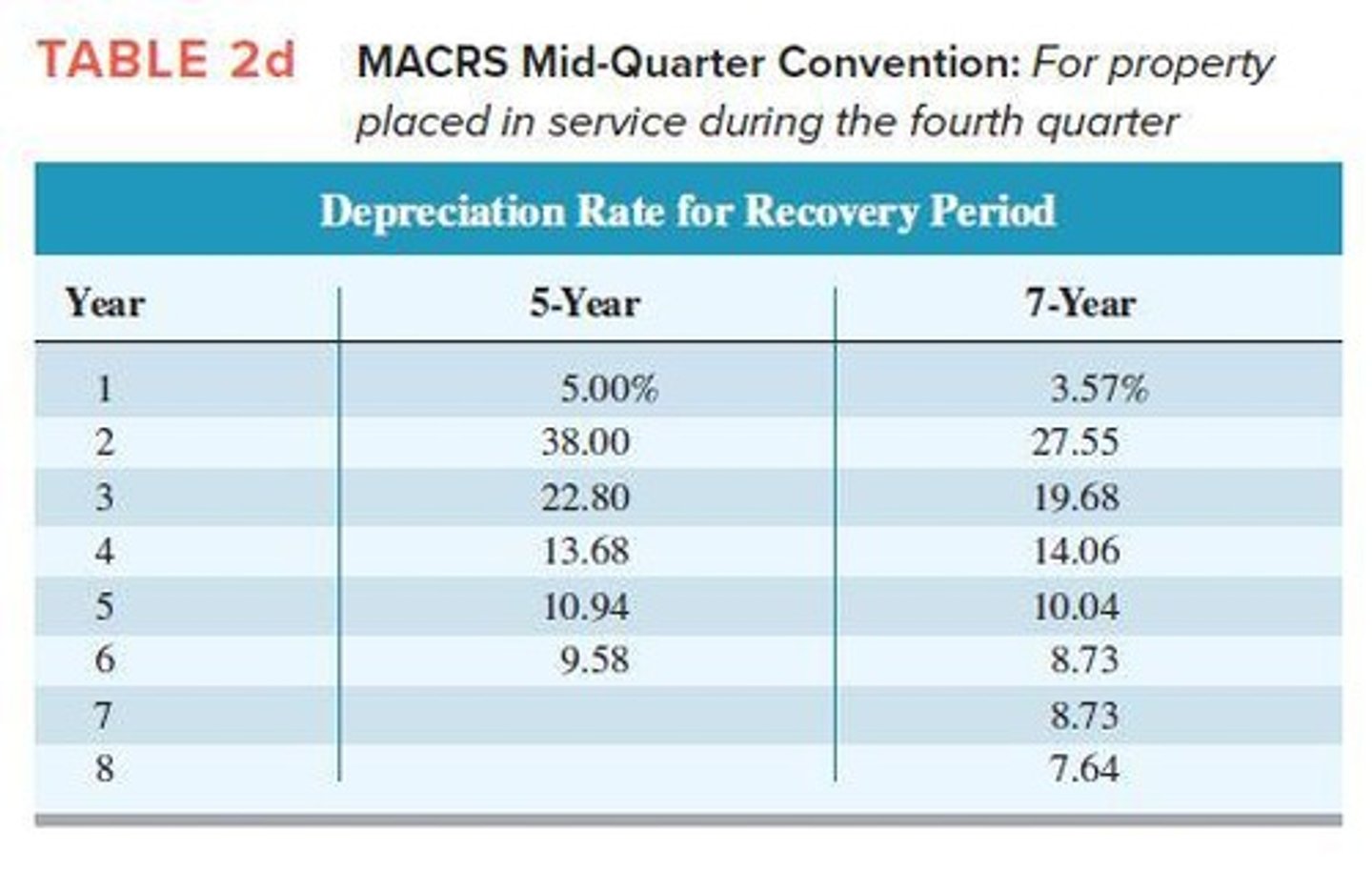

What is the mid-quarter convention?

Applicable when more than 40 percent of qualified property is placed in service in the last quarter of the business's tax year.

What is the first step in calculating depreciation for personal property?

Determine the appropriate convention (half-year or mid-quarter).

Where can the applicable depreciation table be found for calculating depreciation?

In Rev. Proc. 87-57.

What should you select from the depreciation table when calculating depreciation?

The column that corresponds with the asset's recovery period and the row identifying the year of the asset's recovery period.

What is the purpose of Rev. Proc. 87-56?

To help taxpayers categorize each of their assets based on the property's description.

What is the significance of Exhibit 10-4 in the context of depreciation?

It outlines the recovery period for most common business assets.

What is the half-year convention in depreciation?

A method that assumes assets are acquired and disposed of in the middle of the year, affecting the calculation of depreciation.

What is the mid-quarter convention in depreciation?

A method used when assets are placed in service during the last quarter of the year, affecting the depreciation calculation.

What is the maximum amount for immediate expensing under §179 for 2024?

$1,220,000.

What are the limitations on immediate expensing under §179?

Property limitation and taxable business income limitation.

What types of property qualify for immediate expensing under §179?

Tangible personal property, off-the-shelf computer software, and qualified improvement property.

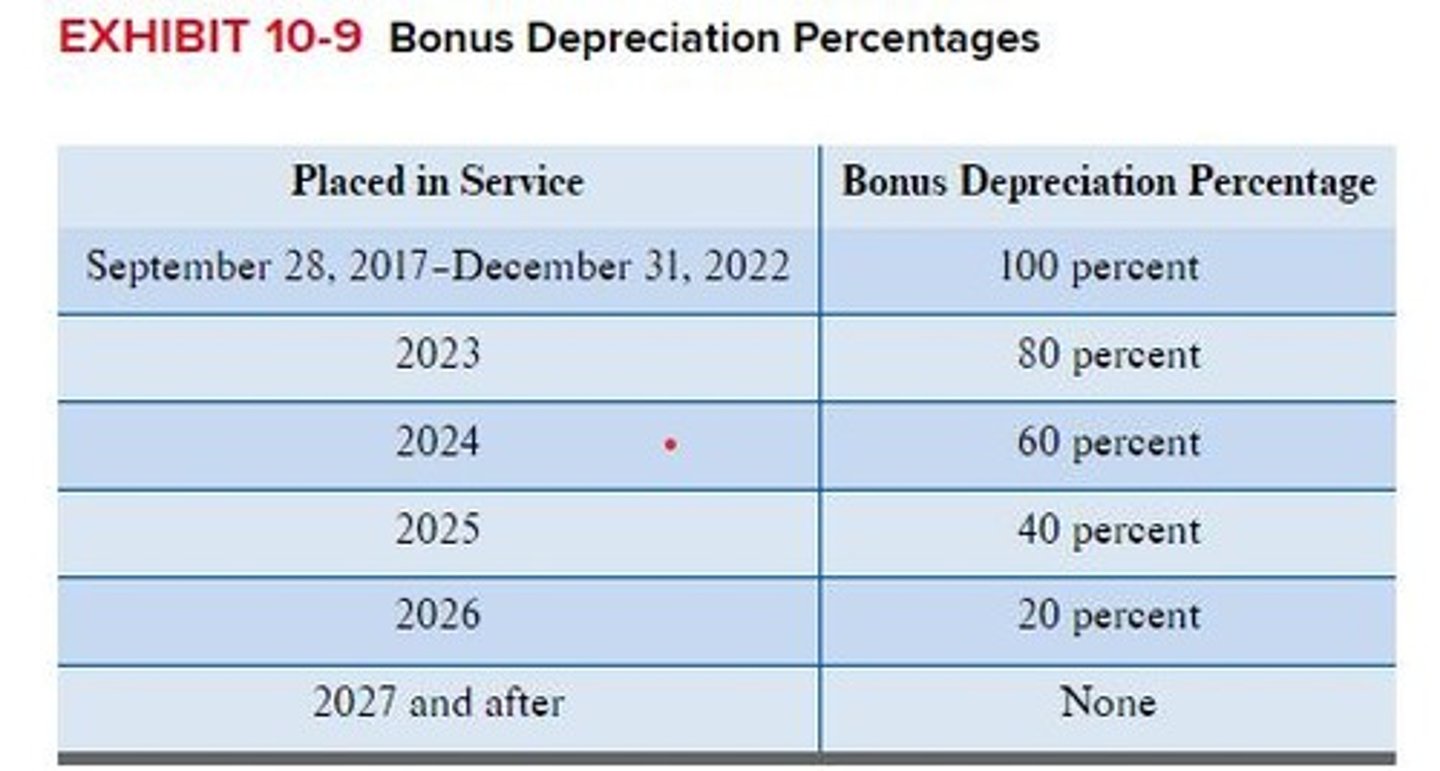

What is bonus depreciation?

An incentive that allows businesses to deduct a significant percentage of the cost of eligible assets in the year they are placed in service.

What is the eligibility criteria for bonus depreciation?

Allowed on qualified property with a recovery period of 20 years or less, including new and used personal property.

What is the impact of §179 expense on bonus depreciation calculation?

The basis is reduced by the §179 expense deduction before calculating bonus depreciation.

What are the automobile depreciation limits for luxury automobiles?

A limit of $12,400, making it often impractical to elect §179 expense for luxury vehicles.

What triggers a realization event in asset dispositions?

The sale or disposition of an asset.

How is the gain or loss realized calculated?

Gain or (loss) realized = Amount realized − Adjusted basis.

What constitutes the amount realized in a disposition?

Everything of value received from the buyer minus any selling costs.

What is the adjusted basis in the context of asset dispositions?

Initial basis minus accumulated depreciation.

What is recognized gain or loss on disposition?

Gains or losses that affect the taxpayer's gross income and must be reported on tax returns.

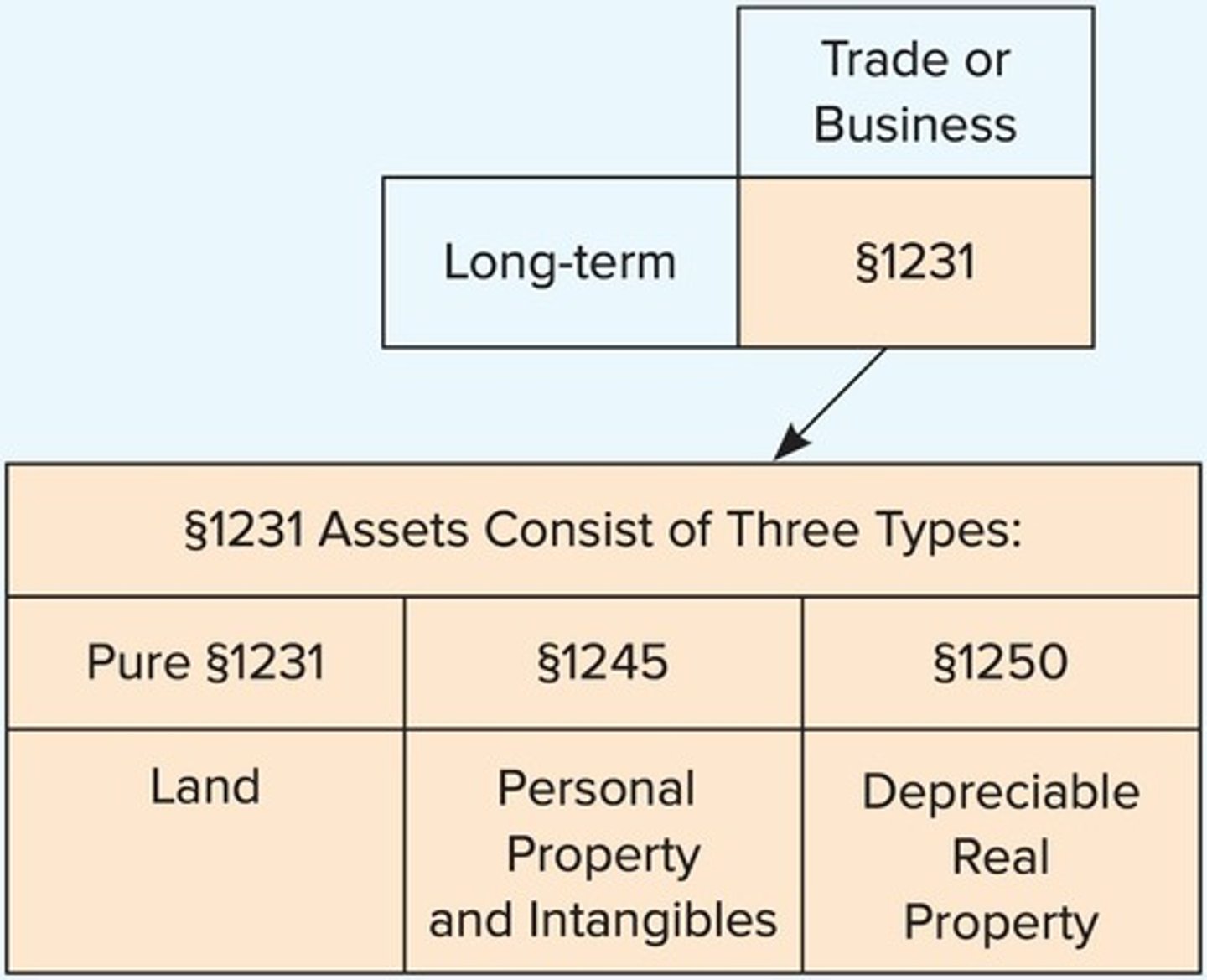

What are §1231 assets?

Depreciable assets and land used in a trade or business held for more than one year.

How is a net §1231 gain treated for tax purposes?

As a long-term capital gain.

How is a net §1231 loss treated for tax purposes?

As an ordinary loss.

What happens to gains on the sale of personal-use assets?

They are considered taxable capital gains, while losses are not deductible.

What is the significance of the holding period for §1231 assets?

It determines the character of the gain or loss as either long-term capital or ordinary.

What is the effect of immediate expensing on the first-year cost recovery percentage?

Assets with the lowest first-year cost recovery percentage should be chosen for immediate expensing.

What is the phaseout threshold for immediate expensing in 2024?

When qualified property placed in service during 2024 exceeds $3,050,000.

What is the treatment of property received as a gift or inheritance regarding bonus depreciation?

Bonus depreciation is not allowed for property received as a gift or inheritance.

What is the calculation order for bonus depreciation?

Calculated after the §179 expense but before regular MACRS depreciation.

How is a net §1231 gain treated for tax purposes?

It is treated as a long-term capital gain.

What happens to §1231 gains on individual depreciable assets?

They may be recharacterized as ordinary income under the depreciation recapture rules.

What is depreciation recapture?

It applies to gains on the sale of depreciable or amortizable business property, recharacterizing the gain but not affecting §1231 losses.

What types of assets are considered §1245 property?

Personal property and amortizable intangible assets.

What is the rule for recognizing gain on §1245 property?

The lesser of the gain recognized or total accumulated depreciation (or amortization) on the asset.

Is there depreciation recapture on assets sold at a loss?

No, there is no depreciation recapture on assets sold at a loss.

What is §1250 property?

Depreciable real property, such as an office building or warehouse.

What is unique about §1250 depreciation recapture?

Depreciable real property sold at a gain is generally no longer subject to §1250 recapture.

What is unrecaptured §1250 gain?

It is the gain that would be §1245 recapture if the asset were §1245 property, taxed at a maximum rate of 25 percent.

What are the criteria for a like-kind exchange?

Real property must be exchanged solely for like-kind property, both must be used in a trade or business or held for investment.

What is considered 'like-kind' property?

Real property used in a trade or business or held for investment is considered like-kind with other similar properties.

What types of property are ineligible for like-kind treatment?

Real property held for sale, property used outside the United States, and domestic property exchanged for foreign property.

What is 'boot' in the context of a like-kind exchange?

Non-like-kind property received as part of a like-kind transaction.

What are the tax consequences when boot is received in a like-kind exchange?

Boot received usually creates recognized gain, which is the lesser of gain realized or boot received.

What happens if cash is transferred as boot in a like-kind exchange?

No gain or loss is recognized if the boot transferred is cash.

What is the impact of depreciation recapture on the character of gain?

It changes the character of the gain but not the amount recognized when selling a depreciable asset.

How is the gain from the sale of depreciable real property treated?

It is generally treated as §1250 property and is not subject to §1250 recapture.

What is the maximum tax rate for unrecaptured §1250 gain?

25 percent.

What is the significance of accumulated depreciation in §1245 property?

It determines the amount of gain recognized under depreciation recapture rules.

What is the treatment of §1231 losses?

They are not affected by depreciation recapture.

What is the relationship between §1231 gains and long-term capital gains?

If characterized as long-term capital gains, they benefit from favorable tax treatment.

What does the term 'recognized gain' refer to in the context of boot?

The gain that is recognized when boot is received, subject to certain limitations.

What is the general rule for gain recognition when boot is received in a nonrecognition transaction?

Gain recognized is the lesser of gain realized or boot received.

How is the adjusted basis of boot received determined in a nonrecognition transaction?

The adjusted basis of boot received is the fair market value of the boot.

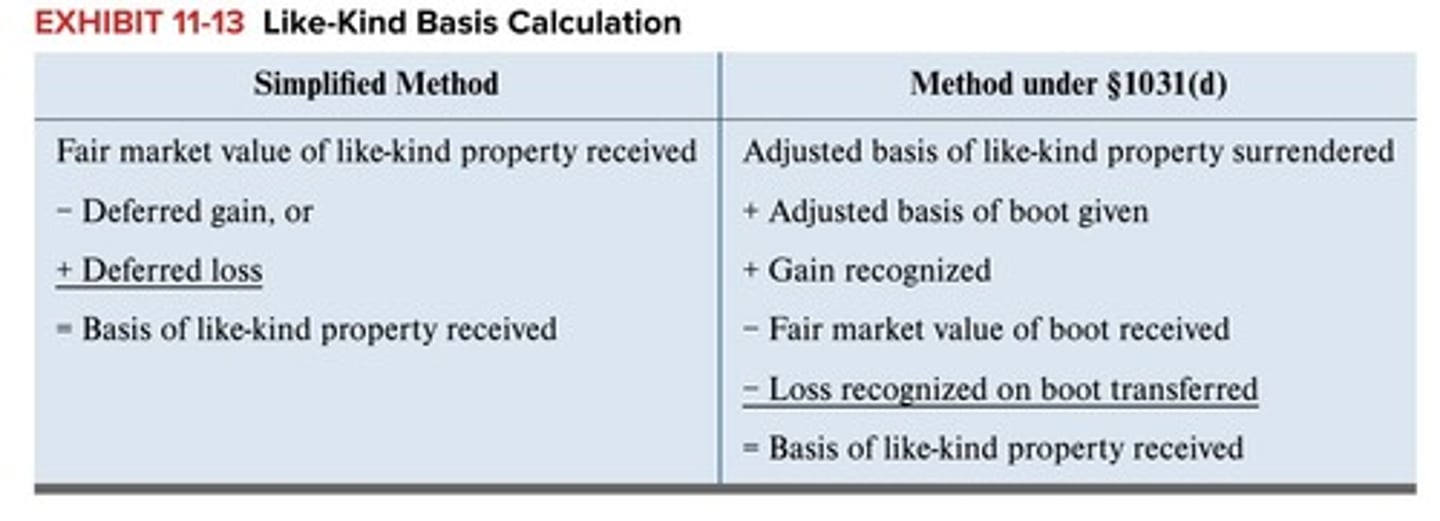

How is the basis of like-kind property received calculated?

Basis of like-kind property received equals the fair market value of the property received minus any deferred gain (or plus deferred loss).

What happens to gain when appreciated property is involuntarily converted?

Gain is deferred when appreciated property is involuntarily converted in an accident or natural disaster.

In an indirect conversion of property, how is the recognized gain determined?

Gain recognized is the lesser of gain realized or the amount of reimbursement not reinvested in qualified property.

What is required for replacement property to qualify in an involuntary conversion?

Qualified replacement property must be of a similar or related use to the original property.

What defines an installment sale?

An installment sale is when the seller receives sale proceeds in more than one period.

What must be recognized on each installment payment received in an installment sale?

A portion of gain must be recognized on each installment payment received.

Which types of property cannot be accounted for under installment sale rules?

Inventory, marketable securities, and depreciation recapture cannot be accounted for under installment sale rules.

How is the tax status of a dwelling unit determined?

A dwelling unit is a residence if personal-use days exceed the greater of 14 days or 10 percent of rental days during the year.

What is the typical tax treatment of gain or loss on the sale of a personal residence?

Typically, gain or loss recognized is capital gain or loss, and any loss is not deductible.

What is the maximum exclusion amount for gain on the sale of a personal residence for married filing jointly taxpayers?

$500,000.

What is the maximum exclusion amount for other taxpayers on the sale of a personal residence?

$250,000.

What happens to gain in excess of the exclusion amount on the sale of a personal residence?

It is generally taxed as long-term capital gains, subject to preferential rates.

What is the ownership test for exclusion on the sale of a personal residence?

The taxpayer must have owned the property for a total of two or more years during the five-year period ending on the date of sale.

What is the use test for exclusion on the sale of a personal residence?

The taxpayer must have used the property as their principal residence for a total of two or more years during the five-year period ending on the date of sale.

What are the exceptions to the general exclusion rules for the sale of a personal residence?

Unforeseen circumstances such as employment, health, or unusual circumstances allow for a reduced exclusion.

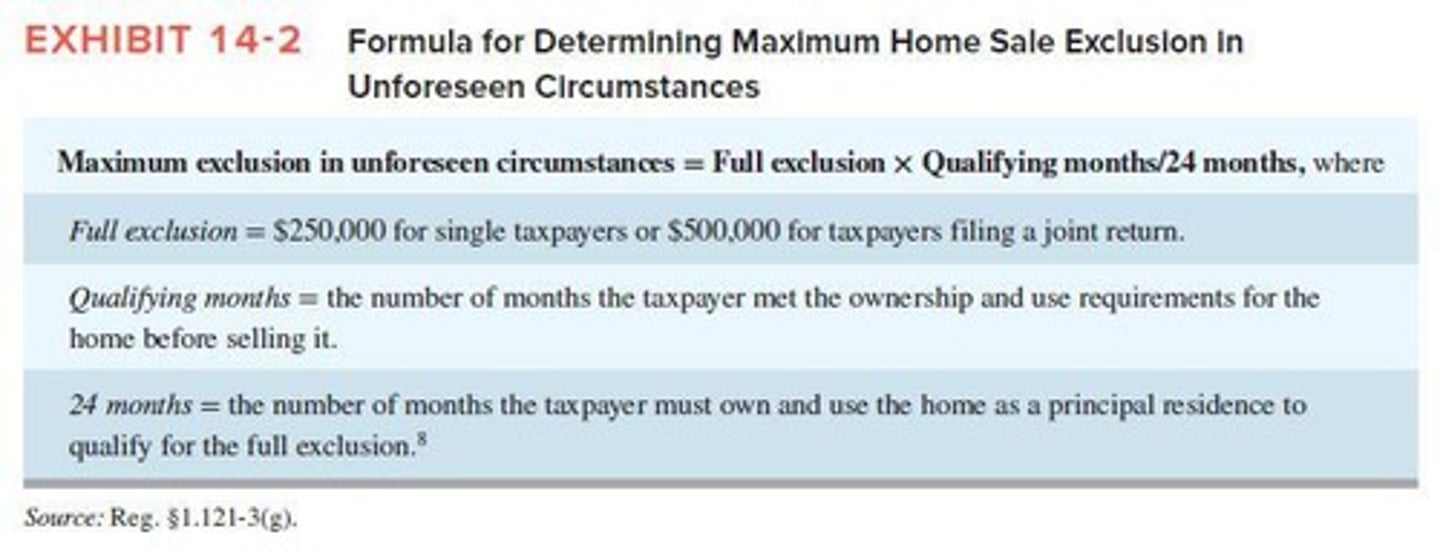

How is the maximum exclusion calculated in hardship circumstances?

The maximum exclusion is reduced based on the number of months the taxpayer meets ownership/use requirements divided by 24 months.

What is the formula for calculating the amount of exclusion in hardship circumstances?

$500,000 (MFJ) or $250,000 (other taxpayers) multiplied by months taxpayer meets ownership/use requirements divided by 24.

What is the home mortgage interest deduction?

Taxpayers can deduct home mortgage interest as an itemized deduction on up to two residences.

What are the three classifications for a second home based on rental use?

1. Residence with minimal rental use (rented for 14 or fewer days) 2. Residence with significant rental use (rented for 15 or more days) 3. Nonresidence.

What defines a residence with minimal rental use?

The taxpayer must live in the home for at least 15 days and rent it out for 14 days or fewer. Rental income can be excluded, and no rental expenses are deducted except for itemized deductions related to the home.

What is required for a residence to be classified as having significant rental use?

The home must be rented for 15 days or more, and personal use must exceed the greater of 14 days or 10 percent of the number of rental days.

How are expenses allocated for a residence with significant rental use?

Expenses are allocated based on the number of days used for each activity divided by total days used. Expenses to acquire tenants are fully deductible.

What is the Tax Court or Bolton method in expense allocation?

Mortgage interest and property taxes can be allocated based on total days in the year instead of days used.

What happens if rental revenue exceeds rental expenses for a significant rental use property?

All rental expenses are deductible in full.

How are rental expenses categorized when they exceed rental revenue?

They are categorized as Tier 1, Tier 2, or Tier 3 expenses.

What are Tier 1 expenses?

Tier 1 expenses are fully deductible and include expenses to acquire tenants, mortgage interest (if itemized), and real property taxes (if under the $10,000 limit).

What are Tier 2 expenses?

Tier 2 expenses are deductible up to the excess of rental revenue over Tier 1 expenses, and excess Tier 2 expenses carry over to the subsequent year.

What are Tier 3 expenses?

Tier 3 expenses include depreciation and are deductible up to the excess of rental revenue over Tier 1 and Tier 2 expenses, with excess carrying over to the subsequent year.

What defines a nonresidence in rental property?

Rental use must be at least one day, and personal use must be no more than the greater of 14 days or 10 percent of rental days.

What are the tax implications for a nonresidence rental property?

The taxpayer includes all income and deducts all rental expenses, but expenses must be allocated between rental and personal use if there is any personal use.

Can the personal use portion of mortgage interest expense be deducted for a nonresidence?

No, the personal use portion of mortgage interest expense cannot be deducted because the property does not qualify as a residence.

What can be deducted from AGI for a nonresidence property?

The personal use portion of real property taxes (subject to limitation) can be deducted as an itemized deduction.