Saving & Investing Test

1/18

Earn XP

Description and Tags

Soltau - Saving & Investing, 5 Steps to Investing, The development of money

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

Investing

redirecting resources from being consumed today so that they may create benefits in the future

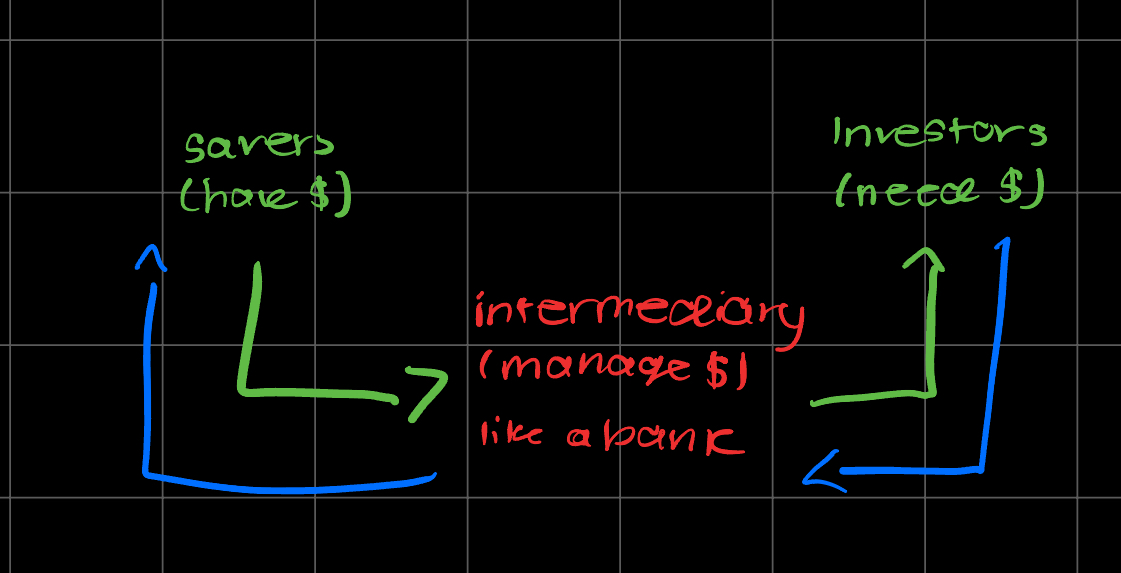

Financial System

system that allows the transfer of money between savers and investors

Financial Asset

claim on the property or income of a borrower (ex: contract)

Financial Intermediary

institution that helps channel funds from savers to borrowers

Types of Intermediaries

Banks, savings and loan associations, credit unions

Finance companies & mutual funds (lend $ to people who do not repay their loans)

Life Insurance policy

pension funds

Risks involved with investing

Credit risk

liquidity risk

inflation rate risk

time risk

Credit risk

borrowers do not pay back loan or are late

Liquidity Risk

cannot convert investment back into cash quickly enough for your needs (selling an ipad)

Inflation rate risk

inflation erodes value of your assets

time risk

have to pass up on opportunities now for investments in the future

Step one of investing

Put and take account (checking, keep 3-6 months of pay in here for bills and emergencies)

Step two of investing

Beginning to invest

low risk investments (savings bonds and mutual funds)

Step three of investing

systemic investing

companies that have been around for a long time

Step four of investing

strategic investing

diversification of stocks to reduce risk

step five of investing

speculative investing

high risk, high reward (owning company)

national bank

issued currency backed by federal bonds

gold standard

1900- money worth a particular amount of gold

Pros of gold standard

-ppl feel secure about currency

-gov’t doesn’t create too much money

-money keeps its value

Cons of gold standard

-dependent on gold being valuable and available

-if people convert their $ into gold, gold could go away