Chapter 7 : Perfect Competition (Micro)

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

What are the 4 main market structures - most competitive to least competitive

Perfect competition

Monopolistic competition

Oligopoly

Monopoly

Perfect Competition

Most competitive market

Relies on supply and demand

Many buyers and sellers for one product exist. If any of them changes their prices, not many changes happen since there are other options .

Homogenous products - the products are absolutely identical

Free entry and exit in the market

Monopolistic competition

differentiated products

Many sellers

Free entry and exit

Oligopoly

Very few sellers

Interdependence, each firms pricing and output decisions depends on competitors

Firms can work together

Barriers to entry are high

Monopoly

One company controls the entire market

Extremely high barriers for entry

One seller, UNIQUE product, ni close substitutes in the market.

Perfectly competitive firms and all other product markets maximize economic profit by producing where

MARGINAL REVENUE equals MARGINAL COST.

Economic Profit

Total revenue minus both explicit and implicit costs.

Marginal revenue

Change in total revenue from the sale of an additional product. change in total revenue divided by the change in quantity. MR = 🔺TR/🔺Q

The profit maximizing output

MR = MC , all profit maximizing firms in every market structure should follow this.

If MR > MC:

You’re making more money from selling the product than it costs to make it.

So you should keep producing to increase profit.

If MR < MC:

It costs more to produce the next unit than what you’ll earn from it.

So producing more will reduce profit.

When MR = MC:

The revenue from the next unit exactly equals the cost to make it.

That’s the sweet spot — any more or less would reduce profit.

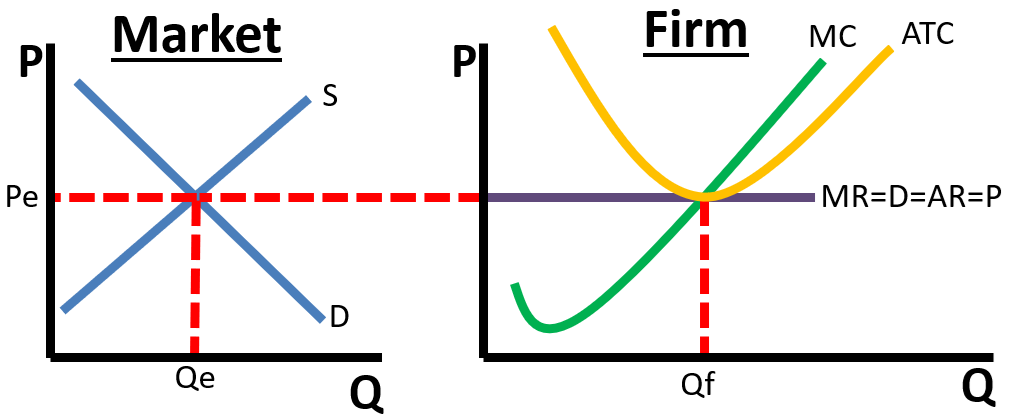

Graphically :

The MR curve is horizontal in perfect competition (equal to price).

The MC curve is U-shaped.

The point where they intersect is the profit-maximizing quantity.

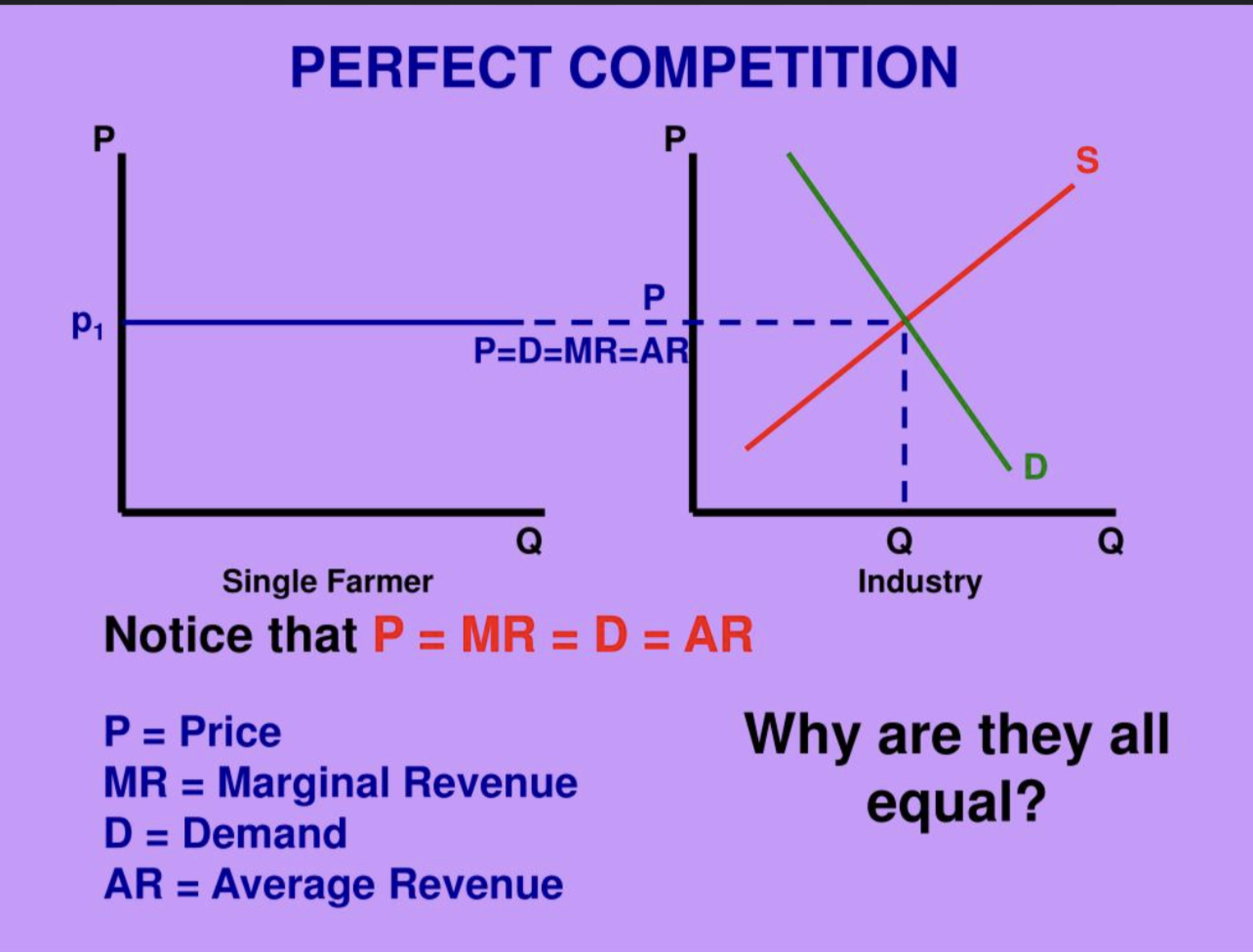

Perfect Competition

Perfectly competitive firms are characterized by the large number of sellers that compete in national and global markets. Firms can easily enter and exit a market, and they have no influence on the price of the product they produce. It’s run by supply and demand.

this means each firm must charge the market price.

This also follows the equation MR = D= AR = P

MR (Marginal Revenue):

Revenue from selling one more unit

In perfect competition: each unit sells at the same price → MR = PD (Demand curve):

The firm’s demand curve is perfectly elastic (horizontal) at the market price → D = PAR (Average Revenue):

Total Revenue ÷ Quantity

AR = \frac{TR}{Q} = \frac{P \times Q}{Q} = PP (Price):

The fixed price determined by the market

Each additional unit sold brings in the same revenue

The firm’s demand curve is flat at the market price

Average and marginal revenues are constant and equal to price

So if you take a look at the market graph, the equilibrium between s and d carries over to the marginal revenue of the firm.

Two types of efficiency that are results from perfectly competitive firms.

Allocative Efficiency

Productive Efficiency

Allocative efficiency

Allocative efficiency occurs when:

P=MC

This means that the price consumers are willing to pay (which reflects the value they place on the good) is equal to the marginal cost of producing that good.

MEANS Its THE SOCIALLY OPTIMAL OUTPUT LEVEL, HOW MUCH SOCIETY WANTS IS BEING PRODUCED.

Productive Efficiency

Productive efficiency occurs when a firm produces at the lowest possible cost, which means: P= MINIMUM ATC

fIRMS ARE PRICE TAKERS

FIRMS ACCEPT MARKET PRICE$

What does it mean when firms are price takers?

A price taker is a firm that cannot set its own price. Why?

In perfect competition, there are many sellers offering identical products.

So, if one firm tries to charge more, buyers will just go to another identical seller.

If it charges less, it would be giving up profit unnecessarily.

Real-World Analogy:

Think of selling identical wheat at a farmer’s market:

If everyone’s selling wheat for $5/bag, you can’t charge $6 — no one will buy it.

You’re stuck with $5 — the market sets the price, not you.

On a graph:

The demand curve for a firm is perfectly elastic (horizontal) at the market price.

That’s because the firm can sell as much as it wants at that price, but nothing at a higher price.

Why do firms in perfect competition earn zero economic profit in the long run?

Why do firms in perfect competition earn zero economic profit in the long run?

Because of free entry and exit in the market.

Let’s break it down:

Short-run:

Firms can earn positive economic profits if market price > ATC.

But…

Positive profits attract new firms.

New firms enter the market (since there are no barriers).

This increases market supply → price falls.

Entry continues until price = ATC → zero economic profit.

If firms are making losses:

Some firms exit the market.

This decreases supply → price rises.

Exit continues until price = ATC again.

In the long run:

Economic profit = 0

That’s because:

P=ATC=MR=AR

Firms still make accounting profit (they cover all costs including normal return), but no extra profit.

So the key reason is: Free entry and exit force price down to ATC, eliminating economic profit over time eliminating economic profit over time

The shut-down rule

The shut down rule states that firms should NOT produce when price falls below AVC. In the short run, a firm has to pay:

Fixed costs no matter what (like rent or equipment)

Variable costs only if it produces (like labor, materials)

If Price < AVC, then the firm:

Can’t even cover its variable costs

So, every unit produced adds to the loss

It loses less money by producing nothing

The shut-down point is where the MC curve intersects the AVC curve

To determine total profits or total losses at the profit-maximizing level of output (MR=MC)

Use Quantity * Price - Average total cost → Q(P-ATC)

Compare P and ATC

If... | Then... | Result |

|---|---|---|

P>ATC | Revenue per unit > Cost per unit | Profit |

P=ATC | Revenue per unit = Cost per unit | Break-even |

P<ATC | Revenue per unit < Cost per unit | Loss |

To determine total profits or losses,

first determine whether at best output P>ATC or ATC>P. In the former case, profits are realized. In the latter case, losses inccured.

Making decisions

Condition | Decision | Why? |

|---|---|---|

P<AVC | Shut down | Can’t cover variable costs |

P=AVC | Indifferent (maybe shut down) | Just covering variable costs |

P>AVC | Stay open, minimize loss | Covering variable, some fixed costs |

P=ATC | Stay open, break even | Covering all costs |

P>ATC | Stay open, earn profit | Making economic profit |

Why don’t perfectly competitive firms earn economic profits in the long run but earn them in the short run?

💰 Why Perfectly Competitive Firms Can Earn Economic Profit in the Short Run:

In the short run, the number of firms in the market is fixed.

If the market price is high, firms can earn economic profits (where P>ATCP > ATC).

This happens due to things like:

Sudden increase in demand

Limited competition at first

Lower initial costs for early entrants

✅ So in the short run, firms can temporarily make profits.

🚪 Why They Earn Zero Economic Profit in the Long Run: 1. Free Entry and Exit

In perfect competition, there are no barriers to entry or exit.

If existing firms earn economic profits, new firms are attracted to enter.

As more firms enter, supply increases → market price falls.

2. Price Falls to Where P=ATCP = ATC

Firms will continue entering until economic profit = 0.

This happens when:

P=ATC(at MR = MC)\boxed{P = ATC} \quad \text{(at MR = MC)}

At this point:

Firms are still making normal profit (i.e. covering all costs, including opportunity cost)

But no extra economic profit

3. If Firms Are Losing Money?

If P<ATCP < ATC, firms make losses in the short run.

Some will exit the market in the long run.

This reduces supply, driving price back up to where P=ATCP = ATC.

⚖ Long-Run Outcome:

Only efficient firms survive

Zero economic profit

Firms produce where:

P=MR=MC=ATC\boxed{P = MR = MC = ATC}

🧠 Summary:

Time Frame | Can Firms Earn Economic Profit? | Why? |

|---|---|---|

Short Run | ✅ Yes | Limited competition, fixed entry |

Long Run | ❌ No | Entry/exit drives price to ATC |

whats long run equillibrium

⚖ What is Long-Run Equilibrium?

In perfect competition, long-run equilibrium is the point where:

P=MR=MC=ATC\boxed{P = MR = MC = ATC}

This means:

Firms are producing at the most efficient output level

No economic profits (only normal profit)

No incentive to enter or exit the market

📉 Why Does This Happen?

Let’s go step-by-step:

🔺 If Firms Are Earning Economic Profits (P > ATC):

New firms enter the market

Supply increases

Price falls

Profits shrink

Eventually → P = ATC → zero economic profit

🔻 If Firms Are Taking Losses (P < ATC):

Some firms exit the market

Supply decreases

Price rises

Losses shrink

Eventually → P = ATC → zero economic loss

🧠 What’s Special About This Point?

At long-run equilibrium:

Firms produce where marginal cost equals marginal revenue

The firm’s ATC curve is tangent to the demand curve (price) at the MR = MC point

Output is both:

Productively efficient → P=min ATC

Allocatively efficient → P=MC

📋 Long-Run Equilibrium Conditions (Summary)

Condition | Meaning |

|---|---|

P=MC | Allocative efficiency — resources go where most valued |

P=ATC | Zero economic profit — normal profit only |

P=MR | Firm is a price taker |

MC=MR | Profit-maximizing output |

graph