Macreconomics: Chapter 8 The Money Market

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

Money market

virtual market in which households/businesses demand money, the Fed/Banks supply money, equilibrium quantity of money and interest rate are determined

Demand for money

the relationship between quantity of real money demanded and nominal interest rate, when all other influences remain the same

Quantity of money demanded depends on

nominal interest rate forgone by not holding an interest earning asset like bonds and savings accounts

People can either have money or bonds that pay them (example)

the nominal interest rate (not the real interest rate)

4 main factors the quantity of money people hold is dependent on

Nominal interest rate, the price level, real gdp, financial innovation

Nominal interest rate

movements along the demand curve

if nominal interest rate rises

the quantity of real money demanded decreases (higher incentive to hold bonds, which earn higher interest rate than holding money)

If nominal interest rate falls

the quantity of real money demanded increases (higher incentive to hold more rather than bonds, which earn low interest)

Rise in the price level

increases the quantity of nominal money, does not change quantity of real money that people plan to hold

real money =

nominal money / price level —→ adjusts for inflation

Nominal money =

amount of money measured in dollars —> doesn’t adjust for inflation

10% rise in price level leads to

increases quantity of nominal money demanded by 10% (it’s a movement)

Real GDP

quantity of money that households and firms plan to hold depends on the total amount they are spending

increase in real GDp

increases aggregate expenditure (total spending) and increases the demand for money (shift)

Financial innovation

Lowers cost of switching between money and interest-earning assets, people are less likely to hold large amount of cash because they can quickly acess savings acconts or other interest-bearing accounts, decreases demand for money (shift)

A decrease in real GDP or financial innovation

decreases demand for money, shifts demand curve left

increase in real GDP

increases demand for money, shifts demand curve right

Supply of money

relationship between the quantity of money supplied and the nominal interest when all other influences on the amount of money that Fed and banks wish to create remain the same

money supply curve is

vertical and controlled by the Fed through Open Market Operations

Adjustments that occur to money market market equilibrium

are different in the short run and long run

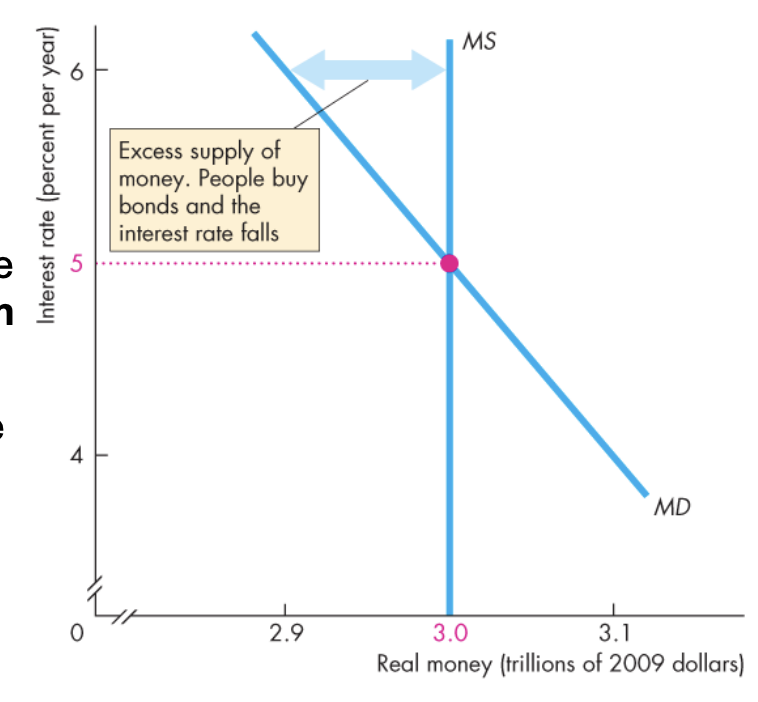

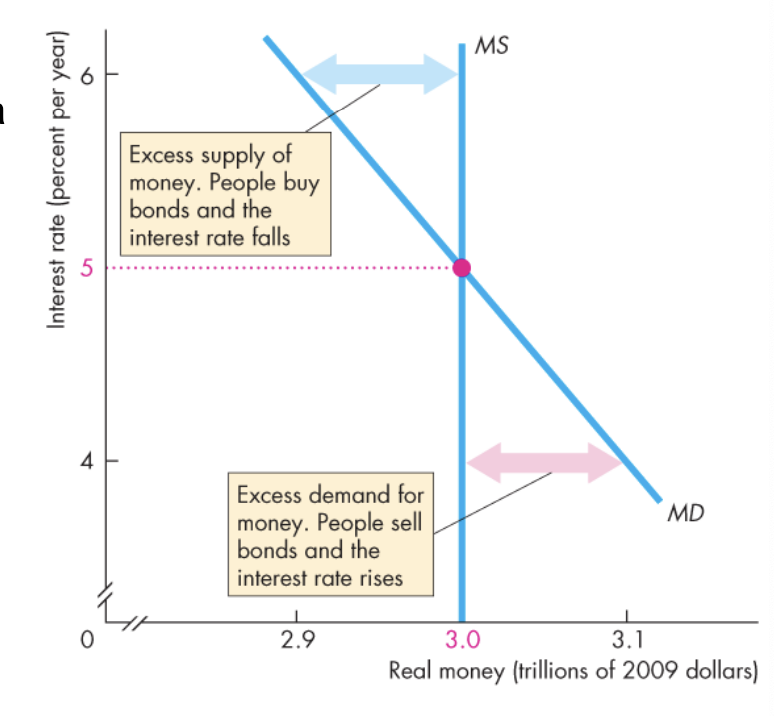

If the Interest rate is 6% a year:

the quantity of money demanded that people are willing to hold is less than quantity supplied, people try to get rid of excess money by buying bonds, this actions lowers the interest rate

If the interest rate is 4% a year, then:

Quantity of money demanded exceeds quantity supplied, people try to get more money by selling bonds, this action raises the interest rate

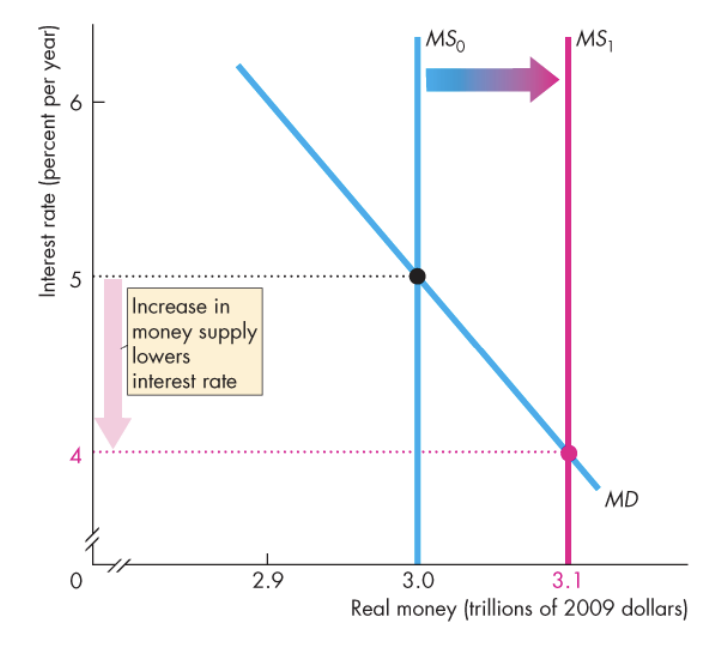

Short run effect of change in quantity of money and MS to the right

Fed increases the supply of money, given surplus of money, people use excess cash to buy bonds, increased demand for bonds raises the bond price and lowers the interest rate

MS Shifts left

Fed decreases the quantity of money, shortage of money, people sell bonds, increased supply of bonds lowers bond price and raises interest rate

In the long run, the loanble fundsd

determines the real interest rate

In the long run, nominal interest rate equals

the equilibrium real interest rate plus the expected inflation rate

In the long run, real GDP equals

potential GDP, so the only variable left to adjust in the long run is the price level

If in long run equilibrium, the Fed increases the quantity of money

the price level changes to move the money market to a new long-run equilibrium

in the long run, nothing real

has changed

Unchanged factors in the long run

Real GDP, employment, quantity of real money, and the real interest rate

In the long run, the price levels rises

by the same percentage as the increase in the quantity of money

Transition from short run to long run

start in full employment equilibrium, if fed increases quantity of money by 10 percent nominal interest rate falls, as people buy bonds the real interest falls, as the real interest rate falls consumption and investment increases so aggregate demand increases, with the economy at full employment the price level rises, as the price level rises the quantity of real money decreases, the nominal interest rate and the real interest rate rise, as the real interest rises expenditure plans are cut back and eventually the original full-employment equilibrium is restored, in the new long run equilibirum the price level has rise 10 percent but nothing real has changed