AP Micro Unit 4 - Imperfect Competition

5.0(1)

5.0(1)

Card Sorting

1/38

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

39 Terms

1

New cards

Monopoly

* A kind of a market where only one firm that dominates the industry and sells a very unique product

2

New cards

Oligopoly

* A kind of market where there are a few, large firms that dominate the industry (usually less than 10)

3

New cards

Monopolistically Competitive Market

* A kind of market where a large number of sellers offer differentiated products

4

New cards

Characteristics of Imperfectly Competitive Firms

* Fewer, larger firms in the industry

* Firms are “price makers” - firms have some or total control over the price they choose to sell their goods at

* Higher barriers to entry, meaning firms cannot enter as easily

* Firms earn long run profits (except for monopolistic competition - it breaks even in the long run)

* Products sold are differentiated

* Non-price competition is used - tools like advertising to promote products

* Firms are inefficient in the long run

* Demand is greater than Marginal Revenue

* Firms are “price makers” - firms have some or total control over the price they choose to sell their goods at

* Higher barriers to entry, meaning firms cannot enter as easily

* Firms earn long run profits (except for monopolistic competition - it breaks even in the long run)

* Products sold are differentiated

* Non-price competition is used - tools like advertising to promote products

* Firms are inefficient in the long run

* Demand is greater than Marginal Revenue

5

New cards

Example Barriers to Entry

* Geography

* If location is close to resources

* Firms is the only one selling product in the area

* Government (US)

* Issues patents and other protections

* Common Use

* Brand name and reputation

* Economies of Scale

* Availability of firms to mass produce at a low-cost

* High Fixed Costs

* Firms may not have the financial resources to pay the upfront costs of entering the market

* If location is close to resources

* Firms is the only one selling product in the area

* Government (US)

* Issues patents and other protections

* Common Use

* Brand name and reputation

* Economies of Scale

* Availability of firms to mass produce at a low-cost

* High Fixed Costs

* Firms may not have the financial resources to pay the upfront costs of entering the market

6

New cards

Monopoly

* A market structure where an individual firm has sufficient control over a market or industry

* They determine the terms of access to other firms

* They determine the terms of access to other firms

7

New cards

Natural Monopoly

* Occurs when an individual firm comes to dominate an industry by producing goods and services at the lowest possible production cost that other firms cannot compete with

* They’re beneficial to society as they charge low prices and promote productive efficiency

* They’re beneficial to society as they charge low prices and promote productive efficiency

8

New cards

Characteristics of Monopolies

* One, large firm

* Firms are “price makers”

* High barriers to entry

* Firms earn long-run profits

* Products sold are unique

* Non-price competition is used

* Firms are inefficient if left unregulated - overcharge and underproduce

* Firms are “price makers”

* High barriers to entry

* Firms earn long-run profits

* Products sold are unique

* Non-price competition is used

* Firms are inefficient if left unregulated - overcharge and underproduce

9

New cards

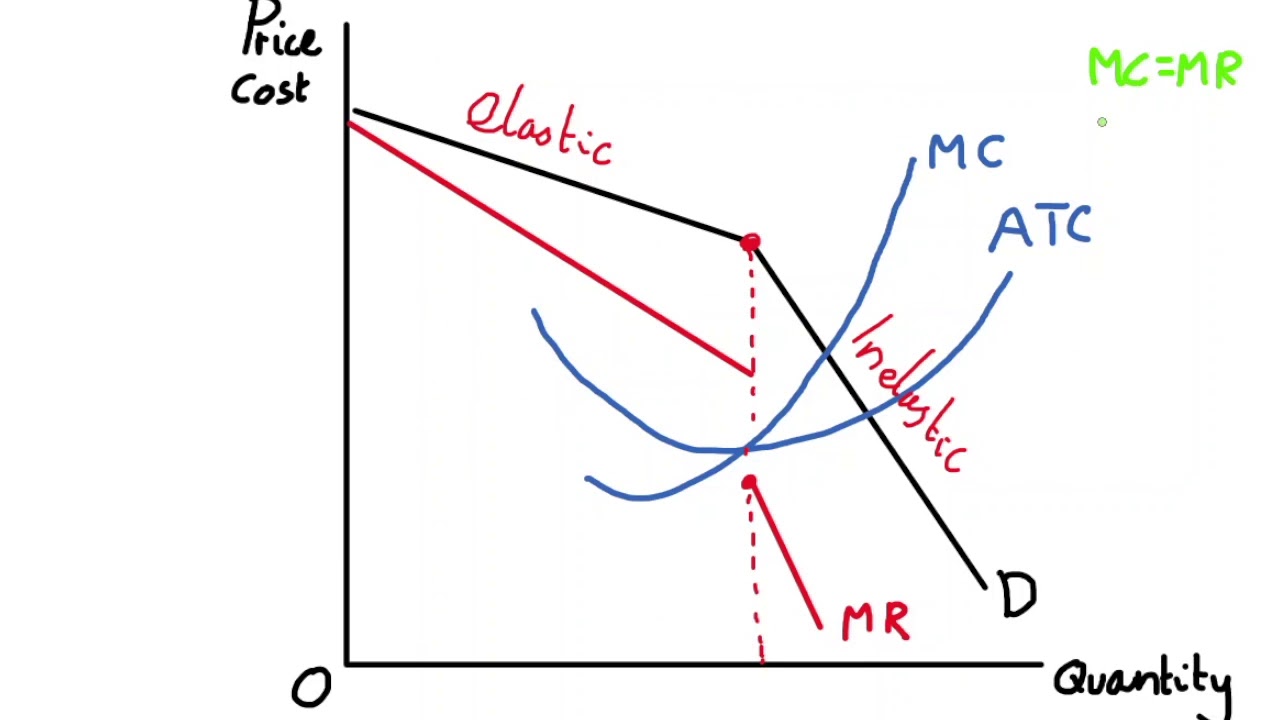

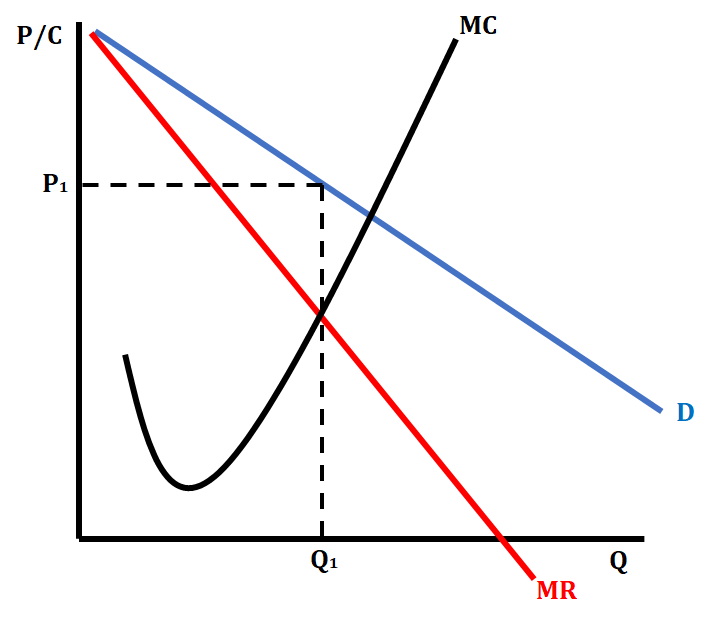

Monopoly Graph

10

New cards

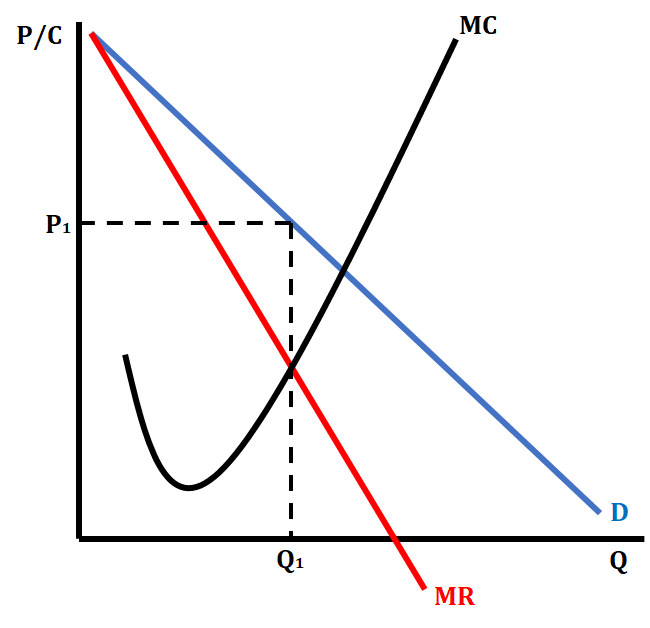

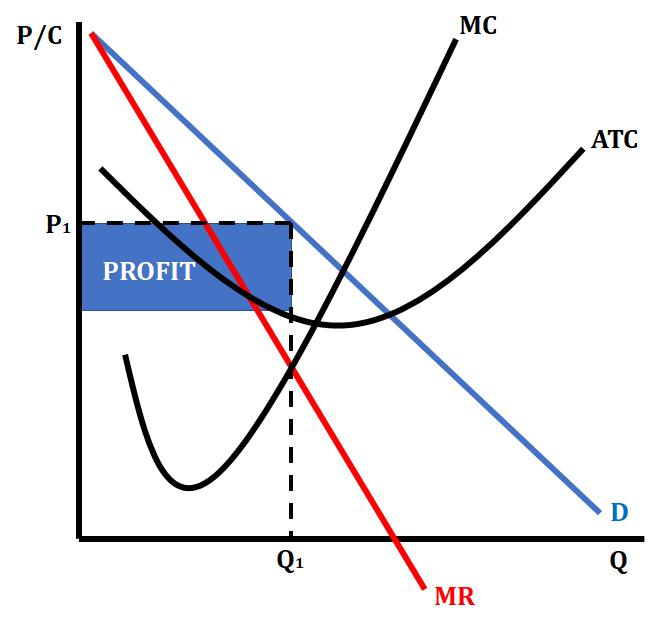

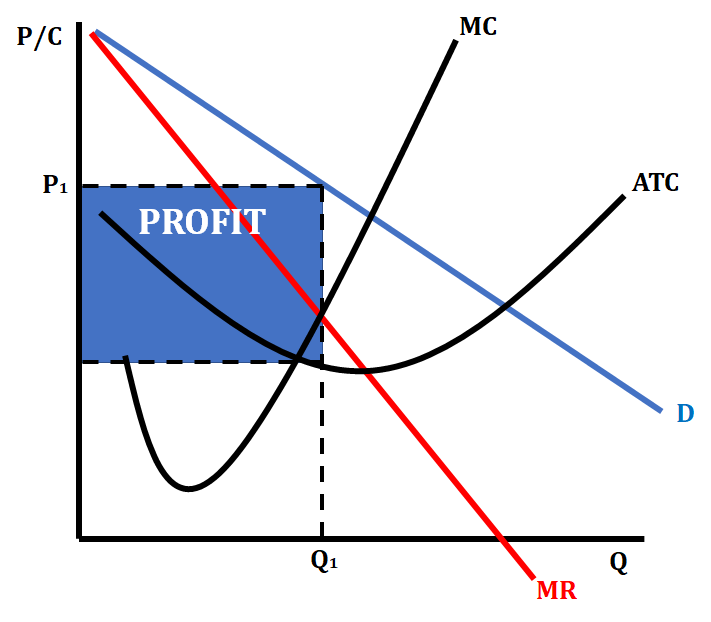

Profit in a Monopoly (graph)

11

New cards

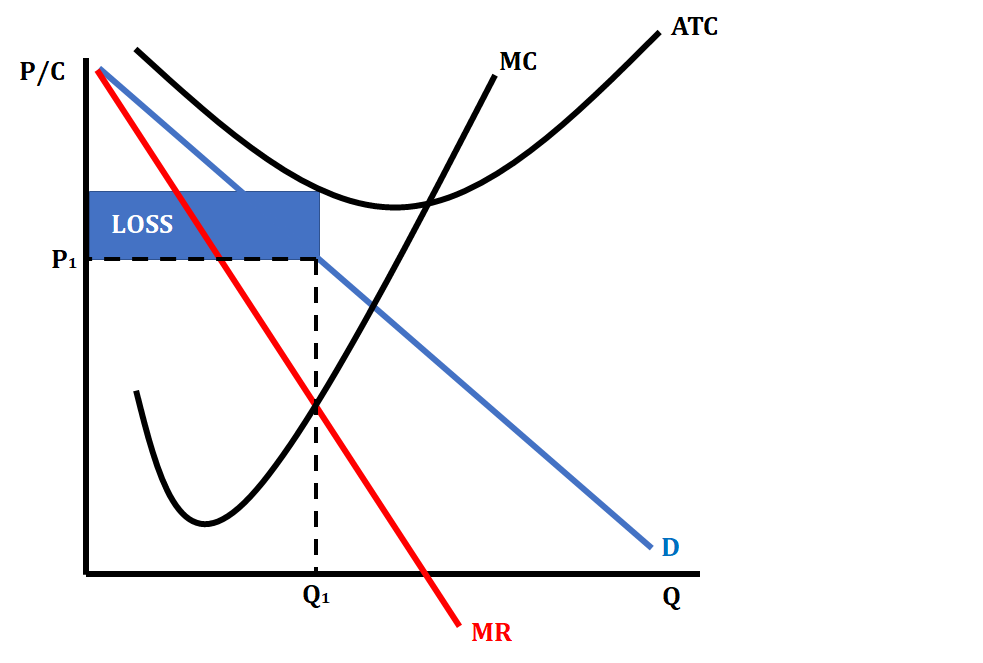

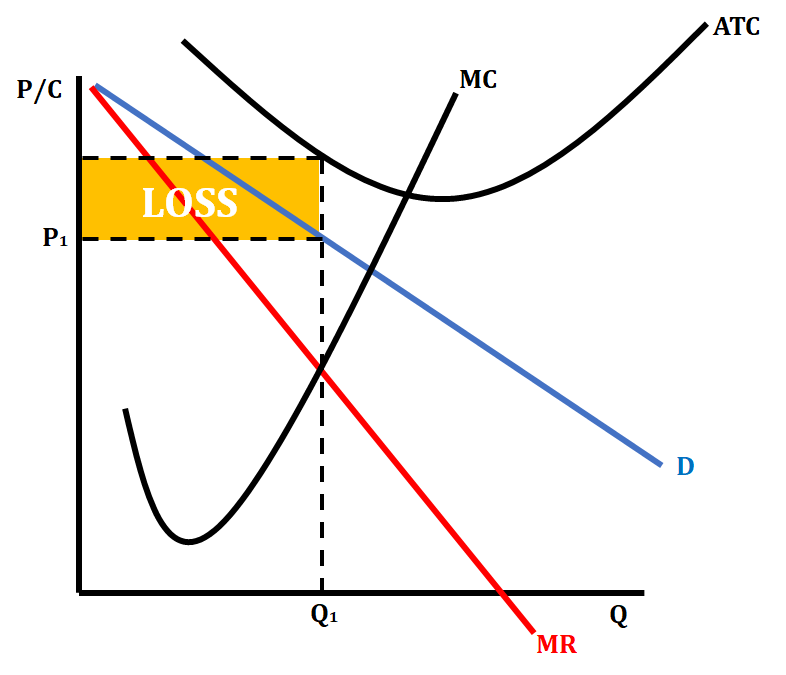

Loss in a Monopoly (graph)

12

New cards

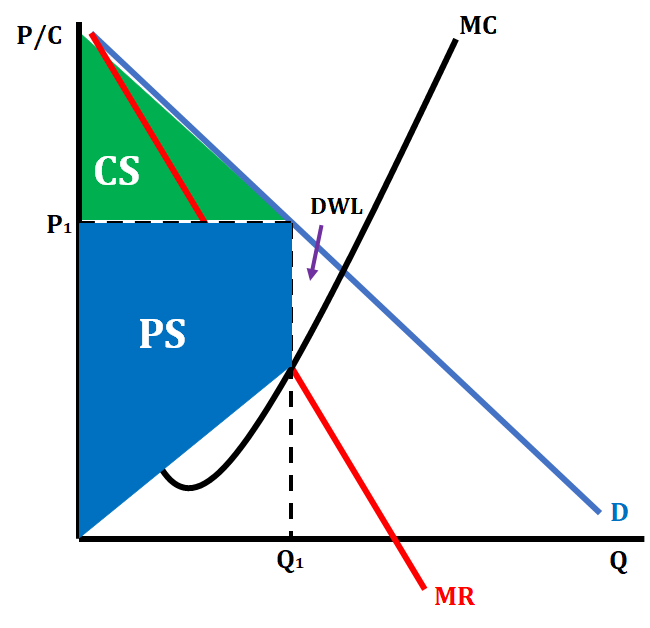

Monopoly with Consumer Surplus, Producer Surplus, and Dead Weight Loss

13

New cards

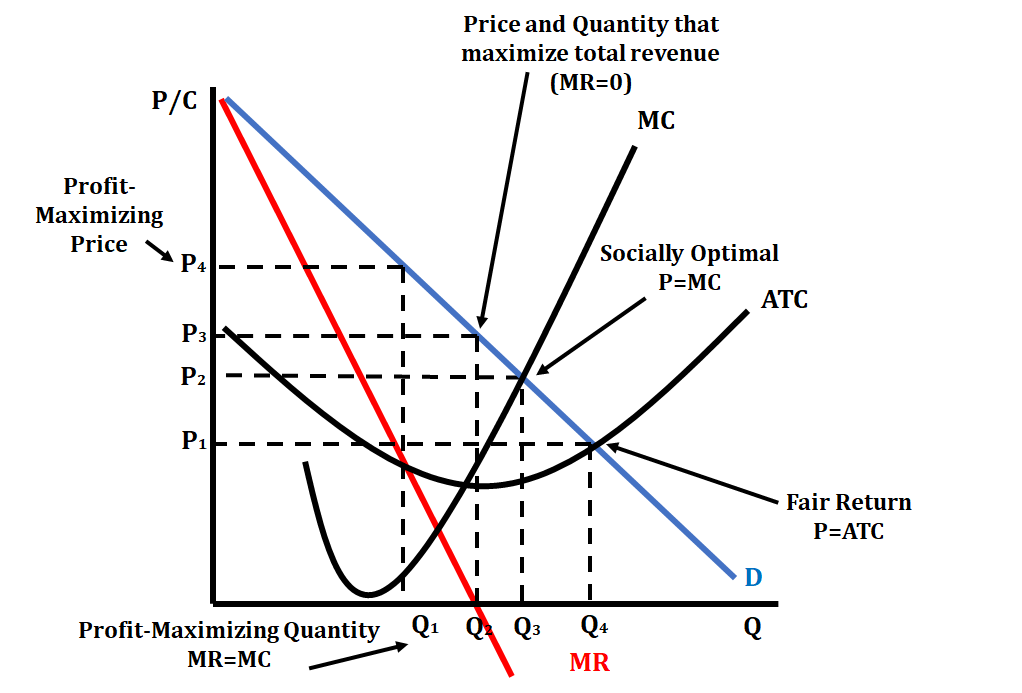

Monopoly Graph

Profit Maximizing Price and Output

(Loss-Minimizing)

Profit Maximizing Price and Output

(Loss-Minimizing)

* MR = MC

14

New cards

Monopoly Graph

Socially Optimal Price and Output

Socially Optimal Price and Output

* P = MC

* Allocatively Efficient

* Allocatively Efficient

15

New cards

Monopoly Graph

Fair-return Price and Output

Fair-return Price and Output

* P = ATC

16

New cards

Monopoly Graph

Maximized Total Revenue Price and Output

Maximized Total Revenue Price and Output

* MR = 0

17

New cards

Key Points on Monopoly Graph

* Profit Maximizing - MR = MC

* Socially Optimal - P = MC

* Fair-Return - P = ATC

* Maximized TR - MR = 0

* Socially Optimal - P = MC

* Fair-Return - P = ATC

* Maximized TR - MR = 0

18

New cards

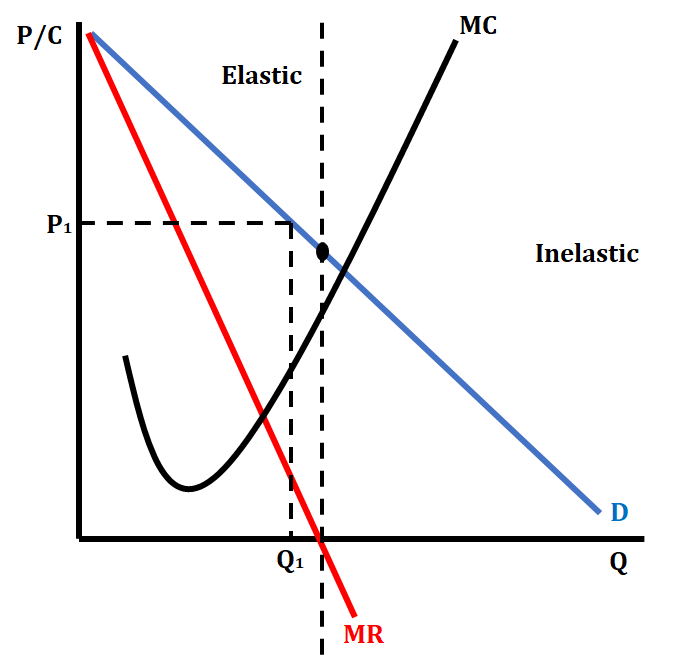

Elasticity in Monopoly

* Unit Elastic Point - point on the demand curve where a horizontal line intersects MR = 0

* Elastic Region - any point above the MR = 0 intersecting line

* Inelastic Region - any point below the MR = 0 intersecting line

* Can also be determined with a TR curve, where the peak matches MR = 0

* Elastic Region - any point above the MR = 0 intersecting line

* Inelastic Region - any point below the MR = 0 intersecting line

* Can also be determined with a TR curve, where the peak matches MR = 0

19

New cards

Price Discrimination

* Practice where specific products are sold to different buyers at the highest price they are willing and able to pay

20

New cards

Conditions required to practice price descrimination

* Monopoly Power

* Able to segregate the market

* Consumers cannot easily re-sell the product

* Able to segregate the market

* Consumers cannot easily re-sell the product

21

New cards

Characteristics of a Price Discriminating Monopoly

* D = MR

* Allocatively Efficient but Productively Inefficient

* Larger long-run economic profits

* Zero consumer surplus

* Allocatively Efficient but Productively Inefficient

* Larger long-run economic profits

* Zero consumer surplus

22

New cards

Characteristics of a Pure Monopoly

* D > MR

* Allocatively and Productively Efficient

* Smaller long-run economic profits

* Some consumer surplus

* Allocatively and Productively Efficient

* Smaller long-run economic profits

* Some consumer surplus

23

New cards

Perfect Price Discrimination

* AKA 1st degree price discrimination

* Demand exactly equals MR

* Three curves: MC, D = MR, and ATC

* Demand exactly equals MR

* Three curves: MC, D = MR, and ATC

24

New cards

Characteristics of Monopolistic Competition

* Many, various sized firms

* Firms are “price makers”

* Low barriers to entry

* Firms break even in the long-run

* Products are differentiated

* Non-price competition is used

* Firms are inefficient if left unregulated

* Firms experience excess capacity - they are productively inefficient

* Firms are “price makers”

* Low barriers to entry

* Firms break even in the long-run

* Products are differentiated

* Non-price competition is used

* Firms are inefficient if left unregulated

* Firms experience excess capacity - they are productively inefficient

25

New cards

Non-Price Competition

* Ways that firms seek to increase sales and attract consumers through methods other than price

* Examples: Brand names and packaging, product attributes and service, advertising

* Examples: Brand names and packaging, product attributes and service, advertising

26

New cards

Monopolistic Competition Graph

* Demand and MR are more elastic

* (Missing ATC)

* (Missing ATC)

27

New cards

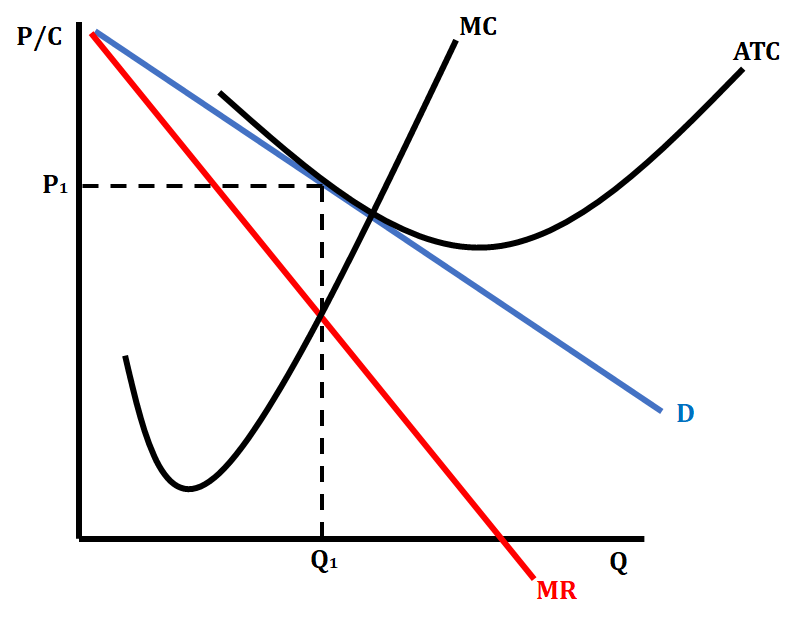

Monopolistic Competition Earning a Profit

28

New cards

Monopolistic Competition Earning a Loss

29

New cards

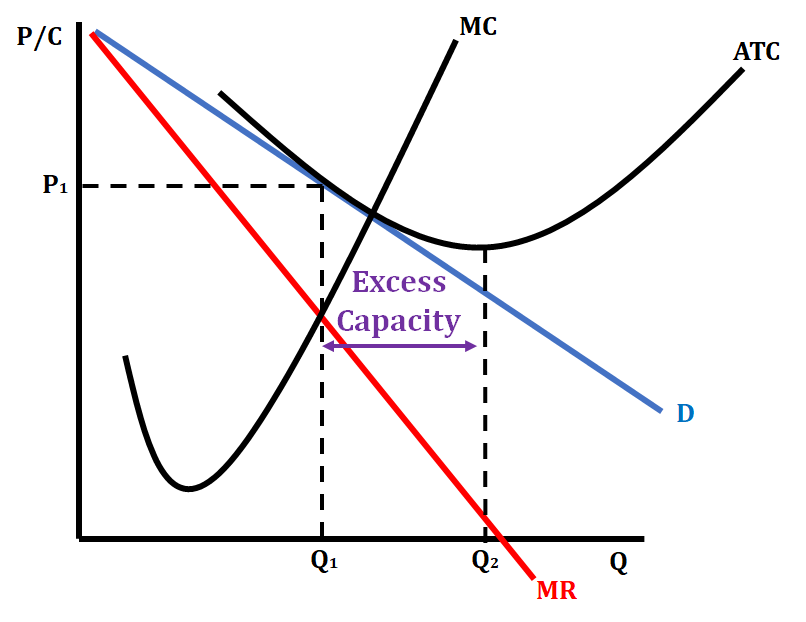

Monopolistic Competition in the Long Run

* ATC will be tangent to the demand curve in the downward sloping region (economies of scale region)

* Productively and Allocatively Inefficient

* Productively and Allocatively Inefficient

30

New cards

Monopolistic Competition

Short Run to Long Run

Short Run to Long Run

* Firms earn short-run profits, so more firms enter the market

* More substitutes are created, so there is less market share for existing firms, so demand and MR curves shift left together until demand is tangent to ATC

* Firms earn short-run losses, so firms exit the market

* There is more market share for existing firms, so demand and MR curves shift right together until demand is tangent to ATC

* More substitutes are created, so there is less market share for existing firms, so demand and MR curves shift left together until demand is tangent to ATC

* Firms earn short-run losses, so firms exit the market

* There is more market share for existing firms, so demand and MR curves shift right together until demand is tangent to ATC

31

New cards

Excess Capacity

* The difference between a firm’s current inefficient level of production and the productively efficient level of output

* If there is productive efficiency, there is no excess capacity, but Monopolistically Competitive Firms are Productively Inefficient in the long-run

* If there is productive efficiency, there is no excess capacity, but Monopolistically Competitive Firms are Productively Inefficient in the long-run

32

New cards

Oligopoly

* An imperfect market structure where the industry is dominated by a few, large firms

* Two kinds:

* Colluding Oligopolies

* AKA cartels

* Firms communicate with each other and act in one unit

* Non-Colluding Oligopolies

* Firms compete and do not work together

* Two kinds:

* Colluding Oligopolies

* AKA cartels

* Firms communicate with each other and act in one unit

* Non-Colluding Oligopolies

* Firms compete and do not work together

33

New cards

Characteristics of Oligopoly

* Few, large firms

* Firms are “price makers”

* High barriers to entry

* Firms earn long-run profits

* Products are differentiated

* Non-price competition is used

* Firms are inefficient if left unregulated

* Firms are “price makers”

* High barriers to entry

* Firms earn long-run profits

* Products are differentiated

* Non-price competition is used

* Firms are inefficient if left unregulated

34

New cards

Game Theory

* The study of how people behave in strategic situations

35

New cards

What is a game (in economics)?

* Any set of circumstances that has a result dependent on the actions of two or more decision-makers

36

New cards

Payoff Matrix

* A chart that shows the actions of two firms and the payoffs of each combination of choices

37

New cards

Dominant Strategy

* A strategy a firm should take no matter what the other firm does

* Sometimes a firm doesn’t have a dominant strategy because their actions should differ based on the other firm’s actions

* Sometimes a firm doesn’t have a dominant strategy because their actions should differ based on the other firm’s actions

38

New cards

Nash Equilibrium

* A point at which there is a stable state in the game in which no participant can unliterally improve their position

* It’s a point where the game equilibrates because **neither** player can improve their position without the other player moving

* You can find this point by determining the best option for either player, and if there are two circles in one box, that is the equilibrium point

* It’s a point where the game equilibrates because **neither** player can improve their position without the other player moving

* You can find this point by determining the best option for either player, and if there are two circles in one box, that is the equilibrium point

39

New cards

Price Leadership

* Model of oligopoly where the dominant firm will initiate a price change in the industry

* We can model the change with a kinked demand curve

* If the dominant firm raises prices, the other firms can either match those prices or ignore those prices and get more consumers - elastic

* if the dominant firm lowers prices, the other firms will usually match your prices and the market will stay relatively similar - inelastic

* Note: Not necessary for the AP, but can help show how the market is influenced by interdependence

* We can model the change with a kinked demand curve

* If the dominant firm raises prices, the other firms can either match those prices or ignore those prices and get more consumers - elastic

* if the dominant firm lowers prices, the other firms will usually match your prices and the market will stay relatively similar - inelastic

* Note: Not necessary for the AP, but can help show how the market is influenced by interdependence