Equity Investments

1/54

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

55 Terms

clearinghouse

In futures markets it is an organization that ensures that no trader is harmed if another trader fails to honor the contract. In effect, the clearinghouse acts as the buyer for every seller and as the seller for every buyer. In other markets, they may act only as escrow agents, transferring money from the buyer to the seller while transferring securities from the seller to the buyer.

The risks of a forward contract

Counterparty risk is the risk that the other party to a contract will fail to honor the terms of the contract

Liquidity risk - Trading out of a forward contract is very difficult because it can only be done with the consent of the other party.

European-style contracts vs American-style contracts

If the holders can exercise their contracts only when they mature, they are European-style contracts. If they can exercise the contracts earlier, they are American-style contracts.

Brokers

agents who fill orders for their clients. They do not trade with their clients. Instead, they search for traders who are willing to take the other side of their clients’ orders.

Investment banks

provide advice to their mostly corporate clients and help them arrange transactions such as initial and seasoned securities offerings.

Exchanges

provide places where traders can meet to arrange their trades. Increasingly, exchanges arrange trades for traders based on orders that brokers and dealers submit to them. Such exchanges essentially act as brokers. Exchanges are easily distinguished from brokers by their regulatory operations. Most exchanges regulate their members’ behavior when trading on the exchange, and sometimes away from the exchange.

Dealers

fill their clients’ orders by trading with them. When their clients want to sell securities or contracts, dealers buy the instruments for their own accounts. If their clients want to buy securities, dealers sell securities that they own or have borrowed. After completing a transaction, dealers hope to reverse the transaction by trading with another client on the other side of the market. The service that dealers provide is liquidity.

broker–dealer

Most dealers also broker orders, and many brokers deal to their customers. Broker–dealers have a conflict of interest with respect to how they fill their customers’ orders. When acting as a broker, they must seek the best price for their customers’ orders. When acting as dealers, however, they profit most when they sell to their customers at high prices or buy from their customers at low prices.

Dealers vs Arbitrageurs

Dealers provide liquidity to buyers and sellers who arrive at the same market at different times. They move liquidity through time. Arbitrageurs provide liquidity to buyers and sellers who arrive at different markets at the same time. They move liquidity across markets.

securitization through a special purpose vehicle

the financial intermediary avoids placing the assets and liabilities on its balance sheet by setting up a special corporation or trust that buys the assets and issues the securities.

long vs short option contract

The long side of an option contract is the side that holds the right to exercise the option. The short side is the side that must satisfy the obligation.

long vs short contract

The long side of a forward or futures contract is the side that will take physical delivery or its cash equivalent. The short side of such contracts is the side that is liable for the delivery. The long side of a futures contract increases in value when the value of the underlying asset increases in value.

call money rate

The interest rate that the buyers pay for their margin loan

initial margin requirement

the minimum fraction of the purchase price that must be trader’s equity.

leverage ratio

ratio of the value of the position to the value of the equity investment in it.

maximum leverage ratio

one divided by the minimum margin requirement (aka maintenance margin requirement)

orders: examples

Execution instructions indicate how to fill the order, validity instructions indicate when the order may be filled, and clearing instructions indicate how to arrange the final settlement of the trade.

bid vs ask

The prices at which they are willing to buy are called bid prices and those at which they are willing to sell are called ask prices,

market bid–ask spread

The highest bid in the market is the best bid, and the lowest ask in the market is the best offer. The difference between the best bid and the best offer

Execution instructions

A market order instructs the broker or exchange to obtain the best price immediately available when filling the order. A limit order conveys almost the same instruction: Obtain the best price immediately available, but in no event accept a price higher than a specified limit price when buying or accept a price lower than a specified limit price when selling. all-or-nothing (AON) orders can only trade if their entire sizes can be traded.

Traders also often indicate a specific display size for their orders. Brokers and exchanges then expose only the display size for these orders. Any additional size is hidden from the public but can be filled if a suitably large order arrives. Traders sometimes call such orders iceberg orders

Validity instructions: list examples

Good-till-cancelled orders (GTC)

Immediate or cancel orders (IOC)

Good-on-close orders can only be filled at the close of trading.

A stop order is an order in which a trader has specified a stop price condition. The stop order may not be filled until the stop price condition has been satisfied.

quote-driven markets

customers trade with dealers. Almost all bonds and currencies and most spot commodities trade in quote-driven markets.

order-driven markets

an order matching system run by an exchange, a broker, or an alternative trading system uses rules to arrange trades based on the orders that traders submit.

brokered markets

brokers arrange trades between their customers. common for transactions of unique instruments, such as real estate properties, intellectual properties, or large blocks of securities.

price weighting

In price weighting, the weight on each constituent security is determined by dividing its price by the sum of all the prices of the constituent securities.

equal weighting

This method assigns an equal weight to each constituent security at inception. Eg. To construct an equal-weighted index from the five securities in, the index provider allocates one-fifth (20 percent) of the value of the index (at the beginning of the period) to each security.

Disadvantage of price weighting

The main disadvantage of price weighting is that it results in arbitrary weights for each security. In particular, a stock split in any one security causes arbitrary changes in the weights of all the constituents’ securities.

Disadvantage of equal weighting

First, securities that constitute the largest fraction of the target market value are underrepresented, and securities that constitute a small fraction of the target market value are overrepresented.

Second, after the index is constructed and the prices of constituent securities change, the index is no longer equally weighted. Therefore, maintaining equal weights requires frequent adjustments (rebalancing) to the index.

market-capitalization weighting

he weight on each constituent security is determined by dividing its market capitalization by the total market capitalization (the sum of the market capitalization) of all the securities in the index.

Disadvantages of market - cap weighting

This weighting method leads to overweighting stocks that have risen in price (and may be overvalued) and underweighting stocks that have declined in price (and may be undervalued).

Fundamental Weighting

using measures of a company’s size that are independent of its security price to determine the weight on each constituent security. These measures include book value, cash flow, revenues, earnings, dividends, and number of employees.

Disadvantage of fundamental weighting

The most important property of fundamental weighting is that it leads to indexes that have a “value” tilt. That is, a fundamentally weighted index has ratios of book value, earnings, dividends, etc. to market value that are higher than its market-capitalization-weighted counterpart. fundamentally weighted indexes generally will have a contrarian “effect” in that the portfolio weights will shift away from securities that have increased in relative value and toward securities that have fallen in relative value whenever the portfolio is rebalanced.

Weak form of market efficiency

security prices fully reflect all past market data

semi-strong-form efficient market,

prices reflect all publicly known and available information, and all past market data

strong-form efficient market,

security prices fully reflect both public and private information.

Fundamental analysis

the examination of publicly available information and the formulation of forecasts to estimate the intrinsic value of assets.

technical analysis

attempt to profit by looking at patterns of prices and trading volume.

Time-Series Anomalies

Two of the major categories of time-series anomalies that have been documented are 1) calendar anomalies and 2) momentum and overreaction anomalies.

Cross-Sectional Anomalies

Two of the most researched cross-sectional anomalies in financial markets are the size effect and the value effect.

The size effect results from the observation that equities of small-cap companies tend to outperform equities of large-cap companies on a risk-adjusted basis.

A number of global empirical studies have shown that value stocks, which are generally referred to as stocks that have below-average price-to-earnings (P/E) and market-to-book (M/B) ratios, and above-average dividend yields, have consistently outperformed growth stocks over long periods of time.

Loss aversion

the tendency of people to dislike losses more than they like comparable gains. This results in a strong preference for avoiding losses as opposed to achieving gains

Herding

investors trade on the same side of the market in the same securities, or when investors ignore their own private information and/or analysis and act as other investors do.

Overconfidence

they overestimate their ability to process and interpret information about a security.

representativeness

investors assess new information and probabilities of outcomes based on similarity to the current state or to a familiar classification

mental accounting

investors keep track of the gains and losses for different investments in separate mental accounts and treat those accounts differently

conservatism

investors tend to be slow to react to new information and continue to maintain their prior views or forecasts

narrow framing

investors focus on issues in isolation and respond to the issues based on how the issues are posed

depository receipt

A depository receipt is created when the equity shares of a foreign company are deposited in a bank (i.e., the depository) in the country on whose exchange the shares will trade. The depository then issues receipts that represent the shares that were deposited. is a security that trades like an ordinary share on a local exchange and represents an economic interest in a foreign company.

Sponsored vs unsponsored depository receipt

A sponsored DR is when the foreign company whose shares are held by the depository has a direct involvement in the issuance of the receipts. Investors in sponsored DRs have the same rights as the direct owners of the common shares (e.g., the right to vote and the right to receive dividends). In contrast, with an unsponsored DR, the underlying foreign company has no involvement with the issuance of the receipts. Instead, the depository purchases the foreign company’s shares in its domestic market and then issues the receipts through brokerage firms in the depository’s local market. In this case, the depository bank, not the investors in the DR, retains the voting rights.

ROE

ROE𝑡=NI𝑡/Average BVE𝑡

FCFE

FCFE = CFO – FCInv + Net borrowing

non-callable, non-convertible perpetual preferred share value

𝑉0=𝐷0/𝑟

non-callable, non-convertible preferred stock with maturity at time n

𝑉0=∑𝐷𝑡/(1+𝑟)^𝑡 + 𝐹/(1+𝑟)^𝑛

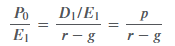

justified forward P/E ratio

g = b × ROE

the dividend payout ratio, p

the law of one price

Identical assets should sell for the same price

Fama and French (1992)

Those three factors are relative size, relative book-to-market value, and beta of the asset.