4.1.7 Balance of payments

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

9 Terms

Components of the balance of payments

Current account

Trade in goods

Trade in services

Investment income (primary income)

Current transfers (secondary income)

Capital account

Some capital goods

Intellectual capital (collective knowledge within an organisation)

Financial account

FDI

Portfolio investment

Hot money

All items could be credit / debit

Credit = money flowing into the country

Debit = money flowing out of the country

Components of the financial account

FDI

Portfolio investment = purchase of shares & bonds in other countries

Hot money flows = short-term money flows in & out of a country driven by speculative purposes (interest rate arbitrage (taking advantage) / currency trading)

Evaluation on why UK’s current account deficit may not be a major concern

1) UK offsets its current account deficit with financial account surplus

= inflows of investment capital balance out payments for g&s & income flows

2) UK is a global leader in attracting financial investment due to

strong institutions

stable legal framework

London’s position as a financial hub

Causes of current account surplus

Goods & services sold abroad are very competitive due to better quality, lower price, favourable exchange rates = foreign countries want to buy more of your goods → exports increases

Economy in recession

lack of demand for imports & domestic gds

Causes of current account deficit

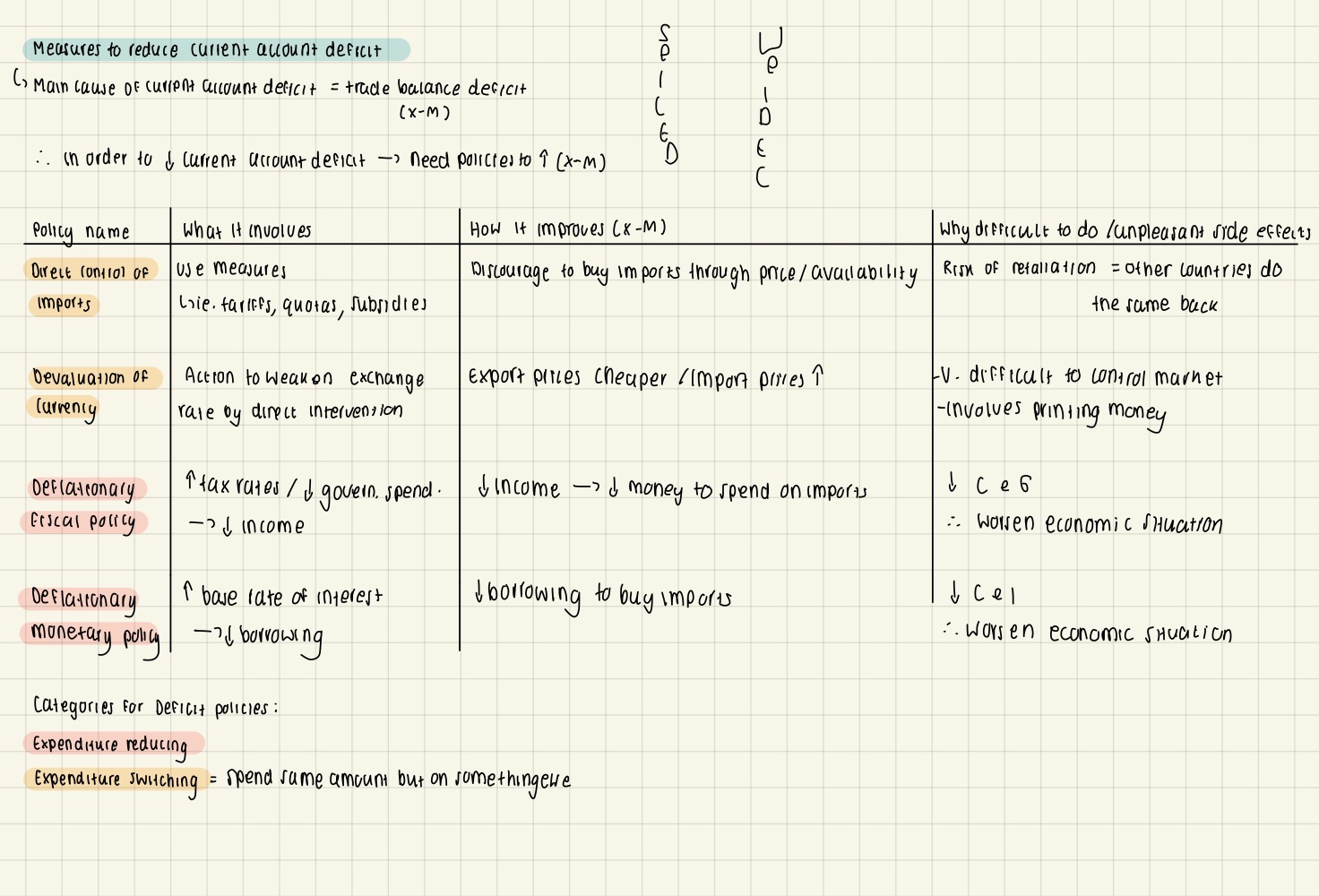

Measures to reduce a country’s imbalance on the current account

Conclusion for using current account deficit reducing policies

Since deficit reducing policies have negative effects

Current account deficits should be ignored

Unless they have arisen from serious long term reasons (ie. Structural causes)

Even then, alternative type of policy - based on improving productivity - could be better

Ie. Supply-side policies

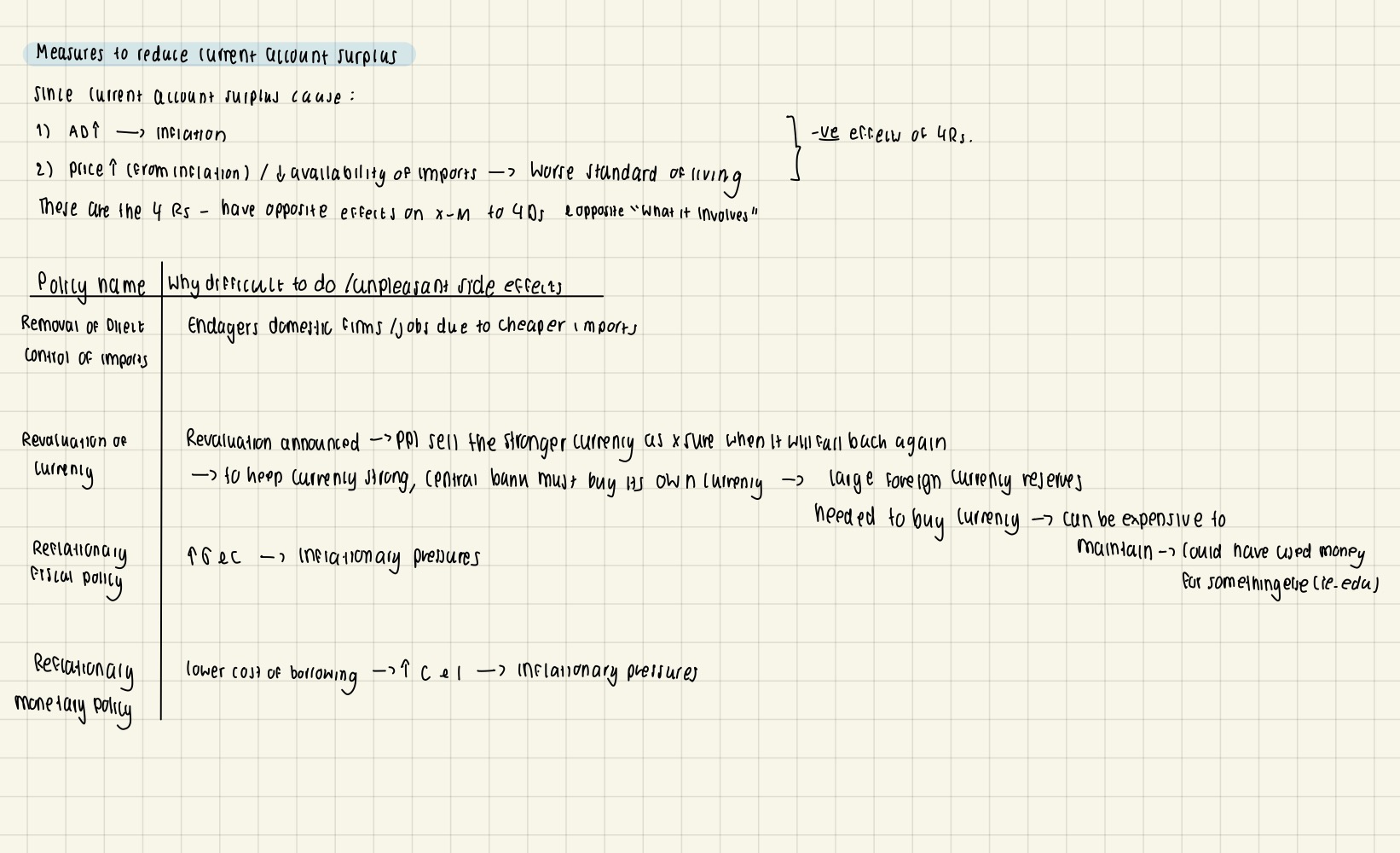

Policies to reduce a current account surplus

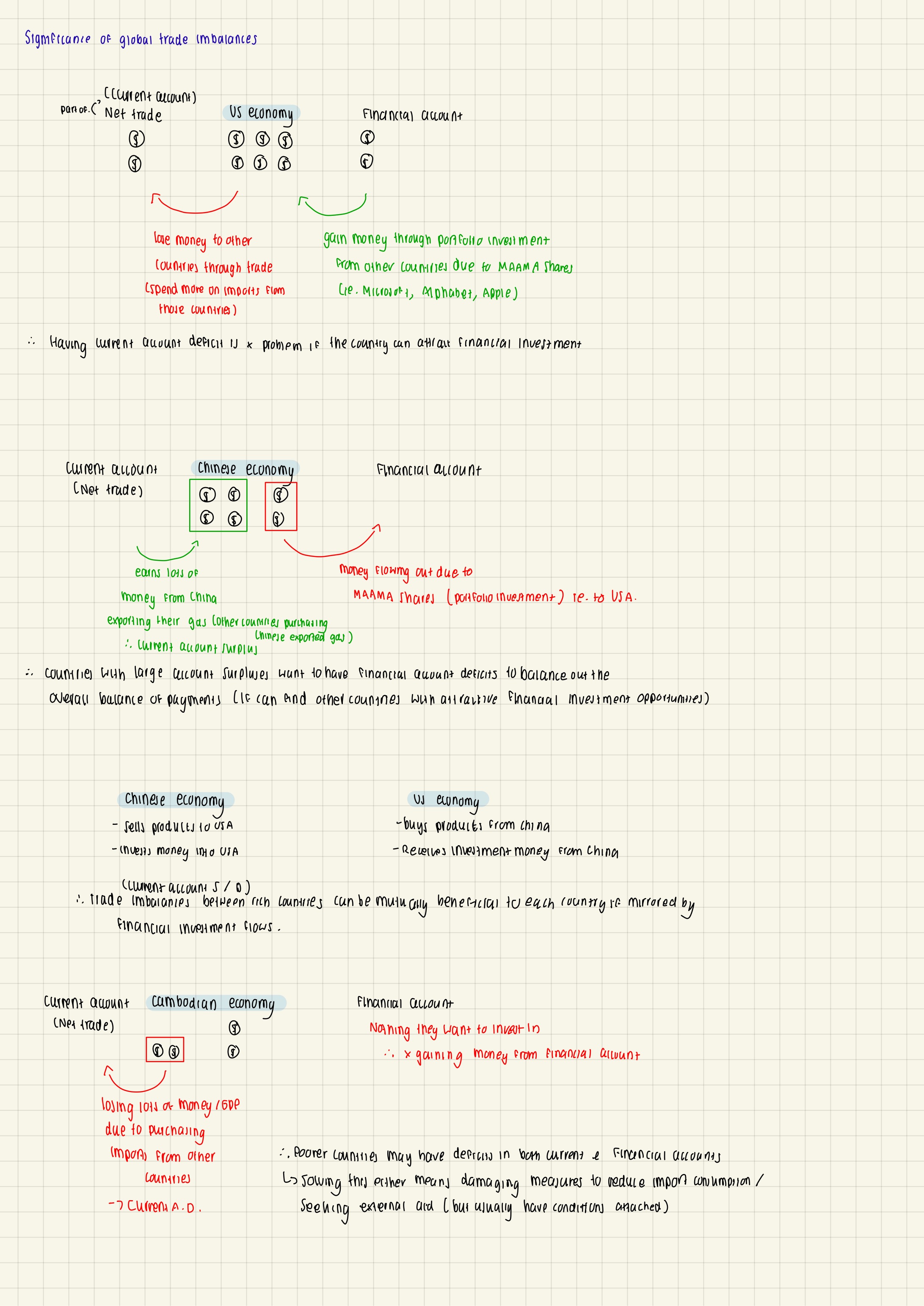

Significance of global trade imbalances