Stabilising the Economy - The Role of the Fed

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

Fed Watch

Analysts attempt to forecast Fed decisions about monetary policy

Greenspan briefcase indicator

Fed decisions have significant effects on financial markets and the macro economy

Is Monetary Policy a major Stabilisation tool?

yes, its quickly decided and implemented and more flexible and responsive than fiscal policy

What is the Primary task of the FOMC (Federal Open Market Committee)?

controlling the money supply

money supply and demand determine the interest rate

the fed manipulates supply to achieve its desired interest rate

Portfolio Allocation Decisions

allocate a persons wealth among alternative forms

Diversification

owning a variety of different assets to manage risk

Demand for Money (Liquidity Preference)

the amount of wealth held in the form of money

What does Demand for Money depend on?

Nominal interest rate (i)

The higher the interest rate, the lower the quantity of money demanded

Real income or output (Y)

The higher the level of income, the greater the quantity of money demanded

The price level (P)

The higher the price level, the greater the quantity of money demanded

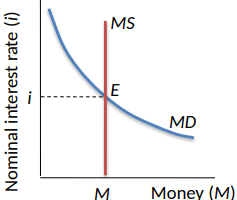

What determines the Nominal Interest Rate?

interaction of the aggregate demand for money and the supply of money

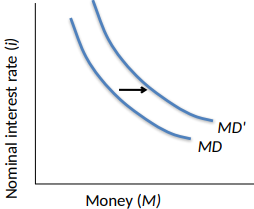

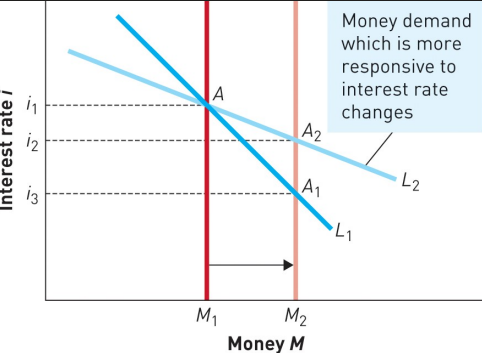

Money Demand Curve

Shows the relationship between the aggregate quantity of money demanded, M, and the nominal interest rate

An increase in the nominal interest rate increases the opportunity cost of holding money

Negative slope

Changes in factors other than the nominal interest rate cause a shift in the curve

A change in demand for money can result from anything that affects the cost or benefit of holding it

What can affect the Cost/Benefit of Holding Money?

An increase in output

Higher price levels

Technological advances

Financial advances

Foreign demand for dollars

Supply of Money

The Fed primarily controls it with open-market operations

An open-market purchase of bonds by the Fed increases it

An open-market sale of bonds by the Fed decreases it

The line is vertical

Equilibrium is at E

What are Bond Prices Inversely related to?

The interest rate

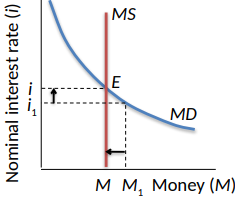

Suppose the interest rate is at i1, below equilibrium

Quantity of money demanded is M1, more than the money available

To get more money, people sell bonds

Bond prices go down, interest rates rise

Quantity of money demanded decreases from M1 to M

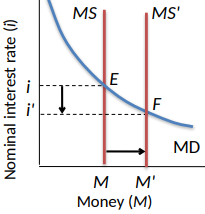

Fed Controls the Nominal Interest Rate

Fed policy is stated in terms of target interest rates

The tool they use is the supply of money

Initial equilibrium at E

Fed increases the money supply to MS'

New equilibrium at F

Interest rated decrease to i' to convince the market to hold the new, larger amount of money

To Decrease the Money Supply

fed sells bonds to the public

supply of bonds increases

price of bonds decreases

interest rate increase

To Increase the Money Supply

fed buys bonds from the public

demand for bonds increase

price of bonds increase

interest rate decreases

Why is Fed Policy announced in terms of Interest Rates?

Public is not familiar with the size of the money supply

Main effects of monetary policy on the economy work through interest rates

Interest rates are easier to monitor than the money supply

Role of the Federal Funds Rate (FFR)

The rate commercial banks charge each other on short-term (usually overnight) loans

Banks borrow from each other if they have insufficient funds

Market determined rate – supply and demand

Targeted by the Fed

Decreasing the FFR

The Fed conducts open market purchases

For example, when the Federal Reserve buys Treasury securities on the open market, it injects reserves into the banking system and lowers the FFR

Reserves increase; excess reserves can be loaned to other banks in the federal funds market

Banks holding excess reserves are incentivized to lend to other banks to avoid holding idle reserves, leading to a downward pressure on interest rates as they compete to offer lower rates

Interest rates tend to move together; consumer, mortgage, prime rates fall

Can the Fed Control the Real Interest Rate?

Yes, in the short run, by changing the nominal interest rate (i), since inflation (π) doesn't respond immediately

Open Market Operations

The main tool of money supply

Fed offers lending facility to banks, called discount window lending

If a bank needs reserves, it can borrow from the Fed at the discount rate

Lending increases reserves and ultimately increases the money supply

Source of liquidity in times of distress or financial stability

Changes in the discount rate signal tightening or loosening of the money supply

The Discount Rate

the rate the Fed charges banks to borrow reserves

typically higher than the FFR

penalty rate that encourages banks to lend and borrow from each other instead

commercial banks can only use it if they meet certain eligibility criteria and pay the rate

What is the Money Supply Determined by?

public currency + (bank reserves / reserve-deposit ratio)

How can the Fed affect the Money Supply?

by affecting any of these three things:

Currency held by the public

Bank reserves

The desired reserve-deposit ratio

Reserve Requirements

The minimum values of the ratio of bank deposits that must be held in reserves

It is rarely changed

Can the Fed change Reserve Requirements?

yes

Quantitative Easing (QE)

The Fed buys financial assets, lowering the yield or return of those assets while injecting liquidity.

Used to stimulate the economy by purchasing assets of longer maturity thereby raising their price and lowering longer-term interest rates

Lower long-term interest rates incentivize households and businesses to borrow and invest more, which stimulates economic activity and job creation

Forward Guidance

the Fed gives indications of its future policies so that markets will react

Interest on Reserves

even at an interest rate of 0, the fed can offer this to give banks a reason the keep money at the Fed

Excess Reserves

Bank reserves in excess of the reserve requirements set by the central bank

As a result, the money supply may not change even if the fed changes the supply of reserves

Risk aversion and low interest rates made commercial banks hold onto their reserves instead of lending them

What is the Zero Lower Bound (ZLB)?

a level, close to 0, below which the central bank can’t further reduce short-term interest rates

can’t go far below 0 - would you pay someone to lend them - would you pay someone to lend them money?

What tools can the Fed use at ZLB?

quantitative easing

forward guidance

negative rates on excess reserves

What happens to Money and Bonds at ZLB?

agents are indifferent between holding them, resulting in a liquidity trap

people and businesses hold onto it instead of spending/investing

What is the Economic effect of a Liquidity Trap?

despite ample liquidity, demand remains low, and the economy can get stuck in a low-growth or no-growth phase

How does the ZLB affect Traditional Monetary Policy?

limits the effectiveness of tools, such as the federal funds rate or the discount rate, in stimulating the economy

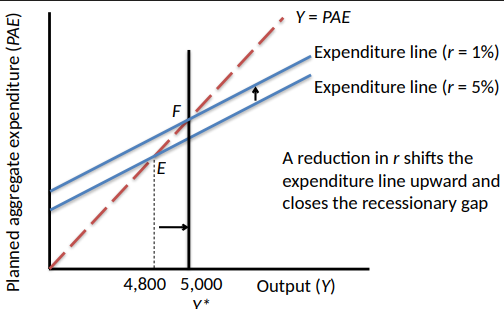

What components of PAE or affected by r?

Saving decisions of households

More saving at higher real interest rates

Higher saving means less consumption

Investment by firms

Higher interest rates mean less investment

Investments are made if the cost of borrowing is less than the return on the investment

Both consumption and planned investment decrease when the interest rate increases

The Fed Fights a Recession

How Effective is Monetary Policy? Money Supply to Interest Rates

How can Expansionary Gaps lead to Inflation?

Planned spending is greater than normal output levels at the established prices

Short-run unplanned decreases in inventories

If gap persists, prices will increase

How does the Fed attempt to close Expansionary Gaps?

Raise interest rates

Decrease consumption and planned investment

Decrease planned aggregate expenditure

Decrease equilibrium output

Why does the Fed have limited ability to manage the Stock Market?

The Fed doesn't know the “right” prices

It has no private information - data is publicly available

Why is Monetary Policy not well suited for addressing Asset Bubbles?

It can raise rates to slow growth

But doing so risks a recession and rising unemployment

What is Forward Guidance in Monetary Policy?

the Fed providing information about how it expects to adjust the FFR in the future, based on the current economic outlook

helps the public and investors better understand the Fed’s views and future policy intentions

What should Central Banks and Regulators do in response to Financial Crises?

Anticipate, defuse threats, and mitigate the effects when crises occur

What conditions help Macroeconomic Policy work best?

Accurate knowledge of current economic conditions

Understanding the economy's path without policy

Precise estimate of potential output

Good control of fiscal and monetary tools

Knowledge of timing and effects of policy changes