Public Economics - Final

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

70 Terms

Low transaction costs, complete information, and competitive markets

What are the conditions that the First Welfare Theorem states are necessary for a set of markets to be Pareto optimal?

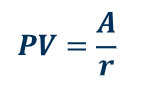

where A is the value received each period

What is the equation to calculate the value of a perpetuity starting next year?

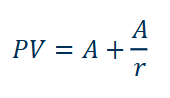

where A is the value received each period

What is the equation to calculate the value of a perpetuity starting this year?

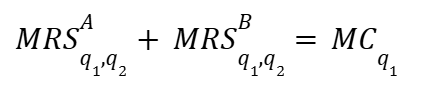

where q1 is a public good and the MRS’s represent how much of good q2 person A and B are willing to give up for q1 (social efficiency is maximized when the marginal cost is set equal to the sum of MRS equal to each individual)

What is the condition for the social-welfare maximizing (i.e., efficient) provision of a public good?

means-tested cash transfer policy; substitution effect

Identify the type of policy and type of effect of the policy which is described by the statement: the return to working is lower (due to diminution of benefits), i.e., the effect of wage is lower

income effect

Identify the type of effect of a means-tested cash transfer program which is described by the statement: individual feels richer and wants to consumer more of all goods, including leisure

Reduction in labor supply

What are the results of both the substitution and income effects related to the provision of means-tested cash transfer programs?

heterogeneity

What is the explanation for variation in outcomes across places which says that different people living in different places (i.e., sorting)

neighborhood effects

What is the explanation for variation in outcomes across places which says that places have a causal effect on upward mobility for a given person

selection bias

Refers to setting where the sample is not drawn randomly from the population of interest

sample

Is the data we actually observe, as drawn from a population

target parameter

Is what we actually want to know about the population

estimator

Is a function of data for the sample (what we actually see); ex: difference in earning between surveyed GT/emory grads

estimand

Is a function of distribution of observable data in the population; ex: difference in earnings between all GT and emory students

statistical inference

The process of learning about the estimand from the estimator

identification

The process of learning about the parameter from the estimand

linear regression

Relates outcomes of interest to “treatment” variable and “control” variables that account for observable differences across units

quasi-experiments

Exploits naturally occuring phenomena to replicate conditions of a randomized control trial

regression discontinuity

A type of quasi-experiment which utilizes the idea that sometimes treatment status is (partially) determined by whether the unit is on one side of some cutoff

smoothness assumption (potential outcomes are continuous are cutoff)

What is the key assumption for a regression discontinuity?

difference-in-differences

A type of quasi-experiment which uses pre-treatment differences to learn about confounding variables and adjust for them.

revealed and stated preference methods

What are the two general types of ways to determine the values of costs and benefits?

hedonics

A type of revealed preference method which attempts to value non-marketed characteristics of marketed goods

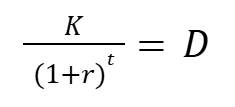

What is the present value of an amount K received in t years with an interest rate of r?

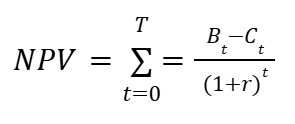

net present value

Is the difference in benefits and costs appropriately discounted across periods

What is the equation for the net present value?

contingent valuation

A type of state preference method where respondents are asked to state preferences in a hypothetical market

choice experiment

A type of stated preference method where respondents select preferred alternatives in an artificial market that imposes trade offs of different product attributes, including price, or cost to respondent

Coase theorem

Says that if transaction costs are low and property rights are clearly defined and enforced, private bargains will ensure that the market equilibrium is efficient even when there are externalities

(1) Assignment problem, (2) holdout problems, (3) free rider problem, (4) transaction costs and negotiating problems

List 3 of the 4 problems with the conditions of the Coase theorem being met

Set per-unit tax = marginal external cost

How would you set a corrective, “pigouvian”, tax so as to correct a negative externality?

principle of targeting

Principle which states that we should tax the externality as directly as possible.

equimarginal principle

States that for given standards, cost minimization requires that the compliance burden is allocated so that the marginal cost of the last unit of compliance “effort” of each firm is equated across all firms, i.e., the costs of the last units of abatement are equalized

quantity regulation

What type of externalities regulation assures that there is as much reduction as desired, regardless of cost?

price regulation through taxes

What type of externalities regulation ensures that the cost of reductions never exceeds the level of reduction cost set, but leaves the amount of reduction uncertain?

nonexcludable

Describes a good where people who don’t pay for it cannot be easily prevented from using it

nonrival

Describes a good where one person’s use of it does not reduces the ability of another person to use it

forced riders

Describes people who pay a share of the costs of a public good but who do not enjoy the benefits

Nash equilibrium

Describes an equilibrium where each agent maximizes his objectives, taking as given the actions of other agents

Warm glow

A model of public goods provision in which individuals care about both the total amount of the public good and their particular contribution as well

1) positive externalities (productivity spillovers); 2) borrowing constraints; 3) family and individual failures

What are 3 reasons that the government should be involved in education?

1) education as human capital accumulation 2) education as a screening device

What are the two main explanations for the reason why higher educated people earn more?

asymmetric information

The difference in information that is available to sellers and purchasers in a market

consumption smoothing

The translation of consumption from periods when consumption is high (and has low marginal utility) to periods when consumption is low (and has high marginal utility)

government coverage mandate (helps w/ adverse selection)

What is a way that government intervention can help with the problem of adverse selection in the insurance market

moral hazard

Adverse actions taken by insured individuals in response to insurance against adverse outcomes

lump sum taxes

Are fixed tax payments that do not change with income or consumption; are efficient but may not satisfy equity objectives

Ramsey rule

States that if goods are unrelated in consumption, then tax rates should be inversely proportional to their elasticities

the elasticity rule

An implication from the Ramsey rule which states that when elasticity of demand for a good is high, it should be taxed at a low rate and when elasticity is low, the tax rate should be high

the broad base rule

An implication from the Ramsey rule which states that it is better to tax a wide variety of goods at a moderate rate than to tax very few goods at a high rate

guarantees efficiency, not equity

What does the Ramsey rule guarantee and not guarantee?

statutory incidence

Burden of a tax as stipulated in legislation

economic incidence

The actual burden of a tax once prices adjust

transfer pricing

A process by which firms determine the prices paid to subsidiaries for goods and services, i.e., licensing of intellectual property

corporate inversion

A merger of a domestic firm with a foreign corporation in a lower tax jurisdiction for which shareholders of the domestic firm retain more than 50% ownership of the merged entity, but HQ moves abroad

vertical equity

The idea that groups with more resources (higher income, higher wealth, etc) should pay higher taxes than do lower resource groups

horizontal equity

The idea that similar individuals who make different economic choices should be treated similarly by the tax system

Haig-Simons comprehensive income definition

Defines taxable resources as an individual's ability to pay taxes (which is equal to an individual's potential annual consumption)

deductibles

(In health insurance): the initial costs borne by the insured

copay

(In health insurance): a small fee charged for access to care

coinsurance

(In health insurance): insured pays a percentage of costs

20%

If you have a coinsurance rate of 20%, what percentage of the total bill do you pay?

Samuelson rule

Rule which says that social efficiency is maximized when the marginal cost is set equal to the sum of MRS equal to each individual

categorical

Type of transfer program where eligibility is restricted by demographic characteristics, e.g. motherhood or disability

means-tested

Type of transfer program where eligibility is restricted by income

1. In kind (ex: food stamps); 2. cash (ex: earned income tax credit)

List the two types of transfer “benefits”

1. self targeting 2. Politics 3. paternalism 4. redistribute from parents to kids

List at least three reasons why, despite being in-kind transfers being weakly inferior to cash transfers, they persist

1. targeting mechanism (something which is correlated with low earnings capacity, is unchangeable, and is easy to verify); 2. ordeal mechanisms

What are two ways that the government can ensure only the truly needy receive welfare?

1. Competition and choice promote static and dynamic efficiency; 2. Market forces lead to educational variety; 3. Decouples residence and school choice

What are at least two arguments in favor of school vouchers?

1. “Cream skimming” w/ negative consequences on peer effects; 2. Sorting can reduce positive diversity effects; 3. Sorting could impose greater per-pupil costs on public schools

What are at least two arguments against school vouchers?