Econ 235 Exam 3 Prep

5.0(1)

Card Sorting

1/76

There's no tags or description

Looks like no tags are added yet.

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

77 Terms

1

New cards

1\. To hedge against a decrease in prices using the futures market, you would:

A. Purchase futures contracts.

B. Sell futures contracts.

C. Purchase or sell futures contracts depending on the futures price.

D. Buy in the cash market.

A. Purchase futures contracts.

B. Sell futures contracts.

C. Purchase or sell futures contracts depending on the futures price.

D. Buy in the cash market.

B. Sell futures contracts

2

New cards

2\. The opening of an ethanol plant in your local area will likely _____________ the basis in the cash corn market.

A. weaken

B. strengthen

C. weaken or strengthen the basis depending on the initial price.

D. There is not enough information to determine what happens to the basis.

A. weaken

B. strengthen

C. weaken or strengthen the basis depending on the initial price.

D. There is not enough information to determine what happens to the basis.

B. strengthen

3

New cards

3\. Would an unexpected decrease in the projected U.S. supply of soybeans in September likely be a favorable or unfavorable development for speculators who were holding short positions in January soybean futures contracts?

A. Favorable. Speculators holding a “short” position would expect the news to have a “bullish” effect on market prices.

B. Favorable. Speculators holding a “short” position would expect the news to have a “bearish” effect on market prices.

C. Unfavorable. Speculators holding a “short” position would expect the news to have a “bullish” effect on market prices.

D. Unfavorable. Speculators holding a “short” position would expect the news to have a “bearish” effect on market prices.

\

A. Favorable. Speculators holding a “short” position would expect the news to have a “bullish” effect on market prices.

B. Favorable. Speculators holding a “short” position would expect the news to have a “bearish” effect on market prices.

C. Unfavorable. Speculators holding a “short” position would expect the news to have a “bullish” effect on market prices.

D. Unfavorable. Speculators holding a “short” position would expect the news to have a “bearish” effect on market prices.

\

D. Unfavorable. Speculators holding a “short” position would expect the news to have a “bearish” effect on market prices.

4

New cards

4\. If corn futures are selling at $4/bu and a hedger expects the basis to be -$0.20, the expected selling price is:

A. $3.20/bu

B. $4.00/bu

C. $4.20/bu

D. $3.80/bu

A. $3.20/bu

B. $4.00/bu

C. $4.20/bu

D. $3.80/bu

D. $3.80/bu

5

New cards

5\. In July, a corn producer hedged his crop by selling December corn futures at $4/bu. In November, the producer bought the December futures contracts back for $4.20/bu and sold in the cash market for $3.85/bu, will receive a net price of ______. Assume that basis remains unchanged between July and November.

A. $3.65/bu

B. $3.85/bu

C. $4.00/bu

D. $4.20/bu

A. $3.65/bu

B. $3.85/bu

C. $4.00/bu

D. $4.20/bu

A. $3.65/bu

6

New cards

6\. You own 10,000 bushels of corn. You hedge the 10,000 bushels on October 1, at a basis of 20 cents under. On November 2, you sell the corn at a basis of 25 cents under and offset (buy back) your futures contracts. What just happened?

A. You earned 5 cents/bu for a month’s storage.

B. You made a net profit of 5 cents/bu.

C. You lost 5 cents/bu (plus any storage and trading commission costs).

D. You gained $1000 less trading commission costs.

A. You earned 5 cents/bu for a month’s storage.

B. You made a net profit of 5 cents/bu.

C. You lost 5 cents/bu (plus any storage and trading commission costs).

D. You gained $1000 less trading commission costs.

C. You lost 5 cents/bu (plus any storage and trading commission costs).

7

New cards

7\. If you buy an option on futures and pay a premium of $0.30, what is the most you can lose?

A. The maximum loss depends on the price.

B. Your potential gain is limited.

C. Your potential loss is unlimited.

D. The most you can lose is $0.30/bu.

A. The maximum loss depends on the price.

B. Your potential gain is limited.

C. Your potential loss is unlimited.

D. The most you can lose is $0.30/bu.

D. The most you can lose is $0.30/bu.

8

New cards

9\. A September wheat call has a strike price of $6.00. The underlying September futures price is $6.50. The intrinsic value is _________.

A. $6.00

B. $6.50

C. $0.50

D. $0.00

A. $6.00

B. $6.50

C. $0.50

D. $0.00

C. $0.50

9

New cards

10\. A December wheat put has a strike price of $6.60. The underlying December futures price is $6.20. The intrinsic value is _________.

A. $6.60

B. $6.20

C. $0.40

D. $0.00

A. $6.60

B. $6.20

C. $0.40

D. $0.00

C. $0.40

10

New cards

12\. An options speculator thinks that May corn futures will decrease in price. What should he/she do to profit from this information in the options market?

A. Purchase a put option.

B. Purchase a call option.

C. Purchase both a put and a call option.

D. Purchase either a put or a call option (either option will work).

A. Purchase a put option.

B. Purchase a call option.

C. Purchase both a put and a call option.

D. Purchase either a put or a call option (either option will work).

A. Purchase a put option.

11

New cards

14\. Premiums for options on futures contracts are

A. set by the exchange staff.

B. determined by buyers and sellers.

C. unaffected by futures prices.

D. none of the above.

A. set by the exchange staff.

B. determined by buyers and sellers.

C. unaffected by futures prices.

D. none of the above.

B. determined by buyers and sellers.

12

New cards

15\. Assume you are a feed mill and decide to hedge your upcoming December purchase of soybeans. At the time (August 1), the January soybean futures are trading at $9.70/bu; the expected local basis for mid-November delivery is 24 cents under the January futures. If you hedge your position with futures, what is your expected purchase (buying) price if the basis is 24 cents under?

A. $9.70/bu

B. $9.94/bu

C. $9.46/bu

D. $9.22/bu

A. $9.70/bu

B. $9.94/bu

C. $9.46/bu

D. $9.22/bu

C. $9.46/bu

13

New cards

16\. A wheat producer is interested in establishing a hedge for part of his production and is considering options. He/she would most likely:

A. buy a call option.

B. buy a put option.

C. sell a put option.

D. sell a call option.

A. buy a call option.

B. buy a put option.

C. sell a put option.

D. sell a call option.

B. buy a put option

14

New cards

17\. Assume you are a food processor and decide to hedge your upcoming purchase of soybean oil. At the time (August 1), December soybean oil futures are trading at 54 cents per pound; the expected local basis for midNovember delivery is 4 cents under December futures. If you hedge your position with futures, what is your expected purchase price if the basis is 4 cents under?

A. 58 cents per pound

B. 54 cents per pound

C. 50 cents per pound

D. Cannot be determined

A. 58 cents per pound

B. 54 cents per pound

C. 50 cents per pound

D. Cannot be determined

C. 50 cents per pound

15

New cards

18\. Hedgers and speculators have similar interests in futures markets in that

A. the more market participants, the greater the futures market’s liquidity and usefulness in the process of price discovery.

B. they are both interested in buying and selling the underlying commodity.

C. trades of speculators can only be offset by trades of a hedger.

D. None of the above, as hedgers and speculators have no similar interests.

A. the more market participants, the greater the futures market’s liquidity and usefulness in the process of price discovery.

B. they are both interested in buying and selling the underlying commodity.

C. trades of speculators can only be offset by trades of a hedger.

D. None of the above, as hedgers and speculators have no similar interests.

A. the more market participants, the greater the futures market’s liquidity and usefulness in the process of price discovery.

16

New cards

19\. Hedging involves

A. holding only a futures market position.

B. holding only a cash market position.

C. taking a futures position identical to one’s current cash market position.

D. taking a futures position opposite to one’s current cash/spot market position.

A. holding only a futures market position.

B. holding only a cash market position.

C. taking a futures position identical to one’s current cash market position.

D. taking a futures position opposite to one’s current cash/spot market position.

D. taking a futures position opposite to one’s current cash/spot market position.

17

New cards

20\. Assume you are a feed mill and decide to hedge your upcoming December purchase of soybeans. At the time (August 1), the January soybean futures are trading at $9.70/bu; the expected local basis for mid-November delivery is 24 cents under the January futures. When you set your hedge, what action do you take in the futures market?

A. Buy soybean futures contract(s).

B. Sell soybean futures contract(s).

C. Buy and sell soybean futures contract(s).

D. Either buy or sell soybean futures contract(s) (either trade works in this situation).

A. Buy soybean futures contract(s).

B. Sell soybean futures contract(s).

C. Buy and sell soybean futures contract(s).

D. Either buy or sell soybean futures contract(s) (either trade works in this situation).

A. Buy soybean futures contract(s).

18

New cards

21\. A hedger who sells a futures contract at a certain price will:

A. receive that price plus the actual basis if the market goes higher.

B. receive that price plus the actual basis if the market goes lower.

C. receive that price plus the actual basis both if the market goes higher and also if the market goes lower.

D. None of the above answers are correct.

A. receive that price plus the actual basis if the market goes higher.

B. receive that price plus the actual basis if the market goes lower.

C. receive that price plus the actual basis both if the market goes higher and also if the market goes lower.

D. None of the above answers are correct.

C. receive that price plus the actual basis both if the market goes higher and also if the market goes lower.

19

New cards

22\. On May 1st, the December Futures price for corn is $3.70 per bushel. You expect that the basis in October will be 28 cents under the December Futures price. You estimate your expected net selling price as _______ and decide to hedge by _________ two December corn futures contracts.

A. $3.70/bu, selling two Dec contracts

B. $3.98/bu, selling two Dec contracts

C. $3.70/bu, buying two Dec contracts

D. $3.42/bu, selling two Dec contracts

A. $3.70/bu, selling two Dec contracts

B. $3.98/bu, selling two Dec contracts

C. $3.70/bu, buying two Dec contracts

D. $3.42/bu, selling two Dec contracts

D. $3.42/bu, selling two Dec contracts

20

New cards

23\. Suppose that the basis for soybeans is -$0.25/bu and you believe it will be $0.00/bu in two months. Which of the following strategies will give you a positive payoff?

A. Take a long position in the cash market and a long position in the futures market.

B. Take a long position in the cash market and a short position in the futures market.

C. Take a short position in the cash market and a short position in the futures market.

D. Take a short position in the cash market and a long position in the futures market.

A. Take a long position in the cash market and a long position in the futures market.

B. Take a long position in the cash market and a short position in the futures market.

C. Take a short position in the cash market and a short position in the futures market.

D. Take a short position in the cash market and a long position in the futures market.

B. Take a long position in the cash market and a short position in the futures market.

21

New cards

24\. You feed cattle and would like to hedge against an increase in the price of corn. It is December and you purchase a May Corn futures contract at $3.88 per bushel. You expect basis to be 5 cents under. In April, you offset your futures position and purchase corn in the cash market. The May futures price is $3.97/bu and basis is 7 cents under when you actually buy corn from your supplier. In this case when the May corn futures price is $3.97, what would be the net purchase price (per bu) in April? \n A. $3.90/bu

B. $3.81/bu

C. $3.95/bu

D. $3.99/bu

B. $3.81/bu

C. $3.95/bu

D. $3.99/bu

B. $3.81/bu

22

New cards

25\. Which statement best describes who benefits (in cash) from basis weakening over a hedge?

A. Buyers gain, sellers lose

B. Buyers lose, sellers gain

C. Both gain

D. Neither since buyers and sellers offset basis risk by hedging.

A. Buyers gain, sellers lose

B. Buyers lose, sellers gain

C. Both gain

D. Neither since buyers and sellers offset basis risk by hedging.

A. Buyers gain, sellers lose

23

New cards

27\. You hold a put option on December corn with a strike price of $4.00/bu. The December corn futures price is $4.75/bu. The intrinsic value of the option is:

A. $4.00/bu

B. $0.00/bu

C. $0.75/bu

D. -$0.75/bu

A. $4.00/bu

B. $0.00/bu

C. $0.75/bu

D. -$0.75/bu

B. $0.00/bu

24

New cards

28\. You hold a call option on December corn with a strike price of $3.50/bu. The December corn futures price is $4.00/bu, and the option premium is $1.20/bu. What is the time value?

A. $1.20/bu

B. $4.00/bu

C. -$0.70/bu

D. $0.70/bu

A. $1.20/bu

B. $4.00/bu

C. -$0.70/bu

D. $0.70/bu

D. $0.70/bu

25

New cards

29\. All else equal, opening an ethanol plant will increase corn basis in a local area.

A. True

B. False

A. True

B. False

A. True (29)

26

New cards

30\. An individual that is short in cash needs to purchase a commodity in the future. \n A. True

B. False

B. False

A. true (30)

27

New cards

31\. Hedging involves taking an opposite futures market position relative to a cash position to guard against production risk.

A. True

B. False

A. True

B. False

B False (31)

28

New cards

32\. Hedging with futures allows farmers to limit downside risk and still make money when prices increase.

A. True

B. False

A. True

B. False

B. false (32)

29

New cards

33\. Hedgers can always count on basis to improve over time.

A. True

B. False

A. True

B. False

B. False (33)

30

New cards

34\. A trader that wants the right but not the obligation to go short in the futures market should purchase a put.

A. True

B. False

A. True

B. False

A. true (34)

31

New cards

35\. The strike price of an option is set by the market and can change daily.

A. True

B. False

A. True

B. False

B. false (35)

32

New cards

36\. There is no downside to buying an option.

A. True

B. False

A. True

B. False

B. false (36)

33

New cards

1\. In a long position in the cash market, a trader has the ability to deliver a commodity.

A. True

B. False

A. True

B. False

A. true (1)

34

New cards

2\. A trader that wants the right but not the obligation to go short in the futures market purchases a put option.

A. True

B. False

A. True

B. False

A. true (2)

35

New cards

3\. Agribusiness firms hedge by taking an opposite position in the cash market to offset gains or losses from a futures position.

A. True

B. False

A. True

B. False

B. false (3)

36

New cards

4\. A hedger can profit from a change in the basis.

A. True

B. False

A. True

B. False

A. true (4)

37

New cards

5\. A farmer can remove price and basis risk by hedging with futures contracts.

A. True

B. False

\

A. True

B. False

\

B. false (5)

38

New cards

7\. The strike price is the price a trader pays to purchase a put option.

A. True

B. False

A. True

B. False

B. false (7)

39

New cards

10\. The time value of an option is zero at the expiration date.

A. True

B. False

A. True

B. False

A. true (10)

40

New cards

11\. The owner of a call option can buy a futures contract at the premium price.

A. True

B. False

A. True

B. False

B. false (11)

41

New cards

15\. By hedging with futures, buyers and sellers are eliminating futures price level risk and assuming basis level risk.

A. True

B. False

A. True

B. False

A. true (15)

42

New cards

16\. The strike price of an option is determined by the market.

A. True

B. False

A. True

B. False

B. false (16)

43

New cards

22\. In which of the following situations would you hedge using a futures contract?

A. You are long in the cash market, the price is at a historical high, and you are certain that the price will decline.

B. You are long in the cash market, the price is at a historical low, and you are certain that the price will increase.

C. You are short in the cash market, the price is at a historical high, and you are certain that the price will decrease.

D. You are short in the cash market, the price is at a historical low, and you are certain that the price will decrease further.

A. You are long in the cash market, the price is at a historical high, and you are certain that the price will decline.

B. You are long in the cash market, the price is at a historical low, and you are certain that the price will increase.

C. You are short in the cash market, the price is at a historical high, and you are certain that the price will decrease.

D. You are short in the cash market, the price is at a historical low, and you are certain that the price will decrease further.

A. You are long in the cash market, the price is at a historical high, and you are certain that the price will decline.

\

\

44

New cards

23\. Complete the sentence - A put option on a futures contract gives its owner:

A. The right to sell a futures contract at the strike price.

B. The right to sell a futures contract at the market price.

C. The right to buy a futures contract at the strike price.

D. The right to buy a futures contract at the market price.

A. The right to sell a futures contract at the strike price.

B. The right to sell a futures contract at the market price.

C. The right to buy a futures contract at the strike price.

D. The right to buy a futures contract at the market price.

A. The right to sell a futures contract at the strike price.

45

New cards

25\. When hedging with options, what is the cost to enter into your hedging position?

A. The basis.

B. The maintenance margin.

C. The strike price.

D. The option premium.

A. The basis.

B. The maintenance margin.

C. The strike price.

D. The option premium.

D. The option premium.

46

New cards

26\. What is the strike price of an option?

A. The intrinsic value of the option.

B. The price you pay to purchase the option.

C. The futures price at which an option can be exercised.

D. The price of the underlying futures contract when you purchase the option.

A. The intrinsic value of the option.

B. The price you pay to purchase the option.

C. The futures price at which an option can be exercised.

D. The price of the underlying futures contract when you purchase the option.

C. The futures price at which an option can be exercised.

47

New cards

27\. You hold a put option on December corn with a strike price of $4.00/bu. The December corn futures price is $4.75/bu. The intrinsic value of the option is:

A. $4.00/bu

B. $0.00/bu

C. $0.75/bu

D. -$0.75/bu

A. $4.00/bu

B. $0.00/bu

C. $0.75/bu

D. -$0.75/bu

B. $0.00/bu

48

New cards

28\. You hold a call option on December corn with a strike price of $3.50/bu. The December corn futures price is $4.00/bu, and the option premium is $1.20/bu. What is the time value?

A. $1.20/bu

B. $4.00/bu

C. $0.70/bu

D. -$0.70/bu

A. $1.20/bu

B. $4.00/bu

C. $0.70/bu

D. -$0.70/bu

C. $0.70/bu

49

New cards

29\. Which statement best describes who benefits from basis strengthening over a hedge with a futures contract?

A. Buyers gain, sellers lose

B. Buyers lose, sellers gain

C. Both gain

D. Neither gains or loses since they have offset their basis risk by hedging

A. Buyers gain, sellers lose

B. Buyers lose, sellers gain

C. Both gain

D. Neither gains or loses since they have offset their basis risk by hedging

B. Buyers lose, sellers gain

50

New cards

30\. A Nov Soybean call has a strike price of $11.50. The underlying November futures price is $12.00. The intrinsic value is _.

A. -$0.50/bu

B. $0.00/bu

C. $1.00/bu

D. $0.50/bu

A. -$0.50/bu

B. $0.00/bu

C. $1.00/bu

D. $0.50/bu

D. $0.50/bu

51

New cards

31\. A May Corn put has a strike price of $5.80. The underlying May futures price is $5.55. The intrinsic value is _.

A. -$0.25/bu

B. $0.00/bu

C. $0.25/bu

D. $0.50/bu

A. -$0.25/bu

B. $0.00/bu

C. $0.25/bu

D. $0.50/bu

C. $0.25/bu

52

New cards

33\. If you pay a premium of 10 cents per bushel for a Corn put option with a strike price of $6.60, what’s the most you can lose?

A. $0.10/bu

B. $6.60/bu

C. $6.70/bu

D. Your potential loss is unlimited.

A. $0.10/bu

B. $6.60/bu

C. $6.70/bu

D. Your potential loss is unlimited.

A. $0.10/bu

53

New cards

34\. What types of risk can firms mitigate using futures contracts?

A. Price Risk

B. Price spread risk

C. Production risk

D. A and B

A. Price Risk

B. Price spread risk

C. Production risk

D. A and B

D. A and B

54

New cards

35\. July corn futures are trading at $6.00. A $5.50 July corn call is trading at a premium of 60 cents. The time value is ______.

A. $0.00/bu

B. $0.10/bu

C. $0.50/bu

D. $0.60/bu

A. $0.00/bu

B. $0.10/bu

C. $0.50/bu

D. $0.60/bu

B. $0.10/bu

55

New cards

36\. September soybean futures are trading at $12.20. A $12.50 September soybean put is trading at a premium of 38 cents. The time value is ______.

A. $0.00/bu

B. $0.08/bu

C. $0.30/bu

D. $0.38/bu

A. $0.00/bu

B. $0.08/bu

C. $0.30/bu

D. $0.38/bu

B. $0.08/bu

56

New cards

37\. The components of option premiums are:

A. Intrinsic value, if any

B. Time value, if any

C. The sum of (A) and (B)

D. The strike price and brokerage commission

A. Intrinsic value, if any

B. Time value, if any

C. The sum of (A) and (B)

D. The strike price and brokerage commission

C. The sum of (A) and (B)

57

New cards

38\. The premise that makes hedging possible is cash and futures prices:

A. move in opposite directions.

B. move upward and downward by identical amounts.

C. generally change in the same direction by similar amounts.

D. are regulated by the exchange.

A. move in opposite directions.

B. move upward and downward by identical amounts.

C. generally change in the same direction by similar amounts.

D. are regulated by the exchange.

C. generally change in the same direction by similar amounts.

58

New cards

39\. What is the difference between purchasing a futures contract and purchasing a call option?

A. Purchasing a call option obligates the trader to sell a futures contract.

B. Purchasing a call option obligates the trader to purchase a futures contract.

C. Purchasing a call option requires a margin account.

D. Purchasing a call option requires the upfront payment of a premium.

A. Purchasing a call option obligates the trader to sell a futures contract.

B. Purchasing a call option obligates the trader to purchase a futures contract.

C. Purchasing a call option requires a margin account.

D. Purchasing a call option requires the upfront payment of a premium.

D. Purchasing a call option requires the upfront payment of a premium.

59

New cards

1\. If you write an option and receive a premium of $0.30/bu, what is the most you can lose?

A. $0.30/bu

B. The initial margin deposit

C. Your potential loss is almost unlimited

D. Not enough information is provided

\

A. $0.30/bu

B. The initial margin deposit

C. Your potential loss is almost unlimited

D. Not enough information is provided

\

C. Your potential loss is almost unlimited

60

New cards

3\. Assume you pay a premium of $0.80/bu for a soybean call option with a strike price of $9.00/bu and that the current futures price is $9.30/bu. What is the option’s current intrinsic value?

A. $0.20/bu

B. $0.30/bu

C. $0.50/bu

D. $0.80/bu

A. $0.20/bu

B. $0.30/bu

C. $0.50/bu

D. $0.80/bu

B. $0.30/bu

61

New cards

4\. Assume you pay a premium of $0.80/bu for a soybean call option with a strike price of $9.00/bu and that the current futures price is $9.30/bu. What is the option’s current time value?

A. $0.20/bu

B. $0.30/bu

C. $0.50/bu

D. $0.80/bu

\

A. $0.20/bu

B. $0.30/bu

C. $0.50/bu

D. $0.80/bu

\

C. $0.50/bu

62

New cards

5\. Assume you pay a premium of $0.50/bu for a soybean call option with a strike price of $9.20/bu and that the current futures price is $8.90/bu. What is the option’s current intrinsic value?

A. $0.50/bu

B. $0.30/bu

C. $0/bu

D. $-0.50/bu

A. $0.50/bu

B. $0.30/bu

C. $0/bu

D. $-0.50/bu

C. $0/bu

63

New cards

6\. Assume you pay a premium of $0.50/bu for a soybean call option with a strike price of $9.20/bu and that the current futures price is $8.90/bu. What is the option’s time value?

A. $0.50/bu

B. $0.30/bu

C. $-0.50/bu

D. $0/bu

A. $0.50/bu

B. $0.30/bu

C. $-0.50/bu

D. $0/bu

A. $0.50/bu

64

New cards

11\. It would require the most money to maintain a margin account when

A. You went short at $4.00 and futures are now at $3.00

B. You went long at $4.00 and futures are now at $3.00

C. You went short at $4.00 and offset your position when futures were at $3.50

D. Either A or B as you need margin money whether you are short or long

A. You went short at $4.00 and futures are now at $3.00

B. You went long at $4.00 and futures are now at $3.00

C. You went short at $4.00 and offset your position when futures were at $3.50

D. Either A or B as you need margin money whether you are short or long

B. You went long at $4.00 and futures are now at $3.00

65

New cards

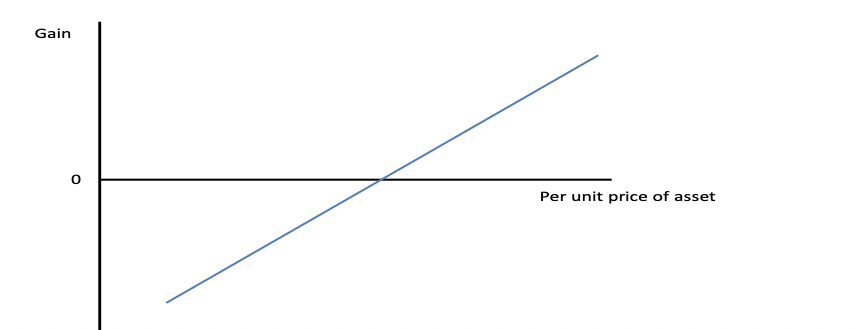

15\. What action did the owner of the position illustrated above take in the futures or options market?

A. Buy a futures.

B. Sell a call option on futures.

C. Sell a futures.

D. Buy a put option on futures.

A. Buy a futures.

B. Sell a call option on futures.

C. Sell a futures.

D. Buy a put option on futures.

A. Buy a futures

66

New cards

18\. If you buy an option for a premium of $0.30/bu what is the most you can lose?

A. $0.30/bu

B. The initial margin deposit plus $0.30/bu.

C. Your potential loss is “unlimited”.

D. The accumulated profit or loss as shown in the margin account.

\

A. $0.30/bu

B. The initial margin deposit plus $0.30/bu.

C. Your potential loss is “unlimited”.

D. The accumulated profit or loss as shown in the margin account.

\

A. $0.30/bu

67

New cards

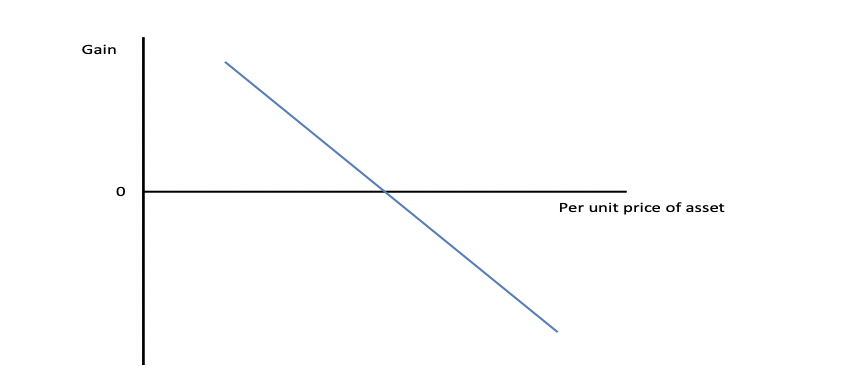

21\. What action did the owner of the position illustrated above take in the futures or options market?

A. Buy a futures.

B. Sell a call option on futures.

C. Sell a futures.

D. Buy a put option on futures

A. Buy a futures.

B. Sell a call option on futures.

C. Sell a futures.

D. Buy a put option on futures

C. Sell a futures.

68

New cards

By hedging with futures, buyers and sellers are eliminating futures price level risk and assuming basis level risk.

A. True

B. False

A. True

B. False

A. True

69

New cards

The premise that makes hedging possible is cash and futures prices:

A. generally change in the same direction by similar amounts.

B. move upward and downward by identical amounts.

C. are regulated by the exchange.

D. move in opposite directions.

A. generally change in the same direction by similar amounts.

B. move upward and downward by identical amounts.

C. are regulated by the exchange.

D. move in opposite directions.

A. Generally change in the same direction by similar amounts

70

New cards

Basis risk involves:

A. the inherent volatility of futures prices.

B. the absolute level of futures prices.

C. the fact that basis cannot be predicted exactly.

A. the inherent volatility of futures prices.

B. the absolute level of futures prices.

C. the fact that basis cannot be predicted exactly.

C. The fact that basis cannot be predicted exactly

71

New cards

Select all correct answers:

A. The more negative (or less positive) the basis becomes, the weaker it is.

B. The basis is generally more stable and predictable than either the cash market or futures market prices.

C. The more positive (or less negative) the basis becomes, the stronger it is.

D. A short hedger benefits from a strengthening basis.

A. The more negative (or less positive) the basis becomes, the weaker it is.

B. The basis is generally more stable and predictable than either the cash market or futures market prices.

C. The more positive (or less negative) the basis becomes, the stronger it is.

D. A short hedger benefits from a strengthening basis.

All of them

72

New cards

Refer to the table below when answering the next two questions:

Short Hedge - Price Decrease and Basis Strengthens

Futures Cash Basis

September Price 3.5 -0.3

December Price 3.0 -0.1

Gain / Loss

Price of corn at beginning of hedge

Gain / loss from cash position

Gain / loss from futures position

Net selling price

What is the net selling price?

A. 3.2

B. 3.6

C.3.4

D. 3

Short Hedge - Price Decrease and Basis Strengthens

Futures Cash Basis

September Price 3.5 -0.3

December Price 3.0 -0.1

Gain / Loss

Price of corn at beginning of hedge

Gain / loss from cash position

Gain / loss from futures position

Net selling price

What is the net selling price?

A. 3.2

B. 3.6

C.3.4

D. 3

C. 3.4

73

New cards

What is the total gain / loss of the trader in $/bu due to the strengthening of the basis?

A. Loss of $0.3/bu.

B. Gain of $0.3/bu.

C. Gain of $0.2/bu.

D. Loss of $0.2/bu.

A. Loss of $0.3/bu.

B. Gain of $0.3/bu.

C. Gain of $0.2/bu.

D. Loss of $0.2/bu.

C. Gain of $0.2/bu

74

New cards

Refer to the table below when answering the next two questions:

Short Hedge - Price Decrease and Basis Strengthens

Futures Cash Basis

September Price 3.5 -0.3

December Price 3.0 -0.5

Gain / Loss

Price of corn at beginning of hedge

Gain / loss from cash position

Gain / loss from futures position

Net selling price

What is the net selling price?

A. 3.2

B. 3

C.3.4

D. 2.8

Short Hedge - Price Decrease and Basis Strengthens

Futures Cash Basis

September Price 3.5 -0.3

December Price 3.0 -0.5

Gain / Loss

Price of corn at beginning of hedge

Gain / loss from cash position

Gain / loss from futures position

Net selling price

What is the net selling price?

A. 3.2

B. 3

C.3.4

D. 2.8

B. 3

75

New cards

What is the total gain / loss of the trader in $/bu due to the weakening of the basis?

A. Loss of $0.2/bu.

B. Gain of $0.5/bu.

C. Loss of $0.7/bu.

D. Gain of $0.2/bu.

A. Loss of $0.2/bu.

B. Gain of $0.5/bu.

C. Loss of $0.7/bu.

D. Gain of $0.2/bu.

A. Loss of $0.2/bu

76

New cards

What would be the total gain / loss of the trader if he had purchased a forward contract to sell corn at $3.5/bu instead of entering into the short hedge described in question 8?

A. loss of .$0.3/bu

B.loss of $0.5/bu

C. gain of $0.5/bu

D. gain of $0.3/bu

A. loss of .$0.3/bu

B.loss of $0.5/bu

C. gain of $0.5/bu

D. gain of $0.3/bu

B. Gain of $0.5/bu

77

New cards

Refer to the table below to answer the question.

\

Long Hedge - Price Increase Long Hedge - Price Decrease

Futures Cash Basis Futures Cash Basis

September Price. 5.5 September Price. 5.5

December Price. 7.5 December Price. 3.5

Gain / Loss Gain / Loss

Price of corn at beginning of hedge Price of corn at beginning of hedge

Gain / loss from cash position Gain / loss from cash position

Gain / loss from futures position Gain / loss from futures position

Net buying price Net buying price

\

The basis is -0.50 in September and strengthens to -0.20 in December.

What is the new net purchasing (buying) price taking into account the change in basis?

A. 4.7

B. 5.3

C. 5.5

D. 5.7

\

Long Hedge - Price Increase Long Hedge - Price Decrease

Futures Cash Basis Futures Cash Basis

September Price. 5.5 September Price. 5.5

December Price. 7.5 December Price. 3.5

Gain / Loss Gain / Loss

Price of corn at beginning of hedge Price of corn at beginning of hedge

Gain / loss from cash position Gain / loss from cash position

Gain / loss from futures position Gain / loss from futures position

Net buying price Net buying price

\

The basis is -0.50 in September and strengthens to -0.20 in December.

What is the new net purchasing (buying) price taking into account the change in basis?

A. 4.7

B. 5.3

C. 5.5

D. 5.7

B. 5.3