Price Action Trading - Daily Review Flashcards

1/88

Earn XP

Description and Tags

Here is a comprehensive list for training the eyes to find the price action relationships that can help you improve your trading when live. These flashcards are my personal interpretations and study notes based on public technical analysis concepts from sources like Dr Brooks, Edwards & Magee, Murphy, and modern price action teachings

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

89 Terms

Daily Chart

Daily chart traders

Buy the Close (BTC)

Sell the Close (STC)

Buy on a Stop 1 Tick above (B STP)

Sell on a Stop 1 Tick below (S STP) traders

Could they get in? Or did they miss out?

Did they get disappointed?

Will they stay in, scale in or breakeven?

Test OHLC?

Daily Chart

Daily Rhythm

Trading Range vs Trend traders

3 in a row?

Breakout vs Failed Breakout

How is the daily chart moving which will influence twhat we expect today?

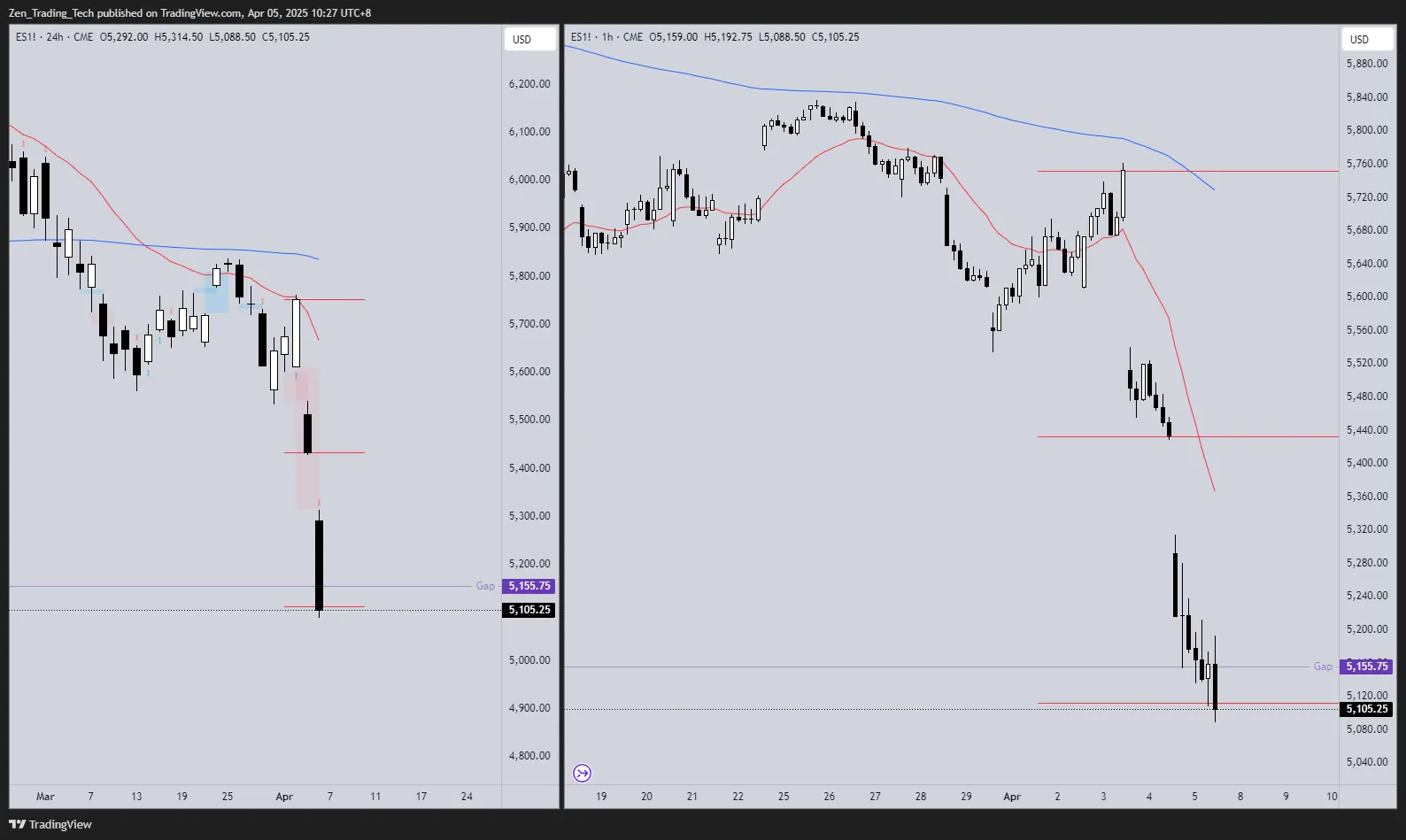

Daily

Daily Gaps

Are we testing gaps on the daily chart?

Daily Chart

Daily - 60m patterns

How is the 60m chart building the daily pattern?

ie Daily pullback bar = 60m spike and channel

ie Daily chart pullback is 10 legs sideways to up correction on the 60m chart

Daily Chart

Daily - Is Yesterday a Good Signal Bar?

Daily Chart

Daily

Measured Move of Yesterday’s Range (MMYD)

Success / fail

MM of a prior day?

Daily Chart

Daily - Yesterday

Where are we opening?

ie 50% pullback of YD, test the lows again?

Daily Chart

Daily

2 tests of Yesterday’s high or low

Should try twice to breakout either way

Inside days are rare

60m

60m- Actions & targets

Did traders BTC/STC of 1st/2nd 60m bar?

Did traders B STP Above or S STP Below the 1st/2nd 60m bar?

Did their trades work or fail by bar 36 or 42?

60m

60m

ES 20pt Swings usually line up with the 60m immediate probability

60m

60m - Good SB H/ L (Live / Done)

Good Signal Bar Live means we are still on a 60m buy or sell that hasn’t failed / reached target yet, probably from yesterday

60m

60m - HTF - LTF BO Trading

Higher timeframe → lower timeframe

ie 60m Breakout trading means that we have had consecutive 60m bars and are expecting a second leg up on the 60m chart. So fading it for scalps at best only

60m

60m - Always in / Structure / Legs

On the 60m chart are we always in long or short?

What 60m pattern are we in?

How many legs on the 60m chart do we have?

60m

60m - Scale in traders

Is the 60m bar good enough to:

Buy below as a bull?

Sell above as a bear?

60m

60m chart traders

Buy the Close (BTC)

Sell the Close (STC)

Buy on a Stop 1 Tick above (B STP)

Sell on a Stop 1 Tick below (S STP) traders

Could they get in? Or did they miss out?

Did they get disappointed?

Will they stay in, scale in or breakeven?

Test OHLC of the 60m bar?

60m

HTF → LTF

(Higher time frame - Lower time frame)

Look for market structure

ie

Tight Channel on 60m chart, what to expect on 5m chart?

Always in Short on 60m chart - what to expect on 5m chart?

15m

15m chart traders

Buy the Close (BTC)

Sell the Close (STC)

Buy on a Stop 1 Tick above (B STP)

Sell on a Stop 1 Tick below (S STP) traders

Could they get in? Or did they miss out?

Did they get disappointed?

Will they stay in, scale in or breakeven?

Test OHLC of the 15m bar?

15m

15m - Actions & targets

Did traders BTC/STC of 1st/2nd 15m bar?

Did traders B STP Above or S STP Below the 1st/2nd 15m bar?

Did their trades work or fail by bar 9 or 12?

15m

15m

ES 20pt Swings usually line up with the 15m immediate probability

15m

15m - Always in / Structure / Legs

On the 15m chart are we always in long or short?

What 15m pattern are we in?

How many legs on the 15m chart do we have?

Open

Open - Hot Zones

Wide stop at a critical point out of current structure

ie breakout point or gap from last structure

We are usually in the middle of these two zones

Open

Open - Wide Stops

Can bears use a bear bar from yesterday RTH?

Can bulls use a bull bar from yesterday RTH?

Open

Open - Magnets / MM / Spike fails

Where are the measured moves from the last spike which failed? Project up 1x and 2x

Open

Open - In/out YD Range

Are we within Yesterday’s range or Yesterday’s channel or did we break it yet?

Open

Open - 18-bar range

90% time, the days HIGH or LOW is formed in the first 18 bars

Open

Open - 2 - 5 Reversals

50% opening moves reverse

80% opens have 2 or more reversals

Many days have 5 mini-reversals inside an opening range

Double Top and Double Bottom and one more for Breakout Mode

For a breakout and measured move

Open

Open - Gap - Agree

Does the first bar of the day agree with the gap direction?

Open

Open - ORBOMM vs Failed

Opening Range Breakout Measured Move

Open

Open - TFO / TRO

Trend From Open / Trading Range Open

Open

Open - Gap Up H1 - Gap Down - L1

On a Gap Down, traders will usually sell below the first and second reasonable sell signal

Did they succeed or get trapped?

One a Gap Up, traders will usually buy above the first and second reasonable buy signal

Did they succeed or get trapped?

Open is the 2nd leg down

Open - Open/1st move broke YD swing points / TL

Open

Open - Gap Pullback (CHPB or MM)

The opening gap is a big bar,

so we are pulling back 50% - 65%

to do a second leg of that move?

Did we go a measured move of the opening gap?

Open

Open - B1 a good trade?

Bar 1 is the high of low of the day 20% of the time

Could you fade bar 1 and make money?

Open

Open - Gap Bigger than YD Range

Open

Open - Gap Close Trades

How can traders profit from the gap closing vs gap staying open?

Open

Open - Give DAILY traders chance to enter?

Did the gap prevent RTH traders a chance to enter at the best DAILY price?

Trend

Early Exit - Get Back In

Trend continues but you exit above a good opposite bar / scalp distance above any bar

How to get back in?

Trend

Reverse get 1:1 loss back

If traders take a loss, were they able to reverse and make it back or not?

Trend

Swing Stop Hit - 1 more leg / take $ soon

Last swing stop was hit

Don’t reverse yet

Last leg coming and final profits soon

Trend

Swing back to trapped traders

Is it a day where ALWAYS IN traders can get out without a loss?

can countertrend traders also do it?

Trend

Doubles

Expect DT in BL to fail

Expect DB in BR to fail

Market Cycle

Spike, Pullback, Channel

Find Spike, PB, CH, TR areas

Market Cycle

Channel is a test target

Spike Channel then,

TR tests start of channel

Market Cycle

Always in

Find Always in areas

Where does always-in finish?

ie Find TR areas

Market Structure

Breakout and Follow-through

BO+FT Close > H vs Failed

BO+FT Close < L vs Failed

Market Structure

Leg counts

Find 2 and 3 legged moves

Market Structure

Trendlines

Trendlines / CH Lines / test / overshoots

Market Structure

Spike break x 3

You see a spike, and then a pullback breaks the spike, it happens 3 times so 3 legs

Market Structure

Best Trade of the Day

Market Structure

Unluckiest trader in the World

Market Structure

Doubles - DB MM Up / DB Fails MM Down / DT MM Down / DT Fails MM Up

Market Structure

Day Structure - 2R of what?

Swing trades on higher timeframes - 2R Daily?, Weekly? 60m? Etc.

Market Structure

Leg 2 / 3 Breaks - MM Up / Down

Bear case:

Going down leg 2 then leg 3,

Then we trade above leg 3 - measured move up?

We go above leg 2 - measured move up?

Market Structure

Open Gaps - Swing to hit em

Market Structure

Pullback tells you where MM is

Market Structure

Trendline Break New H Reversal - Jingle

Market Structure

Swing trade?

Market Structure

Wedges and Countertrend wedges

Market Structure

2 tests

Market Structure

2 closes outside of a range / failed BO range

Trades

Breakout and Follow-through ZIGZAGS

Draw the lightning bolt for every 2 legged move

Trades

Reasonable BTC/STC (Always in entries) / failed

Trades

Reasonable STP entries / failed

Trades

Microchannel entries / failed

Trades

CSC (Consecutive) Bars - BO and FT / failed

Trades

Correct Wide Stop Spike H1 / Spike L1 - success? fail? reverse?

Trades

Test good entries (2nd chance entries)

Trades

Good trade failed - graveyard - look to trade away from it, back to it

Trades

2nd Entry trading system

Trades

Fading countertrend traders

Trades

BO and PB Limit order entry - 2nd Leg

Trades

Shaved bar test - 2L

Trades

Weak Reversal Fade

Trades

Enter where other traders EXIT

TRD

OoD - Middle of the day

TRD

Split into 1/3s - 2ES/3ES Low and 2EL/3EL High

TRD

Moves go back to entry

TRD

Use highs and lows to enter

TRD

Scale in 1x or 2x scalp

TRD

Fading flags at extremes

TRD

Fade 3 CSC (Consecutive) Bars

TRD

Always in - AIL BB Prior Bar / AIS SA Prior Bar

Buy Below / Sell Above

TRD

BB BL Spike / SA BR Spike

TRD

BB Weak S Bottom - SA Weak B Top

TRD

Test Spike break / Trendline break

TRD

Test Good Bar Failed

TRD

Test Weak bar worked

TRD

Breaking DT and DB then reversing

Daily Gap Open

Traps Daily traders