YEAR 10 BUSINESS

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

WHAT IS AN ENTREPENEUR?

A person who sets up a business or businesses, taking on financial risks in the hope of profit.

BEING SELD EMPLOYED (ADV)

ADVANTAGES

Sense of independence

own profit, reward and satisfaction

develop own ideas

employ family members

BEING SELF EMPLOYED (DISADV)

hard work and longer hours

income may fluctuate

risk of failure

stress

high levels of responsibility

SOLE TRADE → LEGAL STRUCTURE

OWNER HAS AND OPERATED BY ONE PERSON

HAS UNLIMITED LIABILITY AND UNINCORPORATED

Adv:

Low entry cost/operation cost

Complete control

Less government regulation

Dis:

Unlimited liability/unincorporated

Difficult to operate when sick

End of business when owner dies

PARTNERSHIP → LEGAL STRUCTURES

OWNER AND OPERATED BY 2-20 PEOPLE

CAN BE FORMED VERBALLY, IN WRITING OR WITHOUT ANY LEGAL BNDING AGREEMENT

HAS UNLIMITED LIABILITY AND UNINCORPORATED

Adv:

Low entry/operation cost

Shared responsibility and workload

Business continues if parter dies

Dis:

Unlimited liability/unincorporated

Possibility of disputes

Difficulty finding suitable partners

PRIVATE COMPANIES → LEGAL STRUCTURES

2-50 PRIVATE SHAREHOLDERS, USUALLY HAS ‘PTY LTD’ AT THE END OF ITS NAME

INCORPORATED, LIMITED LIABILITY

SHARES ONLY SOLD IF THE DIRECTOR APPROVES

ADVANTAGES OF OWNING A COMPOANT

EASIER TO ATTRACT FINANCE

LIMITED LIABILITY/INCORPORATED

EXPERIENCED MANAGEMENT

DISADVANTAGES OF OWNING A COMPANY

COST OF FORMATION

DOUBT TAXATION

MUST MAKE A YEARLY ANNUAL REPORT OF ACCOUNTS

WHAT IS PROMOTION

MAKING PEOPLE AWARE OF YOUR BUSINESS

ADVERTISING → PROMOTION MIX

messages communicated through mass media

ADVANTAGES

Attracts attention

Shares in about business to wider audience

DISADVANTAGES

Costly for advertisements

Risk of low response rates

PERSONAL SELLING→ PROMOTION MIX

the activities of a sales representative directed to a customer to make a sale

ADVANTAGES

Personalised approach → assuming their needs

DISADVANTAGES

Hiring and training a sales force can be expensive

RELATIONSHIP MARKETING →PROMOTION MIX

making long-term, cost effective and strong relationships with individuals customers

ADVNTAGES

Increased customer lifetime value

Improved customer retention

DISADVANTAGES

Difficult to manage time

The expectations of returning customers

SALES PROMOTION → PROMOTION MIX

the use of activities or materials as direct inducements to customers

ADVANTAGES

Enhances the attraction to new customers

Increases productivity and performance of employees

DISADVANTAGES

Short-term impact

Cannibilisation: sales promotion reduces to regular products/services or shift the demand from one period to another

PUBLICITY → SALES PROMOTION MIX

any free news story about business product (not under business control)

ADVANTAGES

Credibility

Cost effective

Broad reach

DISADVANTAGES

Lack of control

Negative publicity

Unreliable timing

PUBLIC RELATIONS → PROMOTION MIX

activities aimed at creating and maintaining favourable relations between the business and its customers

ADVANTAGES:

enhanced brand credibility

Cost-effective

DISADVANTAGED:

increased competition

Unpredictable

PLACE STRATEGIES → DISTRIBUTION CHANNELS

DISTRIBUTION CHANNELS REFERS TO THE CHANNELS CHOSEN TO GET THE PRODUCTS TO THE CUSTOMER. THERE ARE THREE TYPES OF DISTRIBUTION CHANNELS. THESE INCLUDE:

PRODUCER TO CUSTOMER

PRODUCER TO RETAILER TO CUSTOME

RPRODUCER TO WHOLESALER TO RETAILER TO CUSTOMER

CHANNEL CHOICES → PLACE STRATEGIES

CHANNEL CHOICES REFERS TO HOW AVAILABLE THE BUSINESS CHOOSES TO MAKE THE PRODUCT ACROSS A MARKET. THERE ARE THREE CHANNEL CHOICES, THESE INCLUDE:

INTENSIVE

SELECTIVE

EXCLUSIVE

INTENSIVE → CHANNEL CHOICE

Business is available in all stores

ADV:

increased market coverage,

higher sales volume

DIS:

lower profit margins,

increased distribution costs

SELECTIVE → CHANNEL CHOICE

Business is open in certain stores

ADV

greater control over brand image

Better retailer relationships

DIS

Limited market reach

Increased pressure on brand loyalty

EXCLUSIVE → CHANNEL CHOICE

Business is open only in the actual store itself

ADV

strong brand image and prestige

Increased customer loyalty

DIS

Limited market reach

High dependency on the chosen retailer

WHAT IS HUMAN RESOURCES

The management of the relationship between employee and employers

TYPES OF TRAINING METHODS

off the job training → ex, taking courses

On the job training → ex, being taught how to make meals at a restaurant

Mentoring → ex. A mentor is not a dictator, simply a help and guide

BENEFIT OF TRAINING AND DEVELOPMENT → NEW WORKERS

Opportunities for promotion and self improvement

Improved job satisfaction through better job performance

A challenge (chance to learn new things)

INTERNAL SOURCE OF FINANCE

funds generate from inside the business

Main type of finance is; retained profits

Retained profits = profits that are kept in the business for investments in future business activities

In Australia, approx 50% off profits retained to be reinvested.

EXTERNAL SOURCE OF FINANCE

funds provided from sources outside the business

Debt and equity

ADVANTAGES OF DEBT

owner does not have to sell any ownership in the business

Easy to access

Tax deductions

DISADVANTAGES OF DEBT

Needs to be repaid

Has interest

Makes company less attractive to investors

May need to offer ‘collateral’

ADVANTAGES OF EQUITY

No repayments need to be made

Low risk

No additional financial burden

Cheaper source of finance

Investors with expertise and connections

DISADVANTAGES OF EQUITY

loss of ownership and control

Dividends must be paid

Reduced profits for owners

Can’t be acquired at short notice

3 TYPES OF FINANCIAL STATEMENTS

CASH FLOW STATEMENT

INCOME STATENMENT

BALANCE SHEET

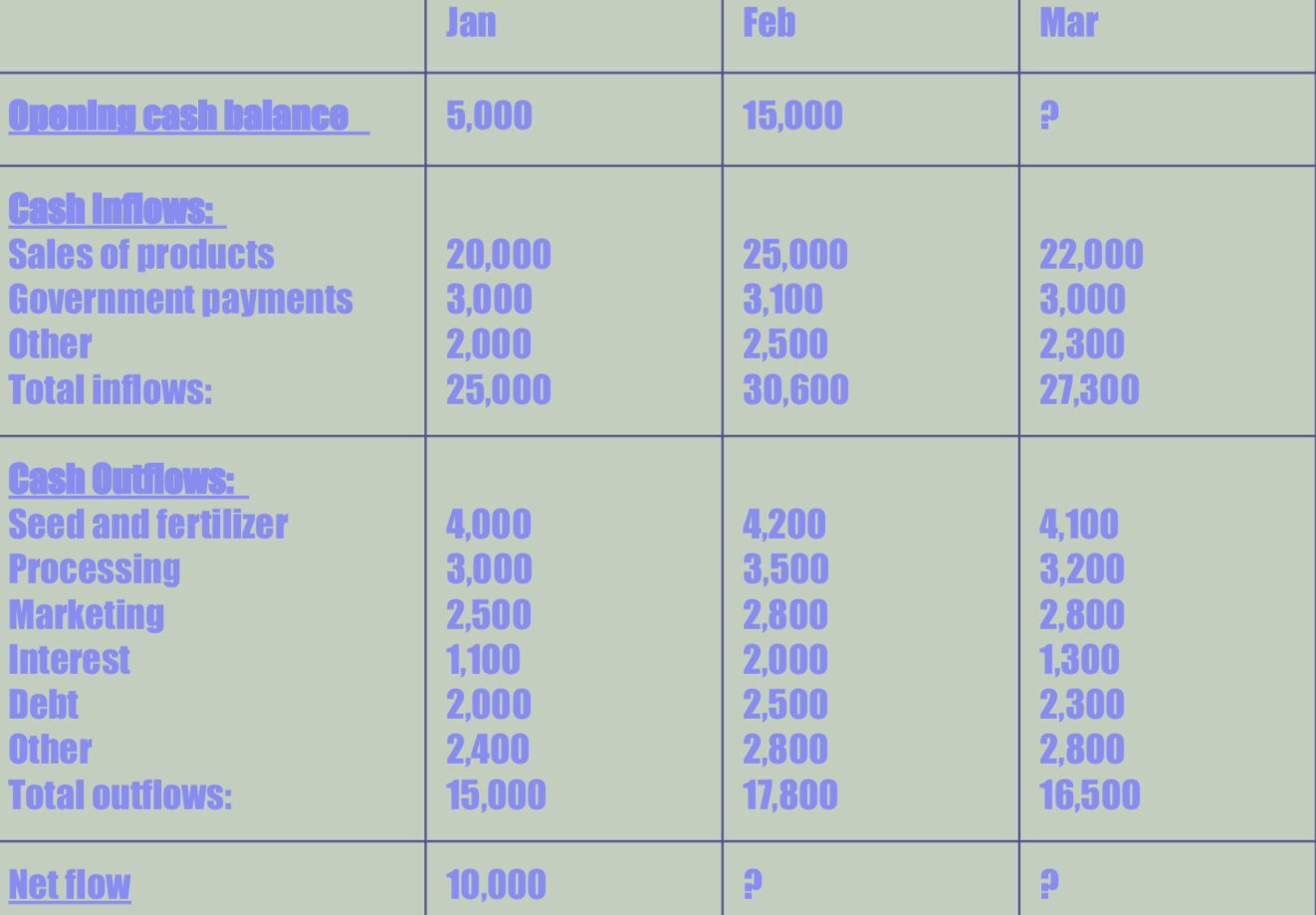

CASH FLOW STATEMENT

indicate the movement of cash receipts and cash payments resulting from transactions over a droid of time.

Measures liquidity → the ability to meet short-term financial obligations

CASH INFLOW → MONEY COMING IN

Sales

Loan

Investment (equity)

CASH OUTFLOW → MONEY COMING OUT

Debt

Wages

Bills

Marketing

WHAT IS LIQUIDITY

means to see if you accomodate for financial obligation

FORMULA:

INFLOW - OUTFLOW → OPENING BALANCE + NETFLOW = CLOSING BALANCE

MARKET SHARE

IS THE AMOUNT OF SALES A BUSINESS HAS IN A INDUSTRY

SHARE MARKET

SHARE MARKET IS WHERE YOU GO TO BUY SHARES (ASX)