11.3 Inflation and Deflation

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

16 Terms

What is inflation

Inflation is the sustained rise in the general price level over time, leading to a decrease in purchasing power of money

What is deflation

Deflation is the opposite of inflation, where the average price level in the economy falls, and there is a negative inflation rate

What is disinflation

Disinflation is the falling rate of inflation, where the price level is still rising, but at a slower rate than before

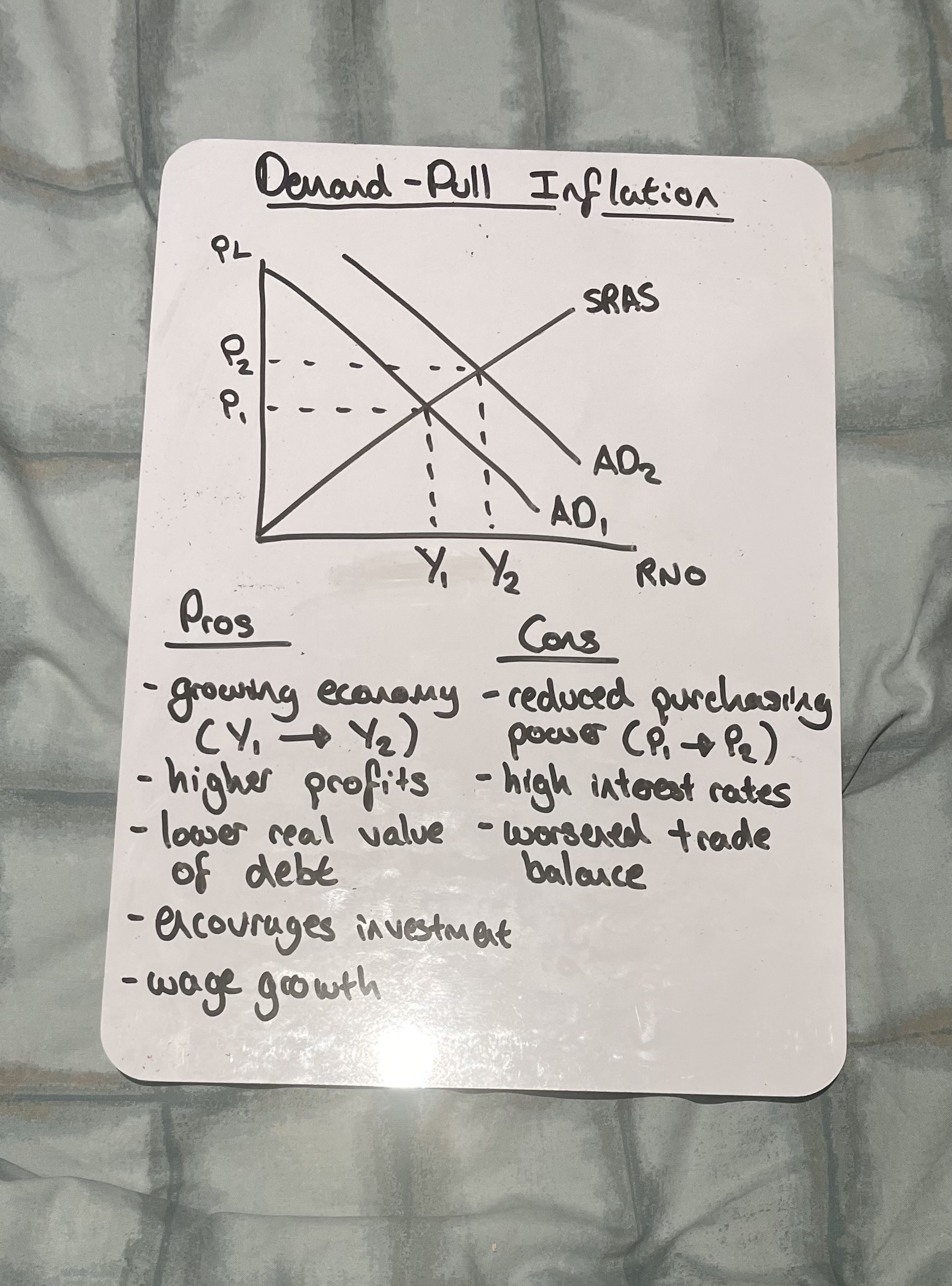

What is demand-pull inflation

Demand-pull inflation occurs when aggregate demand grows unsustainably, putting pressure on resources and causing producers to increase prices

Draw demand-pull inflation

What are the key trigger for demand-pull inflation

Depreciation of the exchange rate

Fiscal stimulus (Lower taxes or more govt spending)

Lower interest rates

High growth in export markets

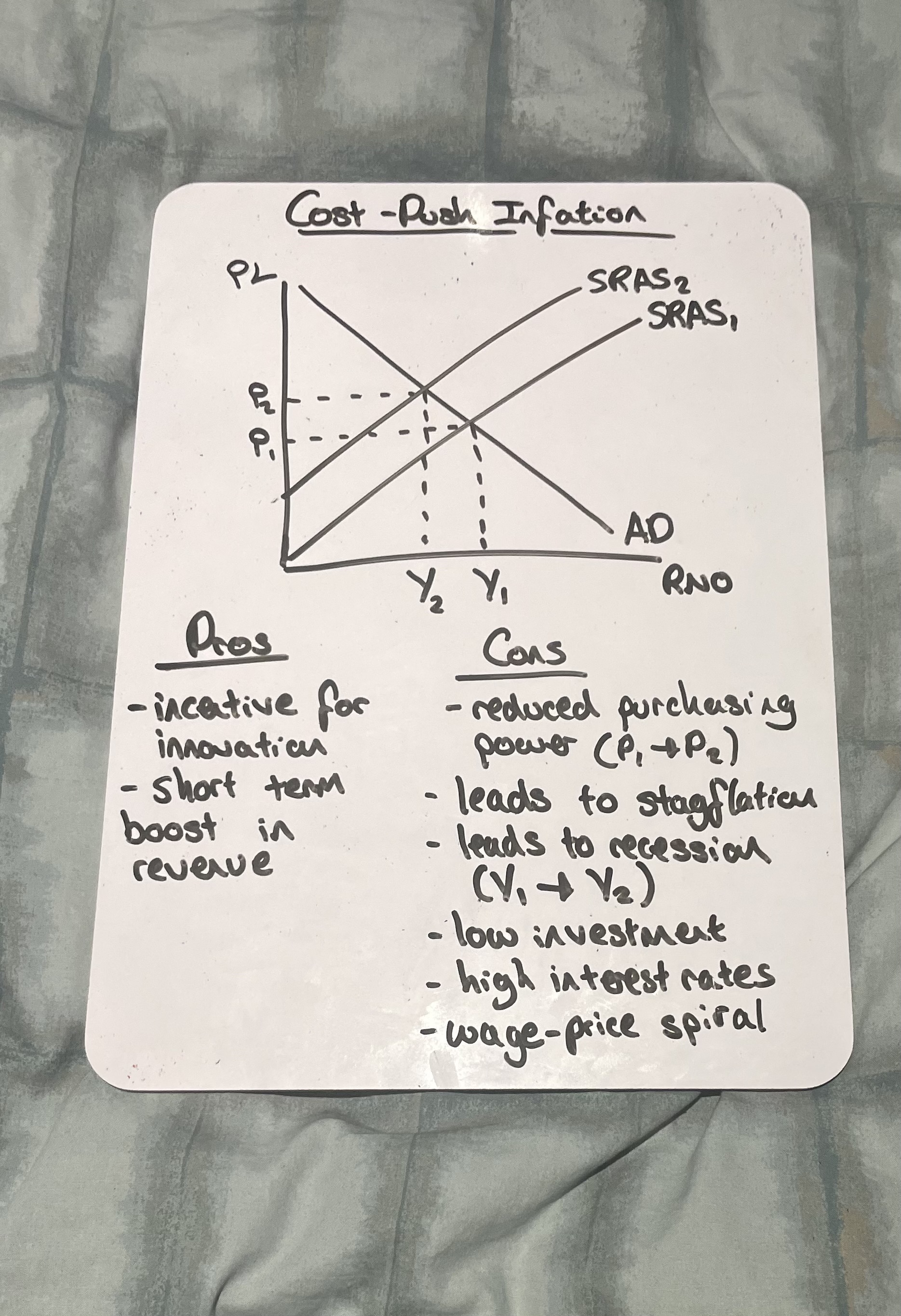

What is cost-push inflation

Cost-push inflation occurs when firms face rising costs of production, pushing up the general price level

Draw cost-push inflation

What are the key factors causing cost-push inflation

Rising commodity prices (e.g. oil)

Increased labour costs

Indirect taxes

Depreciation of the exchange rate

Effect of inflation on consumers

Consumers on low and fixed incomes are hardest hit by inflation due to the rising costs of necessities, which reduces their purchasing power

Effect of inflation on loans

Inflation reduces the real value of debt, making it easier for consumers with loans to repay them

Effect of inflation on firms

High inflation can make borrowing and investing less attractive

Workers may demand higher wages, increasing production costs

Firms may lose global competitiveness if inflation is higher than in other countries

Effect of inflation on the govt

The government may need to increase state pensions and welfare payments due to the rising cost of living

Effect of inflation on workers

Real incomes fall, reducing disposable income

Firms may make redundancies to cut costs

Economic effects of deflation

Economic decline and rising unemployment

Consumers with high debt face more difficulty repaying loans

Wages may fall, leading to lower disposable income and spending

What is Fisher’s equation of exchange

Fisher’s equation is: MV = PQ

M= money supply

V = velocity of circulation

P = price level

Q = quantity of real goods sold