BM Topic 3.3: Costs & Revenues

1/11

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

12 Terms

4 main types of costs

fixed

variable

direct

indirect (overhead)

What are ‘costs’ & some examples?

costs are the charges that an organisation incurs from its operations.

purchase of raw materials & components for production

purchase of stocks (inventory) of components or finished goods from suppliers

rent for hiring the commercial premises or mortgage payments for financing land, premises & buildings

insurance payments for public liability, buildings insurance & vehicle insurance

salaries & wages to employees

payment for utility bills for gas, electricity & telephone charges

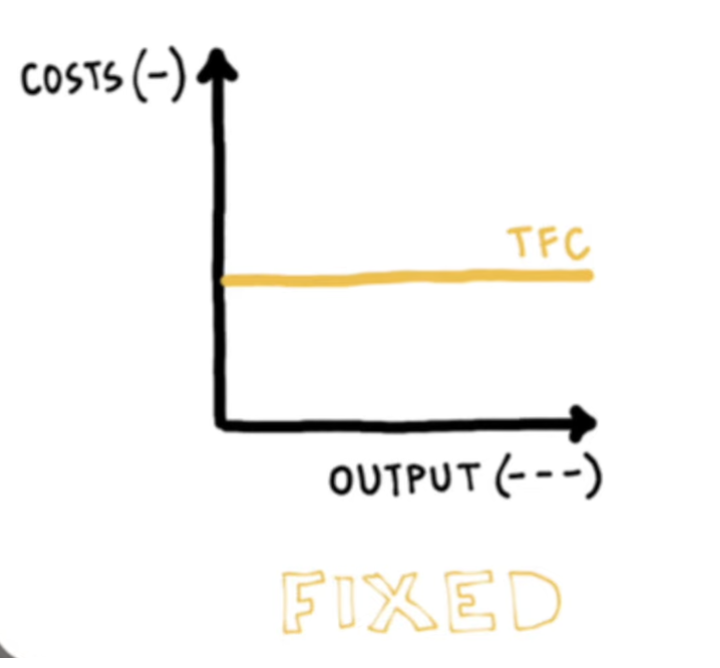

Define ‘fixed costs’ & some examples

costs that do not change depending on the level of output or quantity. have to be paid irrespective of how much is produced or sold.

rent payments

salaries to management

internet

*sometimes referred to as total fixed costs (TFC)

Define ‘variable costs’ & some examples

costs that change in proportion with the level of output. these costs rise when the firm’s output or sales volume increases

purchasing of raw materials & components for productions

commission paid to sales staff

piece-rate wages

***when a firm’s fixed costs are combined with its variable costs, the total cost of production can be determined

What is the ‘total cost of production’ & how to calculate it?

the aggregate amount of money spent on the output of a business

total costs = total fixed costs + total variable costs

What are the ‘average costs (AC) (or average total costs (ATC))’ & how to calculate it?

average cost (AC) refers to the cost per unit

average cost (AC) = total cost (TC) ÷ quantity (Q)

average cost (AC) = average fixed cost (AFC) + average variable cost (AVC)

a decline in average total cost as output rises shows the organization experiences economies of scale

a rise in average cost as output rises shows the organisation experiences diseconomies of scale

average fixed cost will always fall when the level of output increases because total fixed cost is spread over an increasingly larger level of output

Define ‘direct costs AKA cost of sales’ & some examples

expenses that can be directly tied (evidently & explicitly associated) to the output or sale of a certain good, service, or business operation.

e.g. direct costs for a hair salon include money spent on hair products like shampoo, conditioner, hair dyes

Define ‘indirect costs AKA overhead’ & some examples

costs that are not easily identifiable with the sale or output of a specific good, service, department, or business operation

rent on premises

salaries for administrative staff

fees paid for legal & accounting services

general insurance for third parties, fire & theft

costs involved with maintaining & running the organisation

Define ‘revenue’ & how to calculate it

the money coming into a business from the sale of goods and services

total revenue = price of product x quantity sold

Define ‘revenue streams’ & examples

the various sources of revenue for a business (other than trading activity) OR means, other than trading activity, used to generate income for an organisation

dividends

interest on deposits (bank deposits)

merchandise

donations

sponsorship deals

advertising revenue

subscription

rental income

licensing fees

royalties

leasing charges

recurring grants & subsidies from the government

Define ‘total revenue’

the sum of income received by a business from its trading activities