Chapter 5: Economic Growth, The Financial System, and Business Cycle

1/53

Earn XP

Description and Tags

Chapter 5 of Econ 104 Final Exam

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

long-run economic growth

the change in GDP over time. It is the increase in the economy’s capacity to produce goods and services

how is economic growth measured

by the changes in GDP or GDP per capita over a long period of time.

GDP per capita equation

Real GDP

────────

Population

Economic growth equation (% change)

gdp (x) - gdp (y)

growth in x = ────────────── * 100

gdp (y)

Economic growth over a long period of time equation (annual avg. growth rate)

GDP(x)

( --------------------- )1/n − 1 × 100

GDP(y)

Rule of 70

if a country’s real GDP per capita grows at a constant rate of (g) percent, GDP per capita will double its current value

Rule of 70 equation

70

( --------------------- )

growth rate

Determinants of long-run growth

labor productivity

property rights

Labor productivity

the amount of output per hour of work; it is made up of capital (equipment/machinery) per worker and technological change

Property rights

rules that govern ownership and use of resources

The business cycle

cycle that tells us that we are not always performing at our maximum

Potential GDP

the value of GDP when all firms are producing at capacity

Maximum GDP

The level of GDP that an economy can attain and sustain over a long period of time; determined by resources and technology

The financial system

enables businesses to borrow and invest in new capital, research, and innovation, hire workers, and train existing workers; it matches savers and borrowers

Financial system components

capital markets and financial intermediaries

Capital markets

where firms raise funds by selling stocks and bonds (financial securities)

Financial intermediaries

banks that borrow money from savers at a lower interest rate and lend it borrowers like firms at a higher interest rate

Why do we need financial systems?

risk sharing, liquidity, and information

Risk-sharing

financial systems make it possible for low-income people to invest in diversified investment portfolios like mutual funds

liquidity

Refers to the ease of converting an asset into cash; this incentives savers to invest through the financial system

information

financial intermediaries have access to skill and info that you don’t when it comes to risk assessment

What is total savings equal to

total investments

why does total savings=total investments

S=Y-C-G and I=Y-C-G in a closed economy

Private savings

savings by households

Public savings

savings by the government

Private savings equation

S= Y + TR - C - T

Public Savings Equation

S = T - G - TR

national savings

sum of private and public savings

national savings equation

S = Y - C - G

Government budget balance

refers to the difference between tax revenues (T) and its total expenditure (G + TR)

When is there a budget balance

government expenditure = total tax revenues (G + TR = T), and public savings is 0

when is there a budge deficit

when government expenditure > total tax revenue (G+TR > T), and public savings are negative

when is there a budget surplus

when government expenditure < total tax revenues (G + TR < T), and public savings are positive

How does a budget surplus increase total savings

it adds to government savings, which gets added to private savings

The market for loanable funds

illustrates the equivalence of savings and investment in a closed economy (savers loaning to borrowers)

savers role in the market for LF

suppliers

borrowers in the market of LF

buyers

Demand for loanable funds

comes from businesses willingness to borrow and invest

supply of loanable funds

comes from households’ desire to save and governments budget balance

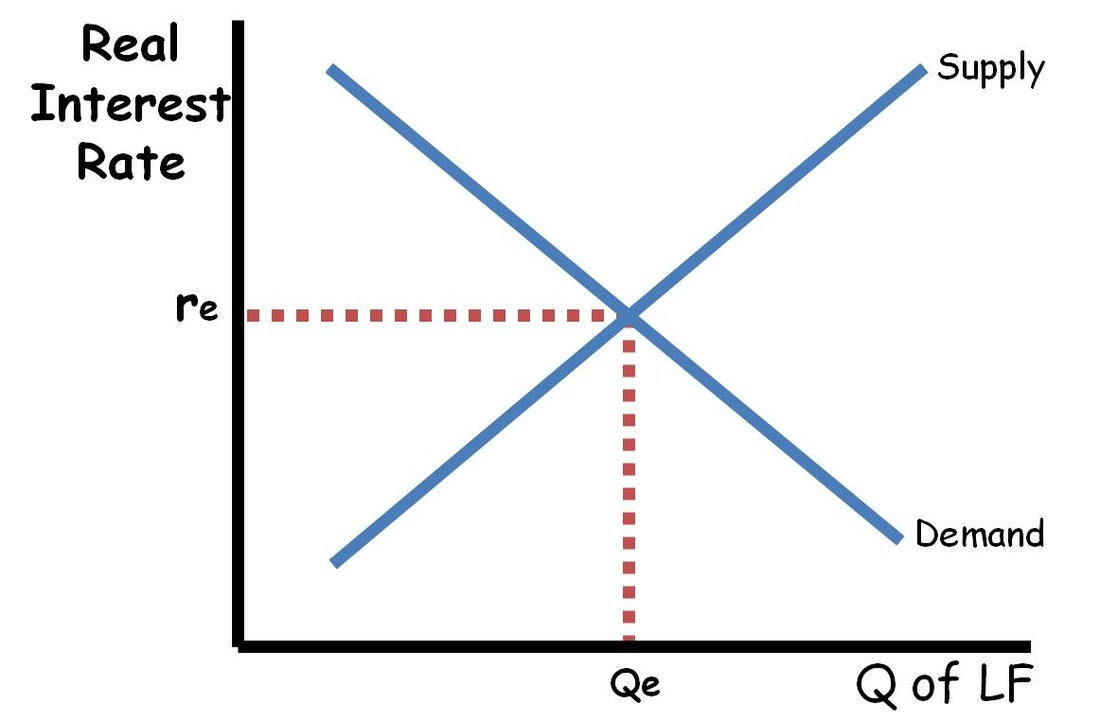

Graph of loanable funds units

Y = real interest rate X=loanable funds per dollar

graph of loanable funds

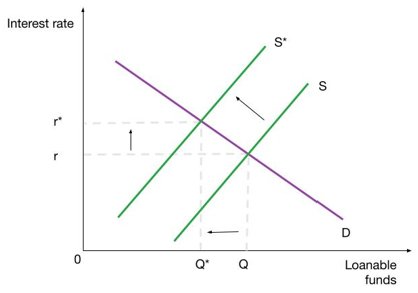

What do changes in savings and investment lead to

Shifts in supply and demand, which leads to a change in the interest rate

the effect of budget deficit on loanable funds

supply shifts left, real interest rate increases, and investment decreases

The effect of budget surplus on loanable funds

Supply shifts right, the real interest rate decreases, and investment increases

The business cycle

alternating periods of expanding and declining economic activity, measured by real GDP

phases of the business cycle

Expansion, peak, recession, trough

expansion phase

production is increasing and so is employment and average incomes

the peak

real gdp had reached its highest short-term level, and signals the end of the expand is on phase

recession phase

follows the peak and its a period of declining production, employment, and average incomes

the trough

at the bottom of the business cycle and signals the end of the recession phase and the start of expansion

the national bureau of economic research (NBER)

publishes business cycle data/dates

when does the inflation rate increase during the business cycle

toward the end of the expansion phase and into the beginning of the next recession

when does the inflation rate decreases during the business cycle

during the recession phase

what is the effect of recessions on the inflation and unemployment rate

inflation rate falls and unemployment rate rises