Bond Default and Liquidity Risks in Financial Markets

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

100 Terms

What are the two financial risks associated with buying and holding bonds discussed in Chapter 17?

Default risk and liquidity risk.

What is default risk in the context of bonds?

Default risk occurs when the issuer of the bond is unable or unwilling to pay the required interest or the face value of the bond at maturity.

Why are US Treasury bonds historically considered default-free?

Most bond investors have great faith in the ability and willingness of the US government to meet its interest payment and maturity obligations.

What is the role of the US Congress regarding the national debt and default risk?

The US Congress has set a self-imposed debt ceiling and must agree by majority vote to raise the ceiling before a default event can occur.

What economic indicators can influence stock and bond prices?

Indicators such as unemployment rates can influence investor expectations regarding economic growth and inflation.

How do stock prices and bond prices typically move in relation to each other?

They often move in opposite directions, although this is not always the case.

What might happen to bond prices if economic growth is anticipated to surge?

Bond investors may bid bond prices lower, pushing yields higher due to concerns about inflation and monetary policy tightening.

What are the implications of a dramatic drop in the unemployment rate for investors?

Stock investors may bid prices higher due to expected increases in corporate profitability, while bond investors may sell bonds due to inflation concerns.

What can cause both stock and bond prices to fall simultaneously?

If both stock and bond investors fear that the Fed will need to raise the Fed Funds rate to contain inflation.

What is liquidity risk in the context of bonds?

Liquidity risk refers to the risk that an investor may not be able to sell a bond quickly or without a significant price reduction.

How does the perception of the business cycle affect bond and stock prices?

The magnitude and direction of price movements depend on investor perceptions of the business cycle phase and expectations for future economic growth and inflation.

What is the significance of the Fed Funds rate in relation to bond and stock prices?

Changes in the Fed Funds rate can influence investor behavior regarding both stocks and bonds, affecting their prices.

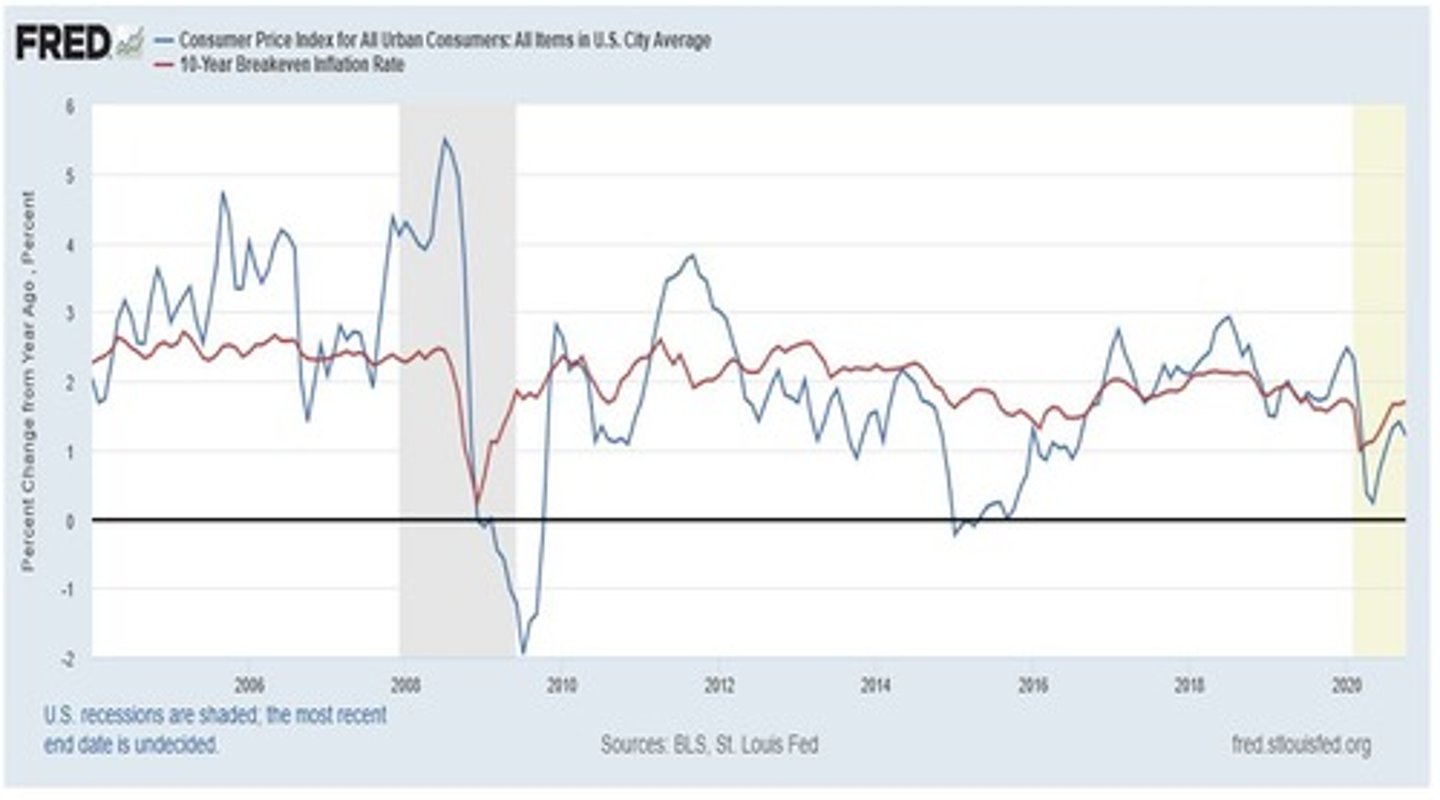

What is the relationship between inflation and bond yields?

As inflation expectations rise, bond yields typically increase as investors demand higher returns to compensate for the loss of purchasing power.

What might lead to a bond investor's decision to sell bonds?

Concerns about rising inflation or anticipated increases in interest rates may prompt bond investors to sell.

What is the primary source of income from bonds?

The income from most types of bonds comes from the yield, or interest, that they pay.

What is a potential consequence of Congress not raising the debt ceiling?

Failure to raise the debt ceiling could lead to a default event where the government cannot meet its debt obligations.

How can the relationship between stock and bond prices affect retirement planning?

Understanding this relationship helps investors make informed decisions about asset allocation in their retirement portfolios.

What is the significance of the year 2022 in the context of stock and bond prices?

In 2022, both stock prices and bond prices fell, illustrating that they do not always move in opposite directions.

What is the impact of economic growth on bond prices?

If economic growth is anticipated, bond prices may decrease due to fears of inflation and subsequent interest rate hikes.

What does it mean for a bond to have a 'face value'?

The face value is the amount the bond issuer agrees to pay the bondholder at maturity.

What is the importance of understanding bond risks for a bond trader?

Understanding bond risks such as default and liquidity risks is crucial for making informed trading decisions and managing investment portfolios.

What can influence the decision-making of both stock and bond investors?

Expectations about economic indicators, such as unemployment rates and inflation, can significantly influence investor decisions.

What is a common misconception about bond income?

Many investors may assume that bond income is guaranteed, but it comes with inherent risks.

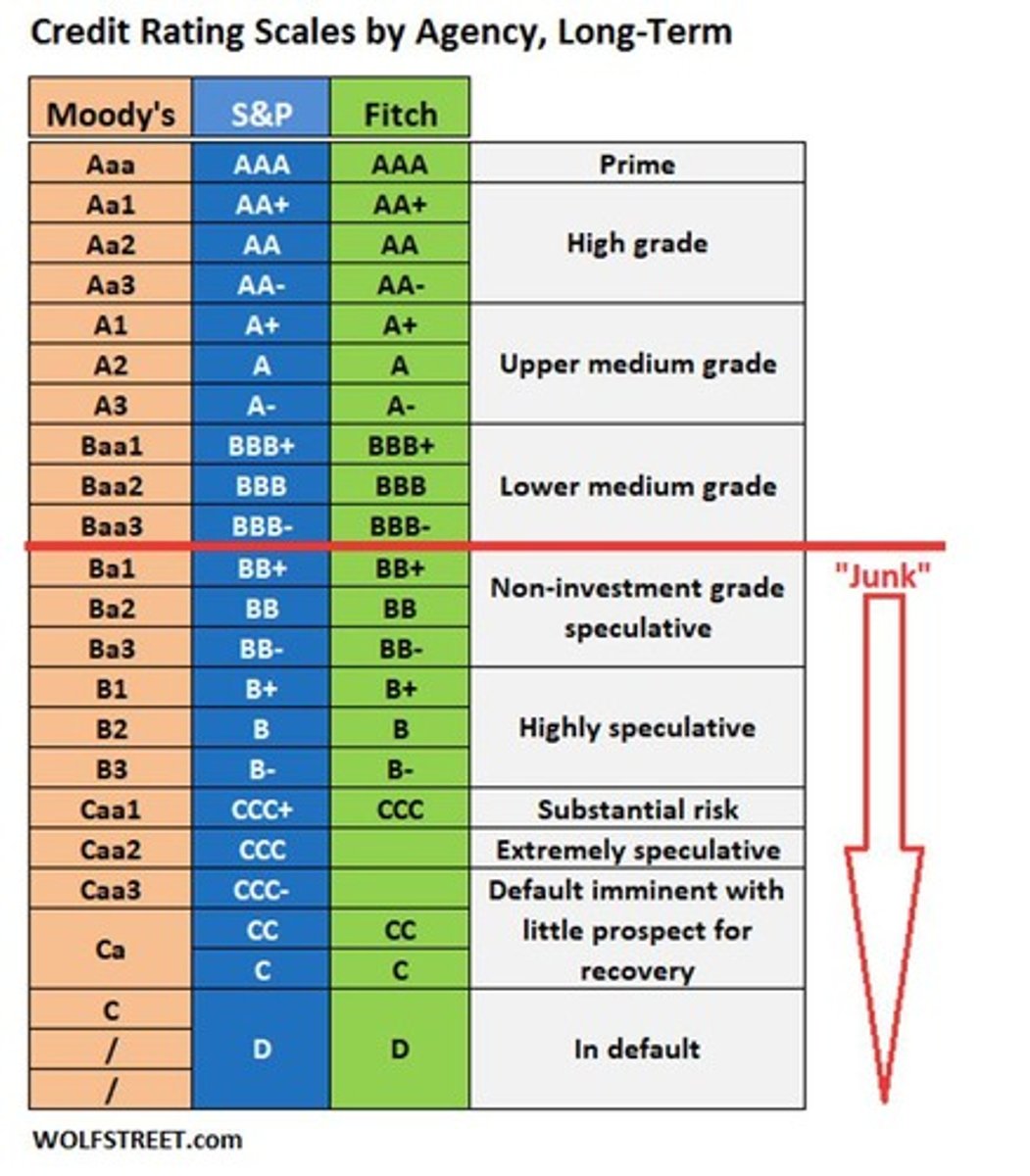

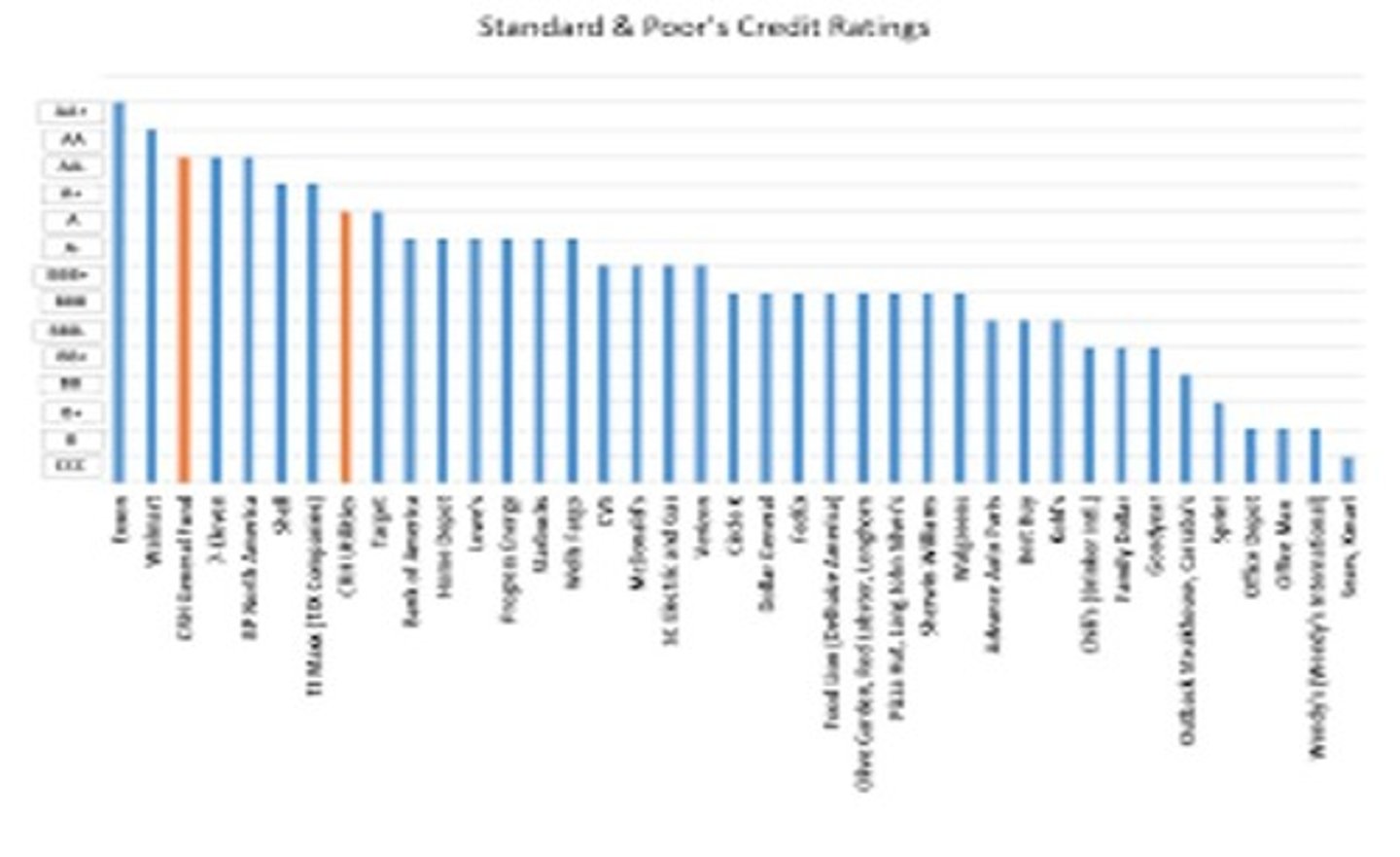

What significant action did Standard and Poor's take in 2011 regarding US Treasury debt?

Lowered its rating from AAA to AA+, its second highest rating.

What political conflict is occurring in early 2023 regarding the federal borrowing limit?

Republicans are trying to reduce federal spending by withholding votes to raise the borrowing limit, while Democrats are attempting to raise it without conditions.

What could happen if the US Treasury is unable to borrow money?

It could lead to a default on Treasury bonds and prevent payments to federal employees, vendors, and entitlement beneficiaries.

Why are Treasury bonds considered to have default-free risk?

Due to widespread expectations of their safety, extensive ownership, and their role as pricing benchmarks in financial markets.

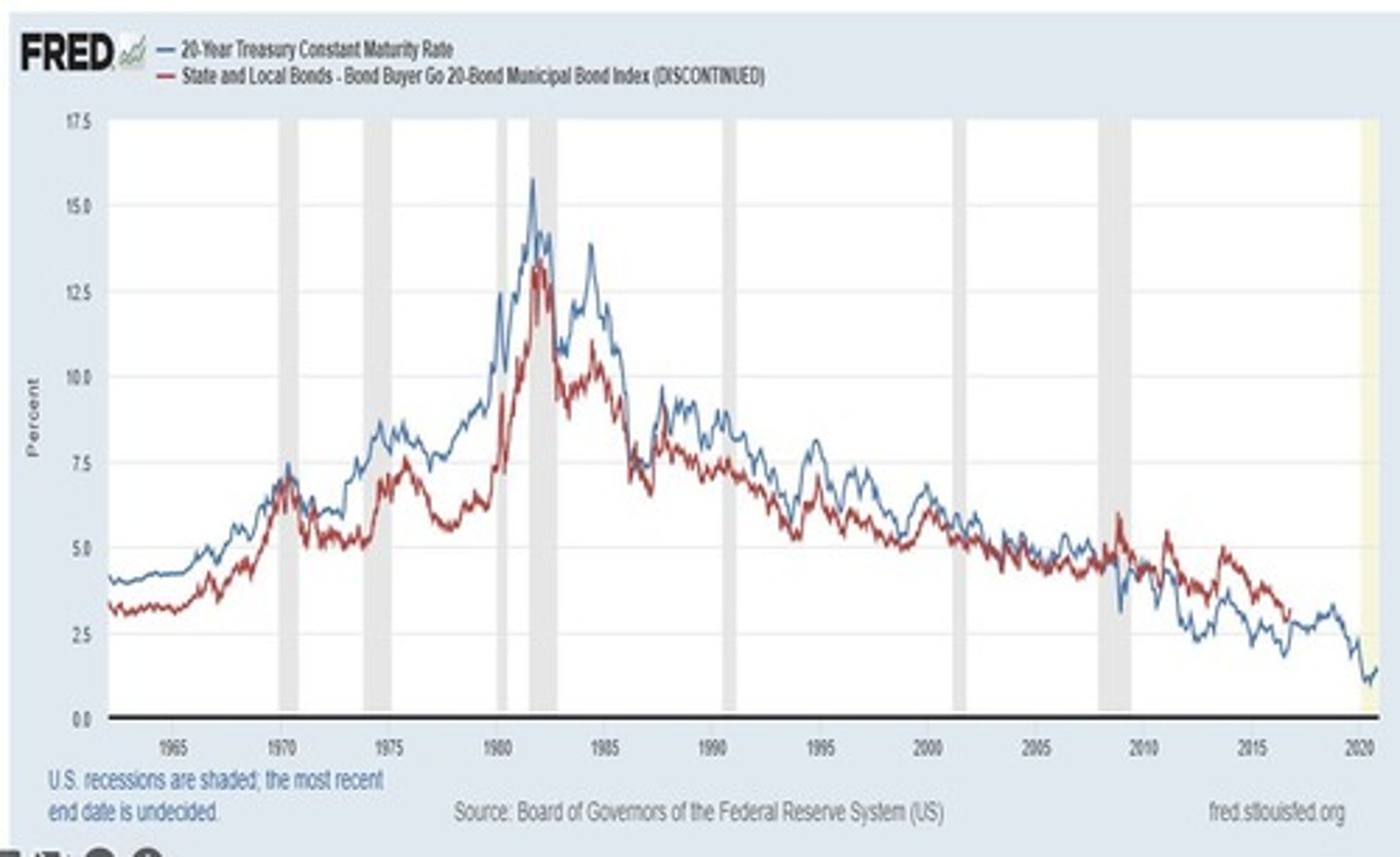

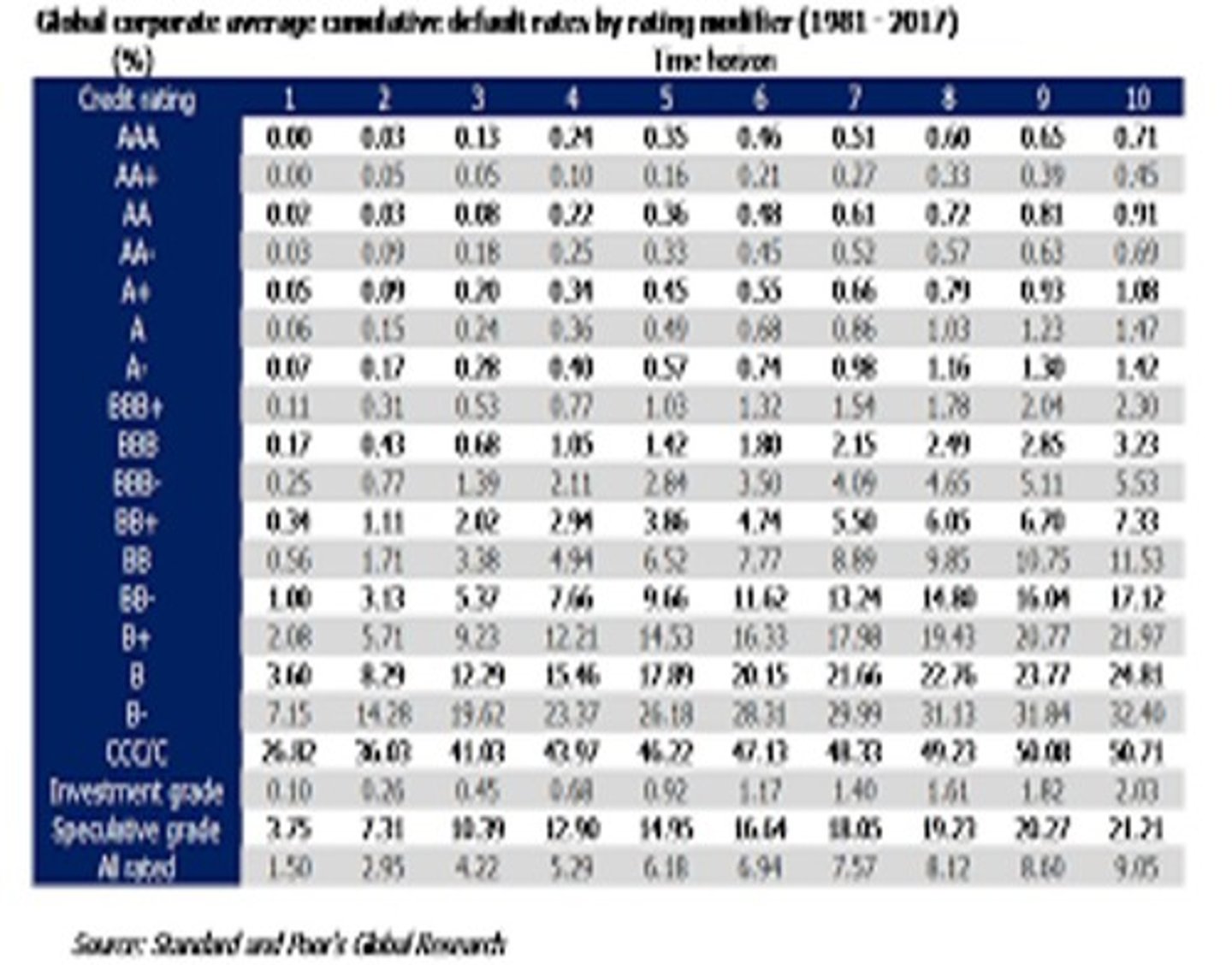

What are the default risks associated with municipal and corporate bonds?

They are not default-free and can go bankrupt, unlike US Treasury bonds.

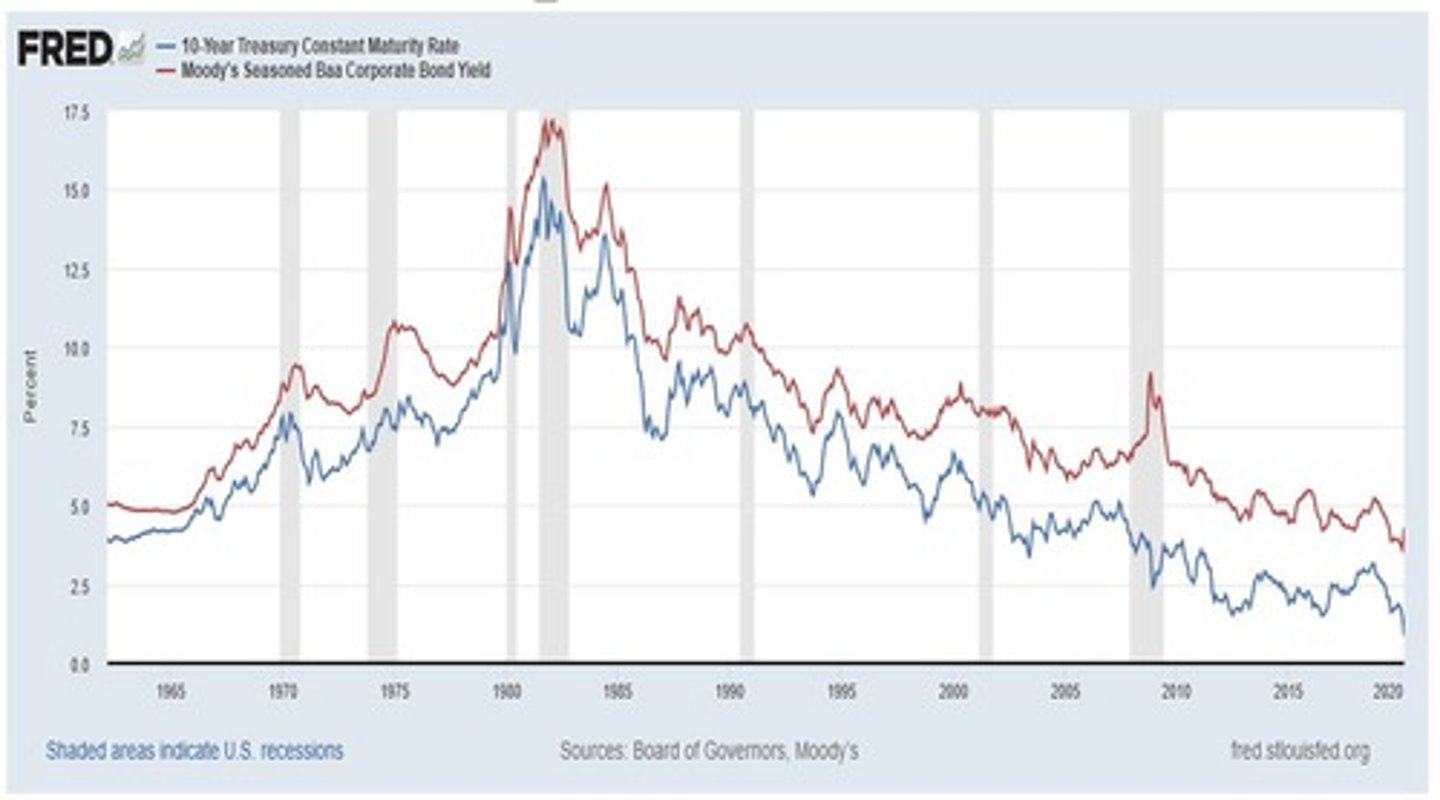

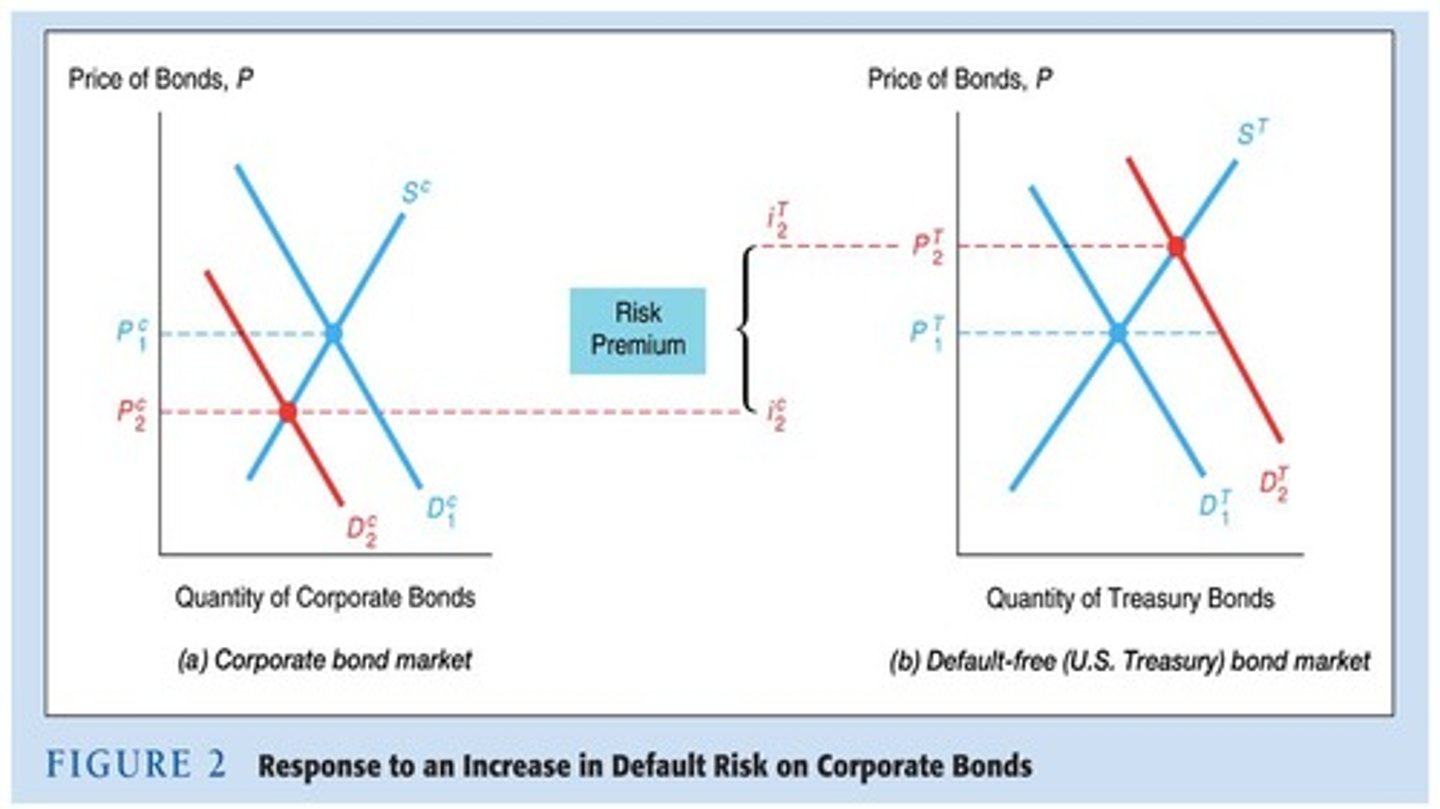

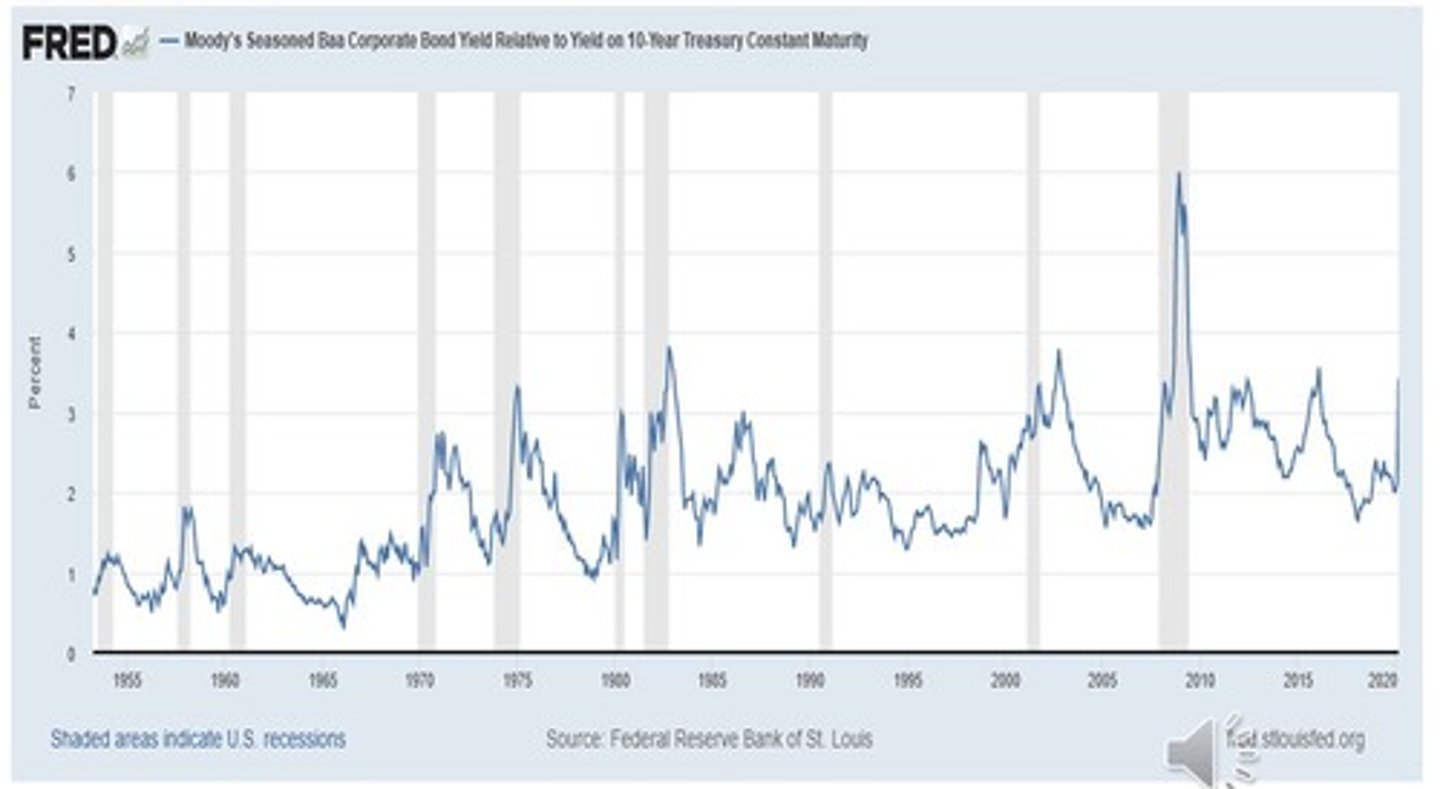

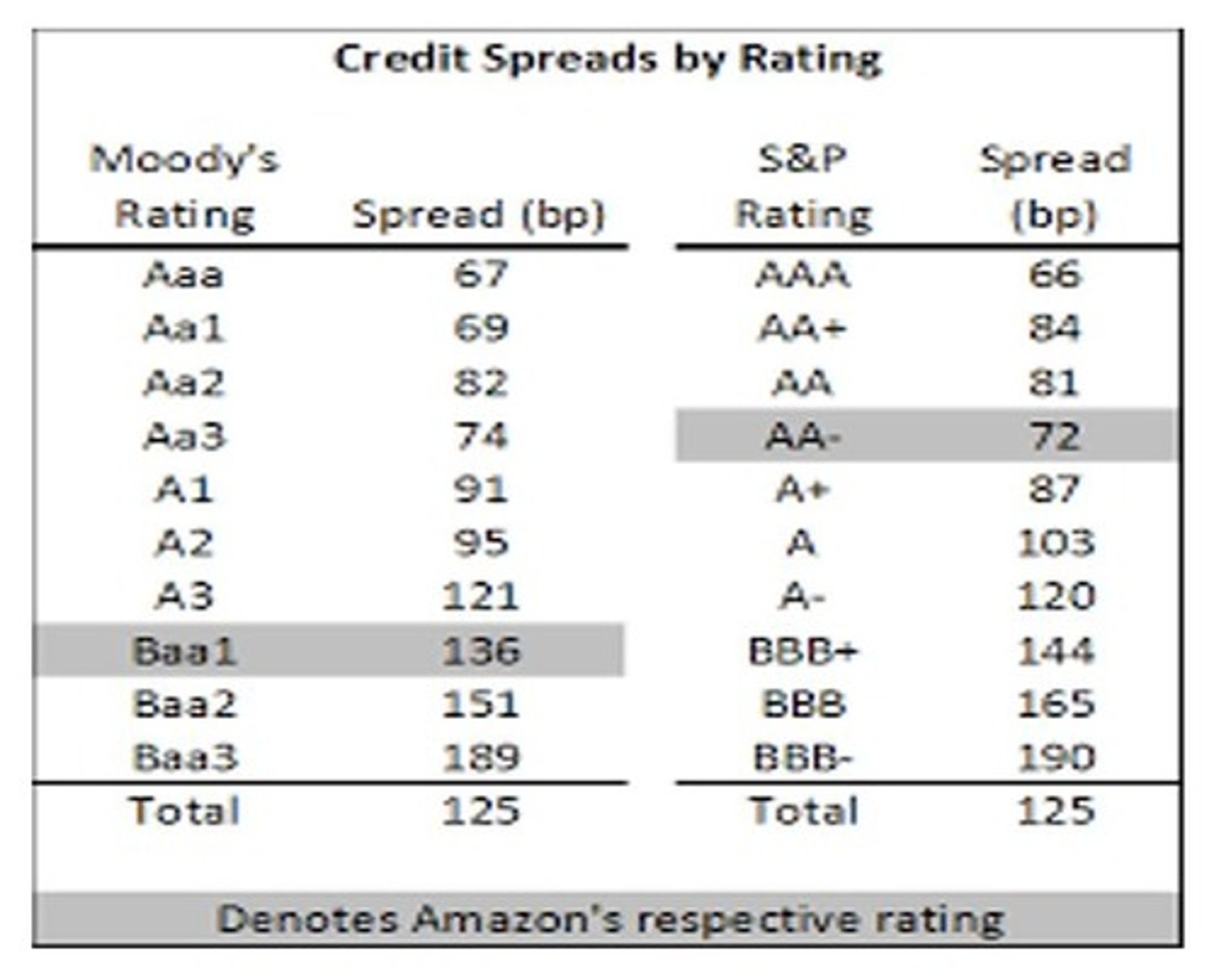

What is the risk premium in bond markets?

The spread between interest rates on bonds with default risk and those on Treasury bonds.

What factors influence the size of the risk premium for corporate or municipal bonds?

The probability of default risk assigned by bond ratings agencies and the bond investors.

What is liquidity in the context of financial assets?

The ease with which an asset can be converted into cash.

What attributes can measure the liquidity of an asset?

Cost of conversion, time needed to convert, bid-offer price gap, and ability to transact large quantities without affecting price.

Why are rare paintings or large parcels of farmland considered illiquid assets?

Their sale process can be slow and expensive, requiring significant time and effort to negotiate.

What makes Treasury bonds highly liquid assets?

The ease, speed, and low cost of transactions, with many buyers and sellers trading large volumes daily.

What is the typical settlement time for Treasury bond transactions?

Cash proceeds are received on the business day after the transaction (T+1).

How do large markets with many buyers and sellers affect bid-offer price gaps?

They usually show smaller gaps due to competition among buyers and sellers for the best price.

What challenges do markets with fewer buyers and sellers face?

They often have larger gaps between bid and offer prices and participants may be reluctant to quote prices.

What role do standardized contracts and technology play in Treasury bond transactions?

They facilitate quick and efficient trading, reducing operational errors and improving market access.

What happens during financial crises regarding institutional buyers of Treasury bonds?

They may lose access to loans that help fund their purchases.

What is the impact of a default on Treasury bonds on the financial markets?

It could be extraordinarily harmful to America and the world due to the bonds' role in financial systems.

What is the relationship between the interest rates of risky bonds and Treasury bonds?

Higher riskier bonds have higher interest rates compared to Treasury bonds of similar duration.

What is the significance of the federal borrowing limit in the context of government finance?

It determines the maximum amount of money the government can borrow to meet its obligations.

What are entitlement beneficiaries in relation to Treasury bond payments?

Individuals or groups entitled to receive payments from the government, such as social security recipients.

What is the consequence of a default on Treasury bonds for government vendors?

They may not receive contractual payments owed to them.

How does the liquidity of Treasury bonds benefit institutional investors?

It allows them to quickly convert bonds into cash when needed, facilitating better cash flow management.

What is the effect of having many buyers and sellers in a market?

It makes market participants less nervous about buying or selling at a disadvantageous price or being stuck with a product that cannot be easily re-sold.

What typically happens to the bid-offer spread for Treasury bonds during crisis situations?

The bid-offer spread can widen.

Why are Treasury bonds easily accepted as collateral in non-crisis times?

Due to their high liquidity.

What significant information do Treasury prices and spreads carry for market participants?

They are used to price financial instruments like swaps and loans and to examine signals about inflation, Fed activity, geopolitical risk, and government election results.

What are the two types of Treasury debt based on issuance?

On-the-run and Off-the-run.

What is on-the-run Treasury debt?

The most recently issued Treasury bill, note, or bond of a certain duration.

What is off-the-run Treasury debt?

The second most recently issued Treasury bill, note, or bond of a certain duration, which tends to be less liquid and may trade at a discount.

What are the five main types of bonds in the US?

US Treasury, US Agency, Asset-Backed Securities, Corporate, and Municipal.

What are the three forms of US Treasury Debt?

Bills, Notes, and Bonds.

What are Treasury bills and how do they work?

They are short-term securities maturing in one year or less, sold at a discount, with the face value received at maturity.

What is the maturity range for Treasury notes?

Between 1 and 10 years.

How do Treasury bonds differ from Treasury notes?

Treasury bonds have maturities greater than 10 years.

How often do Treasury notes and bonds pay interest?

Semi-annually.

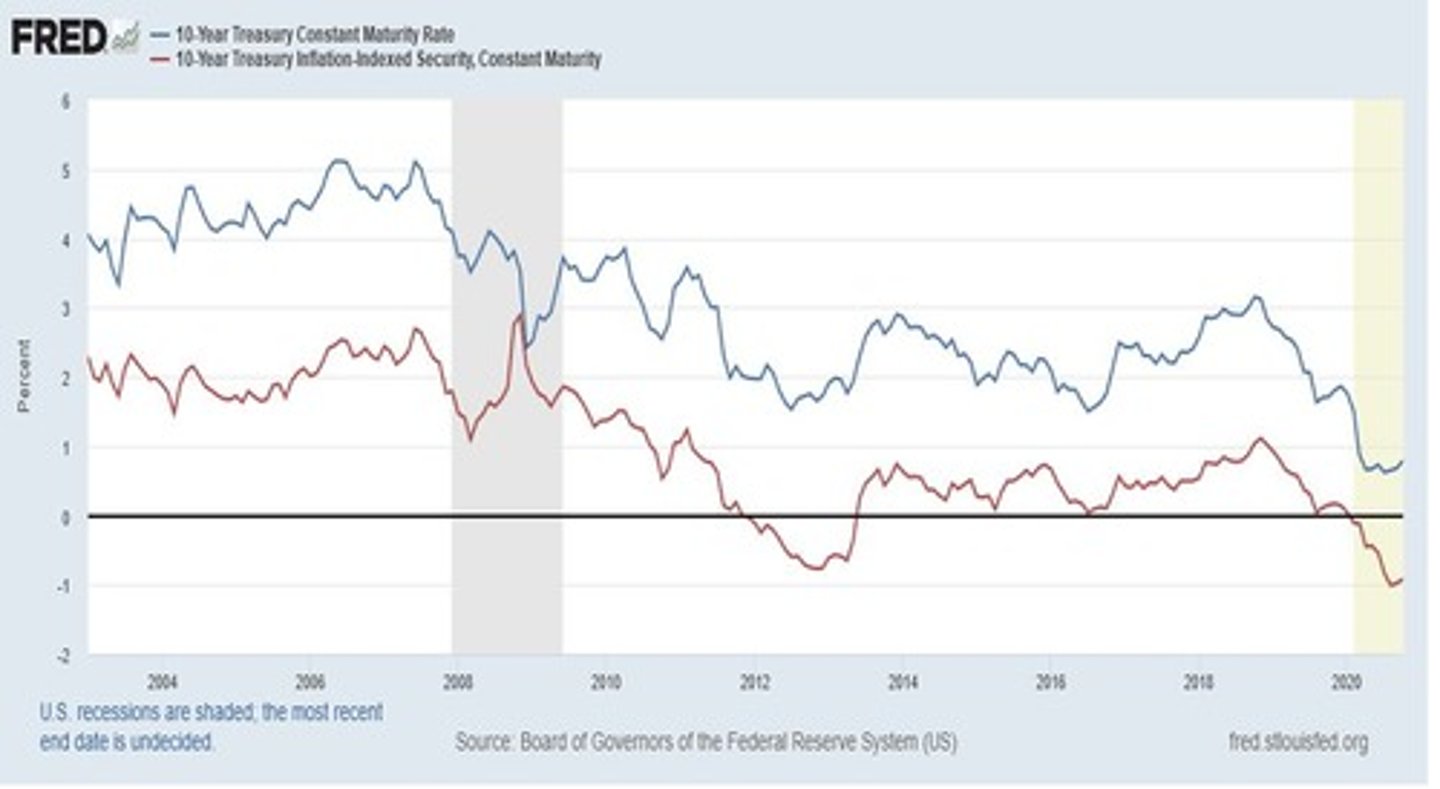

What are TIPS and what do they protect against?

Treasury Inflation Protected Securities protect buyers from inflation.

How does the principal amount of TIPS adjust?

It adjusts upward with rising inflation and downward with falling inflation, based on a predetermined formula.

What happens to the interest payments on TIPS as inflation changes?

The interest amount paid semi-annually changes as the principal changes.

What is the minimum interest rate that TIPS will pay?

0.125%.

What determines the principal-adjustment factor for TIPS?

The non-seasonally adjusted CPI for all Urban Consumers index produced monthly by the Bureau of Labor Statistics.

Why do TIPS tend to trade at a lower yield than other Treasury debt?

Due to their inflation-hedging attribute.

What will happen at maturity for TIPS?

They will be redeemed at the greater of their inflation-adjusted principal or the par amount of the original issue.

What are TIPS and who might find them ideal?

TIPS (Treasury Inflation-Protected Securities) may be ideal investments for investors who anticipate and want to protect debt income from high future inflation.

What should you understand before investing in TIPS or TIPS funds?

You should completely understand the inflation-adjustment mechanism and the fees and policies of the fund.

What is a potential risk of investing in TIPS if inflation falls?

It is possible to earn a lower return from TIPS than a normal Treasury if inflation falls and the TIPS principal adjusts downward.

Can you lose money on TIPS even when inflation is rising?

Yes, it is possible to lose money on TIPS even when inflation is rising, depending on the behavior of the fund that holds the TIPS.

Who distributes all Treasury bills, notes, and bonds?

All Treasury bills, notes, and bonds are distributed by the Federal Reserve Bank of New York through auctions.

Does the Treasury Department pay the New York Fed for distribution services?

No, the Treasury Department does not pay the New York Fed for its distribution services.

What is a 'good book' in the context of Treasury auctions?

A 'good book' consists of robust bond demand from clients at prices that the primary dealer feels it can succeed at auction and earn a healthy profit.

What happens if a primary dealer overbids at an auction?

If a primary dealer overbids at an auction, they may end up holding unwanted bonds in their portfolios, similar to a car dealer stuck with un-refundable inventory.

What are the three forms of US Agency debt?

US Agency debt comes in three forms: Discount Notes, Notes, and Bonds.

What is the maturity profile of Agency discount notes?

Agency discount notes mature within one year.

What is the maturity profile of Agency notes?

Agency notes mature between one to ten years.

What is the maturity profile of Agency bonds?

Agency bonds mature between ten and thirty years.

What are asset-backed securities?

Asset-backed securities refer to securities whose values and coupon payments are underpinned by cash flows from financial assets such as mortgages, credit card receivables, and auto loan receivables.

How do GSEs like Fannie Mae and Freddie Mac classify the agency debt they issue?

They classify the agency debt they issue as liabilities and the cash proceeds from the agency debt issuances as assets.

What are the most relevant GSEs in the financial markets?

The most relevant GSEs are Freddie Mac, Fannie Mae, and Federal Home Loan Banks.

What is a potential consequence of primary dealers not matching bonds bought at auction with pre-sold bonds?

This could lead to primary dealers holding unwanted bonds and potentially cutting prices quickly to sell them.

What is the significance of the auction held by the Fed on February 7, 2008?

It was a 30-year Treasury bond issuance auction where a sharp price drop occurred, indicating potential issues with bond demand.

What factors can lead to primary dealers winning fewer bonds at auction?

If they strive to earn too much profit, they may be undercut by rivals with leaner profit expectations.

What is the role of primary dealers in Treasury auctions?

Primary dealers bid for bonds and try to pre-sell them to clients at agreed-upon yields and prices.

What might happen if there is a misunderstanding of a client order before an auction?

It could lead to overbidding at the auction, resulting in primary dealers holding unwanted bonds.

What is the relationship between US agency debt and asset-backed securities?

US agency debt and asset-backed securities are two different classes of debt.

What do GSEs do with the proceeds from agency debt?

They use the proceeds to fund their operations.

What is the implication of a primary dealer holding unwanted bonds?

They may need to cut prices quickly to sell the unwanted bonds if they are unwilling to bear price risk.

What is the indicative auction data released after a Treasury auction?

It provides information on the auction results, including price changes and demand.

What do Fannie and Freddie do with mortgage loans?

They securitize mortgage loans into mortgage-backed securities (MBS) and sell them to investors.

What guarantee do Fannie and Freddie provide to MBS investors?

They guarantee that investors will receive the cash flows from the mortgage loans underlying the MBS, even if homeowners default.

How are MBS recorded on the balance sheets of Fannie and Freddie?

MBS are recorded as assets for fee income and as liabilities due to the guarantees against homeowner default.

What are private label MBS and how do they differ from GSE-securitized MBS?

Private label MBS are not guaranteed and were less favored after the Great Financial Crisis, leading to higher credit risk for buyers.

Why do private label MBS typically trade at higher interest rates than GSE-guaranteed MBS?

Because private label MBS lack guarantees, which exposes buyers to credit risk.

What are Collateralized Debt Obligations (CDOs)?

CDOs are pooled loans, including mortgages and other debts, structured and sold to investors as packaged investment products.

What challenges did CDOs face during the financial crisis of 2007-2009?

They became difficult to price due to confusion and uncertainty, leading to illiquid markets and volatile price changes.

What types of instruments are included in corporate debt?

Corporate debt includes commercial paper, notes, and bonds issued by companies.

What is the duration of corporate commercial paper?

Corporate commercial paper has a duration of up to 270 days.

What are the duration ranges for corporate notes and bonds?

Corporate notes range from 270 days to 10 years, while corporate bonds exceed 10 years.

What is municipal debt and who issues it?

Municipal debt is issued by state and local governments and their related agencies.