Lo1-4 Opportunity costs and the Time Value of Money

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

Personal opportunity costs

Every Financial decision involves giving up something to obtain something you consider more desirable

Personal resources like financial resources require careful management

Ex: Health, abilities, knowledge, time used for working or studying

Financial opportunity costs

Time Value of Money: Increases in an amount of money as a result of interest earned

Saving today means more money tomorrow

Saving and spending decisions involve considering the trade offs

Opportunity costs are present in retirement contributions, large purchases, and low risk savings

Interest calculations

Three amounts are required to calculate the time value of money

Principal (amount of savings)

Interest rate (annual)

Time period (length of time money is on deposit)

Computing simple interest

Amount in savings X annual interest X time period = interest amount

$500×6%x(6 months/12 months) = 500$ x .06 × ½ year = $15 gained

In six months, a $500 deposit (principal) will earn $15 interest. Therefore, you will have a total of $515 at the end of six months

methods for calculating the time value of money

Formula calculation

Time value of money tables

Financial calculator

Spreadsheet software

Websites and apps

Future value

The amount to which current savings will increase based on a certain interest rate and a certain time period

Also called compounding — earning interest in previously earned interest

Compounding allows for the future value of a deposit to grow faster than it would if interest were paid only on the original deposit

For example: $100 deposited in a 4 percent account for one year will grow to $104. This amount is computed as follows:

Future value = (100 × 0.04 × 1 year) = $104

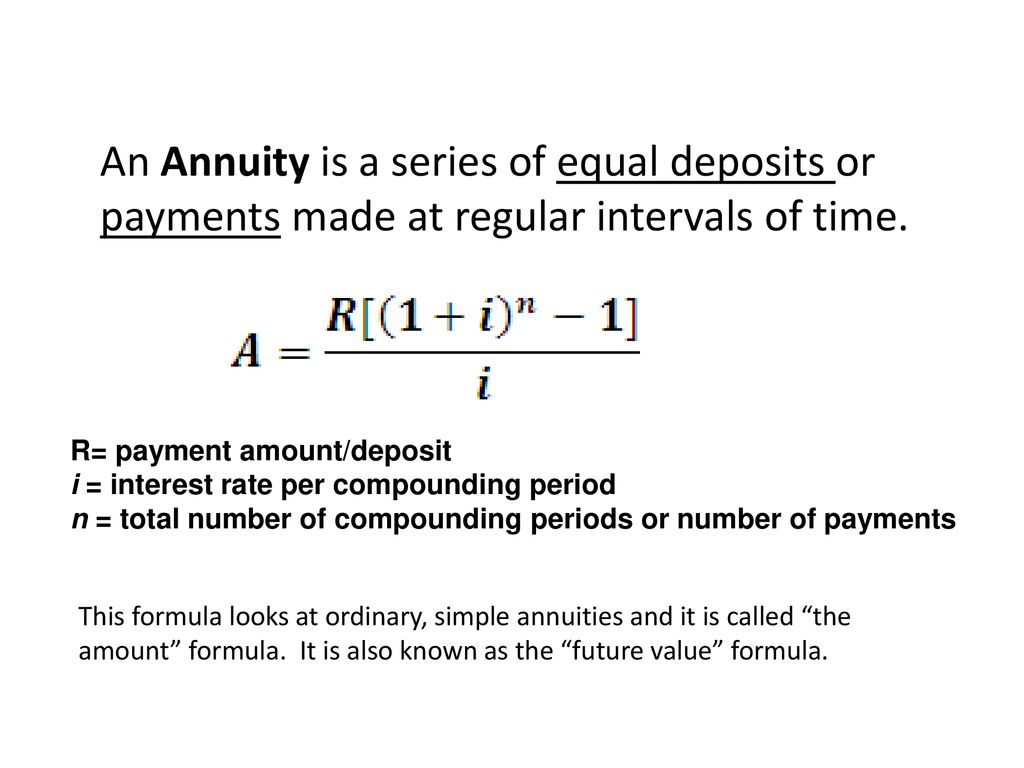

Future value of a series of deposits

Future value can be deposited for a single amount or for a series of deposits (or payments) called in annunity

$50 deposited a year at 7% for six years

Formula shown below

Present Value

the current value of a future amount based on a certain interest rate and a certain time period

present value calculations are also called discounting

The present value of the amount you want in the future will always be less than the future value

Present value can be computed for a single amount or for a series of deposits