ACYTAXN: Corporations

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

The term “corporations” shall include:

I. One Person Corporation

II. Ordinary partnerships

III. Joint stock companies

IV. Joint accounts

V. Associations

VI. Insurance companies

VII. Mutual fund companies

VIII. Regional operating headquarters of multinational corporations

a. I and II only

b. I, II, III, IV and V only

c. I, II and III only

d. All of the above

d. All of the above

Which of the following is taxable based on income from all sources, within and outside?

a. Domestic Corporations

b. Resident Foreign Corporations

c. Non-resident Foreign Corporations

d. All of the choices

a. Domestic Corporations

Which of the following statements is correct?

I. A minimum corporate income tax (MCIT) of 2% of gross income is imposed upon any domestic corporation and resident foreign corporation beginning on the 4th taxable year immediately following the taxable year in which such corporation commenced its business operations.

II. MCIT shall be imposed whenever such corporation has zero or negative taxable income, or when the amount of MCIT is greater than normal income tax due from such corporation.

III. The computation and the payment of MCIT, shall likewise be apply at the time of filing the quarterly corporate income tax.

a. I and II only

b. I, II and III

c. II and III only

d. None of the above

b. I, II and III

Which of the following statements is incorrect?

a. Resident foreign corporations with net taxable income not exceeding P5 million and total assets, excluding land, not exceeding P100 million are taxed at 20%

b. Non-resident cinematographic film owner, lessor or distributor is subject to 25% corporate income tax

c. Rentals and charter fees payable to non-resident owners of vessels chartered by Philippine nationals is subject to 4.5% corporate income tax

d. Income of OBUs and foreign currency deposit units (FCDUs) of depository banks is subject to 25% corporate income tax

a. Resident foreign corporations with net taxable income not exceeding P5 million and total assets, excluding land, not exceeding P100 million are taxed at 20%

Which of the following is not an exempt corporation?

a. Cemetery company owned and operated exclusively for the benefit of its members

b. Civic league or organization not organized for profit but operated exclusively for the promotion of social welfare

c. Labor, agricultural or horticultural organization not organized principally for profit

d. Proprietary educational institutions and non-profit hospitals, on net income if gross income from unrelated trade, business, and other activities does not exceed 50% of the total gross income from all sources.

d. Proprietary educational institutions and non-profit hospitals, on net income if gross income from unrelated trade, business, and other activities does not exceed 50% of the total gross income from all sources.

Which of the following statements is incorrect for taxation on dividends?

a. Dividends received by nonresident foreign corporation from a domestic corporation is subject to either 15% or 25%

b. Dividends received by a resident citizen from a resident foreign corporation is considered as an ordinary income

c. Dividends declared and paid by foreign corporations are subject to predominance test

d. Dividends received by a resident foreign corporation from a domestic corporation is considered as an ordinary income

d. Dividends received by a resident foreign corporation from a domestic corporation is considered as an ordinary income

Which of the following is not one of the requisites for tax exemption on foreign-sourced dividends?

a. Reinvestment should be made within the next two year from the time foreign-sourced dividends where received.

b. The DC holds directly at least 20% of the outstanding shares of the foreign corporation.

c. It has held the shareholdings for a minimum of 2 years at the time of dividend distribution.

d. Funds from such dividends actually received or remitted into the Philippines are reinvested in the business operations of the domestic corporation in the Philippines.

a. Reinvestment should be made within the next two year from the time foreign-sourced dividends where received.

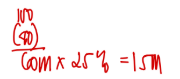

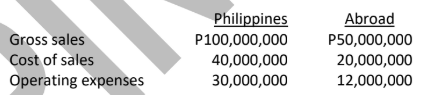

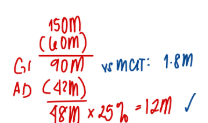

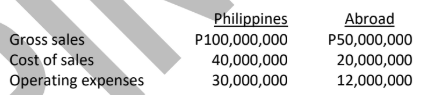

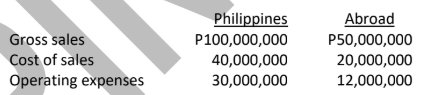

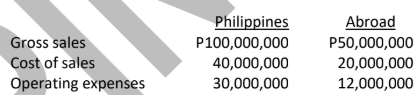

A domestic corporation has the following income and expense for the year:

How much is the income tax due?

a. P12,000,000 b. P13,200,000

c. P14,400,000 d. P18,000,000

a. P12,000,000

A domestic corporation has the following income and expense for the year:

How much is the income tax due assuming the total assets amounted to 80 million only?

a. P9,600,000 b. P12,000,000

c. P14,400,000 d. P18,000,000

b. P12,000,000

A domestic corporation has the following income and expense for the year:

How much is the income tax due assuming the corporation is a resident foreign corporation?

a. P7,500,000 b. P13,200,000

c. P14,400,000 d. P18,000,000

a. P7,500,000

How much is the income tax due assuming the corporation is a nonresident foreign corporation.

a. P7,500,000 b. P13,200,000

c. P14,400,000 d. P15,000,000

d. P15,000,000