Monetary and fiscal policy (Demand side policies)

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

What is Monetary Policy?

Use of interest rates & money supply to influence level of AD and economic activities

What is the central bank?

Independent authority responsible for monetary policy in a country

Controls money supply and setting interest rate

Money supply = refers to the total amount of money in circulation (notes, coins, bank)

What are the 5 functions of central bank

1. Determines money supply and interest rate

Supply of money is always fixed (perfectly inelastic)

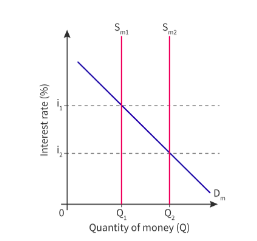

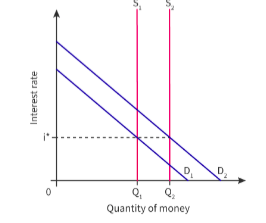

Example of demand and supply for money graph

For example, if CB intervenes to increase money supply from Sm1 to Sm2 → results in increase of Qmoney, driving down interest rate

Example

Y1 is lower than full employment level (Yfe) → central banks can choose to lower interest rates

By lowering interest rates → increase I + C → increases AD (and PL and GDP)

2. Prints physical money and mints coins

Function: increase money supply to align with increases in GDP, replace old/torn bank notes

Also use security features to reduce counterfeit money

3. Lender of last resort for commercial banks

In financial crisis → consumers withdraw money (run on the bank)

Banks will not have the funds

4. Issues bonds and other financial instruments

To raise funds to finance projects (ex. War, infrastructure)

Citizens buy a bond to lend money to the government → repay with interest

5. Regulates the banking system

Ensure commercial banks don’t take too much risk

Function: set reserve requirements (= proportion of deposits that a commercial bank must keep in its vaults in reserve)

4 goals of monetary policy (demand side)

Low and stable rate of inflation

Operates monetary policy to influence AD

Rising prices reduce purchasing power of individuals – uncertainty for firms

a)Inflation targeting

CB maintains it to 2%

Creates greater certainty

Preferable to waiting until inflation is out of control

b) low unemployment

Keeps unemployment low

Unemployment leads to slower economic growth (makes up ⅔ AD)

c) reducing business cycle fluctuations

Long term growth (stable economic environment)

Through managing money supply and interest rates:

Can control inflation and real GDP

External balance

Achieved when imports = exports

How to do this

By raising interest rates, CB discourages spending

If this includes imports, it moves economy to balance

How is money created by commercial banks

Can create money through credit (Credit creation)

Individuals put money into a bank account → bank only keeps a small amount as cash (reserve requirement)

They lend the other amount

This process creates credit

Central bank requires commercial banks to hold some deposits in reserve → ensure banks don’t take too much risk

What are the 4 ways monetary policy is made/tools

Open market operations

Definition: the central bank buying and selling bonds to regulate money supply

Bonds = used by governments to finance infrastructure projects

The central bank buys and sells bonds on the OM to regulate money supply

Ex. when selling a bond for $500, the money supply is reduced by $500

Example: graph shows the supply moving left (when selling a bond)

Interest rate is driven up

Therefore, it can influence interest rate

Minimum reserve requirements

The proportion of bank deposits that a bank must hold in cash

A fall in reserve requirements is expansionary → increased supply (more money can be lent)

An increase in reserve requirements is contractionary → decreases money supply

Example: CB can stimulate economy by lowering reserve requirement

Changes in central bank minimum lending rate

CB can determine interest rates offered by commercial banks

Minimum lending rate = rate which central bank charges commercial banks to borrow money

Example: if CB cutting minimum lending rate, decreases cost of borrowing for commercial banks

Commercial banks also compete to cut mortgage/lending rates

Quantitative easing

Definition: A way for the CB to inject money directly into economy

Definition: where the central bank creates more digital money

CB uses new money to buy bonds

Boosts spending and investment

Example: CB buys assets from banks → banks get more money therefore lending increases → results in lower interest rate for borrowers → boosts investment

*quantitative tightening is the opposite = CB roll back expansion in money supply

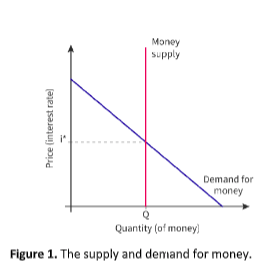

Describe/draw the demand and supply of money graph

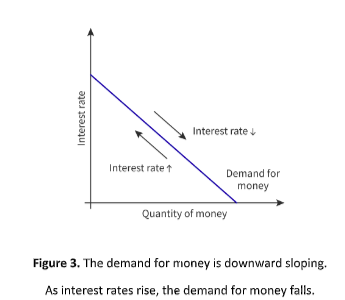

Describe the curve for demand of money and why. What are the 3 reasons to use money

Definition = the willingness and ability for economic agents to use money at a given interest rate and point in time

3 reasons to use money:

1. Transactions motive (buy goods)

2. Precautionary motive (precaution against unexpected events like medical bill)

3. Speculative motive (individuals hold money receive no rate of return and lose purchasing power due to inflation)

Opportunity cost = interest rate lost

Beneficial in stock market crash

Downward sloping (higher interest rate, less likely people hold money)

Define the supply of money

Definition: total amount of money in circulation (coins, banks, notes)

What determines the interest rate

Refers to the price and cost of borrowing money

Determined by forces of supply and demand

How can economy be stabilized by changing money supply

If central bank can increase supply of money at same rate as increase in Dm, can maintain interest rates at i* to maintain stability

What is nominal vs real interest rate, how to calculate

Nominal = the interest rate quoted by commercial bank

Not adjusted for inflation

Real = interest rate with inflation taken into account

True cost of borrowing

When negative = savers lose, borrowers benefit

How to calculate real interest rate

(1+nominal interest rate)/(1+inflation rate) = 1 + real interest rate

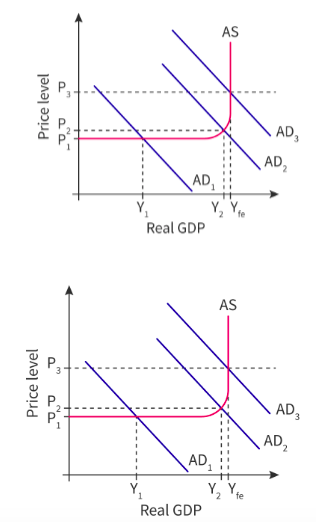

When is expansionary monetary policy used? how does it work?

to close recessionary gap

CB can intervene and increase money supply (Sm1 → Sm2)

Increases money in circulation from Q1 to Q2 → drive down interest rate from i1 to i2

Lowering interest rates = more investment = increase AD = closing recessionary gap

Keynesian vs monetarist view of monetary policy in solving deflationary gap

Keynesian

1. Assume economy at Y1 → economy produces at a level of output lower than full capacity

Any stimulus to increase AD will increase real GDP without pressure on PL

Possible to operate this policy without driving up PL

2. Assume economy at Y2 → at upward sloping section

Supply side bottlenecks

Firms compete with other firms for FOP

This case, the policy will drive up price level

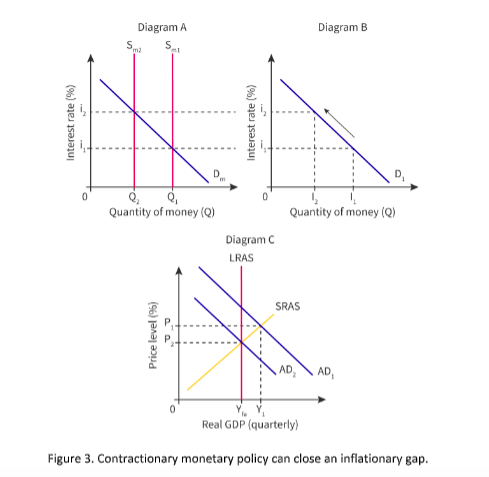

How is contractionary monetary policy used? describe

closing inflationary gap

Definition: an inflationary gap is where the economy overheats and creates upward pressure on PL

Difficult to plan for future

CB will decrease money supply

Reduce money in circulation

Drive up interest rates

Discourage investment, lower AD

what are 2 cons of monetary policy effectivity

Factor | Explanation |

Limited scope for reducing interest rates when close to zero |

|

Low consumer and business confidence |

|

What are 2 pros of monetary policy effectiveness

Factor | Explanation |

Incremental, flexible, easily reversible |

|

Short time lag |

|

How is conflict amongst macroeconomic objectives created using monetary policy

Example: government wants growth = CB uses expansionary monetary policy by lowering interest rates = puts upward pressure on PL = does not meet goals

However, this is possible in LR → if its used to encourage firms to improve LRAS, it will work

What is fiscal policy

Government adjusts government expenditure or taxation to stimulate the economy

What are 4 sources of revenue

Direct taxation

On income

Can be used to redistribute income → progressive taxation

Indirect tax

On expenditure

To discourage consumption of undesirable goods

Sale of goods and services from state-owned entreprises

State owned enterprise = a firm where the government has a significant financial stake and control (ex. Post office)

Resource curse = government difficult to benefit from selling natural resources

Sale of government assets

Selling state-owned entreprises

Privatization = transferring ownership from public to private sector → revenue is 1 time payment

Why: private firms improve efficiency, decrease costs, etc → creates greater revenue for government

What are 3 types of government expenditure

Current expenditure

Involves financing daily expenditure (ex. salaries)

Capital expenditure

Includes building infrastructure financed by government (roads, hospitals)

Long term projects

Transfer payments

Used to redistribute income (ex. Child support)

What are 5 goals of fiscal policy

Low and stable inflation

Beneficial as it gives greater certainty for firms

Low unemployment

Can use expansionary fiscal policy

Can stimulate AD to the level of full employment

Promoting a stable economic environment for long term growth

Through expansionary fiscal policy → build infrastructure like roads

Transport routes increase trade, hospitals for healthy workforce

Reducing business cycle fluctuations

Can increase injections for boost

Can slow economy in boom

Equitable distribution of income

Indirect taxes:

Can lower taxes on essential goods, increase on luxury

Direct taxes:

Progressive system

Transfer payments

External balance:

Through contractionary fiscal policy, can discourage consumption of domestic and imported goods

Can move towards balance

What are 2 ways to do expansionary and contractionary fiscal policy

tax revenue or government expenditure

How can expansionary fiscal policy be used

close recessionary gap

Government can intervene to help recover from recession

Can either increase G or reduce taxation

Both will increase AD → shifts towards full employment → increases price level → increases real GDP

Therefore, gap is closed

Monetarist vs. keynesian view of deflationary gap

Monetarist | Keynesian |

Economy is self correcting, will move to full employment level of equilibrium If in recession → as workers compete for jobs, wages will fall

| Economy not self correcting If in recession → unemployment will rise

|

Deflationary gap is only in short run | Deflationary gap can be in short run and long run |

How is contractionary fiscal policy used

closing inflationary gap

When economy overheats (when AD grows too fast, creating demand-pull inflation)

Causes reduction in confidence

Contractionary policy → increase taxes (direct or indirect) OR reduce G

Reduce disposable income for households

G: unpopular

Wages to workers are cut (current), or hospital doesn’t get built (capital), or unemployment benefits decreased (Transfer)

Both will shift AD back to full employment level

Monetarist vs. keynesian for inflationary gap

Monetarist | Keynesian |

Inflationary gap only in short run

| Any attempt to move output beyond Yfe only results in inflation Need government |

What is keynesian multiplier and formula

The overall increase in GDP is larger than original stimulus due to multiplier effect

Size of effect depends on how much additional income was used for purchases

1/1-MPC OR 1/(MPS+MPT+MPM)

Always greater or equal to 1

When government spends $120M, the firms they hire for projects will notice lack in inventory → increase their output by $120M to hire workers

Households can spend (marginal propensity to consume) or save additional income

By spending $48M on g/s → firms, noticing stock is falling, expand output, which then increases household income by $48M

Give 3 constraints of fiscal policy

Factor | Explain |

Political pressure | Depends on each party’s beliefs |

Time lags | Once a new policy is made, it may take months |

Sustainable debt | Government must operate a budget deficit (borrowing money by selling bonds) if it wants to stimulate the economy Governments respond to high debt by using austerity

|

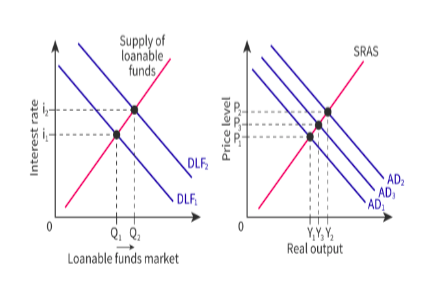

What is crowding out? describe the 2 steps

Definition: when public sector replaces private sector spending

1. Government spends on a road (shift AD right)

Can sell bonds and compete directly with private sector in loanable funds market

2. Competition will drive out interest rates to discourage private firms from investing → AD shifts left

Depends on interest rate change

What are 2 strengths of fiscal policy

ability to target sectors of economy

effective in deep recession

What are automatic stabilizers? give 2

Definition: ongoing government policies that automatically adjust tax rates and transfer payments

2 examples: progressive taxes and unemployment benefits