international economics exam 3

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

15 Terms

less, increase, increase

If e goes form $2/E to $1/E, EU goods are ___ expensive

Imports will ___

Demand for E will ___

more

If e goes from $1/E to $2/E, Europeans will supply ___ Euros

flexible

The US has a ___ exchange rate regime

more, increase, demand, right, depreciate, appreciate

Suppose the demand for EU goods goes up

Americans need ___ Euros, which would ___ demand for Euros

The ___ curve will shift to the ___

$ will ___ and Euros will ____

fixed, low, export

China has a ____ exchange rate regime

China intervenes to keep the value of Yuan ____. This will help with the country’s ____

depreciate, appreciate, decrease, 5, lower, less, demand, left, 0

If the US demands more Chinese goods, $ will ____ and Yuan will ____

To address this issue, China can ____ its interest rate

For instance, you deposited $100 in a Chinese bank when the interest rate was 5%

Your interest income would be $___

The new interest rate would be ___ than 5%

Hence, investing in China is ___ attractive

This will cause the ____ curve to shift to the ____

So we are back to a fixed rate level

However, the main limitation of this policy choice is that the interest rate cannot go below ___

depreciate, appreciate, increase, supply, right

If the US demands more Chinese goods, $ will ___ and Yuan will ____

To address this issue, China can ____ dollar reserves

To do so, China will offer a lot of Yuan in the market in exchange for $

This will cause the ____ curve to shift to the ___

2, 4, EU, EU, increase, demand, right, depreciate, appreciate

Suppose i = 2% and if = 4%. You are investing $100 in either country

In the US, your interest income would be $___

In the EU, your interest income would be $___

Which market will give you a higher interest income? ___ market

As we put our money in the ___ market, the demand for Euros will ____

This will cause the ___ curve to shift to the ___

Hence, $ will ___ and Euros will ___

10, 6, US, US, decrease, demand, left, appreciate, depreciate

Suppose i = 5% and if = 3%. You are investing $200 in either country

In the US, your interest income would be $___

In the EU, your interest income would be $___

Which market will give you a higher interest income? ___ market

As we put our money in the ___ market, the demand for Euros will ____

This will cause the ___ curve to shift to the ___

Hence, $ will ___ and Euros will ___

depreciate, appreciate, 5, 6, 10, in 90 days, EU, increase, increase, depreciate, appreciate

Suppose today’s e = $1.2/E and e^ex = $2/E in 90 days

This means that investors expect $ to ____ and E to ____

You invested $100 in the European bond market when the interest rate is 5%

Your interest rate payment is E___

You can either convert it back to the dollar today or in 90 days

If you do it today, your realized gain will be $___

If you do it in 90 days, your realized gain will be $___

So, which exchange rate yields a higher income? The exchange rate _____

Hence , your expectations will lead you to put money in the ___ market. So demand for E will ____

This will cause the actual exchange rate to ___, meaning that $ will ____ and E will ___

appreciate, depreciate, 3, 4.5, 3, today, US, decrease, decrease, appreciate, depreciate

Suppose today’s e = $1.5/E and e^ex = $1/E in 90 days

This means that investors expect $ to ____ and E to ____

You invested $100 in the European bond market when the interest rate is 3%

Your interest rate payment is E___

You can either convert it back to the dollar today or in 90 days

If you do it today, your realized gain will be $___

If you do it in 90 days, your realized gain will be $___

So, which exchange rate yields a higher income? The exchange rate _____

Hence , your expectations will lead you to put money in the ___ market. So demand for E will ____

This will cause the actual exchange rate to ___, meaning that $ will ____ and E will ___

purchasing power parity, determines, long run, E, law of one price, absolute PPP, relative PPP

PPP stands for __________. It ____ the exchange rate in the ____

For instance, if $1 can get you 2 pencils and €1 can get you 3 pencils, PPP tells us that which currency is more valuable? ___

There are three assumptions of PPP

____

____

____

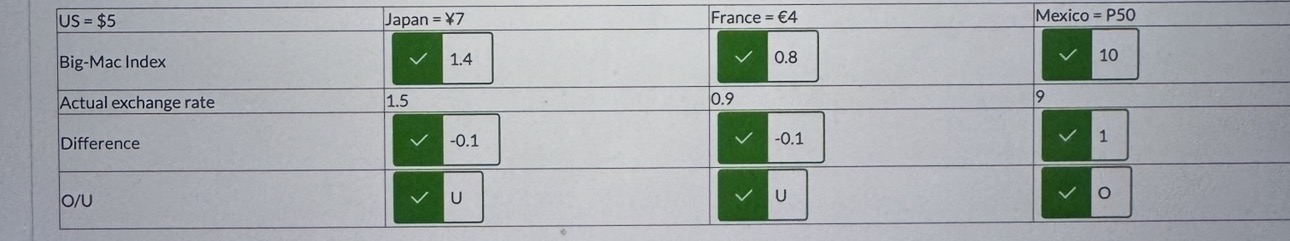

law of one price

The Big-Mac index is based on the _____

150, 300, 0.5, absolute PPP

US CPI = 150

EU HICP = 300

Then, the exchange rate between the dollars and the euros should be (____/____) = ____

This is based on the _____

2, positive, increase, depreciate, appreciate, -1.1, negative, decrease, appreciate, depreciate, relative PPP

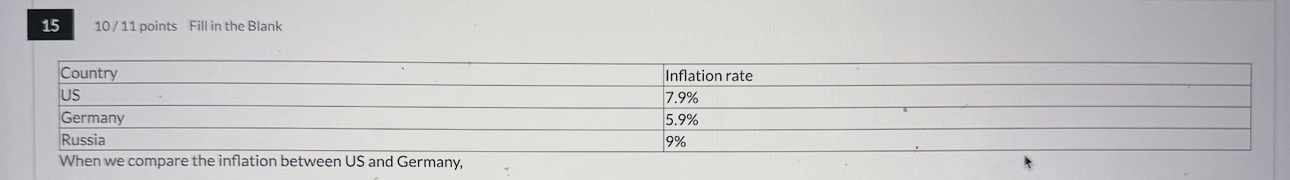

US - Germany = ___%

This value is ____, which implies that the exchange rate will ___

So $ will ___ and E will ____

When we compare the inflation between US and Russia,

US - Russia = ___%

This value is ____, which implies that the exchange rate will ____

So $ will ____ and Rubles will ___

This is based on the _____