AP macro - unit 4

1/80

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

81 Terms

45 degree line

where disposable income = consumption

y axis of income (DI=C) relationship

consumption

dissavings

when consumption is above disposable income (occurs at lower DI levels)

average propensity to consume

avg. percentage of income that is spent

APC calculation

consumption/income

APS calculation

savings/income

average vs. marginal propensity

average = total, marginal = of additional income

MPC calculation

change in consumption/change in income

MPS calculation

change in savings/change in income

main nonincome determinant of consumption / savings

disposable income

wealth

assets - liabilities

wealth effect

wealth rises, consumption rises, savings decreases

determinants of wealth (and eventually DI)

borrowing, expectations, real interest rate

how does borrowing effect consumption?

increased consumption now, decreased consumption later

borrowing effect

reduces wealth by increasing liabilities

expectations effect

high expectations = more consumption, low expectations = less consumption

effect of real interest rates

lower rates = more borrowing = more consumption now, less later (less saving)

why real GDP, not DI

output drives DI for nation

what causes changes in amount consumed?

changes in real GDP

what causes a change in the consumption schedule?

changes in nonincome determinants

effect of increased taxes on consumption schedule

consumption and savings decrease

effect of decreased taxes on consumption schedule

consumption and savings increase

MB

expected rate of return on investments

MC

investment’s real interest rate

r (expected rate of return) calculation

profit/cost

i (real interest rate)

price of financing investment

i < r

invest

i > r

no investment

investments are less risky at ______ rates

lower

investments are more risky at ______ rates

higher

investments are more unstable/volatile due to

expectations, innovation, durability, profit

demand shocks

what do unstable investments cause

reason for multipliers

chain of initial income changes magnifies effect

multiplier equation

change in real GDP/change in spending

MPC multiplier equation

1/1-MPC

MPS multiplier equation

1/MPS

private closed economy

C + Ig

real domestic output

amount of output firms are willing to produce as long as costs are covered/exceeded

equilibrium GDP

spending is equal to output

savings = planned _________

invesment

spending > production

unplanned reduction of inventory - more profit, more production

spending < production

unplanned increase in inventory - less profit, less production

cumulative effect of changes in C + Ig

effect of change accumulates because spending is income for someone else

private open economy

C + Ig + Xn

effect of negative net exports

decreased aggregate expenditures / EQ GDP

international linkages

prosperity abroad, exchange rates, tariffs/devaluing

value of american dollar drops (Xn linkage)

greater consumption from international consumers

value of american dollar increases

international consumption decreases

open mixed economy

C + Ig + Xn + G

which has a greater impact on EQ GDP: gov. spending or taxes

government spending

recessionary gap

gap between aggregate expenditures and full employment GDP, usually due to unemployment

keynes’s solution to recessionary gap

inc. government spending, dec. taxes

inflationary expenditures

where full employment GDP exceeds what is required to achieve FE GDP, all workers are employed

effect of inflationary gap

demand pull inflation

aggregate demand PL/output relationship

negative; greater PL = lower output, lower PL = greater output

real balances effect (ADC)

higher price level reduces purchasing power of society’s savings (less consumption)

interest rate effect (ADC)

higher price level increases demand for money, raises real interest rate

foreign purchasing effect (ADC)

higher price level makes U.S. goods more expensive relatively (lowers Xn)

what can change aggregate demand

consumer spending, investment spending, government spending

MPC

change in consumption/change in income

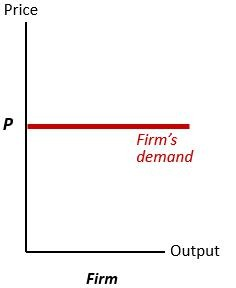

aggregate supply in the immediate short run

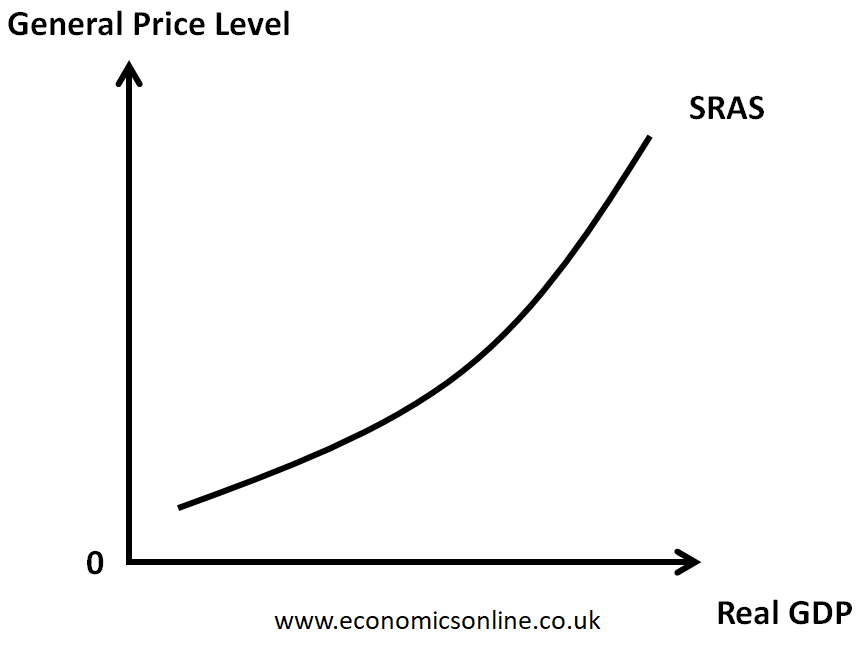

short run aggregate supply graph

aggregate supply in the short run

where output prices are flexible but input prices are fixed

why does the AS graph (short run) slope upwards

output prices outpacing input prices = profit

aggregate supply in the long run

input and output prices are flexible; input prices are full responsive to output prices

effect of aggregate expenditures > output

inflationary gap

effect of output > aggregate expenditures

recessionary gap

tax multiplier

mpc/mps

spending multiplier

1/mps

productivity

total output/total input

increases in aggregate demand

demand pull inflation

decreases in aggregate demand

recession + cyclical unemployment

decrease in aggregate supply

cost push inflation

increases in aggregate supply

full employment and price level stability

effect of decreased AS

price level increases, recession, unemployment

effect of increased AS

offsets inflation (good, not something we try to fix)

discretionary policy

active and intentional change; needs government action (ex: changing taxes / gov. spending)

expansionary fiscal policy

fights recession/unemployment by increasing AD, surpluses decrease or deficits increase (inc. real GDP)

options for expansionary fiscal policy

increased gov. spending, tax reduction, or both

contractionary fiscal policy

fights inflation by reducing AD, increases budget surpluses or decreases budget deficit (decrease real GDP)

options for contractionary fiscal policy

decreased government spending, increased taxes, or both