Unit 2: Budgeting

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Need

something necessary to live/function

Want

something you desire but can live without

Budget

an estimate of your income and expenses

Spending Plan

a plan created to meet expenses and decide how $ should be spent

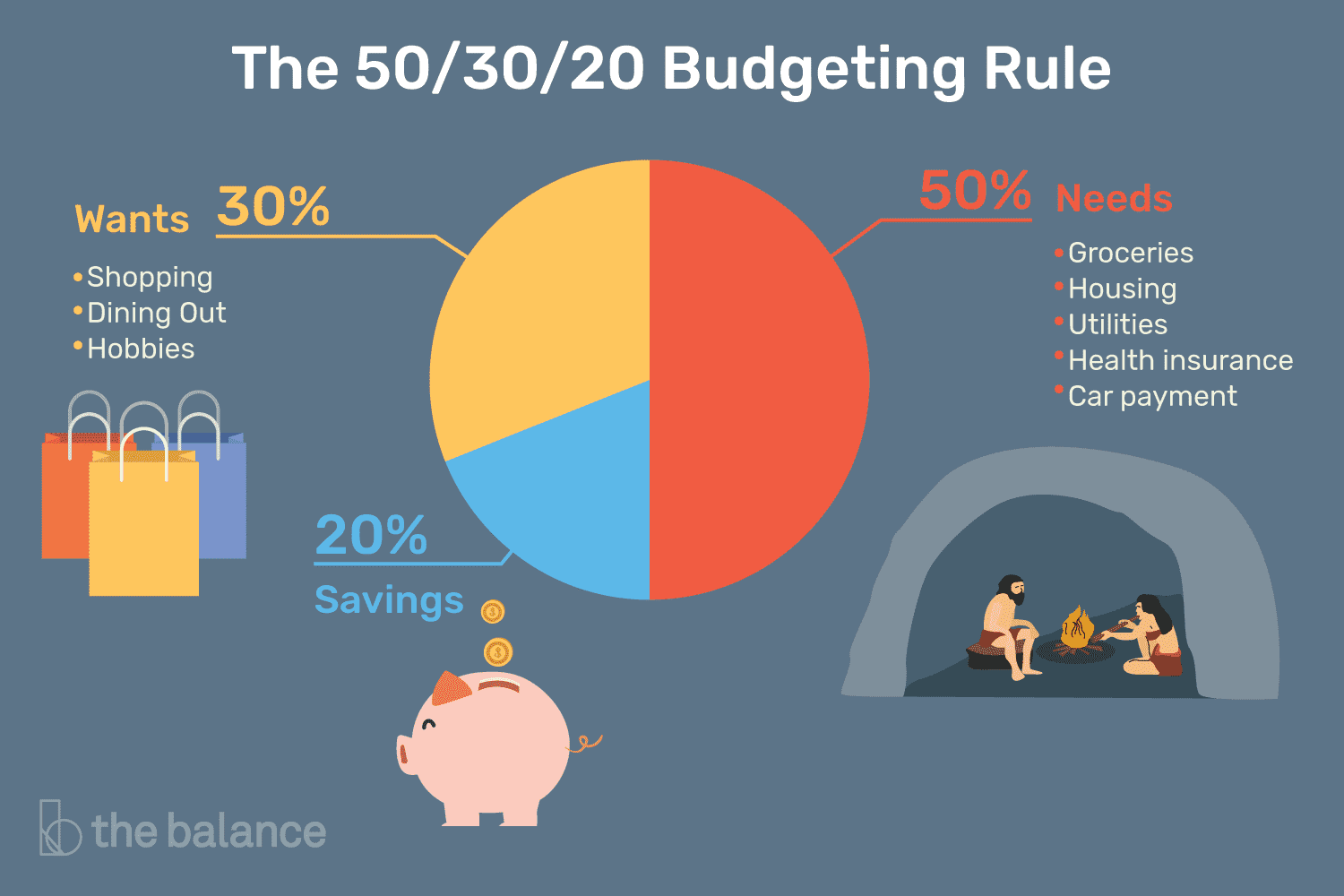

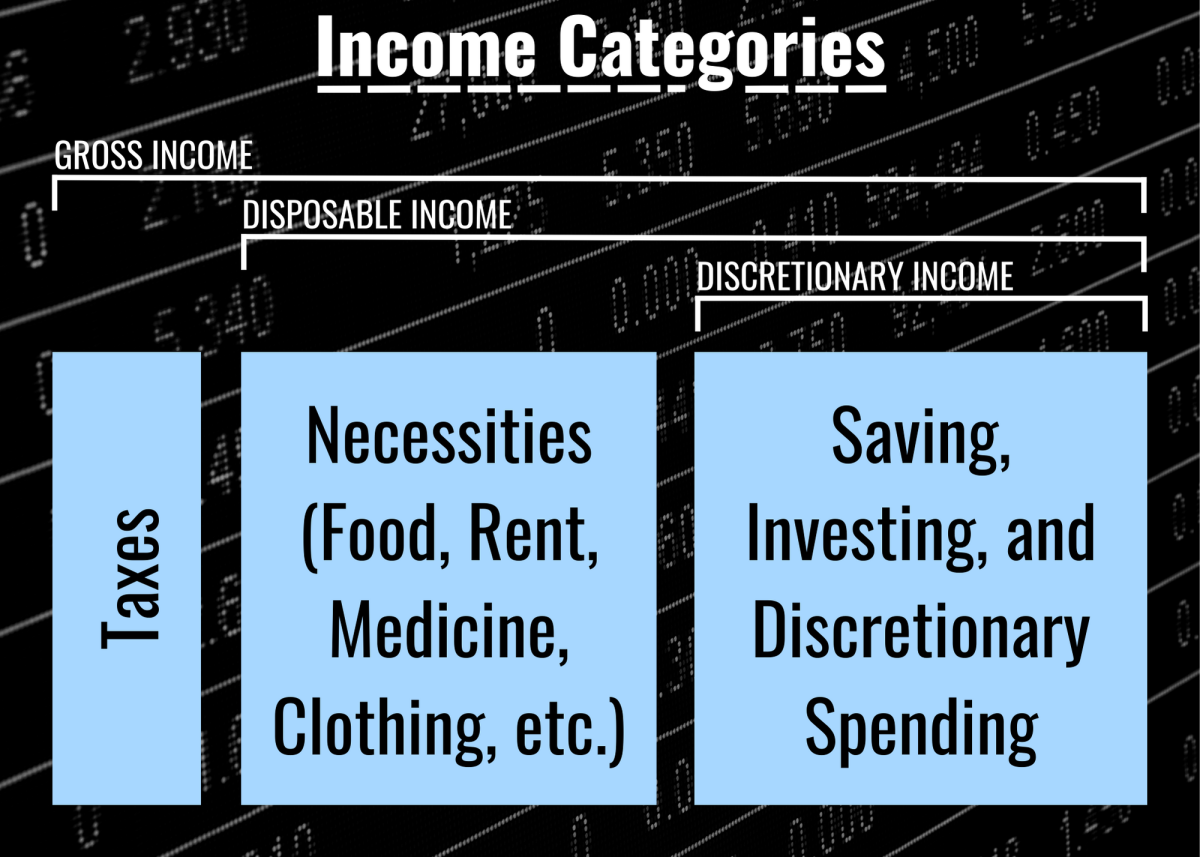

Disposable income

net income (your actual paycheck after deductions)

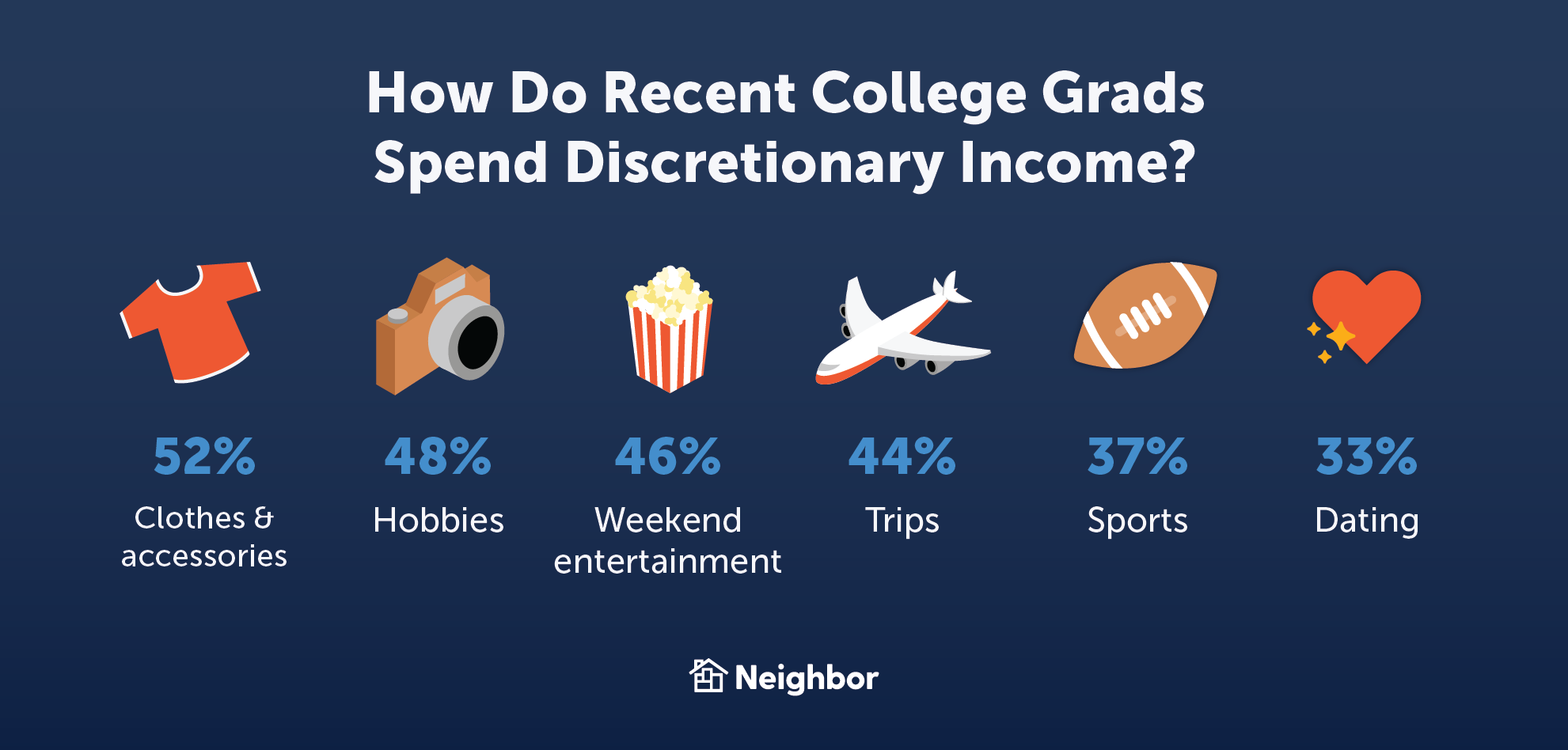

Discretionary income

the amount of $ left after deductions and all needs have been paid for

Expense

cost required for something

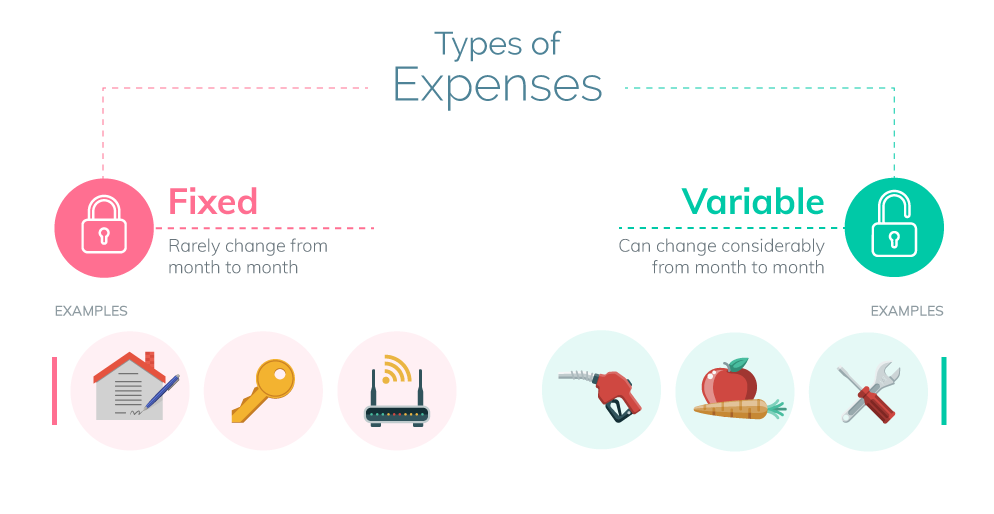

Fixed Expense

expenses that cost the same each month

Variable Expense

expenses that change from month to month

Periodic Expense

expenses that pop up every once in awhile

Cost of living

the cost of maintaining a sustainable standard of living which includes covering basic expenses like housing, food, etc

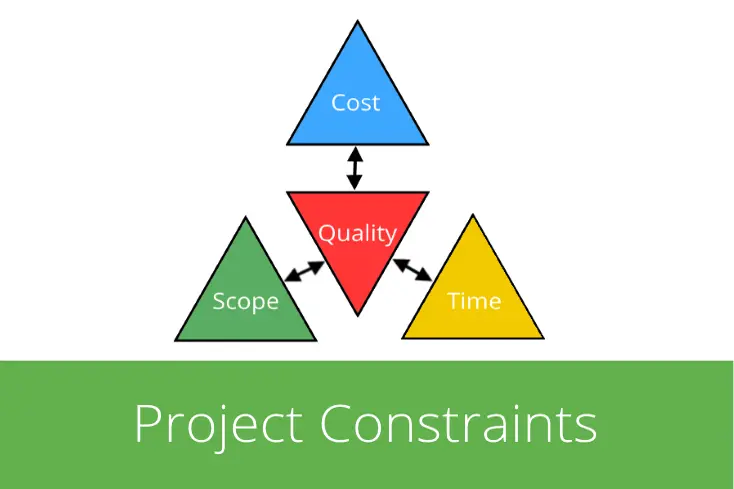

Constraint

limits in purchasing due to income

Lease

a contract that normally lasts a year and includes the rent price, rules, etc

Security Deposit

payment given when you move in to a rental property. Used by landlord for any damages you may do while living there or for breaking your lease. If these don’t happen, you get it back when you move out.

Down Payment

deposit you pay upfront for the house (5%-20% of overall house cost

Mortgage

monthly loan payment to the bank for loaning you money to purchase your home.

Duplex

property divided into 2 separate units

Townhome

multi-story home that shares walls with neighbors and has property in front and behind unit.

Condo

similar to an apartment with amenities but you can own it.

Loan term

Amount of time it takes to pay back your loan

Equity

percentage of your house that you own. It’s based off of how much of your house you have paid off

Escrow

account where the bank puts a percent of your mortgage payment to pay for property taxes and insurance on your home

Fixed Rate

a loan that keeps interest the same during the entire loan term

Adjustable/Variable Rate

a loan that starts with ↓ interest but every 6 months will go ↑ or ↓ over the rest of the loan term based off the market

Jumbo Mortgage

loans for very expensive houses, vacation homes, or investment properties

2nd Mortgage

When you ask for a loan on the $ you’ve already paid into a house so that you can use it for other expenses (college, medical bills, etc.)

Refinancing

revising the terms of your existing loan to ↓ interest rates, change payment schedule, etc.

Mortgage Points

when you spend extra $ to buy down interest rate on your mortgage loan which can lower your overall monthly payment