Aggreage Demand, Aggregate Supply and Inflation

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

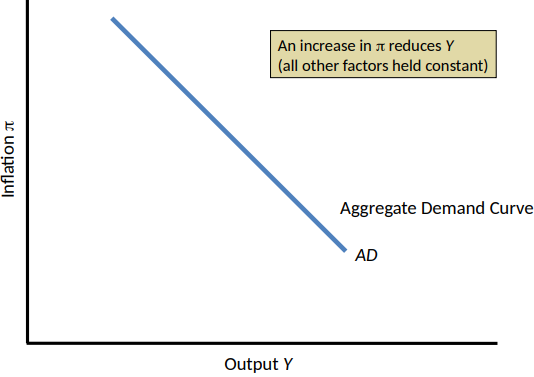

The Aggregate Demand Curve

Shows the relationship between short-run equilibrium output Y and the rate of inflation, π

The name of the curve reflects the fact that short-run equilibrium output is determined by, and equals, total planned spending in the economy

Increases in inflation reduce planned spending and short-run equilibrium output, so the curve is downward-sloping

Movements along the AD Curve

π and Y are inversely related

Changes in π cause a change in Y or a movement along the curve

π increases → r increases → planned spending decreases → Y decreases

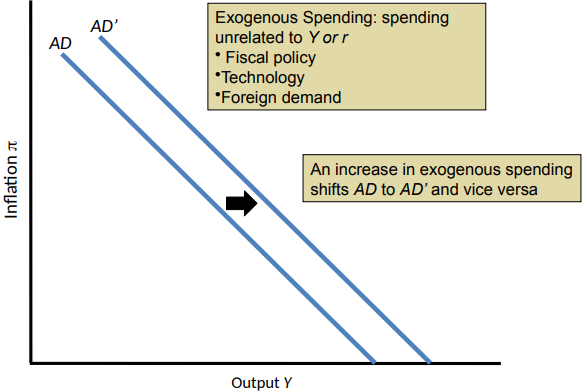

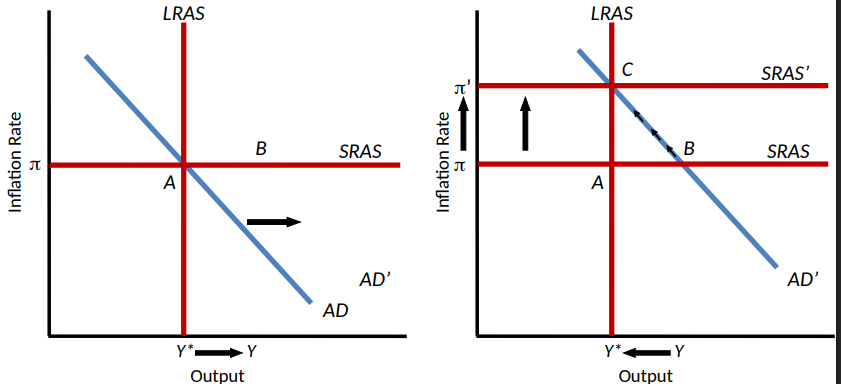

Shifts of the AD Curve

Any factor that changes Y at a given π shifts the AD curve

Can be caused by:

Changes in exogenous spending

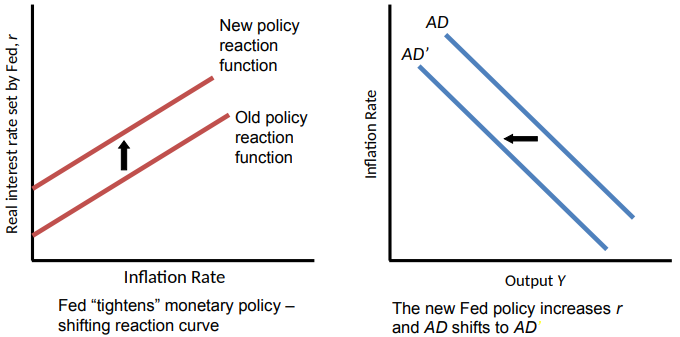

Changes in the Fed’s policy reaction function

Keynesian Model

assumes output adjusts to demand at pre-set prices in the short run

prices don’t remain fixed indefinitely

doesn’t explain the behaviour of inflation

Why does the AD Curve Slope Downward?

Response of real interest rate to inflation through the Fed’s Reaction Function (Taylor Rule)

Distributional effects: Inflation hurts people with lower incomes more. These people also spend more of their income, so Y drops when their income does

Uncertainty: Inflation → uncertainty about future prices, so people may be more cautious in spending

Exports: Inflation → Prices of exported goods rises, lowering exports

The Aggregate Demand Curve

Effect of an Increase in Exogenous Spending

A Shift in the Fed’s Policy Reaction Function

When will Inflation remain Roughly Constant, or have Inertia?

if operating at Y* and there are no external shocks to the price level

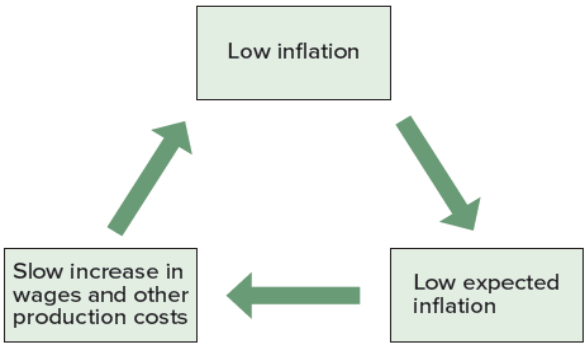

Why does Inflation Inertia occur?

inflation expectations

long-term wage and price contracts

What are 3 Factors that Increase the Inflation Rate?

output gap

inflation shock

shock to potential output

What happens if you think there will be High Inflation?

You’ll agree to much higher prices

This can lead to actual inflation as prices rise

Price Contracts

Union wage contracts set wages for several years

Contracts setting the price of raw materials and parts for manufacturing firms also cover several years

These long-term contracts reflect the inflation expectations at the time they are signed

Virtuous Cycle of Low Inflation and Low Expected Inflation

The Output Gap and Inflation

Relationship of output to potential output | Behaviour of inflation |

No output gap | Inflation remains unchanged |

Expansionary gap | Inflation rises |

Recessionary gap | Inflation falls |

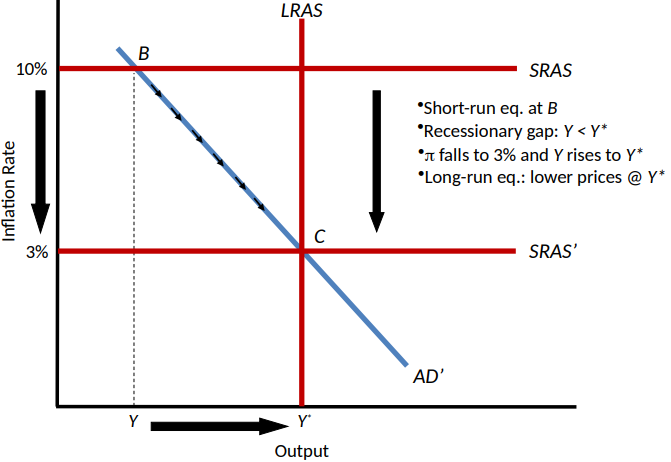

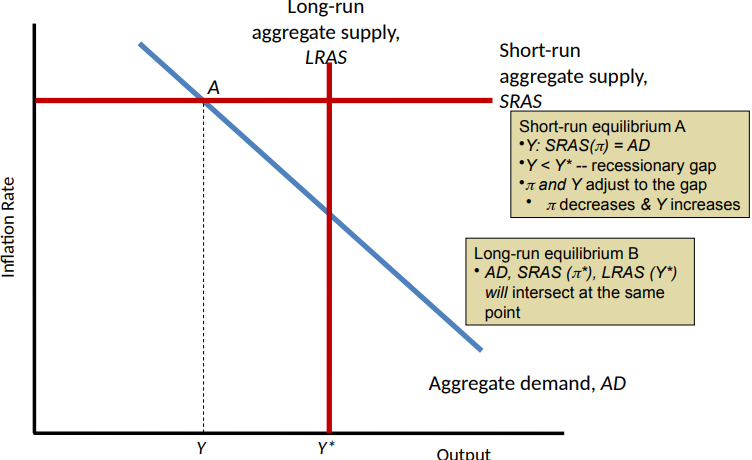

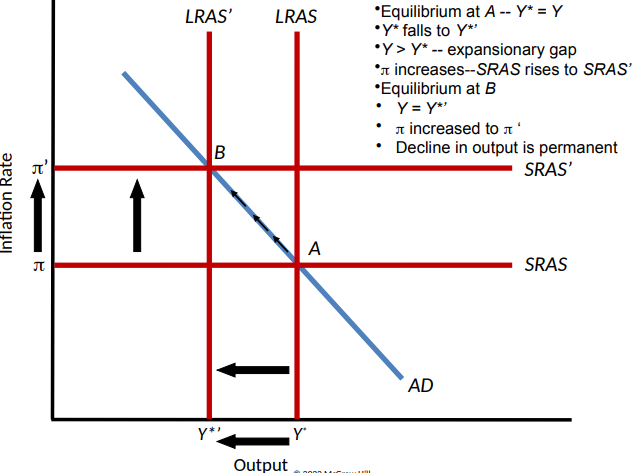

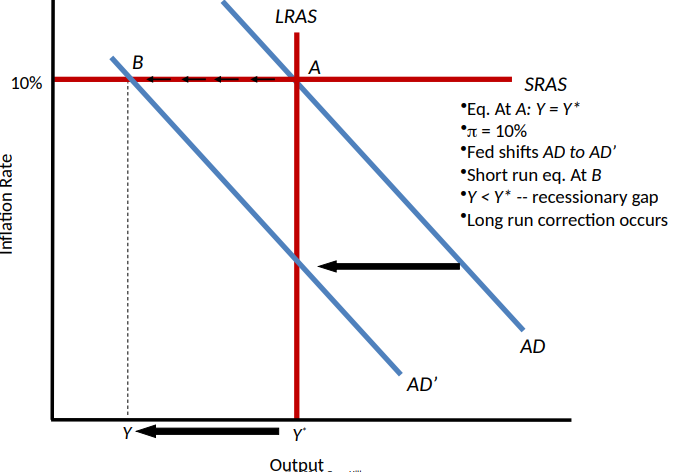

The Aggregate Demand-Aggregate Supply Diagram

Long-run aggregate supply (LRAS)

A vertical line showing the economy’s potential output Y*

Short-run Aggregate Supply (SRAS)

A horizontal line showing the current rate of inflation, as determined by past expectations and pricing decisions

Short-Run Equilibrium

A situation in which inflation equals the value determined by past expectations and pricing decisions and output equals the level of short-run equilibrium output that is consistent with that inflation rate

Graphically, short-run equilibrium occurs at the intersection of the AD curve and the SRAS line

Long-Run Equilibrium

A situation in which actual output equals potential output and the inflation rate is stable

Graphically, long-run equilibrium occurs when the AD curve, the SRAS line, and the LRAS line all intersect at a single point

What does the Self-Correcting Economy concept state?

in the long-run, the economy tends to self-correct

What factors influence the speed of Economic Self-Correction?

use of long-term contracts

efficiency and flexibility of labour markets

War and Military Build-up as a Source of Inflation

Military spending increase → AD increase → Expansionary gap (Y > Y*) → π increases → SRAS shifts to SRAS’ → Long-run equilibrium Y* and π*

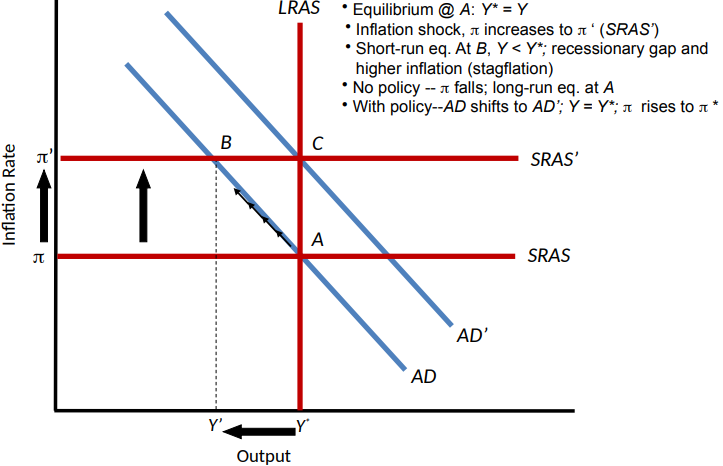

Inflation Shock

a sudden change in the normal behaviour of inflation, unrelated to the nation’s output gap

The Effects of an Adverse Inflation Shock

Aggregate Supply Shock

Either an inflation shock or a shock to potential output

Adverse aggregate supply shocks of both types reduce output and increase inflation

Effects of Aggregate Supply Shock

Short-Run Effects of an Anti-Inflationary Monetary Policy

Long-Run Effects of an Anti-Inflationary Monetary Policy