MAR EXAM 2

0.0(0)

Card Sorting

1/235

Earn XP

Description and Tags

Last updated 10:19 PM on 3/21/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

236 Terms

1

New cards

Features

refer to aspects that are built into a product

e.g. customers don’t buy a product because of its collection of features, they buy a product as a collection of desired benefits

e.g. razor has triple-action cutting system

e.g. customers don’t buy a product because of its collection of features, they buy a product as a collection of desired benefits

e.g. razor has triple-action cutting system

2

New cards

Benefits

refers to what a product does and what people get out of it.

e.g. people buy products for the benefits the products deliver

e.g. razor gives you a smooth shave

e.g. people buy products for the benefits the products deliver

e.g. razor gives you a smooth shave

3

New cards

Creeping Featurism (featuritis)

tendency to simply add features to product without thinking about how they relate to the benefits for users.

* can be detrimental if interfere with or detract from product’s core or expected benefits.

* featuritis curve: shows increasing the number of features initially increases user happiness but at “happy user peal”, it can decrease happiness if becomes more complicated to use.

* e.g. Microsoft many features in MicrosoftWord caused confusion.

* can be detrimental if interfere with or detract from product’s core or expected benefits.

* featuritis curve: shows increasing the number of features initially increases user happiness but at “happy user peal”, it can decrease happiness if becomes more complicated to use.

* e.g. Microsoft many features in MicrosoftWord caused confusion.

4

New cards

product

good, service, or idea consisting of a bundle of tangible and intangible benefits.

* services (stockbroker or tax preparation company) or idea (ideas sold to American public by political campaign

* Tangible: observed and touched

* Intangible: cannot be observed or touched (enhanced social status, improved self-concept, brand-names)

* services (stockbroker or tax preparation company) or idea (ideas sold to American public by political campaign

* Tangible: observed and touched

* Intangible: cannot be observed or touched (enhanced social status, improved self-concept, brand-names)

5

New cards

3 levels of product benefits

**Core**: a basic level that the product has to offer to fit into the product category

* the car has the ability to transport you.

**Expected**: benefits beyond core benefits that consumers expect

* the ability to open and shut the window aren’t essential but customers expect most cars to have this capability.

**Augmented**: benefits are above and beyond what is expected. Allows the brand to delight customers and distinguish its product from the competition.

* some cars are equipped with CarPlay which users use to connect iPhone Apps.

* the car has the ability to transport you.

**Expected**: benefits beyond core benefits that consumers expect

* the ability to open and shut the window aren’t essential but customers expect most cars to have this capability.

**Augmented**: benefits are above and beyond what is expected. Allows the brand to delight customers and distinguish its product from the competition.

* some cars are equipped with CarPlay which users use to connect iPhone Apps.

6

New cards

Points of Parity

expected product benefits that are shared across all brands in the category

7

New cards

Points of Difference

augmented product benefits

8

New cards

Product Item

specific product, identified by an alphanumeric ordering code known as SKU (Stock-keeping unit)

* e.g. SKU for a specific type of nail is F310R90G8BJ1AT

* every product has unique SKU that identifies it (a pack of 2 Bounty paper tower roll have different SKU than 4-pack of the same paper towel)

* Different from UPC (universal product code): first several digits give the company prefix, next gives item reference, last is check digit.

* e.g. SKU for a specific type of nail is F310R90G8BJ1AT

* every product has unique SKU that identifies it (a pack of 2 Bounty paper tower roll have different SKU than 4-pack of the same paper towel)

* Different from UPC (universal product code): first several digits give the company prefix, next gives item reference, last is check digit.

9

New cards

Product Line

group of product items that are closely related (because they satisfied a class of needs, are used together, are sold to the same customer groups, are distributed through the same type of outlets, or fall within a given price range)

* Exists within organization (e.g. Starbucks product lines are coffee, food, and tumblers)

* Exists within organization (e.g. Starbucks product lines are coffee, food, and tumblers)

10

New cards

Product Mix

Set of product lines sold by company

* some companies have only one product line in product mix, whereas other companies have a great variety of product lines in their product mix

\

* some companies have only one product line in product mix, whereas other companies have a great variety of product lines in their product mix

\

11

New cards

Breadth & Depth

**Depth**: number of product items in a product line indicates depth of product line.

**Breadth**: number of product lines indicates the breadth of product lines in a company’s product mix

**Breadth**: number of product lines indicates the breadth of product lines in a company’s product mix

12

New cards

Product Life Cycle (PLC)

4 stages a new product goes through in the marketplace:

1. introduction

2. growth

3. maturity

4. decline

* marketers use as basis for making better managerial decisions

1. introduction

2. growth

3. maturity

4. decline

* marketers use as basis for making better managerial decisions

13

New cards

Introduction stage

* product is first being introduced

* characterized by slow growth and low profit levels

* few suppliers

* focus should be on promotion to generate consumer awareness and consumer demand

1. **primary demand:** consumer desire for product class NOT SPECIFIC BRAND

2. **selective demand**: customer’s desire for the SPECIFIC BRAND

* ***Pricing can be high or low***

1. **Skimming strategy:** firms set high initial price to recover development costs (capitalizes on the fact that customers are more price-insensitive up front) (may cause lot of competition)

2. **Penetration pricing strategy:** strategy in which firm sets low intial price to build unit volume and gain market share. selling too many unites too cheaply can be costly for firm.

* characterized by slow growth and low profit levels

* few suppliers

* focus should be on promotion to generate consumer awareness and consumer demand

1. **primary demand:** consumer desire for product class NOT SPECIFIC BRAND

2. **selective demand**: customer’s desire for the SPECIFIC BRAND

* ***Pricing can be high or low***

1. **Skimming strategy:** firms set high initial price to recover development costs (capitalizes on the fact that customers are more price-insensitive up front) (may cause lot of competition)

2. **Penetration pricing strategy:** strategy in which firm sets low intial price to build unit volume and gain market share. selling too many unites too cheaply can be costly for firm.

14

New cards

Growth Stage

* sales increase rapidly, profit usually peaks

* Competitive entry: occurs at this stage as firms recognize the huge opportunity that the markets offer

* pricing becomes more aggressive as more competitors enter the market and firms use advertising to fight for selective demand and market shares.

* Firms must start to market product variations and work to differentiate their brands from competitors to gain and retain market shares.

* Distribution is key, companies must fight for shelf space and possibilities for expanded distribution.

* # of repeated purchasers increases during the stage, in proportion to first time users

* Competitive entry: occurs at this stage as firms recognize the huge opportunity that the markets offer

* pricing becomes more aggressive as more competitors enter the market and firms use advertising to fight for selective demand and market shares.

* Firms must start to market product variations and work to differentiate their brands from competitors to gain and retain market shares.

* Distribution is key, companies must fight for shelf space and possibilities for expanded distribution.

* # of repeated purchasers increases during the stage, in proportion to first time users

15

New cards

Maturity Stage

* growth of industry sales slows as the number of new buyers falls and most of the product purchasers become repeat purchasers.

* (at the beginning of this stage, **competitive shakeouts** occurs as some competitors decided to exit the market and invest their money elsewhere.)

* marginal competitors begin to leave market during this stage due to profit losses because of fierce price competition and the inability to attract new customers.

* marketing efforts are aimed at keeping existing customers and maintaining market shares.

* (at the beginning of this stage, **competitive shakeouts** occurs as some competitors decided to exit the market and invest their money elsewhere.)

* marginal competitors begin to leave market during this stage due to profit losses because of fierce price competition and the inability to attract new customers.

* marketing efforts are aimed at keeping existing customers and maintaining market shares.

16

New cards

Decline Stage

* Profits begin to drop as new technology and new products make products obsolete.

* characterized by a sharp decrease in sales

* firms must decide if it is worth to continue making the product despite a decline in sales

* can follow 1 of 2 strategies

1. **Deletion**: removing the product from the product line. drastic measure that can upset current customers who are still using the products

2. **Harvesting**: retaining the product but reducing marketing costs so that customers’ requests can be met at a minimal cost to the company.

\

* characterized by a sharp decrease in sales

* firms must decide if it is worth to continue making the product despite a decline in sales

* can follow 1 of 2 strategies

1. **Deletion**: removing the product from the product line. drastic measure that can upset current customers who are still using the products

2. **Harvesting**: retaining the product but reducing marketing costs so that customers’ requests can be met at a minimal cost to the company.

\

17

New cards

Product life cycle lengths

* Business products have longer life cycles than consumer products

* mass communication has effect of informing customers faster and speeding up product life cycles

* technology shortens life cycles as new technology replaces old technology more rapidly

* mass communication has effect of informing customers faster and speeding up product life cycles

* technology shortens life cycles as new technology replaces old technology more rapidly

18

New cards

Product life cycle shape

* generalized life cycle shows a gradual increase in sales, a huge increase in sales, flattening out, and a small decrease in sales but other life cycles shape different products.

* **High learning:** require significant education (the introductory period is extended)

* **Low-learning:** does not require much learning, sales increase immediately

* **Fashion products:** introduced, declined, and then return. cycles can exist over years or decades, as they follow trends that can repeatedly come in and out of style.

* **FADS**: experiences rapid initial sales, then decline just as rapidly, resulting in much shorter PLCS.

* **High learning:** require significant education (the introductory period is extended)

* **Low-learning:** does not require much learning, sales increase immediately

* **Fashion products:** introduced, declined, and then return. cycles can exist over years or decades, as they follow trends that can repeatedly come in and out of style.

* **FADS**: experiences rapid initial sales, then decline just as rapidly, resulting in much shorter PLCS.

19

New cards

Diffusion of innovation

describes how product spreads to new users

* Reasons for why people end up waiting to try a product:

* usage barriers, value barriers, risk barriers, psychological barriers.

* companies overcome by implementing warranties, usage instructions, free samples etc.

* Reasons for why people end up waiting to try a product:

* usage barriers, value barriers, risk barriers, psychological barriers.

* companies overcome by implementing warranties, usage instructions, free samples etc.

20

New cards

5 categories of product adopters

1. Innovators (first 2.5% adopters): venturesome, more-educated people who use multiple sources of information.

2. Early adopters (next 13.5%) social leaders with slightly above-average education

3. Early majority (next 34%) deliberate people with many informal social contacts

4. Late majority (next 34%) skeptical people who are below the average social status

5. Laggards (last 16%) are people who fear debt and use neighbors and friends as primary sources of information.

21

New cards

Product Class

refers to entire product category or industry (e.g. recorded music)

* product class life cycle includes sales of all producers of the product class

* e.g. we can draw the product class life cycle of the car industry.

* product class life cycle includes sales of all producers of the product class

* e.g. we can draw the product class life cycle of the car industry.

22

New cards

Product Form

refers to variations within the product class

* e.g. CDs, cassette tapes, MP3s

* we can draw product form life cycle for sports cars

* Usually driven by technology and consumer tastes

* e.g. CDs, cassette tapes, MP3s

* we can draw product form life cycle for sports cars

* Usually driven by technology and consumer tastes

23

New cards

Brand PLC

brand product life cycle describes products of the specific brands within a product form.

* e.g. we can draw the brand PLC for Ford Mustang

* under marketing control

* e.g. we can draw the brand PLC for Ford Mustang

* under marketing control

24

New cards

Four ways marketers can extend product life cycle:

1. **market penetration:** involves selling more of the product within the same market (increasing sales without entering any new markets)

1. Going deeper into the pockets of current customers (i.e persuading existing customers to use more of its products)

1. firms can use loyalty programs to increase existing customers’ frequency of purchase.

2. **a greater share of wallet:** percentage of customer’s expenditures that the firm accounts for.

2. **market development:** involves extending a product’s life cycle by looking for new markets (e.g. Oreos in China) (multinational marketing is difficult but potential benefits are significant)

3. **product modification:** product modification involves extending the product life cycle by altering a product’s characteristics (quality, performance, appearance to increase sales) (e.g. Oreo’s new flavors)

4. **product repositioning:** involves changing the position that the product occupies in the mind of the consumer. (e.g. changing the packaging and advertising)

25

New cards

4 factors that can trigger Product Repositioning

1. **Changing value offered:** company can change the value the product offers by trading up or down.

1. **Trading up**: involves adding value to a product (product line) through additional features or higher-quality materials.

2. **Trading down:** refers to reducing the number of features, quality, or price. often occurs as a result of downsizing: reducing the content of packages without changing package size, and maintaining or increasing package price.

2. **Reacting to competitor’s position:** a company may want to reposition to avoid tough competition

3. **Reaching new market:** a company may want to reposition itself in order to reach a new market

4. **Catching a rising trend:** repositioning may allow a company to make its product “fit” with new consumer trends.

26

New cards

Product manager (brand manager)

responsible for managing existing brands throughout product life cycle, and many product managers are responsible for developing new products.

* may analyze data relating to market shares, sales, and profit trends.

* uses tools such as BDI (brand development index) and CDI (category development index)

* may analyze data relating to market shares, sales, and profit trends.

* uses tools such as BDI (brand development index) and CDI (category development index)

27

New cards

Brand Development Index (BDI)

a tool used to determine how well a firm’s brand is performing in each geographic territory in which it sells. describes percentage of brands total that fall within a market segment in relation to percentage of total population that fall within a market segment.

\

BDI = $Brand Sales per capita in Territory J/ $Brand sales per capita nationally x 100

\

BDI < 100: brand per capital sales in that territory is below brands national average

BDI=100 brands per capita sales in that territory are at brands national average

BDI>100 above national average.

\

Just an indicator of how a brand is doing in one area relative to another.

\

BDI = $Brand Sales per capita in Territory J/ $Brand sales per capita nationally x 100

\

BDI < 100: brand per capital sales in that territory is below brands national average

BDI=100 brands per capita sales in that territory are at brands national average

BDI>100 above national average.

\

Just an indicator of how a brand is doing in one area relative to another.

28

New cards

Category Development Index (CDI)

category development index measures how an entire product category is performing in the market. describes percentage of a product category’s total sales that fall within a market segment in relation to the percentage of the total population that falls within that market segments.

\

CDI = $Category sales per capita in territory J/ $ category sales per capita nationally x 100

\

CDI >100 category is doing better in that territory than national average

CDI =100 just as well in the territory as national average

CDI< 100 doing worse in that territory than the category’s national average.

\

CDI = $Category sales per capita in territory J/ $ category sales per capita nationally x 100

\

CDI >100 category is doing better in that territory than national average

CDI =100 just as well in the territory as national average

CDI< 100 doing worse in that territory than the category’s national average.

29

New cards

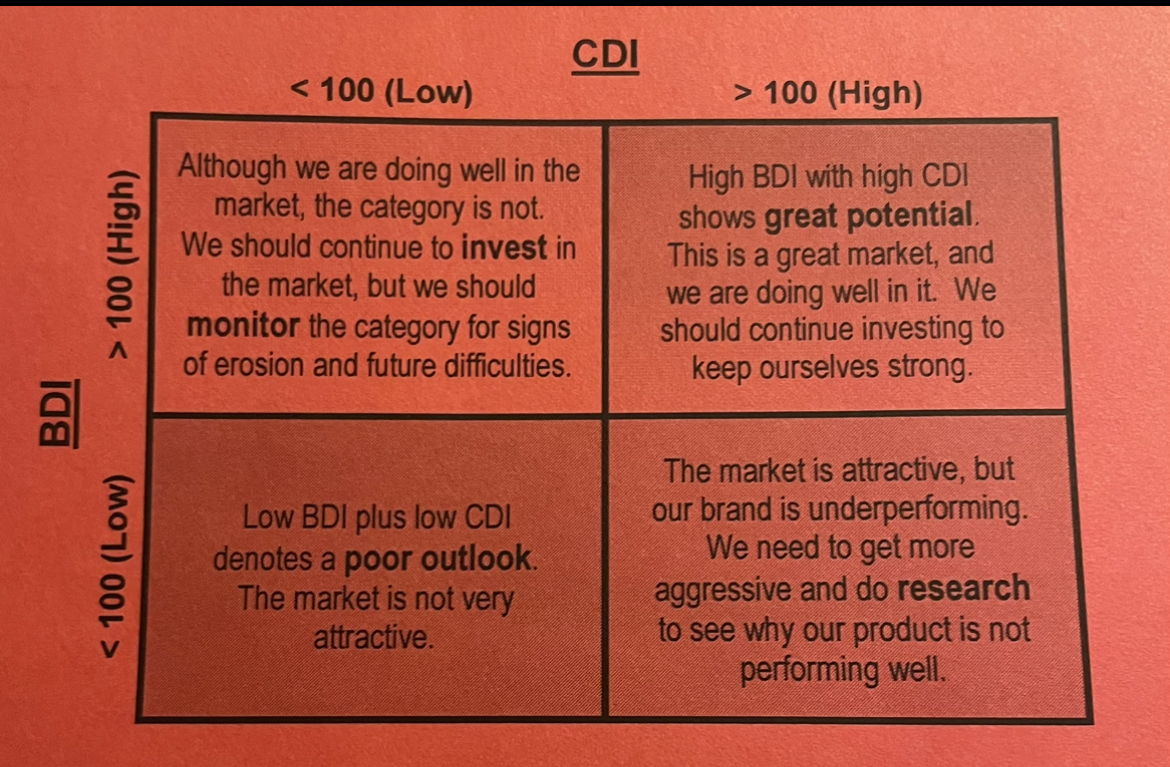

Market Attractiveness analyzed through BDI &CDI

30

New cards

Branding

refers to use of name, phrase, design, symbols, or combination of these to identify products and distinguish them from competitors.

31

New cards

Branding terms

**brand name:** verbal name that is attached to a brand (e.g. Coca-Cola, Apple, Nike, and Pepsi)

**trade name:** the commercial, legal name under which a company does business (e.g. Coca-Cola Company)

**brand mark:** nonverbal representation of a brand (e.g. Nike Swoosh)

**trade character:** personified or character-based representation of the brand (e.g. Ronald McDonald, Progressive Flo)

**Logo:** referring to any verbal or nonverbal representation of a brand. ( Pepsi with Pepsi Zero and Pepsi Max).

**Trademark:** brand or trade name, brand mark, trade character, or logo that is legally protected so the firm has its exclusive use. Registered with U.S. Patent and Trademark Office.

**trade name:** the commercial, legal name under which a company does business (e.g. Coca-Cola Company)

**brand mark:** nonverbal representation of a brand (e.g. Nike Swoosh)

**trade character:** personified or character-based representation of the brand (e.g. Ronald McDonald, Progressive Flo)

**Logo:** referring to any verbal or nonverbal representation of a brand. ( Pepsi with Pepsi Zero and Pepsi Max).

**Trademark:** brand or trade name, brand mark, trade character, or logo that is legally protected so the firm has its exclusive use. Registered with U.S. Patent and Trademark Office.

32

New cards

Family Branding

also known as multiproduct branding or corporate branding, which a firm puts the same basic brand names on all of the products it sells. (Nike with shoes to swimsuits)

* allow firms to take advantage of strong brand names

* allow positive experiences to transfer to other products

* excessive brand extensions, subbranding, and co-branding can lead to **brand dilution**, which occurs when consumer stop associating a brand with a specific product and start thinking less favorably about the brand as a result.

* allow firms to take advantage of strong brand names

* allow positive experiences to transfer to other products

* excessive brand extensions, subbranding, and co-branding can lead to **brand dilution**, which occurs when consumer stop associating a brand with a specific product and start thinking less favorably about the brand as a result.

33

New cards

Multiple Branding

also known as multibranding where company attaches distinctive brand names to various product it sells (e.g. Proctor & Gamble’s marketing program uses multiple branding; the firm has many different brand names (Ace, Always, Bounty, and Crest) representing different products that it manufactures.

* fighting brands: special kind of multibranding in which a company introduces a brand as a defensive move against competitors. (e.g. Frito-Lay introduced Santitas tortilla chips to take sales away from a tortilla chip brand that was reducing sales of its Doritos brand.

* fighting brands: special kind of multibranding in which a company introduces a brand as a defensive move against competitors. (e.g. Frito-Lay introduced Santitas tortilla chips to take sales away from a tortilla chip brand that was reducing sales of its Doritos brand.

34

New cards

Cobranding

occurs when two companies or brands cooperate and put both brands on a product (short term alliances)

* Taco Bell and Doritos teamed up to offer Doritos Locos Tacos

* LEGO staying relevant by creating toy sets based on popular movies and TV shows.

* Taco Bell and Doritos teamed up to offer Doritos Locos Tacos

* LEGO staying relevant by creating toy sets based on popular movies and TV shows.

35

New cards

National Brands

typically talk about in context of consumer goods such as Ragu, Goya, Betty Crocker, Tide.

* designed to attract consumers to brand and develop brand loyalty.

* responsible for major innovations and advertising in a market. take part in a lot of research and development.

* have higher prices and more marketing

* designed to attract consumers to brand and develop brand loyalty.

* responsible for major innovations and advertising in a market. take part in a lot of research and development.

* have higher prices and more marketing

36

New cards

Private Label Brands

brands associated with particular retailer

(e.g. Kirkland is Costco’s private label brand)

* focus is to build store loyalty

* close to national brands in terms of quality but innovation and advertising are much lower.

* different from generic products which have no brand names

(e.g. Kirkland is Costco’s private label brand)

* focus is to build store loyalty

* close to national brands in terms of quality but innovation and advertising are much lower.

* different from generic products which have no brand names

37

New cards

Private branding

also known as private labeling or reseller branding. a company manufactures products and sells them under the brand name of a wholesaler or retailer.

* tend to generate high profit for manufacturers and resellers.

* private brand accounts for 1 in 5 items purchased at U.S supermarkets, drugstores, and mass merchandisers.

* tend to generate high profit for manufacturers and resellers.

* private brand accounts for 1 in 5 items purchased at U.S supermarkets, drugstores, and mass merchandisers.

38

New cards

Mixed branding

firm markets products under its own name(s) and that of a reseller because the segment attracted to the reseller is different from its own market.

(e.g. Elizabeth Arden has skincare products under both its Elizabeth Arden brand name and the “ Skin Simple” private label which is sold at Walmart.

* two products are priced differently to appeal to consumer segments that have different price sensitivities.

\

(e.g. Elizabeth Arden has skincare products under both its Elizabeth Arden brand name and the “ Skin Simple” private label which is sold at Walmart.

* two products are priced differently to appeal to consumer segments that have different price sensitivities.

\

39

New cards

Licensing

branding strategy in which a firm that owns a brand name sells another company the rights to manufacture and sell products under that brand name.

(e.g. Disney might license some characters to producers of various kinds of merchandise)

* company doesn’t have to know anything about the product category that it is licensing its brand name to.

* UF success in licensing the Gatorade brand name to Pepsi, and Coca-Cola’s purchase of the rights to manufacture, distribute, and sell bottled coffee drinks under the Dunkin’s brand name.

(e.g. Disney might license some characters to producers of various kinds of merchandise)

* company doesn’t have to know anything about the product category that it is licensing its brand name to.

* UF success in licensing the Gatorade brand name to Pepsi, and Coca-Cola’s purchase of the rights to manufacture, distribute, and sell bottled coffee drinks under the Dunkin’s brand name.

40

New cards

Brand personality

set of human characteristics associated with the brand name (traditional, rebellious, rugged, sophisticated, etc)

* marketers can give a brand personality through advertising, and consumers often buy the products that match up with their own desired self-image

* marketers can give a brand personality through advertising, and consumers often buy the products that match up with their own desired self-image

41

New cards

Brand equity

added value that a particular brand name provides to a product( beyond the functional benefits provided)

* e.g. brand equity associated with Disney is illustrated in the differences between the value of snack-size pack of apples with cheese and value of a Disney-branded snack-sized pack of apples)

* Provides (1) competitive advantage (2) allows companies to charge more for a product

* e.g. consumers are more willing to pay more for Duracell batteries than “ordinary” batteries

* e.g. brand equity associated with Disney is illustrated in the differences between the value of snack-size pack of apples with cheese and value of a Disney-branded snack-sized pack of apples)

* Provides (1) competitive advantage (2) allows companies to charge more for a product

* e.g. consumers are more willing to pay more for Duracell batteries than “ordinary” batteries

42

New cards

Four important components of brand equity

1. **Awareness**: refers to the degree in which potential customers are familiar with the brand. firms want to be instantly recognized in the consideration set of their consumers. starting point of brand equity

2. **Association**: what comes into mind when a brand is mentioned (e.g. Walmart Vs Target)

3. **Perceived quality**: describes the extent to which consumers believe the product does a great job in delivering the desired product benefits

4. **Loyalty:** an important component of brand equity because it is essentially the result of the money invested in adding value to a brand name.

1. company more loyal will purchase, also be more emotionally attached or psychologically committed to brand.

43

New cards

Customer-based brand equity pyramid

emphasizes that brand awareness is the foundation upon which brand performance and brand imagery are built.

1. developing positive brand awareness

2. establishing a brand’s meaning in customers’ mind

3. eliciting proper (positive) consumer responses to a brand’s meaning and identity

4. creating deep psychological bond between the consumer and the brand

1. developing positive brand awareness

2. establishing a brand’s meaning in customers’ mind

3. eliciting proper (positive) consumer responses to a brand’s meaning and identity

4. creating deep psychological bond between the consumer and the brand

44

New cards

Brand Licensing

contractual agreement whereby one company (the licensor) allow its brand name(s) or trademark(s) to be used with products or services offered by another company (the licensee( for royalty or fee)

45

New cards

2 ways to extend brand equity

launching new products

1. **Line extension:** firm can build brand equity by introducing additional products in the same general product line using the brand name from the parent brand. (e.g. La Croix launched a new kiwi flavor to its existing line of sparking water) (can increase brand awareness and decreases promotional and advertising costs)

2. **Category extension:** extending a brand into another product category. (e.g. if La Croix launched a breakfast cereal. (company may dilute the original brand if it overextends or ventures into a category too far from existing brand associations).

1. **Line extension:** firm can build brand equity by introducing additional products in the same general product line using the brand name from the parent brand. (e.g. La Croix launched a new kiwi flavor to its existing line of sparking water) (can increase brand awareness and decreases promotional and advertising costs)

2. **Category extension:** extending a brand into another product category. (e.g. if La Croix launched a breakfast cereal. (company may dilute the original brand if it overextends or ventures into a category too far from existing brand associations).

46

New cards

Packaging

any container in which product is offered for sale and on which label information is conveyed.

* **label**: integral part of package and typically identifies the product or brand, who made it, where and when it was made, how it is to be used, and package contents and ingredients

* accounts for 15% of the cost of average product

* **label**: integral part of package and typically identifies the product or brand, who made it, where and when it was made, how it is to be used, and package contents and ingredients

* accounts for 15% of the cost of average product

47

New cards

Functions of Packaging

1. **Contain or Protect:** egg cartons are shock resistant

2. **Facilitate use:** resealable packages of food and snack packs with separate compartments

3. **Communicate:** communicates information and portrays image

4. **Fit channel needs:** carry products for other members in the channel (Chiquita redesigned its banana packing to be more efficient and easier for retailers to stack)

5. **Innovation:** packaging can be used to help a firm show that it is innovative, in an attempt to gain a leg up in the marketplace. (e.g. Converse created shoe boxes that used an extra pair of laces as handles for carrying it).

48

New cards

Global Trends involved in packaging

* **The need to connect with customers-** marketers must design packaging to deliver customer value and capture the customer’s attention. Aesthetics and functionality are more important than ever

* **Environmental sensitivity:** consumers are concerned about the amount, composition, and disposal of packaging (led to the increasing use of recycled materials. Companies ensure that packaging and containers are safe

* **Health, safety, and security concerns:** consumers are demanding that companies ensure that packaging and containers are safe. (lighters almost universally come with child-resistant safety latches).

* **cost reduction:** costs of glass, paper, and plastic rise, and firms are looking for ways to reduce amount of materials used in packages and containers.

* **Environmental sensitivity:** consumers are concerned about the amount, composition, and disposal of packaging (led to the increasing use of recycled materials. Companies ensure that packaging and containers are safe

* **Health, safety, and security concerns:** consumers are demanding that companies ensure that packaging and containers are safe. (lighters almost universally come with child-resistant safety latches).

* **cost reduction:** costs of glass, paper, and plastic rise, and firms are looking for ways to reduce amount of materials used in packages and containers.

49

New cards

2 Issues in Branding

1. consumer-brand relationship: relationship between consumer and brand they like is becoming personal (e.g. if brand that is poorly distributed and thus not on the shelves when you want to buy it is like a friend who says they’ll meet up with u and not show up)

2. Brand communities: involves multiple consumers that have relationships with each other because of relationships with the brand. companies encourages this because they foster consumer-brand relationships. interacting with other users reinforce notion of brand as part of identity.

50

New cards

Warranty

a statement indicating the liability of the manufacturers for product deficiencies.

1. express warranties: written statements

1. limited-coverage warranties: states the bounds of coverage and area of noncoverage

2. full warranties have no limits on noncoverage

2. Implied warranties: assign responsibility for product deficiencies to the manufacturer, even without a written statement of liabilities.

(brand perceptions favor brands with full warranties over brands with limited).

1. express warranties: written statements

1. limited-coverage warranties: states the bounds of coverage and area of noncoverage

2. full warranties have no limits on noncoverage

2. Implied warranties: assign responsibility for product deficiencies to the manufacturer, even without a written statement of liabilities.

(brand perceptions favor brands with full warranties over brands with limited).

51

New cards

Goods

products with tangible attributes that five senses may perceive, though a good may also have intangible attributes when it comes to delivery or warranty.

* Nondurable: items consumers use once or a few times (e.g. food products, and fuel)

* Durable: items that sustain many uses (e.g. appliances, automobile, stereo equipments)

* Nondurable: items consumers use once or a few times (e.g. food products, and fuel)

* Durable: items that sustain many uses (e.g. appliances, automobile, stereo equipments)

52

New cards

Consumer products

products purchased by the ultimate consumers

53

New cards

Business products (industrial products or B2B products)

products that assist directly or indirectly in providing products for resale

54

New cards

4 kinds of consumer products

1. **convenience**: items consumer purchase frequently, conveniently, and with minimal effort

2. **shopping products**: items for which consumer compare several alternatives on criteria such as price, quality, or style

3. **specialty:** items consumers make a special effort to seek out and buy

4. **unsought:** items consumers either do not know about or know about but do not initially want

55

New cards

derived demand

sales of business products is the result of derived demand. when sales of business products depend on consumers’ demand for consumer product.

56

New cards

Classifications of Business Products

1. **Components**: items used in the manufacturing process and become part of the final product

* e.g. raw materials, component parts, etc

* sold to industrial users

2. **Support products**: items used to assist in producing other goods and services. there are four main types

* **Installations**: buildings and fixed equipment

* **accessory** **equipment**: tools and office equipment

* **supplies**: products such as stationery, paper clips, and brooms

* **industrial** **services**: intangibles that help the industrial buyers

57

New cards

What is a new product

1. **newness compared to existing products**: creating new industry (Apple II computer) or adding features to existing products (digital devices that integrate cell phones, camera, mp3)

2. **Newness in legal terms:** FTC says the product is new until 6 months after entering the regular distribution

3. **Newness from Company POV:** 3 levels. (1) product line extension: incremental improvement in an existing product (2) significant technological jump (landline to a cell phone) (3) true innovation: new products that are truly revolutionary (first computer)

4. **Newness from the consumer’s POV: classified into 3 categories:**

* **continuous innovation;** does not significantly change how consumers live their everyday lives. does not require learning new behaviors ( new colors, new flavors, new style)

* **dynamically continuous innovation:** requires small amount of new learning and adjustment on part of the consumer; consumers’ adoption of the product involves only few minor changes in behavior (FACE ID)

* **discontinuous innovation**: learning entirely new patterns of consumption . have a broad social impact and changes the way we live our lives. (telephone and internet)

58

New cards

8 marketing-related reasons for new product failures

1. **insignificant point of difference**

2. **incomplete market and product definition before product development starts:**

* research and development need to be focused on the product and market

* **protocol**: a statement that, before product development begins, identifies: 1. a well-defined target market; (2) specific customer needs, wants, and preferences; (3) what the product will be and what it does.

3. **Failure to satisfy needs**: U.S automaker that ships cars to Great Britain will not be successful if it fails to build cars driven from the right side

4. **Bad timing:** consumer taste changes and the product will fail

5. **no economical access to buyers:** shelf space is precious, and many times it is just unavailable for new products

6. **poor execution of marketing mix:** name, price, package, promotion, and distribution all have to be right for the product to be successful

7. **too little market attractiveness:** target market may be too small to be competitive or too small to justify spending money on reaching it.

8. **poor product quality or sensitivity to customer needs on critical factors:** even if the quality is high, problems on just a couple of factors can kill the product. sometimes less is more. take out complicated but useful features.

59

New cards

2 Organizational problems that can contribute to product failures

1. **groupthink:** the tendency of a group member to suppress objections and agree with others to gain acceptance from the group. can restrain individuals from contributing important opinions during the new product process.

2. **failure to address the NIH problem:** in large organization with a good deal of bureaucracy, ideas are frequently rejected simply because they came from outside of the organization. “not-invented-here”

* companies can deal with this problem by encouraging **open innovation:** the use of internal and external ideas and collaboration when conceiving, producing, and marketing new products and services.

60

New cards

New Product Vitality Index:

tracks vitality of company’s new product development efforts as follows.

new product vitality index=sales from new products released in the past 3 years/total current-year sales x 100

* company new product vitality index is considered good if between 20% & 30%

new product vitality index=sales from new products released in the past 3 years/total current-year sales x 100

* company new product vitality index is considered good if between 20% & 30%

61

New cards

New product development process

describes the stages a firm goes through to identify business opportunities and convert them to a salable good or service.

* ideas that are able to advance further have a higher rate of success staying on the market

* firm increase the chances of success by introducing products only after they made it all the way through the process

P&G product planning process:

1) new product strategy

2) idea generation

3) screening and evaluation

4) business analysis

5) prototype development

6) market testing

7) commercialization

* ideas that are able to advance further have a higher rate of success staying on the market

* firm increase the chances of success by introducing products only after they made it all the way through the process

P&G product planning process:

1) new product strategy

2) idea generation

3) screening and evaluation

4) business analysis

5) prototype development

6) market testing

7) commercialization

62

New cards

new product strategy

involves defining the role of a new product in terms of the firm’s overall coporate or brand objectives. firms must use environmental scanning to identify trends that pose either an opportunity for, or a threat to, the new product.

63

New cards

idea generation

developing a pool of concepts as candidate for new products. ideas can come from number of sources, including engineers, marketers, consumer ethnography, the internet, brainstorming session, focus groups, observations, suggestions, and competing products.

64

New cards

crowdsourcing

approach that welcomes, or even encourages, new ideas form any source. can be done internally by sourcing ideas from company employees or externally by sourcing ideas from the public.

65

New cards

screening and evaluation

involve internal and external evaluations of new product ideas to eliminate those that warrant no further effort

**1) feasibility screening (internal):** involves critical examination of each idea by considering whether the idea goes beyond the scope of the firms capabilities.

* central idea to CEM (customer experience management) process of managing the entire customer experience within the company

**2) concept testing (external approach)** involves specifically testing the product conepts with consumers. no actual products or prototype is produced at this stage. marketers simply describe concepts of product to consumers through focus groups or mall intercept surveys.

\

* on average 12 ideas survive feasibility, only 9 survives concept test, rejecting 25%

**1) feasibility screening (internal):** involves critical examination of each idea by considering whether the idea goes beyond the scope of the firms capabilities.

* central idea to CEM (customer experience management) process of managing the entire customer experience within the company

**2) concept testing (external approach)** involves specifically testing the product conepts with consumers. no actual products or prototype is produced at this stage. marketers simply describe concepts of product to consumers through focus groups or mall intercept surveys.

\

* on average 12 ideas survive feasibility, only 9 survives concept test, rejecting 25%

66

New cards

Business analysis

involves specifying product features and marketing strategy, and making financial projections needed to commercialize a product.

* business does economic analysis, legal examination, and market strategy review.

* product is examined to see whether it would be distributed through existing channels or affect sales of existing products.

* involves DEMAND FORECASTING

* the first indication of how much product capacity the firm may need to satisfy consumer demand if the idea goes to market.

* business does economic analysis, legal examination, and market strategy review.

* product is examined to see whether it would be distributed through existing channels or affect sales of existing products.

* involves DEMAND FORECASTING

* the first indication of how much product capacity the firm may need to satisfy consumer demand if the idea goes to market.

67

New cards

Prototype development

stage of the new product processing which the firm develops a few sample products or working models to do some testing.

* turning idea into a prototype -a full scale operating model- performing laboratory and consumer tests to make sure it meets applicable standards.

* turning idea into a prototype -a full scale operating model- performing laboratory and consumer tests to make sure it meets applicable standards.

68

New cards

Market testing

involves exposing actual products to prospective customers under realistic purchase conditions to see if they will buy them. accomplished through a reduced release of products (such as offering new products at particular stores or only in select regions.

* **test marketing:** refers to offering products for sale in defined areas on a limited basis to find out if customers will actually buy the product

* **standard test markets:** developing the product, then selling through standard distribution channels (test markets will represent real markets)

* **controlled test markets:** involves contracting the testing to an outside company. the company then pays retailers for shelf space and can guarantee a certain amount of distribution volume

* **simulated test markets (STMs):** used because they are less expensive than full-blown test marketing. setting up full scale test markets in limited fashion (shopping mall)

* **test marketing:** refers to offering products for sale in defined areas on a limited basis to find out if customers will actually buy the product

* **standard test markets:** developing the product, then selling through standard distribution channels (test markets will represent real markets)

* **controlled test markets:** involves contracting the testing to an outside company. the company then pays retailers for shelf space and can guarantee a certain amount of distribution volume

* **simulated test markets (STMs):** used because they are less expensive than full-blown test marketing. setting up full scale test markets in limited fashion (shopping mall)

69

New cards

commercialization

positioning and launching of new product in full-scale production and sales. usually engaged slowly and gradually because it is the most expensive step

* through regional rollouts: refers to sequential expansion into different geographical areas to allow marketing activities to gradually build up.

* 50/50 chance of success

* through regional rollouts: refers to sequential expansion into different geographical areas to allow marketing activities to gradually build up.

* 50/50 chance of success

70

New cards

adoption process

\

\

process in which consumer decides to adopt a new product for continued used.

1) awareness: brand equity is powerful. most important step

2) interest: must attract

3) evaluation: must view product favorably

4) trail purchase: initial purchase indicates consumer has deemed the product promising enough to try (free samples, coupons, in-store demonstration)

5) adoption: marketers must analyze how frequently and in what quantities the product-adopting consumers make repeat purchases. > create relationship with consumer

1) awareness: brand equity is powerful. most important step

2) interest: must attract

3) evaluation: must view product favorably

4) trail purchase: initial purchase indicates consumer has deemed the product promising enough to try (free samples, coupons, in-store demonstration)

5) adoption: marketers must analyze how frequently and in what quantities the product-adopting consumers make repeat purchases. > create relationship with consumer

71

New cards

Diffusion

cumulative proportion of the market that adopts the product. percentage of the market that adopts a product grows. marketers are interested in both how high %adoption gets and how fast it gets there.

* initial growth is slow, then it takes off, then it slows down

* flattens out at asymptote: highest or peak level of diffusion the product will ever achieve

* initial growth is slow, then it takes off, then it slows down

* flattens out at asymptote: highest or peak level of diffusion the product will ever achieve

72

New cards

5 main factors that influence new product rate of diffusion

**1) relative advantage:** greater the relative advantage, more rapidly the product will diffuse ( most important factor influencing rate of product diffusion)

**2) communicability:** capability to describe benefits. (e.g. chairs have high communicability because people know what they are for)

**3) complexity**: affects speed at which it diffuses. more complex a product is, more slowly it will diffuse

**4) compatibility** how compatible it is with the culture. people have to significantly change their habits to adopt, diffusion will be slow

**5) risks:** buying product can involve various types of risks (financial, social, physical, and performing) higher level risk = slower rate of diffusion (E.g. financial risk associated with the trail purchase of expensive products

\

* increase product rate of diffusion: marketers want to maximize relative advantage, communicability, compatibility, and minimize complexity, and risk.

**2) communicability:** capability to describe benefits. (e.g. chairs have high communicability because people know what they are for)

**3) complexity**: affects speed at which it diffuses. more complex a product is, more slowly it will diffuse

**4) compatibility** how compatible it is with the culture. people have to significantly change their habits to adopt, diffusion will be slow

**5) risks:** buying product can involve various types of risks (financial, social, physical, and performing) higher level risk = slower rate of diffusion (E.g. financial risk associated with the trail purchase of expensive products

\

* increase product rate of diffusion: marketers want to maximize relative advantage, communicability, compatibility, and minimize complexity, and risk.

73

New cards

Four Is of service

1) intangibility

2) inconsistency

3) inseparability (consumer and service have the be in the same place at the same time. ((hairdresser)) involves **co-creation(production**): customization and customer feedback increasing satisfaction)

4) inventory

2) inconsistency

3) inseparability (consumer and service have the be in the same place at the same time. ((hairdresser)) involves **co-creation(production**): customization and customer feedback increasing satisfaction)

4) inventory

74

New cards

service continuum

refers to range from the tangible to intangible or from goods-dominant to service-dominant offerings.

* fast-moving consumer goods, like pasta sauce and paper tower are on the tangible end of the continuum since they are almost entirely dominated by pure goods.

* the other end products are pure services and completely intangible (advice, education)

* fast-moving consumer goods, like pasta sauce and paper tower are on the tangible end of the continuum since they are almost entirely dominated by pure goods.

* the other end products are pure services and completely intangible (advice, education)

75

New cards

industrialize the production of services

using automation, technology, and standardizing process to eliminate inconsistency and much of human elements as possible.

76

New cards

idle production capacity

service provider is avaliable but there is no demands.

* inventory carrying costs refer to cost of paying the person providing the service and cost of needed equipments

* use yield management techniques to match supply with demand

* inventory carrying costs refer to cost of paying the person providing the service and cost of needed equipments

* use yield management techniques to match supply with demand

77

New cards

Classifying service

1. **people or equipment deliver them** (lawyer, security, repairer) or (electric utilities, ATMS, taxis, airlines)

2. **profit or nonprofit** (not taxed thus return to company to continue to provide the service. employ about 10% of workforce turn to marketing efforts to promote cause)

3. **government sponsored:** u.s. post office embracing internet to make services more accessible and valuable to users.

78

New cards

American Consumer Satisfaction Index (ACSI)

measures customer satisfaction in different industries and sectors.

* satisfaction tend to be higher the more an industry is based on providing tangible products or manufactured goods

* tend to be lower more service-dominated an industry is.

Customer satisfaction is directly correlated with company performance

* satisfaction tend to be higher the more an industry is based on providing tangible products or manufactured goods

* tend to be lower more service-dominated an industry is.

Customer satisfaction is directly correlated with company performance

79

New cards

The Purchase Process

numbers of different qualities that consumer look for in service, which fall into two categories:

1) experience properties (discerned either during or after consumption)

2) credence properties (trust in and reliability of the service providers)

1) experience properties (discerned either during or after consumption)

2) credence properties (trust in and reliability of the service providers)

80

New cards

Service in terms of benefits

1. **Core**: having the right product, at the right time, ar the right place, at the right time.

2. **Expected**: meet customer expectations like dependability and courtesy

3. **Augmented**: simply at parity with its competitors when it provides core and expected service. must distinguish itself. builds lifelong bond between consumer and company

4. **potential**: a pool of ideas for providing better service that have not been implemented. must continually come up with new ways to improve service offerings. consider future attributes not yet applied.

81

New cards

RATER model

how consumer evaluate service quality on five dimensions.

1) **Reliability**: deliver what is promised. most important.

2) **Assurance**: gaurantee customers that things are going to be taken care of and that they are in god hands.

3) **Tangible**: free samples and trade characters, as well as appearance related indications of quality such as cleaniness of the store and uniforms of the staffs

4) **Empathy**: provider communicates that they care. a personal touch and individualized attention to customer.

5) **Responsiveness**: willing and able to meet demand (i.e. having the service available when customer wants it) responding appropriately when there is a problem.

1) **Reliability**: deliver what is promised. most important.

2) **Assurance**: gaurantee customers that things are going to be taken care of and that they are in god hands.

3) **Tangible**: free samples and trade characters, as well as appearance related indications of quality such as cleaniness of the store and uniforms of the staffs

4) **Empathy**: provider communicates that they care. a personal touch and individualized attention to customer.

5) **Responsiveness**: willing and able to meet demand (i.e. having the service available when customer wants it) responding appropriately when there is a problem.

82

New cards

Service recovery

refers to service providers response when a customer complains about poor customer experience.

83

New cards

Quality Gap

source of poor-quality service that exists when customer perceptions fall short of customer expectations

* **gap model of service quality:** sums up the negative difference between customer perceptions and expectations as one quality gap

* **extended gap model:** examines a number of potential stages of poor service that may cause given gap

* **gap model of service quality:** sums up the negative difference between customer perceptions and expectations as one quality gap

* **extended gap model:** examines a number of potential stages of poor service that may cause given gap

84

New cards

Quality Gap Components

* **knowledge gap:** exists between what customer expect and what management thinks customers expect. occurs when firms don’t know what customer want because not enough market research (e.g. firm thinks consumer want better quality. consumer actually want quicker service)

* **standards gap:** exists when management accurately perceives customer expectations but sets up inappropriate specifications- standards for service- in attempting to satisfy those expectations. (store thinks customer wants friendly environment. tell sales associate to greet customer by door. customer might perceive as pushy)

* **delivery gap:** exists when management correctly identifies customer expectation and develops appropriate standards for fulfilling them, but the implementation of the service plan goes awry. can be due to incompetent or unmotivated employees. minimized with improved HR to hire good service employee and training.

* **Communication gap:** between implementations, which is what companies really do., and their external communications to customers, which is what companies tell customers they are going to do. Happens if customer doesn’t understand what company is providing even if the service is useful.

* **standards gap:** exists when management accurately perceives customer expectations but sets up inappropriate specifications- standards for service- in attempting to satisfy those expectations. (store thinks customer wants friendly environment. tell sales associate to greet customer by door. customer might perceive as pushy)

* **delivery gap:** exists when management correctly identifies customer expectation and develops appropriate standards for fulfilling them, but the implementation of the service plan goes awry. can be due to incompetent or unmotivated employees. minimized with improved HR to hire good service employee and training.

* **Communication gap:** between implementations, which is what companies really do., and their external communications to customers, which is what companies tell customers they are going to do. Happens if customer doesn’t understand what company is providing even if the service is useful.

85

New cards

customer retention

if company can retain a customer, the total profit it enjoys just from that customer often greatly outweighs the costs of attracting and retaining the customer in the first place.

EARN LARGER PROFIT IF:

* larger, more frequent purchase

* reduced operation costs (existing customers are less expensive than new

* referrals: customer tell other customer about good experience = free advertising. lower cost to get new customers

* price premium: price elasticity decreases as commitment to company increases. returning customers cut some slacks if prices are increased

EARN LARGER PROFIT IF:

* larger, more frequent purchase

* reduced operation costs (existing customers are less expensive than new

* referrals: customer tell other customer about good experience = free advertising. lower cost to get new customers

* price premium: price elasticity decreases as commitment to company increases. returning customers cut some slacks if prices are increased

86

New cards

Customer lifetime value (CLV)

considered the lifetime value of satisfying customers. firms generally care more about profitability than revenues, as profits is more relevant metric to measure customer’s value.

CLV = (profit earned per visit) x (visits per year) x (average life as customer in years)

CLV = (profit earned per visit) x (visits per year) x (average life as customer in years)

87

New cards

relationship marketing

effort by company to development long-term, cost-effective link with individual customers for mutual benefits of the customer and the organization. relationship must be two-sided: the organization must receive a stream of profit and the customer must receive a stream of value from the company

1. **frequency marketing:** reward people for frequency (flyer programs, credit card reward programs, loyalty cards) overall goal is to create brand loyalty, achieve greater share of wallet (the proportion of customer’s overall purchases in the category spent in the company.

* lock in: developing ways to make customers dependent on its products. (free burger on tenth visit)

2. **database marketing:** using large collections of data to make marketing decisions. gather info about birthday, important people, styles they prefer and more.

* often used in **CRM Customer Relationship Management:** uses software to manage customer relationships.

1. **frequency marketing:** reward people for frequency (flyer programs, credit card reward programs, loyalty cards) overall goal is to create brand loyalty, achieve greater share of wallet (the proportion of customer’s overall purchases in the category spent in the company.

* lock in: developing ways to make customers dependent on its products. (free burger on tenth visit)

2. **database marketing:** using large collections of data to make marketing decisions. gather info about birthday, important people, styles they prefer and more.

* often used in **CRM Customer Relationship Management:** uses software to manage customer relationships.

88

New cards

Customer’s RFM

Used in database marketing

* R: how **r**ecently they purchased

* F: how **f**requently they purchase

* M: the **m**onetary value of their purchase

use in alignment with value analysis (RFM) to put customers into different groups based on profitability.

* R: how **r**ecently they purchased

* F: how **f**requently they purchase

* M: the **m**onetary value of their purchase

use in alignment with value analysis (RFM) to put customers into different groups based on profitability.

89

New cards

Customer Pyramid Groups

* **Platinum**: most valuable ones. most profitable, not price-sensitive, highly loyal.

* **Gold**: profitable but not as committed. organizations go out to treat gold customers well but not as well as platinum

* **Iron**: provide volume needed to utilize the firm’s capacity. most customers are at this **level**. profitability isn’t enough to warrant special treatment.

* **Lead**: cost firm money and are ultimately unprofitable. firm wants to minimize this segment ideally by turning them to Iron customers. firm should find appropirate way to terminate the relationships if not serve them at all.

* **Gold**: profitable but not as committed. organizations go out to treat gold customers well but not as well as platinum

* **Iron**: provide volume needed to utilize the firm’s capacity. most customers are at this **level**. profitability isn’t enough to warrant special treatment.

* **Lead**: cost firm money and are ultimately unprofitable. firm wants to minimize this segment ideally by turning them to Iron customers. firm should find appropirate way to terminate the relationships if not serve them at all.

90

New cards

Experience Economy

marketing offers come in different forms: (e.g. coffee)

* **Commodity**: supplying (undifferentiated) raw coffee beans that consumers must bring home and roast/grind/brew to have coffee.

* **Good**: selling varieties of roast beans or ground coffee at the supermarket, which only requires consumers to brew the coffee at home.

* **Service**: serving coffee that has been freshly brewed by a restaurant or coffee shop

* **Experience**: staging an experience for enjoying customized or specialty coffee, offered in a pleasant environment. (free wifi, comfortable furniture, playlist of soothing music)

* as the product progresses through these levels, the prices that consumers are willing to pay rise

* **Commodity**: supplying (undifferentiated) raw coffee beans that consumers must bring home and roast/grind/brew to have coffee.

* **Good**: selling varieties of roast beans or ground coffee at the supermarket, which only requires consumers to brew the coffee at home.

* **Service**: serving coffee that has been freshly brewed by a restaurant or coffee shop

* **Experience**: staging an experience for enjoying customized or specialty coffee, offered in a pleasant environment. (free wifi, comfortable furniture, playlist of soothing music)

* as the product progresses through these levels, the prices that consumers are willing to pay rise

91

New cards

Customer contact audit

a flowchart of the points of interactions between consumer and the service providers. important because research shows that sincerity and authenticity of the customer interactions are major determinants of the success of a customer service relationship. (touchpoints)

92

New cards

7 Ps of Marketing

1. Product

2. Price

3. Place

4. Promotion

\---

5. People

6. Physical environment

7. Process

93

New cards

Price in Marketing

(charges, fees, fares, rates)

two major roles:

1. **indicator of the quality of service (higher prices are perceived as being better than lower-priced**

2. **role in capacity management**

1. for instance: **off-peak pricing** consists of charging different prices during different times of the day or days of the week to reflect variations in demand for the service. (e.g. airlines offer discounts for traveling at nonpeak times)

* consumers also consider nonmonetary costs such as efforts required to consume service

two major roles:

1. **indicator of the quality of service (higher prices are perceived as being better than lower-priced**

2. **role in capacity management**

1. for instance: **off-peak pricing** consists of charging different prices during different times of the day or days of the week to reflect variations in demand for the service. (e.g. airlines offer discounts for traveling at nonpeak times)

* consumers also consider nonmonetary costs such as efforts required to consume service

94

New cards

Place(Distribution) in Marketing

inseparable from service providers, convenient distribution is key. national hair salons, tax preparers, accounting firms, and banks have multiple locations to better serve their customers.

* service firms are increasingly using internet to deliver services to customers 24/7

\

* service firms are increasingly using internet to deliver services to customers 24/7

\

95

New cards

Promotion

presents benefits of purchasing the service, so it is important to stress key value creators, like availability, location, consistent quality, etc.

1. publicity: free public service announcements

2. personal selling: representatives > sales

3. sales promotion: forms of coupons, contests, free trails

4. direct marketing: communicate with specific audience that may be interested in the firm’s service offerings.

1. publicity: free public service announcements

2. personal selling: representatives > sales

3. sales promotion: forms of coupons, contests, free trails

4. direct marketing: communicate with specific audience that may be interested in the firm’s service offerings.

96

New cards

People

highly important in services because of the high degree of interaction between the customer and service provider.

* **Internal marketing:** based on the idea that service organizations must focus on its employees or the internal market, before successful programs can be directed at customers.

* just one component of CEM (customer experience management) > can be used to develop simple customer relationships into customer loyalty.

* **Internal marketing:** based on the idea that service organizations must focus on its employees or the internal market, before successful programs can be directed at customers.

* just one component of CEM (customer experience management) > can be used to develop simple customer relationships into customer loyalty.

97

New cards

Physical Environment

in which the customer interacts with service provider may affect customer’s perception of service quality. (facility, landscaping, signage, and equipment.

* impression management (evidence management) firms strategically manage this to create right impression, or mood in mind of consumer.

* impression management (evidence management) firms strategically manage this to create right impression, or mood in mind of consumer.

98

New cards

Process

customers judge a service’s quality based on procedures, mechanisms, and activity flows by which the service is delivered. managers can improve the process by which services are created and delivered through the use of customer contact audit.

99

New cards

Capacity management

refers to the integration of the service component of the marketing mix with efforts to influence consumer demand. The goal of this is to match capacity to demand over the course of a demand cycle while maximizing the firm’s return on investment.

100

New cards

Capacity Management Dashboard

marketing dashboards for airlines contain measurements of yield, load factors, and operating expenses

* **Yield**: refers to revenue gained per seat for flying one mile

* **Load factor:** refers to % of the available seats occupied by a paying customer, per mile

* **Operating expenses**: refers to the cost per seat for flying one mile

**Operating income (YIELD X LOAD FACTOR) -OPERATING EXPENSES**

* **Yield**: refers to revenue gained per seat for flying one mile

* **Load factor:** refers to % of the available seats occupied by a paying customer, per mile

* **Operating expenses**: refers to the cost per seat for flying one mile

**Operating income (YIELD X LOAD FACTOR) -OPERATING EXPENSES**