ULTIMATE ECON EXAM 2 CHEAT SHEET *not patched 2024*

1/88

Earn XP

Description and Tags

if you play the learn game and memorize every single answer then you will for sure get above a B.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

89 Terms

Brett has agreed to sell a rare comic book to a collector who offered to pay $125. Brett’s producer surplus is:

a. zero since he did not negotiate a price higher than what the collector offered.

b. $125 because it will not cost him anything to sell his comic book.

c. $25 if the minimum price he would have accepted is actually $150.

d. $50 if the minimum price he would have accepted is actually $75.

$50 if the minimum price he would have accepted is actually $75.

Assuming no externalities exist, when the efficient amount of output is being produced in a competitive market, all of the following are true except:

a. marginal benefit is equal to marginal cost.

b. total surplus (consumer surplus plus producer surplus) is maximized.

c. consumer surplus exceeds producer surplus by the greatest amount.

d. there is no deadweight loss.

consumer surplus exceeds producer surplus by the greatest amount.

The difference between the maximum price consumers are willing to pay and the actual price consumers pay in the market measures:

a. deadweight loss.

b. equilibrium price.

c. consumer surplus.

d. producer surplus.

consumer surplus.

A demand curve can be interpreted as a:

a. marginal cost curve.

b. marginal benefit curve.

c. horizontal line corresponding to market price in all markets.

d. vertical line corresponding to market quantity in all markets.

marginal benefit curve.

If haircuts are normal goods, then a decrease in consumer income leads to:

a. an increase in the equilibrium price of haircuts, and producer surplus to barbers will increase.

b. a decrease in the equilibrium price of haircuts, and producer surplus to barbers will increase.

c. an increase in the equilibrium price of haircuts, and producer surplus to barbers will decrease.

d. a decrease in the equilibrium price of haircuts, and producer surplus to barbers will decrease.

a decrease in the equilibrium price of haircuts, and producer surplus to barbers will decrease.

The intent of government policies designed to promote equity is to:

a. generate outcomes that are deemed to be fairer.

b. ensure that production is technically efficient.

c. mimic the free market outcome.

d. equally distribute income and consumption among citizens.

generate outcomes that are deemed to be fairer

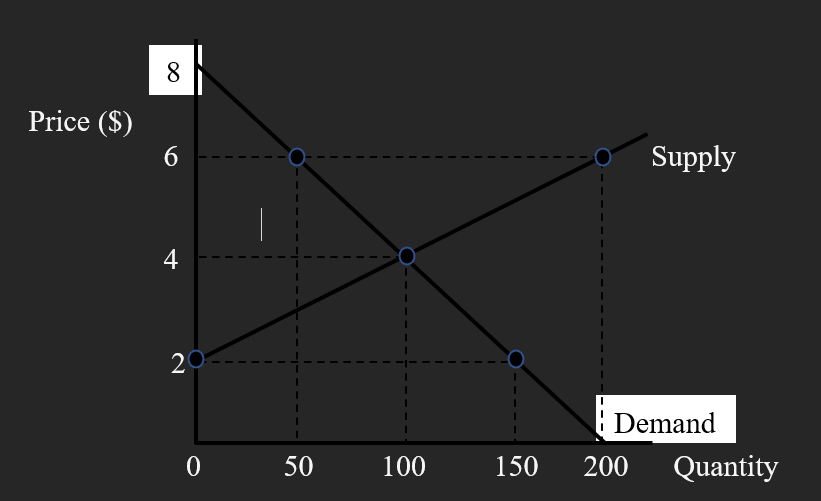

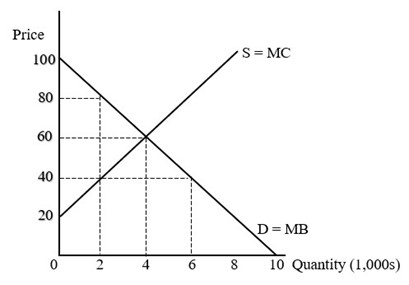

The marginal benefit of the 50th unit is:

a. $2.

b. $4.

c. $6.

d. $8.

$6

Under free market conditions:

a. suppliers will not make this output available unless the price is at least $4 per unit.

b. a quantity of 100 units will be exchanged at a price of $4 per unit.

c. equilibrium price will be $2 and equilibrium quantity will be 150 units.

d. demand and supply will be equal at a market price of $4 per unit.

a quantity of 100 units will be exchanged at a price of $4 per unit.

Under free market conditions:

a. consumer surplus will be $200 and producer surplus will be $100.

b. consumer surplus will be $100 and producer surplus will be $200.

c. consumer surplus will be $300 and producer surplus will be $300.

d. consumer surplus will be $200 and producer surplus will be $200.

consumer surplus will be $200 and producer surplus will be $100

The purpose of setting a price floor above the equilibrium price is to:

a. protect consumers from price gouging.

b. cause market surpluses.

c. maintain a high price for the sellers in the market.

d. prevent market shortages.

maintain a high price for the sellers in the market.

If a product with a relatively elastic demand and a relatively inelastic supply is taxed, the economic burden of the tax is borne:

a. entirely by the sellers of the product.

b. entirely by the consumers of the product.

c. mostly by the sellers of the product.

d. mostly by the consumers of the product.

mostly by the sellers of the product.

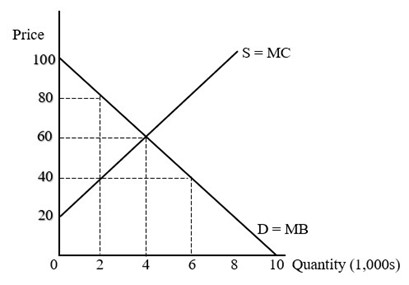

If there is a price ceiling of $40, the quantity bought and sold (exchanged) in this market is equal to:

a. 2,000, and there will be a market surplus.

b. 6,000, and there will be a market surplus.

c. 2,000, and there will be a market shortage.

d 6,000, and there will be a market shortage.

2,000, and there will be a market shortage.

If there is a price ceiling of $40, consumer surplus is equal to:

a. $20,000.

b. $60,000.

c. $80,000.

d. $100,000.

$100,000.

If a given quantity of an item is jointly consumed and those who do not pay for the item cannot be denied enjoying benefits, then the item is:

a. rival and excludable and therefore a private good.

b. non-rival and excludable and therefore a quasi-private good.

c. rival and non-excludable and therefore a common resource.

d. non-rival and non-excludable and therefore a pure public good.

non-rival and non-excludable and therefore a pure public good.

The free-rider problem occurs when:

a. people who do not pay for an output cannot be denied the benefits of the output.

b. the market for an output is in disequilibrium.

c. some consumers enjoy a free-ride to public colleges and universities.

d. a good is non-rival and excludable.

people who do not pay for an output cannot be denied the benefits of the output.

Which of the following is an example of a negative externality?

a. A boy scout troop cleaning up a neighborhood park

b. Toxic chemicals dumped into a river that is used as a water supply

c. A neighbor who plants a beautiful garden in his front yard

d. A lower crime rate in a neighborhood patrolled by a security company

Toxic chemicals dumped into a river that is used as a water supply

In free market equilibrium, total consumer and producer surplus is equal to:

a. $60.

b. $240.

c. $120.

d. $480.

$240.

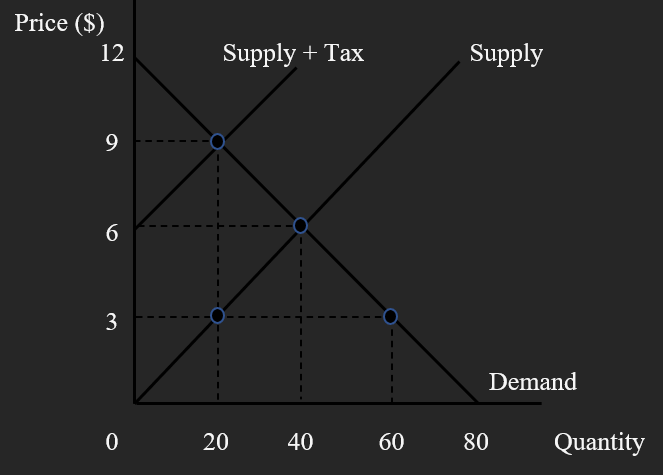

If government imposes a $6 per unit tax in this market, total tax revenue collected will be equal to:

a. $120

b. $360

c. $240

d. $480

$120

The deadweight loss resulting from a $6 per unit tax is equal to:

a. $60.

b. $90.

c. $120.

d. $240.

$60.

When the private benefits associated with an output are less than the social benefits of the output:

a. there is a positive externality, and the free (unregulated) market results in a level of output that is greater than the socially efficient level of output.

b. there is a negative externality, and the free (unregulated) market results in a level of output that is greater than the socially efficient level.

c. there is a positive externality, and the free (unregulated) market results in a level of output that is less than the socially efficient level of output.

d. there is a negative externality, and the free (unregulated) market results in a level of output that is less than the socially efficient level.

there is a positive externality, and the free (unregulated) market results in a level of output that is less than the socially efficient level of output.

The Coase theorem states that an efficient outcome will prevail through private bargaining as long as:

a. property rights are clearly defined and transaction costs are sufficiently high.

b. there are no spillover costs or benefits.

c. there are no free riders.

d. property rights are clearly defined and transaction costs are sufficiently low

property rights are clearly defined and transaction costs are sufficiently low

When costs of producing an output spill over to third parties, from society’s perspective:

a. a negative externality exists and private markets will likely overproduce the output.

b. a negative externality exists and private markets will likely overprice the output.

c. a positive externality exists and private markets will likely underproduce the output.

d. a positive externality exists and private markets will likely underprice the output.

a negative externality exists and private markets will likely overproduce the output.

Government policy can promote a more efficient use of common resources by:

a. ensuring that these resources are available for everyone to use at no cost.

b. converting them into private goods with clearly-defined property rights.

c. providing a subsidy to users.

d. taking no action.

converting them into private goods with clearly-defined property rights

If a corporation goes bankrupt:

a. stockholders may lose their investment but their personal assets are not at risk.

b. stockholders may lose their investment and some of their personal assets if the corporation is unable to pay all creditors.

c. stockholders are not affected.

d. none of the above because corporations do not have stockholders.

stockholders may lose their investment but their personal assets are not at risk.

Stella left her $25,000 per year job as an office manager to paint houses and be her own boss. In her first year, Stella received $50,000 in payments from customers and paid $5,000 for paint and supplies. Stella’s economic profit in her first year is:

a. $15,000.

b. $20,000.

c. $25,000.

d. $45,000.

$20,000.

If a firm is deciding how many workers to hire to operate its existing capital equipment, the firm is:

a. making a short-run decision because one input is fixed.

b. making a short-run decision because all inputs are fixed.

c. not a profit-maximizer.

d. operating in a non-competitive market.

making a short-run decision because one input is fixed.

The assumed goal of firms in the marketplace is to:

a. maximize sales.

b. maximize revenue.

c. maximize opportunity cost.

d. maximize profit.

maximize profit.

According to the law of diminishing marginal product, the marginal product of a variable input must eventually begin to decline because:

a. none of the other inputs are fixed.

b. all of the other inputs are fixed.

c. at least one input is fixed.

d. the most productive units of the variable input are used first.

at least one input is fixed.

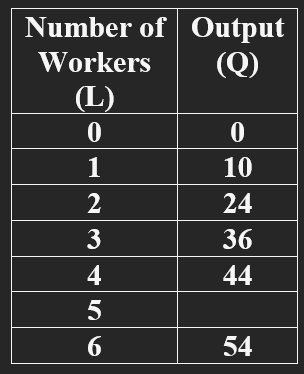

If the marginal product of the 5th worker is 6 units of output, then total output for 5 workers is:

a. 6, and average product for 5 workers is 10.

b. 50, and average product for 5 workers is 10.

c. 49, and average product for 5 is 4.9.

d. 44, and average product for 5 workers is 11.

50, and average product for 5 workers is 10.

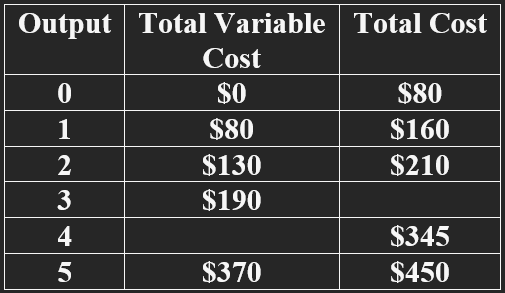

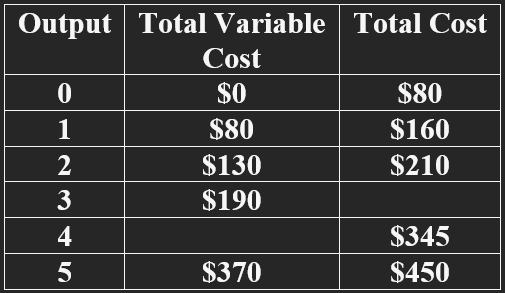

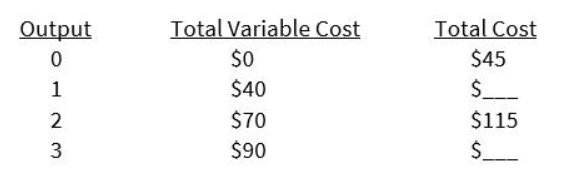

The total cost of producing 3 units of output is:

a. $80

b. $270

c. $190

d. $345

$270

Average variable cost when 4 units of output are produced is:

a. $60.

b. $74.

c. $66.25.

d. $114.

$66.25

The downward-sloping portion of a LRAC curve implies:

a. economies of scale exist over that range of the curve.

b. firms are producing at minimum efficient scale.

c. diseconomies of scale exist over that range of the curve.

d. decreasing returns to scale exist over that range of the curve.

economies of scale exist over that range of the curve.

All of the following are assumptions of the model of perfect competition except:

a. firms in the market produce identical outputs.

b. buyers have perfect information regarding product price and availability.

c. the market consists of a large number of buyers and sellers.

d. entry into the market in the long run is restricted.

entry into the market in the long run is restricted.

The profit-maximizing rule is for firms to produce the amount of output at which:

a. ATC = AVC.

b. P = ATC.

c. MR = MC.

d. MR = P.

MR = MC.

The demand curve for an individual seller in a perfectly competitive market is:

a. upward sloping as a result of the large number of sellers.

b. vertical (perfectly inelastic) at the market-determined quantity because an individual firm in a perfectly competitive market is a price-setter.

c. horizontal (perfectly elastic) at the market-determined price because an individual firm in a perfectly competitive market is a price-taker.

d. downward-sloping; therefore, its elasticity varies along the curve.

horizontal (perfectly elastic) at the market-determined price because an individual firm in a perfectly competitive market is a price-taker.

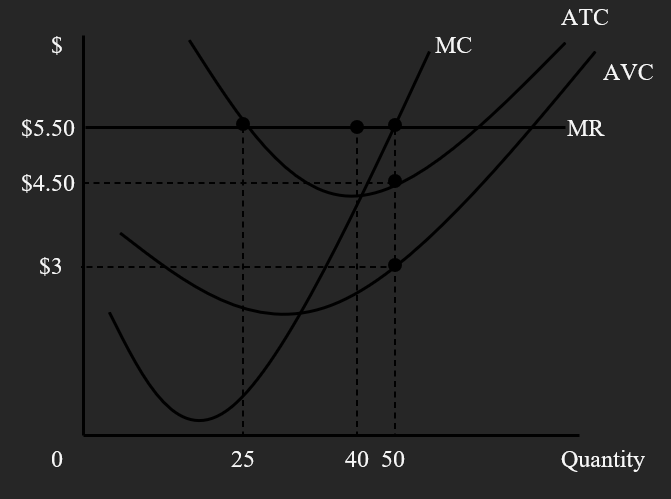

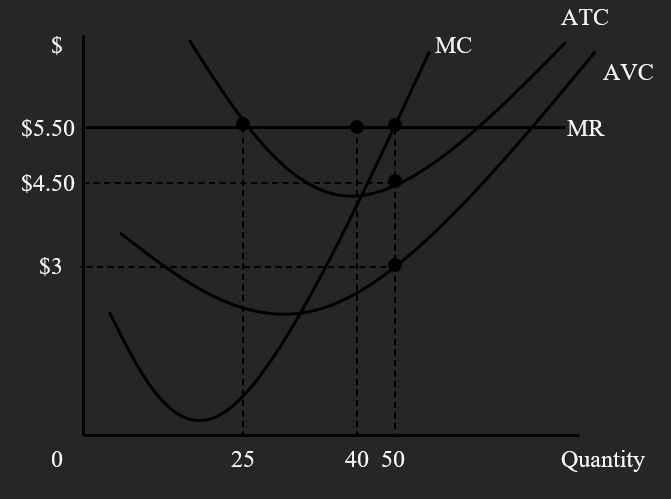

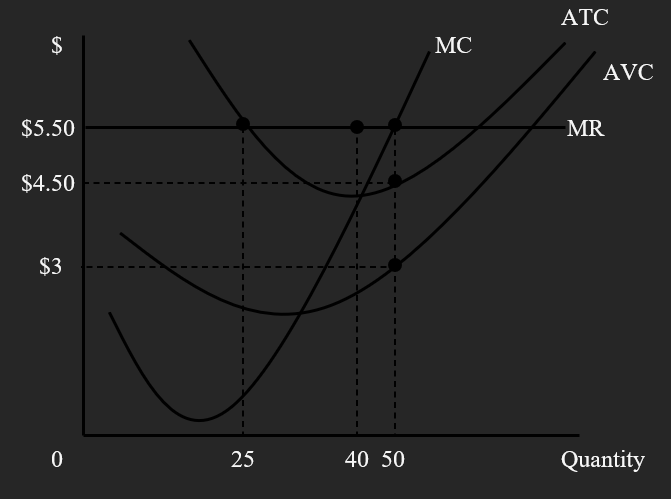

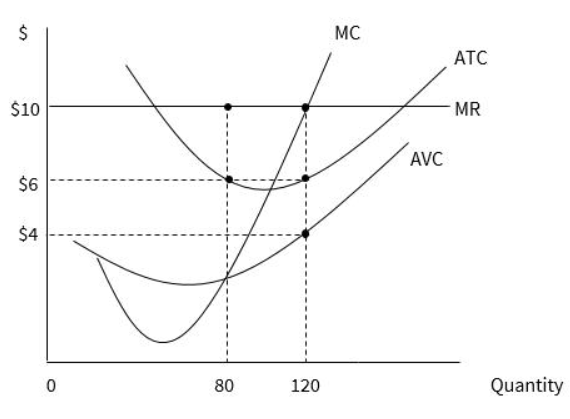

This profit-maximizing firm:

a. produces 40 units of output and has total revenue of $220.

b. produces 40 units of output and has total revenue of $180.

c. produces 50 units of output and has total revenue of $225.

d. produces 50 units of output and has total revenue of $275.

produces 50 units of output and has total revenue of $275.

This profit-maximizing firm is:

a. in long-run equilibrium.

b. earning an economic profit of $40 in the short run.

c. earning an economic profit of $50 in the short run.

d. earning a normal profit (zero economic profit) in the short run.

earning an economic profit of $50 in the short run.

If this firm does NOT produce output in the short run:

a. its total cost and total loss will both be equal to $0.

b. it will incur a loss equal to $75.

c. it will incur a loss equal to $50.

d. its total revenue and total cost will both be equal to $0.

it will incur a loss equal to $75.

Suppose at the profit-maximizing/loss-minimizing level of output P = $6, ATC = $7, and AVC = $5. A firm in this situation will:

a. minimize its losses by producing where MR = MC in the short run.

b. minimize its losses by shutting down production immediately.

c. earn a short-run positive economic profit producing where MR = MC.

d. produce more than the output where MR = MC

minimize its losses by producing where MR = MC in the short run.

If the tomato market is perfectly competitive and tomato growers are earning positive economic profit in the short run, economic theory predicts that:

a. some tomato growers will exit the market, price will rise, and profit will be driven up to zero economic profit in the long run.

b. some tomato growers will exit the market, price will fall, and profit will be driven

up to zero economic profit in the long run.

c. new tomato growers will enter the market, price will rise, and profit will be driven down to zero economic profit in the long run.

d. new tomato growers will enter the market, price will fall, and profit will be driven down to zero economic profit in the long run.

new tomato growers will enter the market, price will fall, and profit will be driven down to zero economic profit in the long run.

The economic burden (economic incidence) of a tax:

a: is always shifted to consumers through higher prices.

b: is partially shifted to consumers through higher prices in many cases.

c: is rarely shifted to consumers through higher prices.

d: falls on sellers if the statutory burden of the tax is on sellers.

is partially shifted to consumers through higher prices in many cases.

The majority of the economic burden (economic incidence) of a tax is borne by:

a: buyers if demand is highly inelastic and supply is elastic.

b: buyers if demand is highly elastic and supply is inelastic.

c: buyers in all cases.

d: sellers in all cases.

buyers if demand is highly inelastic and supply is elastic.

The statutory incidence (burden) of a tax refers to:

a: the legal limit on how much sellers can raise price in an attempt to shift burdens to consumers.

b: how much revenue the tax is able to generate.

c: what percentage of the tax burden falls on buyers and what percentage of the tax burden falls on sellers.

d: which party has the legal obligation to send the tax dollars to the government.

which party has the legal obligation to send the tax dollars to the government.

Ceteris paribus, the more elastic the demand for a taxed commodity:

a: the easier it is for sellers to shift the economic burden of the tax to consumers by raising the product price.

b: the easier it is for sellers to shift the economic burden of the tax to consumers by lowering the product price.

c: the harder it is for sellers to shift the economic burden of the tax to consumers by raising the product price.

d: the harder it is for sellers to shift the economic burden of the tax to consumers by lowering the product price.

the harder it is for sellers to shift the economic burden of the tax to consumers by raising the product price.

conditions for a efficient competitive market

MB = MC, CS and PS are maxxed, No deadweight

Products that generate negative externalities tend to be:

a: underproduced by private markets.

b: overproduced by private markets.

c: efficiently produced by private markets.

d: not produced by private markets.

overproduced by private markets.

Products that generate positive externalities tend to be:

a: underproduced by private markets.

b: overproduced by private markets.

c: efficiently produced by private markets.

d: not produced by private markets.

underproduced by private markets.

Positive externalities occur when:

a: people buy things that work better than expected.

b: costs associated with an activity are borne by a third party.

c: private market demand curves are the same as marginal social benefit curves.

d: market activity creates benefits that spill over to third parties.

market activity creates benefits that spill over to third parties.

Negative externalities occur when:

a: people buy things that work better than expected.

b: costs associated with an activity are borne by a third party.

c: private market demand curves are the same as marginal social benefit curves.

d: market activity creates benefits that spill over to third parties.

costs associated with an activity are borne by a third party.

When some of the costs of a good spill over to a third party:

a: a negative externality exists and the good tends to be overproduced by private markets.

b: a negative externality exists and the good tends to be underproduced by private markets.

c: a positive externality exists and the goods tends to be underproduced by private markets.

d: a positive externality exists and the goods tends to be overproduced by private markets.

a negative externality exists and the good tends to be overproduced by private markets.

The Tragedy of the Commons refers to:

a: the tendency for the quality of output to decline as it becomes more readily available, or common.

b: the inability of the common man to successfully negotiate with large corporations when negative externalities arise.

c: the tendency to use common resources more than is desirable from society's point of view.

d: the fact that common areas are often little-used and ignored on college campuses.

the tendency to use common resources more than is desirable from society's point of view.

Rivalry and Excludability

Private goods are rival and excludable in consumption, Public goods are non-rival and non-excludable

If a sole proprietorship goes bankrupt:

a: owners lose their investment but personal assets are not at risk.

b: owners lose their investment and personal assets are also at risk.

c: owners must be compensated for the amount invested.

d: the owners of the company are not affected.

owners lose their investment and personal assets are also at risk.

Which of the following is the best example of a good or service sold in a perfectly competitive market?

a: Avocados

b: Movies shown in theaters

c: Ibrance, a patented drug used to slow the spread of breast cancer

d: Airplanes

Avocados

Economic theory divides decisions into those made in the:

a: short run, when all inputs are fixed, and the long run, when all inputs are variable.

b: short run, when at least one input is fixed, and the long run, when all inputs are variable.

c: short run, when all inputs are variable, and the long run, when all inputs are fixed.

d: short run, when at least one input is variable, and the long run, when all inputs are fixed.

short run, when at least one input is fixed, and the long run, when all inputs are variable.

A firm that is deciding how many workers to hire in order to produce the profit-maximizing level of output in its current factory space is:

a: a short-run profit-maximizer but not a long-run profit-maximizer.

b: a long-run profit-maximizer but not a short-run profit-maximizer.

c: making a long-run decision.

d: making a short-run decision.

making a short-run decision.

Suppose a doggie day care business firm uses only two inputs: hourly workers (labor) and a building (capital). In the short run, the firm most likely considers:

a: both capital and labor to be fixed.

b: both capital and labor to be variable.

c: capital to be variable and labor to be fixed.

d: labor to be variable and capital to be fixed.

labor to be variable and capital to be fixed.

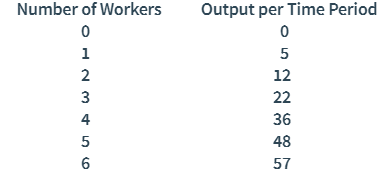

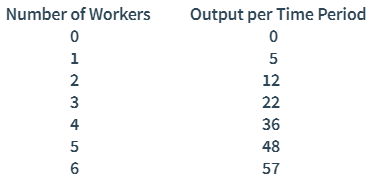

Based on the production function data below, the marginal product of the fifth worker is:

a: 14, and average product is 12 when 5 workers are hired.

b: 12, and average product is 14 when 5 workers are hired.

c: 12, and average product is 9.6 when 5 workers are hired.

d: 14, and average product is 9.6 when 5 workers are hired.

12, and average product is 9.6 when 5 workers are hired.

Based on the production function data, diminishing marginal product (diminishing returns) sets in with the addition of the:

a: third worker.

b: fourth worker.

c: fifth worker.

d: sixth worker.

fifth worker.

According to the law of diminishing marginal product, the marginal product of a variable input must eventually begin to fall because:

a: at least one input is being held fixed.

b: none of the other inputs are fixed.

c: all of the other inputs are fixed.

d: the most productive units of the variable input are used first.

at least one input is being held fixed.

Based on the cost data, the marginal cost (MC) of the third unit of output is equal to:

a: $6.67; at output equal to 3 units, average total cost (ATC) is equal to $45.

b: $20; at output equal to 3 units, average total cost (ATC) is equal to $30.

c: $6.67; at output equal to 3 units, average total cost (ATC) is equal to $30.

d: $20; at output equal to 3 units, average total cost (ATC) is equal to $45.

$20; at output equal to 3 units, average total cost (ATC) is equal to $45.

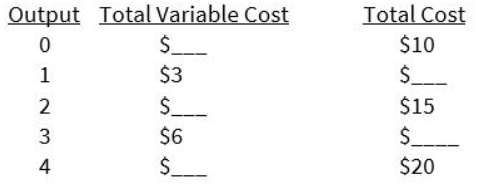

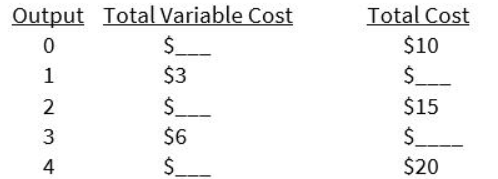

Based on the cost data, this firm has total fixed costs of:

$10

Based on the cost data, average variable cost when 4 units of output are produced is:

$2.50

Based on the cost data, the marginal cost of the 3rd unit of output is equal to:

$40

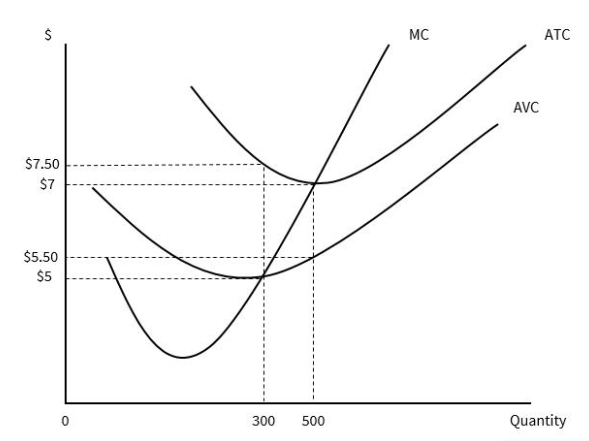

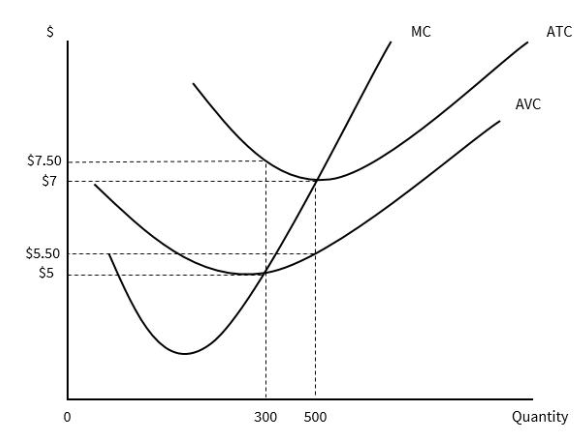

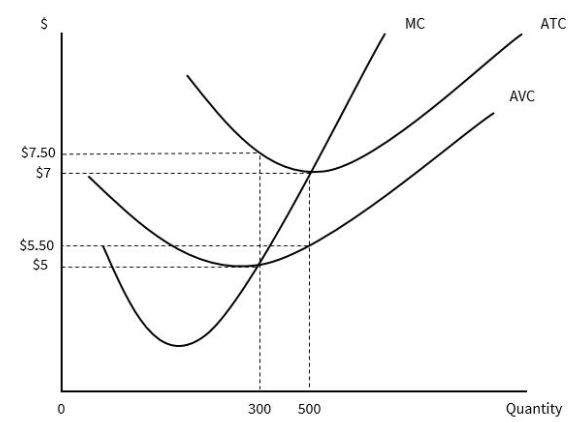

Based on the graph, when output is 300 units, average fixed cost is equal to:

a: $7.50, and average fixed cost is equal to $7 when output is 500 units.

b: $5.50, and average fixed cost is equal to $5 when output is 500 units.

c: $2.50, and average fixed cost is equal to $1.50 when output is 500 units.

d: $7, and average fixed cost is equal to $5 when output is 500 units.

$2.50, and average fixed cost is equal to $1.50 when output is 500 units.

Based on the graph, total fixed cost is equal to:

$750

Based on the graph, when output is 300 units, average variable cost is equal to:

$5

The demand curve for an individual firm in a perfectly competitive market is:

a: less elastic than the market demand curve for its product.

b: perfectly elastic at the market price.

c: downward-sloping to the right.

d: vertical at the market price.

perfectly elastic at the market price.

An individual firm operating in a perfectly competitive market:

a: is a price-taker and has a demand curve that is perfectly elastic at the price determined by the market forces of demand and supply.

b: is a price-taker and has a demand curve that slopes downward to the right.

c: is a price-setter and has a demand curve that is perfectly elastic at the price determined by the market forces of demand and supply.

d: is a price-setter and has a demand curve that slopes downward to the right.

is a price-taker and has a demand curve that is perfectly elastic at the price determined by the market forces of demand and supply.

A firm that chooses not to produce in the short run suffers a loss equal to:

a: zero

b: marginal cost.

c: total variable cost.

d: total fixed cost.

total fixed cost

A perfectly competitive firm producing where MR = MC and P < ATC in the short run is:

a: making an economic profit equal to zero.

b: making an economic profit greater than zero.

c: incurring a short-run loss, but should continue to produce if P < AVC.

d: incurring a short-run loss, but should continue to produce if P > AVC.

incurring a short-run loss, but should continue to produce if P > AVC.

The short-run supply curve for the perfectly competitive firm is:

a: the portion of the MC curve that lies above the ATC curve.

b: the portion of the MC curve that lies above the minimum of the AVC curve.

c: the portion of the ATC curve that lies above MC curve.

d: the portion of the AVC curve that lies above the minimum of the MC curve.

the portion of the MC curve that lies above the minimum of the AVC curve.

A firm is in long-run equilibrium in a perfectly competitive market when:

a: P > MR = MC = ATC.

b: P = MR > MC = ATC.

c: P = MR = MC > ATC.

d: P = MR = MC = ATC.

P = MR = MC = ATC.

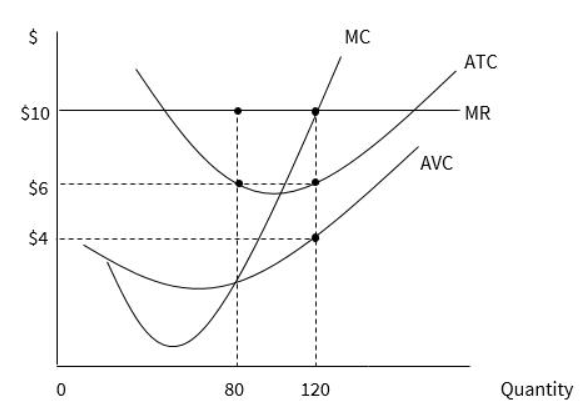

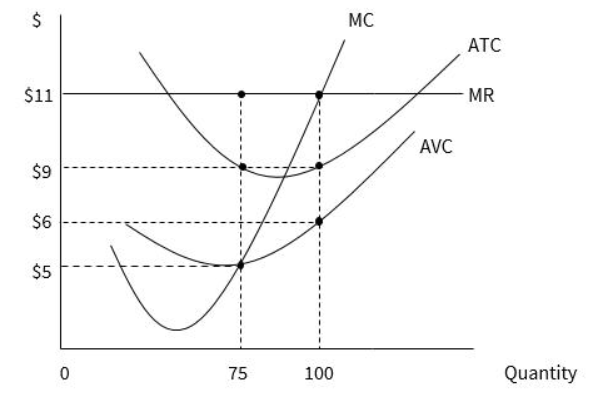

If the firm represented by the graph follows the profit-maximizing rule:

a: it will earn total revenue equal to $800 and incur total cost equal to $320.

b: it will earn total revenue equal to $800 and incur total cost equal to $480.

c: it will earn total revenue equal to $1,200 and incur total cost equal to $480.

d: it will earn total revenue equal to $1,200 and incur total cost equal to $720.

it will earn total revenue equal to $1,200 and incur total cost equal to $720.

If the firm represented by the graph follows the profit-maximizing rule, it will earn economic profit equal to:

a: $320.

b: $480.

c: $720.

d: $1,200.

$480

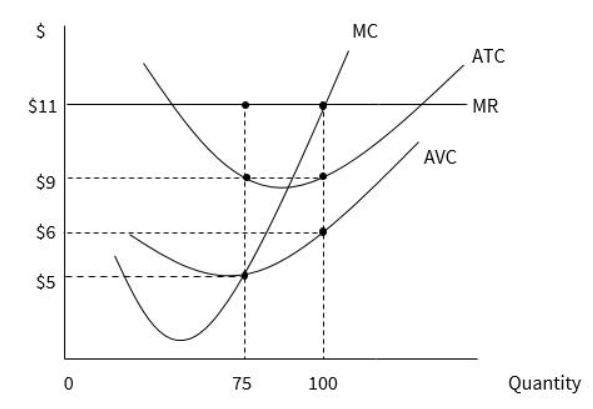

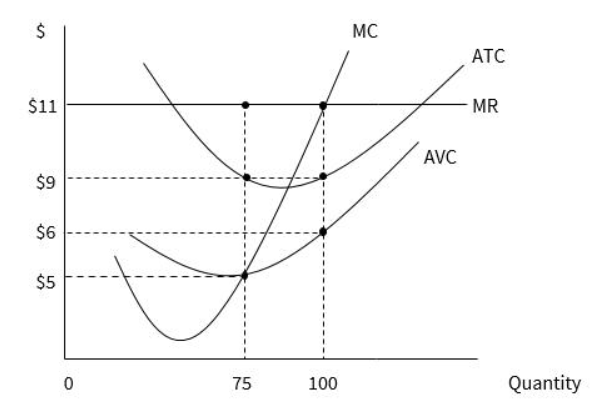

This profit-maximizing/loss-minimizing firm will:

a: produce 85 units of output and earn total revenue equal to $765.

b: produce 100 units of output and earn total revenue equal to $900.

c: produce 85 units of output and earn total revenue equal to $935.

d: produce 100 units of output and earn total revenue equal to $1,100.

produce 100 units of output and earn total revenue equal to $1,100.

Based on the information in the graph, total fixed cost is equal to:

a: $600.

b: $200.

c: $300.

d: $500.

$300

This profit-maximizing/loss-minimizing firm is:

a: incurring an economic loss of $500 in the short run.

b: earning an economic profit of $200 in the short run.

c: earning an economic profit of $300 in the short run.

d: earning a normal profit (zero economic profit) in the short run.

earning an economic profit of $200 in the short run.

Firms in perfectly competitive markets:

a: are price-takers and sell output at the price determined by the market forces of demand and supply.

b: are price-setters and sell output at the price that maximizes their revenue.

c: erect barriers to entry in order to prevent other firms from earning profit.

d: sell outputs that do not have close substitutes.

are price-takers and sell output at the price determined by the market forces of demand and supply.

If perfectly competitive firms are incurring economic losses in the short run, the adjustment to long-run equilibrium includes:

a: firms exiting the market which causes market supply to increase and market price to decrease.

b: firms entering the market which causes market supply to increase and market price to decrease.

c: firms exiting the market which causes market supply to decrease and market price to increase.

d: firms entering the market which causes market supply to decrease and market price to decrease.

firms exiting the market which causes market supply to decrease and market price to increase.

Assume blueberries are produced in a perfectly competitive market. If existing sellers in this market are earning positive economic profit:

a: the number of sellers would be expected to increase in the long run, resulting in a higher equilibrium price, ceteris paribus.

b: the number of sellers would be expected to increase in the long run, resulting in a lower equilibrium price, ceteris paribus.

c: the number of sellers would be expected to decrease in the long run, resulting in a higher equilibrium price, ceteris paribus.

d: the number of sellers would be expected to decrease in the long run, resulting in a lower equilibrium price, ceteris paribus.

the number of sellers would be expected to increase in the long run, resulting in a lower equilibrium price, ceteris paribus.

If pencil manufacturers are earning positive economic profit in the short run, and there are no barriers to entry into the pencil market, economic theory predicts that:

a: new firms will enter the market and drive down the price of pencils in the long run, ceteris paribus.

b: new entrants into the pencil market will drive up the price of pencils because each pencil manufacturer will be producing fewer pencils and the cost per pencil will increase, ceteris paribus.

c: some firms will exit the pencil market in the long run, causing the price of pencils to fall, ceteris paribus.

d: some firms will exit the pencil market in the long run, causing the price of pencils and the profits of pencil manufacturers to increase in the long run, ceteris paribus.

new firms will enter the market and drive down the price of pencils in the long run, ceteris paribus.

examples of positive and negative externalities

Positive externality: Benefits received by a third party from the actions of others, like education improving society.

Negative externality: Costs imposed on a third party from the actions of others, such as pollution harming the environment.

examples of common resources

Examples of common resources include air, water, and fish stocks.

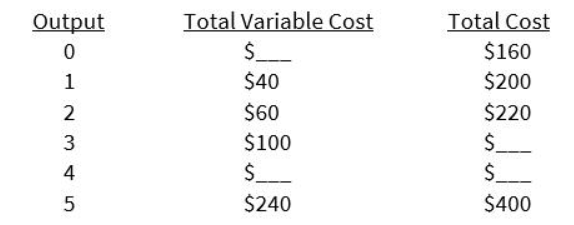

chart for prices