AS business topic 5 CAIE

1/51

Earn XP

Description and Tags

finance and accounting

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

52 Terms

why businesses need finance

setting up a business will require cash injections from the owners to purchase essential capital equipment which is called start up capital

all businesses need to finance their working capital

when businesses grow, further finance will be needed to buy more assets and to pay for higher working capital needs

growth can be achieved by taking over other businesses, finance is then needed to buy out the owners of the other firm

special situations may lead to a need for finance such as a decline in sales

start up capital is the capital needed by an entrepreneur to set up a business

working capital is the capital needed to pay for raw materials, day-to-day running costs and credit offered to customers, it is found with this equation: working capital = current assets - current liabilities

the distinction between short and long term need for finance

short term finance is money required for short periods of time of up to one year

long term finance money required for more than one year

the difference between cash and profits

many business failures result from owners and managers not understanding the difference between cash and profit

profit is the value of goods sold - costs

cash is the physical currency the business owns and any money it has in the bank

administration, bankruptcy and liquidation

If a business fails due to lack of finance it is placed into administration, which is when administrators manage a business that is unable to pay its debts with the intention of selling it as a going concern

If administration fails then then bankruptcy occurs and the business is declared bankrupt, which is the legal procedure for liquidating a business which cannot fully pay its debts out of its current assets

Once bankruptcy occurs the business goes into liquidation which is when a business ceases trading and its assets are sold for cash to pay suppliers and other creditors

liquidity is the ability of a business to pay its short-term debts

meaning and importance of working capital

working capital is the finance needs by all businesses to pay for everyday expenses

without sufficient capital, a business will be illiquid and unable to pay its immediate or short-term debts

a high level of working capital can also be a disadvantage as their is an opportunity cost of having too much capital tied up in inventories, accounts receivable, and idle cash

the working capital requirement for any business will depend upon the length of its working capital cycle

the calculation for working capital is:

working capital = current assets - current liabilities

current assets are assets that are either cash or likely to be turned into cash within 12 months

current liabilities are debts that usually have to be paid within one year

managing working capital

managing the level of working capital can be achieved by managing inventory and inventory can be managed in the following ways:

keeping smaller inventory levels

using computer systems to record sales and inventory levels and to order inventory as required

efficient inventory control, inventory use and inventory handling

minimise the working capital tied up in inventories by producing only when orders have been received

getting foods to customers as quickly as possible to speed up payments from them

trade payables can be managed by:

delaying payments to suppliers to increase the credit period

only buying goods from suppliers who will offer credit

trade receivables can be managed by:

only selling products for cash and not on credit

reducing the credit period offered to customers

capital expenditure and revenue expenditure

capital expenditure is the purchase of non-current assets that are expected to last for more than one year, such as buildings and machinery

revenue expenditure is the spending on all costs and assets other than non-current assets, which includes wages, salaries and inventory of materials

finance for limited companies

companies are able to raise finance from a range of sources which are classified as:

internal sources which raise finance from the businesses own assets or from profits left in the business

external sources which raise finance from sources outside the business

internal sources of finance

retained earnings - this is profit after tax retained in a company instead of paying out in dividends to shareholders

sale of unwanted assets - this is the selling of assets that are no longer used

working capital - when companies reduce the finance held as working capital then finance is released for other uses

short term external sources of finance

bank overdraft - this is where a bank allows a business to overdraw (go negative) in their account at the bank by making payments up to a greater value than the balance in the account, the limit figure should be decided beforehand

trade credit - by delaying payment to suppliers for goods or services received then a business is technically obtaining finance, the suppliers will then become trade payables/trade creditors

debt factoring - when a business sells its goods on credit it then created trade receivables, a business can sell these claims to a debt factor who give them that money straight away but will take a certain percentage as that is how they earn profit

long term external sources of finance

hire purchase - is where a company purchases an asset and agrees to pay fixed repayments over an agreed company and so the company that is using it does not own it

leasing - is the obtaining of the use of an asset and paying a lease payment over a fixed period

long term bank loans - this is where a business borrows money from a bank and pays it back in regular instalments with interest, long term loans last over one year

debentures - a company wanting to raise funds can issue or sell debentures (bonds) to interested investors and the company agree to pay a fixed rate of interest p/a for the life of the debenture and pay the full sum at the pre-determined maturity date, they do not require collateral security which is an asset a business pledges to a lender which must be sold off to pay for debt if they do not pay back

business mortgages - are used when businesses want to purchase premises and can pay this back over a period of time with interest

long term external sources of finance - 2

share/equity capital - all limited companies will issue shares when they are first formed, private limited companies can sell additional shares to existing shareholders or can choose to undergo flotation to become a public limited company and so can sell shares to the public, which can be done in 2 ways:

- Obtain a listing on the Alternative Investment market which is a part of the Stock Exchange for smaller companies which doest want to raise very much capital

-They could also apply for a full listing on the stock exchange by meeting the criteria of (A) selling at least £50,000 worth of shares and (b) having a satisfactory trading record to give investors confidence and security inter investments, the sale of shares is done in 2 ways: public issue by prospectus which advertises the company and its share sale to the public, or rights issue of shares to existing shareholders where they are given the right to buy additional shares at a discounted price

government grants - there are agencies that are prepared, under certain circumstances to grand funds to businesses

venture capital - small companies that are not listed on the stock exchange (unquoted companies) can gain long term funds from venture capitalists which are specialist organisations or wealthy individuals which are prepared to lend risk capital to, or buy shares in, business start ups

finance for unincorporated businesses

microfinance - is the providing of financial services for poor and low-income customers who do not have access to the banking services like loans and overdrafts which are offered by traditional commercial banks

crowd funding - is the use of small amounts sos capital from a large number of individuals to finance a new business venture

factors affecting the source of finance - why it is needed and for how long

it is risky and expensive to use long-term finance to pay for short-term needs and so businesses should match the sources of finance to the length of time that it is needed for

permanent capital such as issues of shares ma bye needed for long-term business expansion or long-term research projects

short-term finance would be advisable to finance a short-term need to increase inventories or pay creditors

factors affecting the source of finance - cost

obtaining finance is never free

loans may become very costly during a period of rising interest rates

a Stock Exchange listing of a newly formed public limited company can be very expensive in fees and promotion

once equity finance has been raised, dividends to shareholders are not tax deductible for the business unlike loan interest

factors affecting the source of finance - amount required

issues of new shares and debentures, because of administration and other costs are generally only used for large capital sums

small bank loans, overdrafts or reducing trade receivables payment period could be used to raise small sums

retained profit may be too low to provide the finance needed for a major expansion programme

factors affecting the source of finance - form of business ownership and control

share issues can only be used by limited companies, and only public limited companies can sell shares directly to the public

issuing additional shares risks the current owners losing some control

if the owners want to retain ownership of the business at all costs then a sale of shares could be unwise

factors affecting the source of finance - level of existing borrowing

the higher the existing debts of a business the greater the risk of borrowing more

a high level of existing debt might mean that internal sources should be considered such as the sale of assets

factors affecting the source of finance - flexibility

when a firm has a variable need for finance, a flexible form of finance is better than a long-term and inflexible source

meaning and purpose of cash flow forecasts

The planning of cash flows using cash flow forecasts is particularly important for entrepreneurs starting a new business because:

new business start-ups are often offered much shorter credit to pay suppliers than larger, well-established firms

banks and other lenders will need to see evidence of a cash flow forecast before making any finance available

finance is often very tight at start ups and so accurate planning is much more significant for new businesses

Without a positive cash flow any company will become insolvent and bankrupt

cash flow forecast - an estimate of the future cash inflows and outflows of a business

insolvent - when a business cannot meet its short term debts

cash inflows - the cash payments into a business

cash outflows - the cash payments out of a business

interpretation of cash flow forecasts

cash inflows:

owners own capital injection

bank loan payments

customers’ cash payments

trade receivables payments

cash outflows

lease payments for premises

annual rent payment

electricity, gas, water, and telephone bills

wage payments

cost of materials and payments to suppliers

structure of cash flow forecasts

cash inflows - the cash payments into a business

cash outflows - the cash payments out of a business

net cash flow - estimated difference between cash inflows and cash outflows doe the period

opening cash balance - cash held by the business at the start of the month

closing cash balance - cash held by the business at the end of the month, which becomes the next months opening balance

benefits and limitations of cash flow forecasting

benefits

they show negative closing cash flows which means plans can be made to source additional finance

they indicate periods of time when negative net cash flows are excessive

they are essential to all business plans

limitations

mistakes can be made in preparing the revenue and cost forecasts

unexpected cost increases lead to major inaccuracies in forecasts

incorrect assumption can be made in estimating the sales of the business

causes of cash flow problems

lack of planning

poor credit control which is the monitoring of debts to ensure that credit periods are not exceeded

allowing customers too long to pay debts

expanding too rapidly

unexpected events

methods of improving cash flow and drawbacks

overdraft - interest rates can be high, potentially with an arrangement fee and overdrafts can be withdrawn by the bank causing insolvency

short-term loan - the interest costs have to be paid and the loan must be repaid by the due date

sale of assets - selling assets quickly can result in a low price and the assets might be required at a later date, the assets could ;also have been used as collateral for future loans

sale and leaseback - the leasing costs add to annual overheads, there could also be a loss of potential profits if the assets rise n prices and the assets could have been used as collateral

improving cash flow by managing trade receivables and the drawbacks

delaying capital expenditure - the efficiency of the business may fall if inefficient equipment is not replaced and expansion becomes difficult

using leasing - the asset is not owned by the business and leasing charges include an interest cost and add to annual overheads

cut overhead costs which do not directly affect output - future demand may be reduces by failing to promote the products effectively

managing trade payables:

purchasing more supplies on credit and not cash - some suppliers may refuse to offer credit terms

extend the period of time taken to pay - suppliers may be reluctant to supply products or to offer a good service if they confer that a business is a late payer the

the need for accurate cost information

calculation of profit or loss

pricing decisions

measuring performance

setting budgets

resource use

making choices

types of costs

direct cost - these costs are easy to identify as being incurred by a particular cost centre an example of direct costs is the purchase of meat for a fast-food business to make burgers

indirect cost - these are costs that cannot be identified with a unit of production or allocated accurately to a cost centre and an example would be the rent for a garage

fixed costs - they do not change when the level of output changes, for example the rent

variable costs - these are costs which vary as the output changes such as the electricity

semi-variable costs - include both a fixed and veritable elect such as a salespersons fixed basic wage and the commission that comes with sales

important concepts in terms of costing

a cost centre is the section of a business that incurs the cost, an example would be the different subject departments at a school

a profit centre is a section of a business to which both costs and revenues can be allocated, an example would be each branch of a chain of shops

overheads are the indirect expenses of a business typically classified into four main groups: production overheads [eg rent], selling and distribution overheads [eg warehouse], administration overheads [eg clerical salaries], and finance overheads [eg loan interest]

average cost is also known as the unit cost and is calculated by the formula: average cost = total cost of producing the product/number of units produced

full costing technique

full costing is a method of costing in which all indirect and direct costs are allocated to the products, services or divisions of a business

the stages of full costing are:

identify and add up all the of the direct costs

calculate the total overheads of the business for a given time period

add the total direct costs of making the product

calculate the average cost of producing each product by dividing total costs by output

They also need to find a method of allocating indirect costs and continue to use this

uses and limitations of full costing

uses

it is particularly relevant for single product businesses as there is no uncertainty about the share of overheads

all costs are allocated so there are no costs left out of the calculation

full costing is a good basis for pricing decisions in single product firms

full costing data can be compared from one time period to another to assess performance

limitations

there is no attempt to allocate each overhead cost to cost centres or profit centres on the basis of actual expenditure incurred

inappropriate methods of overhead allocation can lead to inconsistencies between departments and products

it can be risky to use this cost method for making decisions as the figures can be misleading

if full costing is used, it is essential to allocate the overheads on the same basis over time

the full unit cost will only be accurate id the actual Lebel of output is equal to the calculation

contribution costing

contribution costing is a costing method that allocates only direct costs to cost centres and profit centres, not overhead costs, it focuses on two very important concepts:

marginal cost which is the cost of producing one extra unit

the contribution of a product is the revenue lines prom selling a product - its marginal cost

contribution cost is the indirect costs plus profit

limitations of contribution costing

Contribution costing may provide a misleading picture of profitability in the short-run, as it overlooks the impact of fixed costs.

It is not acceptable for external financial reporting as it violates the principle of matching costs with revenues.

situations where contribution costing would be used

contribution costing avoids inaccuracies and arbitrary indirect cost allocations and gives a contribution, not a profit total and so it can be used in setting prices that just cover the direct costs of production

decisions about a product or profit centre are made on the bases of its contribution to indirect costs and not profit or loss based on what may be an inaccurate full cost calculation

excuses capacity is more likely to be effectively used is special orders or contracts that make a positive contribution are accepted

situations where contribution costing wouldn’t be used

by ignoring indirect costs then contribution costing does not take into account that some products may result in much higher indirect costs than others

contribution costing would not be used when making decisions about business expansion or developing new products

contribution costing may lead managers to choose to maintain the production of goods just because of the positive contribution

as in all areas of decision making, qualitative factors may beg important too

contribution costing as a means to help make special order decisions

If a customer offers a special order contract at a price below full unit cost then it can lead to an increase in the total profits of the business

This is because the fixed overhead costs are being payed anyway and so any extra contribution earned will increase profit, there are dangers:

existing customers may realise that lower prices are being offered to new customers and demand a similar price which could lead to am overall loss being made

when high prices are a key feature in establishing the exclusivity of a brans then to offer some customers lower prices could destroy the image

where there is no excess capacity then sales at a price based on contribution cost may be reducing sales based on the full cost price

in some circumstances, lower-priced goods or services may be resold into the higher priced market by customers

cost information and calculations

indirect costs are not always 50/50 and can sometimes be more like 90/10 and so should be allocated this way

contribution - overheads = profit

marginal cost information is used in decision making when using contribution costing

total cost info is essential for the budgetary process to monitor and improve the business performance

total cost Fata is essential when calculating profit or loss

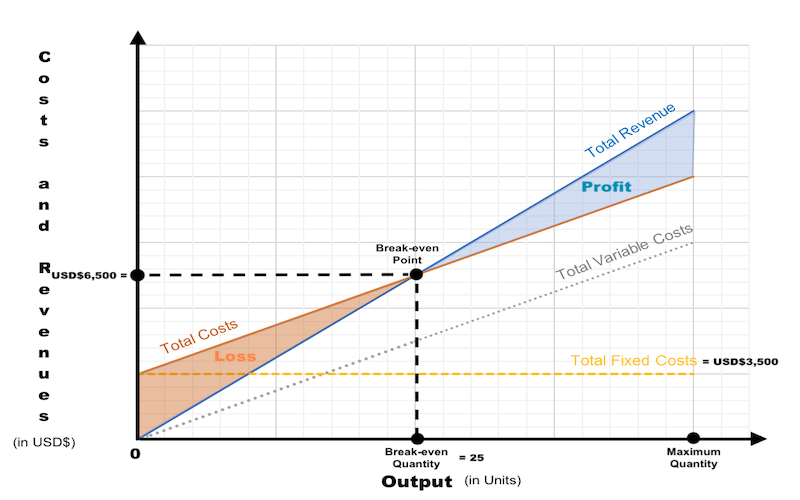

break even analysis

break even analysis used cost and revenue data to determine the break-even point of production

the break even chart

It is usually drawn showing 3 pieces of information:

fixed costs which in the short term will not vary with the level of output and need to be paid whether the firm produces anything or not, it is horizontal showing that they are constant

total costs which are the addition of fixed and variable costs, this line begins at the level of fixed costs

revenue which is obtained by multiplying selling price by output level

the sales revenue line start at the origin (0) because if no sales are made then there can be no revenue

the variable cost line also starts from the origin because if no goods are produced then there will be no variable costs

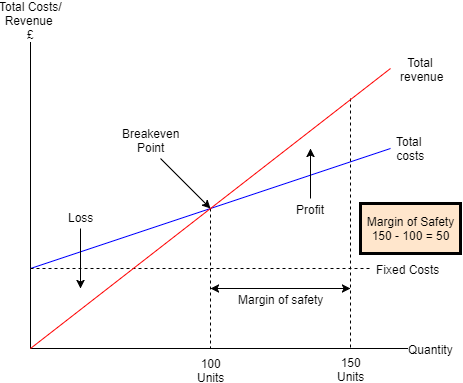

margin of safety

the margin of safety is the amount by which the current output level exceeds the break-even level of output

an example of this is:

if the break even output is 400 units and the current production is 600 units it means the margin of safety is 200 units

it can then be expressed as a percentage of the break-even point:

production over break-even point = 200/400 = 50%

the break even equation

a formula can be used to calculate the break-even:

break even level of output = fixed cost/contribution per unit

contribution per unit is the price of a product - the direct (variable) costs of producing it

uses of break even analysis

a marketing decision

an operations management decision

a location decisions

the benefits of break even analysis

charts are relatively easy to construct and interpret

analysis provides useful guidelines to management on break-even points, safety margins, and profit/loss levels at different rates of output

comparisons can be made between different options by constructing new charts to show changed circumstances

the equation produces a precise break-even result

break-even analysis can be used to assist managers when taking important decisions

limitations of break even analysis

the assumption that costs and revenues are always represented by straight lines is unrealistic

the revenue line could be influenced by the price reductions needed to sell a high level of output

not all costs can be easily classified into fixed and variable costs

the break-even chart makes no allowance for inventory levels

it is also unlikely that fixed costs will remain unchanged at different output levels up to maximum capacity

for new businesses, break-even data will be based on forecasts and these could be inaccurate

the meaning and purpose of budgets

budgeting is the planning of future activities by establishing performance targets, especially financial ones

financial planning for the future is important for all businesses because if no plans are made a business will:

be without a direction or purpose

be unable to allocate the scarce resources of the business effectively

have demotivated employees with no plans or targets to work towards

be unable to measure its progress by measuring the plans against actual performance

benefits of using budgets

planning

allocating resources

setting targets

coordination

controlling and monitoring a business

measuring and assessing performance

variance analysis can be used and it is the calculation of the differences between budgets and actual figures, and analysis of the reasons for such differences

drawbacks of using budgets

lack of flexibility

focus on the short term

unnecessary spending

training on budgets

budgets for new products

key features of effective budgeting

a budget is not a forecast but a plan that businesses aim to fulfil

budget may be established for any part of an organisation as long as the outcome of its operation is measurable

coordination between departments when establishing budgets is essential

budget setting should involve participation

budgets are used to review the performance of each manager controlling a cost or profit centre

setting and using budgets

incremental budgeting uses last year’s budget as a basis and an adjustment is made for the coming year

zero budgeting sets budgets to zero each year and budget holders have to argue their case for target labels and to receive any finance

flexible budgeting cost budgets for each expense are allowed to vary if sales or output vary from budgeted levels

Variance analysis

A variance is the difference between a budget and the actual figures achieved at the end of the budget period, a favourable variances is a change from the budget that leads to higher than planned profit, an adverse variance is a change from the budget that leads to lower than planned profit

it is important to calculate and analyse the reasons for these variances because:

variances measure differences from the planned performance of each department over a given period

riding out the reason for variances can help set more realistic budgets in the future

finding out the reasons for variances can help the business take better decisions

the performance of each individual cost centre and profit centre may be appraised in an accurate and objective way

possible causes of adverse variances

revenue is below budget because either fewer units were sold or the selling price had to be lowered due to competition

actual raw material costs are higher than planned because either output was higher than budgeted or the cost per unit of materials increased

about costs are above budget because either wage rates were raised due to shortages of workers or the labour time taken to complete the work was longer than expected

overhead costs are higher than budgeted

possible causes of favourable variances

revenue is above budget due to higher-than-expected economic growth or a competitor closing down

raw material costs are lower because either output was below budget or the unit cost of materials was below budget

about costs are below budget because of either lower wage rates or quicker completion of the work

overhead costs are lower than budgeted