Financial Accounting

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

28 Terms

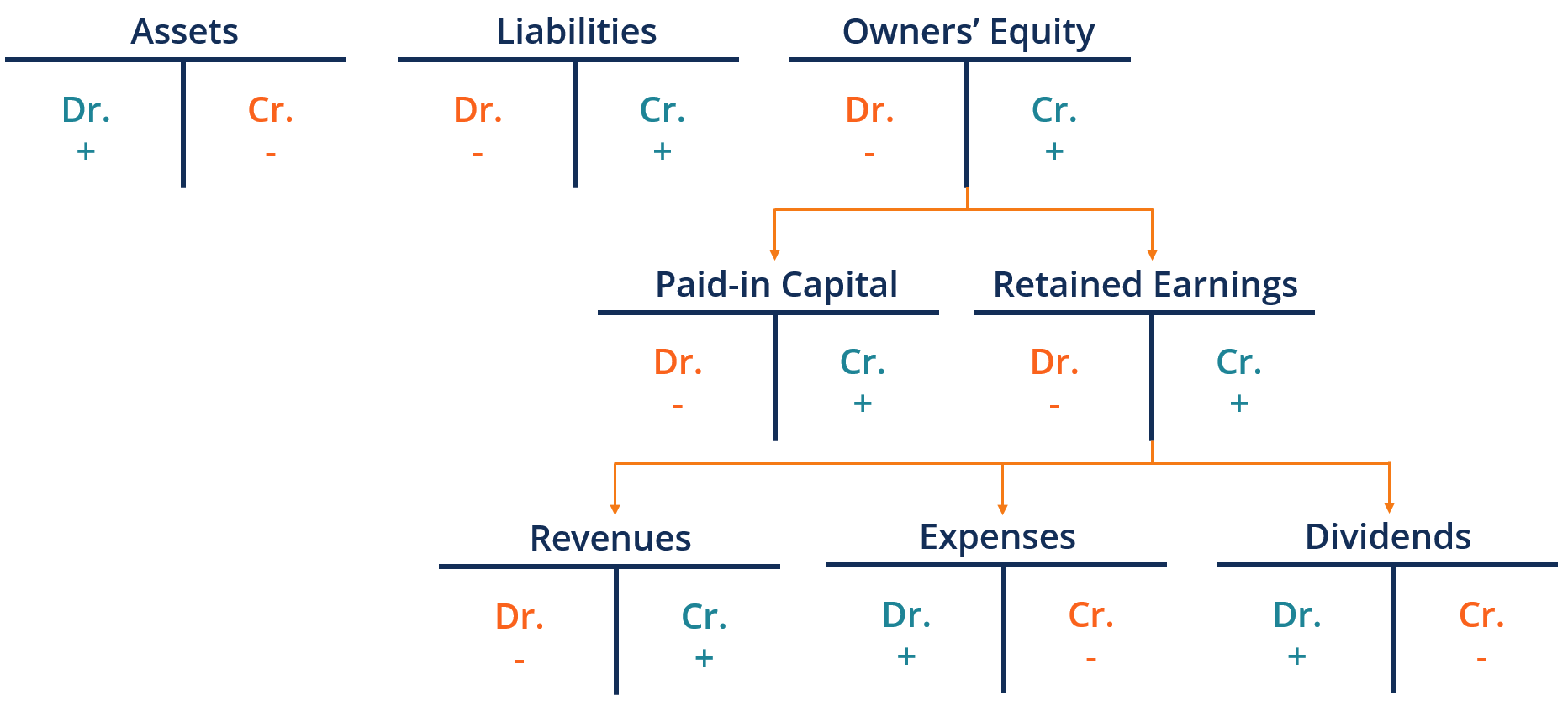

Double Entry Accounting

The concept of present-day bookkeeping which states that every financial transaction has equal and opposite effects in at least two different accounts (Credit and Debit).

The Accounting Equation

Assets = Liabilities + Equity

Credit

Where economic benefits flow from.

Debit

Where economic benefit flows to.

General Ledger

A database that stored a complete record of all accounts and financial transactions.

Account

A place where we record, sort and share all financial transactions that affect a related fetus of items.

Six types of Accounts

Assets

Liabilities

Equity

Revenue

Expenses

Withdrawals

T-Accounts

A visual representation of an account.

Trial Balance

An accounting report showing the closing balances of all general ledger accounts (helps to check errors but mainly to build financial statements).

Adjusting Entries

Journal entries posted at the end of an accounting period to bring a business’s books in line with the accrual method of accounting (that is IFRS or GAAP).

Accrual Method

Revenue is recognized as it’s earned expense are recorded as they incurred.

Financial Statements

Accounting reports that summarize a business’s activities over a period of time.

Deferred Revenue/Unearned Revenue is a…

Liability

True or False: Liabilites usually have the word ‘payable’ in it.

True

Closing Entries

A journal entry that transfers balances from temporary accounts to permanent accounts in the balance sheet.

Retained Earnings

Profits that will be stored for future use.

Deferred Revenue/Unearned Revenue

Cash received from customers for goods or services that has not yet been delivered.

Owner’s Equity consists of:

Retained Earnings and Commonstock

Commonstock

Basic form of ownership, entitling shareholders to vote on company matters and share in profits and assets after creditors and preferred shareholders and paid.

Assets owed to you are…

Debits

Owner’s equity— where business’s owner gives their cash to the business…

Credit

Loans owed to others…

Credit

Dividends…

Debits

Expenses that a business pays a third party for goods/services that have provided

Debit

DEALER

Dividends + Equity + Assets = Liabilities + Expenses + Revenue

Double Entry Bookkeeping

To record a transaction, you need to write down both sides of it in at least two T-accounts.

Journal Entries

A record of a financial transaction.